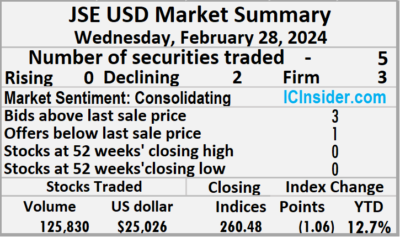

Trading on the Jamaica Stock Exchange US dollar market ended on Wednesday, with a 1,853 percent jump in the volume of stocks exchanged following 234 percent more US dollars passing through the market than on Tuesday and resulting in trading in five securities, compared to seven on Tuesday with prices of no rising, two declining and three ending unchanged.

The market closed with an exchange of 125,830 shares for US$25,026 compared to 6,443 units at US$7,499 on Tuesday.

The market closed with an exchange of 125,830 shares for US$25,026 compared to 6,443 units at US$7,499 on Tuesday.

Trading averaged 25,166 units at US$5,005 versus 920 shares at US$1,071 on Tuesday, with a month to date average of 49,133 shares at US$6,355 compared with 50,100 units at US$6,410 on the previous day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index slipped 1.06 points to settle at 260.48.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Proven Investments dipped 0.06 of a cent in closing at 14.44 US cents with investors trading 275 stocks, Sygnus Credit Investments remained at 8.9 US cents with an exchange of 5,448 units and Transjamaican Highway fell 0.02 of a cent to end at 2.11 US cents in trading 109,605 shares.

At the close, Proven Investments dipped 0.06 of a cent in closing at 14.44 US cents with investors trading 275 stocks, Sygnus Credit Investments remained at 8.9 US cents with an exchange of 5,448 units and Transjamaican Highway fell 0.02 of a cent to end at 2.11 US cents in trading 109,605 shares.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.149 in switching ownership of 9,519 stock units and Productive Business Solutions 9.25% preference share remained at US$11.50, with 983 shares crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD trading bounces

Sharp fall in trading

Trading dropped by 92 percent after 30 percent fewer US dollars passed through the Jamaica Stock Exchange US dollar market on Tuesday, and resulted in trading of seven securities, compared to nine on Monday with prices of two rising, three declining and two ending unchanged.

The market closed with an exchange of 6,443 shares for US$7,499 down from 83,412 units at US$10,690 on Monday.

The market closed with an exchange of 6,443 shares for US$7,499 down from 83,412 units at US$10,690 on Monday.

Trading averaged 920 units at US$1,071 versus 9,268 shares at US$1,188 on Monday, with a month to date average of 50,100 shares at US$6,410 compared with 53,042 units at US$6,729 on the previous day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index popped 4.23 points to 261.54.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, First Rock Real Estate USD share sank 0.6 of a cent to close at 4.1 US cents as investors traded 3,600 stocks, MPC Caribbean Clean Energy lost 6 cents to close at 55 US cents with 38 units clearing the market, Proven Investments popped 0.8 of a cent to end at 14.5 US cents with investors transferring 1,167 shares.  Sterling Investments increased 0.24 of a cent in closing at 1.99 US cents after an exchange of 490 stock units and Transjamaican Highway remained at 2.13 US cents with an exchange of 1 share,

Sterling Investments increased 0.24 of a cent in closing at 1.99 US cents after an exchange of 490 stock units and Transjamaican Highway remained at 2.13 US cents with an exchange of 1 share,

In the preference segment, JMMB Group US8.5% preference share ended at US$1.149, with 500 units crossing the market and Sygnus Credit Investments E8.5% declined US$1.01 in closing at US$10.01 while exchanging 647 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with the volume of stocks changing hands declining 77 percent after 43 percent lower US dollars passed through the market than on Friday, resulting in trading in nine securities, compared to four on Friday with prices of six rising, two declining and one ending unchanged.

The market closed with an exchange of 83,412 shares for US$10,690 compared to 361,086 units at US$18,726 on Friday.

The market closed with an exchange of 83,412 shares for US$10,690 compared to 361,086 units at US$18,726 on Friday.

