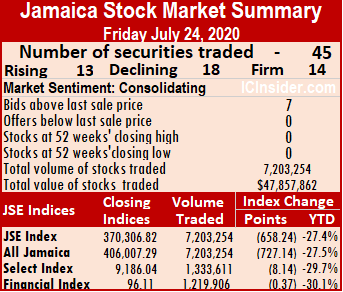

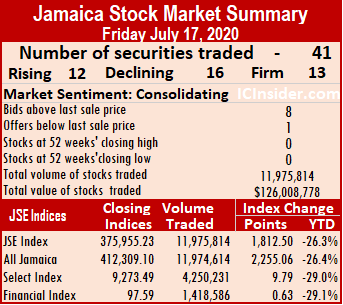

The slide continued on the Jamaica Stock Exchange for a fourth consecutive day on Friday and in the process wiping 6,905 points off the All Jamaica Composite Index since the close on Monday and down 5,574 points for the week as trading levels remained modest.

At the close, the All Jamaican Composite Index declined by 727.14 points to 406,007.29, the Main Index carved out a loss 658.24 points to 370,306.82, the JSE Financial Index fell 0.37 points to 96.11.

At the close, the All Jamaican Composite Index declined by 727.14 points to 406,007.29, the Main Index carved out a loss 658.24 points to 370,306.82, the JSE Financial Index fell 0.37 points to 96.11.

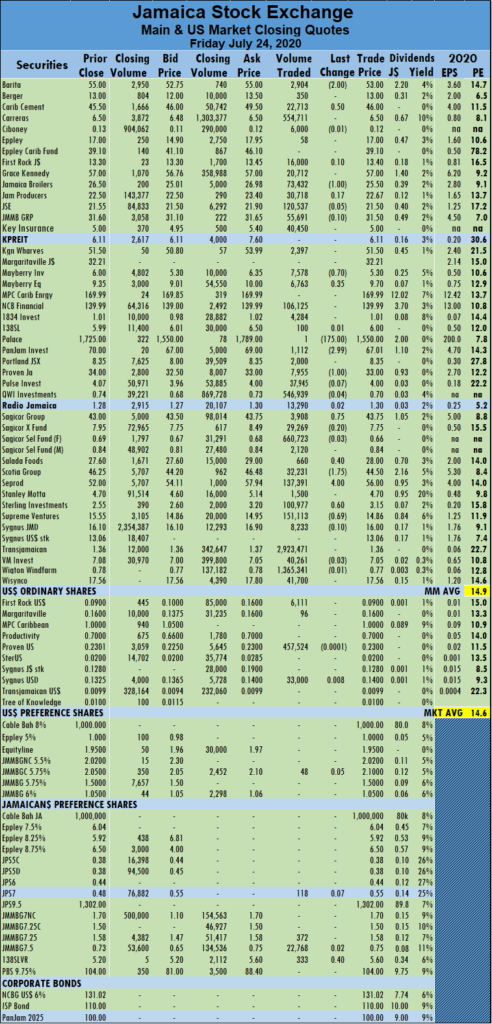

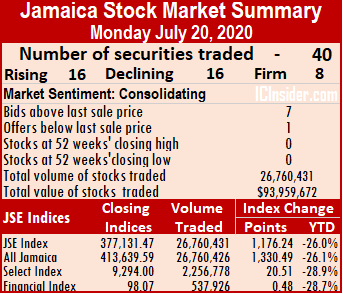

Trading ended with 45 securities changing hands, up from just 38 on Thursday and the market closed on Friday, with the prices of 13 stocks rising, the prices of 18 declining and 14 remaining unchanged and the average PE Ratio of the market ended at 14.9 based on IC Insider.com’s forecast of 2020-21 earnings.

The market closed with an exchange of 7,203,254 shares for $47,857,862 compared to 4,909,660 units at $39,906,681 on Thursday.

Transjamaican Highway led trading with 2.92 million shares for 40.6 percent of total volume followed by Wigton Windfarm with 1.37 million units for 19 percent of the day’s trade and Sagicor Select Financial Fund with 660,723 units for 9.2 percent market share.

An average of 160,072 units traded for the day at $1,063,508 for each security in comparison to an average of 129,202 at $1,050,176 on Thursday. An average of 381,808 units traded for the month to date at $2,640,059 for each security that traded, in contrast to 396,128 units at $2,741,845. In contrast, June ended with an average of 818,748 units at $7,498,308.

An average of 160,072 units traded for the day at $1,063,508 for each security in comparison to an average of 129,202 at $1,050,176 on Thursday. An average of 381,808 units traded for the month to date at $2,640,059 for each security that traded, in contrast to 396,128 units at $2,741,845. In contrast, June ended with an average of 818,748 units at $7,498,308.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows seven stocks ended with bids higher than their last selling prices and one with lower offers.

