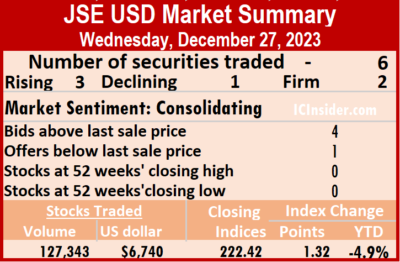

Trading resumed on Wednesday on the Jamaica Stock Exchange US dollar market after the break for the Christmas Holidays and ended with a 20 percent decline in the volume of stocks changing hands but with 146 percent greater value than on Friday, resulting in trading in six securities, similar to Friday and ended with prices of three stocks rising, one declining and two ending unchanged.

At the close of trading, 127,343 shares were exchanged at US$6,740 compared with 159,494 stock units at US$2,742 on Friday.

At the close of trading, 127,343 shares were exchanged at US$6,740 compared with 159,494 stock units at US$2,742 on Friday.

Trading ended with an average of 21,224 shares at US$1,123 compared to 26,582 shares at US$457 on Friday, with a month to date average of 28,258 units at US$1,365 compared with 28,793 stock units at US$1,383 previously. November ended with an average of 249,102 shares for US$14,204.

The US Denominated Equities Index added 1.32 points to close at 222.42.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Margaritaville rose 1.75 cents to close at 12.5 US cents in exchanging 95 shares, Proven Investments climbed 0.91 of one cent to 14.91 US cents after trading of 3,543 stocks, Sterling Investments popped 0.02 of a cent to close at 1.6 US cents with a transfer of 350 shares. Sygnus Credit Investments ended at 9 US cents after 8,525 stocks were exchanged and Transjamaican Highway ended at 1.6 US cents with a transfer of 114,502 shares.

At the close, Margaritaville rose 1.75 cents to close at 12.5 US cents in exchanging 95 shares, Proven Investments climbed 0.91 of one cent to 14.91 US cents after trading of 3,543 stocks, Sterling Investments popped 0.02 of a cent to close at 1.6 US cents with a transfer of 350 shares. Sygnus Credit Investments ended at 9 US cents after 8,525 stocks were exchanged and Transjamaican Highway ended at 1.6 US cents with a transfer of 114,502 shares.

In the preference segment, Productive Business Solutions 9.25% preference share dipped 50 cents to US$11, with 328 units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Subdued trading on the JSE USD Market

Trading picks up on the JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks changing hands surging 2,344 percent valued at 758 percent more than on Thursday and resulting in the trading of six securities, compared to three on Thursday with none rising, one declining and five ending unchanged.

Overall, 159,494 shares were traded, for US$2,742 compared with 6,525 units at US$320 on Thursday.

Overall, 159,494 shares were traded, for US$2,742 compared with 6,525 units at US$320 on Thursday.

Trading ended with an average of 26,582 shares for US$457 compared with 2,175 units at US$107 on Thursday. Trading for the month to date averages 28,793 shares at US$1,383 compared to 28,974 units at US$1,459 on the previous day, well off from November, with an average of 249,102 units for US$14,204.

The US Denominated Equities Index dipped 2.03 points to 221.10.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close of trading, Productive Business Solutions ended at US$1.55 in an exchange of 64 shares, Proven Investments remained at 14 US cents with investors transferring 364 units, Sterling Investments ended at 1.58 US cents after an exchange of 8,885 shares. Sygnus Credit Investments remained at 9 US cents with investors swapping 144 stock units and Transjamaican Highway declined 0.05 of a cent to close at 1.6 US cents, with 150,000 shares crossing the exchange.

At the close of trading, Productive Business Solutions ended at US$1.55 in an exchange of 64 shares, Proven Investments remained at 14 US cents with investors transferring 364 units, Sterling Investments ended at 1.58 US cents after an exchange of 8,885 shares. Sygnus Credit Investments remained at 9 US cents with investors swapping 144 stock units and Transjamaican Highway declined 0.05 of a cent to close at 1.6 US cents, with 150,000 shares crossing the exchange.

In the preference segment, JMMB Group 6% remained at US$1.05 with traders dealing in 37 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks up on the JSE USD Market

Trading climbed back from Thursday’s depressed levels on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks changing hands rising 393 percent valued 782 percent more than on Thursday and resulting in trading of five securities, compared to three on Thursday with none rising, three declining and two ending unchanged.

A total of 49,892 shares were traded for US$8,545, up sharply from just 10,110 units at a mere US$968 on Thursday.

