Dolphin Cove returns to the ICInsider.com TOP10 list after a very long absence. The company’s half year results show a major upturn in fortunes, with prospects of good full year results. The stock replaces CAC2000 that slipped out of the top list.

Dolphin Cove reported a profit of US$1.24 million in the June quarter or 49 cents in Jamaican currency, thus wiping out the first quarter loss of US$155,000 and seems on target to generate around $3.3 million in profit for the year.

Dolphin Cove reported a profit of US$1.24 million in the June quarter or 49 cents in Jamaican currency, thus wiping out the first quarter loss of US$155,000 and seems on target to generate around $3.3 million in profit for the year.

Last week’s number one Main Market stock – RJR, dropped to position 7 this week, with the price jumping to $3.50 from $2.25 last week. It could be out of the TOP10 next week if buying interest continues to come into the market, with the stock gaining 60 percent for the week and a respectable 91 percent for the year to date. That is not a bad performance for a stock sold for $1.10 in December last year and one that not many investors looked at until recent results were released. Interestingly, while many investors looked elsewhere, the smart money was laser focused on the future and the boom in revenues that was to come from growth in various areas of the economy that would increase advertising spend and push quarter profits to record levels.  The smart money bought 52 million shares on April 6 last year, at an average of $1.33. On April 13, 95.4 million units were picked up and 67.7 million on April 27 at $1.26. The next big buy was August 17th, with 10 million units at $1.30 and 0n October 19 with 20 million units.

The smart money bought 52 million shares on April 6 last year, at an average of $1.33. On April 13, 95.4 million units were picked up and 67.7 million on April 27 at $1.26. The next big buy was August 17th, with 10 million units at $1.30 and 0n October 19 with 20 million units.

Outside the Junior and Main markets TOP10, investors should watch AMG Packaging and Sterling Investments.

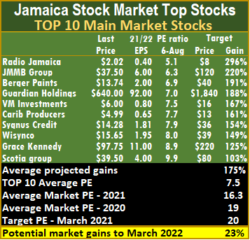

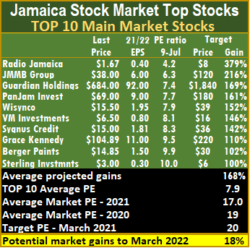

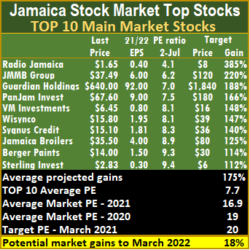

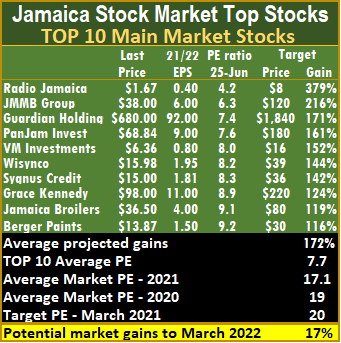

After more than a year and a half at the top of the ICTOP10 listing Radio Jamaica finally broke lose this week, with the price hitting new daily 52 weeks’ highs and ended at $3.50 on Friday. The top three Main Market stocks are now headed by Berger Paints, with the potential to gain 277 percent, followed by JMMB Group and Guardian Holdings, with expected gains of 202 to 277 percent for the three, versus last weeks’ 200 to 300 percent.

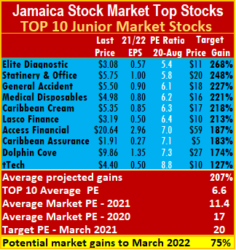

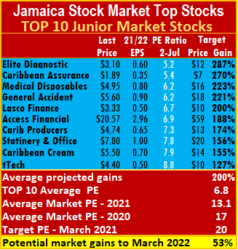

The top three stocks in the Junior Market are Elite Diagnostic, followed by Stationery and Office Supplies that fell on Friday to $5.75, from $7.43 last week and General Accident, with all three having the potential to gain between 221 percent and 295 percent, compared to 256 and 336 percent, last week.

The top three stocks in the Junior Market are Elite Diagnostic, followed by Stationery and Office Supplies that fell on Friday to $5.75, from $7.43 last week and General Accident, with all three having the potential to gain between 221 percent and 295 percent, compared to 256 and 336 percent, last week.

