During the past week, the Junior Market moved decisively up, with the market index closing well above the 2,900 mark that became a barrier for weeks, surpassing the 3,000 level, but closed trading since Tuesday just a few points below and is poised to move higher in the weeks ahead. Main Market stocks remain in the consolidation zone awaiting profit results to move prices higher.

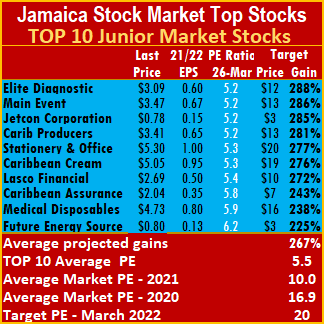

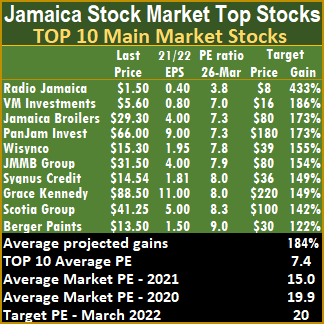

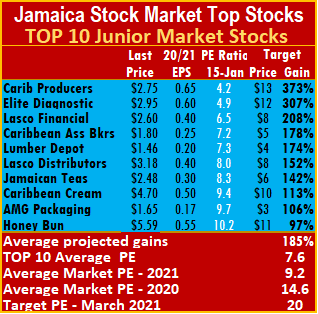

TOP 10 stocks had a few changes during the past week, with Berger Paints back in the Main Market TOP10, replacing Sterling Investments that entered the list last week, while in the Junior Market, Caribbean Assurance Brokers returns to the TOP 10 as General Accident moved out.

TOP 10 stocks had a few changes during the past week, with Berger Paints back in the Main Market TOP10, replacing Sterling Investments that entered the list last week, while in the Junior Market, Caribbean Assurance Brokers returns to the TOP 10 as General Accident moved out.

This publication has stated that Junior Market TOP10 contains several companies that suffered a sharp reversal of fortunes in 2020, with recovery projected in 2021. Green shoots are showing for some with sales picking up in recent quarters, with improving profit. Some of these companies may require another quarter or two of improvement before meaningful buying starts. Main Event is one such company, reporting a profit on reduced income for the January quarter. Revenues climbed solidly in the latest quarter over the October and July quarters, but still far below the prior year’s level.

Caribbean Producers is another that will definitely benefit from pick up in the tourist trade later in the year. Expect also companies such as Knutsford Express, Express Catering and Stationery and Office Supplies to be on that list.

Caribbean Producers is another that will definitely benefit from pick up in the tourist trade later in the year. Expect also companies such as Knutsford Express, Express Catering and Stationery and Office Supplies to be on that list.

The Main Market has a number in the list that have put out record profits or show signs of strong earnings in 2021, with the stocks clearly undervalued; these include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

Both the Junior Market and the Main Market continue to get support from technical indicators that point to robust gains ahead. To benefit from the growth in the market to come, many investors will need to be on board at an early stage.

This week’s focus: Future Energy Source Company Initial Public Offer of 500 million shares at 80 cents per share opens on Wednesday, with pretax earnings for the fiscal year to March this year around 7 cents per shares. The shares should be snapped up quickly by investors, with the company having long-term prospects for strong growth.

This week’s focus: Future Energy Source Company Initial Public Offer of 500 million shares at 80 cents per share opens on Wednesday, with pretax earnings for the fiscal year to March this year around 7 cents per shares. The shares should be snapped up quickly by investors, with the company having long-term prospects for strong growth.

The top three stocks in the Junior Market mostly changed, with the potential to gain between 285 to 288 percent are Elite Diagnostic, followed by Main Event and Jetcon Corporation. The top three Main Market stocks with expected gains of 173 to 433 percent are Radio Jamaica, followed by VM Investments and Jamaica Broilers.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 50 percent of the PE of that market.

The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 50 percent of the PE of that market.

