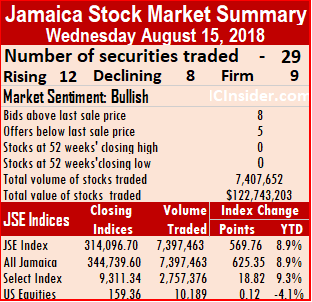

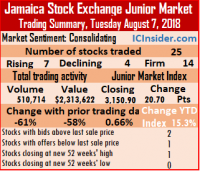

Trading on the Jamaica Stock Exchange resulted in further declines in the market indices but by less than the approximate 2,000 points decline on Friday, even as advancing stocks outnumbered declining ones.

Trading on the Jamaica Stock Exchange resulted in further declines in the market indices but by less than the approximate 2,000 points decline on Friday, even as advancing stocks outnumbered declining ones.

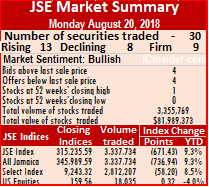

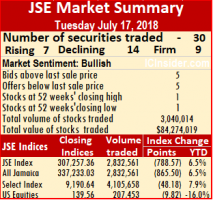

At the close, the All Jamaican Composite Index declined by 736.94 points to 345,989.59 and the JSE Index lost 671.43 points to 315,235.59. Market activities resulted in 30 securities trading including 4 in the US dollar market compared to 31 securities trading on Friday.

At the end of trading, the prices of 13 stocks rose, 8 declined and 9 traded unchanged. Trading in the main market ended with 3,337,734 units valued at over $77,717,624, compared to 12,389,267 units valued $54,066,117 on Friday.

Trading resulted in an average of 128,374 units valued at an average of $2,989,139 for each security traded. In contrast to 442,474 units for an average of $1,930,933 on Friday. For the month to date an average of 223,710 shares valued at an average of $4,528,884 versus 231,530 shares valued at an average of $4,665,985 on Friday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

Trading resulted in an average of 128,374 units valued at an average of $2,989,139 for each security traded. In contrast to 442,474 units for an average of $1,930,933 on Friday. For the month to date an average of 223,710 shares valued at an average of $4,528,884 versus 231,530 shares valued at an average of $4,665,985 on Friday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

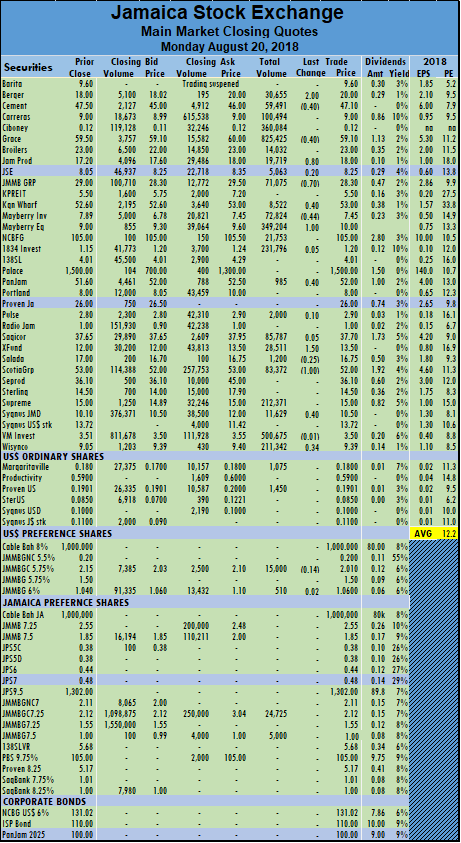

The day’s volume was led by, Grace Kennedy with 825,425 units 24.73 percent of the traded volume followed by Victoria Mutual Investments with 500,675 units 15 percent of the day’s volume and Ciboney Group with 360,084 units and 10.79 percent of the main market volume.

