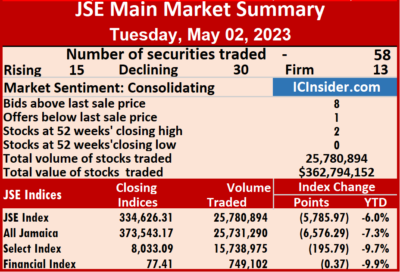

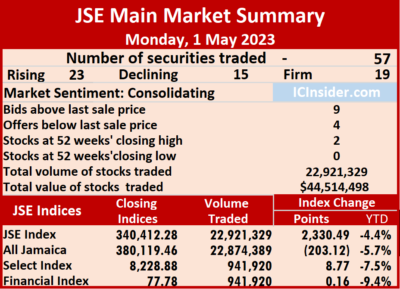

Stocks mostly dropped in market activity on the Jamaica Stock Exchange Main Market ended on Tuesday following a 12 percent increase in the volume of stocks traded after investors pumped in 715 percent more money into stocks compared with trading on Monday, resulting in the trading of 58 securities compared to 57 on Monday, with 15 rising, 30 declining and 13 ending unchanged.

All of 25,780,894 shares were traded for $362,794,152 versus 22,921,329 units at $44,514,498 on Monday.

All of 25,780,894 shares were traded for $362,794,152 versus 22,921,329 units at $44,514,498 on Monday.

Trading averaged 444,498 shares at $6,255,072, compared with 402,129 shares at $780,956 on Monday and month to date, an average of 423,498 units at $3,541,814, compared with 402,129 units at $780,956, previously. April closed with an average of 264,549 units at $1,409,410.

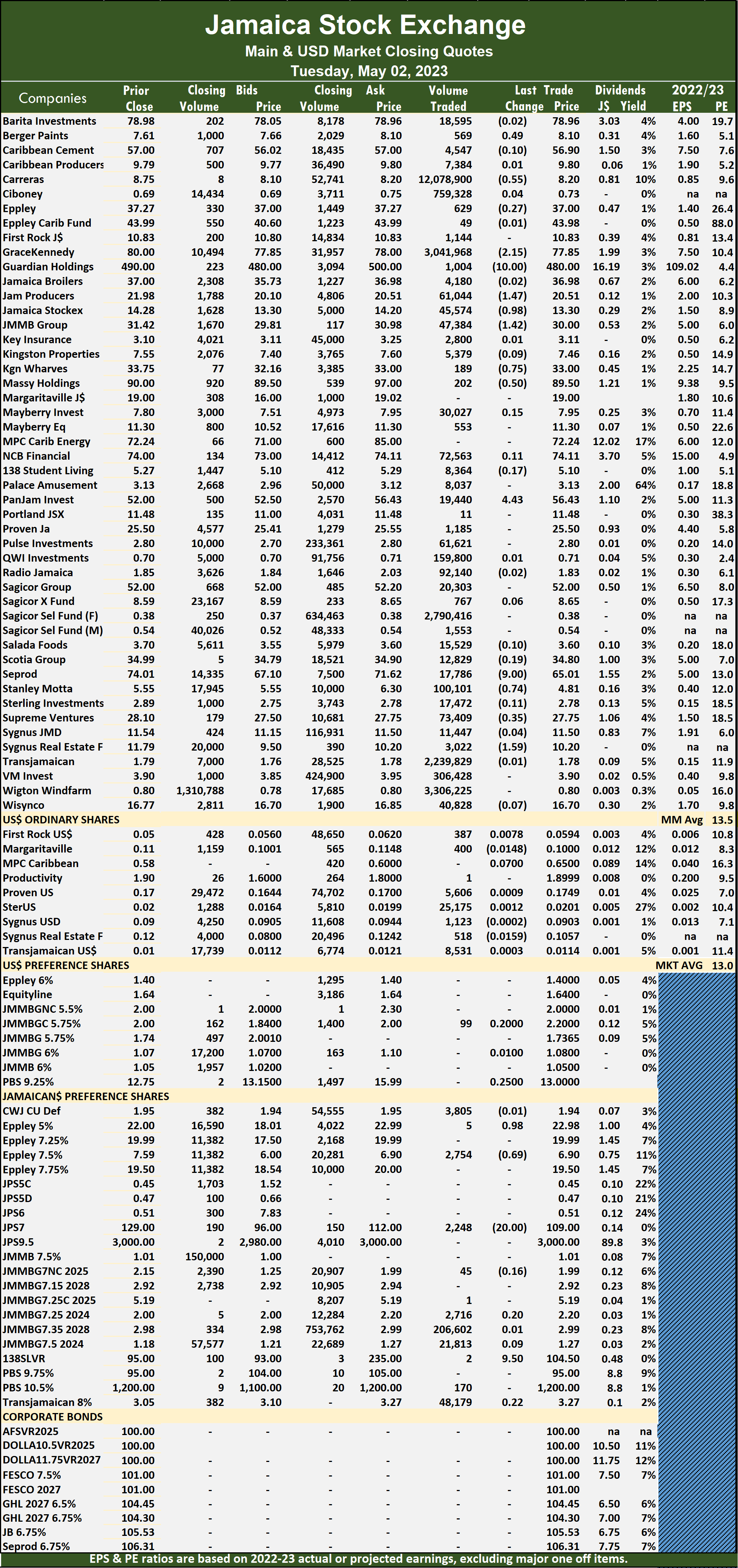

Carreras led trading with 12.08 million shares for 46.9 percent of the day’s volume followed by Wigton Windfarm with 3.31 million units for 12.8 percent of the day’s trade, GraceKennedy with 3.04 million units for 11.8 percent market share, Sagicor Select Financial Fund with 2.79 million units for 10.8 percent and Transjamaican Highway with 2.24 million units for 8.7 percent of total volume.

The All Jamaican Composite Index fell 6,576.29 points to finish at 373,543.17, the JSE Main Index dropped 5,785.97 points to close at 334,626.31 and the JSE Financial Index dipped 0.37 points to 77.41.

The All Jamaican Composite Index fell 6,576.29 points to finish at 373,543.17, the JSE Main Index dropped 5,785.97 points to close at 334,626.31 and the JSE Financial Index dipped 0.37 points to 77.41.