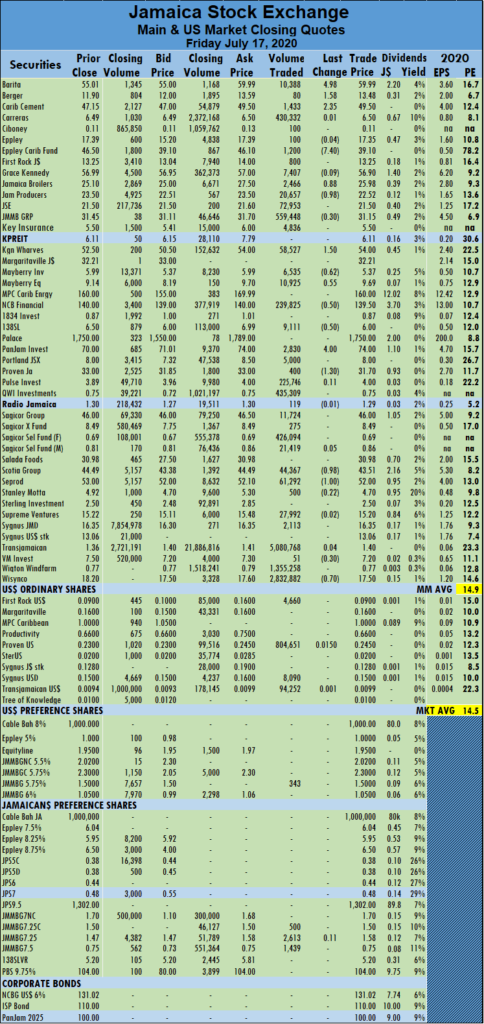

At the close of the market, Barita Investments fell $2 to close at $53, with 2,904 shares crossing the exchange, Caribbean Cement climbed 50 cents in closing at $46, with 22,713 stock units changing hands. Jamaica Broilers Group lost $1 to settle at $25.50 after 73,432 shares cleared the market, Mayberry Investments fell 70 cents to settle at $5.30 in trading 7,578 units, Mayberry Jamaican Equities increased 35 cents to close at $9.70 after exchanging 6,763 stock units.  Palace Amusement dived $175 to $1,550 after exchanging one stock unit, PanJam Investment shed $2.99 in closing at $67.01 with investors swapping 1,112 shares, Proven Investments dropped $1 to settle at $33 in an exchange of 7,955 stock units. Sagicor Group carved out a gain of 75 cents to close at $43.75, with 3,908 units crossing the exchange, Salada Foods climbed 40 cents to settle at $28 trading 660 units, Scotia Group fell $1.75 to $44.50 and finishing trading with 32,231 shares. Seprod jumped $4 in ending at $56 with 137,391 units passing through the market after the company reported a strong increase in half-year profit. Sterling Investments climbed by 60 cents to settle at $3.15 after 100,977 shares crossed the market and Supreme Ventures lost 69 cents in closing at $14.86 with an exchange of 151,113 units.

Palace Amusement dived $175 to $1,550 after exchanging one stock unit, PanJam Investment shed $2.99 in closing at $67.01 with investors swapping 1,112 shares, Proven Investments dropped $1 to settle at $33 in an exchange of 7,955 stock units. Sagicor Group carved out a gain of 75 cents to close at $43.75, with 3,908 units crossing the exchange, Salada Foods climbed 40 cents to settle at $28 trading 660 units, Scotia Group fell $1.75 to $44.50 and finishing trading with 32,231 shares. Seprod jumped $4 in ending at $56 with 137,391 units passing through the market after the company reported a strong increase in half-year profit. Sterling Investments climbed by 60 cents to settle at $3.15 after 100,977 shares crossed the market and Supreme Ventures lost 69 cents in closing at $14.86 with an exchange of 151,113 units.

In the Preference share segment, 138 Student Living climbed 40 cents and ended at $5.60 after clearing the market with 333 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

