The Jamaica Stock Exchange jumped higher to close out the first month of 2024 positively with all three markets rising on Wednesday, as the Main Market and the JSE USD market closed the month higher than they closed at in 2024, the Junior Market ended the month with a minor slippage as trading ended with the number shares exchanged in the overall market climbed, at a reduced value compared with the previous day, after prices of 53 shares rose and only 18 declined.

At the close of the market, the JSE Combined Market Index jumped by 4,021.70 points to 341,461.84 the All Jamaican Composite Index rallied 4,164.96 points to 365,827.98, the JSE Main Index climbed 3,750.40 points to 328,475.09. The Junior Market Index popped 57.59 points to 3,814.18 and the JSE USD Market Index rose 2.46 points to conclude trading at 249.26.

At the close of the market, the JSE Combined Market Index jumped by 4,021.70 points to 341,461.84 the All Jamaican Composite Index rallied 4,164.96 points to 365,827.98, the JSE Main Index climbed 3,750.40 points to 328,475.09. The Junior Market Index popped 57.59 points to 3,814.18 and the JSE USD Market Index rose 2.46 points to conclude trading at 249.26.

At the close of trading, 35,568,273 shares were exchanged in all three markets, up from 23,163,225 units on Tuesday, with the value of stocks traded on the Junior and Main markets amounted to $134.96 million, down from $247.43 million yesterday and the JSE USD market closed with an exchange of 15,298 shares for US$860 compared to 286,861 units at US$30,962 on Tuesday.

Main Market trading was dominated by Wigton Windfarm led trading with 10.87 million shares followed by JMMB 9.5% preference share with 3.85 million units, Transjamaican Highway ended with 1.74 million units and Carreras with 1.53 million units.

In the Junior Market, Fosrich led trading with 3.20 million shares followed by ONE on ONE Educational with 2.72 million units, Stationery and Office Supplies ended with 1.45 million stock units and Derrimon Trading with 1.08 million stocks.

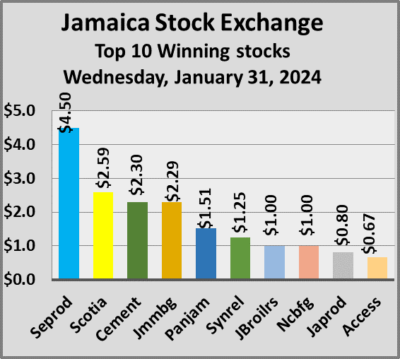

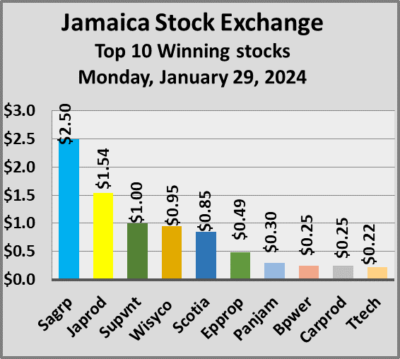

At the close of the market, some of the major Main Market stocks that rose are Caribbean Cement popping $2.30 in closing at $57, Jamaica Broilers climbing $1 to close at $34 and Jamaica Producers rose 80 cents and ended at $24. JMMB Group rallied $2.29 to end at $26, NCB Financial advanced $1 and closed at $67.50, Pan Jamaica rose $1.51 to close at $51.51, Scotia Group popped $2.59 to $42.59, Seprod increased $4.50 and ended at $89 and Sygnus Real Estate Finance advanced $1.25 to end at $11.50.

At the close of the market, some of the major Main Market stocks that rose are Caribbean Cement popping $2.30 in closing at $57, Jamaica Broilers climbing $1 to close at $34 and Jamaica Producers rose 80 cents and ended at $24. JMMB Group rallied $2.29 to end at $26, NCB Financial advanced $1 and closed at $67.50, Pan Jamaica rose $1.51 to close at $51.51, Scotia Group popped $2.59 to $42.59, Seprod increased $4.50 and ended at $89 and Sygnus Real Estate Finance advanced $1.25 to end at $11.50.

There were no major declining Main Market stocks on Wednesday.

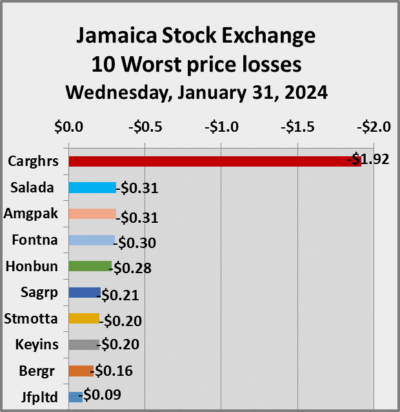

Stocks with major gains in the Junior Market are Access Financial, which rallied 67 cents to end at $22.67 while Spur Tree Spices rose 40 cents to end at $2.88, with the major losing stock being Cargo Handlers sinking $1.92 and ended at $13.

In the preference segment, Eppley 7.75% preference share rose $4.95 to $22.95 and 138 Student Living preference share fell $25.72 to close at $192.28.

