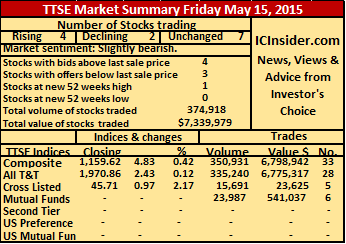

At the close of the market, the Composite Index advanced by 0.17 points to close at 1,154.45, the All T&T Index added just 0.14 points to close at 1,968.54 and the Cross Listed Index increased by 0.02 points to end at 44.63

Gains| Stocks increasing in price at the close are, ANSA McAL that gained 1 cent in closing at $67.02 with 290 shares changing hands, Clico Investment Fund ended with 60,533 shares trading, valued at $1,368,305 but gained 5 cents to end at $22.60. Massy Holdings had 76,650 shares changing hands for a value of $4,871,107 to end 7 cents higher, at $63.55 and Sagicor Financial Corporation ended with 24,892 shares carrying a value of $147,693 to end with a 10 cents gain, at $6.

Firm Trades| Stocks closing with prices unchanged at the end of trading are, First Citizens Bank trading 4,349 shares to close at $35.80, One Caribbean Media ended with just 50 shares changing hands at $22.30, Prestige Holdings closed with 1,050 share trading to end at $10. Republic Bank added 14,539 shares valued at $1,671,985 to close at $115, Scotiabank contributed 3,919 shares, to end at $62.51, Scotia Investments ended with 2,000 shares trading at $1.50 and Trinidad Cement ended up with 13,000 units at $2.80.

Firm Trades| Stocks closing with prices unchanged at the end of trading are, First Citizens Bank trading 4,349 shares to close at $35.80, One Caribbean Media ended with just 50 shares changing hands at $22.30, Prestige Holdings closed with 1,050 share trading to end at $10. Republic Bank added 14,539 shares valued at $1,671,985 to close at $115, Scotiabank contributed 3,919 shares, to end at $62.51, Scotia Investments ended with 2,000 shares trading at $1.50 and Trinidad Cement ended up with 13,000 units at $2.80.IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 7 stocks with the bid higher than their last selling prices and 1 with a lower offer.