The average projected gain for the Junior Market IC TOP 10 stocks is 267 percent and 184 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

The Main Market has a number in the list that have put out record profits or show signs of strong earnings in 2021, with the stocks clearly undervalued, these include, JMMB Group, Jamaica Broilers,

The Main Market has a number in the list that have put out record profits or show signs of strong earnings in 2021, with the stocks clearly undervalued, these include, JMMB Group, Jamaica Broilers,  This week’s focus:

This week’s focus: The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 49 percent of the PE of that market.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 15 and the Junior Market 10, based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.5 at just 55 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.4 or 49 percent of the PE of that market. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

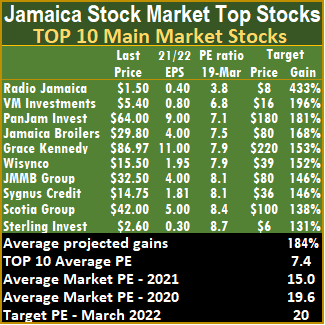

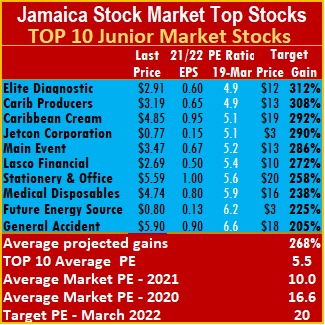

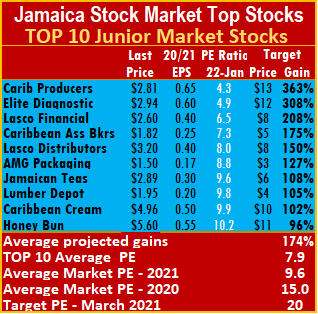

The Junior Market TOP10 contains companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some, with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. The Main Market has a number in the list that has put out record profits or shows strong earnings in 2021, with the stocks clearly undervalued. These include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

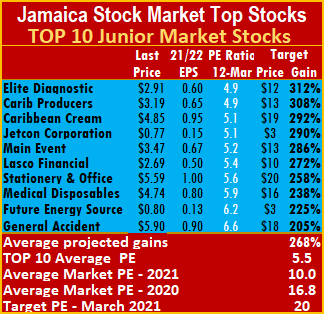

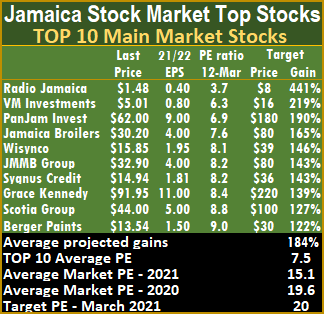

The Junior Market TOP10 contains companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some, with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. The Main Market has a number in the list that has put out record profits or shows strong earnings in 2021, with the stocks clearly undervalued. These include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside. The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Elite Diagnostic, followed by Caribbean Producers and Caribbean Cream. With expected gains of 190 to 441 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.

The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Elite Diagnostic, followed by Caribbean Producers and Caribbean Cream. With expected gains of 190 to 441 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment. The Main Market TOP 10 stocks trade at a PE of 7.5 or 50 percent of that market’s PE.

The Main Market TOP 10 stocks trade at a PE of 7.5 or 50 percent of that market’s PE.

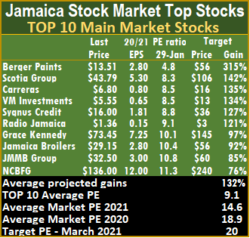

The Main Market has a number in the list that have put out record profits or show signs of strong earnings with the stocks clearly undervalued; these include, JMMB Group, Jamaica Broilers, Sygnus Credit Investments, Grace Kennedy are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

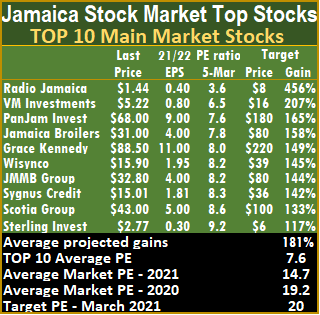

The Main Market has a number in the list that have put out record profits or show signs of strong earnings with the stocks clearly undervalued; these include, JMMB Group, Jamaica Broilers, Sygnus Credit Investments, Grace Kennedy are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside. With expected gains of 165 to 456 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.