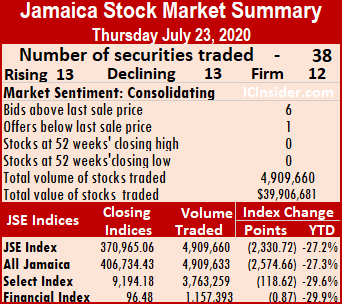

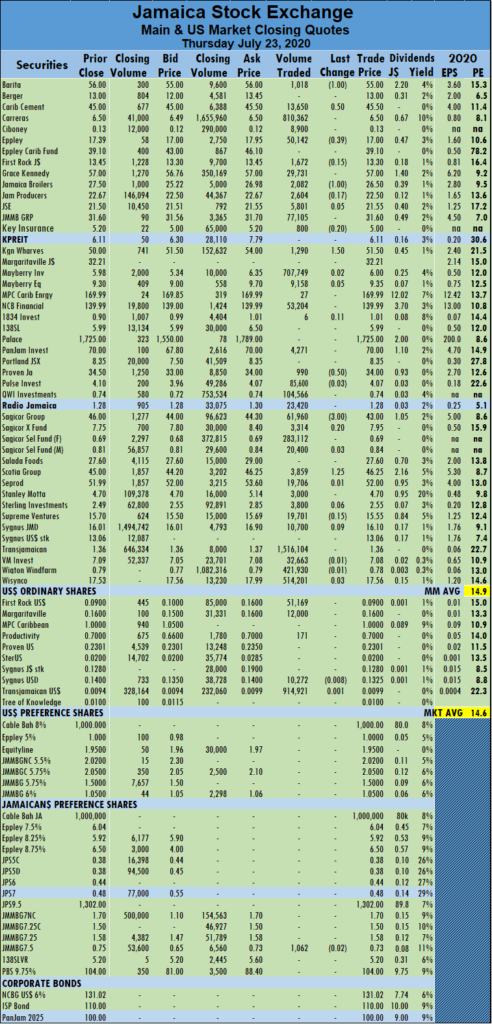

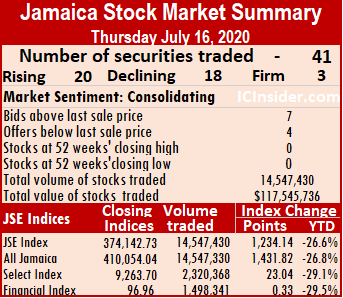

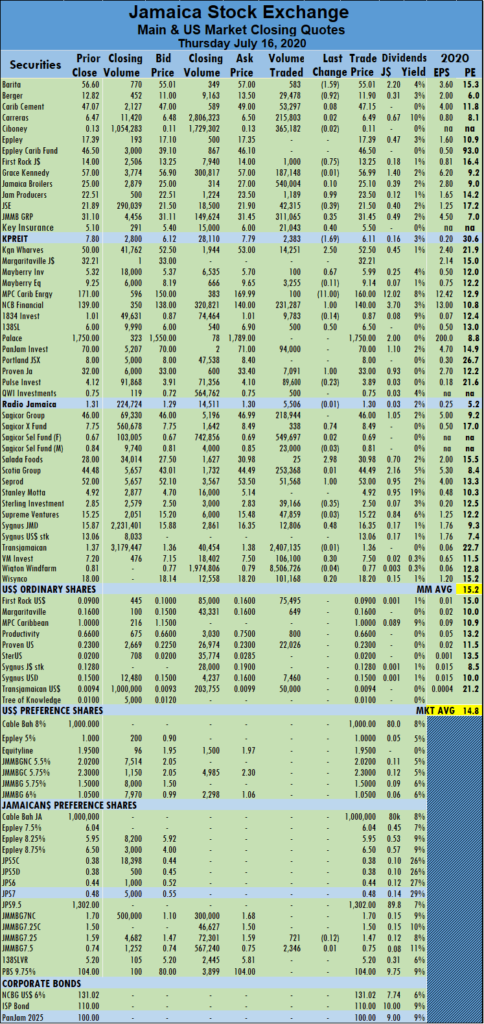

The Main Market of the Jamaica Stock Exchange gave back more of the gains enjoyed last week as investors cut, the All Jamaican Composite Index down by 2,574.66 points to 406,734.43 and slashed 2,330.72 points off the Main Index to close at 370,965.06.

The Main Market of the Jamaica Stock Exchange gave back more of the gains enjoyed last week as investors cut, the All Jamaican Composite Index down by 2,574.66 points to 406,734.43 and slashed 2,330.72 points off the Main Index to close at 370,965.06.  The market closed with an exchange of 4,909,660 shares for $39,906,681 compared to 5,825,935 units at $58,494,661 on Wednesday. Transjamaican Highway led trading with 1.52 million shares for 30.9 percent of total volume, followed by Carreras with 810,362 units for 16.5 percent of the day’s trade and Mayberry Investments with 707,749 units for 14.4 percent market share.

The market closed with an exchange of 4,909,660 shares for $39,906,681 compared to 5,825,935 units at $58,494,661 on Wednesday. Transjamaican Highway led trading with 1.52 million shares for 30.9 percent of total volume, followed by Carreras with 810,362 units for 16.5 percent of the day’s trade and Mayberry Investments with 707,749 units for 14.4 percent market share. At the close of the market, Barita Investments carved out a loss $1 to end at $55 in trading 1,018 shares, Caribbean Cement gained 50 cents to settle at $45.50 to finish with 13,650 stock units changing hands, Eppley dropped 39 cents to close at $17 trading 50,142 units. Jamaica Broilers Group fell $1 to settle at $26.50 in exchanging 2,082 shares, Kingston Wharves gained $1.50 to settle at $51.50 with 1,290 stock units passing through the market, Proven Investments lost 50 cents to settle at $34, with 990 shares crossing the exchange. Sagicor Group fell $3 to settle at $43 while exchanging 61,960 units and Scotia Group carved out a gain of $1.25 and ending at $46.25, with 3,859 shares crossing the exchange.