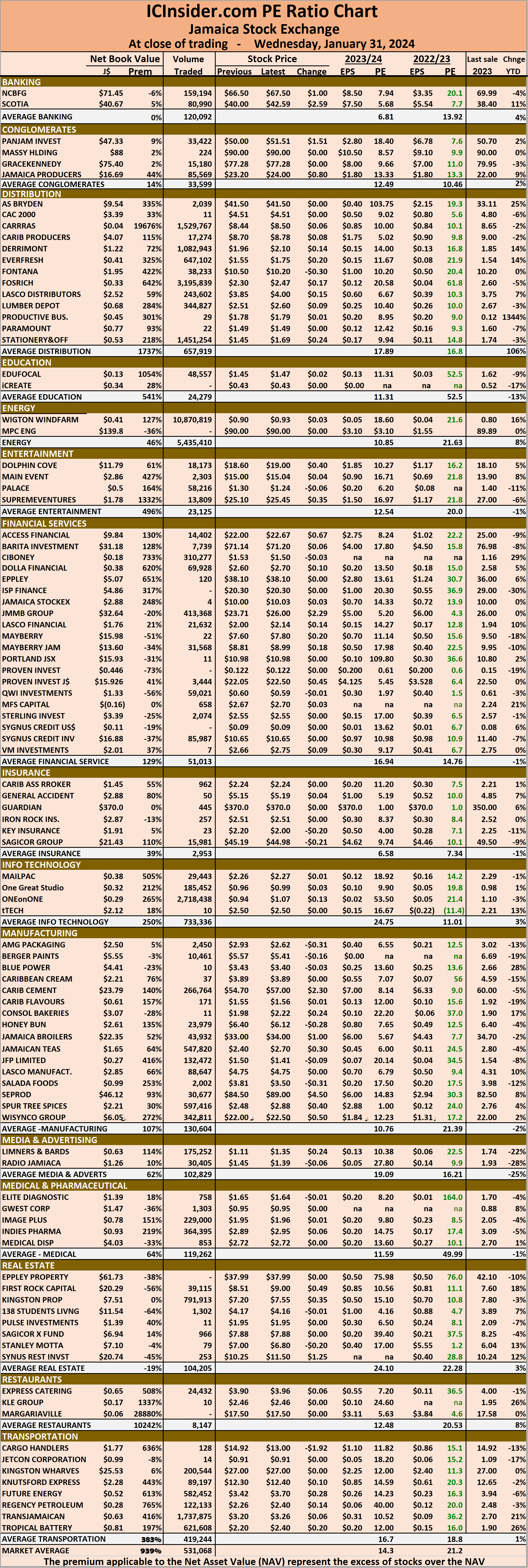

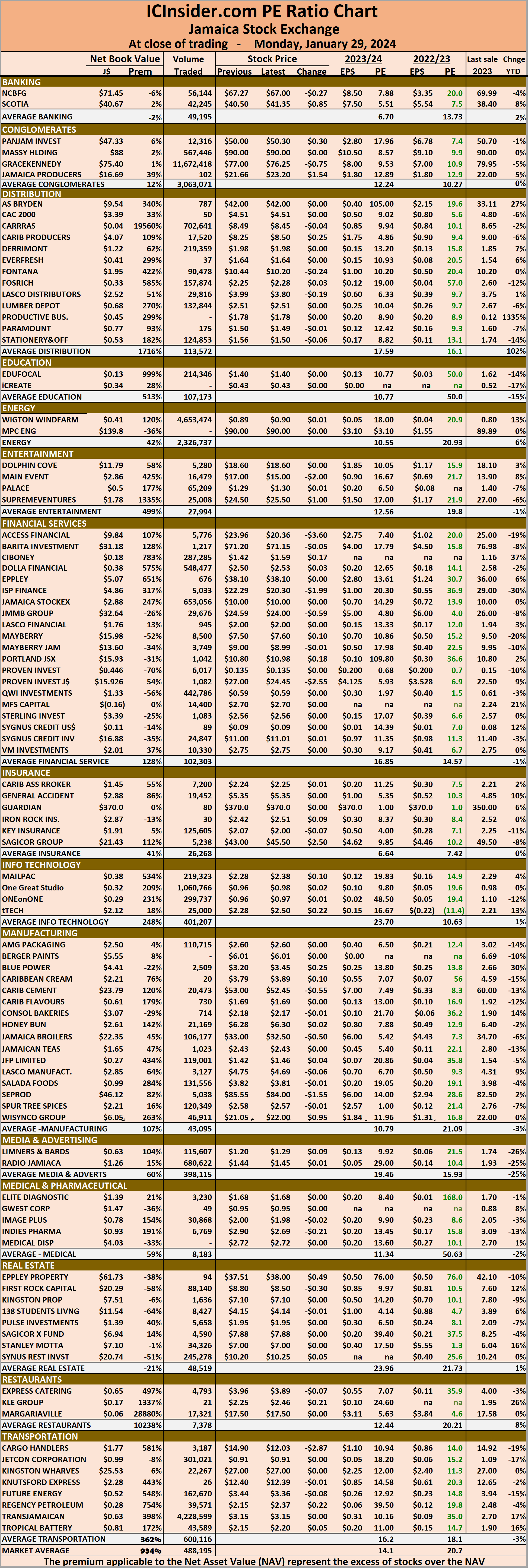

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21.2 on 2022-23 earnings and 14.3 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Jamaica Stock Exchange closes higher

JSE Main Market trading cooled on Tuesday

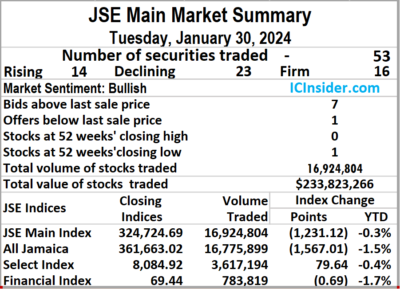

Trading cooled off on Tuesday on the Jamaica Stock Exchange Main Market, with a 43 percent decline in the volume of stocks traded, with the value falling 77 percent below Monday’s level, following trading in 53 securities down from 59 on Monday, with prices of 14 stocks rising, 23 declining and 16 ending unchanged.

The market closed with trading of 16,924,804 shares for $233,823,266 compared with 29,601,305 units at $1,004,348,955 on Monday.

The market closed with trading of 16,924,804 shares for $233,823,266 compared with 29,601,305 units at $1,004,348,955 on Monday.

Trading averaged 319,336 shares at $4,411,760 compared with 501,717 units at $17,022,864 on Monday and month to date, an average of 260,532 units at $2,471,058, in comparison with 257,735 units at $2,378,727 on the previous day and December with an average of 264,266 stock units at $3,755,946.

Wigton Windfarm led trading with 7.09 million shares for 41.9 percent of the volume, Transjamaican Highway followed with 4.92 million units for 29.1 percent of the day’s trade and GraceKennedy with 2.23 million units for 13.2 percent market share.

The All Jamaican Composite Index dipped 1,567.01 points to lock up trading at 361,663.02, the JSE Main Index sank 1,231.12 points to end at 324,724.69 and the JSE Financial Index fell 0.69 points to 69.44.