Last week, a few companies’ profit results were highlighted; one that was not and came out with less than exciting profit numbers is Elite that is top of the Junior Market listing. The company came to the market with much promise but has failed to deliver on its promise. A close assessment of the June results shows an increase in revenue in each quarter in the last fiscal year over the prior quarter, suggesting that if the trend continues, the current fiscal year should see a big rise in revenues and profits. The paying of a dividend that is greater than the reported profit for the last fiscal year is an indication that things are likely to be better in the current year. The other factor is that EBITA is strong with a fairly stable depreciation charge of 20 percent of revenues.

This past week the average gains projected for the Junior Market moved from 193 percent to 207 percent and Main Market stocks from 180 percent to 172 percent.

This past week the average gains projected for the Junior Market moved from 193 percent to 207 percent and Main Market stocks from 180 percent to 172 percent.

The Junior Market closed the week with an average PE of 11.4 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year, based on 2020 earnings.

The JSE Main Market ended the week with an overall PE of 15.6, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022.  The Main Market TOP 10 trades at a PE of 7.6, with a 41 percent discount to the PE of that market, well off the potential of 20.

The Main Market TOP 10 trades at a PE of 7.6, with a 41 percent discount to the PE of that market, well off the potential of 20.

The TOP10 stocks are not always the best in the market but are likely to be the best winners within a fifteen-month period. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

The bad news is that many persons ignore ICInnsider.com’s forecast of great things to come from the company, with many chasing after it on Friday after the release of the results on Thursday. Some readers bought into the vision but not all. The good news is that, with projected earnings of 45 cents per share, there is much room for this stock to run. The other good news is that there is much more to be gained by owning the stock as the company completes projects that will boost revenues and grow profits in the years to come.

The bad news is that many persons ignore ICInnsider.com’s forecast of great things to come from the company, with many chasing after it on Friday after the release of the results on Thursday. Some readers bought into the vision but not all. The good news is that, with projected earnings of 45 cents per share, there is much room for this stock to run. The other good news is that there is much more to be gained by owning the stock as the company completes projects that will boost revenues and grow profits in the years to come. With those strong results and the promise of 45 cents per share to be earned for this year and 80 cents in the next year, one would be forgiven if they felt that RJR should be dislodged from the ICTOP10 listing. Well, the top three Main Market stocks are headed again by Radio Jamaica, but the potential gains rose from 296 percent to 300 percent, even as the price moved up to a 52 weeks’ closing high of $2.25 from $2.02 last week, due to upgrading in the earnings to 45 cents per share or $1.1 billion. RJR is followed by

With those strong results and the promise of 45 cents per share to be earned for this year and 80 cents in the next year, one would be forgiven if they felt that RJR should be dislodged from the ICTOP10 listing. Well, the top three Main Market stocks are headed again by Radio Jamaica, but the potential gains rose from 296 percent to 300 percent, even as the price moved up to a 52 weeks’ closing high of $2.25 from $2.02 last week, due to upgrading in the earnings to 45 cents per share or $1.1 billion. RJR is followed by The PE Ratio of the TOP 10 Junior Market stocks trade at a 44 percent discount to the market average and Main Market stocks 54 percent, indicating the potential gains in these stocks compared with many of those outsides of them.

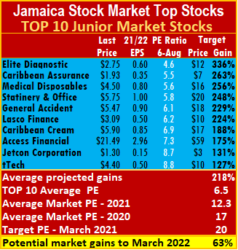

The PE Ratio of the TOP 10 Junior Market stocks trade at a 44 percent discount to the market average and Main Market stocks 54 percent, indicating the potential gains in these stocks compared with many of those outsides of them. This past week, the average gains projected for the Junior Market moved from 218 percent to 193 percent and Main Market stocks to 180 percent from 175 percent.

This past week, the average gains projected for the Junior Market moved from 218 percent to 193 percent and Main Market stocks to 180 percent from 175 percent. The Junior Market Top 10 stocks average PE is a mere 6.9, just 54 percent of the market average, indicating substantial gains ahead.

The Junior Market Top 10 stocks average PE is a mere 6.9, just 54 percent of the market average, indicating substantial gains ahead.

The top three stocks in the Junior Market, continue to be Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 256 percent and 336 percent compared to 221 and 287 percent, last week. Medical Disposables continues the addition of new products to its portfolio that will add revenues and profit going forward. The acquisition of the 60 percent majority ownership in Cornwall Enterprises, will result in economies of scale and an expanded portfolio to market nationally to an expanded clientele.

