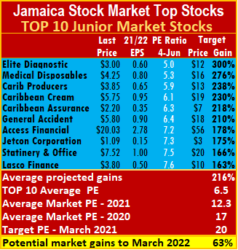

Two companies in the transportation sector swapped places in the IC Junior Market TOP10 this week as another TOP10 stock gained more than 100 percent for the year, the fourth such feat for the Junior Market TOP10. Jetcon Corporation’s price popped 61 percent for the week to a 52 weeks’ high of $1.75 to record gains of 122 percent for the year to date and dropped out of the TOP10, and is replaced by Future Energy Sources.

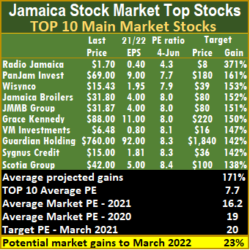

Other than Jetcon, prices of other TOP10 stocks had notable increases during the past week; these include; Jamaica Broilers and Grace Kennedy from the main market but Radio Jamaica, PanJam and Scotia Group prices took hits. In the Junior Market, Caribbean Cream, Access and Stationery and Office Supplies had nice gains resulted in the average gains projected slipping from 216 percent last week to 210 percent. The average projected gains for the Main Market stocks inched up last week from 169 to 170 percent.

Other than Jetcon, prices of other TOP10 stocks had notable increases during the past week; these include; Jamaica Broilers and Grace Kennedy from the main market but Radio Jamaica, PanJam and Scotia Group prices took hits. In the Junior Market, Caribbean Cream, Access and Stationery and Office Supplies had nice gains resulted in the average gains projected slipping from 216 percent last week to 210 percent. The average projected gains for the Main Market stocks inched up last week from 169 to 170 percent.

