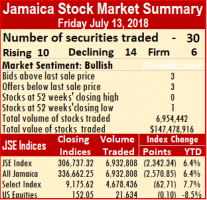

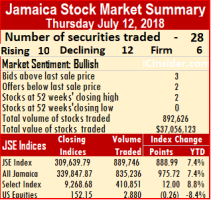

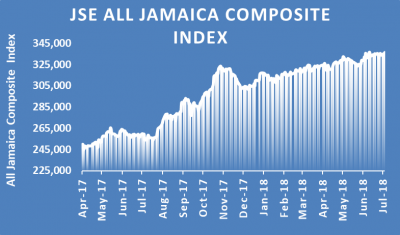

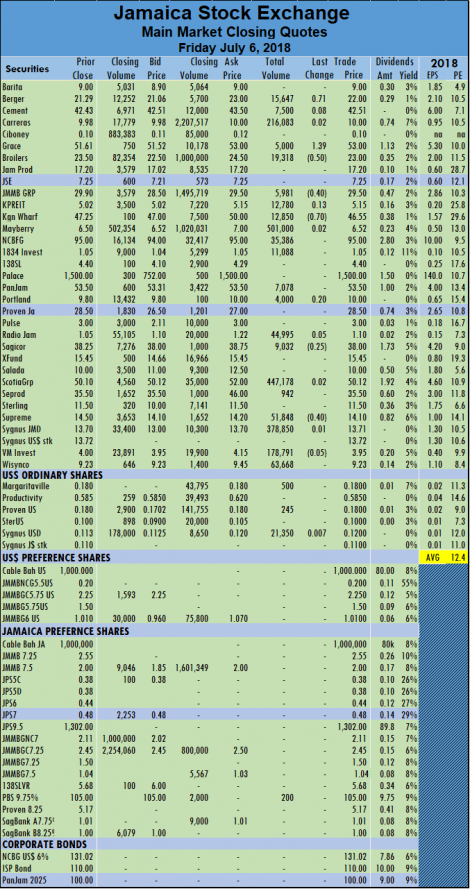

The Jamaica Stock Exchange climbed to the fifth straight record high, reached seconds after opening on Friday, when the All Jamaican Composite Index rose 1,082.40 points to 340,315.50 with the JSE Index rising 986.19 points to 310,065.85 but lost the gains by the close.

The Jamaica Stock Exchange climbed to the fifth straight record high, reached seconds after opening on Friday, when the All Jamaican Composite Index rose 1,082.40 points to 340,315.50 with the JSE Index rising 986.19 points to 310,065.85 but lost the gains by the close.

At the end of trading, the All Jamaican Composite Index dropped 2,570.85 points to 336,662.25 and the JSE Index dived 2,342.34 points to 306,737.32.

Activities in the main market and US dollar market resulted in 30 securities trading including 4 from the US dollar market, compared to 28 securities trading on Thursday. At the end of trading, the prices of 10 stocks advanced, 14 declined and 6 closed unchanged from an exchange of 6,932,808 units valued $147,102,076 compared to 889,746 units valued at $37,006,553 on Thursday.

The day’s volume was led by, Jamaica Broilers with 2,084,581 units amounting to 30 percent of the volume traded, followed by Sagicor Group with 1,331,080 units accounting for 19 percent of the day’s volume of and Jamaica Stock Exchange with 1,083,267 units for 15.6 percent of the day’s volume.

The day’s volume was led by, Jamaica Broilers with 2,084,581 units amounting to 30 percent of the volume traded, followed by Sagicor Group with 1,331,080 units accounting for 19 percent of the day’s volume of and Jamaica Stock Exchange with 1,083,267 units for 15.6 percent of the day’s volume.

Stocks with major price changes are, Caribbean Cement lost $2 and finished at $41, with 20,107 shares, JMMB Group declined 49 cents and ended at $29.50, with 56,845 shares. Kingston Wharves dropped $2 finished at $50 with 124,720 stock units, NCB Financial Groupshed $1.50 to $94.50, with 65,326 shares, PanJam Investment dropped $3.99 and closed at $55, with 24,570 stock units trading. Scotia Group traded at $50.90, and lost 40 cents with 153,731 units, Sterling Investments rose $1.01 and closed at $11.01, with 66,652 shares and Supreme Ventures ended at $15, with 31,100 shares but fell 50 cents.