Trading averaged 9,268 units at US$1,188 versus 90,272 shares at US$4,682 on Friday, with a month to date average of 53,042 shares at US$6,729 compared to 56,690 units at US$7,191 on the previous trading day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index lost 2.63 points to cease trading at 257.31.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.1. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, MPC Caribbean Clean Energy climbed 4 cent and ended at 61 US cents after a transfer of 250 units, Proven Investments rose 0.1 of a cent to 13.7 US cents, with 6,316 stocks crossing the exchange, Sterling Investments gained 0.3 of a cent in closing at 1.75 US cents with investors trading 150 shares.  Sygnus Credit Investments popped 0.03 of a cent to close at 8.9 US cents with 5,137 stock units clearing the market, Sygnus Real Estate Finance USD share declined 0.54 of one cent to end at 7.5 US cents with an exchange of 347 shares and Transjamaican Highway increased 0.13 of a cent in closing at 2.13 US cents after 64,527 units passed through the market.

Sygnus Credit Investments popped 0.03 of a cent to close at 8.9 US cents with 5,137 stock units clearing the market, Sygnus Real Estate Finance USD share declined 0.54 of one cent to end at 7.5 US cents with an exchange of 347 shares and Transjamaican Highway increased 0.13 of a cent in closing at 2.13 US cents after 64,527 units passed through the market.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.149 with investors swapping 6,600 stocks, JMMB Group 5.75% lost 1 cent and ended at US$1.90, with 68 stock units changing hands and Productive Business Solutions 9.25% preference share rallied 45 cents to end at US$11.50 with a transfer of 17 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks exchanged rising by 16 percent after 69 percent more US dollars changed hands than on Thursday and resulting in trading in four securities, compared to eight on Thursday with prices of one rising, one declining and two ending unchanged.

The market closed with an exchange of 361,086 shares for US$18,726 compared to 310,053 units at US$11,086 on Thursday.

The market closed with an exchange of 361,086 shares for US$18,726 compared to 310,053 units at US$11,086 on Thursday.

Trading averaged 90,272 units at US$4,682 versus 38,757 shares at US$1,386 on Thursday, with a month to date average of 56,690 shares at US$7,191 compared with 55,399 units at US$7,287 on the previous day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index increased 4.73 points to 259.94.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.8. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Margaritaville ended at 12.78 US cents in switching ownership of just one share, Sygnus Real Estate Finance USD share popped 1.04 cents in closing at 8.04 US cents after 647 units changed hands and Transjamaican Highway remained at 2 US cents with an exchange of 359,378 shares.

At the close, Margaritaville ended at 12.78 US cents in switching ownership of just one share, Sygnus Real Estate Finance USD share popped 1.04 cents in closing at 8.04 US cents after 647 units changed hands and Transjamaican Highway remained at 2 US cents with an exchange of 359,378 shares.

In the preference segment, Sygnus Credit Investments US 8% shed 4 cents and ended at US$10.50 after trading 1,060 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

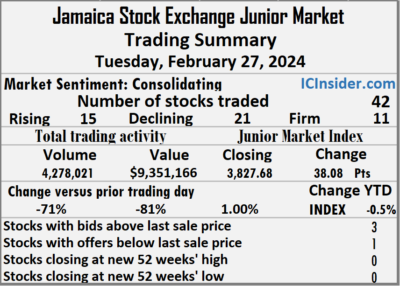

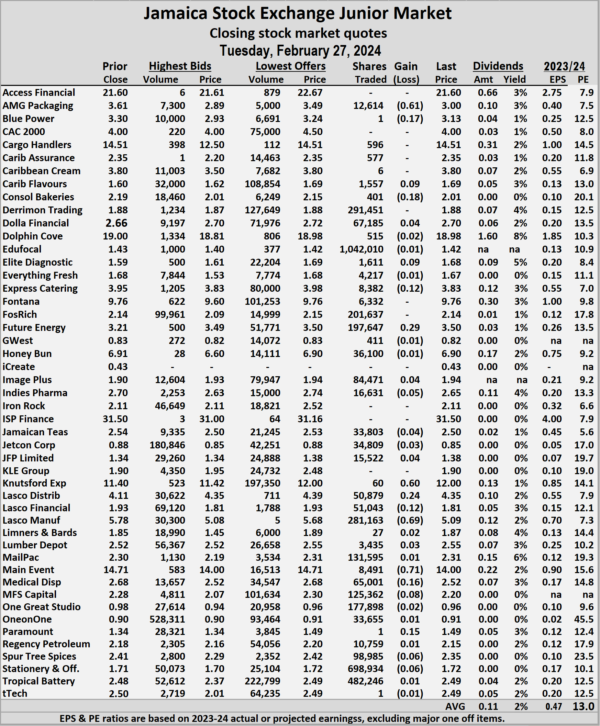

The market closed with 4,278,021 shares being traded for $9,351,166 compared with 14,902,945 units at $48,199,902 on Monday.