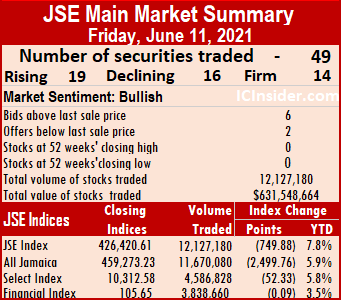

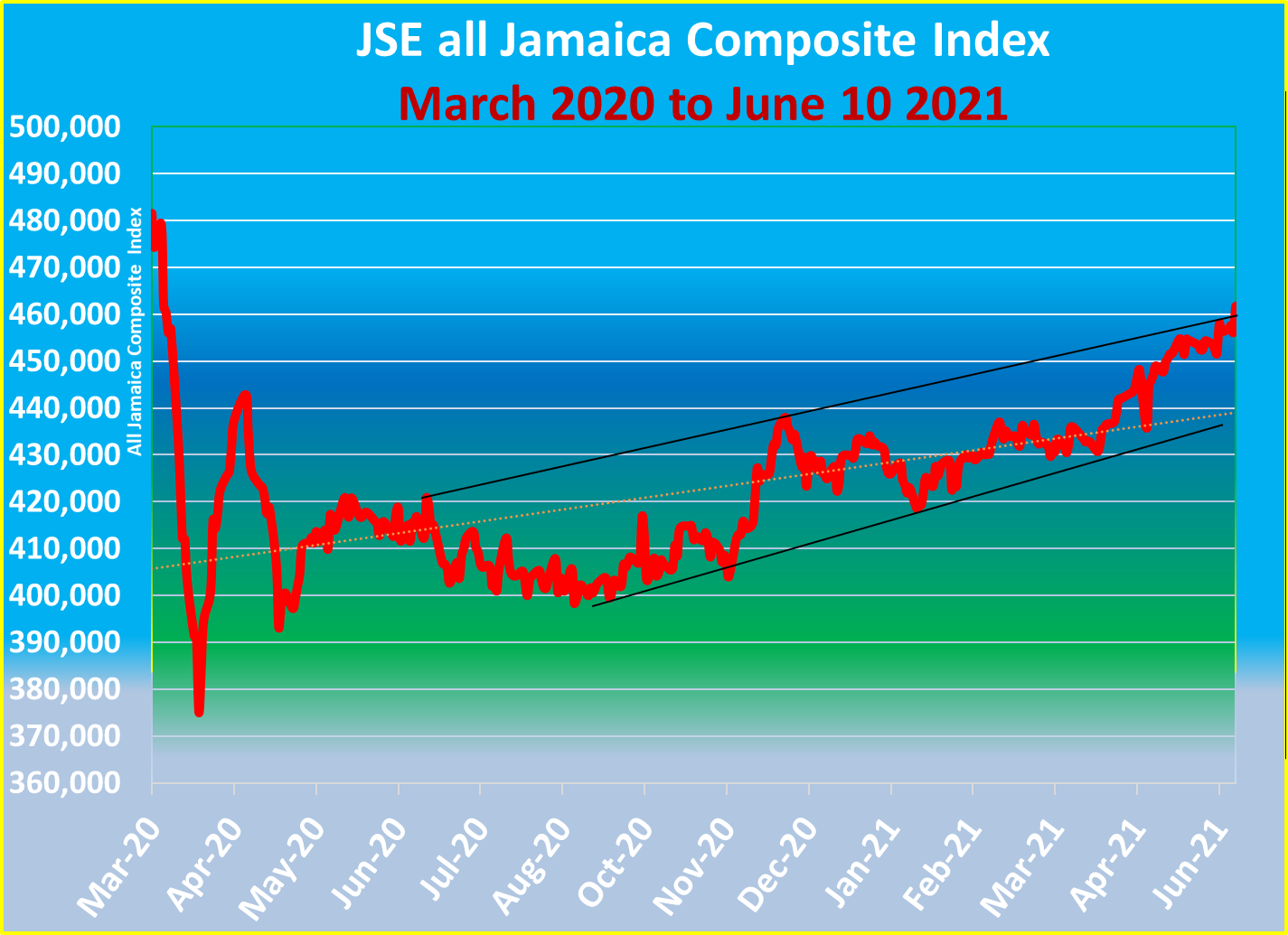

The Junior Market closed the week at 3,327.84, down from 3,339.02, last week, as it continues to consolidate around the zone of resistance.  The JSE All Jamaica Composite Index hit 466,915.58 points during the morning session on Friday, before closing lower at 459,273.23, up from 456,395.73, at the close of the previous week, as the market continues to wrestle with resistance.

The JSE All Jamaica Composite Index hit 466,915.58 points during the morning session on Friday, before closing lower at 459,273.23, up from 456,395.73, at the close of the previous week, as the market continues to wrestle with resistance.

The top three stocks in the Junior Market are Elite Diagnostic heading the list, followed by Medical Disposables and Caribbean Assurance, with potential to gain between 250 to 303 percent. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by PanJam Investments and Wisynco, with expected gains of 153 to 394 percent.

This week’s focus: Access Financial Services came out with full year results that reflected increased lending and EPS of 50 cents in the March quarter. ICInsider.com upgraded earnings to just under $3 per share for the current fiscal year. Scotia Group also reported results for the six months to April, with a 12 percent rise in profit for the April quarter over the 2020 same quarter and an 11.4 percent rise for the six months results. The big negative is that the loan portfolio continued its decline into the April quarter. ICInsider.com now projects 2021 earnings at $4 per share.

This week’s focus: Access Financial Services came out with full year results that reflected increased lending and EPS of 50 cents in the March quarter. ICInsider.com upgraded earnings to just under $3 per share for the current fiscal year. Scotia Group also reported results for the six months to April, with a 12 percent rise in profit for the April quarter over the 2020 same quarter and an 11.4 percent rise for the six months results. The big negative is that the loan portfolio continued its decline into the April quarter. ICInsider.com now projects 2021 earnings at $4 per share.

The targeted PE ratio for the market averages 20 based on companies’ profits reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March 2021 with the average PE at 17 for Junior Stocks and 19 times for the Main Market.

The targeted PE ratio for the market averages 20 based on companies’ profits reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March 2021 with the average PE at 17 for Junior Stocks and 19 times for the Main Market.

The Junior Market, with an average PE 12.6 based on ICInsider.com’s 2021-22 earnings, is currently trading below the target, as well as the recent historical average of 17.1; this represents another 35 percent rise in the market that would equate to a rise of 59 percent to March 2022. The Junior Market Top 10 stocks average a mere 6.6 at just 53 percent of the market average, indicating substantial gains ahead. The JSE Main Market ended the week with an overall PE of 17.1, still some distance from the 19 the market ended March, suggesting a 17 percent rise from now to March 2022. The Main Market TOP 10 trades at a PE of 7.8 or 45 percent of the PE of that market and well off the potential of 20.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in periodic movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in periodic movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

122% gain pushes stock out of ICTOP10

SOS back in ICTOP10 stocks

Main Event price popped nearly 14 percent from $4.65 last week to $5.28 following this week’s public forum the company CEO presented, leading the stock to dropped out of the Junior Market ICTOP10 and Stationery and Office Supplies price dipped to $7.52 and moved in to fill the slot left by Main Event.

Stationery & Office Supplies – Montego Bay office.

Prices of some ICTOP10 stocks bounced around during the week, resulting in changes within the list as a result. The average gains projected for the Junior Market fell from 218 percent last week to 216 percent. The average projected gains for Main Market stocks moved up last week, from 162 to 169 percent, are up again this week to 171 percent.