Trading resulted in an average of 266,646 units valued at an average of $5,657,772 for each security traded. In contrast to 34,221 units for an average of $1,423,329 on Thursday. The average volume and value for the month to date amounts 168,594 units valued at $3,230,262 compared to 158,477 units valued at $2,952,222 on Thursday. June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

Trading resulted in an average of 266,646 units valued at an average of $5,657,772 for each security traded. In contrast to 34,221 units for an average of $1,423,329 on Thursday. The average volume and value for the month to date amounts 168,594 units valued at $3,230,262 compared to 158,477 units valued at $2,952,222 on Thursday. June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

Trading in the US dollar market continue to be modest and closed with just 21,634 units valued at US$2,833, as Margaritaville lost 2.7 cents and finished at a 52 weeks’ low of 15.3 US cents with 10,000 shares, changing hands, Proven Investments closed at 18 US cents with 2,241 units changing hands, Sygnus Credit trading 7,500 units and rose 1 cents at 12 US cents and JMMB Group 5.75 % preference share fell 19 cents to US$2.06 after trading 1,893 units. The JSE USD Equities Index slipped 0.10 points up to 152.05.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ended with bids higher than their last selling prices and 3 closing with lower offers.

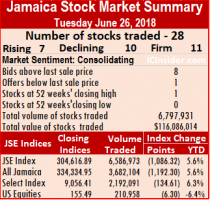

JSE Majors retreat from Friday’s record

4 straight JSE main market record close

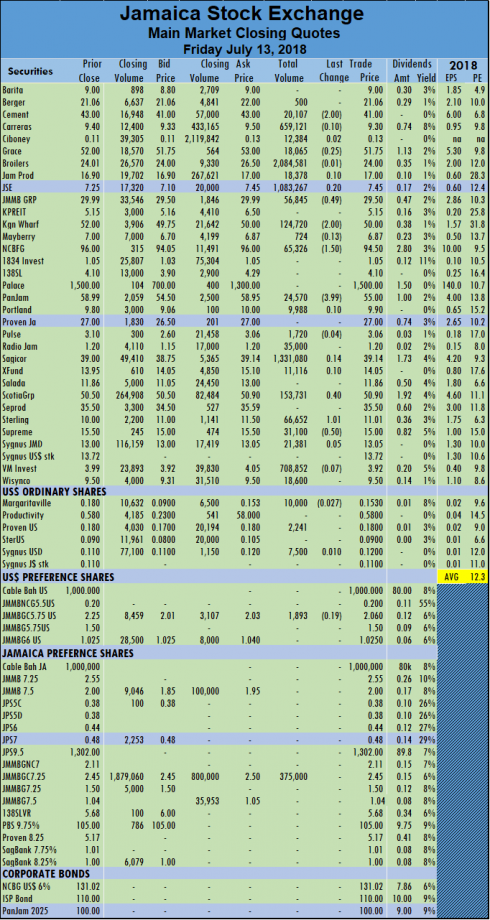

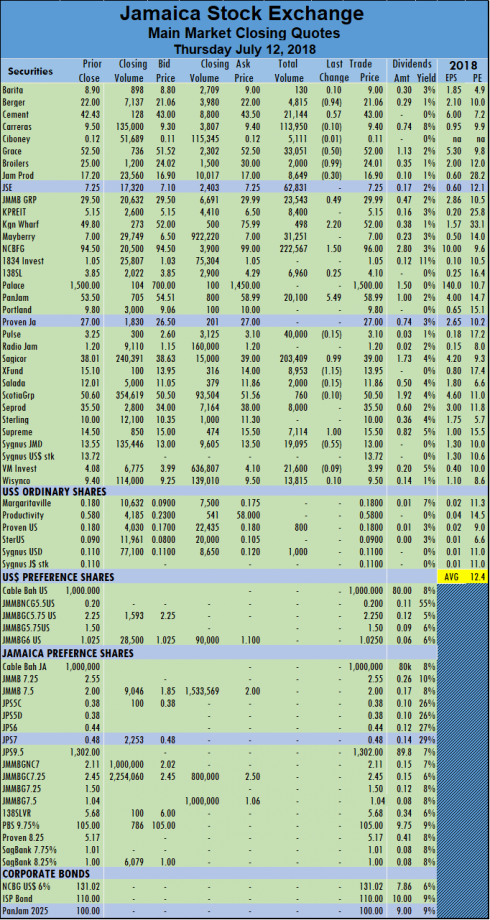

The Jamaica Stock Exchange ended trading for the fourth straight at an all-time closing high, the All Jamaican Composite Index climbed 975.72 points to a record 339,847.87 with the JSE Index rising 888.99 points to a record 309,639.79.

The Jamaica Stock Exchange ended trading for the fourth straight at an all-time closing high, the All Jamaican Composite Index climbed 975.72 points to a record 339,847.87 with the JSE Index rising 888.99 points to a record 309,639.79.

Activities in the main market resulted in 28 securities trading including 2 from the US dollar market, compared to 23 securities trading on Wednesday. At the close, the prices of 10 stocks advanced, 12 declined and 6 closed unchanged.