The market closed with 4,278,021 shares being traded for $9,351,166 compared with 14,902,945 units at $48,199,902 on Monday. The Junior Market ended trading with an average PE Ratio of 13.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

The Junior Market ended trading with an average PE Ratio of 13.1, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024. Future Energy popped 29 cents to end at $3.50 after an exchange of 197,647 stocks, Knutsford Express rallied 60 cents in closing at $12 with a transfer of 60 stock units, Lasco Distributors rose 24 cents to close at $4.35 while exchanging 50,879 shares. Lasco Financial dipped 12 cents to $1.81 in trading 51,043 units, Lasco Manufacturing shed 69 cents to close at $5.09 after 281,163 stocks crossed the exchange, Main Event declined 71 cents to end at $14 with investors transferring 8,491 stock units. Medical Disposables fell 16 cents in closing at $2.52 after an exchange of 65,001 shares, MFS Capital Partners lost 8 cents and ended at $2.20 after trading 125,362 stock units and Paramount Trading gained 15 cents to close at $1.49 with an exchange of just one stock.

Future Energy popped 29 cents to end at $3.50 after an exchange of 197,647 stocks, Knutsford Express rallied 60 cents in closing at $12 with a transfer of 60 stock units, Lasco Distributors rose 24 cents to close at $4.35 while exchanging 50,879 shares. Lasco Financial dipped 12 cents to $1.81 in trading 51,043 units, Lasco Manufacturing shed 69 cents to close at $5.09 after 281,163 stocks crossed the exchange, Main Event declined 71 cents to end at $14 with investors transferring 8,491 stock units. Medical Disposables fell 16 cents in closing at $2.52 after an exchange of 65,001 shares, MFS Capital Partners lost 8 cents and ended at $2.20 after trading 125,362 stock units and Paramount Trading gained 15 cents to close at $1.49 with an exchange of just one stock. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.  At the close of trading, the JSE Combined Market Index fell 2135.47 points to 346,386.21, the All Jamaican Composite Index dropped 4,582.25 points to finish at 372,562.75, the JSE Main Index shed 2,632.54 points to lock up trading at 333,599.81. The Junior Market Index jumped 38.08 points to finish at 3,827.68 and the JSE USD Market Index dipped 1.13 points to conclude trading at 256.18.