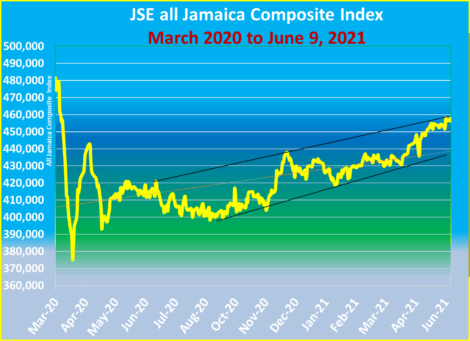

The markets continue to face resistance, with the Junior Market trading at the very top of its upward sloping channel while the JSE Main Market sits a few thousand points away and facing turbulence in getting to the peak. The recent release of results by two Lasco companies did not move the market this past week, investors are likely to be looking at a sideward moving market until later in the month, in keeping with the historical pattern of a recess after the completion of earnings season.

The Junior Market Index closed the week at 3,339.02, slightly up from 3,329.50, last week, after it was up moderately from 3,324 at the end of the previous week. The JSE All Jamaica Composite Index ended at 456,395.73 on Friday, up from 454,375.81 at the close of the previous week.

The Junior Market has to decidedly break the upper limit of the current upward sloping trading channel to free it to move on to the next area of resistance, of just over 4,000 mark, but the Main Market has room to run for a few thousand points before it hits the channel top at 460,000 points which it came close to on Friday at 459,758 before pulling back.

The Junior Market has to decidedly break the upper limit of the current upward sloping trading channel to free it to move on to the next area of resistance, of just over 4,000 mark, but the Main Market has room to run for a few thousand points before it hits the channel top at 460,000 points which it came close to on Friday at 459,758 before pulling back.

The top three stocks in the Junior Market for this week, are Elite Diagnostic, followed by Medical Disposables and Caribbean Producers, with the potential to gain between 238 to 300 percent. The top three Main Market stocks are Radio Jamaica, followed by PanJam Investments and Wisynco Group, with expected gains of 153 to 371 percent. The latter potential gain is based on earnings for the financial year starting in July, investors should not expect an early upward movement for the price until after the release of full year results to June this year, around the end of August.

The targeted PE ratio for the market averages 20 based on profits of companies reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March, with the average PE at 17 for Junior Market stocks and 19 for the Main Market.

The targeted PE ratio for the market averages 20 based on profits of companies reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March, with the average PE at 17 for Junior Market stocks and 19 for the Main Market.

The Junior Market with an average PE of 12.3 based on ICInsider.com’s 2021-22 earnings, is currently trading below the target, as well as the recent historical average of 17, this represents another 37 percent rise in the market that would equate to a rise of 63 percent to March 2022. The Junior Market Top 10 stocks average a mere 6.5 at just 52 percent of the market average, indicating substantial gains ahead. The JSE Main Market ended the week with an overall PE of 16.2, some distance from the 19 the market ended March, suggesting a 23 percent rise from now to March 2022. The Main Market TOP 10 trades at a PE of 7.7 or 48 percent of the PE of that market and well off the potential of 20.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