Trading activity on the Jamaica Stock Exchange closed with an exchange of 889,746 units valued at $37,006,553 compared to 3,345,840 units valued $86,257,264 on Wednesday.

The day’s volume was led by, NCB Financial Group with just 222,567 units amounting to 25 percent of the volume traded, followed by Sagicor Group with 203,409 units accounting for 22.86 percent of the day’s volume of and Carreras with 113,950 units for 12.8 percent of the day’s volume.

Stocks with major price changes are, Berger Paints lost 94 cents and ended at $21.06, with 4,815 stock units, Caribbean Cement gained 57 cents and settled at $43.00, with 21,144 shares, Grace Kennedy shed 50 cents to end at $52, with 33,051 stock units, Jamaica Broilers lost 99 cents trading 2,000 units at $24.01 after trading at a record high of $33. JMMB Group rose 49 cents to end at $29.99, with 23,543 shares, Kingston Wharves gained $2.20 and settled at a 52 weeks’ high of $52, in trading just 498 units, NCB Financial Group traded at $96 after rising $1.50 with 222,567 shares, PanJam Investment jumped $5.49 to a record high of $58.99, with 20,100 units, Sagicor Group gained 99 cents and ended trading at $39, with 203,409 stock units changing hands, Sagicor Real Estate Fund finished trading after falling $1.15 to end at $13.95, with 8,953 stock units. Supreme Ventures climbed $1 and settled at $15.50, with 7,114 shares and Sygnus Credit Investments closed with a fall of 55 cents at $13.

Stocks with major price changes are, Berger Paints lost 94 cents and ended at $21.06, with 4,815 stock units, Caribbean Cement gained 57 cents and settled at $43.00, with 21,144 shares, Grace Kennedy shed 50 cents to end at $52, with 33,051 stock units, Jamaica Broilers lost 99 cents trading 2,000 units at $24.01 after trading at a record high of $33. JMMB Group rose 49 cents to end at $29.99, with 23,543 shares, Kingston Wharves gained $2.20 and settled at a 52 weeks’ high of $52, in trading just 498 units, NCB Financial Group traded at $96 after rising $1.50 with 222,567 shares, PanJam Investment jumped $5.49 to a record high of $58.99, with 20,100 units, Sagicor Group gained 99 cents and ended trading at $39, with 203,409 stock units changing hands, Sagicor Real Estate Fund finished trading after falling $1.15 to end at $13.95, with 8,953 stock units. Supreme Ventures climbed $1 and settled at $15.50, with 7,114 shares and Sygnus Credit Investments closed with a fall of 55 cents at $13.

Trading resulted in an average of 34,221 units valued at an average of $1,423,329 for each security traded. In contrast to 145,471 units for an average of $3,750,316 on Wednesday. The average volume and value for the month to date amounts 158,477 units valued at $2,952,222 compared to 172,772 units valued at $3,149,989 on Wednesday. June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

In contrast to 145,471 units for an average of $3,750,316 on Wednesday. The average volume and value for the month to date amounts 158,477 units valued at $2,952,222 compared to 172,772 units valued at $3,149,989 on Wednesday. June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

Trading in the US dollar market was modest following no trading having taken place on Wednesday. The market closed with just 2,880 units valued at $378, as Proven Investments closed at 18 US cents with 880 units changing hands and Sygnus Credit trading 2,000 units at 11. The JSE USD Equities Index slipped 0.26 points up to 152.15.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ended with bids higher than their last selling prices and 2 closing with lower offers.

Record high for JSE main market

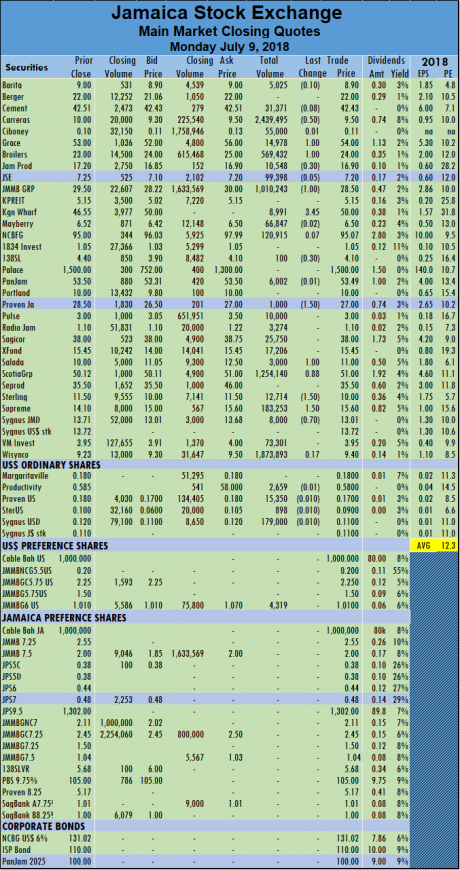

At the close of the trading on Monday, the main market of the Jamaica Stock Exchange closed at a new record high, with the All Jamaican Composite Index climbing 868.61 points to a record close of 337,258.91 and the JSE Index rising 791.40 points to a record 307,280.95.