Stocks with major price changes| Berger Paints jumped $2 and ended at $20, in trading 30,655 stock units, Caribbean Cement fell 40 cents and finished at $47.10, trading 59,491 shares, Grace Kennedy fell 40 cents and ended trading 825,425 shares to close at $59.10, Jamaica Producers finished trading 19,719 units at $18 with a rise of 80 cents, JMMB Group lost 70 cents and ended at $28.30, exchanging 71,075 shares, Kingston Wharves added 40 cents to finish at $53, trading 8,522 stock units, Mayberry Investments lost 44 cents to settle at $7.45, trading 72,824 units,  Mayberry Jamaica Euities jumped $1 to settle at an all-time closing high of $10, trading 349,204 units, PanJam Investment gained 40 cents and concluded trading 985 shares and closed at $52, Sagicor Real Estate Fund jumped $1.50 to $13.50, with 28,511 shares, Salada Foods shed 25 cents to close at $16.75, in exchanging 1,200 units, Scotia Group shed $1 in traded 83,372 shares to close at $52, Sygnus Credit Investments rose 40 cent to close at $10.50 in trading 11,629 shares and Wisynco Group rose 34 cents and finished trading 211,342 shares to end at $9.39.

Mayberry Jamaica Euities jumped $1 to settle at an all-time closing high of $10, trading 349,204 units, PanJam Investment gained 40 cents and concluded trading 985 shares and closed at $52, Sagicor Real Estate Fund jumped $1.50 to $13.50, with 28,511 shares, Salada Foods shed 25 cents to close at $16.75, in exchanging 1,200 units, Scotia Group shed $1 in traded 83,372 shares to close at $52, Sygnus Credit Investments rose 40 cent to close at $10.50 in trading 11,629 shares and Wisynco Group rose 34 cents and finished trading 211,342 shares to end at $9.39.

Trading in the US dollar market closed with 18,035 units valued at over $31,181, as JMMB Group 6 % preference share gained 2 cents and completed trading at $1.06 with 510 stock units, JMMB Group 5.75% preference share lost 14 cents in concluding of 15,000 shares at $2.01. Margaritaville traded 1,075 shares and ended at 18 US cents Proven Investments trading 1,450 shares and closed at 19.01 US cents. The JSE USD Equities Index advanced by 0.32 points to close at 159.56.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading shows 4 stocks ended with bids higher than their last selling prices and 4 closing with lower offers.

JSE stocks retreat from Thursday’s record

Mayberry Jamaican Equities traded 1M shares & the price hits a new high of $10 but retreated by Friday’s close.

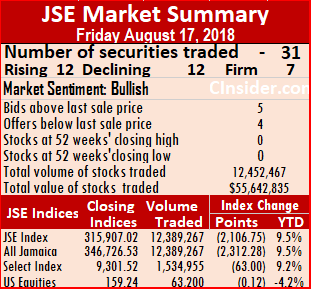

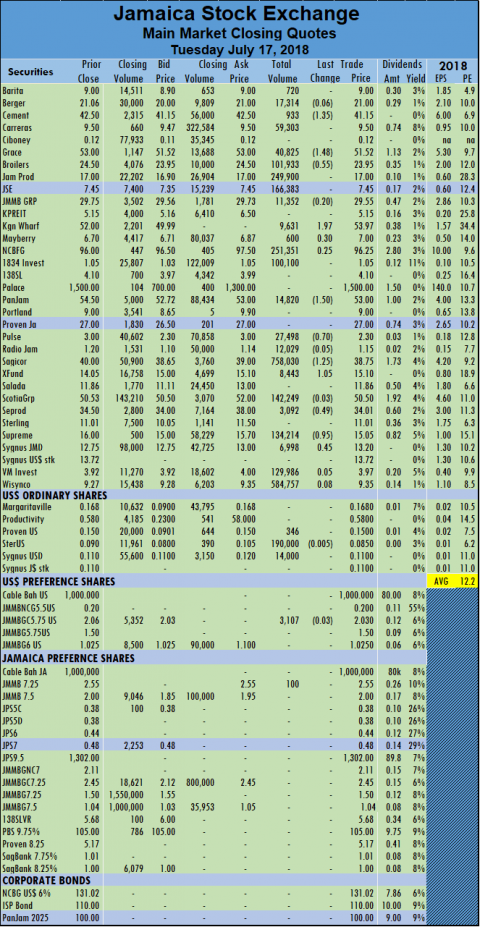

The All Jamaican Composite Index of the Jamaica Stock Exchange and the JSE index fell more than 2,000 points as main market stocks retreated from Thursday’s record close as the market set its sight on breaking through the 350,000 mark this coming week.