A total of 49,892 shares were traded for US$8,545, up sharply from just 10,110 units at a mere US$968 on Thursday.

Trading averaged 9,978 units at US$1,709, versus 3,370 shares at US$323 on Thursday, with a month to date average of 29,349 shares at US$1,693 compared with 31,248 units at US$1,691 on the previous day, well down on November with an average of 249,102 units for US$14,204.

The US Denominated Equities Index sank 4.56 points to close at 219.33.

The PE Ratio10.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and none with a lower offer.

At the close, MPC Caribbean Clean Energy ended at 57 US cents after 32 units passed through the market,  Productive Business Solutions ended at US$1.55 after 33 stocks were traded, Proven Investments slipped 0.43 of a cent to 13.09 US cents after 18,770 shares were traded and Transjamaican Highway dipped 0.02 of a cent to end at 1.68 US cents, with 25,739 stock units crossing the market.

Productive Business Solutions ended at US$1.55 after 33 stocks were traded, Proven Investments slipped 0.43 of a cent to 13.09 US cents after 18,770 shares were traded and Transjamaican Highway dipped 0.02 of a cent to end at 1.68 US cents, with 25,739 stock units crossing the market.

In the preference segment, JMMB Group 6% fell 1 cent to close at US$1.05 while exchanging 5,318 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading sank on the JSE USD Market

Trading came to a virtual halt on Thursday as it sank drastically on the Jamaica Stock Exchange US dollar market, with a 99 percent plunge in the volume of stocks changing hands and a 93 percent collapse in value compared to Wednesday and resulting in the trading of three securities, similar to Wednesday with all three rising.

Overall, 10,110 shares were traded, for US$968 down sharply from 730,855 units at US$13,102 on Wednesday.

Overall, 10,110 shares were traded, for US$968 down sharply from 730,855 units at US$13,102 on Wednesday.

Trading averaged 3,370 units at US$323, versus 243,618 shares at US$4,367 on Wednesday, with a month to date average of 31,248 shares at US$1,691 down from 32,990 units at US$1,777 on the previous day and well off from November with an average of 249,102 units for US$14,204.

The US Denominated Equities Index rose 0.13 points to finish at 223.89.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Sygnus Real Estate Finance USD share climbed 0.29 of one cent to close at 7 US cents in an exchange of 81 stocks and Transjamaican Highway rose 0.05 of a cent to 1.7 US cents with 9,960 units crossing the market.

At the close, Sygnus Real Estate Finance USD share climbed 0.29 of one cent to close at 7 US cents in an exchange of 81 stocks and Transjamaican Highway rose 0.05 of a cent to 1.7 US cents with 9,960 units crossing the market.

In the preference segment, Productive Business Solutions 9.25% preference share rallied 10 cents in closing at US$11.50 after an exchange of 69 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading jumps on the JSE USD Market

Trading picked up on the Jamaica Stock Exchange US dollar market on Wednesday, with the volume of stocks changing hands surging 613 percent with 35 percent higher valued than Tuesday, resulting from trading in three securities, down from eight on Tuesday with two rising, one declining.

A total of 730,855 shares were traded for US$13,102, up from 102,487 stock units at US$9,725 on Tuesday.

A total of 730,855 shares were traded for US$13,102, up from 102,487 stock units at US$9,725 on Tuesday.

Trading averaged 243,618 units at US$4,367 compared with 12,811 shares at US$1,216 on Tuesday, with a month to date average of 32,990 shares at US$1,777 compared to 18,949 units at US$1,604 on the previous day, down from November with an average of 249,102 units for US$14,204.

The US Denominated Equities Index increased 1.76 points to culminate at 223.76.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Sygnus Credit Investments gained 0.19 of one cent to end at 8.9 US cents with investors transferring 1,500 stock units and Transjamaican Highway shed 0.07 of a cent in closing at 1.65 US cents with 729,305 shares crossing the market.

At the close, Sygnus Credit Investments gained 0.19 of one cent to end at 8.9 US cents with investors transferring 1,500 stock units and Transjamaican Highway shed 0.07 of a cent in closing at 1.65 US cents with 729,305 shares crossing the market.

In the preference segment, Productive Business Solutions 9.25% preference share popped US$1.39 to close at US$11.40 with an exchange of 50 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Sharp drop in JSE USD Market trades

Trading dropped sharply on the Jamaica Stock Exchange US dollar market on Monday, with a 93 percent fall in the volume of stocks changing hands at 87 percent lower value than on Friday, resulting from trading in just three securities, down from eight on Friday and closed with the price of one rising, two declining and none trading unchanged.