At the close of the trading on Monday, the main market of the Jamaica Stock Exchange closed at a new record high, with the All Jamaican Composite Index climbing 868.61 points to a record close of 337,258.91 and the JSE Index rising 791.40 points to a record 307,280.95.

Activities in the main and US dollar markets resulted in 31 securities trading including 5 from the US dollar market, compared to 27 securities trading on Friday. At the close, the prices of 9 stocks advanced, 16 declined and 6 closed unchanged.

Trading activity on the Jamaica Stock Exchange rose strongly over Friday’s level, with an exchange of 7,903,876 units valued at $168,386,017 compared to 2,029,215 units valued at $42,587,552 on Friday.

The day’s volume was led by Carreras with 2,439,495 units and accounted for 30.86 percent of the day’s volume, followed by Wisynco Group with 1,873,893 units or 23.71 percent of the day’s volume, Scotia Group with 1,254,140 units accounting for 15.87 percent of the volume traded and JMMB Group with 1,010,243 units.

The day’s volume was led by Carreras with 2,439,495 units and accounted for 30.86 percent of the day’s volume, followed by Wisynco Group with 1,873,893 units or 23.71 percent of the day’s volume, Scotia Group with 1,254,140 units accounting for 15.87 percent of the volume traded and JMMB Group with 1,010,243 units.

Stocks with major price changes are, Grace Kennedy climbing $1 to $54. Jamaica Broilers up $1 to end at $24, JMMB Group falling $1 to $28.50, Kingston Wharves jumping $3.45 to $50, Proven Investments fell $1.50 in the Jamaican market to$27 but is still priced well above the US dollar market listing. Salada Foods rose $1 to $11, Scotia Group jumped 88 cents to $51, Sterling Investments fell $1.50 to $10, Supreme Ventures gained $1.50 in closing at $15.60 and Sygnus Credit Investments lost 70 cents in closing at $13.01. 138 Student Living traded with a loss of 30 cents to end at a 52 weeks’ low of $4.10.

In the US dollar market, 202,559 units valued at $28,806 as JMMB Group 6% preference share ended trading at US$1.01 with 4,319 stock units, Productivity Business declined by 0.5 cent and ended at 58 US cents with 2,659 shares traded, Proven Investments lost 1 cent and closed at 17 US cents with 15,350 units changing hands,  Sterling Investments ended trading at 9 US cents with 898 shares after falling 1 cent and Sygnus Credit Investments ended trading 179,000 shares after falling 1 cent to 11 US cents. The JSE USD Equities Index lost 2.81 points up to 150.39.

Sterling Investments ended trading at 9 US cents with 898 shares after falling 1 cent and Sygnus Credit Investments ended trading 179,000 shares after falling 1 cent to 11 US cents. The JSE USD Equities Index lost 2.81 points up to 150.39.

Trading resulted in an average of 303,995 units valued at an average of $6,476,385 for each security traded, in contrast to 92,237 units for an average of $1,935,798 on Friday. The average volume and value for the month to date amounts 163,654 units valued at $2,946,511 compared to 167,222 units valued at $2,763,542, on Friday. June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 4 stocks ended with bids higher than their last selling prices and 2 closing with lower offers.

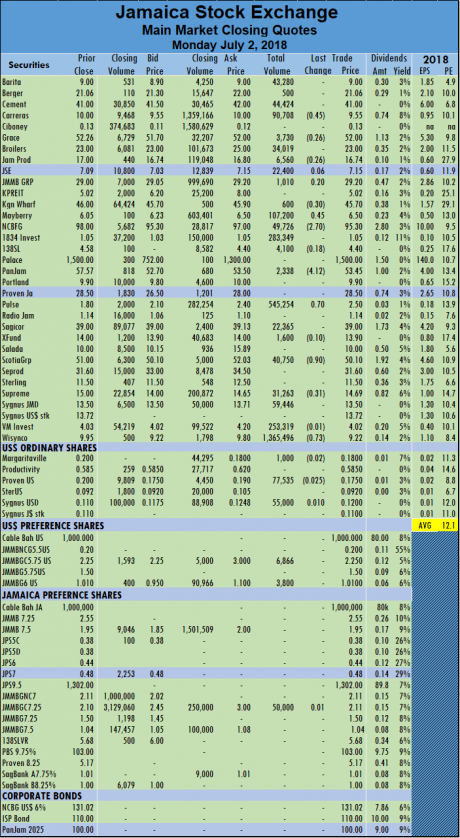

JSE majors 300 points from record

Jamaica Stock Exchange main market continues its slow upward climb as it eyes new highs ahead.