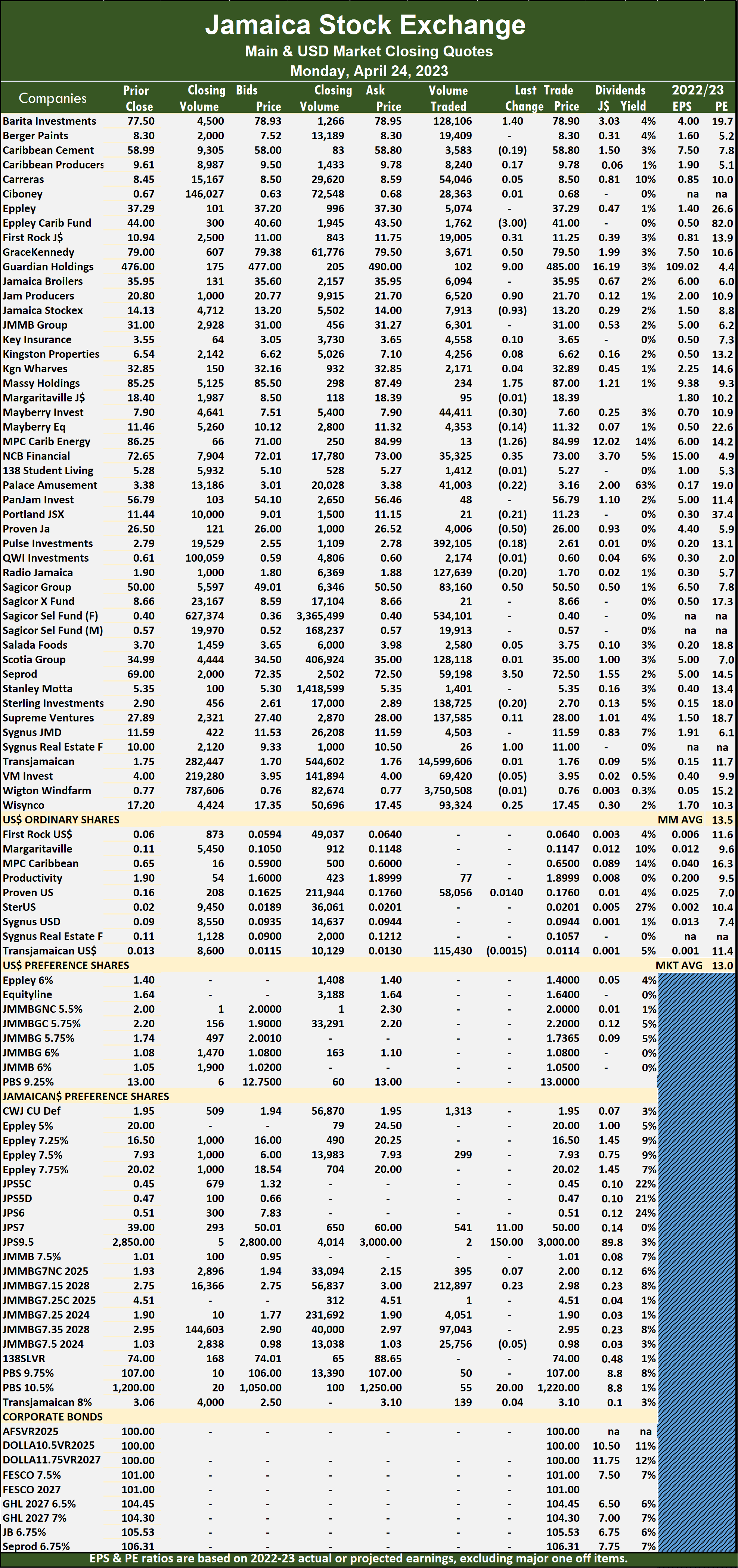

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are based on the last prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and one with a lower offer.

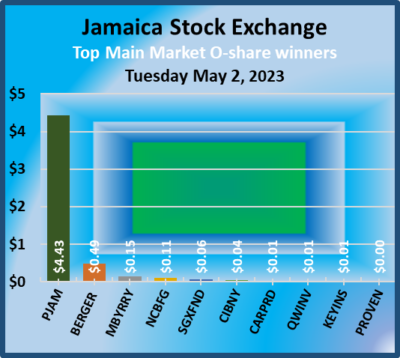

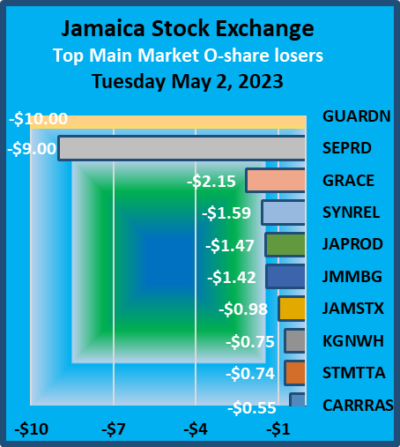

At the close, Berger Paints rallied 49 cents in closing at $8.10, with 569 shares crossing the market, Carreras fell 55 cents to end at $8.20 after an exchange of 12,078,900 units, GraceKennedy shed $2.15 to finish at $77.85., with investors transferring 3,041,968 stocks. Guardian Holdings dropped $10 to close at $480 as investors traded 1,004 stock units,  Jamaica Producers declined $1.47 to $20.51 with an exchange of 61,044 units, Jamaica Stock Exchange fell 98 cents to $13.30 with 45,574 stocks crossing the market. JMMB Group shed $1.42 to end at $30 after an exchange of 47,384 shares, Kingston Wharves dipped 75 cents to end at $33 with 189 stock units clearing the market, Massy Holdings lost 50 cents to end at $89.50 with a transfer of 202 stock units. Pan Jamaica Group advanced $4.43 to $56.43 in trading 19,440 stocks, Seprod dropped $9 to end at $65.01 with the swapping of 17,786 units, Stanley Motta lost 74 cents to close at $4.81 with 100,101 shares crossing the market. Supreme Ventures lost 35 cents in closing at $27.75 with 73,409 stock units changing hands and Sygnus Real Estate Finance shed $1.59 to end at $10.20 after swapping 3,022 units.

Jamaica Producers declined $1.47 to $20.51 with an exchange of 61,044 units, Jamaica Stock Exchange fell 98 cents to $13.30 with 45,574 stocks crossing the market. JMMB Group shed $1.42 to end at $30 after an exchange of 47,384 shares, Kingston Wharves dipped 75 cents to end at $33 with 189 stock units clearing the market, Massy Holdings lost 50 cents to end at $89.50 with a transfer of 202 stock units. Pan Jamaica Group advanced $4.43 to $56.43 in trading 19,440 stocks, Seprod dropped $9 to end at $65.01 with the swapping of 17,786 units, Stanley Motta lost 74 cents to close at $4.81 with 100,101 shares crossing the market. Supreme Ventures lost 35 cents in closing at $27.75 with 73,409 stock units changing hands and Sygnus Real Estate Finance shed $1.59 to end at $10.20 after swapping 3,022 units.

In the preference segment, Eppley 5% preference share popped 98 cents to $22.98 trading 5 shares,  Eppley 7.50% preference share lost 69 cents to close at $6.90 in switching ownership of 2,754 stocks, Jamaica Public Service 7% dropped $20 after ending at $109 with 2,248 shares crossing the exchange and 138 Student Living preference share rose $9.50 in closing at a 52 weeks’ high of $104.50 in a transfer of 2 stocks.

Eppley 7.50% preference share lost 69 cents to close at $6.90 in switching ownership of 2,754 stocks, Jamaica Public Service 7% dropped $20 after ending at $109 with 2,248 shares crossing the exchange and 138 Student Living preference share rose $9.50 in closing at a 52 weeks’ high of $104.50 in a transfer of 2 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

iCreate in ICTOP10 Image Plus EPS jumps

The markets are changing, with the Main Market up for three consecutive weeks but the Junior Market meandering for the last four weeks. Against this backdrop, there was one change to the TOP10, with iCreate coming in and Dolla Financial falling out, but Dolla and Honey Bun, that slipped out the previous week, sit immediately below the TOP10.

There were no significant winners for the past week in both markets’ TOP10 as losers dominated. The Junior market had Consolidated Bakeries falling 11 percent to $2.17 and general Accident down 10 percent to $5.40 and Lasco Distributors down 3 percent, with the stock selling at just 5.5 times 2023 estimated earnings and only 8.5 times the company’s nine month results. By any stretch, the stock is considerably undervalued and there are more profits to come in the current fiscal year.

There were no significant winners for the past week in both markets’ TOP10 as losers dominated. The Junior market had Consolidated Bakeries falling 11 percent to $2.17 and general Accident down 10 percent to $5.40 and Lasco Distributors down 3 percent, with the stock selling at just 5.5 times 2023 estimated earnings and only 8.5 times the company’s nine month results. By any stretch, the stock is considerably undervalued and there are more profits to come in the current fiscal year.