At the close, the All Jamaican Composite Index dropped 2,312.28 points to 346,726.53 and the JSE Index dived 2,106.75 points to 315,907.02. Market activities resulted in 31 securities trading including 3 in the US dollar market compared to 27 securities trading on Thursday.

At the end of trading, the prices of 12 stocks rose, 12 declined and 7 traded unchanged. Trading in the main market ended with 12,389,267 units valued $54,066,117, compared to 7,549,926 units valued at $378,631,059 on Thursday.

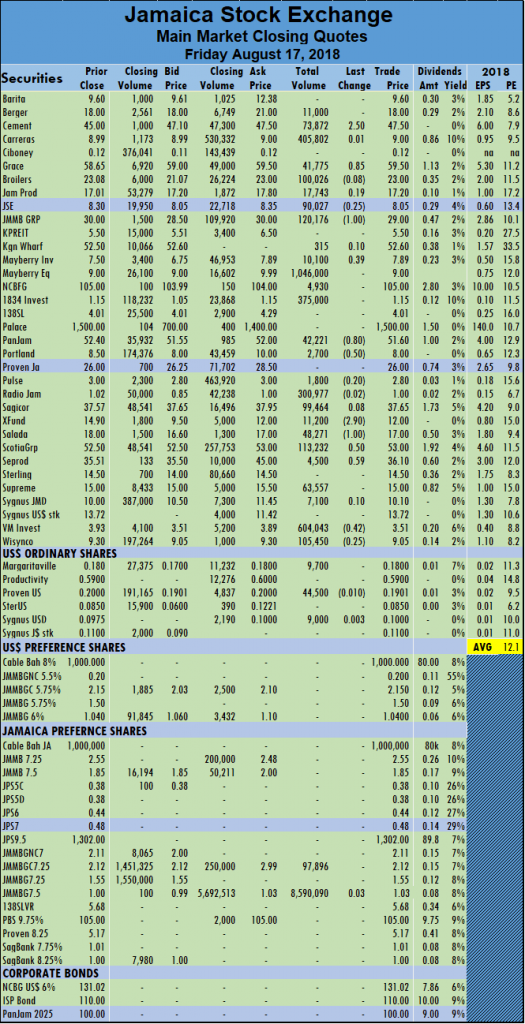

The day’s volume was led by, JMMB Group 7.5% preference share concluded trading at $1.03, with 8,590,090 shares with 69.3 percent of the traded volume, followed by Mayberry Equities that closed at $9 in trading 1,046,000 shares,  for just 8.4 percent of the day’s volume after trading at an intraday high of $10 and Supreme Ventures with 604,043 units and 4.9 percent of the main market volume.

for just 8.4 percent of the day’s volume after trading at an intraday high of $10 and Supreme Ventures with 604,043 units and 4.9 percent of the main market volume.

Stocks with major price changes| Caribbean Cement jumped $2.50 and finished at $47.50, trading 73,872 shares, Grace Kennedy rose 85 cents and ended trading at $59.50, with 41,775 shares, JMMB Group lost $1 and ended at $29, exchanging 120,176 shares, Mayberry Investments gained 39 cents to settle at $7.89, with 10,100 units, PanJam Investment fell 80 cents and concluded trading 42,221 shares and closed at $51.60, Portland JSX lost 50 cents and ended at $8 trading 2,700 units, Sagicor Real Estate Fund dived $2.90 to $12, with 11,200 shares, Salada Foods shed $1 to close at $17, in exchanging 48,271 units, Scotia Group rose 50 cents in traded 113,232 shares to close at $53, Seprod finished trading 4,500 shares, and gained 59 cents to close at $36.10, ended at $15, with 21,164 shares after losing 30 cents,  Victoria Mutual Investments lost 42 cents in concluding trading at $3.51, with 604,043 stock units and Wisynco Group fell 25 cents and finished trading 105,450 shares to end at $9.05.

Victoria Mutual Investments lost 42 cents in concluding trading at $3.51, with 604,043 stock units and Wisynco Group fell 25 cents and finished trading 105,450 shares to end at $9.05.

Trading in the US dollar market closed with Margaritaville traded 9,700 shares and ended at 18 US cents Proven Investments trading 44,500 shares, falling 0.09 cent and closed at 19.01 US cents and Sygnus Credit Investments traded 9,000 shares and rose 0.03 cent to 10 US cents. The JSE USD Equities Index slipped 0.12 points to end at 159.24.