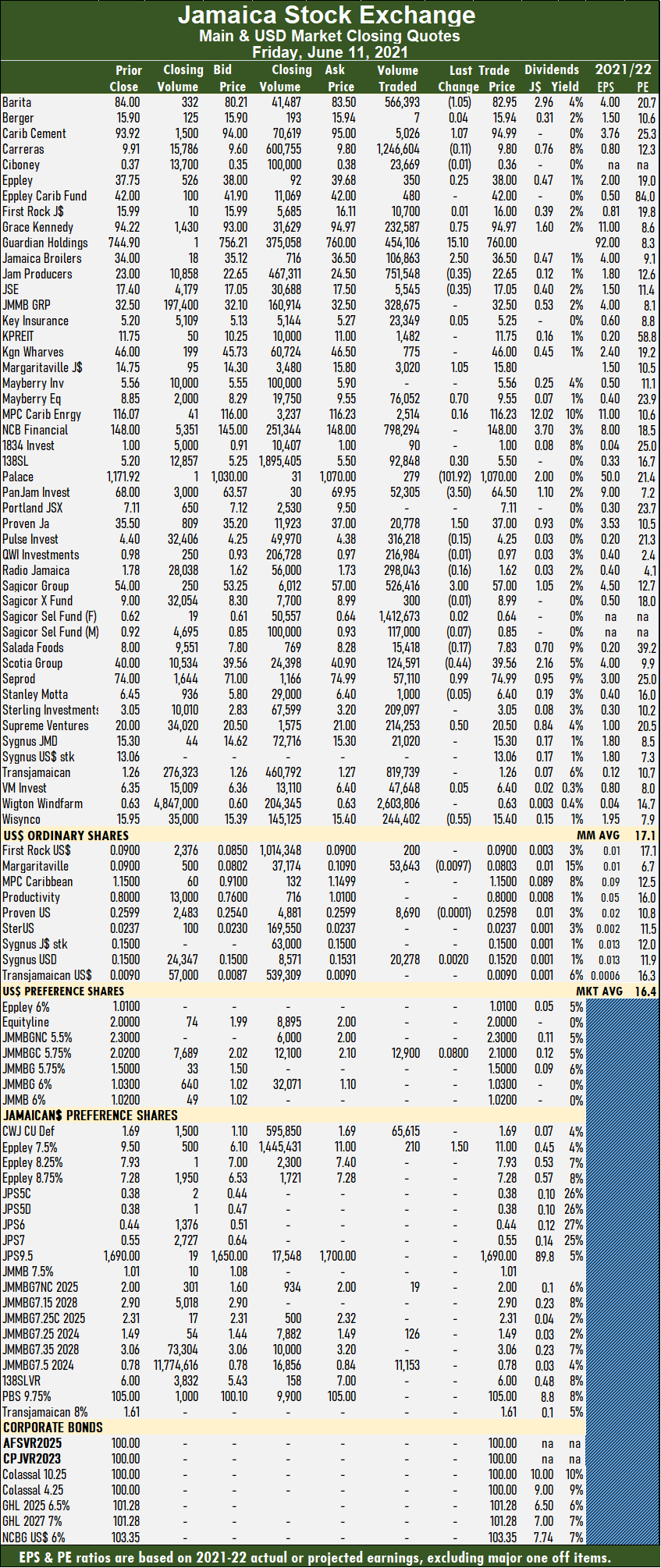

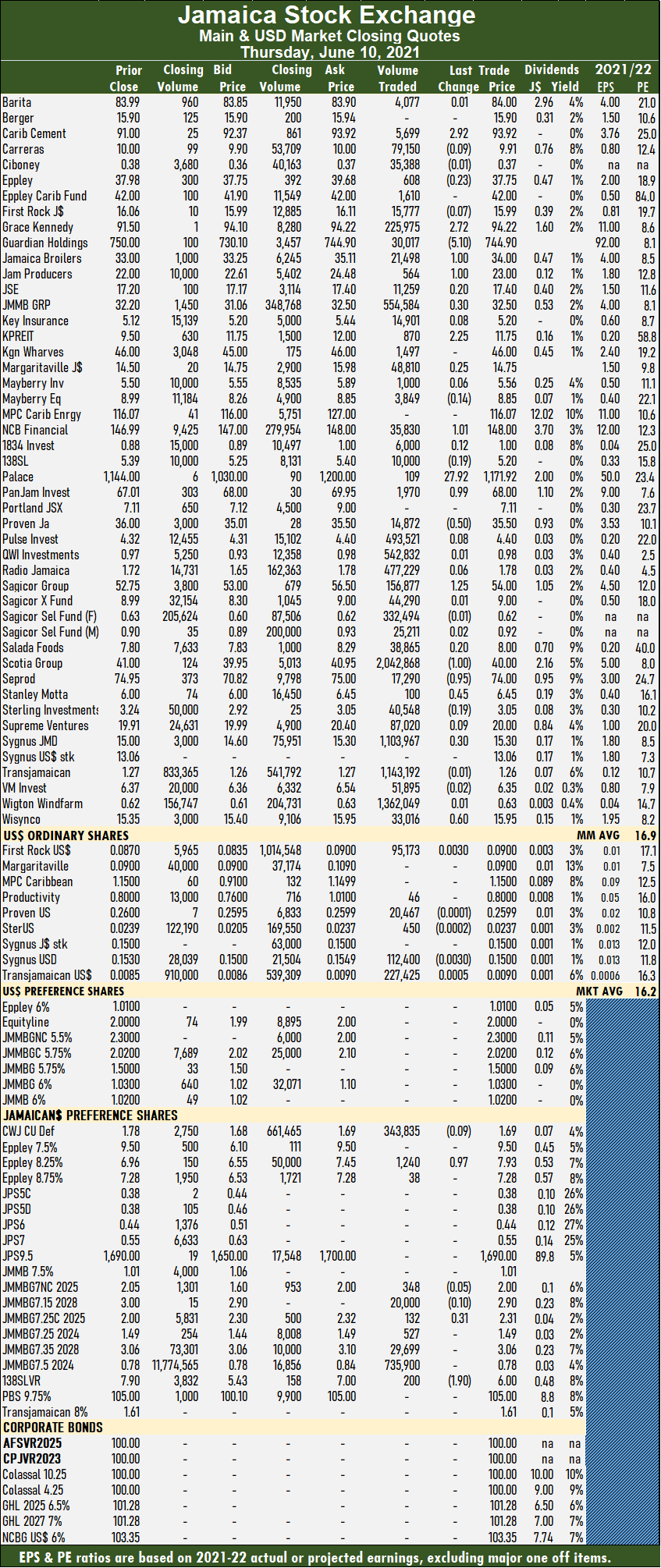

At the close, the JSE Main Index fell 749.88 points to end at 426,420.61 and the JSE Financial Index slipped 0.09 points to 105.65.