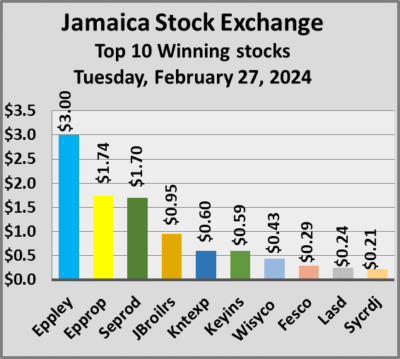

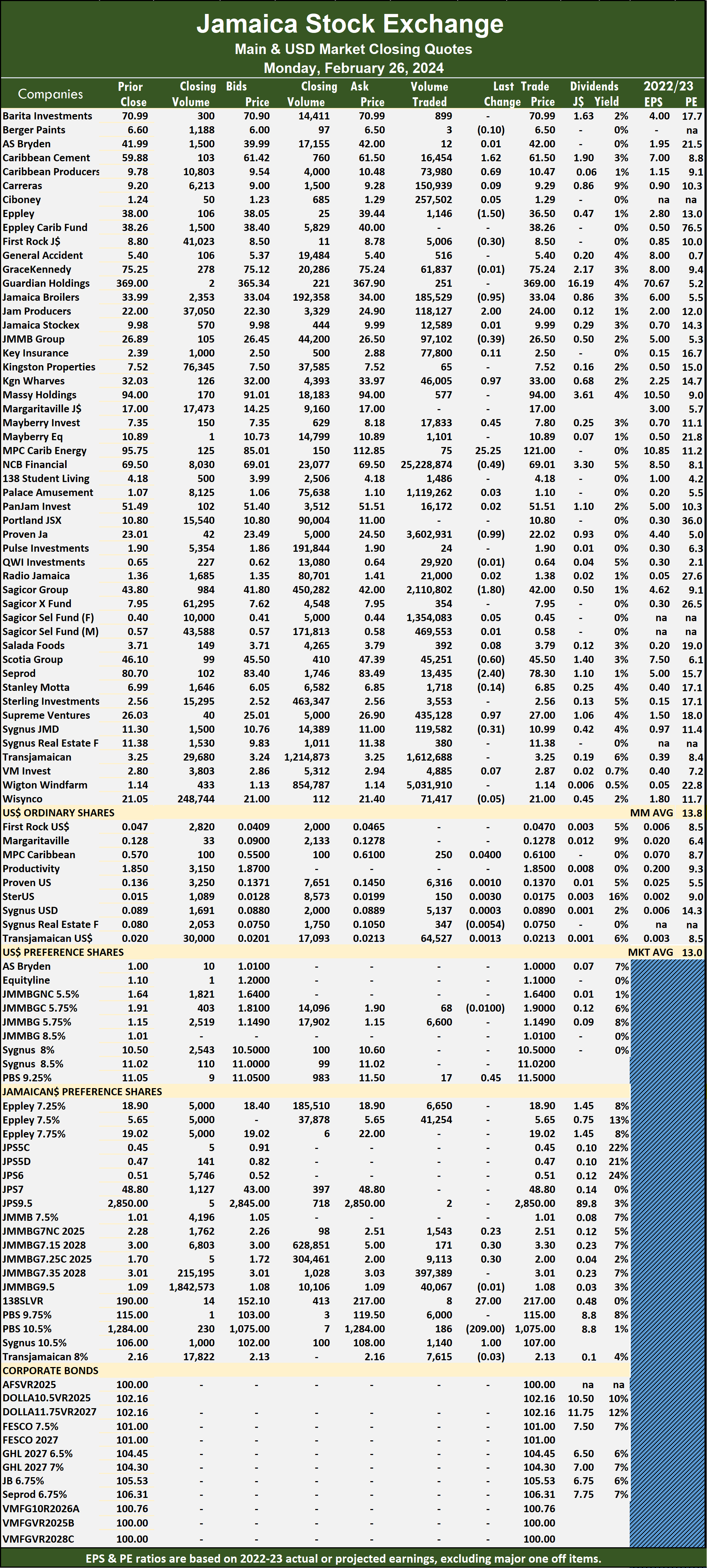

At the close of trading, the JSE Combined Market Index fell 2135.47 points to 346,386.21, the All Jamaican Composite Index dropped 4,582.25 points to finish at 372,562.75, the JSE Main Index shed 2,632.54 points to lock up trading at 333,599.81. The Junior Market Index jumped 38.08 points to finish at 3,827.68 and the JSE USD Market Index dipped 1.13 points to conclude trading at 256.18. At the close of trading the Main Market listed Eppley rose $3 in closing at $39.50 with investors dealing in 1,560 stocks, Eppley Caribbean Property Fund gained $1.74 to close at $40, Jamaica Broilers popped 95 cents to $33.99, Seprod climbed $1.70 to $80,

At the close of trading the Main Market listed Eppley rose $3 in closing at $39.50 with investors dealing in 1,560 stocks, Eppley Caribbean Property Fund gained $1.74 to close at $40, Jamaica Broilers popped 95 cents to $33.99, Seprod climbed $1.70 to $80, Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

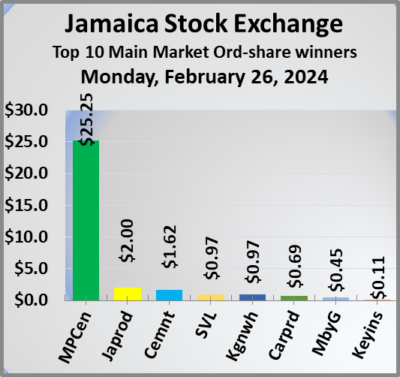

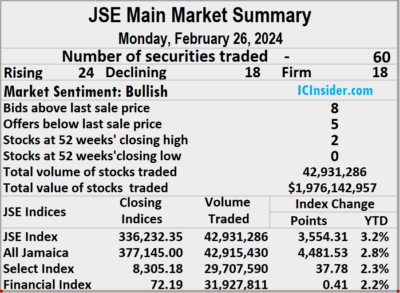

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed after 42,931,286 shares were traded for $1,976,142,956 in comparison with 11,253,996 stock units at $82,073,604 on Friday.

