NCB Financial stock closed at $110 after hitting $125 on Friday.

The main stocks of interest this week are Stationery and Office Supplies, CAC 2000, NCB Financial, Caribbean Cream, Main Event and Wisynco, most of these have limited supplies.

Barita Investments that was highlighted as a stock with main stock to watch this past week, moved $12.95, to end at $18.50 after it traded as high as $19.50. The movement in the price resulted in Cornerstone more than doubling their investment in the company within a short time frame. While it is not listed as a lead stock to watch this week, the stock has much more room to grow over the coming months as demand increases and supplies decline as the potential for much increased profit unfolds.

Bulls pushed the Jamaican stock market, to new heights last week, with the main market having 12 straight days of record highs and the Junior Market moving to new highs as well.

The main moved within 1,600 points of the All Jamaica Composite Index 400,000 points last week but pulled back from what is a major resistance point. The supply of several of the main market stocks are extremely scarce and that is working in market favour to move much higher, before too long. There are several stocks priced well below the market’s average and that could encourage buying interest in them as well.

Investors should keep their eyes on a number of stocks as some may move and others may trade in a narrow band. NCB Financial closed on $110, could move higher but there is a big gap between the offer prices and the bids and this seems likely to maintain volatility in the price for a while.

Grace Kennedy may not be ready to break out of the $60 range as yet but it’s a stock to keep an eye on. Caribbean Cement keeps trading between $46 to $50, but there appears no real desire to move the price forward. Kingston Wharves has just 9,700 units on offer up to $75, with 200,000 on the bid at $68.51, so it could move back to the $75 price this week. Supply of JMMB Group have dried up and that could create the environment for the price to move higher.

An overall view of stocks indicates that the main market continues to be steered higher by an upward sloping support line as well the 45 and 125 day moving averages, lending support just below, but the 400,000 points resistance could likely stall the rally in the main market for a while. The Junior Market that traded recently at an all-time high, is being steered by an upward rising long-term support line and a golden cross. The golden cross is a very strong bullish long-term signal.

Everything Fresh is one of a hand full of initial public stock offers to be selling below the IPO price months after the issue. The stock that was over priced has only been partially helped by a big jump in 2018 half year profit.

Everything Fresh is one of a hand full of initial public stock offers to be selling below the IPO price months after the issue. The stock that was over priced has only been partially helped by a big jump in 2018 half year profit.

During the past week, the main market of the Jamaica Stock Exchange, racked up more record closes but pulled back on sharply on Thursday and Junior market hit new highs during the week but dropped sharply on Friday due mainly to

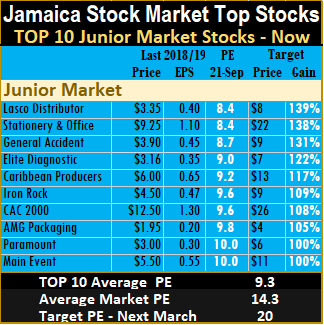

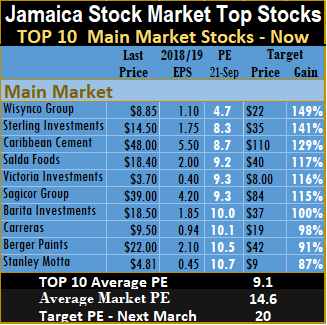

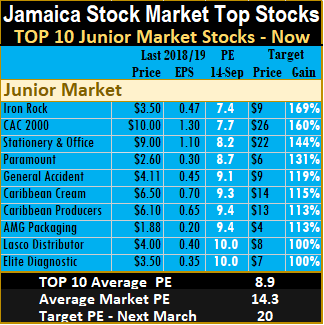

During the past week, the main market of the Jamaica Stock Exchange, racked up more record closes but pulled back on sharply on Thursday and Junior market hit new highs during the week but dropped sharply on Friday due mainly to  The PE ratio for Junior Market Top 10 stocks average 9.3 up from 8.9 last week, as the market continues to revalue the multiple higher and the main market PE is now 9.1, up from 8.8 last week, for the top stocks.