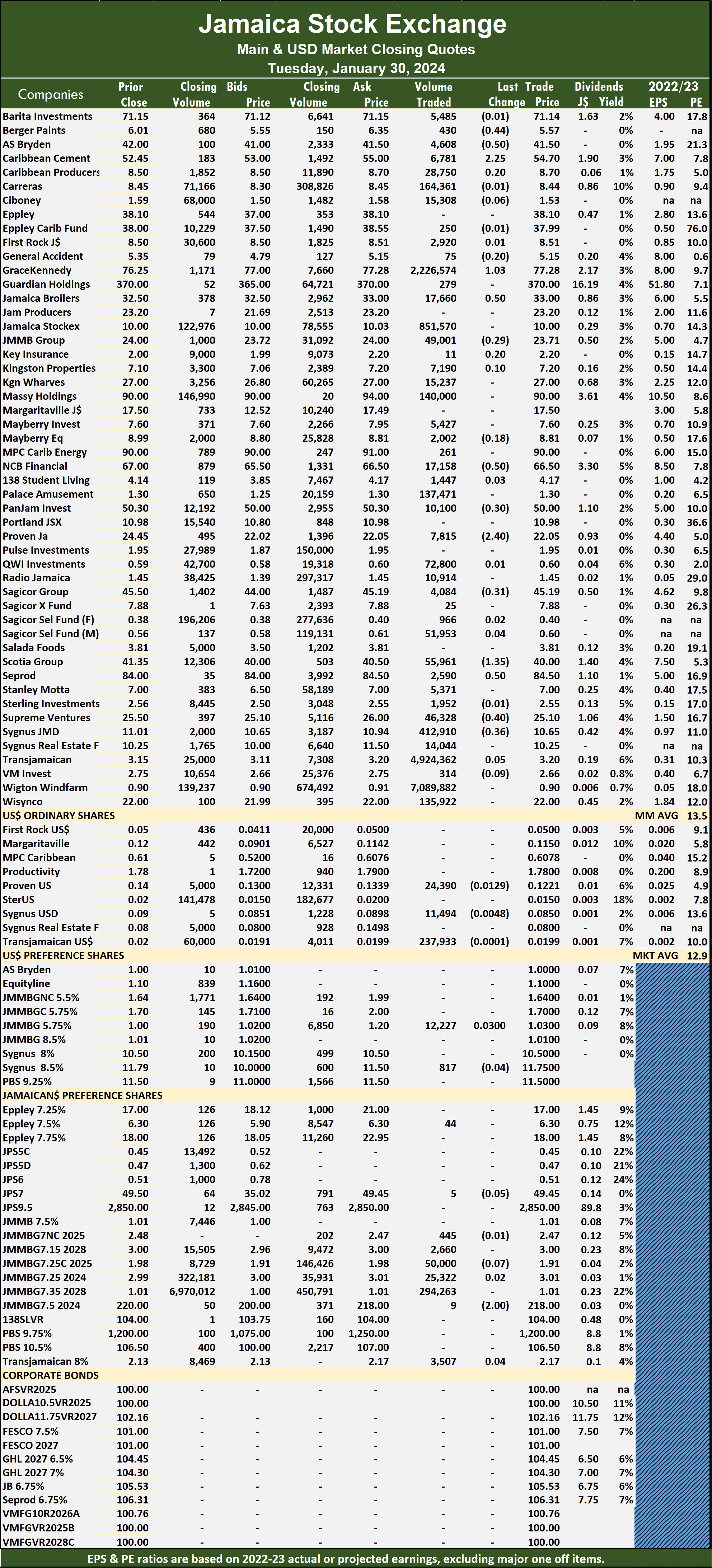

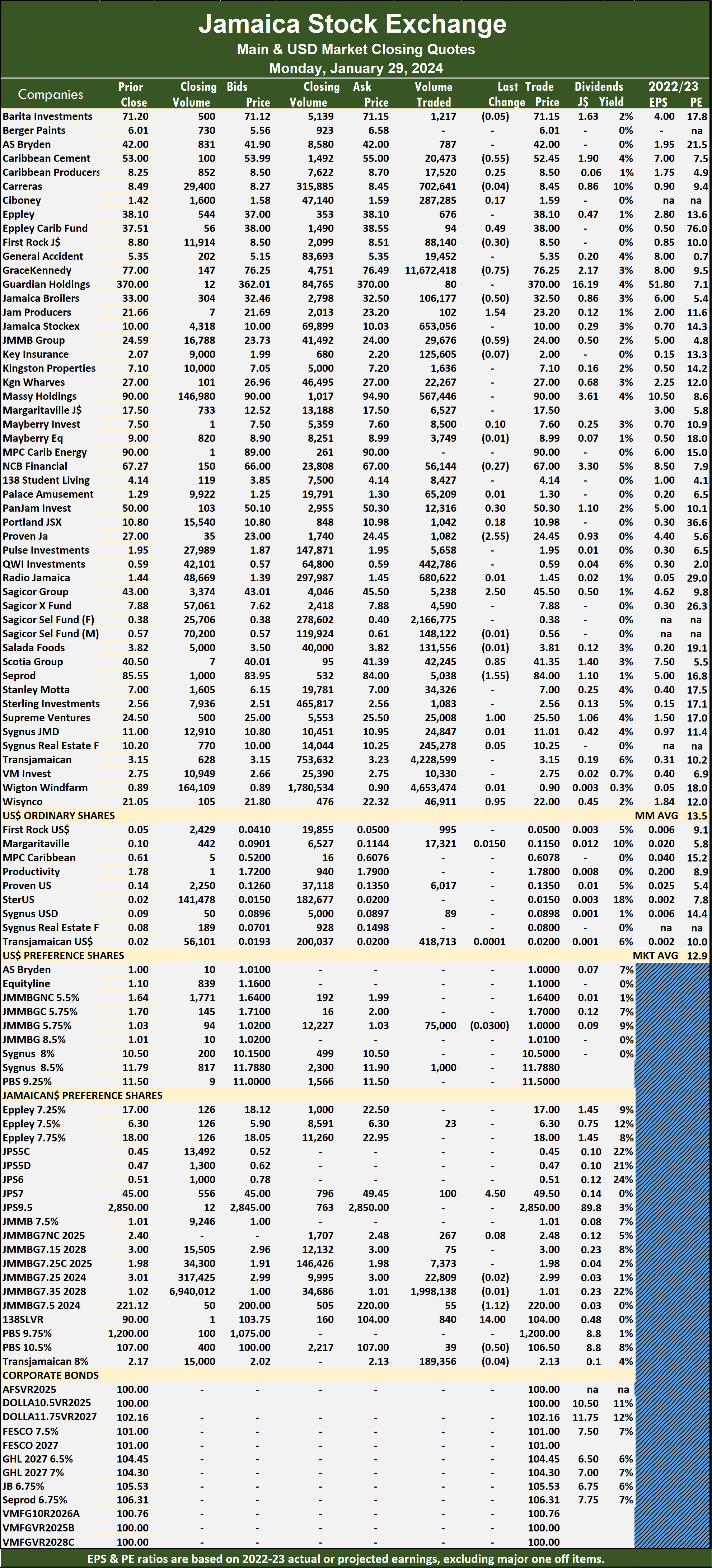

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

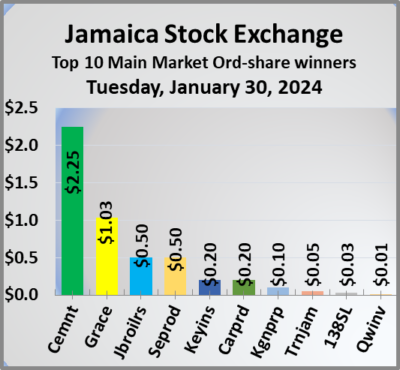

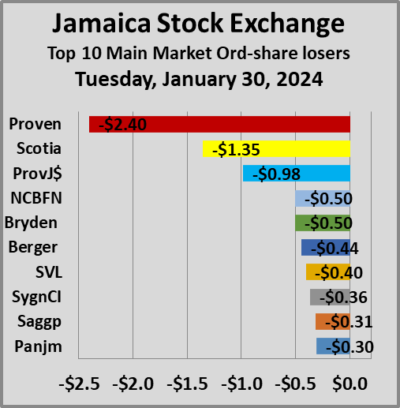

At the close, AS Bryden fell 50 cents in closing at $41.50 in an exchange of 4,608 shares, Berger Paints sank 44 cents to $5.57 with investors swapping 430 stocks, Caribbean Cement rose $2.25 to close at $54.70 after an exchange of 6,781 shares. GraceKennedy rallied $1.03 to end at $77.28 after investors ended trading 2,226,574 stock units, Jamaica Broilers popped 50 cents and ended at $33 as investors exchanged 17,660 shares, NCB Financial skidded 50 cents to $66.50 with a transfer of 17,158 stock units. Pan Jamaica lost 30 cents and ended at $50, with 10,100 units clearing the market,  Proven Investments declined $2.40 to end at $22.05 and closed after 7,815 stocks were traded, Sagicor Group shed 31 cents in closing at $45.19 in trading 4,084 shares. Scotia Group dropped $1.35 to close at $40 after a transfer of 55,961 stocks, Seprod advanced 50 cents to $84.50, with 2,590 units changing hands, Supreme Ventures dipped 40 cents to close at $25.10 with an exchange of 46,328 stock units and Sygnus Credit Investments lost 36 cents to end at $10.65, with 412,910 shares crossing the market.

Proven Investments declined $2.40 to end at $22.05 and closed after 7,815 stocks were traded, Sagicor Group shed 31 cents in closing at $45.19 in trading 4,084 shares. Scotia Group dropped $1.35 to close at $40 after a transfer of 55,961 stocks, Seprod advanced 50 cents to $84.50, with 2,590 units changing hands, Supreme Ventures dipped 40 cents to close at $25.10 with an exchange of 46,328 stock units and Sygnus Credit Investments lost 36 cents to end at $10.65, with 412,910 shares crossing the market.

In the preference segment, 138 Student Living preference share sank $2 in closing at $218 with traders dealing in 9 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD trading drops on Tuesday

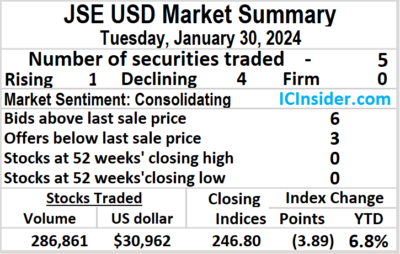

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the volume of stocks exchanged declining 45 percent after 69 percent fewer US dollars changed hands compared to Monday, resulting in trading in five securities, compared to seven on Monday with prices of one rising, four declining and no ending unchanged.