The market closed after 42,931,286 shares were traded for $1,976,142,956 in comparison with 11,253,996 stock units at $82,073,604 on Friday. The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

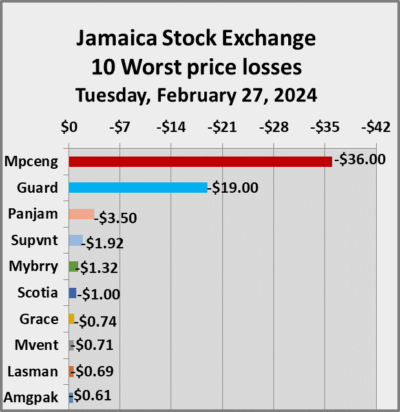

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. MPC Caribbean Clean Energy jumped $25.25 to end at $121 after an exchange of 75 units, NCB Financial skidded 49 cents to $69.01 with a transfer of 25,228,874 stocks, Proven Investments sank 99 cents in closing at $22.02 after an exchange of 3,602,931 stock units. Sagicor Group shed $1.80 to close at $42 with investors trading 2,110,802 shares, Scotia Group dropped 60 cents and ended at $45.50 as investors exchanged 45,251 stock units, Seprod fell $2.40 to end at $78.30, with 13,435 units crossing the market. Supreme Ventures gained 97 cents in closing at $27 with investors dealing in 435,128 stocks and Sygnus Credit Investments skidded 31 cents to $10.99 while exchanging 119,582 units.

MPC Caribbean Clean Energy jumped $25.25 to end at $121 after an exchange of 75 units, NCB Financial skidded 49 cents to $69.01 with a transfer of 25,228,874 stocks, Proven Investments sank 99 cents in closing at $22.02 after an exchange of 3,602,931 stock units. Sagicor Group shed $1.80 to close at $42 with investors trading 2,110,802 shares, Scotia Group dropped 60 cents and ended at $45.50 as investors exchanged 45,251 stock units, Seprod fell $2.40 to end at $78.30, with 13,435 units crossing the market. Supreme Ventures gained 97 cents in closing at $27 with investors dealing in 435,128 stocks and Sygnus Credit Investments skidded 31 cents to $10.99 while exchanging 119,582 units. 138 Student Living preference share rose $27 and ended at $217 in an exchange of 8 stocks, Productive Business Solutions 10.5 % preference share sank $209 to $1,075 after 186 units passed through the market and Sygnus Credit Investments C10.5% gained $1 to end at $107, with 1,140 stocks crossing the exchange.

138 Student Living preference share rose $27 and ended at $217 in an exchange of 8 stocks, Productive Business Solutions 10.5 % preference share sank $209 to $1,075 after 186 units passed through the market and Sygnus Credit Investments C10.5% gained $1 to end at $107, with 1,140 stocks crossing the exchange. The market closed on Monday with trading of 14,902,945 shares for $48,199,902 compared to 9,473,714 units at $35,695,598 on Friday.

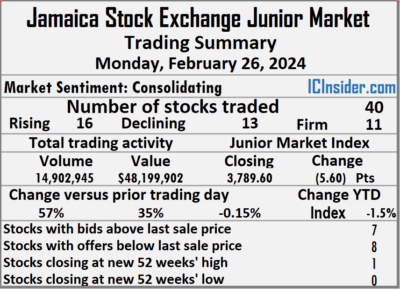

The market closed on Monday with trading of 14,902,945 shares for $48,199,902 compared to 9,473,714 units at $35,695,598 on Friday. At the close of trading, the Junior Market Index lost 5.60 points to lock up trading at 3,789.60.