With expected gains of 165 to 456 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.  The average projected gain for the Junior Market IC TOP 10 stocks is 274 percent and 181 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 274 percent and 181 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information. Coming into the TOP10 are Fesco, the latest IPO that is expected to come to market shortly, with the prospectus having been released but temporarily withdrawn to correct some errors. JMMB Group and Sygnus Credit Investments are now in the TOP10 Main market listing.

Coming into the TOP10 are Fesco, the latest IPO that is expected to come to market shortly, with the prospectus having been released but temporarily withdrawn to correct some errors. JMMB Group and Sygnus Credit Investments are now in the TOP10 Main market listing.

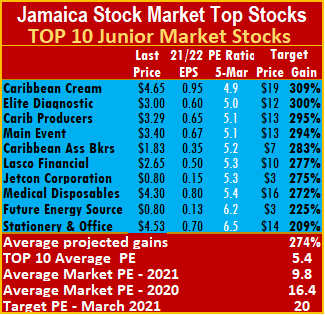

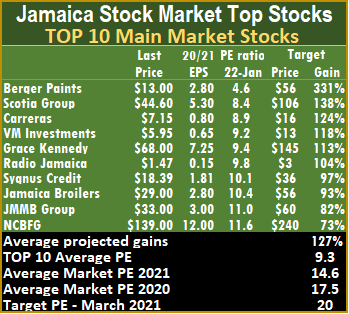

This week’s focus: Grace Kennedy had outstanding results for 2020 with much more to come in 2021; expect the price to move sharply over the next few weeks. Caribbean Cement reported a 70 percent rise in profit for 2020 and is projected to earn $6.70 for 2021, the stock is an ideal candidate to move higher in the weeks ahead.

This week’s focus: Grace Kennedy had outstanding results for 2020 with much more to come in 2021; expect the price to move sharply over the next few weeks. Caribbean Cement reported a 70 percent rise in profit for 2020 and is projected to earn $6.70 for 2021, the stock is an ideal candidate to move higher in the weeks ahead. The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, a clear indication of strong gains ahead. The JSE Main Market ended the week, with an overall PE of 14.7 and the Junior Market 9.8 based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.2 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.1 or 48 percent of the PE of that market.

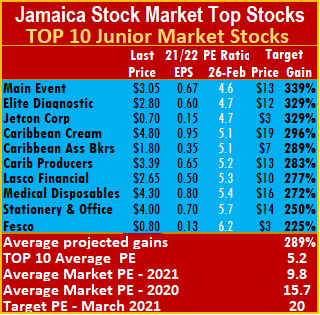

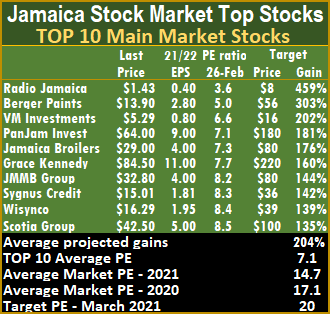

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, a clear indication of strong gains ahead. The JSE Main Market ended the week, with an overall PE of 14.7 and the Junior Market 9.8 based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.2 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.1 or 48 percent of the PE of that market. The average projected gain for the Junior Market IC TOP 10 stocks is 289 percent and 204 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 289 percent and 204 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Lasco Distributors earnings were also adjusted down, with the release of the nine months results showing earnings per share of 21 cents and 7 cents for the December quarter, putting the full-year numbers at 30 cents per share.

Lasco Distributors earnings were also adjusted down, with the release of the nine months results showing earnings per share of 21 cents and 7 cents for the December quarter, putting the full-year numbers at 30 cents per share. The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings.

The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings. Main Market TOP 10 stocks trade at a PE of 9.1 or 48 percent of the PE of that market.

Main Market TOP 10 stocks trade at a PE of 9.1 or 48 percent of the PE of that market. While the Junior Market had a new addition, the Main Market TOP10 continued with the same stocks as the week before but Grace Kennedy price rose from $68 to $73.45 with the stock moving from 5th spot to 7th.

