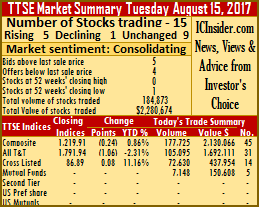

Trading on the Trinidad & Tobago Stock Exchange on Tuesday ended with 15 securities changing hands compared to 13 on Monday as 5 stocks advanced, 1 declined and 9 remained unchanged.

Trading on the Trinidad & Tobago Stock Exchange on Tuesday ended with 15 securities changing hands compared to 13 on Monday as 5 stocks advanced, 1 declined and 9 remained unchanged.

At the market’s close, 184,873 shares traded valued at $2,280,674 compared to Monday’s trades of 118,498 units valued at $1,263,460. The Composite Index dipped 0.24 points to 1,219.91, the All T&T Index lost 1.06 points to 1,791.94 and the Cross Listed Index gained 0.08 points to 86.89.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended with 5 stocks with bids higher than last selling prices and 4 with lower offers.

Gains| First Citizens closed with a 1 cent gain to $31.67 trading 5,346 shares, Guardian Holdings gained 1 cent and closed at $16.51 exchanging 4,908 shares, Republic Financial Holdings closed at $101.91, gaining 1 cent with 65 shares traded. Sagicor Financial advanced 5 cents to $8.15 with 20,609 shares changing hands and Scotiabank gained 1 cent, closing at $58.03 with 42 shares.

Losses| Massy Holdings closed at a 52 weeks’ low of $48.95, with a loss of 4 cents trading 4,770 shares.

Firm Trades| Stocks trading with the prices unchanged and volumes changing hands at the close are, Angostura Holdings exchanged 30,000 shares at $15.01 valued at $450,300, Clico Investment traded 7,148 shares at $21, First Caribbean International closed at $8.05, with 27,921 shares. Grace Kennedy held firm at $2.85, with 10,000 shares, JMMB Group closed at $1.20 with an exchange of 14,100 shares, National Flour Millsclosed at $2 trading 1,154 shares. Prestige Holdings traded 14,004 shares at $10.64, Trinidad Cement closed at $4.14 trading 23,420 shares and Trinidad & Tobago NGL remained at $23.45 exchanging 21,386 shares valued at $500,752.

Firm Trades| Stocks trading with the prices unchanged and volumes changing hands at the close are, Angostura Holdings exchanged 30,000 shares at $15.01 valued at $450,300, Clico Investment traded 7,148 shares at $21, First Caribbean International closed at $8.05, with 27,921 shares. Grace Kennedy held firm at $2.85, with 10,000 shares, JMMB Group closed at $1.20 with an exchange of 14,100 shares, National Flour Millsclosed at $2 trading 1,154 shares. Prestige Holdings traded 14,004 shares at $10.64, Trinidad Cement closed at $4.14 trading 23,420 shares and Trinidad & Tobago NGL remained at $23.45 exchanging 21,386 shares valued at $500,752.

Archives for August 2017

TTSE rose moderately on Tuesday

Forex inflows drop to US$30M – Monday

Trading in the Jamaican foreign exchange market on Monday resulted inflows of US$30.45 million in contrast to US$47.01 million on Friday and outflows of US$27.05 million compared to US$39.89 million of all currencies previously.

Trading in the Jamaican foreign exchange market on Monday resulted inflows of US$30.45 million in contrast to US$47.01 million on Friday and outflows of US$27.05 million compared to US$39.89 million of all currencies previously.

Approximately, 25 percent of the intake is to be surrendered by dictate to Bank of Jamaica and would amount to $7.6 million, which is well short of the net inflows of $4 million.

In USA dollar trading, inflows ended at US$25.6 million versus US$38.25 million on Friday with outflows of US$24.65 million compared to US$30.84 million.

The value of the Jamaican dollar rose in value against the US dollar, with the selling rate ending at J$128.40 from J$128.55 previously. Dealers bought the US currency at an average of J$127.01, versus J$127.38 on Friday.

The selling rate for the Canadian dollar climbed to J$101.85 from J$101.83 at the close on Friday while the British Pound was less costly at the close, with J$165.57 buying the British currency versus J$166.34 and the euro, declined in value against the Jamaican dollar, with it taking J$150.48 to buy the European common currency, versus J$150.77 previously.

