The old stock market adage of sell in May and go away continued to influence the market this past week, helped by funds tied up in the Dolla Financial IPO, but most investors should get full refunds early this coming week, as well as the likelihood of the trading commencing in the stock in the latter part of the week.

The week ended with three new listings in the TOP10, as declining stocks dominated the Junior and Main Market.

The week ended with three new listings in the TOP10, as declining stocks dominated the Junior and Main Market.

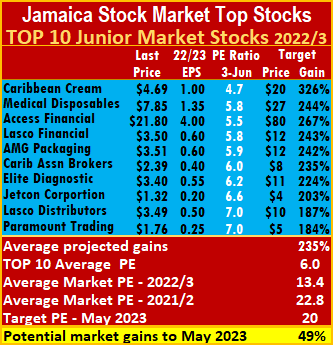

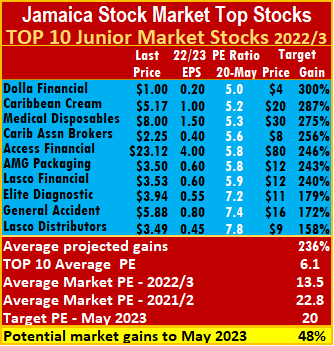

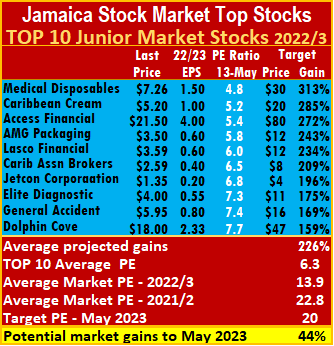

In the Junior Market, the only worthwhile gain was a 14 percent rise by Paramount Trading to $2. Access Financial shed 6 percent to close at $20.45, stocks that declined by 5 percent each are Lasco Financial to $3.43, Jetcon Corporation to $1.26 and Medical Disposables to $7.45.

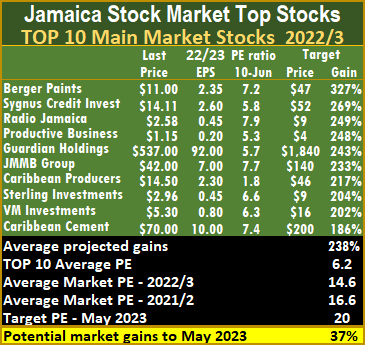

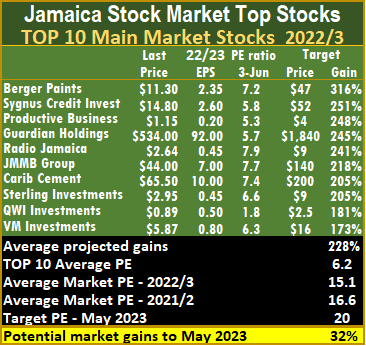

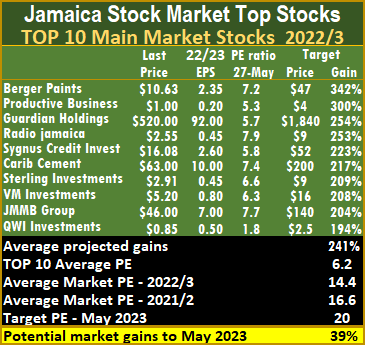

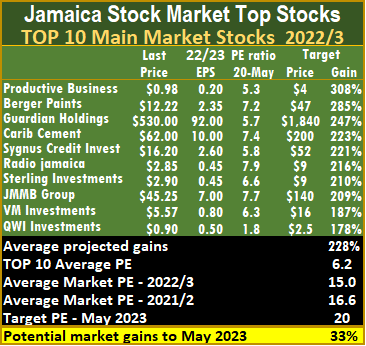

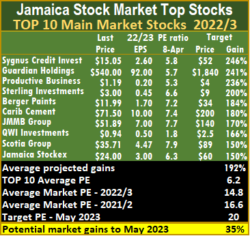

For the TOP10 Main Market stocks, Caribbean Cement gained 7 percent to $70 after the company reported a proposed $1.50 dividend payment in August. VM Investments lost 10 percent to $5.30, Berger Paints slipped 3 percent to $11, JMMB Group down 5 percent to $42 and Sygnus Credit Investments dipped 5 percent to $14.11.

Lasco Distributors and Paramount Trading dropped out of the Junior Market TOP10. They were replaced by Dolphin Cove, with the price dropping to $15.40 and Stationery and Office Supplies (SOS).

SOS got an earnings upgrade to $1.70, with first quarter revenues 24 percent ahead of 2019, the previous best quarter before the negative impact of Covid-19, with the full reopening of the economy after, suggesting revenues should be running even further ahead of 2019 for the second quarter onwards.  Dolphin Cove is benefitting from a resurgence in the tourism industry that is delivering increased revenues compared to 2021. The increased income and cost reduction contribute to a substantial profit increase that will carry over into the first half of 2023. It will enjoy increased revenues since the tourism recovery was not at full force in the first half of this year.