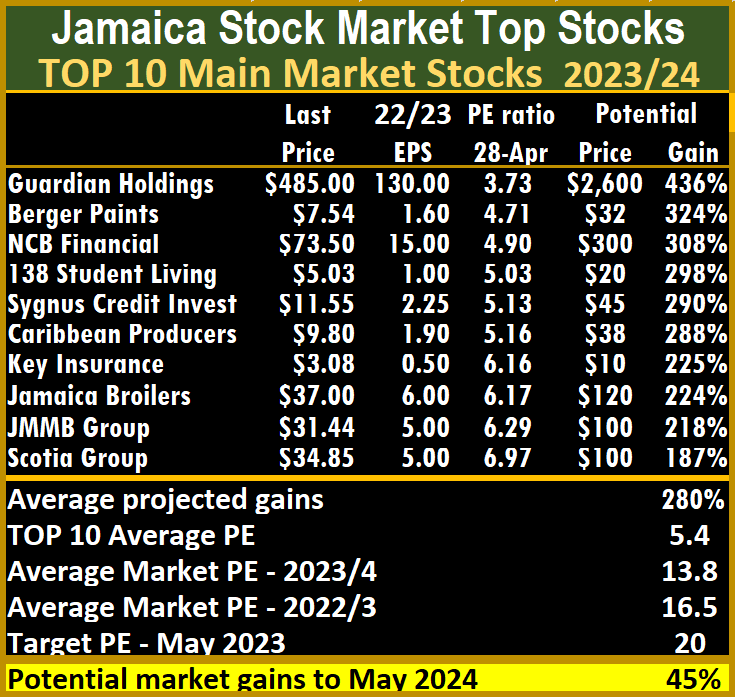

Main Market stocks had a 13 percent fall in Key Insurance after the price closed at $3.08, Berger Paints contracted by 9 percent to $7.54 and 138 Student Living slipped 5 percent to $5.03, while Jamaica Broilers rose just 3 percent to $37.

Stocks are being prepped to rally, with early signals that interest rates will be declining across the board sooner than later. This stems from the continued slide of rates on BOJ CDs since March, that saw the rate falling by 23 percent to 8.11 percent against a background where inflation since November last year is running at less than one percent per annum.

At the week’s close, Image Plus released full year results showing profit after tax jumping 125.6 percent to $213 million or 21 cents per share. ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously.

At the week’s close, Image Plus released full year results showing profit after tax jumping 125.6 percent to $213 million or 21 cents per share. ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index this past week, with the supply of some stocks falling sharply.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.4, well below the market average of 13.8, while the Junior Market Top 10 PE sits at 5.9 compared with the market at 11.6. The differences are important indicators of the level of likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 257 percent and the Main Market TOP10 by an average of 280 percent to May 2024, based on 2023 forecasted earnings.

The Junior Market has 11 stocks representing 23 percent of the market, with PEs from 15to 27, averaging 21, well above the market’s average. The top half of the market has an average PE of 17, suggesting that this may currently be the lowest fair value for Junior Market stocks.

The 18 highest valued Main Market stocks are priced at a PE of 15 to 115, with an average of 29 and 20 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

The 18 highest valued Main Market stocks are priced at a PE of 15 to 115, with an average of 29 and 20 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Honey Bun rises 8% to exit ICTOP10

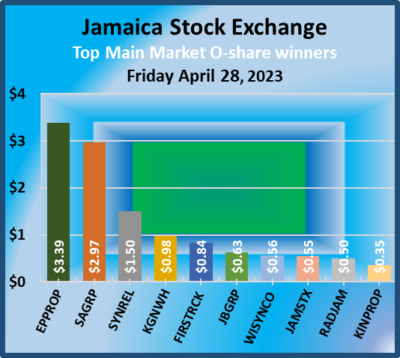

The Junior Market of the Jamaica Stock Exchange recorded solid gains during the past week as the Main Market declined, resulting in three solid gains for the ICTOP10 Junior Market stocks and just one notable move in the performance of the ICTOP10 Main Market as General Accident added 18 percent to its value to be the best performing stock for the week.

General Accident selling supply of stocks is down sharply.

The Junior Market had one change in the TOP10 as Honey Bun moved out for a second time in weeks with a rise of 8 percent, allowing Dolla Financial to come in at number 10. Dolla is likely to enjoy a doubling in profit for the current year, having expanded the loan portfolio dramatically since taking on the billion dollar loan. Investors in the stock can look forward to healthy gains in the stock price during the year.

Main Event, one of the previous week’s top performers that exited the Top 10 with a 6 percent gain to close at $12.95, keeps on rolling on and climbed another 13.5 percent this week to $14.70, up 63.5 percent for the year to date as investors continue to applaud the company’s performance by buying up the stocks as they see more profits to come this year, with the economy fully opened up for entertainment.

The other major price movements during the week were a 9 percent rise for Lasco Distributors, that ended at $2.36 and Honey Bun, up 8 percent to $6.57. There are only two stocks with losses of two percent or less.

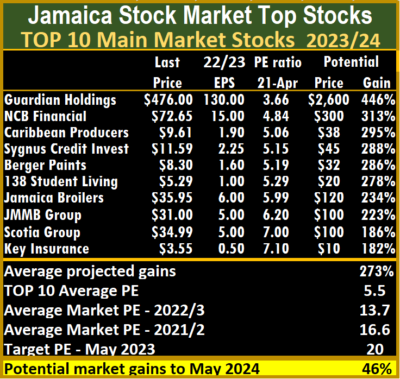

In the Main Market, only three stocks recorded declines, but Berger Paints was the only stock with a meaningful move, gaining 8 percent to $8.30.

Interest rates on Bank of Jamaica CDs dipped again at this past week’s auction that, which saw the average rate slipping to 8.21 percent from 8.41 percent at the previous week’s auction. Over the past five months, inflation has been running at less than one percent per annum, which has set the stage for BOJ to act quickly to slash interest rates, a positive development for the market.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index this past week, with the supply of some stocks falling sharply.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index this past week, with the supply of some stocks falling sharply.

Honey Bun’s fall from the TOP10 Junior Market list is not the end of the road for this outstanding performer with increased investors’ interest with an expected jump in revenues and profits for the first quarter with the Easter coming at the beginning of April versus the 17th of April last year as well as improvement of gross profit margin that slipped previous year. ICInsider.com expects the price to increase by up to 200 percent this year.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.5, well below the market average of 13.7, while the Junior Market Top 10 PE sits at 5.9 compared with the market at 11.6. The differences are important indicators of the level of likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 246 percent and the Main Market TOP10 by an average of 273 percent, by May 2024, based on 2023 forecasted earnings.

The Junior Market has 13 stocks representing 27 percent of the market, with PEs from 15 to 27, averaging 19, well above the market’s average. The top half of the market has an average PE of 16, suggesting this may be the current lowest fair value for Junior Market stocks.

The 16 highest valued Main Market stocks are priced at a PE of 15 to 114, with an average of 31 and 21 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

The 16 highest valued Main Market stocks are priced at a PE of 15 to 114, with an average of 31 and 21 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