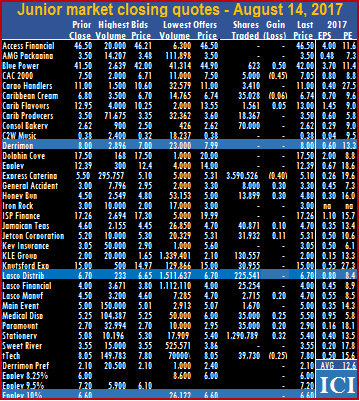

Junior market closed higher – Monday

Trading in the Junior Market of the Jamaica Stock Exchange closed on Monday with a number of stocks rising out pacing those declining 2 to 1. The volume and value of stocks traded declined sharply compared to that on Friday and the market index closed higher.

Trading in the Junior Market of the Jamaica Stock Exchange closed on Monday with a number of stocks rising out pacing those declining 2 to 1. The volume and value of stocks traded declined sharply compared to that on Friday and the market index closed higher.

The Market index surged 45.93 points to close at 3,195.72 as 5,636,428 shares valued at $31,083,116 traded compared with 15,739,900 units valued at $100,160,789 on Friday.

Overall Market activity resulted from trading in 22 stocks, down from 25 on Friday as the market closed with 10 advancing, with Stationery and Office Supplies closing at a new high of $5.40, as the prices of 4 declined and 10 remaining unchanged.

Trading in the Junior Market of the Jamaica Stock Exchange closed on Monday with a number of stocks advancing out pacing those declining. The volume and value of stocks traded advanced compared to that on Friday and the market index closed higher.

Trading in the Junior Market of the Jamaica Stock Exchange closed on Monday with a number of stocks advancing out pacing those declining. The volume and value of stocks traded advanced compared to that on Friday and the market index closed higher.

At the close of the market, stocks trading and their last traded price are: Blue Power traded 623 shares and rose 50 cents to end at $42, CAC 2000 fell 45 cents to $7.05 with 5,000 shares, Cargo Handlers closed at $11 with 3,410 shares, Caribbean Cream lost 6 cents and closed at $6.74 with 35,028 shares, Caribbean Flavours climbed 5 cents and ended at $13 with 1,561 shares, Caribbean Producers closed at $3.50 with 18,367 shares, Consolidated Bakeries closed at $2.62 with 70,000 shares, Express Catering closed at $5.10 with 3,590,526 shares after falling 40 cents, General Accident climbed 30 cents to $3.30 with 8,000 shares, Honey Bun rose 30 cents to closed at $4.80 with 13,899 shares,  Jamaican Teas closed at $4.70 having gained 10 cents with 40,871 shares, Jetcon Corporation closed 11 cents higher at $5.31 with 31,932 shares, KLE Group closed at $2 with 130,557 shares, Knutsford Express closed at $15 with 30,955 shares, Lasco Distributors traded 225,541 shares at $6.70, Lasco Financial closed at $4 with 25,254 shares, Lasco Manufacturing closed 20 cents higher at $4.70 with 2,715 shares, Main Event closed at $5 with 1,670 shares, Medical Disposables gained 25 cents and closed at $5.50 with 35,000 shares, Paramount Trading added 25 cents to close at $2.90 with 35,000 shares Stationery and Office Supplies traded 1,290,789 units as the price climbed to a new closing high of $5.40 after rising 32 cents, earlier in trading the stock went as high as $6 before pulling back ahead of the close and tTech fell 25 cents to $7.80 with 39,730 shares.

Jamaican Teas closed at $4.70 having gained 10 cents with 40,871 shares, Jetcon Corporation closed 11 cents higher at $5.31 with 31,932 shares, KLE Group closed at $2 with 130,557 shares, Knutsford Express closed at $15 with 30,955 shares, Lasco Distributors traded 225,541 shares at $6.70, Lasco Financial closed at $4 with 25,254 shares, Lasco Manufacturing closed 20 cents higher at $4.70 with 2,715 shares, Main Event closed at $5 with 1,670 shares, Medical Disposables gained 25 cents and closed at $5.50 with 35,000 shares, Paramount Trading added 25 cents to close at $2.90 with 35,000 shares Stationery and Office Supplies traded 1,290,789 units as the price climbed to a new closing high of $5.40 after rising 32 cents, earlier in trading the stock went as high as $6 before pulling back ahead of the close and tTech fell 25 cents to $7.80 with 39,730 shares.

Moderate gains from low level trading

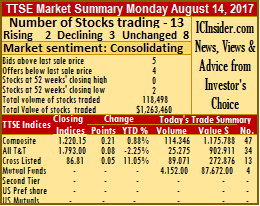

Trading on the Trinidad & Tobago Stock Exchange on Monday ended with 13 securities changing hands, the same as on Friday, with 2 stocks advancing, 4 declining and 7 holding firm.