Dolphin Cove is benefitting from a resurgence in the tourism industry that is delivering increased revenues compared to 2021. The increased income and cost reduction contribute to a substantial profit increase that will carry over into the first half of 2023. It will enjoy increased revenues since the tourism recovery was not at full force in the first half of this year.

In the Main Market, Caribbean Producers is back, with upgraded earnings for the fiscal year to June 2023 of $2.30 per share that will flow from increased earnings for the year starting in July as it benefits from the recovery in the tourism sectors from which the bulk of its revenues is earned. QWI Investments has dropped out of the ten.

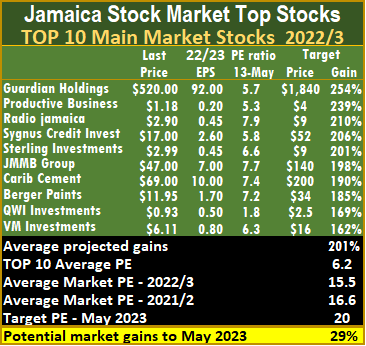

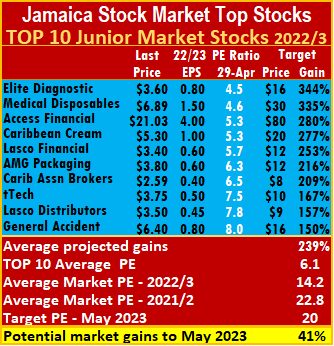

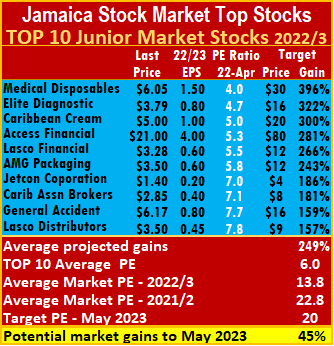

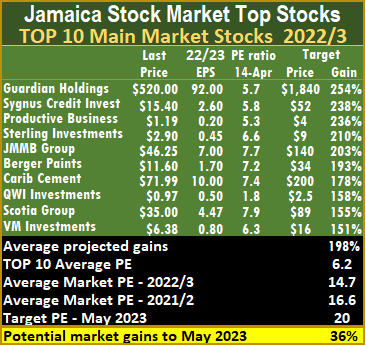

The average PE for the JSE Main Market TOP 10 ends the week at 6.2, well below the market average of 14.6, while the Junior Market PE for the Top 10, is 6 versus the market at 12.9. The Junior Market TOP10 is projected to gain an average of 235 percent to May 2023 and the Main Market 228 percent.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023. They are ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Following last week’s 330 points fall, the Junior Market index recovered 143 points by the end of the week, while the Main Market All Jamaica Index lost 211 points on top of the 5,954.55 points given up in the previous week.

Following last week’s 330 points fall, the Junior Market index recovered 143 points by the end of the week, while the Main Market All Jamaica Index lost 211 points on top of the 5,954.55 points given up in the previous week. Jetcon Corporation price dipped to $1.32 and squeezed out General Accident from the Junior Market TOP10.

Jetcon Corporation price dipped to $1.32 and squeezed out General Accident from the Junior Market TOP10. ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes. The shifting of Dolla Financial out of the TOP10 resulted in

The shifting of Dolla Financial out of the TOP10 resulted in  During the week, General Accident reported first quarter results with profit due to shareholders of the parent company rising 36 percent to $49 million, Friday after trading, Lasco Distributors reported profit increasing 12 percent for the full year to $1 billion but the final quarter being up 35 percent to $241 million and Lasco Manufacturing rising 45 percent in the March quarter to $522 million and the full year up 24 percent to $1.7 billion.ICInsider.com upgraded earnings for Lasco Distributors to 50 cents from 45 cents, but the others remain as previously stated. All three stocks are trading below ten times 2022 earnings and therefore have huge potential to appreciate.

During the week, General Accident reported first quarter results with profit due to shareholders of the parent company rising 36 percent to $49 million, Friday after trading, Lasco Distributors reported profit increasing 12 percent for the full year to $1 billion but the final quarter being up 35 percent to $241 million and Lasco Manufacturing rising 45 percent in the March quarter to $522 million and the full year up 24 percent to $1.7 billion.ICInsider.com upgraded earnings for Lasco Distributors to 50 cents from 45 cents, but the others remain as previously stated. All three stocks are trading below ten times 2022 earnings and therefore have huge potential to appreciate. Watch these stocks that sit just outside the TOP10 that investors should watch. They include Key Insurance, followed by Caribbean Producers and Scotia Group from the Main Market. In the Junior Market, Iron Rock Insurance, Dolphin Cove, Jetcon Corporation, Stationery and Office Supplies and Lasco Manufacturingreported strong fourth quarter results to March this year.