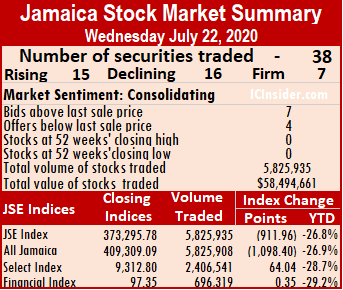

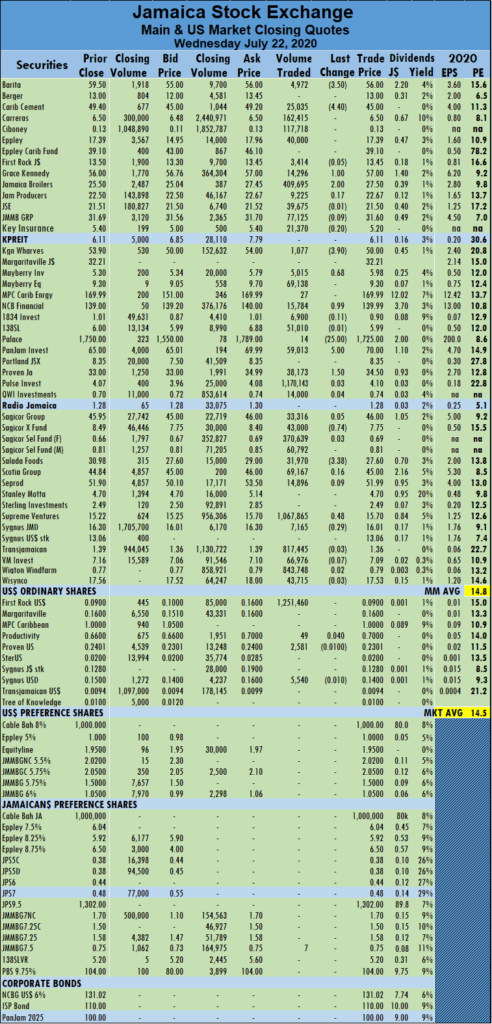

At the close of the market, Barita Investments carved out a loss $1 to end at $55 in trading 1,018 shares, Caribbean Cement gained 50 cents to settle at $45.50 to finish with 13,650 stock units changing hands, Eppley dropped 39 cents to close at $17 trading 50,142 units. Jamaica Broilers Group fell $1 to settle at $26.50 in exchanging 2,082 shares, Kingston Wharves gained $1.50 to settle at $51.50 with 1,290 stock units passing through the market, Proven Investments lost 50 cents to settle at $34, with 990 shares crossing the exchange. Sagicor Group fell $3 to settle at $43 while exchanging 61,960 units and Scotia Group carved out a gain of $1.25 and ending at $46.25, with 3,859 shares crossing the exchange. At the close, the All Jamaican Composite Index lost 1,098.40 points to 409,309.09, the Main Index carved out a loss 911.96 points to 373,295.78 and the JSE Financial Index increased 0.35 points to close at 97.35.

At the close, the All Jamaican Composite Index lost 1,098.40 points to 409,309.09, the Main Index carved out a loss 911.96 points to 373,295.78 and the JSE Financial Index increased 0.35 points to close at 97.35. An average of 153,314 units traded for the day at $1,539,333, for each security, in comparison to an average of 688,966 at $2,207,104 on Tuesday. An average of 411,515 units traded for the month to date at $2,839,392 for each security that traded, in contrast to 427,314 units at $2,918,945. In contrast, June ended with an average of 818,748 units at $7,498,308.

An average of 153,314 units traded for the day at $1,539,333, for each security, in comparison to an average of 688,966 at $2,207,104 on Tuesday. An average of 411,515 units traded for the month to date at $2,839,392 for each security that traded, in contrast to 427,314 units at $2,918,945. In contrast, June ended with an average of 818,748 units at $7,498,308. Caribbean Cement dropped $4.40 to close at $45 while exchanging 25,035 stock units, Gracekennedy advanced by $1 to $57 with an exchange of 14,296 units. Jamaica Broilers Group increased $2 to close at $27.50, with 409,695 stock units crossing the exchange, Kingston Wharves carved out a loss $3.90 to close at $50 after 1,077 units crossed the market, Mayberry Investments rose 68 cents to $5.98, with 5,015 stock units crossing the market. NCB Financial Group jumped 99 cents to end at $139.99 with investors swapping 15,784 stock units, Palace Amusement shed $25 to end at $1725 with investors switching ownership of 14 shares, PanJam Investment gained $5 to end at $70 in trading 59,013 units. Proven Investments jumped $1.50 to end at $34.50 in an exchange of 38,173 stock units, Sagicor Real Estate Fund dropped by 74 cents to $7.75 in an exchange of 43,000 stock units. Salada Foods fell $3.38 to close at $27.60, with 31,970 shares changing hands and Supreme Ventures advanced 48 cents to close at $15.70 in trading 1,067,865 units.