The market closed with an exchange of 286,861 shares for US$30,962 compared to 519,135 units at US$98,529 on Monday.

The market closed with an exchange of 286,861 shares for US$30,962 compared to 519,135 units at US$98,529 on Monday.

Trading averaged 57,372 units at US$6,192 versus 74,162 shares at US$14,076 on Monday, with a month to date average of 43,045 shares at US$5,149 compared with 42,458 units at US$5,106 on the previous day and December that ended with an average of 28,010 units for US$1,403.

The US Denominated Equities Index skidded 3.89 points to culminate at 246.80.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.6. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Proven Investments declined 1.29 cents to end at 12.21 US cents, with 24,390 stock units changing hands, Sygnus Credit Investments fell 0.48 of a cent to 8.5 US cents with a transfer of 11,494 shares and Transjamaican Highway lost 0.01 of a cent and ended at 1.99 US cents with investors swapping 237,933 units.

At the close, Proven Investments declined 1.29 cents to end at 12.21 US cents, with 24,390 stock units changing hands, Sygnus Credit Investments fell 0.48 of a cent to 8.5 US cents with a transfer of 11,494 shares and Transjamaican Highway lost 0.01 of a cent and ended at 1.99 US cents with investors swapping 237,933 units.

In the preference segment, JMMB US8.5% preference share popped 3 cents to close at US$1.03 after a transfer of 12,227 stocks and Sygnus Credit Investments E 8.5% dipped 3.8 cents in closing at US$11.75 with investors dealing in 817 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market falls again on Monday

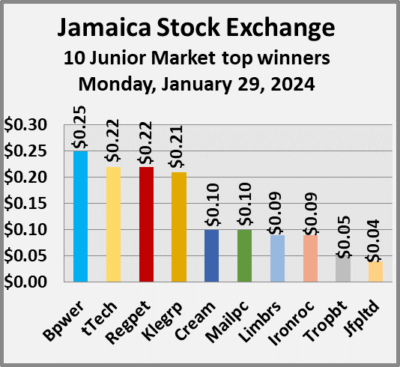

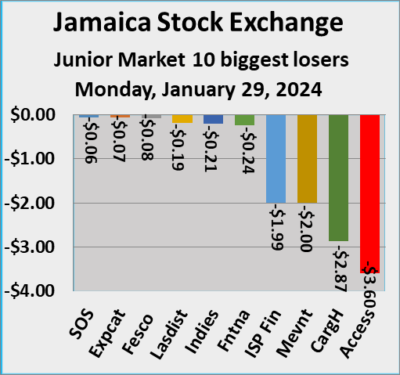

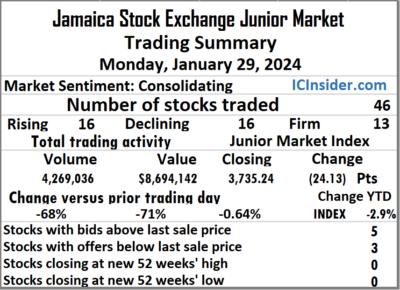

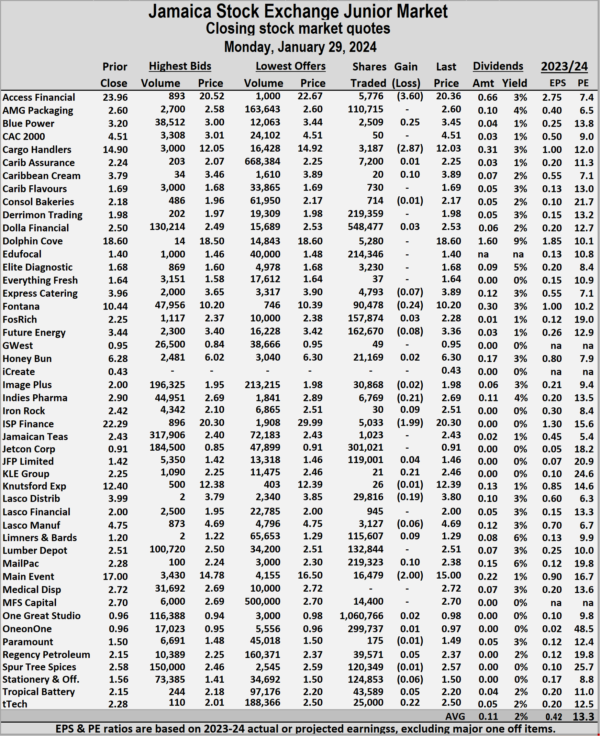

Trading closed on the Junior Market of the Jamaica Stock Exchange Monday, with a 68 percent decline in the volume of stocks traded, following a 71 percent drop in value, with trading in 46 securities compared with 45 on Friday and ending with prices of 16 rising, 16 declining and 14 closing unchanged.