Trading resulted in an average of 492,474 units valued at over $1,930,933, in contrast to 290,382 shares valued at $14,562,733 on Thursday. For the month to date an average of 231,530 shares valued at an average of $4,665,985 versus 211,092 shares valued at an average of $4,956,066 on Thursday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading shows 5 stocks ended with bids higher than their last selling prices and 4 closing with lower offers.

Record close for JSE – Thursday

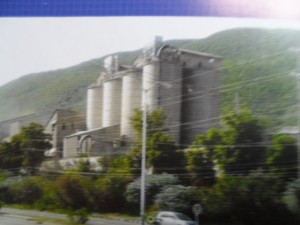

The All Jamaican Composite Index of the Jamaica Stock Exchange surged to more than 345,000 points in the early morning session on Thursday but failed to hold on at that level but still managed to end at a new record close.

The All Jamaican Composite Index of the Jamaica Stock Exchange surged to more than 345,000 points in the early morning session on Thursday but failed to hold on at that level but still managed to end at a new record close.

At the close, the All Jamaican Composite Index held on to just 119.17 points of the early gains to end at a record closing high of 344,070.11 and the JSE Index clung to 108.58 points to end at record closing high of 313,486.71.

Trading in the main market ended with 4,999,824 units valued at over $34,788,166 compared to 34,917,482 units valued at $108,176,982 on Tuesday.

Market activities resulted in 31 securities trading including 4 in the US dollar market compared to 29 securities trading on Tuesday. At the end of trading, the prices of 14 stocks rose, 8 declined and 9 traded unchanged.

Market activities resulted in 31 securities trading including 4 in the US dollar market compared to 29 securities trading on Tuesday. At the end of trading, the prices of 14 stocks rose, 8 declined and 9 traded unchanged.

The day’s volume was led by, Mayberry Investments trading 1,003,340 shares to close at $7, after it traded at an intraday 52 weeks’ high of $7.60 JMMB Group 7.5% preference share closing at $1, in trading 952,000 shares and Mayberry Equities closed trading at $8.50 with 522,731 shares trading.

Major price changes| Grace Kennedy traded at an intraday 52 weeks’ high of $56.70 but ended trading at a 52 weeks’ closing high of $56.01. Jamaica Producers rose 30 cents to $17, trading 5,988 stock units, Mayberry Equities lost 55 cents trading 522,731 shares to end at $8.60, PanJam Investment concluded trading 51,973 shares at $51, after falling $1.54, Sagicor Group shed 40 cents and settled at $38.10, with 21,574 shares trading, Scotia Group traded 13,284 units and rose $1.10 to end at $52.20 and Sterling jumped $1.50 and finished trading at $13.50, with 2,952 shares changing hands.

Trading in the US dollar market closed with 98,429 units valued at US$87,029 as JMMB Group 6 percent preference share completed trading 80,000 stock units at $1.05, Margaritaville ended trading 10,524 shares to close at 16.9 US cents and Proven Investments rose 1 cent to 19 US cents trading 5,105 shares. The JSE USD Equities Index rose 1.62 points to 155.14.

Trading resulted in an average of 185,179 units valued at an average of $1,288,451 for each security traded. In contrast to 1,342,980 units for an average of $4,160,653 on Tuesday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 7 stocks ended with bids higher than their last selling prices and 2 closing with lower offers.

The day’s volume was led by, Wisynco Group with 2,011,245 units and 27.2 percent of the main market volume, followed by Sagicor Group exchanging 1,110,079 shares and 15 percent of the day’s trades and Carreras with 737,830 units accounting for 10 percent of traded volume.

The day’s volume was led by, Wisynco Group with 2,011,245 units and 27.2 percent of the main market volume, followed by Sagicor Group exchanging 1,110,079 shares and 15 percent of the day’s trades and Carreras with 737,830 units accounting for 10 percent of traded volume. The Trading in the US dollar market closed with 10,189 units valued at US$1,891 as Margaritaville traded 2,339 shares at 18 US cents and Proven Investments cents and closed at 20 US cents trading 2,850 shares. JSE USD Equities Index rose 0.12 points to 159.36.