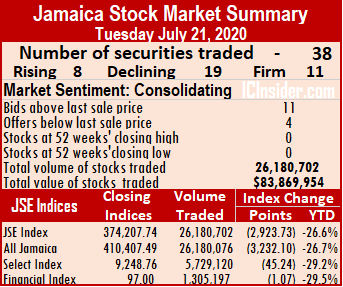

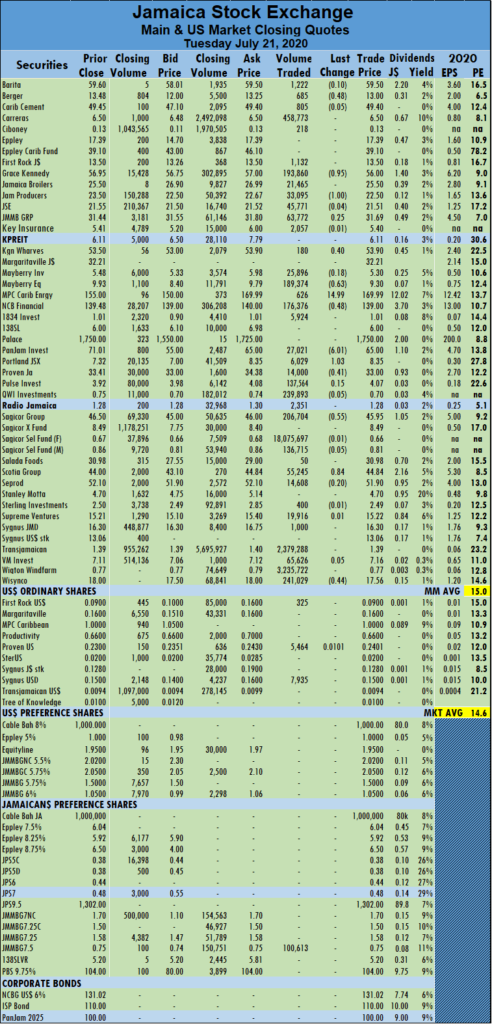

Caribbean Cement dropped $4.40 to close at $45 while exchanging 25,035 stock units, Gracekennedy advanced by $1 to $57 with an exchange of 14,296 units. Jamaica Broilers Group increased $2 to close at $27.50, with 409,695 stock units crossing the exchange, Kingston Wharves carved out a loss $3.90 to close at $50 after 1,077 units crossed the market, Mayberry Investments rose 68 cents to $5.98, with 5,015 stock units crossing the market. NCB Financial Group jumped 99 cents to end at $139.99 with investors swapping 15,784 stock units, Palace Amusement shed $25 to end at $1725 with investors switching ownership of 14 shares, PanJam Investment gained $5 to end at $70 in trading 59,013 units. Proven Investments jumped $1.50 to end at $34.50 in an exchange of 38,173 stock units, Sagicor Real Estate Fund dropped by 74 cents to $7.75 in an exchange of 43,000 stock units. Salada Foods fell $3.38 to close at $27.60, with 31,970 shares changing hands and Supreme Ventures advanced 48 cents to close at $15.70 in trading 1,067,865 units. At the close, the All Jamaican Composite Index lost 3,232.1 points to end at 410,407.49, the Main Index declined by 2,923.73 points to 374,207.74 and the JSE Financial Index lost 1.07 points to 97.00.

At the close, the All Jamaican Composite Index lost 3,232.1 points to end at 410,407.49, the Main Index declined by 2,923.73 points to 374,207.74 and the JSE Financial Index lost 1.07 points to 97.00. An average at 688,966 units traded for the day at $2,207,104 for each security in compared to an average of 669,011 at $2,349,202 on Monday. An average of 427,315 units traded for the month to date at $2,918,945 for each security that traded, in contrast to 410,605 units at $2,968,326. In contrast, June ended with an average of 818,748 units at $7,498,308.

An average at 688,966 units traded for the day at $2,207,104 for each security in compared to an average of 669,011 at $2,349,202 on Monday. An average of 427,315 units traded for the month to date at $2,918,945 for each security that traded, in contrast to 410,605 units at $2,968,326. In contrast, June ended with an average of 818,748 units at $7,498,308. MPC Caribbean Clean Energy jumped $14.99 to $169.99 and trading 626 units. NCB Financial Group declined by 48 cents to settle at $139 with 176,376 stock units changing hands, PanJam Investment lost $6.01 to close at $65 with investors switching ownership of 27,021 shares, Portland JSX carved out a gain of $1.03 to close at $8.35 while exchanging 6,029 shares. Proven Investments fell 41 cents to $33, with 14,000 stock units changing hands, Sagicor Group lost 55 cents in closing at $45.95, with 206,704 stock units passing through the market. Scotia Group climbed 84 cents to finish at $44.84 while exchanging 55,245 units and Wisynco Group fell 44 cents to close at $17.56 after 241,029 shares passed through the market.

MPC Caribbean Clean Energy jumped $14.99 to $169.99 and trading 626 units. NCB Financial Group declined by 48 cents to settle at $139 with 176,376 stock units changing hands, PanJam Investment lost $6.01 to close at $65 with investors switching ownership of 27,021 shares, Portland JSX carved out a gain of $1.03 to close at $8.35 while exchanging 6,029 shares. Proven Investments fell 41 cents to $33, with 14,000 stock units changing hands, Sagicor Group lost 55 cents in closing at $45.95, with 206,704 stock units passing through the market. Scotia Group climbed 84 cents to finish at $44.84 while exchanging 55,245 units and Wisynco Group fell 44 cents to close at $17.56 after 241,029 shares passed through the market. At the end of trading on Monday, the Main Index added 1,176.24 points to end at 377,131.47 while the JSE Financial Index, gained just 0.48 points to close at 98.07.

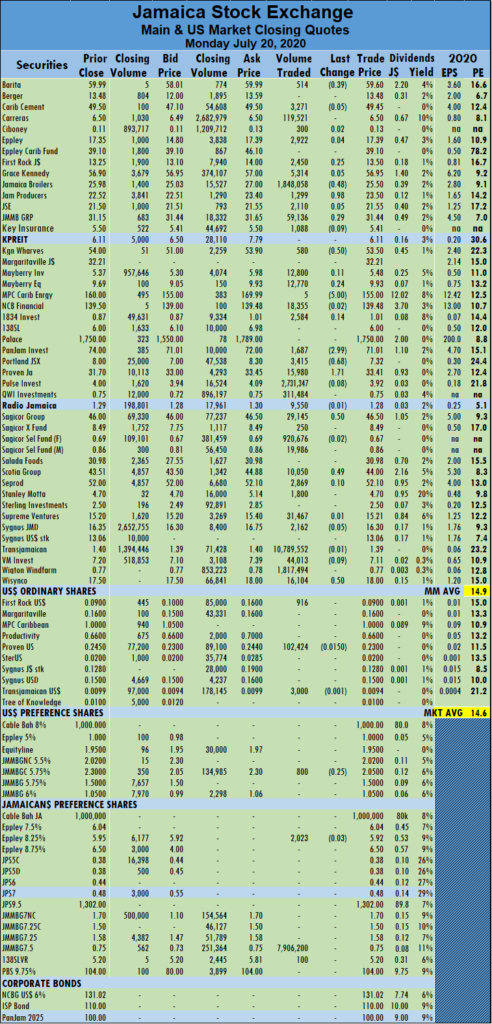

At the end of trading on Monday, the Main Index added 1,176.24 points to end at 377,131.47 while the JSE Financial Index, gained just 0.48 points to close at 98.07. An average of 669,011 units traded for the day at $2,349,202 for each security, in comparison to an average of 292,093 at $3,073,385 on Friday. An average of 410,260 units traded for the month to date at $2,965,343, for each security that traded, in contrast to 391,200 units at $3,014,746. For comparative purposes, June ended with an average of 818,748 units at $7,498,308.