The main market closed with trading of 4,269,036 shares for $8,694,142 down from 13,178,824 units at $30,106,364 on Friday.

The main market closed with trading of 4,269,036 shares for $8,694,142 down from 13,178,824 units at $30,106,364 on Friday.

Trading averaged 92,805 shares at $189,003 compared to 292,863 units at $669,030 on Friday with a month to date average of 170,860 stock units at $394,395 compared to 175,359 stocks at $406,235 previously and December with an average of 466,866 units at $1,111,272.

One Great Studio led trading with 1.06 million shares for 24.8 percent of total volume followed by Dolla Financial with 548,477 units for 12.8 percent of the day’s trade and Jetcon Corporation with 301,021 units for 7.1 percent market share.

At the close of trading, the Junior Market Index dipped 24.13 points to wrap-up trading at 3,735.24.

The Junior Market ended trading with an average PE Ratio of 13.3, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and three with lower offers.

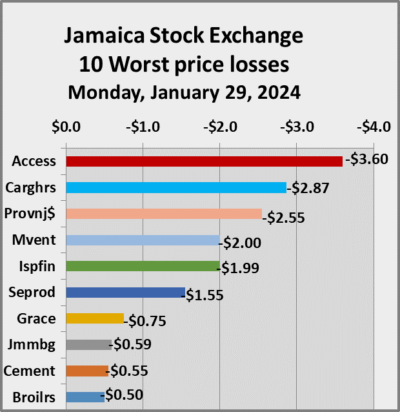

At the close, Access Financial fell $3.60 and ended at $20.36 after an exchange of 5,776 stock units, Blue Power climbed 25 cents to $3.45 and closed with an exchange of 2,509 shares, Cargo Handlers skidded $2.87 to close at $12.03 after a transfer of 3,187 units. Caribbean Cream popped 10 cents in closing at $3.89, with 20 stocks crossing the exchange, Fontana sank 24 cents to end at $10.20 in switching ownership of 90,478 units, Future Energy dropped 8 cents in closing at $3.36, with 162,670 stocks clearing the market. Indies Pharma shed 21 cents to close at $2.69 in an exchange of 6,769 shares, Iron Rock Insurance rallied 9 cents to close at $2.51, with 30 stock units crossing the market,  ISP Finance lost $1.99 and ended at $20.30 while exchanging 5,033 shares. KLE Group increased 21 cents to end at $2.46 in trading 21 stocks, Lasco Distributors declined 19 cents in closing at $3.80 after 29,816 units passed through the market, Limners and Bards rose 9 cents to $1.29, after trading at an intraday 52 weeks’ low of $1.13 with 115,607 stock units changing hands. Mailpac Group advanced 10 cents and ended at $2.38 as investors exchanged 219,323 shares, Main Event dipped $2 to end at $15 with a transfer of 16,479 stocks, Regency Petroleum gained 22 cents to close at $2.37 after exchanging 39,571 units and tTech popped 22 cents to $2.50 with investors dealing in 25,000 stock units.

ISP Finance lost $1.99 and ended at $20.30 while exchanging 5,033 shares. KLE Group increased 21 cents to end at $2.46 in trading 21 stocks, Lasco Distributors declined 19 cents in closing at $3.80 after 29,816 units passed through the market, Limners and Bards rose 9 cents to $1.29, after trading at an intraday 52 weeks’ low of $1.13 with 115,607 stock units changing hands. Mailpac Group advanced 10 cents and ended at $2.38 as investors exchanged 219,323 shares, Main Event dipped $2 to end at $15 with a transfer of 16,479 stocks, Regency Petroleum gained 22 cents to close at $2.37 after exchanging 39,571 units and tTech popped 22 cents to $2.50 with investors dealing in 25,000 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market pushes higher, Main & USD markets slipped

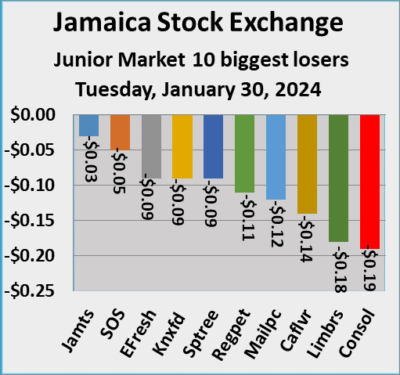

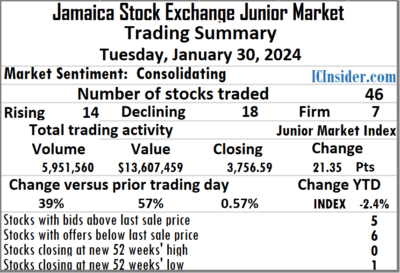

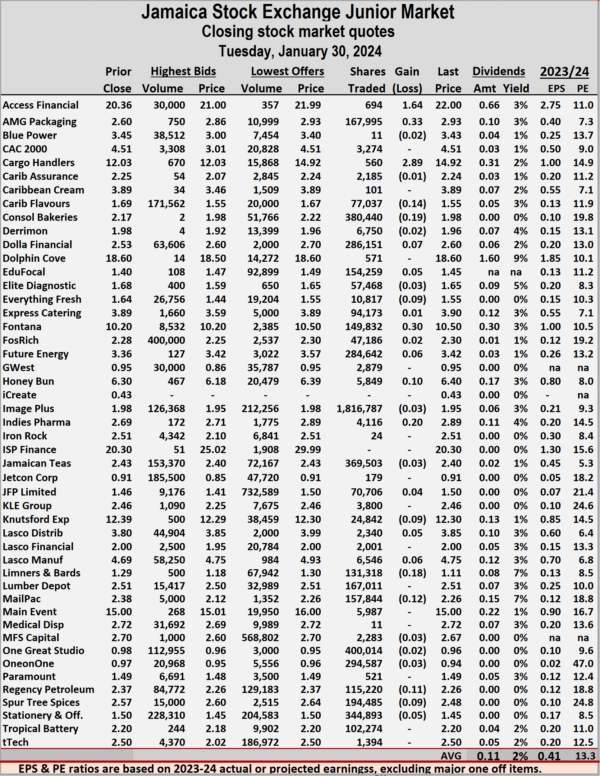

Junior Market stocks pushed higher at the of trading on the Jamaica Stock Exchange gained in trading on Tuesday as the Main Market and the JSE USD market slipped with trading ending with the number and the value of stocks that were exchanged fell, sharply compared to the previous day and resulted in 37 shares declining and just 25 rising.