A mere 3,759 shares were traded for just US$430 down from 57,458 units at US$3,210 on Friday.

A mere 3,759 shares were traded for just US$430 down from 57,458 units at US$3,210 on Friday.

Trading averaged 1,253 units at US$143, versus 7,182 shares at US$401 on Friday, with a month to date average of 20,276 shares at US$1,688 compared with 21,954 units at US$1,825 on the previous day and well off November with an average of 249,102 units for US$14,204.

The US Denominated Equities Index dropped 6.78 points to close at 223.83.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, First Rock Real Estate USD share declined 0.03 of a cent to 4.37 US cents as investors exchanged 1,887 stocks, Margaritaville increased 0.11 of a cent to end at 11 US cents after a transfer of 1,774 units and Productive Business Solutions fell 10.77 cents in closing at US$1.55, with 98 shares crossing the exchange

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

The value of stocks traded on the Junior and Main markets surged to $527.23 million compared with a mere $48.29 million on Thursday. The JSE USD market closed after 159,494 shares were traded, for US$2,742 compared to 6,525 units at US$320 on Thursday.

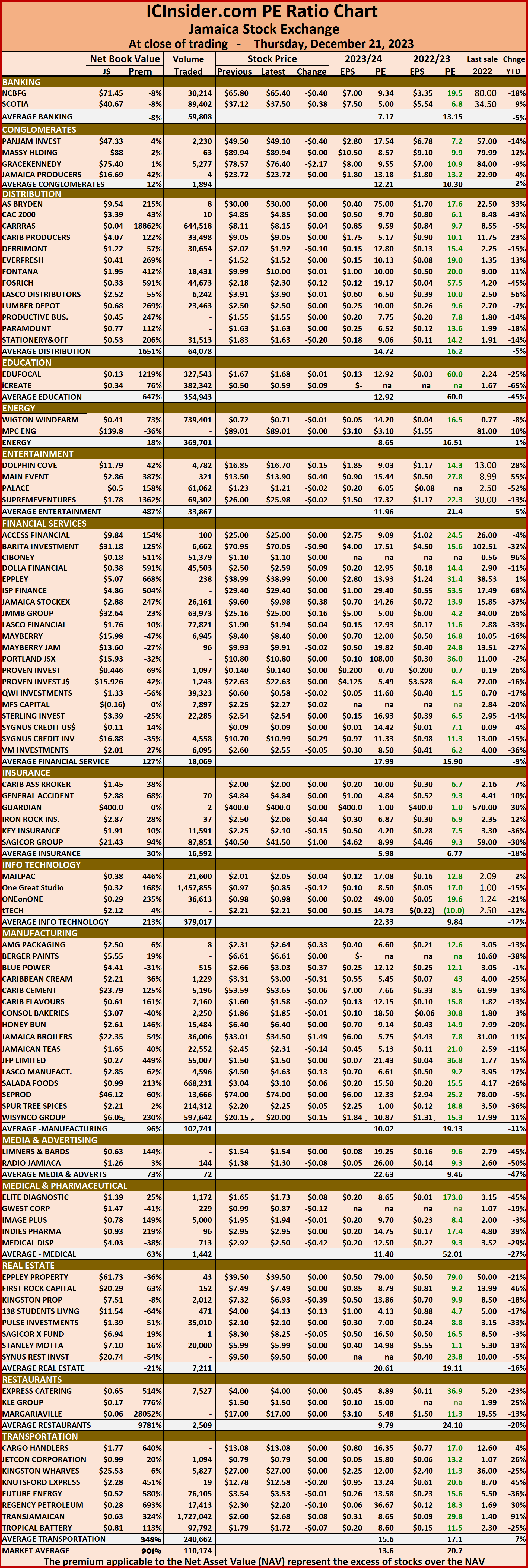

The value of stocks traded on the Junior and Main markets surged to $527.23 million compared with a mere $48.29 million on Thursday. The JSE USD market closed after 159,494 shares were traded, for US$2,742 compared to 6,525 units at US$320 on Thursday. the JSE Main Index rallied by 812.63 points to end trading at 316,798.45. The Junior Market Index rallied 45.75 points to end the day at 3,728.14 and the JSE USD Market Index skidded 2.03 points to wrap up trading at 221.10.