An average of 669,011 units traded for the day at $2,349,202 for each security, in comparison to an average of 292,093 at $3,073,385 on Friday. An average of 410,260 units traded for the month to date at $2,965,343, for each security that traded, in contrast to 391,200 units at $3,014,746. For comparative purposes, June ended with an average of 818,748 units at $7,498,308. Kingston Wharves shed 50 cents in closing at $53.50 and clearing the market with 580 shares, MPC Caribbean Clean Energy fell $5 to end at $155 after exchanging 5 shares, PanJam Investment dropped $2.99 to settle at $71.01 with an exchange of 1,687 stock units. Portland JSX declined by 68 cents to close at $7.32 with investors switching ownership of 3,415 units, Proven Investments climbed $1.71 to close at $33.41, with 15,980 units crossing the exchange, Sagicor Group carved out a gain of 50 cents to settle at $46.50, with 29,145 shares changing hands. Scotia Group, after rising 49 cents and ended at $44 in exchanging 10,050 stock units and Wisynco Group climbed 50 cents to close at $18, with investors switching ownership of 16,104 units.

Kingston Wharves shed 50 cents in closing at $53.50 and clearing the market with 580 shares, MPC Caribbean Clean Energy fell $5 to end at $155 after exchanging 5 shares, PanJam Investment dropped $2.99 to settle at $71.01 with an exchange of 1,687 stock units. Portland JSX declined by 68 cents to close at $7.32 with investors switching ownership of 3,415 units, Proven Investments climbed $1.71 to close at $33.41, with 15,980 units crossing the exchange, Sagicor Group carved out a gain of 50 cents to settle at $46.50, with 29,145 shares changing hands. Scotia Group, after rising 49 cents and ended at $44 in exchanging 10,050 stock units and Wisynco Group climbed 50 cents to close at $18, with investors switching ownership of 16,104 units.

There are just about six offers on the stock exchange board at the close on Friday with the lowest offer at $4.30 and the only large visible offer for 500,000 shares at $6.

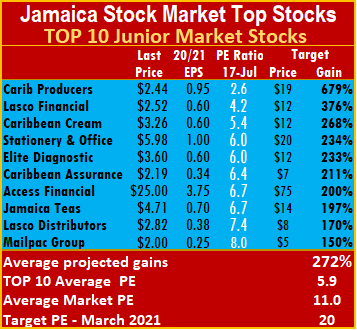

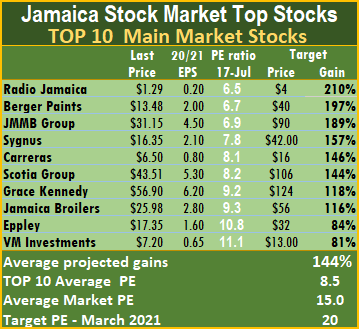

There are just about six offers on the stock exchange board at the close on Friday with the lowest offer at $4.30 and the only large visible offer for 500,000 shares at $6. The top three stocks in the Main Market, with expected gains of 189 to 210 percent are Radio Jamaica followed by Berger Paints and JMMB Group that reported decent full-year March results.

The top three stocks in the Main Market, with expected gains of 189 to 210 percent are Radio Jamaica followed by Berger Paints and JMMB Group that reported decent full-year March results. The PE ratio for the Junior Market Top 10 stocks averages a mere 5.9 at just 54 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at 8.5 or 56 percent of the PE of the overall market.

The PE ratio for the Junior Market Top 10 stocks averages a mere 5.9 at just 54 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at 8.5 or 56 percent of the PE of the overall market. The Main Index gained 1,812.5 points to 375,955.23 while the JSE Financial Index rose 0.63 points to 97.59.

The Main Index gained 1,812.5 points to 375,955.23 while the JSE Financial Index rose 0.63 points to 97.59.  The market closed in June with an average of 818,748 units at $7,498,308.

The market closed in June with an average of 818,748 units at $7,498,308. Mayberry Jamaican Equities gained 55 cents to close at $9.69 with 10,925 stock units clearing the market, NCB Financial declined by 50 cents to settle at $139.50 with investors swapping 239,825 stock units. 138 Student Living fell 50 cents to end at $6 after exchanging 9,111 stock units, PanJam Investment jumped $4 to $74 with 2,830 units crossing the market, Proven Investments declined $1.30 to close at $31.70 trading 400 shares, Scotia Group lost 98 cents to settle at $43.51 in the trading of 44,367 shares. Seprod fell $1 in ending at $52 while exchanging 61,292 stock units, Victoria Mutual Investments dropped by 30 cents to settle at $7.20 in trading 51 stock units and Wisynco Group declined by 70 cents to $17.50 with investors switching ownership of 2,832,882 stock units.

Mayberry Jamaican Equities gained 55 cents to close at $9.69 with 10,925 stock units clearing the market, NCB Financial declined by 50 cents to settle at $139.50 with investors swapping 239,825 stock units. 138 Student Living fell 50 cents to end at $6 after exchanging 9,111 stock units, PanJam Investment jumped $4 to $74 with 2,830 units crossing the market, Proven Investments declined $1.30 to close at $31.70 trading 400 shares, Scotia Group lost 98 cents to settle at $43.51 in the trading of 44,367 shares. Seprod fell $1 in ending at $52 while exchanging 61,292 stock units, Victoria Mutual Investments dropped by 30 cents to settle at $7.20 in trading 51 stock units and Wisynco Group declined by 70 cents to $17.50 with investors switching ownership of 2,832,882 stock units.