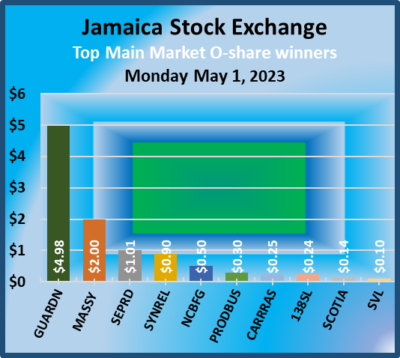

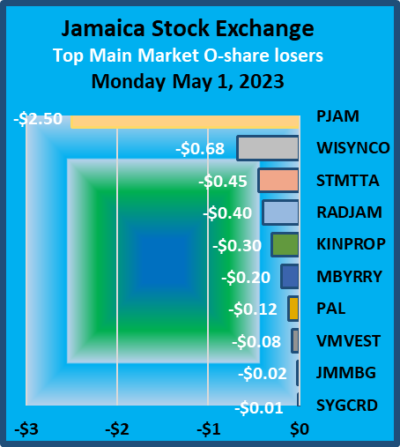

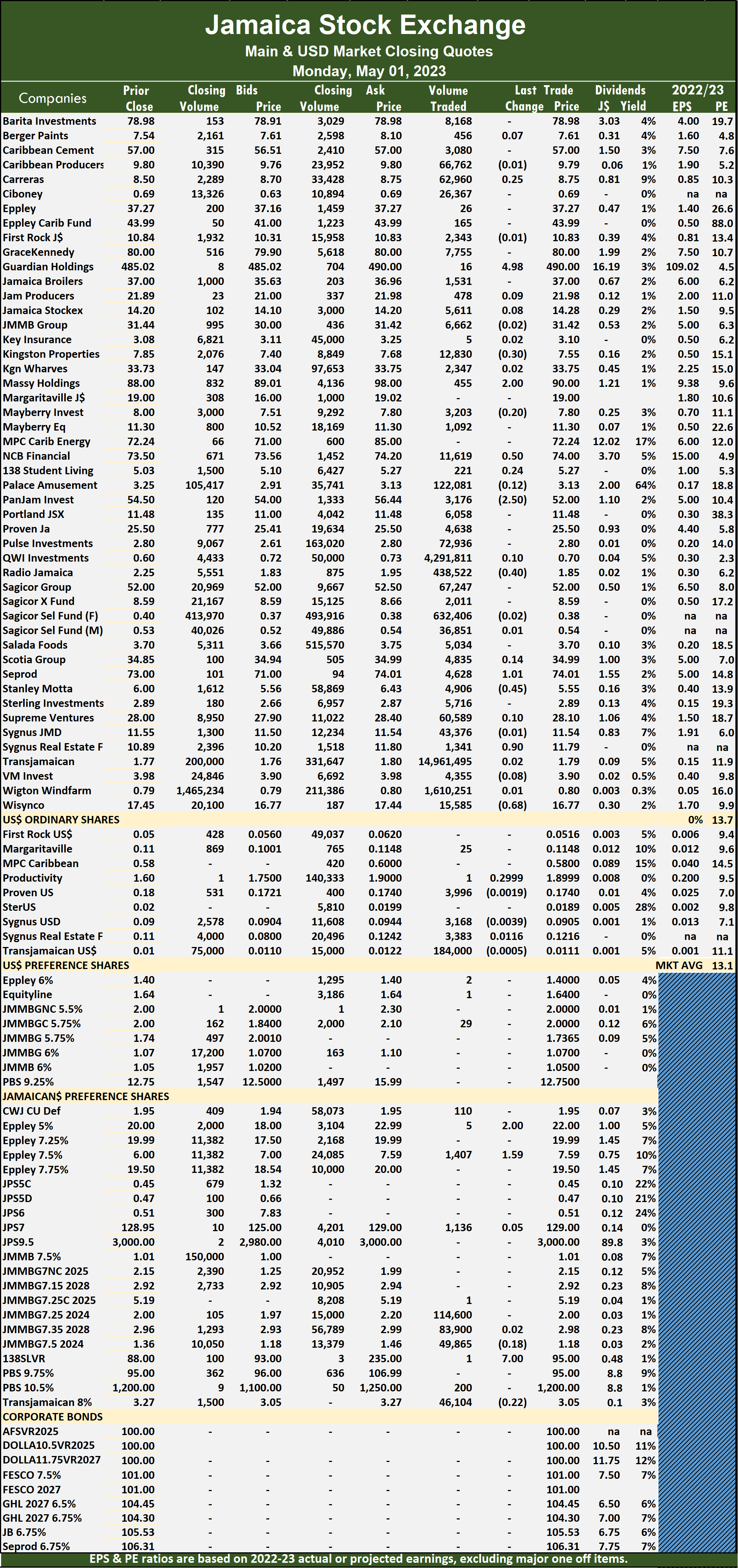

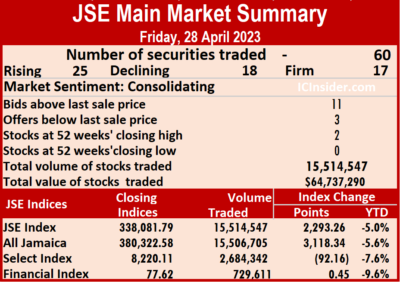

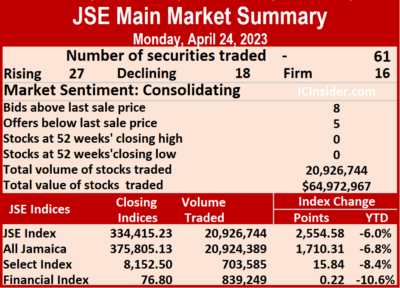

At the close, 22,921,329 shares were traded for $44,514,498 compared with 15,514,547 units at $64,737,290 on Friday.

At the close, 22,921,329 shares were traded for $44,514,498 compared with 15,514,547 units at $64,737,290 on Friday. PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with their financial year ending between November 2022 and August 2023.

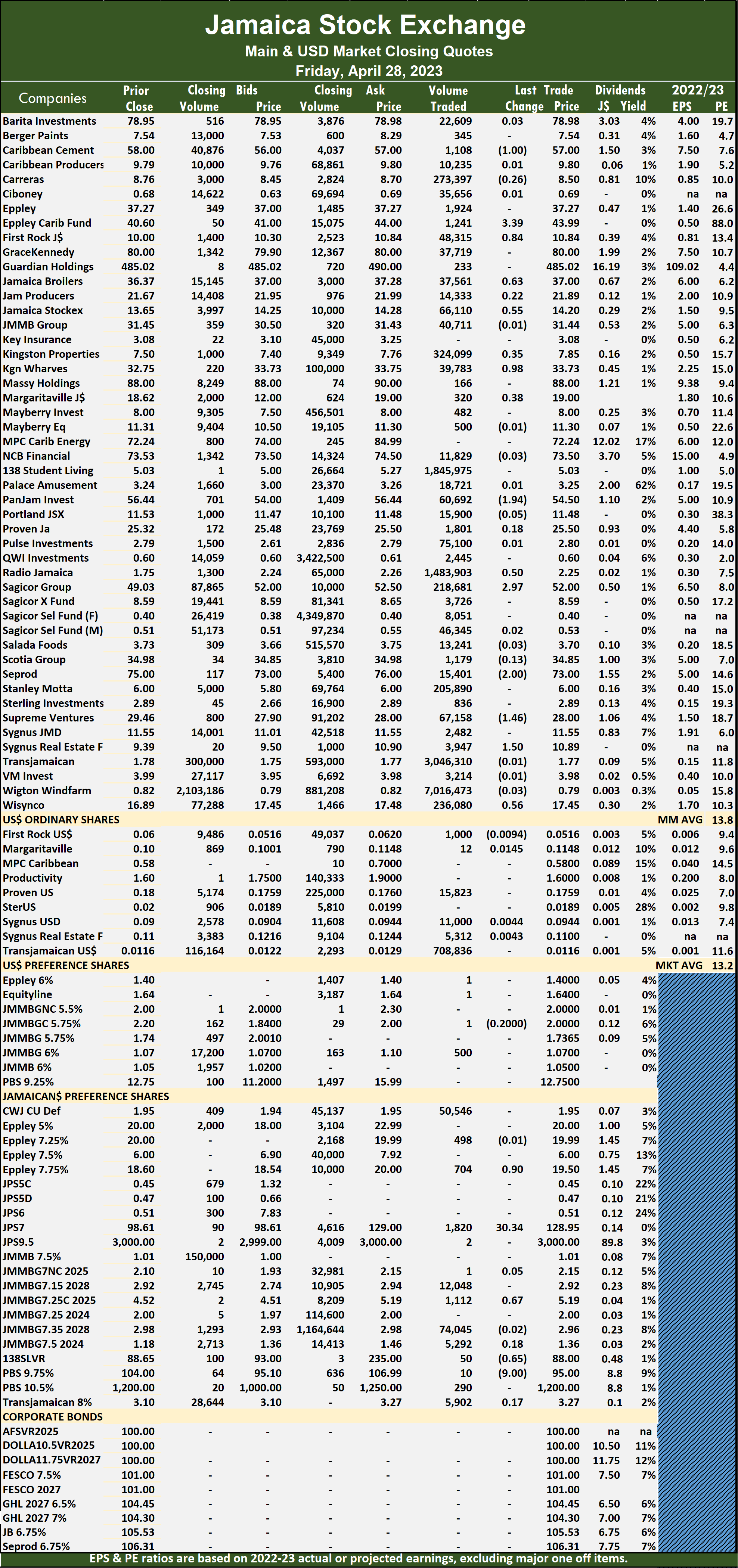

PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with their financial year ending between November 2022 and August 2023. 138 Student Living in pushing the price by 24 cents to $5.27, Pan Jamaica Group shed $2.50 in ending at $52 and closed with 3,176 stock units changing hands, Radio Jamaica fell 40 cents in closing at $1.85 in switching ownership of 438,522 stocks, Seprod rallied $1.01 to $74.01 in trading 4,628 shares, Stanley Motta dropped 45 in closing at $5.55, with 4,906 stock units crossing the exchange, Sygnus Real Estate Finance popped 90 cents to end at $11.79 as investors exchanged 1,341 units and Wisynco Group lost 68 cents to close at $16.77, with 15,585 units clearing the market.