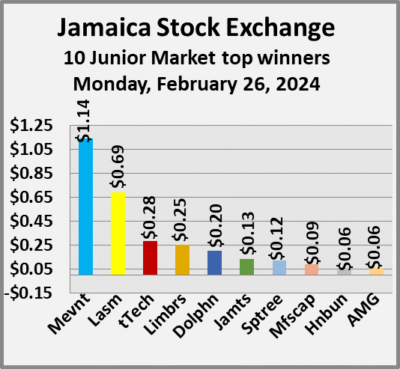

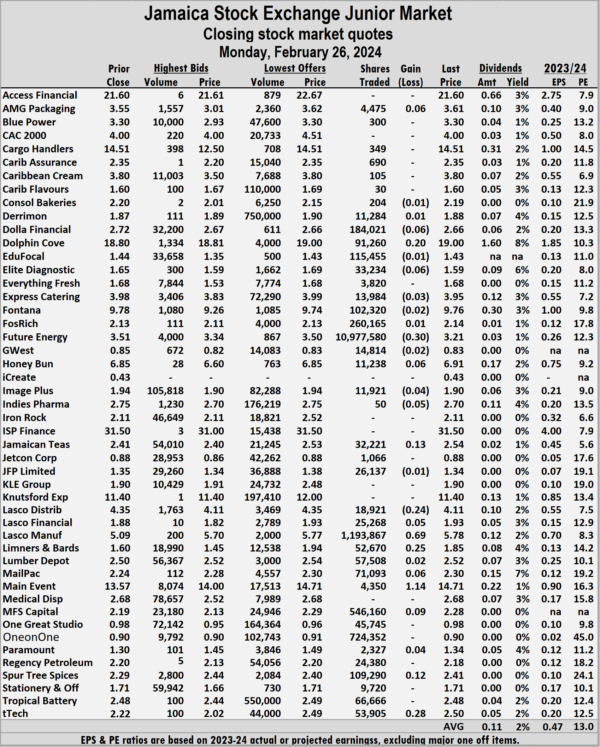

At the close of trading, the Junior Market Index lost 5.60 points to lock up trading at 3,789.60. Lasco Distributors sank 24 cents and ended at $4.11 in trading 18,921 stock units, Lasco Manufacturing rose 69 cents to close at $5.78 after exchanging 1,193,867 shares, Limners and Bards advanced 25 cents to $1.85, with 52,670 units crossing the market. Main Event popped $1.14 to end at $14.71 in an exchange of 4,350 stocks, MFS Capital Partners rallied 9 cents in closing at $2.28 with investors transferring 546,160 stock units, Spur Tree Spices gained 12 cents and ended at $2.41, with 109,290 shares crossing the exchange and tTech popped 28 cents to close at $2.50 with traders dealing in 53,905 stocks.

Lasco Distributors sank 24 cents and ended at $4.11 in trading 18,921 stock units, Lasco Manufacturing rose 69 cents to close at $5.78 after exchanging 1,193,867 shares, Limners and Bards advanced 25 cents to $1.85, with 52,670 units crossing the market. Main Event popped $1.14 to end at $14.71 in an exchange of 4,350 stocks, MFS Capital Partners rallied 9 cents in closing at $2.28 with investors transferring 546,160 stock units, Spur Tree Spices gained 12 cents and ended at $2.41, with 109,290 shares crossing the exchange and tTech popped 28 cents to close at $2.50 with traders dealing in 53,905 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of the market, the JSE Combined Market Index climbed 3,284.31 points to 348,521.68, the All Jamaican Composite Index rose 4,481.53 points to 377,145.00, the JSE Main Index climbed 3,554.31 points to 336,232.35. The Junior Market Index dropped 5.60 points to settle at 3,789.60 and the JSE USD Market Index slipped 2.68 points to end the day at 257.31.

At the close of the market, the JSE Combined Market Index climbed 3,284.31 points to 348,521.68, the All Jamaican Composite Index rose 4,481.53 points to 377,145.00, the JSE Main Index climbed 3,554.31 points to 336,232.35. The Junior Market Index dropped 5.60 points to settle at 3,789.60 and the JSE USD Market Index slipped 2.68 points to end the day at 257.31. In the Junior Market, Future Energy led trading with 10.98 million shares followed by Lasco Manufacturing with 1.19 million units and ONE on ONE Educational ended trading with 724,352 stock units.

In the Junior Market, Future Energy led trading with 10.98 million shares followed by Lasco Manufacturing with 1.19 million units and ONE on ONE Educational ended trading with 724,352 stock units. Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

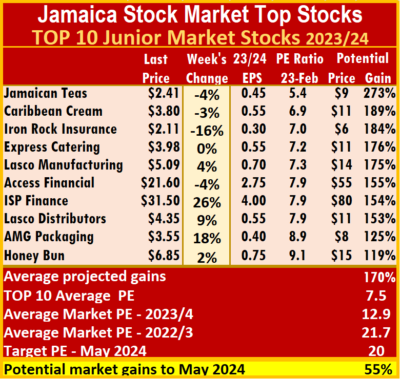

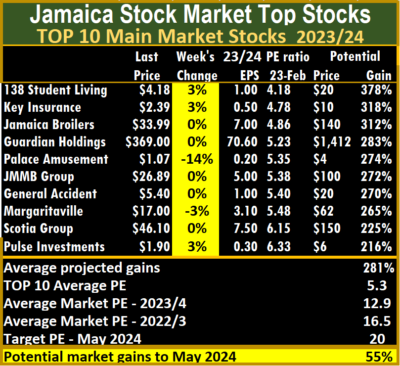

The Main Market ICTOP10 is projected to gain an average of 281 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 170 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 281 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 170 percent over the same period. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.