The average trade for the day ended at 354,815 units at $2,866,969 in contrast to an average of 210,408 at $4,640,489 on Wednesday. An average of 399,294 units traded for the month to date at $3,005,630 for each security, in contrast to 403,250 units at $3,017,962. In contrast, June ended with an average of 818,748 units at $7,498,308.

The average trade for the day ended at 354,815 units at $2,866,969 in contrast to an average of 210,408 at $4,640,489 on Wednesday. An average of 399,294 units traded for the month to date at $3,005,630 for each security, in contrast to 403,250 units at $3,017,962. In contrast, June ended with an average of 818,748 units at $7,498,308.  NCB Financial Group rose $1 to $140 after trading 231,287 stock units, 138 Student Living added 50 cents to end at $6.50 with investors switching ownership of 500 shares, Proven Investments increased $1 to $33 with 7,091 stock units changing hands. Sagicor Real Estate Fund rose 74 cents to settle at $8.49 after 338 shares changed hands, Salada Foods ended rising $2.98 to settle at $30.98 with investors swapping 25 shares, Seprod rose $1 in closing at $53, with 51,568 units clearing the market. Sterling Investments shed 35 cents to settle at $2.50 in trading 39,166 shares. Sygnus Credit Investments increased 48 cents to close at $16.35, with 12,806 stock units changing hands and Victoria Mutual Investments rose 30 cents to end at $7.50 with an exchange of 106,100 shares.

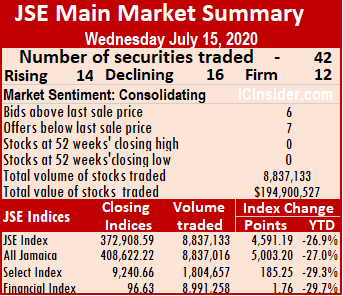

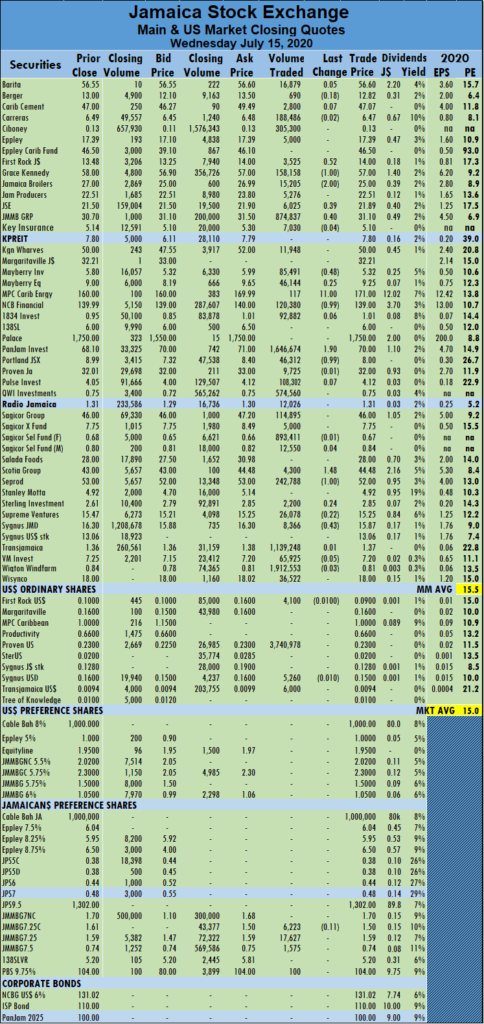

NCB Financial Group rose $1 to $140 after trading 231,287 stock units, 138 Student Living added 50 cents to end at $6.50 with investors switching ownership of 500 shares, Proven Investments increased $1 to $33 with 7,091 stock units changing hands. Sagicor Real Estate Fund rose 74 cents to settle at $8.49 after 338 shares changed hands, Salada Foods ended rising $2.98 to settle at $30.98 with investors swapping 25 shares, Seprod rose $1 in closing at $53, with 51,568 units clearing the market. Sterling Investments shed 35 cents to settle at $2.50 in trading 39,166 shares. Sygnus Credit Investments increased 48 cents to close at $16.35, with 12,806 stock units changing hands and Victoria Mutual Investments rose 30 cents to end at $7.50 with an exchange of 106,100 shares. Index climbed 4,591.19 points to 372,908.59 while the JSE Financial Index rose 1.76 points to 96.63.

Index climbed 4,591.19 points to 372,908.59 while the JSE Financial Index rose 1.76 points to 96.63. An average of 403,249 units traded for the month to date, at $3,017,962 for each security that traded, in contrast to 422,580 units at $2,855,323. In contrast, trading in June resulted in an average of 818,748 units at $7,498,308.