138 Student Living in pushing the price by 24 cents to $5.27, Pan Jamaica Group shed $2.50 in ending at $52 and closed with 3,176 stock units changing hands, Radio Jamaica fell 40 cents in closing at $1.85 in switching ownership of 438,522 stocks, Seprod rallied $1.01 to $74.01 in trading 4,628 shares, Stanley Motta dropped 45 in closing at $5.55, with 4,906 stock units crossing the exchange, Sygnus Real Estate Finance popped 90 cents to end at $11.79 as investors exchanged 1,341 units and Wisynco Group lost 68 cents to close at $16.77, with 15,585 units clearing the market. and 138 Student Living preference share climbed $7 and ended at $95 with investors transferring just one stock.

and 138 Student Living preference share climbed $7 and ended at $95 with investors transferring just one stock. A total of 15,514,547 shares were traded for $64,737,290 compared to 9,660,257 units at $49,441,575 on Thursday.

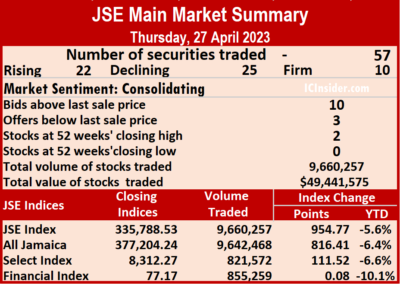

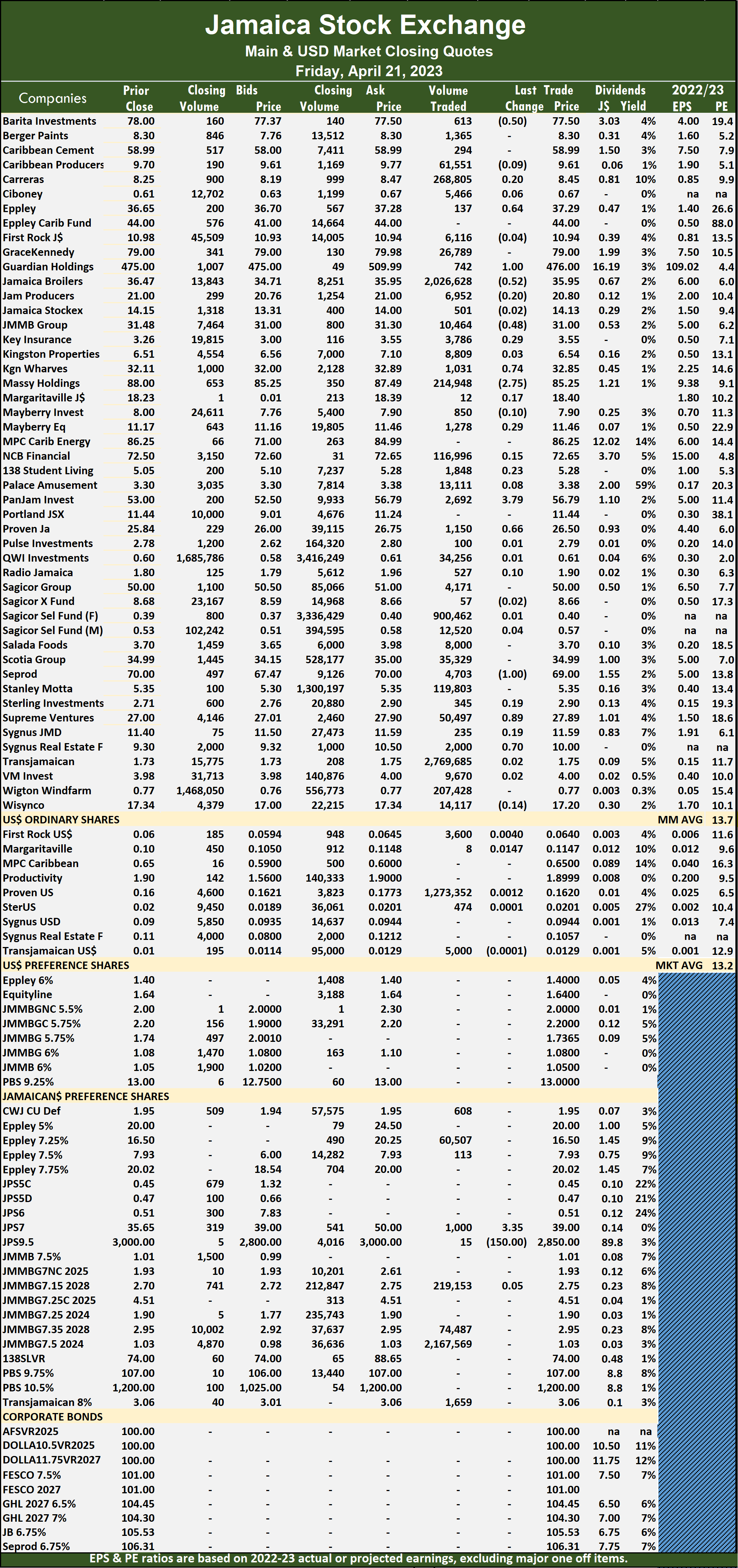

A total of 15,514,547 shares were traded for $64,737,290 compared to 9,660,257 units at $49,441,575 on Thursday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.8 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

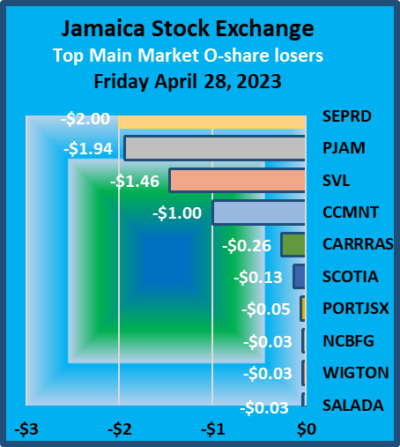

The PE Ratio, a formula used to compute appropriate stock values, averages 13.8 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Pan Jamaica Group dropped $1.94 in closing at $54.50 after an exchange of 60,692 shares, Radio Jamaica jumped 50 cents to end at $2.25 after 1,483,903 stocks changed hands, Sagicor Group climbed $2.97 to $52 with the swapping of 218,681 stock units, Seprod fell $2 in closing at $73 as investors exchanged 15,401 units. Supreme Ventures dipped $1.46 to $28 in an exchange of 67,158 stock units, Sygnus Real Estate Finance rallied $1.50 to close at $10.89 after a transfer of 3,947 shares and Wisynco Group popped 56 cents to end at $17.45 with 236,080 stocks crossing the exchange.

Pan Jamaica Group dropped $1.94 in closing at $54.50 after an exchange of 60,692 shares, Radio Jamaica jumped 50 cents to end at $2.25 after 1,483,903 stocks changed hands, Sagicor Group climbed $2.97 to $52 with the swapping of 218,681 stock units, Seprod fell $2 in closing at $73 as investors exchanged 15,401 units. Supreme Ventures dipped $1.46 to $28 in an exchange of 67,158 stock units, Sygnus Real Estate Finance rallied $1.50 to close at $10.89 after a transfer of 3,947 shares and Wisynco Group popped 56 cents to end at $17.45 with 236,080 stocks crossing the exchange. 138 Student Living preference share shed 65 cents in ending at $88, with 50 units crossing the market and Productive Business Solutions 9.75% preference share lost $9 in closing at $95 after exchanging 10 stock units.