Trading on the Trinidad & Tobago Stock Exchange on Monday ended with 13 securities changing hands, the same as on Friday, with 2 stocks advancing, 4 declining and 7 holding firm.

The market closed as 118,498 shares traded valued at $1,263,460 compared to Friday’s trades of 419,775 valued at $2,356,840.

The Composite Index advanced 0.21 points to 1,220.15, the All T&T Index gained 0.08 points to 1,793 and the Cross Listed Index was up 0.05 points to 86.81.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended with 5 stocks with bids higher than last selling prices and 4 with lower offers.

Gains| JMMB Group closed at $1.20 with gains of 2 cents trading 12,525 shares and Scotiabank gained 2 cents to close at $58.02 exchanging 1,622 shares.

Losses| Clico Investment lost 50 cents to close at a 52 weeks’ low of $21 trading 4,152 shares, Massy Holdings closed at a 52 weeks’ low of $48.99, losing 1 cent with 3,173 shares and Trinidad & Tobago NGL was down 5 cents, closing at $23.45 with an exchange of 7,920 shares.

Firm Trades| First Citizens closed at $31.66, with 5,232 shares, Guardian Holdings held firm at $16.50, with 4,308 shares changing hands, National Enterprises closed at $10.47 trading 200 units, Prestige Holdings traded 700 units at $10.64. Republic Financial Holdings remained at $101.90 exchanging 1,905 shares, Sagicor Financial closed at $8.10 trading 15,188 shares and Scotia Investments exchanged 61,358 shares at $2.20 and West Indian Tobacco closed at $125.50, in exchanging 215 units.

Firm Trades| First Citizens closed at $31.66, with 5,232 shares, Guardian Holdings held firm at $16.50, with 4,308 shares changing hands, National Enterprises closed at $10.47 trading 200 units, Prestige Holdings traded 700 units at $10.64. Republic Financial Holdings remained at $101.90 exchanging 1,905 shares, Sagicor Financial closed at $8.10 trading 15,188 shares and Scotia Investments exchanged 61,358 shares at $2.20 and West Indian Tobacco closed at $125.50, in exchanging 215 units.

SOS trades at a record $5.75

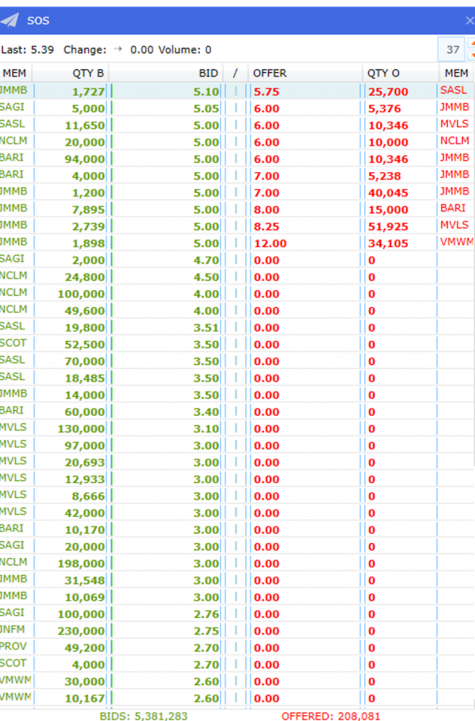

With about 8 minutes to the opening of the Jamaica Stock Exchange this morning there are orders to purchase 5.38 million units of Stationery and Office Supplies shares and only 208,000 units being offered.

With about 8 minutes to the opening of the Jamaica Stock Exchange this morning there are orders to purchase 5.38 million units of Stationery and Office Supplies shares and only 208,000 units being offered.

The bids range from 2.60 to a high of $5.10 while the offers start at $5.75. Including in the bids are two amounts totalling 2.34 million units at $2.60 each. The stock eventually traded at $5.75 with 38,000 units after the market opened with the bid moving to $5.75.

Forex inflows in at US$47M – Friday

Trading in the Jamaican foreign exchange market on Friday resulted inflows of US$47.01 million in contrast to US$48.44 million on Thursday and outflows of US$39.89 million compared to US$37.65 million of all currencies previously.

Trading in the Jamaican foreign exchange market on Friday resulted inflows of US$47.01 million in contrast to US$48.44 million on Thursday and outflows of US$39.89 million compared to US$37.65 million of all currencies previously.

Approximately, 25 percent of the intakes are surrendered by dictates to Bank of Jamaica and would amount to $12 million, which is well short of the net inflows of $7 million.

