Revenues at Kingston Wharves jumped 19 percent or $467 million over the corresponding period in 2016 to $2.9 billion for the six months to June 2017 and 22 percent for the June quarter to $1.55 billion.

Revenues at Kingston Wharves jumped 19 percent or $467 million over the corresponding period in 2016 to $2.9 billion for the six months to June 2017 and 22 percent for the June quarter to $1.55 billion.

The strong revenue growth resulted in profit before taxation climbing 32 percent from $650 million in 2016 to $857 million for the half year and an even more impressive 40 percent in the quarter, to $454 million. Net profit attributable to shareholders increased 34 percent, moving by $187 million to $742 million over the comparable period in 2016 for the six months and a strong 46 percent in the latest quarter, to $414 million. The results produced earnings per stock unit of 29 cents for the quarter and 52 cents for the half year.

The strong quarterly performance comes against the background of a sharp fall in other operating income from $105 million to just $17 million, partially offset by finance costs declining to $31 million from $67 million in 2016 June quarter.

The Terminal Operations Division delivered revenues of $2.3 billion, a 19 percent increase over the corresponding period in 2016. Divisional operating profits increased by 50 percent from $485 million to $727 million. The key drivers include growth in container handling, motor units and break bulk operations amongst other areas. “Total revenues earned in the Logistics and Ancillary division amounted to $676 million, with operating profits totaling $192 million, an increase of 15 percent and 6 percent respectively, over the corresponding period in 2016 due primarily to continuous expansion of KWL’s service offering and a widening of its customer base, as well as improved operational efficiencies gained through increased use of technology to manage the warehousing operations and security services,” the chairman Jeffrey Hall, the company’s chairman reported to shareholders.

Administrative expenses rose much faster than revenues at 30 percent for the quarter, to $290 million and 18 percent for the six months to $543 million.

The Group’s balance sheet reflects short term investments and cash of $3.1 billion, shareholders’ equity of $19 billion and borrowed funds amounting to $2.4 billion.

The growth for the half year has been very strong suggesting that IC Insider.com’s forecast of $1.13 for the full year is on track and may even be exceeded if the second quarter pace of growth continues. The stock traded at on the Jamaica Stock Exchange on Friday gone at $30, resulting in one of the highest valued stock on the market at a PE of 27 times current year’s earnings. If the growth continues at the current pace into 2018 then the current value would be acceptable as the valuation would fall under 20 times 2018 earnings.

Kingston Wharves will shortly launch new logistics facilities for the warehousing of general cargo, and the storage of bulk and automotive cargo for domestic and transshipment markets and have already had acceptance from potential customers. The location of this is slated for lands adjacent to the Tinson Pen airport in Kingston.

Archives for August 2017

Profits surge at Kingston Wharves

Kingston Wharves pumps up JP profits

Jamaica Producers current HQ.

Jamaica Producers made improvement in its operations, with strong gains in operating profit, helped by the consolidation of Kingston Wharves (KW), but importantly, gains from its other core business.

The company reported profit attributable to shareholders of $158 million for the second quarter and $251 million for the half year to June, 2017.

The results flowed from revenues of $7.4 billion up from $4.6 billion in 2016 for the half year and $4 billion for the quarter, up from $2.4 billion in 2016. In 2016 the group’s share of KW was treated as an associate as such the revenues for 2016 does not include that for wharf as is the case in 2017.

Closer look at the numbers, shows that while profit jumped sharply, the subsidiary Kingston Wharves accounted for $485 million of the $546 million profit generated from operations in the June quarter and $918 million of the $981 million generated for the half year. Revenues from KW amounts to $1.55 billion for the quarter and $2.94 billion for the six months, less than 40 percent of JP group’s revenues.

The numbers suggest there is much work to be done, to knock Producers as the group is called, into shape. Relocation of the head office from rented property to an existing property owned by them and serving other group companies and the consolidation of the Tortuga Rum Cake operations in Kingston with modern equipment and other changes, will help to improve profitability of the core business.

The results for 2017 translate to 14 cents per share for the quarter and 22 cents for the half year and should end around 50 cents for the year. With a stock price of $13.75 the market value is a very rich 29 times earnings against a market average of just over 13. The stock which traded as high as $22 earlier this year has been slowly correcting and seems headed lower as investors get a clearer picture of the likely full year’s earnings.

