Jamaica Stock Exchange markets closed mixed on Friday, with the Main and the US denominated market rising and the Junior Market slipping for a second day, but was only down 20.57 points to 4444.25, compared to a fall of 99.65 points on Thursday. At the close, the JSE Combined Index rose 1,784.92 2,632.85 points to close at 416,375.44.

The All Jamaican Composite Index popped 2,855.20 points to 461,683.05, the JSE Main Index shed 2,101.59 points to 402,589.33 and the JSE USD market index gained 3.62 points to end at 227.59.

The All Jamaican Composite Index popped 2,855.20 points to 461,683.05, the JSE Main Index shed 2,101.59 points to 402,589.33 and the JSE USD market index gained 3.62 points to end at 227.59.

Trading ended with an exchange of 24,928,782 shares in all markets. The value of stocks traded in the Main and Junior Markets amounts to $159.8 million and the JSE USD market, US$59,279. The market’s PE ratio ended at 25.7 based on 2021-22 earnings and 13.5 times those for 2022-23 at the close of the Jamaica Stock Exchange.

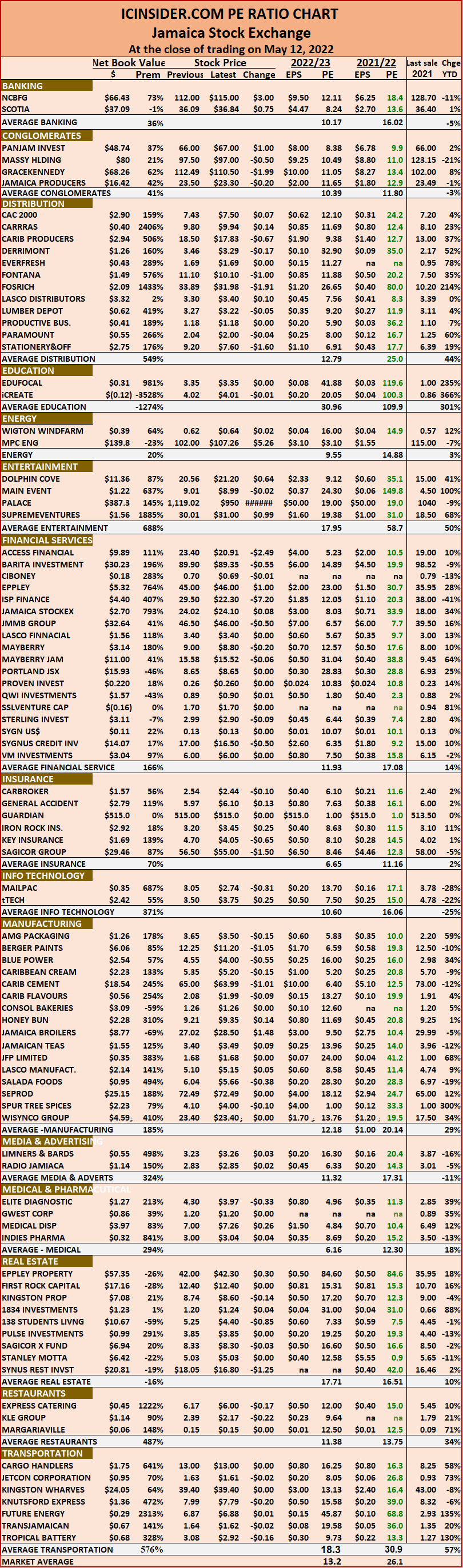