In USA dollar trading, inflows ended at US$38.25 million versus US$42.03 million on Thursday with outflows of US$30.84 million compared to US$34.14 million.

The value of the Jamaican dollar slipped in value against the US dollar, with the selling rate ending at J$128.55 from J$128.44 previously. Dealers bought the US currency at an average of J$127.38, versus J$127.36 on Thursday.

The selling rate for the Canadian dollar climbed to J$101.83 from J$101.30 at the close on Thursday while the British Pound was less costly at the close, with J$166.34 buying the British currency versus J$167.68 and the euro, declined in value against the Jamaican dollar, with it taking J$150.77 to buy the European common currency, versus J$151.67 previously.

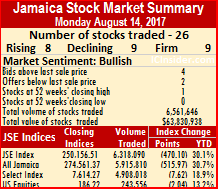

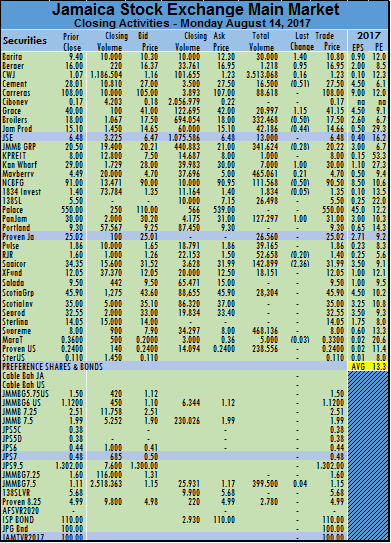

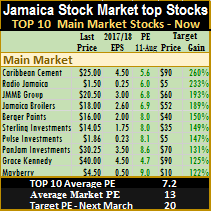

he main market stocks of the Jamaica Stock Exchange declined for the second consecutive day with moderate fall in the indices at the close on Monday.

he main market stocks of the Jamaica Stock Exchange declined for the second consecutive day with moderate fall in the indices at the close on Monday.  The main market ended with 6,318,090 units valued at $56,287,458 changing hands compared to 7,902,262 units valued at $237,278,617 at the close on Friday. Trading in the US dollar market accounted for 243,556 units valued at US$58,933, bringing the total of all trades to J$63,830,938.

The main market ended with 6,318,090 units valued at $56,287,458 changing hands compared to 7,902,262 units valued at $237,278,617 at the close on Friday. Trading in the US dollar market accounted for 243,556 units valued at US$58,933, bringing the total of all trades to J$63,830,938. JMMB Group lost 28 cents to close at $20.22, with 341,624 shares. Kingston Properties exchanged 1,000 shares at $8, Kingston Wharves traded $1 higher to $30, with an exchange of 7,000 shares, Mayberry Investments gained 21 cents to close at $4.70, with 465,061 shares changing hands, NCB Financial Group dipped 50 cents to $90.50, after exchanging 111,568 shares, 1834 Investments lost 5 cents to close at $1.35 while trading 1,834 shares, 138 Student Living traded 26,498 shares at $5.50, PanJam Investment closed $1 higher to $31 trading 127,297 shares,Proven Investments exchanged 26,560 shares at $25.02, Pulse Investments closed at $1.86 trading 39,165 shares, Radio Jamaica lost 20 cents exchanging 52,658 shares to close at $1.40, Sagicor Group closed $2.36 lower to $31.99, with 142,899 shares, Sagicor Real Estate Fund exchanged 18,151 shares at $12.05, Scotia Group closed at $45.90 with trades of 28,304 shares, Supreme Ventures traded 468,136 shares at $8. Margaritaville Turks US ordinary share was down 3 US cents to 33 US cents trading 5,000 units, Proven Investments US ordinary share closed at 24 US cents with 238,566 units changing hands, JMMB Group 7.5% preference share gained 4 cents, closing at $1.15, with 399,500 units changing owners and Proven 8.25% preference share closed at $4.99 exchanging 2,780 units.