The results for 2017 translate to 14 cents per share for the quarter and 22 cents for the half year and should end around 50 cents for the year. With a stock price of $13.75 the market value is a very rich 29 times earnings against a market average of just over 13. The stock which traded as high as $22 earlier this year has been slowly correcting and seems headed lower as investors get a clearer picture of the likely full year’s earnings.

The group’s main activities are port terminal operations, logistics, the cultivation, marketing and distribution of fresh produce, food and juice manufacturing, land management and the holding of investments.

Forex inflows drop during current week

Foreign exchange trading this week resulted in total inflows being less than in the previous week and ended at US$196 million versus US$222 million previously while outflows ended at US$160 million versus US$169 million.

Foreign exchange trading this week resulted in total inflows being less than in the previous week and ended at US$196 million versus US$222 million previously while outflows ended at US$160 million versus US$169 million.

Trading in the Jamaican foreign exchange market on Friday ended in inflows remaining low compared to the first three days of the week, but climbed above inflows of US$32.94 million on Thursday to US$35.35 million. Outflows amounted to US$30.09 million compared to US$32.74 million of all currencies previously.

In USA dollar trading, inflows ended at US$28.90 million versus US$27.59 million on Thursday with outflows of US$26.16 million compared to US$26.19 million.

The value of the Jamaican dollar gained modestly in value against the US dollar, with the selling rate ending at J$128.50 from J$128.51 previously. Dealers bought the US currency at an average of J$127.11, versus J$127.15 on Thursday.

The selling rate for the Canadian dollar rose to J$102.50 from J$101.69 at the close on Thursday while the British Pound was more costly, with J$166.16 buying the British currency versus J$164.96 and the euro, receded in value against the Jamaican dollar, with it taking J$149.50 to buy the European common currency, versus J$149.92 previously.

The selling rate for the Canadian dollar rose to J$102.50 from J$101.69 at the close on Thursday while the British Pound was more costly, with J$166.16 buying the British currency versus J$164.96 and the euro, receded in value against the Jamaican dollar, with it taking J$149.50 to buy the European common currency, versus J$149.92 previously.

NCB closes at a new high on TTSE

NCBFG trades at new high in Trinidad on Friday of TT$4.50.

NCB Financial Holdings closed at new high on the Trinidad & Tobago Stock Exchange on Friday and have almost closed the gaping gap in trading prices between Jamaica and Trinidad. At the close 11 securities traded compared to 13 on Thursday.

Trading activity increased over Thursday’s levels by more than 100 percent in dollars and volume. With trading dominated by Angostura Holdings with 42 percent of the trades followed by Clico Investment and Trinidad & Tobago NGL with 27 percent and 23 percent respectively.

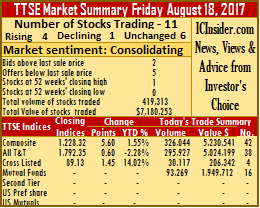

The market closed with 4 stocks having advanced, 1 declined and 6 were unchanged as 419,313 shares traded at a value of $$7,180,253 compared to Thursday’s trades of 210,213 valued at $3,263,460.

The Composite Index advanced 5.60 points to 1,228.32, the All T&T Index gained 0.60 points to 1,792.35 and the Cross Listed Index added 1.45 points to 89.13 points.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended with 2 stocks with bids higher than last selling prices and 5 with lower offers suggesting some softness in the market ahead of Monday’s opening.

Gains| Stocks closing with the prices rising based on the last sale and volumes changing hands were Clico Investment with a 1 cent gain to $21 with 93,269 shares valued at $1,949,712, First Caribbean International rising 3 cents to close at $8.05 with 20,117 shares, NCB Financial Group advanced 21 cents to a 52 weeks’ high of $4.50 with 10,000 shares, as investors pushed the price to be more or less in line with the price it closed at in Kingston of J$90.95 and  Trinidad & Tobago NGL traded 20 cents higher to $23.45 with 70,233 shares valued at $1,647,548.

Trinidad & Tobago NGL traded 20 cents higher to $23.45 with 70,233 shares valued at $1,647,548.

Losses| Prestige Holdings lost 1 cent, to last traded at $10.64 with 8,876 shares changing hands.

Firm Trades| Stocks trading with the last price remaining unchanged and the volumes changing hands are, Angostura Holdings ending at $15.01 with 200,000 shares valued at $3,002,000, Ansa Merchant Bank trading at $40 with 1,056 shares, First Citizens exchanging 1,800 shares at $31.67. Massy Holdings closed at $48.95 with 379 units, National Enterprises remained at $10.48 with 13,161 shares and Scotiabank closed with 422 units trading at $58.02.