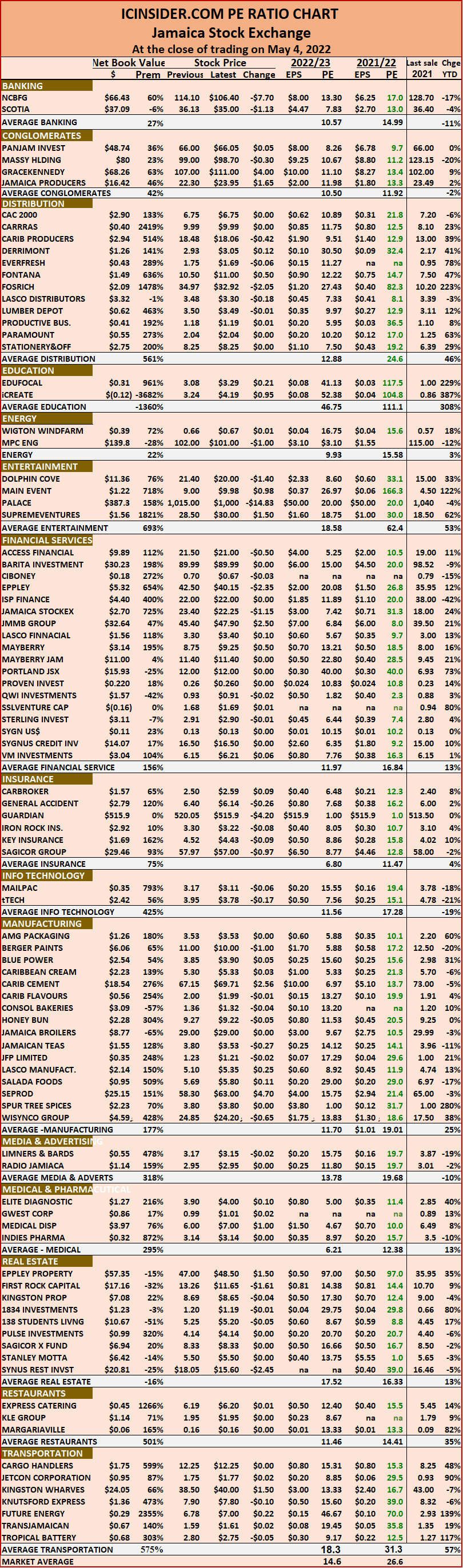

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

JSE Main Markets rise Juniors fall

JSE markets all fall

On Thursday, investors pushed the Junior Market index down sharply by 99.65 points to close at 4,464.82. The Jamaica Stock Exchange Main Market and US dollar market experienced declines, with the JSE Combined Index dropping 2,632.85 points to close at 414,590.52.

The All Jamaican Composite Index dropped 2,109.81 points to 458,827.85, the JSE Main Index shed 1,867.85 points to 400,487.74 and the JSE USD market index fell 1.00 points to end at 223.97.

The All Jamaican Composite Index dropped 2,109.81 points to 458,827.85, the JSE Main Index shed 1,867.85 points to 400,487.74 and the JSE USD market index fell 1.00 points to end at 223.97.

Trading ended with an exchange of 44,200,570 shares in all markets. The value of stocks traded in the Main and Junior Markets amounts to $580.9 million and the JSE USD market, US$14,366. The market’s PE ratio ended at 26.1 based on 2021-22 earnings and 13.2 times those for 2022-23 at the close of the Jamaica Stock Exchange.