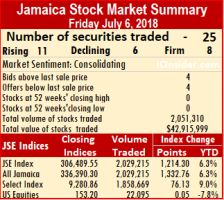

At the close of the trading on Friday, the All Jamaican Composite Index sits just 300 points and the JSE Index just 276 points from the record high reach on June 13, after rising over 1,200 points on Friday.

The All Jamaican Composite Index climbs 1,332.76 points to close at 336,390.30 while the JSE Index advanced by 1,214.30 points to close at 306,489.55.

Trading activity on the Jamaica Stock Exchange on Friday remained low, with an exchange of just 2,029,215 units valued at $42,587,552 compared to 4,036,088 units valued at $49,293,055 on Thursday.

Activities in the main and US dollar markets resulted in 25 securities trading including 3 from the US dollar market, compared to 27 securities trading on Thursday. At the close, the prices of 11 stocks advanced, 6 declined and 8 closed unchanged.

Activities in the main and US dollar markets resulted in 25 securities trading including 3 from the US dollar market, compared to 27 securities trading on Thursday. At the close, the prices of 11 stocks advanced, 6 declined and 8 closed unchanged.

Thursday’s volume was led by Mayberry Investments that settled at $6.52, with 501,000 units trading, Scotia Group traded at $50.12, with 447,178 units and Sygnus Credit Investments traded 378,850 shares at $13.71.

Stocks with major price changes are, Berger Paints that rose 71 cents to $22, Grace Kennedy climbing $1.39 to $53. Jamaica Broilers lost 50 cents to end at $23, JMMB Group declined 40 cents to $29.50, Kingston Wharves lost 70 cents to end at $46.55 and Supreme ventures lost 40 cents in closing at $14.10.

In the US dollar market, 22,095 units valued at $2,546 as with Margaritaville traded 500 shares at 18 US cents, Proven Investments closed at 18 US cents with just 245 units changing hands and Sygnus Credit Investments ended trading 21,350 shares after rising 0.7 cent to 12 US cents. The JSE USD Equities Index inched 0.05 points up to 153.20.

In the US dollar market, 22,095 units valued at $2,546 as with Margaritaville traded 500 shares at 18 US cents, Proven Investments closed at 18 US cents with just 245 units changing hands and Sygnus Credit Investments ended trading 21,350 shares after rising 0.7 cent to 12 US cents. The JSE USD Equities Index inched 0.05 points up to 153.20.

Trading resulted in an average of 92,237 units valued at an average of $1,935,798 for each security traded. In contrast to 161,444 units for an average of $1,971,722 on Thursday. The average volume and value for the month to date amounts 167,222 units valued at $2,763,542 compared to 183,396 units valued at $2,264,736, on Thursday. June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 4 stocks ended with bids higher than their last selling prices and 4 closing with lower offers.

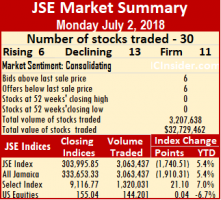

JSE Trading climbs sharply – Monday

The volume traded on the Jamaica Stock Exchange declined sharply on Monday to 3,063,437 units valued at $29,501,732 compared to a much larger 16,726,086 shares valued at $358,993,001 on Friday.

The volume traded on the Jamaica Stock Exchange declined sharply on Monday to 3,063,437 units valued at $29,501,732 compared to a much larger 16,726,086 shares valued at $358,993,001 on Friday.

Market activities in the main and US dollar markets resulted in 30 securities trading including 5 from the US dollar market. At the close, the price of just 6 stocks advanced, 13 declined and 11 closing unchanged, compared to 24 securities trading on Friday.

At the close on the Jamaica Stock Exchange on Monday, the All Jamaican Composite Index dropped 1,910.31 points to 333,653.33 while the JSE Index dived 1,740.51 points to end at 303,995.85.

Monday’s volume was led by Wisynco Group with 1,365,496 units accounting for 44.57 percent of the day’s volume, followed by Pulse Investments with 545,254 units or 17.80 percent of total volume.

Stocks with major price changes are, Carreras fell 45 cents and closed at $9.55, Mayberry Investments rose 45 cents to $6.50, NCB Financial dropped $2.70 to $95.30, PanJam Investment dropped $4.12 to close at $53.45, Pulse Investments climbed 70 cents to $2.50, Scotia Group lost 90 cents to end at $50.10 and Wisynco Group lost 73 cents and ended at $9.22.