Forex inflows drop to US$33M – Thursday

Trading in the Jamaican foreign exchange market on Thursday resulted much lower inflows of US$32.94 million in contrast to US$43.52 million on Wednesday and outflows of US$32.74 million compared to US$32.38 million of all currencies previously.

Trading in the Jamaican foreign exchange market on Thursday resulted much lower inflows of US$32.94 million in contrast to US$43.52 million on Wednesday and outflows of US$32.74 million compared to US$32.38 million of all currencies previously.

Approximately, 25 percent of the intake is surrendered by dictate to Bank of Jamaica and would amount to $8 million based on Thursdays trading.

In USA dollar trading, inflows ended at US$27.59 million versus US$38.58 million on Wednesday with outflows of US$26.19 million compared to US$27 million.

The value of the Jamaican dollar fell in value against the US dollar, with the selling rate ending at J$128.51 from J$128.49 previously. Dealers bought the US currency at an average of J$127.15, versus J$127.32 on Wednesday.

The selling rate for the Canadian dollar rose to J$101.69 from J$101.54 at the close on Wednesday while the British Pound was less costly, with J$164.96 buying the British currency versus J$165.40 and the euro, receded in value against the Jamaican dollar, with it taking J$149.92 to buy the European common currency, versus J$151.97 previously.

TTSE closed with mixed indices move

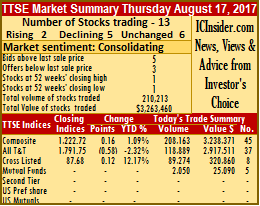

The Trinidad & Tobago Stock Exchange on Thursday traded 13 securities compared to 14 on Wednesday with the prices of 2 advancing, 5 declining and 6 remaining unchanged.

The Trinidad & Tobago Stock Exchange on Thursday traded 13 securities compared to 14 on Wednesday with the prices of 2 advancing, 5 declining and 6 remaining unchanged.

The Composite Index gained 0.16 points to 1,222.72, the All T&T Index lost 0.58 points to 1,791.75 and the Cross Listed Index gained 0.12 points to 87.68 points.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended with 5 stocks with bids higher than last selling prices and 3 with lower offers.

At the close, 210,213 shares traded at a value of $3,263,460 compared to Wednesday’s trades of 388,836 units valued at $2,901,484.

Gains| Stocks closing with the prices rising and volumes changing hands are Sagicor Financial climbing 30 cents to $8.50 with 24,507 shares and Praetorian Property Mutual closing 3 cents higher at a 52 weeks’ high of $3.05, with 1,000 shares.

Losses| Stocks declining based on the last traded prices and volumes changing hands are Clico Investment with a loss of 1 cent, closing at a 52 weeks’ low of $20.99 with 1,050 shares, First Caribbean International with a loss of 3 cents, to $8.02 with 5,107 shares, Republic Financial Holdings with a loss of 1 cent, closed at $101.90 with 1,340 shares. Scotiabank with a loss of 1 cent, to end at $58.02 with 24,775 shares valued at $1,437,558 and Trinidad & Tobago NGL with a loss of 15 cents to $23.25 with 4,270 shares.

Republic Financial Holdings with a loss of 1 cent, closed at $101.90 with 1,340 shares. Scotiabank with a loss of 1 cent, to end at $58.02 with 24,775 shares valued at $1,437,558 and Trinidad & Tobago NGL with a loss of 15 cents to $23.25 with 4,270 shares.

Firm Trades| Stocks trading unchanged at the last traded prices and volumes changing hands are Ansa McAL closed at $66 with 3,721 shares, First Citizens closing at $31.67, with 3,273 shares, Guardian Holdings with 5,000 shares at $16.50,. JMMB Group closing at $1.20 with 59,660 shares, Massy Holdings closing with 280 units at $48.95 while National Enterprises closed at $10.48 with 76,230 shares valued at $798,890.

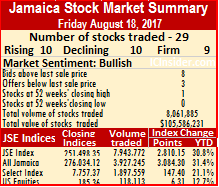

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids higher than their last selling prices and 3 with lower offers.