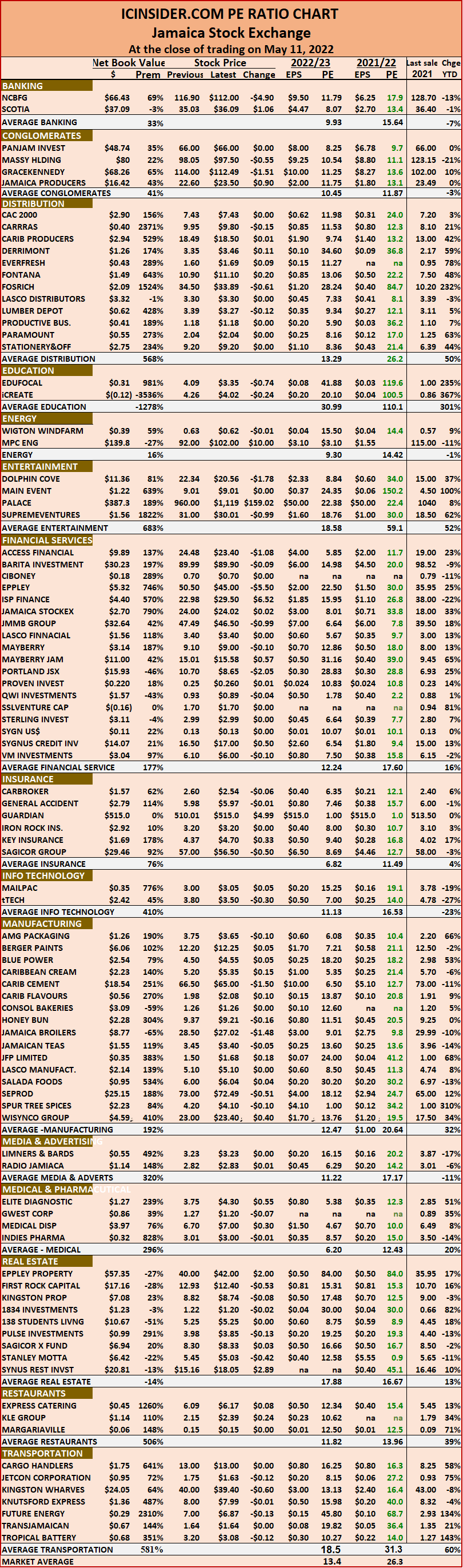

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

JSE markets enjoy moderate gains

Investors pushed the Junior Market index up moderately on Wednesday, just managing to hold on to a modest gain of 3.59 points to close on Wednesday at 4,564.38. The Jamaica Stock Exchange Main Market and US dollar market experienced moderate gains, with the JSE Combined Index gaining 656.44 points to close at 417,223.38.

The All Jamaican Composite Index rose 506.15 points to 460,937.66, the JSE Main Index added 667.03 points to end at 402,355.60 and the JSE USD market index rose 3.03 points to end at 224.97.

The All Jamaican Composite Index rose 506.15 points to 460,937.66, the JSE Main Index added 667.03 points to end at 402,355.60 and the JSE USD market index rose 3.03 points to end at 224.97.

Trading ended with an exchange of 34,398,166 shares in all markets. The value of stocks traded in the Main and Junior Markets amounts to $172.7 million and the JSE USD market, US$7,903. The market’s PE ratio ended at 26.3 based on 2021-22 earnings and 13.4 times those for 2022-23 at the close of the Jamaica Stock Exchange.

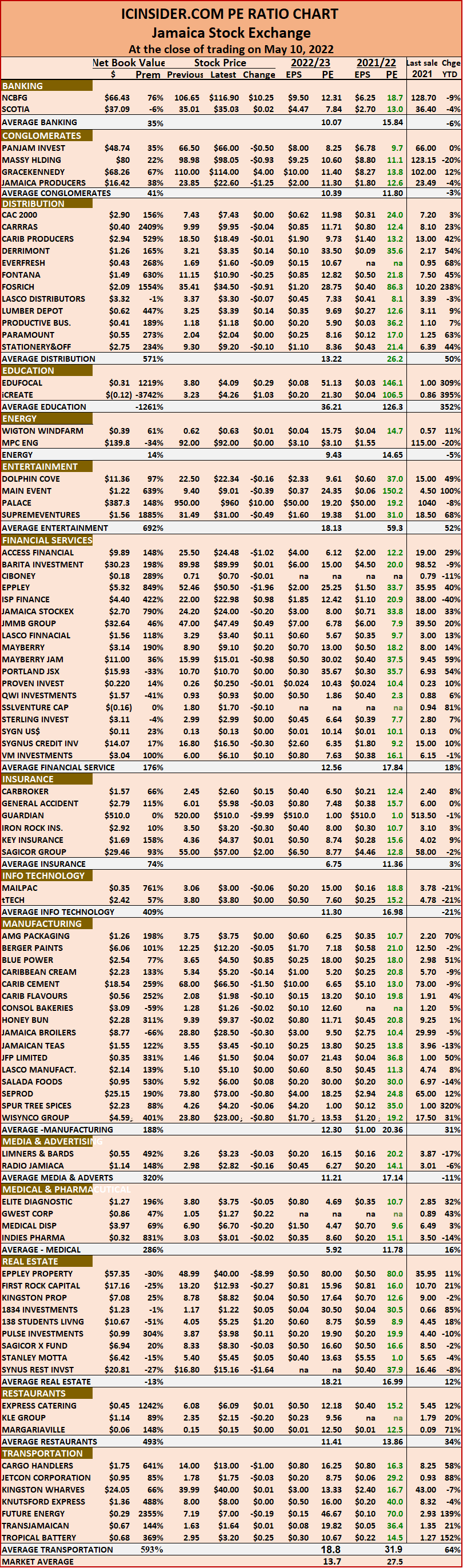

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Junior Market falls, Main Market rises

Investors pushed the Junior Market index up to a record intraday high of 4,669.78 in early trading on Tuesday, but the market failed to hold on to the positive gains and closed 21.62 points lower than Monday at 4,560.79. The Jamaica Stock Exchange Main Market enjoyed a modest rise and US dollar market experienced moderate slippage, with the JSE Combined Index gaining 785.38 points to close at 416,566.94.