Watch these stocks that sit just outside the TOP10 that investors should watch. They include Key Insurance, followed by Caribbean Producers and Scotia Group from the Main Market. In the Junior Market, Iron Rock Insurance, Dolphin Cove, Jetcon Corporation, Stationery and Office Supplies and Lasco Manufacturingreported strong fourth quarter results to March this year. The other stock to climb into the ICTOP10 this week is Lasco Distributors, back in at the number 10 spot.

The other stock to climb into the ICTOP10 this week is Lasco Distributors, back in at the number 10 spot.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

Access Financial jumped 22 percent last week, and is down 16 percent this past week at $21.50, and attracted more buying interest as the release of year results approaches. tTech tumbled 8 percent during the week and

Access Financial jumped 22 percent last week, and is down 16 percent this past week at $21.50, and attracted more buying interest as the release of year results approaches. tTech tumbled 8 percent during the week and  The primary mover in the main market was Caribbean Cement that fell 12 percent to $61 as buying interest in the stock remains low, even as the first quarter results suggest the stock is highly undervalued, no other stock had any serious change.

The primary mover in the main market was Caribbean Cement that fell 12 percent to $61 as buying interest in the stock remains low, even as the first quarter results suggest the stock is highly undervalued, no other stock had any serious change.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes. In addition to the Top15 selection for each market at the start of the year, we added a few stocks. There were nine winning stocks with good gains. The list includes AMG Packaging 73 percent, Dolphin Cove 47 percent, Elite up 26 percent, Everything Fresh 83 percent, iCreate 263 percent, Jetcon 75 percent, Spur Tree Spices 215 percent, Stationery and Office Supplies 46 percent and Tropical Batteries up 124 percent for the year to date and up 64 percent since ICInsider.com added it was added to the TOP10 on February 25. Caribbean Cream, down 7 percent, is the only Junior Market stock selection to fall.

In addition to the Top15 selection for each market at the start of the year, we added a few stocks. There were nine winning stocks with good gains. The list includes AMG Packaging 73 percent, Dolphin Cove 47 percent, Elite up 26 percent, Everything Fresh 83 percent, iCreate 263 percent, Jetcon 75 percent, Spur Tree Spices 215 percent, Stationery and Office Supplies 46 percent and Tropical Batteries up 124 percent for the year to date and up 64 percent since ICInsider.com added it was added to the TOP10 on February 25. Caribbean Cream, down 7 percent, is the only Junior Market stock selection to fall. The big TOP15 winners for the Main Market are Caribbean Producers, up 42 percent, Jamaica Stock Exchange at 22 percent, JMMB Group at 16 percent and Proven at 14 percent. Berger Paints, down 7 percent, Jamaica Broilers, with a fall of 3 percent and Scotia Group, down one percent, are the only losers in this segment.

The big TOP15 winners for the Main Market are Caribbean Producers, up 42 percent, Jamaica Stock Exchange at 22 percent, JMMB Group at 16 percent and Proven at 14 percent. Berger Paints, down 7 percent, Jamaica Broilers, with a fall of 3 percent and Scotia Group, down one percent, are the only losers in this segment. ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

The Junior Market ended with three stocks rising from 8 to 15 percent. Caribbean Assurance Brokers climbed 10 percent for the week while Jetcon Corporation rose 8 percent to close at $1.40. Declining were Lasco Financial, down 8 percent and Access Financial and AMG Packaging, down 5 percent, as buying eased markedly following improved results released at the close of the market ahead of the Easter weekend. Investors seem not to be factoring in cost savings and increased efficiency that the newly installed machine brings to the business following the close of the recent quarter. With a 5 percent rise, Guardian Holdings was the biggest mover in the Main Market.

The Junior Market ended with three stocks rising from 8 to 15 percent. Caribbean Assurance Brokers climbed 10 percent for the week while Jetcon Corporation rose 8 percent to close at $1.40. Declining were Lasco Financial, down 8 percent and Access Financial and AMG Packaging, down 5 percent, as buying eased markedly following improved results released at the close of the market ahead of the Easter weekend. Investors seem not to be factoring in cost savings and increased efficiency that the newly installed machine brings to the business following the close of the recent quarter. With a 5 percent rise, Guardian Holdings was the biggest mover in the Main Market. ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes. General Accident returned to the Junior Market TOP10 as tTech dropped out and VM Investments returns to the Top10 Main Market as Jamaica Stock Exchange fell out.

General Accident returned to the Junior Market TOP10 as tTech dropped out and VM Investments returns to the Top10 Main Market as Jamaica Stock Exchange fell out. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes. Scotia Group is ICInsider.com’s new stock for the future that comes into the Main Market ICTOP10 at number 9, with projected earnings of $4.47 per share as the group generates increasing income from the sharp hike BOJ induced hike in interest rates on investments.

Scotia Group is ICInsider.com’s new stock for the future that comes into the Main Market ICTOP10 at number 9, with projected earnings of $4.47 per share as the group generates increasing income from the sharp hike BOJ induced hike in interest rates on investments. ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to shares that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to shares that often result in costly mistakes.