Stocks with major price changes are, Carreras fell 45 cents and closed at $9.55, Mayberry Investments rose 45 cents to $6.50, NCB Financial dropped $2.70 to $95.30, PanJam Investment dropped $4.12 to close at $53.45, Pulse Investments climbed 70 cents to $2.50, Scotia Group lost 90 cents to end at $50.10 and Wisynco Group lost 73 cents and ended at $9.22.

In the US dollar market, 144,201 units traded valued at $24,829 with JMMB 5.75% preference share closed at US$2.25 trading 6,866 shares and JMMB 6% preference share $1 completed trading at $1 with 3,800 stock units, Margaritaville lost 2 cents and finished trading 18 US cents with 1,000 shares,  Proven Investments traded 77,535 units and fell 2.5 cents to 17.5 cents and Sygnus Credit traded 55,000 units and closed with the price rising 1 cent to end at 12 US cents. The JSE USD Equities Index closed with a rise of just 0.04 points to 155.04.

Proven Investments traded 77,535 units and fell 2.5 cents to 17.5 cents and Sygnus Credit traded 55,000 units and closed with the price rising 1 cent to end at 12 US cents. The JSE USD Equities Index closed with a rise of just 0.04 points to 155.04.

Trading resulted in an average of 122,537 units valued at an average of $1,180,069 for each security traded, in contrast to 727,221 units valued at an average of $15,608,391 on Friday. June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 6 stocks ended with bids higher than their last selling prices and 6 closing with lower offers.

PanJam jumps $5 to record high on Tuesday

Pan Jam office building in Kingston Jamaica.

PanJam Investment jumped $5.07 to a record high of $57.57, in trading on the Jamaica Stock Exchange on Tuesday, but the market indices dropped more than 1,000 points.

At the close on the Jamaica Stock Exchange on Tuesday, the All Jamaican Composite Index declined by 1,192.30 points to 334,334.95 while the JSE Index fell 1,086.32 points to 304,616.89.

Stocks with major price changes are, Carreras with a fall of $1 to $9, Grace Kennedy down $1 to $53, Portland JSX up 75 cents to $9.80, Salada Foods falling $2.50 to $10, Scotia Group rising 50 cents to end at $52, Supreme Ventures dropping $1.10 to $14 and Sygnus Credit rising 50 cents to $13.50.

At the close of market activity 6,586,973 units valued at $111,180,207 changed hands compared to 4,037,181 units valued at $55,669,184, on Monday.

Trading volume was dominated by Wisynco Group with 2,466,837 units, accounting for 37.45 percent of the volume traded, followed by Mayberry Investments with 835,956 units or just 12.69 percent of the main market volume and Carreras with 613,398 stock units or 9.3 percent.

Trading volume was dominated by Wisynco Group with 2,466,837 units, accounting for 37.45 percent of the volume traded, followed by Mayberry Investments with 835,956 units or just 12.69 percent of the main market volume and Carreras with 613,398 stock units or 9.3 percent.

Market activities in the main and US dollar markets resulted in 25 securities trading of which 7 advanced, 10 declined and 11 closing unchanged, compared to 30 securities trading on Monday.

In the US dollar market, 210,958 units traded valued at $38,935 with Margaritaville trading with 7,958 shares at 19.95 US cents compared to 20 US cents previously and  Proven Investments traded 203,000 units at 20 US cents. The JSE USD Equities Index dropped 6.30 points to close at 155.49.

Proven Investments traded 203,000 units at 20 US cents. The JSE USD Equities Index dropped 6.30 points to close at 155.49.

Trading resulted in an average of 253,345 units valued at an average of $4,276,162 for each security traded, in contrast to 168,216 units for an average of $2,319,549 on Monday. For the month to date 216,970 units traded with an average value of $5,389,348 and on the previous day 219,629 units traded with an average value of $5,567,307 on average. May closed with an average of 589,414 shares with a value of $16,532.367, for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ended with bids higher than their last selling prices and 1 closing with a lower offer.

JSE up one day down another

Syngus Credit Jamaica stock dip below IPO price but teh US based rose.

The Jamaica Stock Exchange main market retreated on Tuesday after it gained on Monday following Friday’s losses as declining stocks had the upper hand over advancing ones.

At the close, the All Jamaican Composite Index fell 634.73 points to 333,735.28 while the JSE Index slipped 578.31 points to 304,070.53, as declining stocks dominated trading.

Market activities in the main and US dollar markets resulted in 32 securities trading of which 9 advanced, 11 declined and 12 traded firm, compared to 22 securities trading on Monday.

At the close of market activity 6,395,222 units valued at $50,487,361 traded compared to 3,061,341 units valued at over $40,934,808 changed hands, on Monday.