The All Jamaican Composite Index rose 2,354.48 points to 460,431.50 points to 458,077.02, the JSE Main Index added 1,043.96 points to end at 401,688.56 and the JSE USD market index slipped 1.31 points to end at 221.93.

The All Jamaican Composite Index rose 2,354.48 points to 460,431.50 points to 458,077.02, the JSE Main Index added 1,043.96 points to end at 401,688.56 and the JSE USD market index slipped 1.31 points to end at 221.93.

Trading ended with an exchange of 37,384,823 shares in all markets. The value of stocks traded in the Main and Junior Markets amounts to $398.6 million and the JSE USD market, US$14,833. The market’s PE ratio ended at 27.5 based on 2021-22 earnings and 13.7 times those for 2022-23 at the close of the Jamaica Stock Exchange.

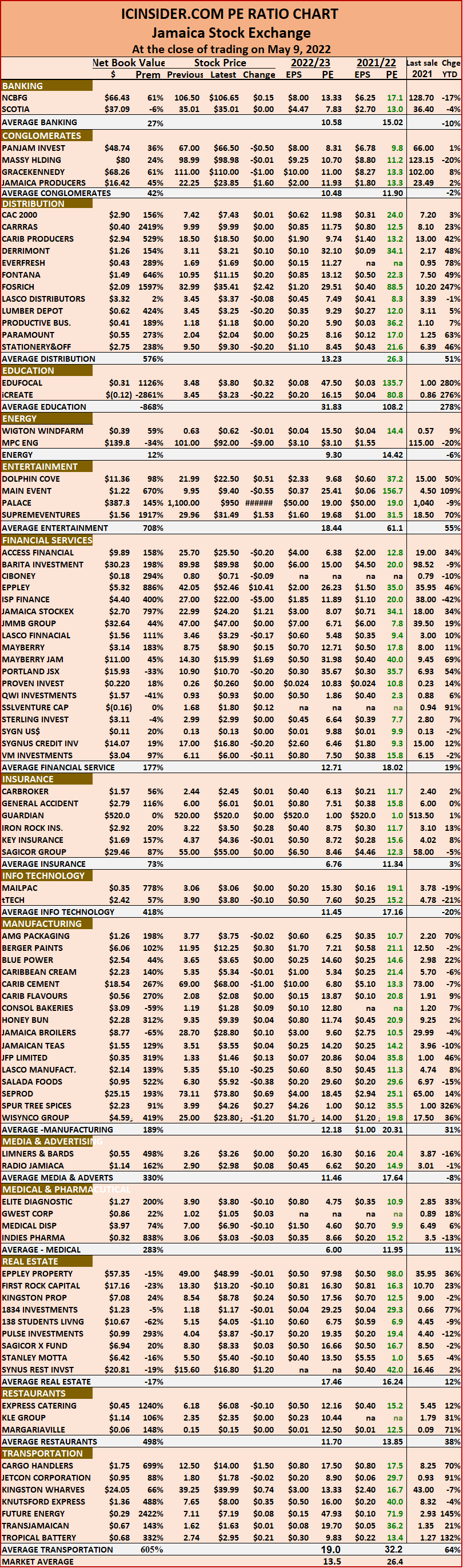

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Junior Markets 4,582 record close, majors fall

The Junior Market pushed 45.26 points higher in trading on Monday, closing at another record high of 4,582.41 after it traded over the 4,600 points mark for the first time, hitting 4613.27 just after the market opened as fresh results posted since the close on Friday saw investors pushing some stocks higher in response. The Jamaica Stock  Exchange Main Market and US dollar market experienced moderate slippage, with the JSE Combined Index falling 600.65 points to close at 415,781.56.

Exchange Main Market and US dollar market experienced moderate slippage, with the JSE Combined Index falling 600.65 points to close at 415,781.56.

The All Jamaican Composite Index lost 1,039.71 points to 458,077.02, the JSE Main Index lost 1,070.82 points to end at 400,644.60 and the JSE USD market index slipped 0.48 points to end at 223.24.

Trading ended with an exchange of 52,943,073 shares in all markets. The value of stocks traded in the Main and Junior Markets amounts to $536.6 million and the JSE USD market, US$14,951. The market’s PE ratio ended at 26.4 based on 2021-22 earnings and 13.5 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Results push Junior Market to record 4,613

The release of results for Junior Market companies since Friday’s market close helped to push the Junior Market to a new record of 4,613.27 points after the market opened on Monday, surpassing the record close of 4,537.15 on Friday, with the index crossing over into the 4,600 mark for the first time.