At the close, the JSE Main Index fell 749.88 points to end at 426,420.61 and the JSE Financial Index slipped 0.09 points to 105.65. Trading averaged 247,493 units at $12,888,748, compared to 193,417 shares at $3,594,165 on Thursday. Trading month to date averages 233,635 units at $5,124,111, in contrast to 231,890 units at $4,146,046 on Thursday. May ended with an average of 439,937 units at $4,698,961.

Trading averaged 247,493 units at $12,888,748, compared to 193,417 shares at $3,594,165 on Thursday. Trading month to date averages 233,635 units at $5,124,111, in contrast to 231,890 units at $4,146,046 on Thursday. May ended with an average of 439,937 units at $4,698,961. Sagicor Group spiked $3 to $57 after 526,416 shares cleared the market. Scotia Group fell 44 cents to close at $39.56, with 124,591 stocks changing hands. Seprod rose 99 cents to $74.99 after exchanging 57,110 stock units, Supreme Ventures gained 50 cents to close at $20.50 after trading 214,253 units and Wisynco Group shed 55 cents to end at $15.40 with 244,402 stock units changing hands.

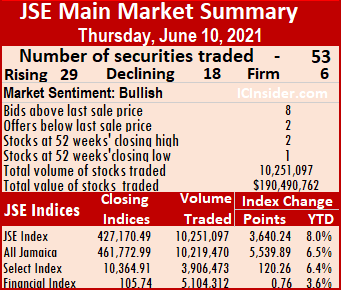

Sagicor Group spiked $3 to $57 after 526,416 shares cleared the market. Scotia Group fell 44 cents to close at $39.56, with 124,591 stocks changing hands. Seprod rose 99 cents to $74.99 after exchanging 57,110 stock units, Supreme Ventures gained 50 cents to close at $20.50 after trading 214,253 units and Wisynco Group shed 55 cents to end at $15.40 with 244,402 stock units changing hands. Securities trading surged to 53 from 48 on Wednesday, with 29 rising, 18 declining and six ending unchanged. At the close, the JSE Main Index advanced 3,640.24 points to end at 427,170.49 and the JSE Financial Index gained 0.76 points to 105.74.

Securities trading surged to 53 from 48 on Wednesday, with 29 rising, 18 declining and six ending unchanged. At the close, the JSE Main Index advanced 3,640.24 points to end at 427,170.49 and the JSE Financial Index gained 0.76 points to 105.74. Trading averaged 193,417 units at $3,594,165, compared to 234,498 shares at $4,350,058 on Wednesday. Trading month to date averages 231,890 units at $4,146,046, in contrast to 237,958 units at $4,233,099 on Wednesday. May closed with an average of 439,937 units at $4,698,961.

Trading averaged 193,417 units at $3,594,165, compared to 234,498 shares at $4,350,058 on Wednesday. Trading month to date averages 231,890 units at $4,146,046, in contrast to 237,958 units at $4,233,099 on Wednesday. May closed with an average of 439,937 units at $4,698,961. Scotia Group shed $1 in ending at $40 after an exchange of 2,042,868 shares, Seprod shed 95 cents to close at $74 with 17,290 units changing hands, Stanley Motta rose 45 cents to $6.45 with 100 stock units crossing the market, Sygnus Credit Investments climbed 30 cents to $15.30 in exchanging 1,103,967 shares and Wisynco Group gained 60 cents to close at $15.95 with a transfer of 33,016 stock units.

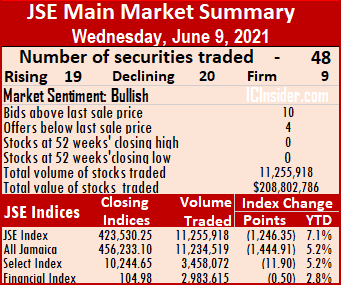

Scotia Group shed $1 in ending at $40 after an exchange of 2,042,868 shares, Seprod shed 95 cents to close at $74 with 17,290 units changing hands, Stanley Motta rose 45 cents to $6.45 with 100 stock units crossing the market, Sygnus Credit Investments climbed 30 cents to $15.30 in exchanging 1,103,967 shares and Wisynco Group gained 60 cents to close at $15.95 with a transfer of 33,016 stock units. At the close, the All Jamaican Composite Index dropped 1,444.91 points to finish at 456,233.10, the JSE Main Index shed 1,246.35 points to end at 423,530.25 and the JSE Financial Index slipped 0.50 points to 104.98.

At the close, the All Jamaican Composite Index dropped 1,444.91 points to finish at 456,233.10, the JSE Main Index shed 1,246.35 points to end at 423,530.25 and the JSE Financial Index slipped 0.50 points to 104.98. Trading averaged 234,498 units at $4,350,058, versus 251,952 shares at $3,318,266 on Tuesday. Trading month to date averages 237,958 units at $4,233,099, in contrast to 238,535 units at $4,213,605 on Tuesday. May ended with an average of 439,937 units at $4,698,961.