At the close of market activity 6,395,222 units valued at $50,487,361 traded compared to 3,061,341 units valued at over $40,934,808 changed hands, on Monday.

Trading volume was dominated by 1834 Investments with 2 million units followed by Ciboney with 1,589,845 units and Mayberry Investments with 1,084,672 units.

Stocks with major price changes are, JMMB Group rising 50 cents to $29, Sagicor Group climbing $1.10 to $39.10 and Supreme Ventures gaining $1.09 to close at $15, Sygnus Credit falling $2.30 to a low of $13.70 and Productive Business Solution Preference share rose $2 to $105.

Trading resulted in an average of 220,525 units valued at over $1,740,943, in contrast to 113,383 shares valued at $1,516,104 on Monday.  For the month to date 195,519 units traded with an average value of $6,383,337 and on the previous day 203,633 units traded with an average value of $6,596,529 on average. May closed with an average of 589,414 shares with a value of $16,532.367, for each security traded.

For the month to date 195,519 units traded with an average value of $6,383,337 and on the previous day 203,633 units traded with an average value of $6,596,529 on average. May closed with an average of 589,414 shares with a value of $16,532.367, for each security traded.

In the US dollar market, 174,740 units valued at over $22,872 traded with Proven Investments ended trading with 6070 units at 20 US cents, Sugnus Credit Investments 167,670 shares and rose 1.5 cents to a new high of 12.5 US cents and JMMB Group 6% preference share advanced by 10 cents in trading 1,000 stock units at $1.10. The JSE USD Equities Index rose 1.32 points to close at 163.15.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 5 stocks ended with bids higher than their last selling prices and 1 closing with a lower offer.

JSE climbs sharply to record close – Tuesday

Investors pushed the Jamaica Stock Exchange o another record close on Tuesday with the All Jamaican Composite Index jumped 3,471.47 points to close at 336,007.19 and the JSE Index climbed 3,162.90 points to 306,140.51.

Investors pushed the Jamaica Stock Exchange o another record close on Tuesday with the All Jamaican Composite Index jumped 3,471.47 points to close at 336,007.19 and the JSE Index climbed 3,162.90 points to 306,140.51.

Market activities resulted in 25 securities trading, compared to 33 on Monday in the main and US dollar markets of which 10 advanced, 8 declined and 7 traded firm.

Stocks with major price changes are, Caribbean Cement with a fall of $1 to $39.50, Jamaica Broilers gaining $1.20 to $22.80, NCB Financial Group rising $1 to $98, Seprod rising $1 to $36 and Supreme Ventures climbing $1.50 to $15.

The volume of stocks trading on the main market jumped sharply to 11,446,622 units valued at $579,818,518 from 3,192,844 units valued at $66,838,582, on Monday as NCB Financial Group accounted for 5,014,800 units traded amounting to 43.81 percent of the total volume traded. Supreme Ventures closed trading with 20.25 percent of the day’s volume amounting to 2,317,772 units and Jamaica Broilers with 1,005,810 units or just 8.79 percent of the overall volume.

Trading resulted in an average of 497,679 units valued at an average of $25,209,501 for each security traded. In contrast to 106,428 units valued at an average of $2,227,953 on Monday. For the month to date 215,958 units traded with an average value of $7,679,455 and on the previous day 184,656 units traded with an average value of $5,451,880. May closed with an average of 589,414 shares with a value of $16,532.367, for each security traded.

Trading resulted in an average of 497,679 units valued at an average of $25,209,501 for each security traded. In contrast to 106,428 units valued at an average of $2,227,953 on Monday. For the month to date 215,958 units traded with an average value of $7,679,455 and on the previous day 184,656 units traded with an average value of $5,451,880. May closed with an average of 589,414 shares with a value of $16,532.367, for each security traded.

In the US dollar market, 4,741 units valued at just US$1,039 traded as Margaritaville closed with a loss of 0.05 cent at 19.95 US cents with 4,500 units and Productivity Business settling with a loss of 0.04 cent at 58.5 US cents trading 241 shares. The JSE USD Equities Index dropped 5.76 points to close at 160.75.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ended with bids higher than their last selling prices and 6 closing with lower offers.

For more details of market activities see – NCB pushes JSE trading volume on Tuesday.

Jamaica Broilers grabs 99% of trade – Thursday

Jamaica Broilers traded 169,101,565 units accounting for 99.35 percent of the overall volume of 170,209,058 units on Thursday valued at $3,113,335,699 that traded on the Jamaica Stock Exchange.

Jamaica Broilers traded 169,101,565 units accounting for 99.35 percent of the overall volume of 170,209,058 units on Thursday valued at $3,113,335,699 that traded on the Jamaica Stock Exchange.