Spur Tree Spices generated revenues of $237 millionin their first quarter to March, an increase of 40.7 percent over the $168 million in 2021, helped by the newly acquired subsidiary, Exotic Products generated revenues of $73 million for the quarter, with only $2.18M is included in the consolidated revenue of $237 million. Profit before tax was $51 million, an improvement of $28.6M or 128 percent above the $22.4 million for the 2021 quarter. Investors traded 9 million shares for $36 million up to $4.30.

Spur Tree Spices generated revenues of $237 millionin their first quarter to March, an increase of 40.7 percent over the $168 million in 2021, helped by the newly acquired subsidiary, Exotic Products generated revenues of $73 million for the quarter, with only $2.18M is included in the consolidated revenue of $237 million. Profit before tax was $51 million, an improvement of $28.6M or 128 percent above the $22.4 million for the 2021 quarter. Investors traded 9 million shares for $36 million up to $4.30.

Dolphin Cove reported US$2.3 million in revenue in quarter Q1 2022, up from just US$374,000 in 2021, as visitors to the parks bounced sharply in the quarter to reach 58 percent of the attendance in the first quarter of 2019. Profitability was enhanced by the strict management of costs, with the quarter incurring only US$1.5 million of expenses, a decline of almost US$1 million compared to the first quarter of 2019, reflecting permanent efficiencies that were put in place. Net profit amounted to US$795,000, compared to a loss of US$154,000 in 2021. The stock traded up to $23.25 before settling at $22.51 after trading 131,329 shares.

Fosrich traded 368,000 shares early Monday.

Fontana grew revenues by 24 percent to $1.52 billion, over the $1.22 billion for the 2021 first quarter, with net profits popping by 43.4 percent, to $105 million from $72.9 million in the first quarter last year. Investors traded the stock at $11.18 after an exchange of 158,512 shares.

Fosrich posted blowout results with a 64 percent surge in revenues to $900 million from$549 million in 2021 and profits surging 314 percent to $159 million in the March Quarter from just $38 million in 2021. The investors responded instantly to the news by trading 368,361 shares up to $36.22.

RJR back in 3rd spot as Access jumps 22%

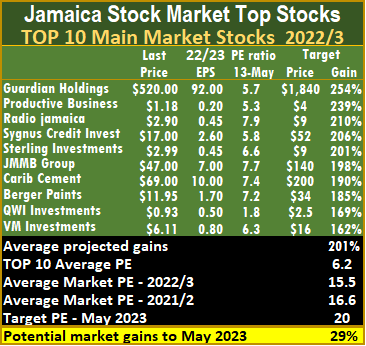

There is only one change to ICInsider.com TOP10 listings this week, with Radio Jamaica coming back in the Main Market list at position 3. Following an earnings upgrade for the 2023 fiscal year, it replaces Jamaica Stock Exchange that ICInsider.com projects to have explosive results for the first quarter.

Radio Jamaica

In the wider market, Junior Market stocks keep on piling the pressure on the main market with the former closing the week at a record high, with year to date gains of 32.8 percent and is well on the way to ICInsider.com forecast of 60 percent for the year.

Thanks to a takeover announcement of AS Bryden, a Trinidad based company by Seprod, the Main Market moved higher for the week, with the All Jamaica Index just under 460,000 points, still well below 2020 high.

TOP10, Access Financial shares moved higher this past week as selling seems to have dried up and led the stock to a 22 percent rise during the week, to be the best performing stock in the TOP10. Access Financial has been beaten up for more than two years but is now worth watching. On Friday, well ahead of the close of the market, a buy order for 100,000 Access Financial shares was placed at $25.60, but only18,000 units were filled up to the close. There were no stocks on offer with any sizable quantity close to the bid price just before close, indicating that the price is heading higher.