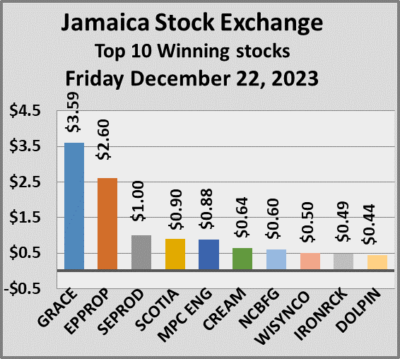

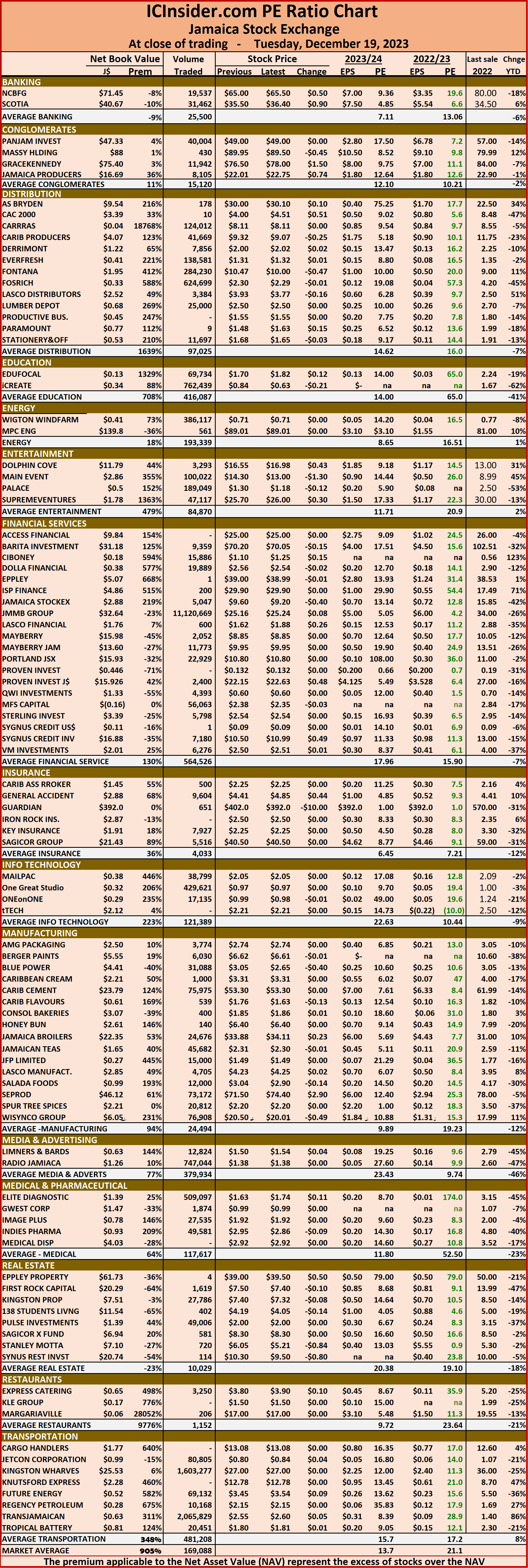

the JSE Main Index rallied by 812.63 points to end trading at 316,798.45. The Junior Market Index rallied 45.75 points to end the day at 3,728.14 and the JSE USD Market Index skidded 2.03 points to wrap up trading at 221.10. The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

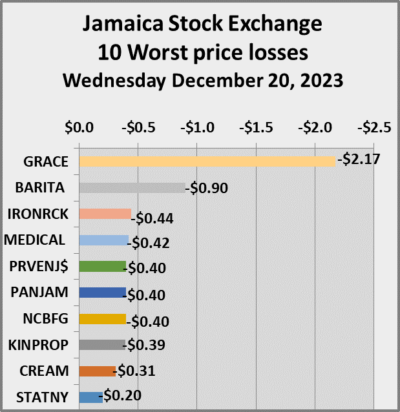

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. At the close of the market, Main Market stocks rallying were Jamaica Broilers with a gain of $1.49, Sagicor Group up $1 and Scotia Group closing at a new 52 weeks’ closing high of $37.50, after gaining 38 cents. Declining Main Market stocks include GraceKennedy down $2.17 and Barita Investments with a fall of 90 cents.