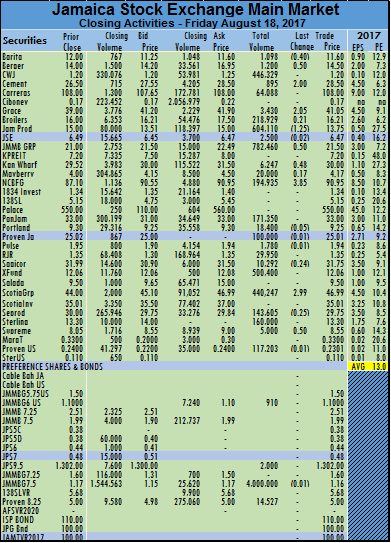

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids higher than their last selling prices and 3 with lower offers. Mayberry Investments gained 17 cents to end at $4.17 with 20,000 shares, NCB Financial Group jumped $3.85 to $90.95 with 194,935 shares, PanJam Investment closed at $33 with 171,350 shares, Portland JSX lost 5 cents, closing at $9.25 with 18,400 shares. Proven Investments lost 1 cent to close at $25.01 with 100,000 shares, Pulse Investments eased 1 cent, to $1.94 with 1,780 shares, Radio Jamaica closed at $1.35 with 29,950 shares, Sagicor Group traded 24 cents lower, closing at $31.75 with 10,292 shares, Sagicor Real Estate Fund closed at $12.06 with 500,400 shares, Scotia Group climbed $2.99 to $46.99 with 440,247 shares, Seprod lost 25 cents to close at $29.75 with 143,605 shares, Sterling Investments closed at $13.30 with 160,000 shares, Supreme Ventures closed at a 52 weeks’ high of $8.55 with 5,000 shares after gaining 50 cents. Proven Investments US ordinary shares lost 0.99 US cent and closed at 23.01 US cents with 117,203 units, JMMB Group US 6% preference share closed at US$1.10 with 910 units, Proven Investments 8.25% preference share closed at $5 with 14,527 units, Jamaica Public Service 9.5% preference share closed at $1,302 with 2,000 units and JMMB Group 7.5% preference share lost 1 cent to close at $1.16 with 4,000,000 units.

Mayberry Investments gained 17 cents to end at $4.17 with 20,000 shares, NCB Financial Group jumped $3.85 to $90.95 with 194,935 shares, PanJam Investment closed at $33 with 171,350 shares, Portland JSX lost 5 cents, closing at $9.25 with 18,400 shares. Proven Investments lost 1 cent to close at $25.01 with 100,000 shares, Pulse Investments eased 1 cent, to $1.94 with 1,780 shares, Radio Jamaica closed at $1.35 with 29,950 shares, Sagicor Group traded 24 cents lower, closing at $31.75 with 10,292 shares, Sagicor Real Estate Fund closed at $12.06 with 500,400 shares, Scotia Group climbed $2.99 to $46.99 with 440,247 shares, Seprod lost 25 cents to close at $29.75 with 143,605 shares, Sterling Investments closed at $13.30 with 160,000 shares, Supreme Ventures closed at a 52 weeks’ high of $8.55 with 5,000 shares after gaining 50 cents. Proven Investments US ordinary shares lost 0.99 US cent and closed at 23.01 US cents with 117,203 units, JMMB Group US 6% preference share closed at US$1.10 with 910 units, Proven Investments 8.25% preference share closed at $5 with 14,527 units, Jamaica Public Service 9.5% preference share closed at $1,302 with 2,000 units and JMMB Group 7.5% preference share lost 1 cent to close at $1.16 with 4,000,000 units.

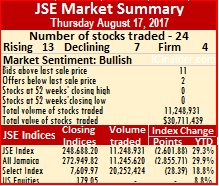

Trading ended with the market sentiments looking strong for Monday’s activity as 7 stocks ended with bids higher than their last selling prices and 2 with lower offers.

Trading ended with the market sentiments looking strong for Monday’s activity as 7 stocks ended with bids higher than their last selling prices and 2 with lower offers.

The main market ended trading with an average of 468,705 units valued at $9,377,059 for each security traded compared to an average of 100,124 units valued at $4,478,034. The average volume and value for the month to date ended at 180,487 units with an average value of $3,861,556 compared with an average of 151,666 units with an average value of $3,310,005 on the previous trading day. The average volume and value for July ended at 160,668 units with an average value of $2,691,438.