Trading averaged 234,498 units at $4,350,058, versus 251,952 shares at $3,318,266 on Tuesday. Trading month to date averages 237,958 units at $4,233,099, in contrast to 238,535 units at $4,213,605 on Tuesday. May ended with an average of 439,937 units at $4,698,961. PanJam Investment fell 99 cents to $67.01 trading 22,843 stocks, Proven Investments shed $1 in closing at $36 after a transfer of 701,801 shares, Sagicor Group rose 70 cents to $52.75 with 323,788 shares crossing the market. Sagicor Real Estate Fund popped 64 cents to $8.99 with the swapping of 294 stock units, Scotia Group shed 55 cents to close at $41 in exchanging 78,321 units. Seprod rallied $1.93 to $74.95 in trading 101,870 shares and Supreme Ventures declined 99 cents to $19.91 with an exchange of 75,612 stock units.

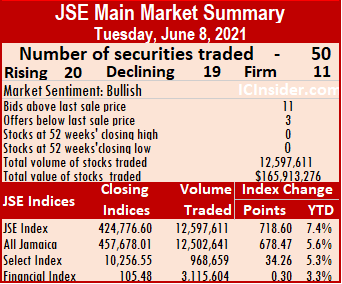

PanJam Investment fell 99 cents to $67.01 trading 22,843 stocks, Proven Investments shed $1 in closing at $36 after a transfer of 701,801 shares, Sagicor Group rose 70 cents to $52.75 with 323,788 shares crossing the market. Sagicor Real Estate Fund popped 64 cents to $8.99 with the swapping of 294 stock units, Scotia Group shed 55 cents to close at $41 in exchanging 78,321 units. Seprod rallied $1.93 to $74.95 in trading 101,870 shares and Supreme Ventures declined 99 cents to $19.91 with an exchange of 75,612 stock units. At the close of trading, the All Jamaican Composite Index climbed 678.47 points to finish at 457,678.01, just a few thousand points away from resistance around the 460,000 mark. The JSE Main Index rose 718.60 points to end at 424,776.60 and the JSE Financial Index popped 0.30 points to 105.48.

At the close of trading, the All Jamaican Composite Index climbed 678.47 points to finish at 457,678.01, just a few thousand points away from resistance around the 460,000 mark. The JSE Main Index rose 718.60 points to end at 424,776.60 and the JSE Financial Index popped 0.30 points to 105.48. Trading averaged 251,952 units at $3,318,266, up from 143,638 shares at $2,497,595 on Monday. Trading month to date averages 238,535 units at $4,213,605, in contrast to 235,716 units at $4,401,702 on Monday. May ended with an average of 439,937 units at $4,698,961.

Trading averaged 251,952 units at $3,318,266, up from 143,638 shares at $2,497,595 on Monday. Trading month to date averages 238,535 units at $4,213,605, in contrast to 235,716 units at $4,401,702 on Monday. May ended with an average of 439,937 units at $4,698,961. Sagicor Group fell 70 cents to $52.05 after 91,205 stock units crossed the exchange. Sagicor Real Estate Fund shed 64 cents to $8.35 with the swapping of 15,100 shares, Scotia Group gained 55 cents to $41.55 in trading 10,068 stocks. Seprod rose $1.02 to $73.02 in an exchange of 19,247 stock units, Supreme Ventures popped 90 cents higher to $20.90 in switching ownership of 26,108 units and Sygnus Credit Investments rallied 70 cents to $15 in trading 1,016,997 stocks.

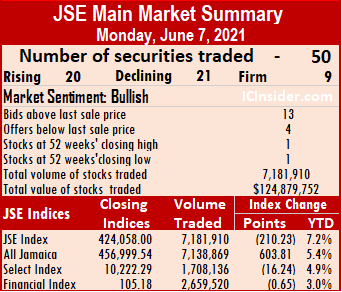

Sagicor Group fell 70 cents to $52.05 after 91,205 stock units crossed the exchange. Sagicor Real Estate Fund shed 64 cents to $8.35 with the swapping of 15,100 shares, Scotia Group gained 55 cents to $41.55 in trading 10,068 stocks. Seprod rose $1.02 to $73.02 in an exchange of 19,247 stock units, Supreme Ventures popped 90 cents higher to $20.90 in switching ownership of 26,108 units and Sygnus Credit Investments rallied 70 cents to $15 in trading 1,016,997 stocks. The All Jamaican Composite Index rose 603.81 points to 456,999.54, the JSE Main Index shed 210.23 points to end at 424,058.00 and the JSE Financial Index lost 0.65 points to settle at 105.18.