At the close of trading on Tuesday, the JSE Combined Market Index dropped 967.64 points to close at 337,440.14, the All Jamaican Composite Index shed 1,567.01 points to end the day at 361,663.02, the JSE Main Index lost 1,231.12 points to settle at 324,724.69. The Junior Market Index popped 21.35 points to 3,756.59 and the JSE USD Market Index skidded 3.89 points to settle at 246.80.

At the close of trading on Tuesday, the JSE Combined Market Index dropped 967.64 points to close at 337,440.14, the All Jamaican Composite Index shed 1,567.01 points to end the day at 361,663.02, the JSE Main Index lost 1,231.12 points to settle at 324,724.69. The Junior Market Index popped 21.35 points to 3,756.59 and the JSE USD Market Index skidded 3.89 points to settle at 246.80.

At the close of trading, 23,163,225 shares were exchanged in all three markets, down from 34,389,476 units on …day, with the value of stocks traded on the Junior and Main markets amounted to $247.43 million, down from $1.01 billion yesterday and the JSE USD market closed with an exchange of 286,861 shares for US$30,962 compared to 519,135 units at US$98,529 on Monday.

Main Market trading was dominated by Wigton Windfarm led trading with 7.09 million shares followed by Transjamaican Highway with 4.92 million units and GraceKennedy with 2.23 million units.

In the Junior Market, Image Plus led trading with 1.82 million shares followed by One Great Studio with 400,014 units and Consolidated Bakeries with 380,440 units.

At the close of the market, some of the major Main Market stocks that rose are Caribbean Cement that rose $2.25 to close at $54.70 and GraceKennedy rallying $1.03 to end at $77.28.

The major declining Main Market stocks include Proven Investments declining $2.40 to end at $22.05 and Scotia Group dropping $1.35 to close at $40.

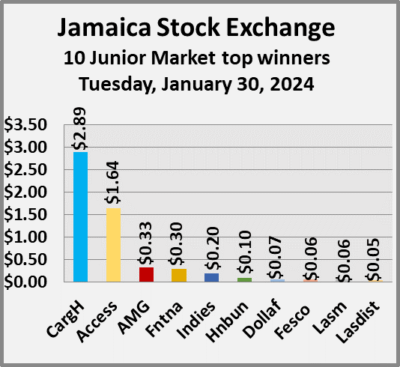

Stocks ending with major gains in the Junior Market are Access Financial advanced $1.64 to $22 and Cargo Handlers rallied $2.89 to end at $14.92, with the market closing with no major losses.

Stocks ending with major gains in the Junior Market are Access Financial advanced $1.64 to $22 and Cargo Handlers rallied $2.89 to end at $14.92, with the market closing with no major losses.

In the preference segment,138 Student Living was the only preference share with a major price change with the price dropping $2 in closing at $218.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.7 on 2022-23 earnings and 14. times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Junior Market falls again on Monday

Trading closed on the Junior Market of the Jamaica Stock Exchange Monday, with a 68 percent decline in the volume of stocks traded, following a 71 percent drop in value, with trading in 46 securities compared with 45 on Friday and ending with prices of 16 rising, 16 declining and 14 closing unchanged.

The main market closed with trading of 4,269,036 shares for $8,694,142 down from 13,178,824 units at $30,106,364 on Friday.

The main market closed with trading of 4,269,036 shares for $8,694,142 down from 13,178,824 units at $30,106,364 on Friday.

Trading averaged 92,805 shares at $189,003 compared to 292,863 units at $669,030 on Friday. Trading for the month to date, averages 170,860 units at $394,395 compared with 175,359 stocks at $406,235 on the previous trading day and December that ended with an average of 466,866 units at $1,111,272.

One Great Studio led trading with 1.06 million shares for 24.8 percent of total volume followed by Dolla Financial with 548,477 units for 12.8 percent of the day’s trade and Jetcon Corporation with 301,021 units for 7.1 percent market share.

At the close of trading, the Junior Market Index dipped 24.13 points to wrap up trading at 3,735.24.

The Junior Market ended trading with an average PE Ratio of 13.3, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

The Junior Market ended trading with an average PE Ratio of 13.3, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and three with lower offers.

At the close, Access Financial fell $3.60 and ended at $20.36 after an exchange of 5,776 stock units, Blue Power climbed 25 cents to $3.45 and closed with an exchange of 2,509 shares, Cargo Handlers skidded $2.87 to close at $12.03 after a transfer of 3,187 units. Caribbean Cream popped 10 cents in closing at $3.89, with 20 stocks crossing the exchange, Fontana sank 24 cents to end at $10.20 in switching ownership of 90,478 units, Future Energy dropped 8 cents in closing at $3.36, with 162,670 stocks clearing the market. Indies Pharma shed 21 cents to close at $2.69 in an exchange of 6,769 shares, Iron Rock Insurance rallied 9 cents to close at $2.51, with 30 stock units crossing the market, ISP Finance lost $1.99 and ended at $20.30 while exchanging 5,033 shares. KLE Group increased 21 cents to end at $2.46 in trading 21 stocks,  Lasco Distributors fell by 19 cents in closing at $3.80 after 29,816 units passed through the market, Limners and Bards rose 9 cents to $1.29, after trading at an intraday 52 weeks’ low of $1.13 with 115,607 stock units changing hands. Mailpac Group advanced 10 cents and ended at $2.38 as investors traded 219,323 shares, Main Event dipped $2 to $15 after a transfer of 16,479 stock units, Regency Petroleum gained 22 cents to close at $2.37 after exchanging 39,571 units and tTech popped 22 cents to $2.50 with investors dealing in 25,000 stock units.

Lasco Distributors fell by 19 cents in closing at $3.80 after 29,816 units passed through the market, Limners and Bards rose 9 cents to $1.29, after trading at an intraday 52 weeks’ low of $1.13 with 115,607 stock units changing hands. Mailpac Group advanced 10 cents and ended at $2.38 as investors traded 219,323 shares, Main Event dipped $2 to $15 after a transfer of 16,479 stock units, Regency Petroleum gained 22 cents to close at $2.37 after exchanging 39,571 units and tTech popped 22 cents to $2.50 with investors dealing in 25,000 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

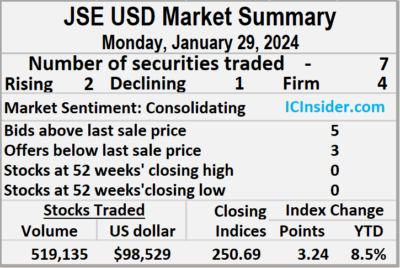

More gains for JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with a 23 percent decline in the volume of stocks that were exchanged after 265 percent more US dollars changed hands than Friday, resulting in trading in seven securities, compared to six on the prior trading day with prices of two rising, one declining and four ending unchanged.