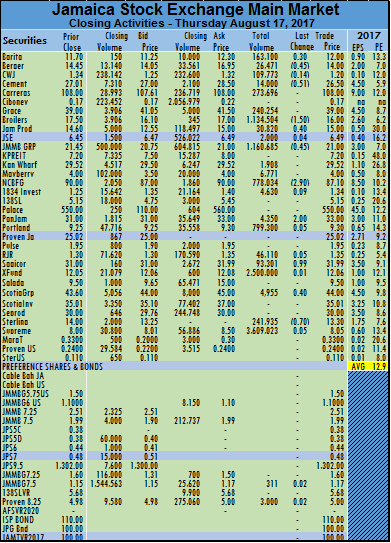

The main market ended trading with an average of 468,705 units valued at $9,377,059 for each security traded compared to an average of 100,124 units valued at $4,478,034. The average volume and value for the month to date ended at 180,487 units with an average value of $3,861,556 compared with an average of 151,666 units with an average value of $3,310,005 on the previous trading day. The average volume and value for July ended at 160,668 units with an average value of $2,691,438. Mayberry Investments closed at $4 with 6,771 shares, NCB Financial Group dropped $2.90 to $87.10 with 778,034 shares, 1834 Investments closed 9 cents higher at $1.34 with 4,630 shares, PanJam Investment jumped $2 to $33 with 4,350 shares, Portland JSX ended 5 cents higher at $9.30 with 799,300 shares, Radio Jamaica traded 5 cents higher to $1.35 with 46,110 shares, Sagicor Group climbed 99 cents to $31.99 with 93,301 shares, Sagicor Real Estate X Fund rose 1 cent higher to $12.06 with 2,500,000 shares, Scotia Group rose 40 cents to $44 with 4,955 shares, Sterling Investments ended with a loss of 70 cents in closing at $13.30, with 241,935 shares, Supreme Ventures closed 5 cents higher at $8.05 with 3,609,023 shares, JMMB Group 7.5% preference share added 2 cents to close at $1.17 with 311 shares and Proven preference share rose 2 cents to $5 with 3,000 shares.

Mayberry Investments closed at $4 with 6,771 shares, NCB Financial Group dropped $2.90 to $87.10 with 778,034 shares, 1834 Investments closed 9 cents higher at $1.34 with 4,630 shares, PanJam Investment jumped $2 to $33 with 4,350 shares, Portland JSX ended 5 cents higher at $9.30 with 799,300 shares, Radio Jamaica traded 5 cents higher to $1.35 with 46,110 shares, Sagicor Group climbed 99 cents to $31.99 with 93,301 shares, Sagicor Real Estate X Fund rose 1 cent higher to $12.06 with 2,500,000 shares, Scotia Group rose 40 cents to $44 with 4,955 shares, Sterling Investments ended with a loss of 70 cents in closing at $13.30, with 241,935 shares, Supreme Ventures closed 5 cents higher at $8.05 with 3,609,023 shares, JMMB Group 7.5% preference share added 2 cents to close at $1.17 with 311 shares and Proven preference share rose 2 cents to $5 with 3,000 shares.

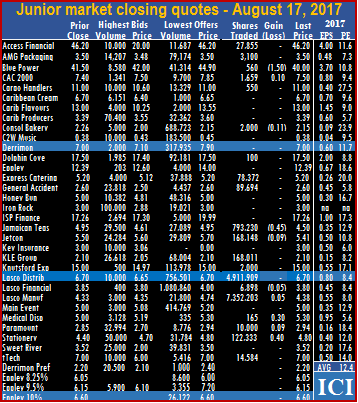

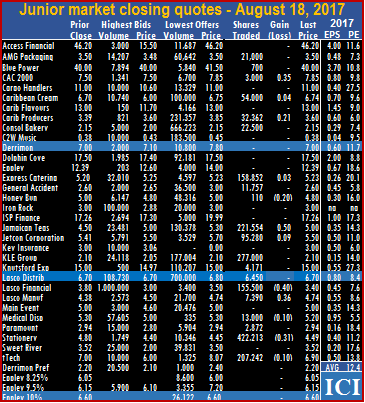

The average volume and value for the month to date amounts to 344,257 units valued at $1,813,259 compared to 309,916 units valued at $1,627,630 previously. In contrast, July closed with average of 536,395 units at $1,905,441 for each security traded.

The average volume and value for the month to date amounts to 344,257 units valued at $1,813,259 compared to 309,916 units valued at $1,627,630 previously. In contrast, July closed with average of 536,395 units at $1,905,441 for each security traded.