138 Student Living preference share shed 65 cents in ending at $88, with 50 units crossing the market and Productive Business Solutions 9.75% preference share lost $9 in closing at $95 after exchanging 10 stock units. A total of 9,660,257 shares were traded for just $49,441,575 versus 27,085,519 units at $325,797,894 on Wednesday.

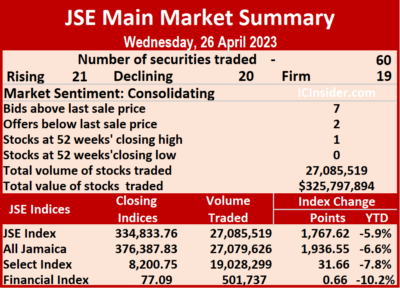

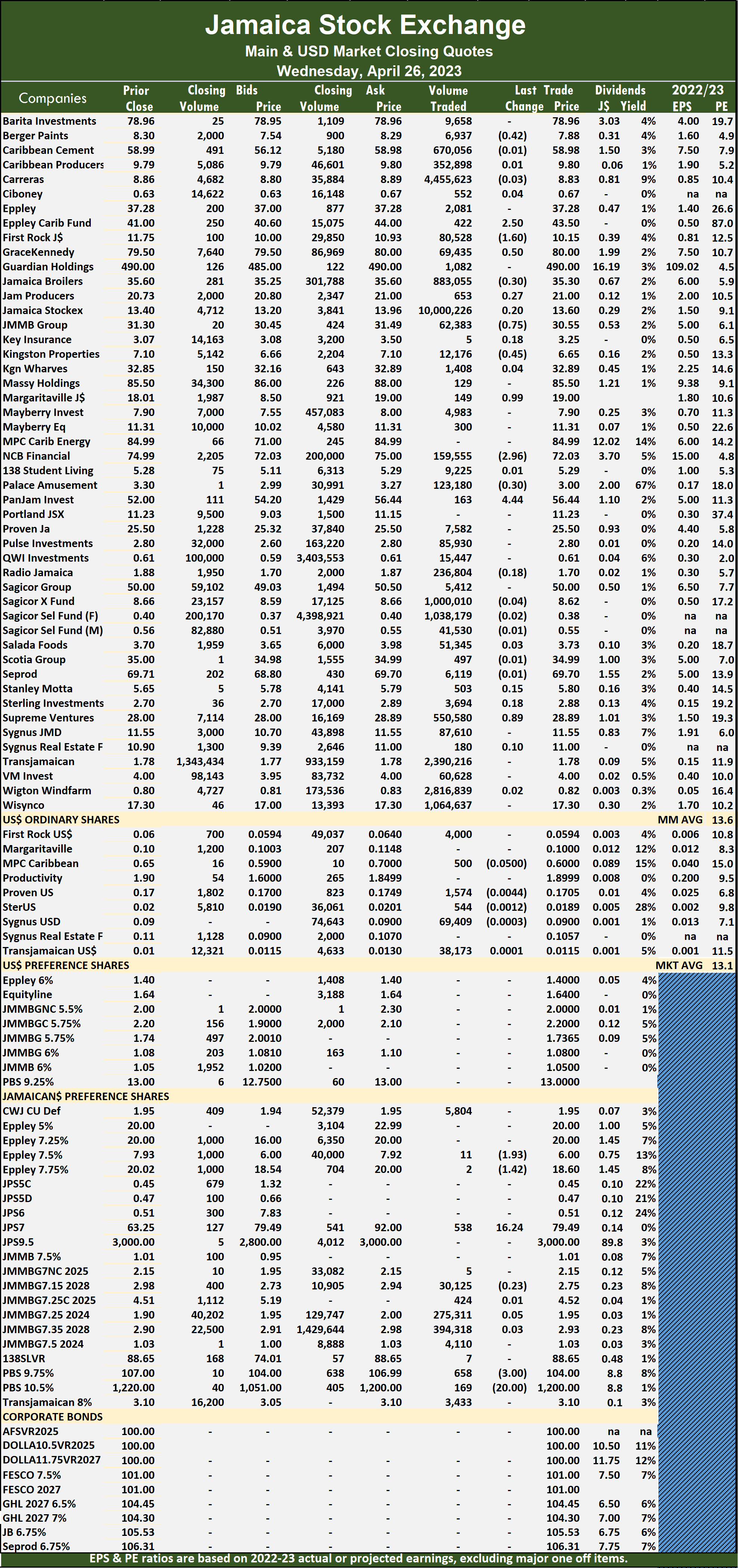

A total of 9,660,257 shares were traded for just $49,441,575 versus 27,085,519 units at $325,797,894 on Wednesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

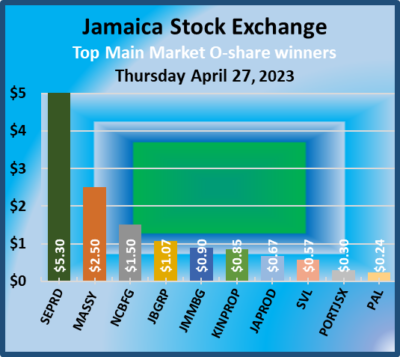

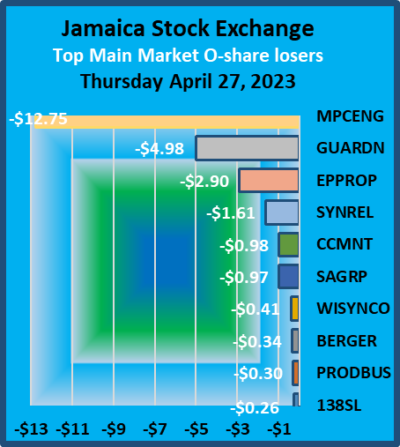

The PE Ratio, a formula used to compute appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Kingston Properties rallied 85 cents to close at $7.50 after trading 123,711 stock units, Margaritaville dropped 38 cents in closing at $18.62 with the swapping of 451 stocks, Massy Holdings gained $2.50 to end at $88, with 64 stocks crossing the market. MPC Caribbean Clean Energy shed $12.75 to end at $72.24 in switching ownership of 156 shares, NCB Financial increased $1.50 to close at $73.53 after 27,308 stock units passed through the exchange, Sagicor Group dipped 97 cents in ending at $49.03 as 15,946 units passed through the market, Seprod advanced $5.30 in closing at $75 with an exchange of 30,340 stocks. Supreme Ventures climbed 57 cents to $29.46 and closed with an exchange of 96,813 stock units, Sygnus Real Estate Finance declined $1.61 to end at $9.39 in trading 2 units and Wisynco Group shed 41 cents to $16.89 trading 101,965 shares.

Kingston Properties rallied 85 cents to close at $7.50 after trading 123,711 stock units, Margaritaville dropped 38 cents in closing at $18.62 with the swapping of 451 stocks, Massy Holdings gained $2.50 to end at $88, with 64 stocks crossing the market. MPC Caribbean Clean Energy shed $12.75 to end at $72.24 in switching ownership of 156 shares, NCB Financial increased $1.50 to close at $73.53 after 27,308 stock units passed through the exchange, Sagicor Group dipped 97 cents in ending at $49.03 as 15,946 units passed through the market, Seprod advanced $5.30 in closing at $75 with an exchange of 30,340 stocks. Supreme Ventures climbed 57 cents to $29.46 and closed with an exchange of 96,813 stock units, Sygnus Real Estate Finance declined $1.61 to end at $9.39 in trading 2 units and Wisynco Group shed 41 cents to $16.89 trading 101,965 shares. In the preference segment, Jamaica Public Service 7% gained $19.12 to close at $98.61 with investors transferring 1,183 shares. JMMBG 7.5% closed at a 52 weeks’ high of $1.18 after trading 27,760 shares.