The market closed with an exchange of 519,135 shares for US$98,529 compared to 670,997 units at US$26,968 on Friday.

The market closed with an exchange of 519,135 shares for US$98,529 compared to 670,997 units at US$26,968 on Friday.

Trading averaged 74,162 stock units at US$14,076 versus 111,833 shares at US$4,495 on Friday, with a month to date average of 42,458 shares at US$5,106 compared with 40,528 units at US$4,560 on the previous day and December that ended with an average of 28,010 units for US$1,403.

The US Denominated Equities Index climbed 3.24 points to lock up trading at 250.69, with a gain of 8.5 percent for the year to date.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, First Rock Real Estate USD share ended at 5 US cents with investors swapping 995 units,  Margaritaville rose 1.5 cents to end at 11.5 US cents with 17,321 stocks, crossing the market, Proven Investments ended at 13.5 US cents after investors traded 6,017 shares. Sygnus Credit Investments ended at 8.98 US cents 89 stock units passed through the market and Transjamaican Highway gained 0.01 of a cent to close at 2 US cents after exchanging 418,713 shares.

Margaritaville rose 1.5 cents to end at 11.5 US cents with 17,321 stocks, crossing the market, Proven Investments ended at 13.5 US cents after investors traded 6,017 shares. Sygnus Credit Investments ended at 8.98 US cents 89 stock units passed through the market and Transjamaican Highway gained 0.01 of a cent to close at 2 US cents after exchanging 418,713 shares.

In the preference segment, JMMB US8.5% preference share fell 3 cents to US$1 in trading 75,000 stocks and Sygnus Credit Investments E 8.5% remained at US$11.788 after an exchange of 1,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

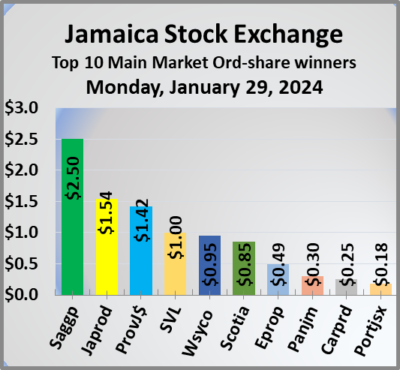

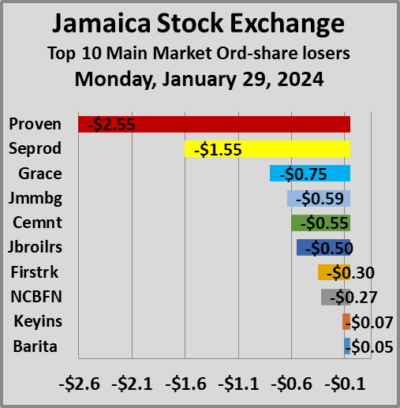

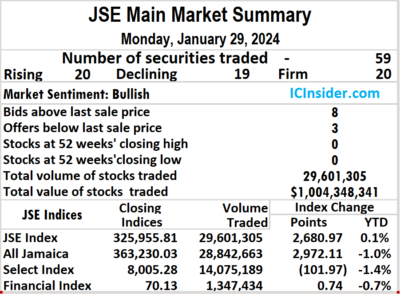

Grace dominated JSE Main Market trading Monday

GraceKennedy dominated trading on the Jamaica Stock Exchange Main Market on Monday, with nearly 12 million shares for $899 million and pushing the volume of stocks traded by 216 percent and the value 948 percent more than in market activity on Friday, from trading in 59 securities, similar to Friday and ended with prices of 20 stocks rising, 19 declining and 20 ending unchanged.

The market closed with an exchange of 29,601,305 shares for a massive $1,004,348,955, up sharply from just 9,369,749 stock units at $95,805,466 on Friday.

The market closed with an exchange of 29,601,305 shares for a massive $1,004,348,955, up sharply from just 9,369,749 stock units at $95,805,466 on Friday.

Trading averaged 501,717 shares at $17,022,864 compared with 158,809 units at $1,623,821 on Friday and month to date, an average of 257,735 units at $2,378,727, in comparison to 244,090 stock units at $1,559,766 previously traded and December that closed with an average of 264,266 units at $3,755,946.

GraceKennedy led trading with 11.67 million shares for 39.4 percent of total volume followed by Wigton Windfarm with 4.65 million units for 15.7 percent of the day’s trade, Transjamaican Highway chipped in with 4.23 million units for 14.3 percent market share, Sagicor Select Financial Fund with 2.17 million units for 7.3 percent market share and JMMB 9.5% preference share with 2.0 million units for 6.8 percent of total volume.

The All Jamaican Composite Index climbed 2,972.11 points to finish at 363,230.03, the JSE Main Index rallied 2,680.97 points to wrap up trading at 325,955.81 and the JSE Financial Index rose 0.74 points to lock up trading at 70.13.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and the USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with their financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and the USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with their financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and three with lower offers.

At the close, Caribbean Cement declined 55 cents to finish at $52.45 in switching owners of 20,473 stocks, Eppley Caribbean Property Fund advanced 49 cents and ended at $38 after an exchange of 94 units, First Rock Real Estate sank 30 cents to end at $8.50 with investors trading 88,140 shares. GraceKennedy dipped 75 cents in closing at $76.25, with 11,672,418 stock units crossing the exchange, Jamaica Broilers fell 50 cents to close at $32.50 after a transfer of 106,177 shares, Jamaica Producers popped $1.54 to $23.20 as investors exchanged 102 stock units. JMMB Group skidded 59 cents and ended at $24, with 29,676 units crossing the market, Pan Jamaica increased 30 cents to close at $50.30 while exchanging 12,316 stocks, Proven Investments lost $2.55 to end at $24.45 after trading 1,082 shares.  Sagicor Group climbed $2.50 in closing at $45.50 in an exchange of 5,238 stock units, Scotia Group rose 85 cents to $41.35, with 42,245 stocks changing hands, Seprod dropped $1.55 in closing at $84 after an exchange of 5,038 units. Supreme Ventures gained $1 to end at $25.50 with investors dealing in 25,008 stocks and Wisynco Group rallied 95 cents and ended at $22 with a transfer of 46,911 shares.

Sagicor Group climbed $2.50 in closing at $45.50 in an exchange of 5,238 stock units, Scotia Group rose 85 cents to $41.35, with 42,245 stocks changing hands, Seprod dropped $1.55 in closing at $84 after an exchange of 5,038 units. Supreme Ventures gained $1 to end at $25.50 with investors dealing in 25,008 stocks and Wisynco Group rallied 95 cents and ended at $22 with a transfer of 46,911 shares.

