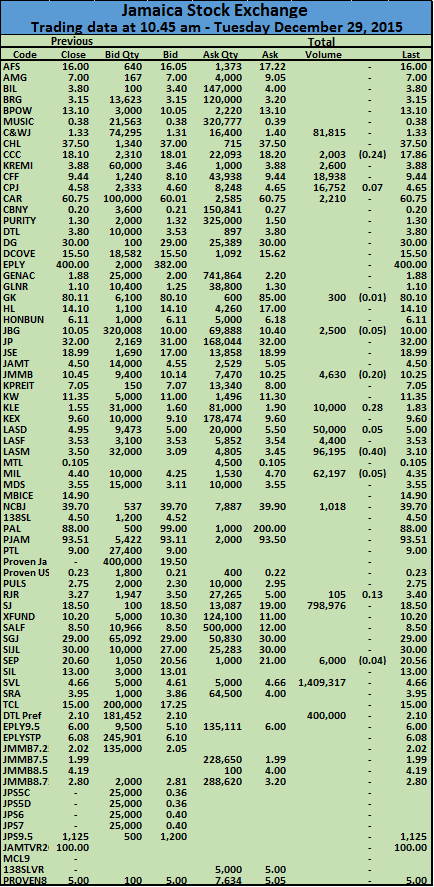

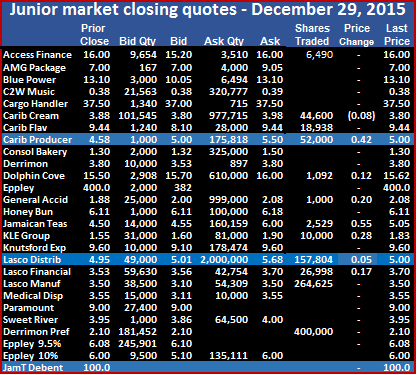

Trading ended with 12 securities trading of which 7 advanced and 1 declined with 3 closing at a new 52 weeks high. Volume changing hands amounted to 986,076 units, valued at $3,374,729.

At the close there was 1 security ending with no bid to buy and 5 securities had no stocks being offered for sale. A total of 4 stocks closed with bids higher than their last traded prices while none closed with a lower offer.

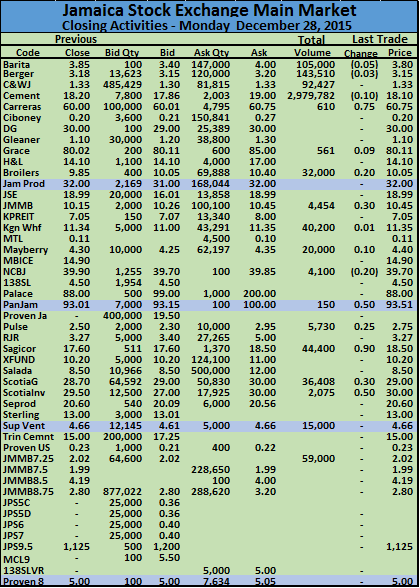

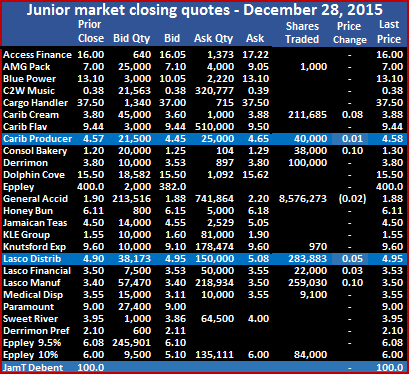

In trading, Access Financial closed with 6,490 units changing hands at $16, Caribbean Cream slipped 8 cents with 44,600 shares changing hands at $3.80, Caribbean Flavours closed at $9.44 with 18,938 shares changing hands, Caribbean Producers rose 42 cents in trading 52,000 units to close at $5. Dolphin Cove ended with 1,092 shares changing hands at $15.62 by gaining 12 cents, General Accident gained 20 cents with 1,000 shares trading close at $2.08. Jamaican Teas ended up by 55 cents with only 2,529 shares trading,

KLE Group ended at $1.83 with 10,000 shares changing hands to record a gain of 28 cents, Lasco Distributors rose by 5 cents and closed with 157,804 shares changing hands at $5 for a 52 weeks’ high, after trading earlier at an all-time high of $5.50. Lasco Financial rose 17 cents to close at a new 52 weeks’ high of $3.70, with 26,998 shares changing hands, Lasco Manufacturing closed at $3.50 with 264,625 shares trading, the stock traded earlier as low as $3.10 and Derrimon Trading preference share ended with 400,000 shares trading at $2.10.

KLE Group ended at $1.83 with 10,000 shares changing hands to record a gain of 28 cents, Lasco Distributors rose by 5 cents and closed with 157,804 shares changing hands at $5 for a 52 weeks’ high, after trading earlier at an all-time high of $5.50. Lasco Financial rose 17 cents to close at a new 52 weeks’ high of $3.70, with 26,998 shares changing hands, Lasco Manufacturing closed at $3.50 with 264,625 shares trading, the stock traded earlier as low as $3.10 and Derrimon Trading preference share ended with 400,000 shares trading at $2.10.