In the preference segment, Jamaica Public Service 7% gained $19.12 to close at $98.61 with investors transferring 1,183 shares. JMMBG 7.5% closed at a 52 weeks’ high of $1.18 after trading 27,760 shares. A total of 27,085,519 shares were traded for $325,797,894 compared to 27,564,223 units at $93,817,986 on Tuesday.

A total of 27,085,519 shares were traded for $325,797,894 compared to 27,564,223 units at $93,817,986 on Tuesday. The All Jamaican Composite Index climbed 1,936.55 points to 376,387.83, the JSE Main Index rallied, 1,767.62 points to finish at 334,833.76 and the JSE Financial Index popped 0.29 points to 77.09.

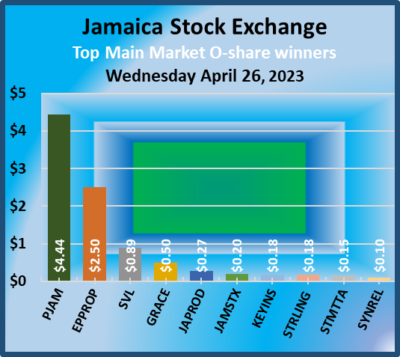

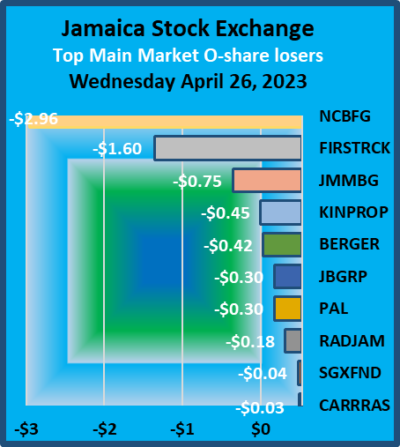

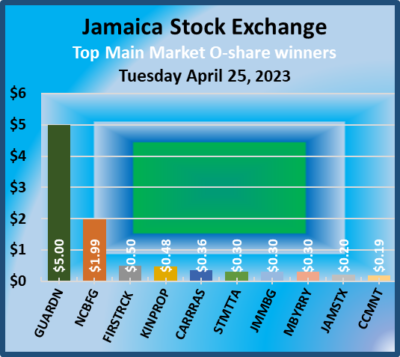

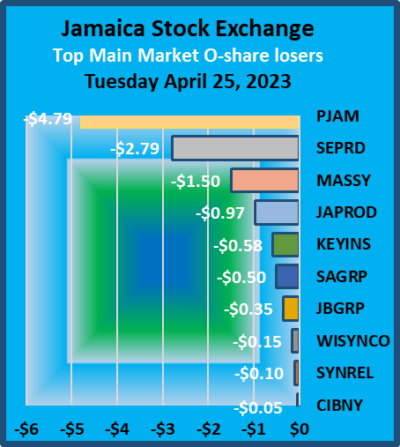

The All Jamaican Composite Index climbed 1,936.55 points to 376,387.83, the JSE Main Index rallied, 1,767.62 points to finish at 334,833.76 and the JSE Financial Index popped 0.29 points to 77.09. JMMB Group shed 75 cents in closing at $30.55 with the swapping of 62,383 units, Kingston Properties lost 45 cents in closing at $6.65 after exchanging 12,176 stocks, Margaritaville gained 99 cents after ending at $19 with 149 stock units clearing the market, NCB Financial dipped $2.96 to $72.03 and closed after trading 159,555 shares, Pan Jamaica Group rallied $4.44 to $56.44 in an exchange of 163 units and Supreme Ventures rose 89 cents to close at $28.89 as investors exchanged 550,580 stock units.

JMMB Group shed 75 cents in closing at $30.55 with the swapping of 62,383 units, Kingston Properties lost 45 cents in closing at $6.65 after exchanging 12,176 stocks, Margaritaville gained 99 cents after ending at $19 with 149 stock units clearing the market, NCB Financial dipped $2.96 to $72.03 and closed after trading 159,555 shares, Pan Jamaica Group rallied $4.44 to $56.44 in an exchange of 163 units and Supreme Ventures rose 89 cents to close at $28.89 as investors exchanged 550,580 stock units. Jamaica Public Service 7% popped $16.24 to close at $79.49 as 538 shares passed through the market and Productive Business Solutions 9.75% preference share fell $3 in closing at $104 after a transfer of 658 stocks.

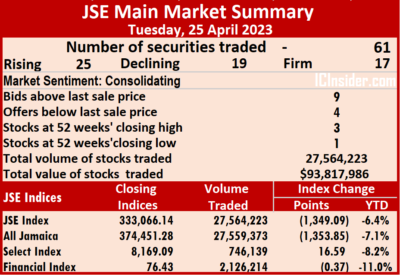

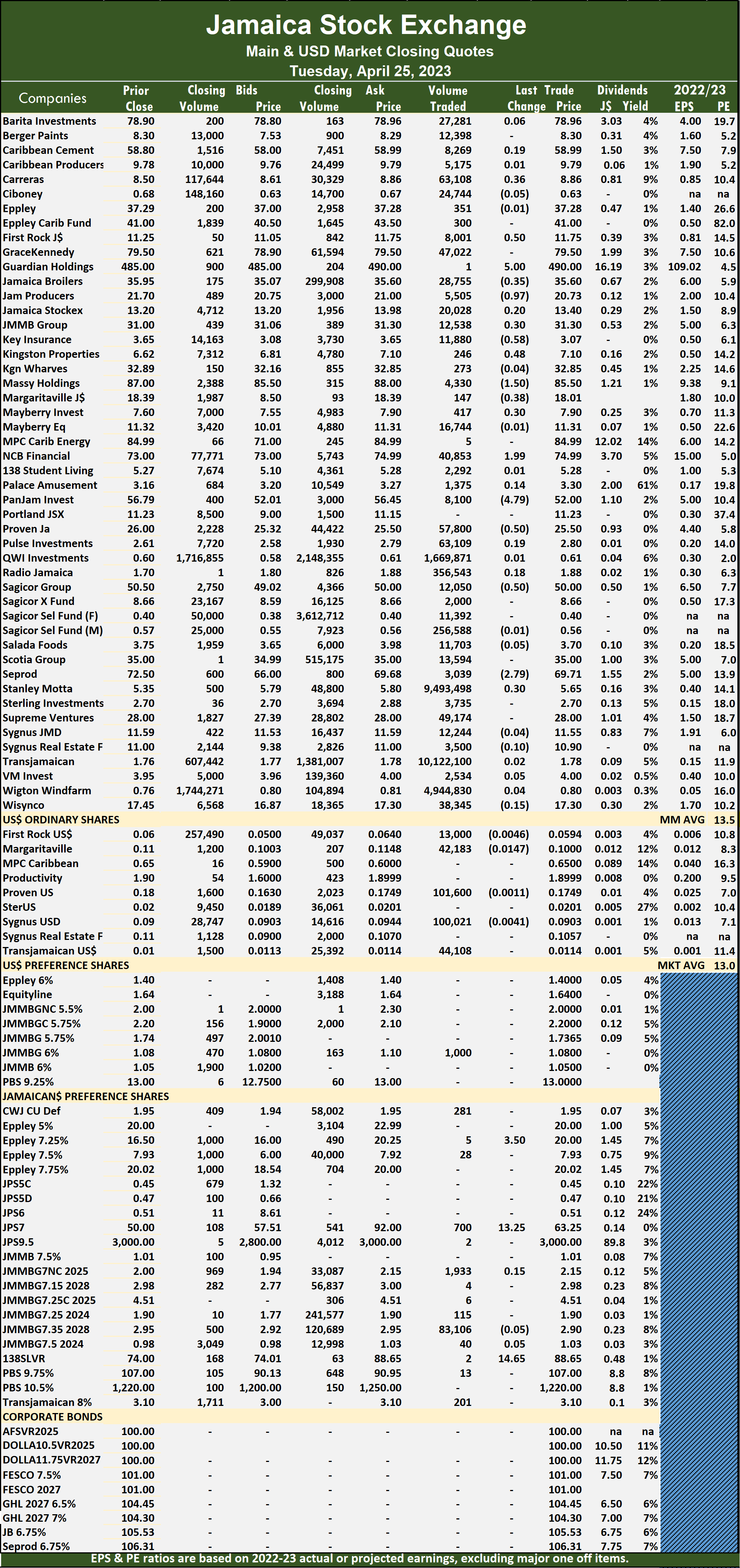

Jamaica Public Service 7% popped $16.24 to close at $79.49 as 538 shares passed through the market and Productive Business Solutions 9.75% preference share fell $3 in closing at $104 after a transfer of 658 stocks. A total of 27,564,223 shares were traded for $93,817,986 compared to 20,926,744 units at $64,972,967 on Monday.