While the Junior Market had a new addition, the Main Market TOP10 continued with the same stocks as the week before but Grace Kennedy price rose from $68 to $73.45 with the stock moving from 5th spot to 7th.

In this regard, based on 2020 release of results, interim financials are expected this week, from Access Financial, Barita Investments, Iron Rock Insurance, NCB Financial, the Lasco group of companies and Jamaican Teas.

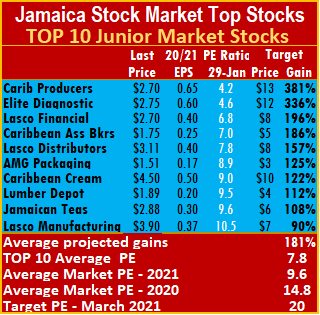

In this regard, based on 2020 release of results, interim financials are expected this week, from Access Financial, Barita Investments, Iron Rock Insurance, NCB Financial, the Lasco group of companies and Jamaican Teas. The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, from now to the second quarter in 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 18.9 and the Junior Market 14.8, based on ICInsider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 7.8 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.1 or 48 percent of the PE of that market.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, from now to the second quarter in 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 18.9 and the Junior Market 14.8, based on ICInsider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 7.8 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.1 or 48 percent of the PE of that market. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

initially reported by the company to just $29 million with the stock selling off to a low of 95 cents but bounced a bit thereafter.

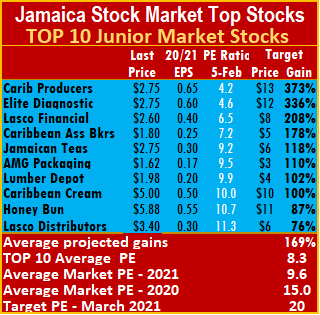

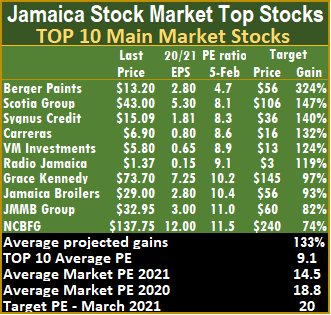

initially reported by the company to just $29 million with the stock selling off to a low of 95 cents but bounced a bit thereafter. The top three stocks in the Junior Market with the potential to gain between 208 to 363 percent are Caribbean Producers followed by Elite Diagnostic and Lasco Financial. With expected gains of 124 to 331 percent, the top three Main Market stocks are, Berger Paints followed by Scotia Group and Carreras.

The top three stocks in the Junior Market with the potential to gain between 208 to 363 percent are Caribbean Producers followed by Elite Diagnostic and Lasco Financial. With expected gains of 124 to 331 percent, the top three Main Market stocks are, Berger Paints followed by Scotia Group and Carreras. The average projected gain for the Junior Market IC TOP 10 stocks is 174 percent and 127 percent for the JSE Main Market, based on 2020-21 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 174 percent and 127 percent for the JSE Main Market, based on 2020-21 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The stock gained 50 cents at the close on Friday but traded as high as $5 during the week and moved from fifth spot last week to ninth position on the 2020/21 TOP10 list. Jamaican Teas gained 25 percent since December and seems poised to move higher as interest in the stock grows since the announcement of a three for one stock split late last year. An indication of increased interest is the exchange of 4 million shares on Friday. The stock moved from the fourth position last week to seventh this past week as it gained 24 percent for the week.

The stock gained 50 cents at the close on Friday but traded as high as $5 during the week and moved from fifth spot last week to ninth position on the 2020/21 TOP10 list. Jamaican Teas gained 25 percent since December and seems poised to move higher as interest in the stock grows since the announcement of a three for one stock split late last year. An indication of increased interest is the exchange of 4 million shares on Friday. The stock moved from the fourth position last week to seventh this past week as it gained 24 percent for the week. The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings.

The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings. The PE ratio for the Junior Market Top 10 stocks average a mere 7.6 at just 52 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.2 or 56 percent of the PE of that market.

The PE ratio for the Junior Market Top 10 stocks average a mere 7.6 at just 52 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.2 or 56 percent of the PE of that market.