On Wednesday the market closed with 2,629,595 units valued at $48,019,325. Market activities resulted in 26 securities trading, compared to 24 on Wednesday, in the main and US markets. The market recovered some of the grounds lost on the previous days as advancing stocks had the upper hand over declining stocks. At the close of market activity, 11 securities gained, 5 declined and 8 traded firm.

the All Jamaican Composite Index rose 1,297.53 points to 325,475.89 and the JSE Index climbed 1,182.20 points to close at 296,545.31.

Stocks with major price changes are, Caribbean Cement rising $1.95 to $40, Jamaica Broilers down $3.81 to $18.19, Kingston Wharves up $1.90 to end at $46.90, NCB Financial Group trading at $95 after rising $1, Sagicor Group rallying $1.30 to $38.30 and Scotia Group declining $1.53 to $50. Productivity Business Solutions, preference share lost $2 to end at $103.

Trading resulted in an average of 7,092,044 units valued at an average of $129,722,321 for each security traded, in contrast to 114,330 units for an average of $2,087,797 on Wednesday. The average for the month to date is 589,414 shares with a value of $16,532.367, previously 307,202 shares with a value of $11,110,094. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

In the US dollar market, Productivity Business Solutions, ordinary share finished trading with a fall of 1 cent, to 61 US cents, with 1,512 units trading and Proven Investments ended with 12,550 units trading with the rise of 1 cents to 23 US cents. The JSE USD Equities Index rose 7.33 points to close at 181.11.

In the US dollar market, Productivity Business Solutions, ordinary share finished trading with a fall of 1 cent, to 61 US cents, with 1,512 units trading and Proven Investments ended with 12,550 units trading with the rise of 1 cents to 23 US cents. The JSE USD Equities Index rose 7.33 points to close at 181.11.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ended with bids higher than their last selling prices and just 4 closing with lower offers.

For more details of market activities see – JSE main market in recovery mode – Thursday.

,

New closing high for JSE on Thursday

The Jamaica Stock Exchange main market recovered from losses on Wednesday to end at a new closing record high on Thursday, with the market indices rising more than 1,000 points.

The Jamaica Stock Exchange main market recovered from losses on Wednesday to end at a new closing record high on Thursday, with the market indices rising more than 1,000 points.

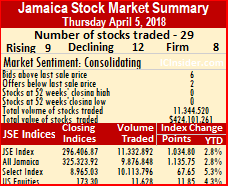

At the end of trading, the JSE All Jamaican Composite Index climbed 1,135.75 points to record close of 325,323.92 and the JSE Index rose 1,034.80 points to record closing high of 296,406.87.

At the close with only 29 securities traded versus 25 on Wednesday. Trading resulted in the prices of 9 stocks rising, 12 falling and 8 trading firm, in the main and US dollar markets.

Securities closing with sizable price changes include, NCB Financial Group trading down $2.15 to $97.10,

Grace traded nearly 7.8 million shares on Thursday.

Palace Amusement dropped $200 to $900, Sagicor Group lost $2 to $37 and Scotia Group finished with a rise of $2.50 to $53.50.

Main market activity ended with 11,332,892 units valued at over $423,780,603 compared to 2,346,923 units valued at $42,062,008 changing hands on Wednesday. Grace Kennedy trade 7,778,385 units valued at $$380 million, accounting for 68.64 percent of the overall market volume. Carreras with 1,133,057 units and 10 percent of total volume traded and Victoria Mutual Investments closed with 657,398 units changing hands.

Trading resulted in an average of 419,737 shares valued at $15,695,578, for each security traded, compared to 97,788 shares valued at $1,752,584 on Wednesday. The average for the month to date is 1,510,327 shares with a value of $7,058,809 and previously 2,887,284 shares with a value of $2,486,402. In contrast, March closed with an average of 626,526 units with an average value at $20,492,207 for each security traded.

The US dollar market closed on Thursday with 11,628 units valued at US$2,565 as Margaritaville traded 237 units to gain 5 US cents to 25 US cents and Proven Investments traded 11,391 units closing with a gain of 2 US cents to end at 22 US cents and pushing the market index up by 11.85 points to close at 173.30.

The US dollar market closed on Thursday with 11,628 units valued at US$2,565 as Margaritaville traded 237 units to gain 5 US cents to 25 US cents and Proven Investments traded 11,391 units closing with a gain of 2 US cents to end at 22 US cents and pushing the market index up by 11.85 points to close at 173.30.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 6 stocks ended with bids higher than their last selling prices and 2 with a lower offers.

For more details of market activities see – Grace Kennedy top traded stock on JSE

- « Previous Page

- 1

- …

- 55

- 56

- 57

- 58

- 59

- 60

- Next Page »