The All Jamaican Composite Index rose 603.81 points to 456,999.54, the JSE Main Index shed 210.23 points to end at 424,058.00 and the JSE Financial Index lost 0.65 points to settle at 105.18. Trading averaged 143,638 units at $2,497,595, compared to 471,529 shares at $4,645,412 on Friday. Trading month to date ended with a average of 235,716 units at $4,401,702, in contrast to 260,205 units at $4,908,113 on Friday. May closed with an average of 439,937 units at $4,698,961.

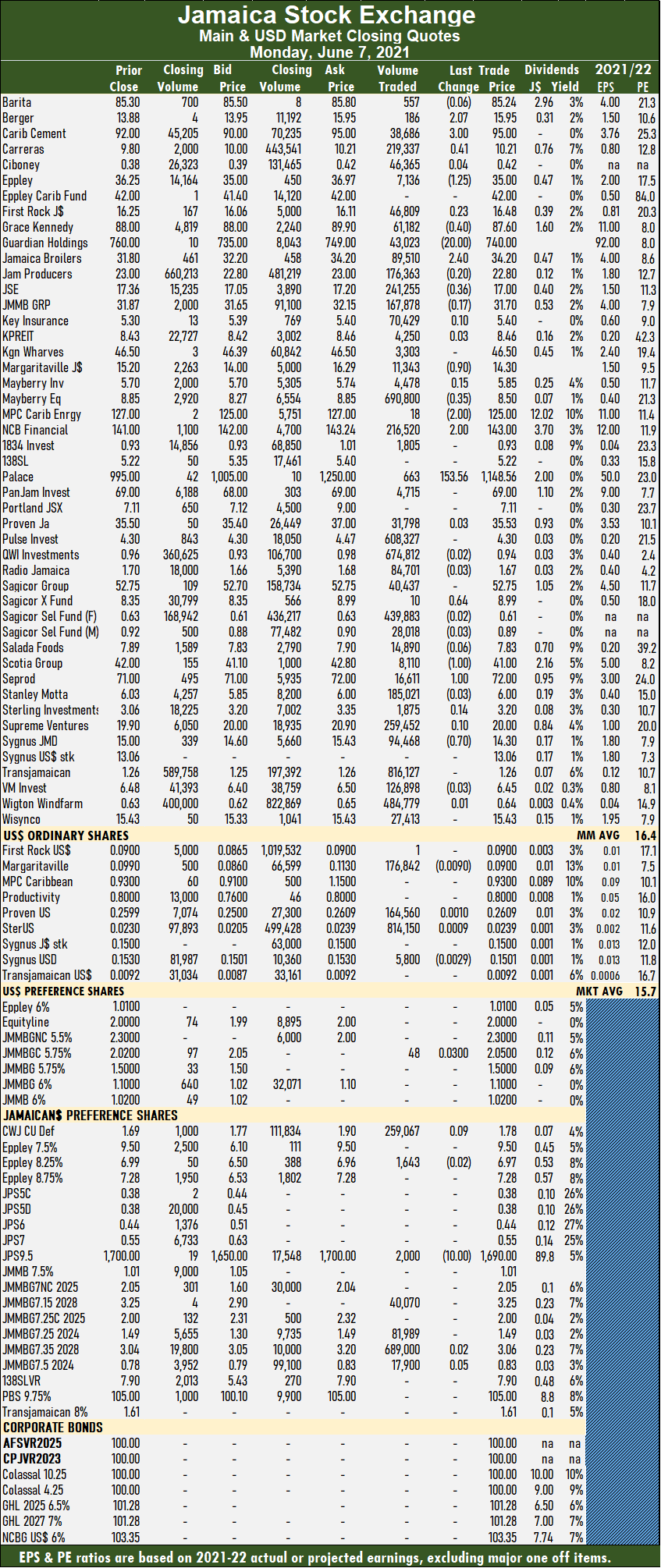

Trading averaged 143,638 units at $2,497,595, compared to 471,529 shares at $4,645,412 on Friday. Trading month to date ended with a average of 235,716 units at $4,401,702, in contrast to 260,205 units at $4,908,113 on Friday. May closed with an average of 439,937 units at $4,698,961. Palace Amusement surged $153.56 to $1,148.56, after hitting $1,250 in early trading with a transfer of 663 units, Sagicor Real Estate Fund rose 64 cents to $8.99 in trading 10 shares, Scotia Group fell $1 to $41 after exchanging 8,110 stock units, Seprod advanced $1 to $72 in switching ownership of 16,611 shares and Sygnus Credit Investments shed 70 cents to finish at $14.30 in exchanging 94,468 units.