The Trading in the US dollar market closed with 10,189 units valued at US$1,891 as Margaritaville traded 2,339 shares at 18 US cents and Proven Investments cents and closed at 20 US cents trading 2,850 shares. JSE USD Equities Index rose 0.12 points to 159.36.

The day’s volume was led by,

The day’s volume was led by,  Trading in the US dollar market closed with 35,200 units valued at US$65,830 as JMMB Group 5.75% preference share rose 12 cents and closed at US$2.15 trading 35,200 shares and Margaritaville rose 1 cent in trading 5,000 shares at 18 US cents. The JSE USD Equities Index rose 0.47 points to 159.31.

Trading in the US dollar market closed with 35,200 units valued at US$65,830 as JMMB Group 5.75% preference share rose 12 cents and closed at US$2.15 trading 35,200 shares and Margaritaville rose 1 cent in trading 5,000 shares at 18 US cents. The JSE USD Equities Index rose 0.47 points to 159.31. The All Jamaican Composite Index of the Jamaica Stock Exchange traded at an intraday record high of

The All Jamaican Composite Index of the Jamaica Stock Exchange traded at an intraday record high of

Proven Investments added 1 cent and closed at 20 US cents trading 38,800 shares and Sygnus Credit closed 10 US cents in trading 210 shares. The JSE USD Equities Index lost 0.71 points and closed at 154.43

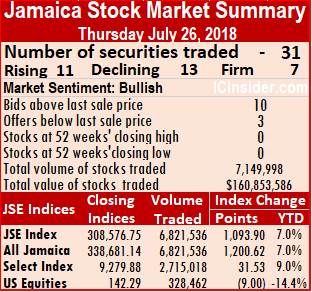

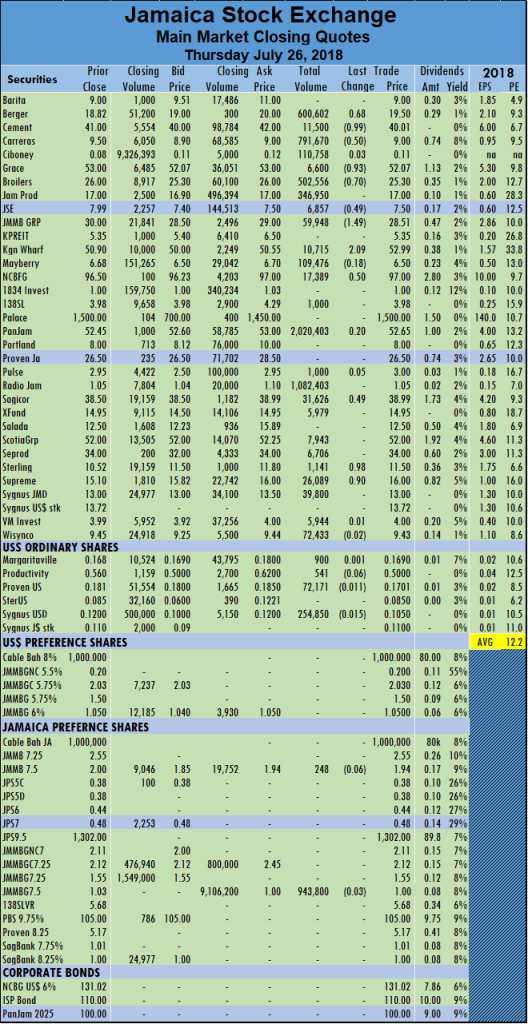

Proven Investments added 1 cent and closed at 20 US cents trading 38,800 shares and Sygnus Credit closed 10 US cents in trading 210 shares. The JSE USD Equities Index lost 0.71 points and closed at 154.43 The main market of the Jamaica Stock Exchange suffered moderate losses in the main indices with just over 30 points drop at the close on Thursday as advancing stocks out-paced decliners.