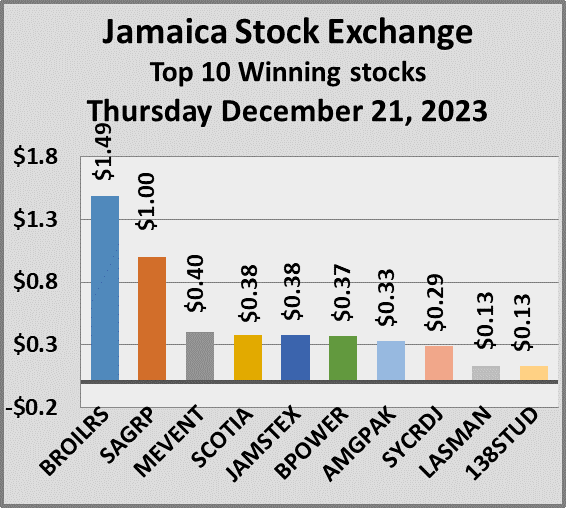

At the close of the market, Main Market stocks rallying were Jamaica Broilers with a gain of $1.49, Sagicor Group up $1 and Scotia Group closing at a new 52 weeks’ closing high of $37.50, after gaining 38 cents. Declining Main Market stocks include GraceKennedy down $2.17 and Barita Investments with a fall of 90 cents. Investors traded 10,449,490 shares, in all three markets, down from 13,761,322 units on Tuesday. The value of stocks traded on the Junior and Main markets amounts to $48.29 million compared with $65.97 million on Tuesday. The JSE USD market closed after just 6,525 shares were traded, for US$320 compared to 130,502 units at US$2,973 on Wednesday.

Investors traded 10,449,490 shares, in all three markets, down from 13,761,322 units on Tuesday. The value of stocks traded on the Junior and Main markets amounts to $48.29 million compared with $65.97 million on Tuesday. The JSE USD market closed after just 6,525 shares were traded, for US$320 compared to 130,502 units at US$2,973 on Wednesday. The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

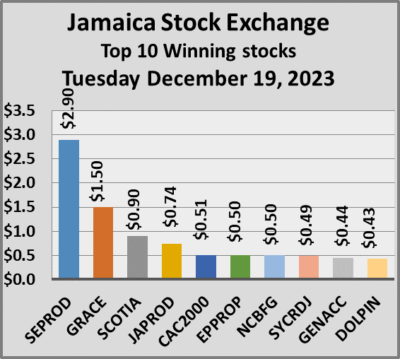

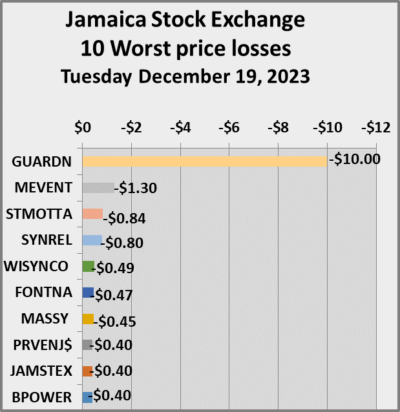

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. At the close of the market, the Main Market stocks rallying were Seprod up $2.90 followed by GraceKennedy with a rise of $1.50, Scotia Group climbing 90 cents to close at a new 52 weeks’ closing high and Jamaica Producers up by 74 cents. Declining Main Market stocks include Guardian Holdings down $10, Stanley Motta off 84 cents and Sygnus Real Estate Finance losing 80 cents.