In the preference segment, Jamaica Public Service 7% increased $4.50 to close at $49.50 with investors swapping 100 units, 138 Student Living preference share shed $1.12 to end at $220 after 55 stock units passed through the market, Productive Business Solutions 9.75% preference share climbed $14 and ended at $104 after closing with an exchange of 840 shares and Sygnus Credit Investments C 10.5% dropped 50 cents to close at $106.50, with 39 stock units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading surges to $1 billion on the JSE on Monday

The Main Market of the Jamaica Stock Exchange maintained its bullish stance in evidence since last October, with another solid gain in trading on Monday and the JSE USD market continues to post fresh 2024 highs, with more gains but the Junior Market slipped for a second day as trading in the overall market jumped sharply higher than Friday following big trades in shares of GraceKennedy that pushed the volume and value of trading sharply higher over Friday as trading ended after prices of 32 shares rose and 31 declined.

At the close of market activity, the Jamaica Stock Exchange Combined Market Index climbed 2,303.01 points to finish the day at 338,407.78, the All Jamaican Composite Index popped 2,972.11 points to close at 363,230.03, the JSE Main Index gained 2,680.97 points to finish at 325,955.81. The Junior Market Index dropped 24.13 points to 3,735.24 and the JSE USD Market Index climbed 3.24 points to 250.69.

At the close of market activity, the Jamaica Stock Exchange Combined Market Index climbed 2,303.01 points to finish the day at 338,407.78, the All Jamaican Composite Index popped 2,972.11 points to close at 363,230.03, the JSE Main Index gained 2,680.97 points to finish at 325,955.81. The Junior Market Index dropped 24.13 points to 3,735.24 and the JSE USD Market Index climbed 3.24 points to 250.69.

At the close of trading, 34,389,476 shares were exchanged in all three markets, up from 23,219,570 units on Friday, with the value of stocks traded on the Junior and Main markets amounted to $1.01 billion, up from $125.91 million on Friday and the JSE USD market closed with an exchange of 519,135 shares for US$98,529 compared with 670,997 units at US$26,968 on Friday.

Main Market trading was dominated by GraceKennedy led trading with 11.67 million shares followed by Wigton Windfarm with 4.65 million units, Transjamaican Highway with 4.23 million stock units, Sagicor Select Financial Fund with 2.17 million units and JMMB 9.5% preference share with 2.0 million units

In the Junior Market, One Great Studio led trading with 1.06 million shares followed by Dolla Financial with 548,477 units and Jetcon Corporation with 301,021 stock units.

At the close of the market, some of the major Main Market stocks that rose are Jamaica Producers popped $1.54 to $23.20, Sagicor Group climbed $2.50 in closing at $45.50, Scotia Group rose 85 cents to $41.35 Supreme Ventures gained $1 to end at $25.50 and Wisynco Group rallied 95 cents and ended at $22.

At the close of the market, some of the major Main Market stocks that rose are Jamaica Producers popped $1.54 to $23.20, Sagicor Group climbed $2.50 in closing at $45.50, Scotia Group rose 85 cents to $41.35 Supreme Ventures gained $1 to end at $25.50 and Wisynco Group rallied 95 cents and ended at $22.

The major declining Main Market stocks include Proven Investments lost $2.55 to end at $24.45 and Seprod dropped $1.55 in closing at $84.

On a day when there were no notable price gains on the Junior Market, the major losing stocks were Access Financial that fell $3.60 and ended at $20.36, Cargo Handlers skidding $2.87 to close at $12.03, ISP Finance losing $1.99 and ended at $20.30 and Main Event dipping $2 to end at $15.

In the preference segment, Jamaica Public Service 7% increased by $4.50 to close at $49.50, 138 Student Living preference share shed $1.12 to $220, Productive Business Solutions 9.75% preference share climbed $14 and ended at $104.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.7 on 2022-23 earnings and 14.1 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

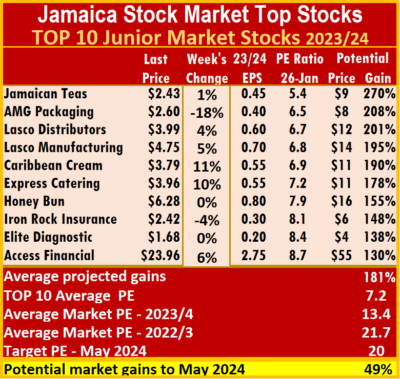

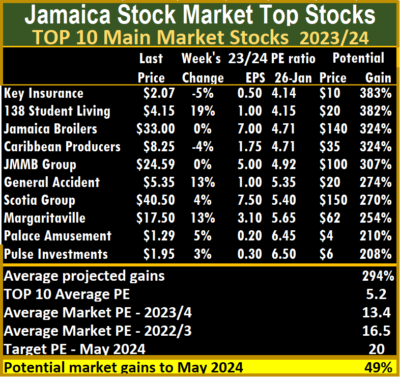

Positive moves for ICTOP10

At the end of the past week, the Main Market moved within less than one percent for the year’s highest close as the market is showing bullish signs. The junior Market closed the week higher than the close of the previous week but the market closed with the ICInsider.com TOP 10 stocks remaining unchanged.

Two stocks with a notable gain in the Junior Market TOP 10 are Caribbean Cream rising 11 percent to close at $3.79 and Express Catering rose 10 percent to $3.96. AMG Packaging skidded 18 percent to close at $2.60. In the Main Market, there were three stocks with outsize movements. 138 Student Living jumped 19 percent to $4.15 followed by a 13 percent rise respectively for General Accident to $5.35 and Margaritaville to $17.50.

Two stocks with a notable gain in the Junior Market TOP 10 are Caribbean Cream rising 11 percent to close at $3.79 and Express Catering rose 10 percent to $3.96. AMG Packaging skidded 18 percent to close at $2.60. In the Main Market, there were three stocks with outsize movements. 138 Student Living jumped 19 percent to $4.15 followed by a 13 percent rise respectively for General Accident to $5.35 and Margaritaville to $17.50.

For the full list of percentage changes for the week for the ICTOP10 stocks, check the attached charts that now show a column of the weekly price movements.

The average PE for the JSE Main Market ICTOP 10 stands at 5.2, well below the market average of 13.4 and the Junior Market TOP10 sits at 7.2, just over half of the market, with an average of 13.4

The Main Market ICTOP10 is projected to gain an average of 294 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 181 percent over the same time frame.

The Main Market ICTOP10 is projected to gain an average of 294 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 181 percent over the same time frame.

In the Main Market ICTOP 10, a total of 14 of the most highly valued stocks representing 29 percent of the Main Market are priced at a PE of 15 to 108, with an average of 32 and 22 excluding the highest PE ratios, and a PE of 25 for the top half and 18 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 14 stocks, or 29 percent of the market, with PEs ranging from 15 to 48, averaging 21, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks, currently.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

- « Previous Page

- 1

- …

- 68

- 69

- 70

- 71

- 72

- …

- 639

- Next Page »