The top three stocks in the Junior Market, continue to be Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 256 percent and 336 percent compared to 221 and 287 percent, last week. Medical Disposables continues the addition of new products to its portfolio that will add revenues and profit going forward. The acquisition of the 60 percent majority ownership in Cornwall Enterprises, will result in economies of scale and an expanded portfolio to market nationally to an expanded clientele. The Top10 Main Market leader Radio Jamaica continues to enjoy buying interest that is whittling away the supply of stocks on offer in the market. A barrage of new results are due this coming week as the final reporting day for the period will be Saturday this coming week.

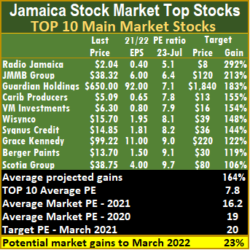

The Top10 Main Market leader Radio Jamaica continues to enjoy buying interest that is whittling away the supply of stocks on offer in the market. A barrage of new results are due this coming week as the final reporting day for the period will be Saturday this coming week. The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 54 percent discount to the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 54 percent discount to the PE of that market, well off the potential of 20. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

The top three stocks in the Junior Market, continue, with Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 221 percent and 287 percent compared to 237 and 291 percent, last week. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by JMMB Group and Guardian Holdings, with expected gains of 184 to 296 percent, versus last weeks’ 183 to 292 percent.

The top three stocks in the Junior Market, continue, with Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 221 percent and 287 percent compared to 237 and 291 percent, last week. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by JMMB Group and Guardian Holdings, with expected gains of 184 to 296 percent, versus last weeks’ 183 to 292 percent. The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.6 or 46 percent of the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.6 or 46 percent of the PE of that market, well off the potential of 20. The TOP10 stocks are not always the best stocks in the market but ones that are most likely to be the best winners within a fifteen months period. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

The TOP10 stocks are not always the best stocks in the market but ones that are most likely to be the best winners within a fifteen months period. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

That is one reason why many of the selections at the start of the year have done well. Examples are as such, Caribbean Cream up 43 percent for the year to date started the year at the number 2 spot, Caribbean Producers the number 3 spot selection is up 82 percent, Main Event up 73 percent, Medical Disposables up just 12 percent, Stationery & Office Supplies 55 percent, Lumber Depot 116 percent and Mailpac 32 percent. Later, Future Energy Source was added to the list at the IPO stage and is up an impressive 110 percent. Additionally, Jetcon Corporation up 76 percent and Jamaican Teas 100 percent are not being counted. The Main Market with few overall winners for that market so far also produced winners from the TOP15 list, posted at the start of the year, Grace, Carreras, Caribbean Cement and Jamaica Broilers.

That is one reason why many of the selections at the start of the year have done well. Examples are as such, Caribbean Cream up 43 percent for the year to date started the year at the number 2 spot, Caribbean Producers the number 3 spot selection is up 82 percent, Main Event up 73 percent, Medical Disposables up just 12 percent, Stationery & Office Supplies 55 percent, Lumber Depot 116 percent and Mailpac 32 percent. Later, Future Energy Source was added to the list at the IPO stage and is up an impressive 110 percent. Additionally, Jetcon Corporation up 76 percent and Jamaican Teas 100 percent are not being counted. The Main Market with few overall winners for that market so far also produced winners from the TOP15 list, posted at the start of the year, Grace, Carreras, Caribbean Cement and Jamaica Broilers.  PanJam Investment earnings is downgraded to $4.50 per share and the stock moved out of the TOP10 Main Market listing and is replaced by Scotia Group, now in at tenth spot. There are no changes in or out of the Junior Market list.

PanJam Investment earnings is downgraded to $4.50 per share and the stock moved out of the TOP10 Main Market listing and is replaced by Scotia Group, now in at tenth spot. There are no changes in or out of the Junior Market list. The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 17 percent to hit a PE of 19 and 23 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 6.8, just 52 percent of the market average, indicating substantial gains ahead.

The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 17 percent to hit a PE of 19 and 23 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 6.8, just 52 percent of the market average, indicating substantial gains ahead. The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.8 or 48 percent of the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.8 or 48 percent of the PE of that market, well off the potential of 20.

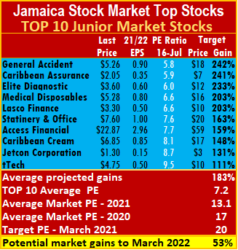

This past week the average gains projected for the Junior Market fell from 202 percent last week to 183 percent and Main Market stocks moved to 176 percent from 170 percent.