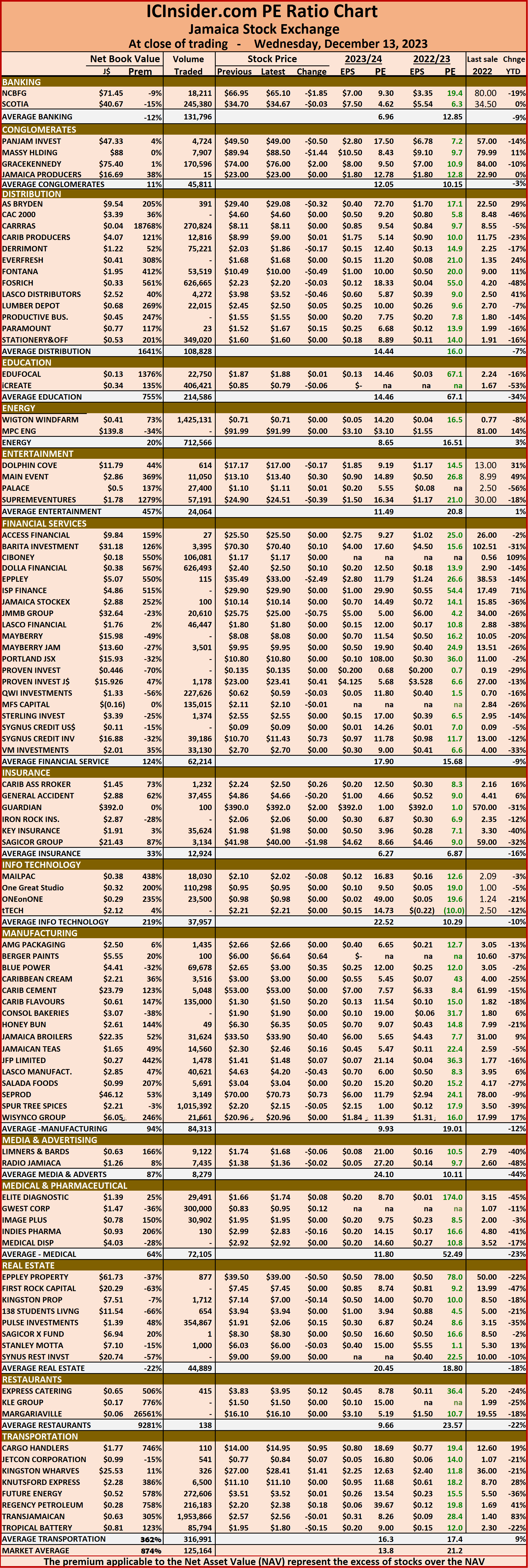

At the close of the market, the Main Market stocks rallying were Seprod up $2.90 followed by GraceKennedy with a rise of $1.50, Scotia Group climbing 90 cents to close at a new 52 weeks’ closing high and Jamaica Producers up by 74 cents. Declining Main Market stocks include Guardian Holdings down $10, Stanley Motta off 84 cents and Sygnus Real Estate Finance losing 80 cents. Investors traded 20,978,708 shares, in all three markets, up from 12,392,600 units on Monday. The value of stocks traded on the Junior and Main markets amounts to $360.1 million up from $120.48 million on Monday. The JSE USD market closed after 47,641 shares were traded, for US$822 compared to 286,910 units at US$7,613 on Monday.

Investors traded 20,978,708 shares, in all three markets, up from 12,392,600 units on Monday. The value of stocks traded on the Junior and Main markets amounts to $360.1 million up from $120.48 million on Monday. The JSE USD market closed after 47,641 shares were traded, for US$822 compared to 286,910 units at US$7,613 on Monday. The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

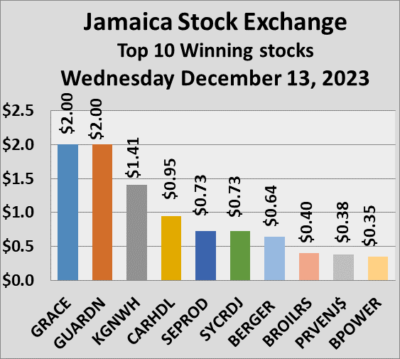

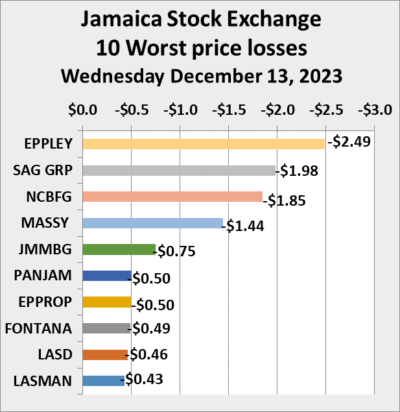

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Both GraceKennedy and Guardian Holdings led rising stocks with a gain of $2, followed by Kingston Wharves up $1.141 but declining stocks held the upper hand with Eppley dropping $2.49, Sagicor Group with a loss of $1.98, followed by NCB Financial down $1.85 and Massy Holdings off $1.44.

Both GraceKennedy and Guardian Holdings led rising stocks with a gain of $2, followed by Kingston Wharves up $1.141 but declining stocks held the upper hand with Eppley dropping $2.49, Sagicor Group with a loss of $1.98, followed by NCB Financial down $1.85 and Massy Holdings off $1.44. In the preference segment, Eppley 7.50% preference share increased $1.26 and ended at $6.76 Jamaica Public Service 7% fell $1.50 to $44.5 and Productive Business Solutions 9.75% preference share skidded $11.15 to $105.

In the preference segment, Eppley 7.50% preference share increased $1.26 and ended at $6.76 Jamaica Public Service 7% fell $1.50 to $44.5 and Productive Business Solutions 9.75% preference share skidded $11.15 to $105. The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.