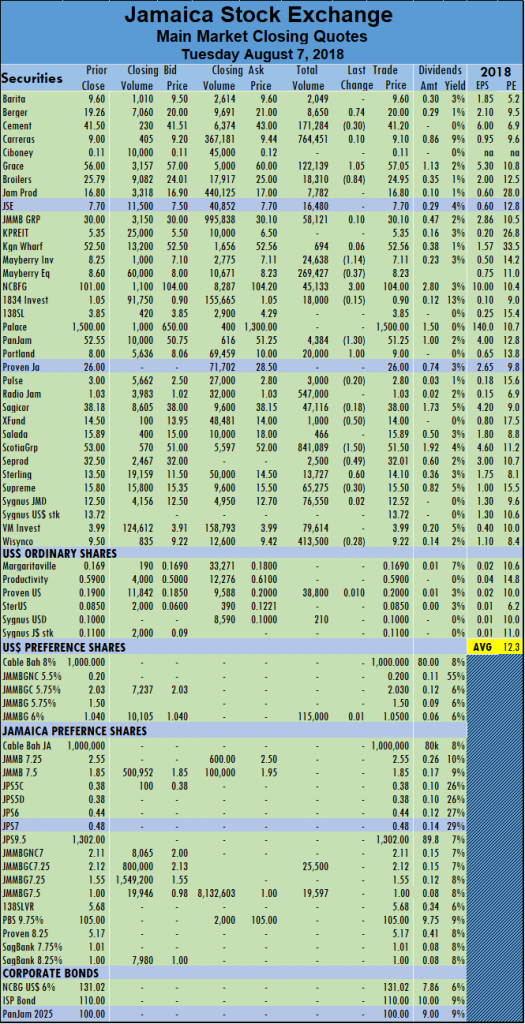

The main market of the Jamaica Stock Exchange suffered moderate losses in the main indices with just over 30 points drop at the close on Thursday as advancing stocks out-paced decliners.  The day’s volume was led by, PanJam Investment that closed at $52.65, with 2,20,403 stock units, Radio Jamaica with 1,082,403 shares, JMMB Group 7.5% preference share trading 943,000 units, Carreras with 791,670 units and Berger Paints with 600,602 shares.

The day’s volume was led by, PanJam Investment that closed at $52.65, with 2,20,403 stock units, Radio Jamaica with 1,082,403 shares, JMMB Group 7.5% preference share trading 943,000 units, Carreras with 791,670 units and Berger Paints with 600,602 shares. Trading in the US dollar market closed with 328,462 units valued at US$40,221 as Margaritaville rose 0.10 cent and ended at 16.90 US cents with 900 shares and Productivity Business ended trading 6 cents lower to 50 cents with 541 shares, Proven Investments lost 1.09 cents to 17.01 US cents with 72,171 shares trading and Sygnus Credit Investments closed with 254,850 units trading with a decline of 1.5 cents to 10.50 US cents. The JSE USD Equities Index fell 9 points to 142.29.

Trading in the US dollar market closed with 328,462 units valued at US$40,221 as Margaritaville rose 0.10 cent and ended at 16.90 US cents with 900 shares and Productivity Business ended trading 6 cents lower to 50 cents with 541 shares, Proven Investments lost 1.09 cents to 17.01 US cents with 72,171 shares trading and Sygnus Credit Investments closed with 254,850 units trading with a decline of 1.5 cents to 10.50 US cents. The JSE USD Equities Index fell 9 points to 142.29. The main market pulled back on but blasted to a new intraday high on Friday confirming that the bull run is in its early stages, while the Junior Market continues to bounce around.

The main market pulled back on but blasted to a new intraday high on Friday confirming that the bull run is in its early stages, while the Junior Market continues to bounce around. versus a last sale of 15 cents and is being offered at 18.5 cents to sell 1,050 units.

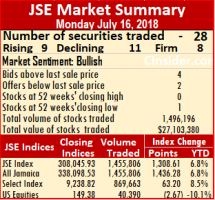

versus a last sale of 15 cents and is being offered at 18.5 cents to sell 1,050 units. Trading picked up on the Jamaica Stock Exchange on Tuesday, compared to the very modest level on Monday. Trading ended with an exchange of 2,832,561 units valued at over $81,949,830 compared to a mere 1,455,806 units valued just $24,016,207 on Monday.

Trading picked up on the Jamaica Stock Exchange on Tuesday, compared to the very modest level on Monday. Trading ended with an exchange of 2,832,561 units valued at over $81,949,830 compared to a mere 1,455,806 units valued just $24,016,207 on Monday.