A total of 27,564,223 shares were traded for $93,817,986 compared to 20,926,744 units at $64,972,967 on Monday. The All Jamaican Composite Index fell 1,353.85 to 374,451.28, the JSE Main Index slipped 1,349.09 points to 333,066.14 and the JSE Financial Index fell 0.37 points to 76.43.

The All Jamaican Composite Index fell 1,353.85 to 374,451.28, the JSE Main Index slipped 1,349.09 points to 333,066.14 and the JSE Financial Index fell 0.37 points to 76.43. Producers fell 97 cents to $20.73 after a transfer of 5,505 units. Key Insurance shed 58 cents in closing at $3.07, with 11,880 stock units changing hands, Kingston Properties rallied 48 cents to $7.10 as investors exchanged 246 stocks, Margaritaville dipped 38 cents to $18.01 while trading 147 units, Massy Holdings dropped $1.50 after ending at $85.50, with 4,330 stock units changing hands. NCB Financial jumped $1.99 to $74.99 trading 40,853 units, Pan Jamaica Group declined $4.79 to close at $52 and closed, with an exchange of 8,100 shares, Proven Investments lost 50 cents in closing at $25.50 in trading 57,800 stock units. Sagicor Group dipped 50 cents to end at $50 in an exchange of 12,050 units and Seprod dipped $2.79 after ending at $69.71 with a transfer of 3,039 shares.

Producers fell 97 cents to $20.73 after a transfer of 5,505 units. Key Insurance shed 58 cents in closing at $3.07, with 11,880 stock units changing hands, Kingston Properties rallied 48 cents to $7.10 as investors exchanged 246 stocks, Margaritaville dipped 38 cents to $18.01 while trading 147 units, Massy Holdings dropped $1.50 after ending at $85.50, with 4,330 stock units changing hands. NCB Financial jumped $1.99 to $74.99 trading 40,853 units, Pan Jamaica Group declined $4.79 to close at $52 and closed, with an exchange of 8,100 shares, Proven Investments lost 50 cents in closing at $25.50 in trading 57,800 stock units. Sagicor Group dipped 50 cents to end at $50 in an exchange of 12,050 units and Seprod dipped $2.79 after ending at $69.71 with a transfer of 3,039 shares. Jamaica Public Service 7% rose $13.25 to close at $63.25 with the swapping of 700 shares and 138 Student Living preference share gained $14.65 in closing at $88.65 with an exchange of 2 units.

Jamaica Public Service 7% rose $13.25 to close at $63.25 with the swapping of 700 shares and 138 Student Living preference share gained $14.65 in closing at $88.65 with an exchange of 2 units. A total of 20,926,744 shares were traded for $64,972,967 compared to 9,481,950 units at $117,605,489 on Friday.

A total of 20,926,744 shares were traded for $64,972,967 compared to 9,481,950 units at $117,605,489 on Friday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded price of stocks and earnings forecasts done by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

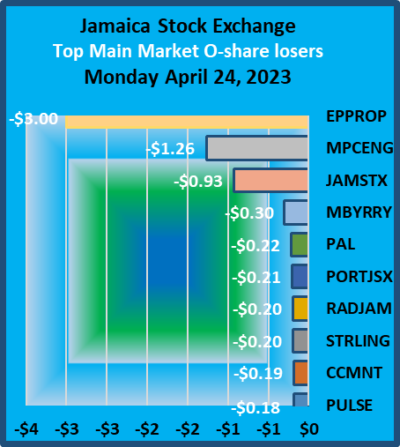

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded price of stocks and earnings forecasts done by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. MPC Caribbean Clean Energy lost $1.26 to close at $84.99, with 13 stock units clearing the market, Proven Investments shed 50 cents to end at $26 and closed with 4,006 units changing hands, Sagicor Group gained 50 cents after ending at $50.50 with a transfer of 83,160 stock units, Seprod jumped $3.50 in closing at $72.50 after investors traded 59,198 stocks and Sygnus Real Estate Finance gained $1 after ending at $11 as investors exchanged 26 shares.

MPC Caribbean Clean Energy lost $1.26 to close at $84.99, with 13 stock units clearing the market, Proven Investments shed 50 cents to end at $26 and closed with 4,006 units changing hands, Sagicor Group gained 50 cents after ending at $50.50 with a transfer of 83,160 stock units, Seprod jumped $3.50 in closing at $72.50 after investors traded 59,198 stocks and Sygnus Real Estate Finance gained $1 after ending at $11 as investors exchanged 26 shares. Jamaica Public Service 9.5% rallied $150 to close at $3000 with an exchange of just two shares.

Jamaica Public Service 9.5% rallied $150 to close at $3000 with an exchange of just two shares. A total of 9,481,950 shares were traded for $117,605,489 versus 20,316,713 units at $95,105,433 on Thursday.

A total of 9,481,950 shares were traded for $117,605,489 versus 20,316,713 units at $95,105,433 on Thursday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last sale prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

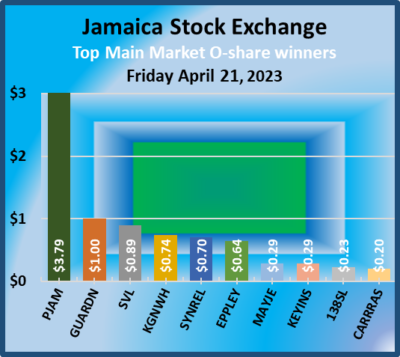

The PE Ratio, a formula used to compute appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last sale prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Massy Holdings lost $2.75 to close at $85.25, with 214,948 shares clearing the market, Pan Jamaica Group advanced $3.79 to end at $56.79 with investors trading 2,692 stocks, Proven Investments gained 66 cents in closing at $26.50 after an exchange of 1,150 shares, Seprod fell $1 to $69 in swapping 4,703 stocks, Supreme Ventures rallied 89 cents to end at $27.89 with investors transferring 50,497 units and Sygnus Real Estate Finance rose 70 cents in closing at $10 with an exchange of 2,000 stock units.

Massy Holdings lost $2.75 to close at $85.25, with 214,948 shares clearing the market, Pan Jamaica Group advanced $3.79 to end at $56.79 with investors trading 2,692 stocks, Proven Investments gained 66 cents in closing at $26.50 after an exchange of 1,150 shares, Seprod fell $1 to $69 in swapping 4,703 stocks, Supreme Ventures rallied 89 cents to end at $27.89 with investors transferring 50,497 units and Sygnus Real Estate Finance rose 70 cents in closing at $10 with an exchange of 2,000 stock units. In the preference segment, Jamaica Public Service 7% gained $3.35 after ending at $39 as investors exchanged 1,000 shares and Jamaica Public Service 9.5% dipped $150 to close at $2850 in trading 15 stock units.

In the preference segment, Jamaica Public Service 7% gained $3.35 after ending at $39 as investors exchanged 1,000 shares and Jamaica Public Service 9.5% dipped $150 to close at $2850 in trading 15 stock units.