Palace Amusement surged $153.56 to $1,148.56, after hitting $1,250 in early trading with a transfer of 663 units, Sagicor Real Estate Fund rose 64 cents to $8.99 in trading 10 shares, Scotia Group fell $1 to $41 after exchanging 8,110 stock units, Seprod advanced $1 to $72 in switching ownership of 16,611 shares and Sygnus Credit Investments shed 70 cents to finish at $14.30 in exchanging 94,468 units. The All Jamaican Composite Index dropped 1,636.66 points to 456,395.73 after it hit 459,788.11 points at the market’s opening, the highest it had been since early March last year. The JSE Main Index fell 1,361.86 points to end at 456,395.73 and the JSE Financial Index slipped 0.7 points to settle at 105.83.

The All Jamaican Composite Index dropped 1,636.66 points to 456,395.73 after it hit 459,788.11 points at the market’s opening, the highest it had been since early March last year. The JSE Main Index fell 1,361.86 points to end at 456,395.73 and the JSE Financial Index slipped 0.7 points to settle at 105.83. Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and two with lower offers. Sterling Investments popped 23 cents lower to $3.06 after exchanging 185,283 shares, Supreme Ventures gained 35 cents in ending at $19.90, with 17,150 stocks clearing the market, Sygnus Credit Investments shed 30 cents to end at $15 after an exchange of 110,835 stock units. Victoria Mutual Investments rose 37 cents to $6.48 after transferring 209,147 shares and Wisynco Group fell 37 cents to $15.43 with 323,590 stocks crossing the market.

Sterling Investments popped 23 cents lower to $3.06 after exchanging 185,283 shares, Supreme Ventures gained 35 cents in ending at $19.90, with 17,150 stocks clearing the market, Sygnus Credit Investments shed 30 cents to end at $15 after an exchange of 110,835 stock units. Victoria Mutual Investments rose 37 cents to $6.48 after transferring 209,147 shares and Wisynco Group fell 37 cents to $15.43 with 323,590 stocks crossing the market.

Trading averaged 175,326 units at $2,192,538, compared to 256,975 shares at $8,858,513 on Wednesday. Trading month to date averages 193,705 units at $4,990,781, in contrast to 202,991 units at $6,404,631 on Wednesday. May closed with an average of 439,937 units at $4,698,961.

Trading averaged 175,326 units at $2,192,538, compared to 256,975 shares at $8,858,513 on Wednesday. Trading month to date averages 193,705 units at $4,990,781, in contrast to 202,991 units at $6,404,631 on Wednesday. May closed with an average of 439,937 units at $4,698,961. Sygnus Credit Investments gained 30 cents to settle at $15.30 in trading 25,434 stock units, Victoria Mutual Investments slipped 39 cents to $6.11 in the transfer of 185,406 shares and Wisynco Group popped 60 cents to $15.80 with the swapping of 130,777 stocks.

Sygnus Credit Investments gained 30 cents to settle at $15.30 in trading 25,434 stock units, Victoria Mutual Investments slipped 39 cents to $6.11 in the transfer of 185,406 shares and Wisynco Group popped 60 cents to $15.80 with the swapping of 130,777 stocks. The All Jamaican Composite Index declined 994.79 points to 451,670.82, the JSE Main Index lost 199.45 points to end at 420,160.07 and the JSE Financial Index gained 0.29 points to settle at 104.48.

The All Jamaican Composite Index declined 994.79 points to 451,670.82, the JSE Main Index lost 199.45 points to end at 420,160.07 and the JSE Financial Index gained 0.29 points to settle at 104.48. Trading close with an average of 256,975 units at $8,858,513, compared to 150,132 shares at $4,001,871 on Tuesday. Trading month to date averages 202,991 units at $6,404,631, in contrast to 150,132 units at $4,001,871 on Tuesday. May closed with an average of 439,937 units at $4,698,961.

Trading close with an average of 256,975 units at $8,858,513, compared to 150,132 shares at $4,001,871 on Tuesday. Trading month to date averages 202,991 units at $6,404,631, in contrast to 150,132 units at $4,001,871 on Tuesday. May closed with an average of 439,937 units at $4,698,961. Scotia Group rose $1.01 to $41 after trading 47,810 stocks, Seprod gained 20 cents to close at $73 with the swapping of 12,488 units, Stanley Motta shed 20 cents to close at $5.80 after exchanging 10,000 shares. Sterling Investments picked up 29 cents to finish at $3.29 in switching ownership of 1,000 units, Supreme Ventures rallied 20 cents to $20 in trading 61,340 shares and Wisynco Group shed 30 cents in ending at $15.20 after an exchange of 121,439 stock units.

Scotia Group rose $1.01 to $41 after trading 47,810 stocks, Seprod gained 20 cents to close at $73 with the swapping of 12,488 units, Stanley Motta shed 20 cents to close at $5.80 after exchanging 10,000 shares. Sterling Investments picked up 29 cents to finish at $3.29 in switching ownership of 1,000 units, Supreme Ventures rallied 20 cents to $20 in trading 61,340 shares and Wisynco Group shed 30 cents in ending at $15.20 after an exchange of 121,439 stock units.