June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

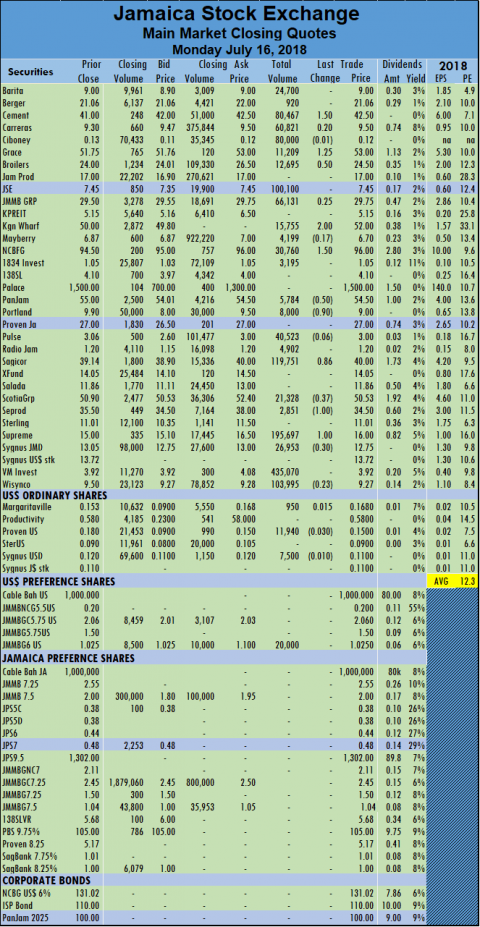

June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded. After falling sharply on Friday the Jamaica Stock Exchange climbed on Monday, when the All Jamaican Composite Index rose 1,436.28 points to close at 338,098.53 and the JSE Index rising 1,308.61 points to 308,045.93 as trading levels was miniscule.

After falling sharply on Friday the Jamaica Stock Exchange climbed on Monday, when the All Jamaican Composite Index rose 1,436.28 points to close at 338,098.53 and the JSE Index rising 1,308.61 points to 308,045.93 as trading levels was miniscule.  are, Caribbean Cement rose $1.50 and finished at $42.50, with 80,467 shares, Grace Kennedy climbed $1.25 and ended at $53, trading 11,209 shares. Kingston Wharves jumped $2 finished at $52 with 15,755 stock units, NCB Financial Grouprose $1.50 to $96, with 30,760 shares, PanJam Investment dropped 50 cents and closed at $54.50, as 5,784 stock units traded. Portland JSX lost 90 cents as 8,000 shares traded at $9, Sagicor Group rose 86 cents to $40 with the trading of 119,751 units, Seprod lost $1 to $34.50 in trading 2,851 units and Supreme Ventures ended at $16, with 195,697 shares and rose $1.

are, Caribbean Cement rose $1.50 and finished at $42.50, with 80,467 shares, Grace Kennedy climbed $1.25 and ended at $53, trading 11,209 shares. Kingston Wharves jumped $2 finished at $52 with 15,755 stock units, NCB Financial Grouprose $1.50 to $96, with 30,760 shares, PanJam Investment dropped 50 cents and closed at $54.50, as 5,784 stock units traded. Portland JSX lost 90 cents as 8,000 shares traded at $9, Sagicor Group rose 86 cents to $40 with the trading of 119,751 units, Seprod lost $1 to $34.50 in trading 2,851 units and Supreme Ventures ended at $16, with 195,697 shares and rose $1. Trading in the US dollar market continue to be modest and closed with 40,390 units valued at US$23,566. JMMB Group 6% preference share completed trading at $1.03 with 20,000 stock units, Margaritaville gained 1.5 cents and finished at 16.8 US cents with 20,000 shares changing hands, Proven Investments lost 3 cents and closed at a 52 weeks’ low of 15 US cents trading 11,940 shares and Sygnus Credit traded 7,500 units and lost 1 cent to end at 11 US cents. The JSE USD Equities Index dropped 2.67 points up to 149.38.

Trading in the US dollar market continue to be modest and closed with 40,390 units valued at US$23,566. JMMB Group 6% preference share completed trading at $1.03 with 20,000 stock units, Margaritaville gained 1.5 cents and finished at 16.8 US cents with 20,000 shares changing hands, Proven Investments lost 3 cents and closed at a 52 weeks’ low of 15 US cents trading 11,940 shares and Sygnus Credit traded 7,500 units and lost 1 cent to end at 11 US cents. The JSE USD Equities Index dropped 2.67 points up to 149.38.