This past week the average gains projected for the Junior Market fell from 202 percent last week to 183 percent and Main Market stocks moved to 176 percent from 170 percent. The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 as well as the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 19 percent to hit a PE of 19 and 24 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 7.2., just 55 percent of the market average, indicating substantial gains ahead.

The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 as well as the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 19 percent to hit a PE of 19 and 24 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 7.2., just 55 percent of the market average, indicating substantial gains ahead. This week’s focus: Results for

This week’s focus: Results for  IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

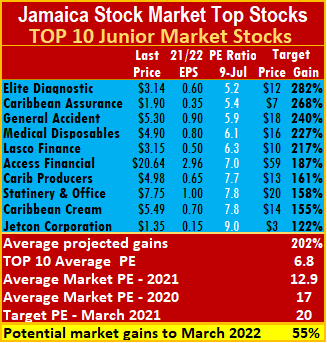

This past week the average gains projected for the Junior Market rose from 200 percent last week to 202 percent and Main Market stocks edged down from last week’s 171 percent to 168 percent.

This past week the average gains projected for the Junior Market rose from 200 percent last week to 202 percent and Main Market stocks edged down from last week’s 171 percent to 168 percent. For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 32 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would need to rise by 11 percent to hit a PE of 19 and 17 percent to get to the target of 20.

For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 32 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would need to rise by 11 percent to hit a PE of 19 and 17 percent to get to the target of 20. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

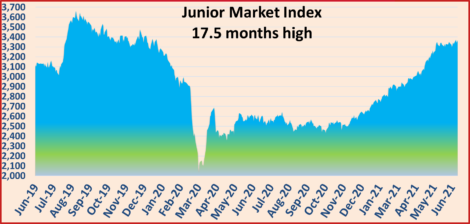

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information. The Junior Market recovered all of its Covid-19 related loss and more in hitting its highest level this week, since the first week of December 2019, helped by a number of ICInsider.com Top stocks of which 6 recorded gains between 69 percent and 81 and two over 100 percent, with the market up 29 percent for 2021 to date.

The Junior Market recovered all of its Covid-19 related loss and more in hitting its highest level this week, since the first week of December 2019, helped by a number of ICInsider.com Top stocks of which 6 recorded gains between 69 percent and 81 and two over 100 percent, with the market up 29 percent for 2021 to date.

The top three stocks in the Junior Market are Elite, Caribbean Assurance and Medical Disposables, with the potential to gain between 223 and 287 percent, following the range of 254 to 276 percent last week. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by JMMB Group and Guardian Holdings, with expected gains of 171 to 379 percent versus last weeks’ 188 to 385 percent.

The top three stocks in the Junior Market are Elite, Caribbean Assurance and Medical Disposables, with the potential to gain between 223 and 287 percent, following the range of 254 to 276 percent last week. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by JMMB Group and Guardian Holdings, with expected gains of 171 to 379 percent versus last weeks’ 188 to 385 percent. For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 31 percent and requires a rise of 54 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would need to rise by 11 percent to hit a PE of 19 and 17 percent to get to the target of 20.

For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 31 percent and requires a rise of 54 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would need to rise by 11 percent to hit a PE of 19 and 17 percent to get to the target of 20. Main market had three days of decline but ended the week with a fall of points after recording a strong rise the previous week.

Main market had three days of decline but ended the week with a fall of points after recording a strong rise the previous week.

This past week the average gains projected for the Junior stocks slipped from 207 percent last week to 204 percent and the Main Market stocks moved up from last week’s 166 percent up to 172 percent with the upgrading of JMMB earnings.

This past week the average gains projected for the Junior stocks slipped from 207 percent last week to 204 percent and the Main Market stocks moved up from last week’s 166 percent up to 172 percent with the upgrading of JMMB earnings. The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year based on 2020 earnings. For the market to trade at the historical average, the PE Ratio would have to rise by 31 percent and require a rise of 52 percent to March 2022 to reach the targeted PE of 20.

The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year based on 2020 earnings. For the market to trade at the historical average, the PE Ratio would have to rise by 31 percent and require a rise of 52 percent to March 2022 to reach the targeted PE of 20. The Main Market TOP 10 trades at a PE of 7.9 or 46 percent of the PE of that market, well off the potential of 20.

The Main Market TOP 10 trades at a PE of 7.9 or 46 percent of the PE of that market, well off the potential of 20. The market was only above Friday’s close for one day in early January last year when the index closed at 3,378.20 points on January 3 and one day in June this year.

The market was only above Friday’s close for one day in early January last year when the index closed at 3,378.20 points on January 3 and one day in June this year.