The PE ratio for Junior Market Top 10 stocks average 9.3 up from 8.9 last week, as the market continues to revalue the multiple higher and the main market PE is now 9.1, up from 8.8 last week, for the top stocks. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

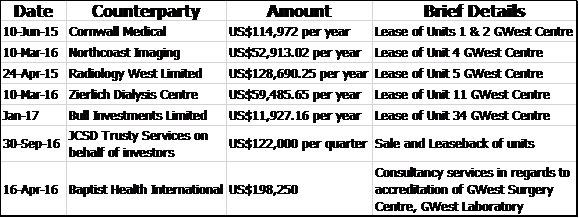

The above list has no contract in connection with the issue of preference shares to shareholders prior to the IPO.

The above list has no contract in connection with the issue of preference shares to shareholders prior to the IPO. Further, by an ordinary resolution dated November 28, 2017 the 10,000 shareholdings of shareholders on register at November 27, 2017 were split such that their holdings of ordinary shares became 10,000,000 ordinary shares. Additionally, the shareholders who were allocated the 9,800 available shares at March 31, 2017, were further allocated 314,848,485 ordinary shares for the consideration of $50 million of interest converted to capital on March 31, 2017. (13.3) On December 7, 2017 the company made an offer for subscription to the public (IPO), of 160,000,000 of its ordinary shares at a price of $2.50 per share through the Junior Market of the Jamaica Stock Exchange (JSE). The company was officially registered on the Junior Stock Market on December 21, 2017. Total cost of the IPO of $30.848 million has been off-set against the issued share capital.”

Further, by an ordinary resolution dated November 28, 2017 the 10,000 shareholdings of shareholders on register at November 27, 2017 were split such that their holdings of ordinary shares became 10,000,000 ordinary shares. Additionally, the shareholders who were allocated the 9,800 available shares at March 31, 2017, were further allocated 314,848,485 ordinary shares for the consideration of $50 million of interest converted to capital on March 31, 2017. (13.3) On December 7, 2017 the company made an offer for subscription to the public (IPO), of 160,000,000 of its ordinary shares at a price of $2.50 per share through the Junior Market of the Jamaica Stock Exchange (JSE). The company was officially registered on the Junior Stock Market on December 21, 2017. Total cost of the IPO of $30.848 million has been off-set against the issued share capital.” The Jamaica Stock Exchange climbed sharply within just a minute of the opening of trading on Thursday, with the All Jamaican Composite Index surging to just under 5,800 points to a new record high and pushing the index within 1,700 points of the critical 400,000 points mark.

The Jamaica Stock Exchange climbed sharply within just a minute of the opening of trading on Thursday, with the All Jamaican Composite Index surging to just under 5,800 points to a new record high and pushing the index within 1,700 points of the critical 400,000 points mark.  The Jamaica Stock Exchange climbed more than 5,000 points after 25 minutes of opening with the All Jamaican Composite Index surging to just under 9,000 points from big resistance point of 400,000.

The Jamaica Stock Exchange climbed more than 5,000 points after 25 minutes of opening with the All Jamaican Composite Index surging to just under 9,000 points from big resistance point of 400,000.  The main stock of interest this week is Barita Investments that came into buying interest this past week leading the price to move to $12.95, this one seems headed higher in the short term as the supply that is on the market has been taken out with few stocks on offer now.

The main stock of interest this week is Barita Investments that came into buying interest this past week leading the price to move to $12.95, this one seems headed higher in the short term as the supply that is on the market has been taken out with few stocks on offer now.

The gains in the two markets is driving the PE ratio of the market higher with the overall PE for the Junior Market rising from to 13 and the main market from 13.7 last week to 13.7 and 14 respectively, this week. Recent movement in the PE suggest that average PE for the market will end 2018 around 18 and 20 by the end of January as conditions continue to favour stocks as the preferred investment of choice along with real estate.

The gains in the two markets is driving the PE ratio of the market higher with the overall PE for the Junior Market rising from to 13 and the main market from 13.7 last week to 13.7 and 14 respectively, this week. Recent movement in the PE suggest that average PE for the market will end 2018 around 18 and 20 by the end of January as conditions continue to favour stocks as the preferred investment of choice along with real estate. The latest valuation compares to an average PE for the overall market of 14.3, based on 2018 estimated earnings. The main market PE is now 8.8 and is the up from 8.5 last week, for the top stocks, compared to a market average of 14.6.

The latest valuation compares to an average PE for the overall market of 14.3, based on 2018 estimated earnings. The main market PE is now 8.8 and is the up from 8.5 last week, for the top stocks, compared to a market average of 14.6. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.