An average of 403,249 units traded for the month to date, at $3,017,962 for each security that traded, in contrast to 422,580 units at $2,855,323. In contrast, trading in June resulted in an average of 818,748 units at $7,498,308. Mayberry Investments shed 48 cents after closing at $5.32 trading 85,491 stock units. MPC Caribbean Clean Energy jumped $11 to end at $171 as 117 shares cleared the market, NCB Financial Group fell 99 cents to end at $139 with 120,380 units changing hands, PanJam Investment increased by $1.90 to settle at $70 trading 1,646,674 stock units. Portland JSX declined by 99 cents in closing at $8 and exchanging 46,312 shares, Scotia Group gained $1.48 to close at $44.48 after trading 4,300 stock units, Seprod dropped $1 to end at $52 with an exchange of 242,788 shares and Sygnus Credit Investments fell 43 cents to close at $15.87 in an exchange of 8,366 stock units.

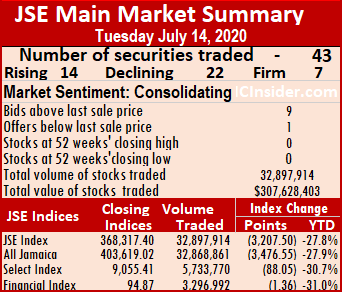

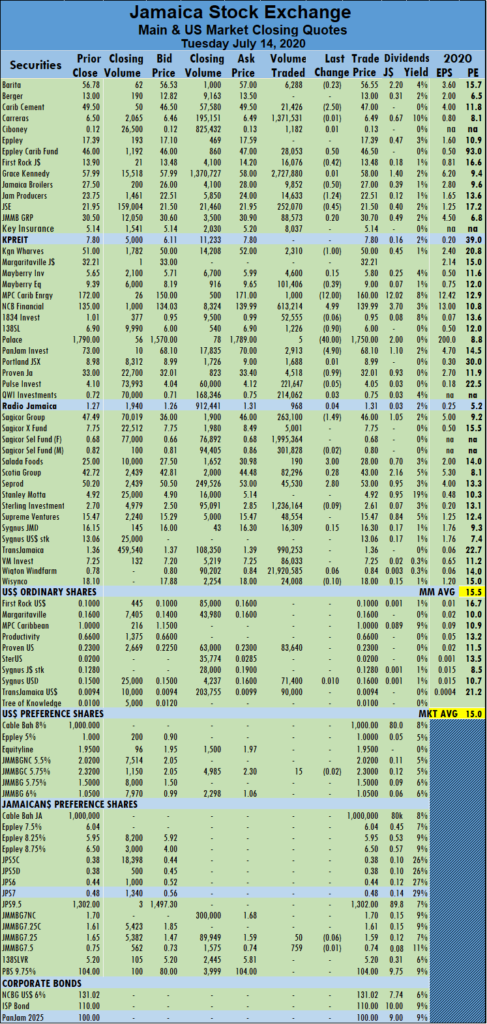

Mayberry Investments shed 48 cents after closing at $5.32 trading 85,491 stock units. MPC Caribbean Clean Energy jumped $11 to end at $171 as 117 shares cleared the market, NCB Financial Group fell 99 cents to end at $139 with 120,380 units changing hands, PanJam Investment increased by $1.90 to settle at $70 trading 1,646,674 stock units. Portland JSX declined by 99 cents in closing at $8 and exchanging 46,312 shares, Scotia Group gained $1.48 to close at $44.48 after trading 4,300 stock units, Seprod dropped $1 to end at $52 with an exchange of 242,788 shares and Sygnus Credit Investments fell 43 cents to close at $15.87 in an exchange of 8,366 stock units. At the close, the All Jamaican Composite Index declined 3,476.55 points to close at 403,619.02, the Main Index dived 3,207.50 points to 368,317.40 and the JSE Financial Index lost 1.36 to end at 94.87.

At the close, the All Jamaican Composite Index declined 3,476.55 points to close at 403,619.02, the Main Index dived 3,207.50 points to 368,317.40 and the JSE Financial Index lost 1.36 to end at 94.87. The average trade for the previous month ended at 856,725 units at $7,148,772.

The average trade for the previous month ended at 856,725 units at $7,148,772. MPC Caribbean Clean Energy carved out a loss $12, in closing at $160 with an exchange of 1,000 stock units, NCB Financial Group jumped $4.99 to settle at $139.99 with investors swapping 613,214 stock units, 138 Student Living lost 90 cents to settle at $6 trading 1,226 units. Palace Amusement fell $40 in closing at $1,750 with an exchange of a mere five units, PanJam Investment lost $4.90 to close at $68.10 with an exchange of 2,913 stock units, Proven Investments fell 99 cents in ending at $32.01 after trading 4,518 shares. Sagicor Group shed $1.49 to $46 with an exchange of 263,100 stock units, after trading at a 52 weeks’ intraday low of $34. Salada Foods gained $3 to close at $28 with 190 stock units changing hands and Seprod jumped $2.80 to end at $53 trading 45,530 shares.

MPC Caribbean Clean Energy carved out a loss $12, in closing at $160 with an exchange of 1,000 stock units, NCB Financial Group jumped $4.99 to settle at $139.99 with investors swapping 613,214 stock units, 138 Student Living lost 90 cents to settle at $6 trading 1,226 units. Palace Amusement fell $40 in closing at $1,750 with an exchange of a mere five units, PanJam Investment lost $4.90 to close at $68.10 with an exchange of 2,913 stock units, Proven Investments fell 99 cents in ending at $32.01 after trading 4,518 shares. Sagicor Group shed $1.49 to $46 with an exchange of 263,100 stock units, after trading at a 52 weeks’ intraday low of $34. Salada Foods gained $3 to close at $28 with 190 stock units changing hands and Seprod jumped $2.80 to end at $53 trading 45,530 shares.