JMMB Group lost 28 cents to close at $20.22, with 341,624 shares. Kingston Properties exchanged 1,000 shares at $8, Kingston Wharves traded $1 higher to $30, with an exchange of 7,000 shares, Mayberry Investments gained 21 cents to close at $4.70, with 465,061 shares changing hands, NCB Financial Group dipped 50 cents to $90.50, after exchanging 111,568 shares, 1834 Investments lost 5 cents to close at $1.35 while trading 1,834 shares, 138 Student Living traded 26,498 shares at $5.50, PanJam Investment closed $1 higher to $31 trading 127,297 shares,Proven Investments exchanged 26,560 shares at $25.02, Pulse Investments closed at $1.86 trading 39,165 shares, Radio Jamaica lost 20 cents exchanging 52,658 shares to close at $1.40, Sagicor Group closed $2.36 lower to $31.99, with 142,899 shares, Sagicor Real Estate Fund exchanged 18,151 shares at $12.05, Scotia Group closed at $45.90 with trades of 28,304 shares, Supreme Ventures traded 468,136 shares at $8. Margaritaville Turks US ordinary share was down 3 US cents to 33 US cents trading 5,000 units, Proven Investments US ordinary share closed at 24 US cents with 238,566 units changing hands, JMMB Group 7.5% preference share gained 4 cents, closing at $1.15, with 399,500 units changing owners and Proven 8.25% preference share closed at $4.99 exchanging 2,780 units.

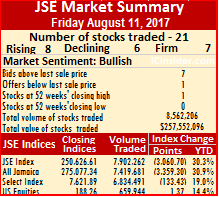

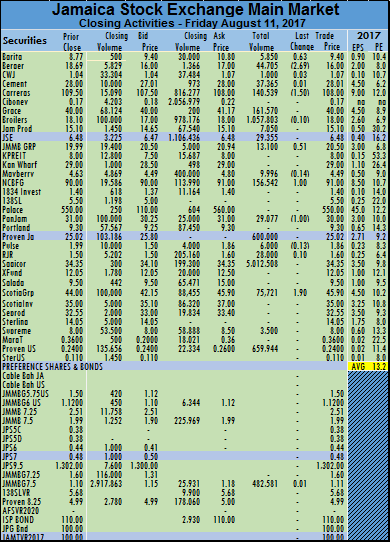

Sagicor Group moving from $31.50 to $34.35 and Salada Foods that closed at $9.50, up from $9.

Sagicor Group moving from $31.50 to $34.35 and Salada Foods that closed at $9.50, up from $9.

Trading in the US dollar market accounted for 659,944 units valued at US$158,387 bringing the total of all trades to J$257,552,096.

Trading in the US dollar market accounted for 659,944 units valued at US$158,387 bringing the total of all trades to J$257,552,096. Jamaica Broilers lost 10 cents exchanging 1,057,803 shares at $18, Jamaica Producers closed at $15.10 trading 7,050 shares, Jamaica Stock Exchange closed at $6.48 with 29,355 shares changing hands, JMMB Group gained 51 cents to close at $20.50, with 13,100 shares. Mayberry Investments lost 14 cents to close at $4.49, with 9,996 shares changing hands, NCB Financial Group traded $1 higher to $91, after exchanging 156,542 shares, PanJam Investment shed $1 to $30 trading 29,077 shares, Proven Investments exchanged 600,000 shares at $25.02, Pulse Investments lost 13 cents to close at $1.86 trading 6,000 shares, Radio Jamaica gained 10 cents in exchanging 28,000 shares to close at $1.60. Sagicor Group traded 5,012,508 shares at $34.35, Scotia Group closed $1.90 higher to $45.90 with 75,721 shares, Supreme Ventures exchanged 3,500 shares at $8. Proven Investments US ordinary shares, traded 659,944 units at 24 US cents and JMMB Group 7.5% preference share gained 1 cent, closing at $1.11, with 482,581 units.

Jamaica Broilers lost 10 cents exchanging 1,057,803 shares at $18, Jamaica Producers closed at $15.10 trading 7,050 shares, Jamaica Stock Exchange closed at $6.48 with 29,355 shares changing hands, JMMB Group gained 51 cents to close at $20.50, with 13,100 shares. Mayberry Investments lost 14 cents to close at $4.49, with 9,996 shares changing hands, NCB Financial Group traded $1 higher to $91, after exchanging 156,542 shares, PanJam Investment shed $1 to $30 trading 29,077 shares, Proven Investments exchanged 600,000 shares at $25.02, Pulse Investments lost 13 cents to close at $1.86 trading 6,000 shares, Radio Jamaica gained 10 cents in exchanging 28,000 shares to close at $1.60. Sagicor Group traded 5,012,508 shares at $34.35, Scotia Group closed $1.90 higher to $45.90 with 75,721 shares, Supreme Ventures exchanged 3,500 shares at $8. Proven Investments US ordinary shares, traded 659,944 units at 24 US cents and JMMB Group 7.5% preference share gained 1 cent, closing at $1.11, with 482,581 units.