Elite Diagnostic  gained 8 percent to close the week at $3.90, but Caribbean Assurance Brokers that reported a profit for the first quarter versus a loss in 2021, fell by 6 percent and so did General Accident that is said to be having a good 2022, with Trinidad and Barbados expected to deliver positive results versus a loss of around $200 million in 2021. Movement of main market stocks was more subdued than their junior counterpart, with the Jamaica Stock Exchange rising a mere 4 percent and selling at 8 times this year’s earnings, with a blowout first quarter results due shortly. Caribbean Cement, surprisingly, fell 8 percent as buying interest in the stock is low, even as the first quarter results suggest the stock is highly undervalued.

gained 8 percent to close the week at $3.90, but Caribbean Assurance Brokers that reported a profit for the first quarter versus a loss in 2021, fell by 6 percent and so did General Accident that is said to be having a good 2022, with Trinidad and Barbados expected to deliver positive results versus a loss of around $200 million in 2021. Movement of main market stocks was more subdued than their junior counterpart, with the Jamaica Stock Exchange rising a mere 4 percent and selling at 8 times this year’s earnings, with a blowout first quarter results due shortly. Caribbean Cement, surprisingly, fell 8 percent as buying interest in the stock is low, even as the first quarter results suggest the stock is highly undervalued.

The average PE for the JSE Main Market TOP 10 ends the week at 6.2, well below the market average of 15.5, while the Junior Market PE for the TOP10, sits at 6.2 versus the market at 13.8. The Junior Market TOP10 is projected to gain an average of 230 percent to May 2023 and the Main Market 201 percent.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

New Junior Market record close of 4,537 as majors rise

The Junior Market squeezed out another closing record high as the week ended on Friday. The market index rose just 5.78 points to close at 4,537.15, as the Jamaica Stock Exchange Main Market and US dollar market enjoyed modest gains at the close. Trading resulted in the JSE Combined Index rising 1,184.96 points to close at 416,382.22.

The All Jamaican Composite Index rose 726.82 points to 459,116.74, the JSE Main Index added 1,210.82 points to end at 401,715.42 and the JSE USD market index rallied 0.60 points to end at 223.73.

The All Jamaican Composite Index rose 726.82 points to 459,116.74, the JSE Main Index added 1,210.82 points to end at 401,715.42 and the JSE USD market index rallied 0.60 points to end at 223.73.

Trading ended with an exchange of 30,223,124 shares in all markets. The value of stocks traded in the Main and Junior markets amounts to $185.7 million and the JSE USD market, US$21,115. The market’s PE ratio ended at 26.4 based on 2021-22 earnings and 13.6 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange.  It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Record Junior Markets close of 4,531, Majors fall

The Junior Market was at it again at the close of trading on Thursday after a few days’ break from clocking more record close, the market surged 69.15 points and closed at 4,531.37, but the Jamaica Stock Exchange Main Market pulled back marginally at the close. Trading on the overall market saw the JSE Combined Index slipping 248.15 points to close at 415,197.25.

The All Jamaican Composite Index shed 432.04 points to 458,389.92, the JSE Main Index fell 920.96 points to end at 400,504.59 and the JSE USD market index slipped 0.49 points to end at 223.12.

The All Jamaican Composite Index shed 432.04 points to 458,389.92, the JSE Main Index fell 920.96 points to end at 400,504.59 and the JSE USD market index slipped 0.49 points to end at 223.12.

Trading ended with 23,196,143 shares in all markets. The value of stocks traded in the Main and Junior Markets totalled $173.3 million and the JSE USD market amounts to US$12,453.

The market’s PE ratio ended at 26.3 based on 2021-22 earnings and 13.5 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Two JSE markets rise one fall

The Jamaica Stock Exchange three markets enjoyed mixed fortunes at the close of trading on Wednesday, with Main and Junior Markets recording gains, but the JSE USD market slipped modestly. The JSE Combined Index rose 1,616.71 points to close at 415,445.40.

The All Jamaican Composite Index climbed 2,293.01 points to 458,821.97,  the JSE Main Index rallied 1,632.06 points to end at 401,425.56, the Junior Market rose 9.99 points to 4,462.21 and the JSE USD market index lost 1.15 points to end at 223.61.

the JSE Main Index rallied 1,632.06 points to end at 401,425.56, the Junior Market rose 9.99 points to 4,462.21 and the JSE USD market index lost 1.15 points to end at 223.61.

Trading ended with an exchange of 24,826,294 shares in all markets. The value of stocks traded in the Main and Junior Markets totalled $446.3 million and the JSE USD market amounts to US$363,713.

The market’s PE ratio ended at 26.6 based on 2021-22 earnings and 14.6 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help with decision-making.

Investors should use the chart to help make rational investment decisions by investing in stocks that are close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange. It shows companies grouped on an industry basis, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show the closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.