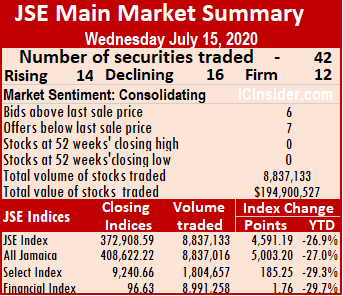

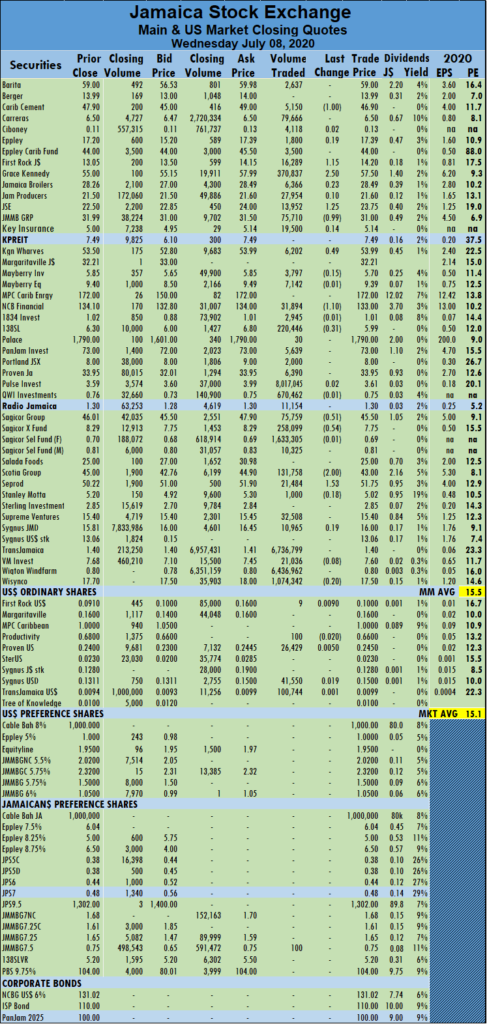

The Jamaica Stock Exchange Main Market stocks push the major market indices sharply higher on Wednesday even as trading levels dipped from Tuesday strong showing.

At the close, the All Jamaican Composite Index jumped 5,003.2 points to 408,622.22, the JSE Main  Index climbed 4,591.19 points to 372,908.59 while the JSE Financial Index rose 1.76 points to 96.63.

Index climbed 4,591.19 points to 372,908.59 while the JSE Financial Index rose 1.76 points to 96.63.

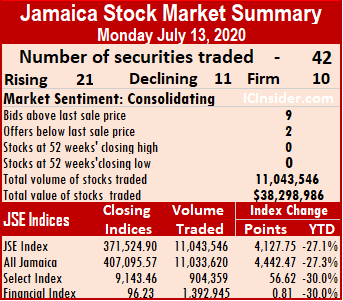

Trading ended with 42 securities changing hands with the prices of 14 stocks rising, the prices of 16 declining, with 12 remaining unchanged.

The average PE Ratio of the Main Market ended at 15.5 based on IC Insider.com’s forecasted 2020-21 earnings. The market closed with an exchange of 8,833,133 shares for $194,889,167 compared to 32,897,914 units at $307,628,403 on Tuesday.

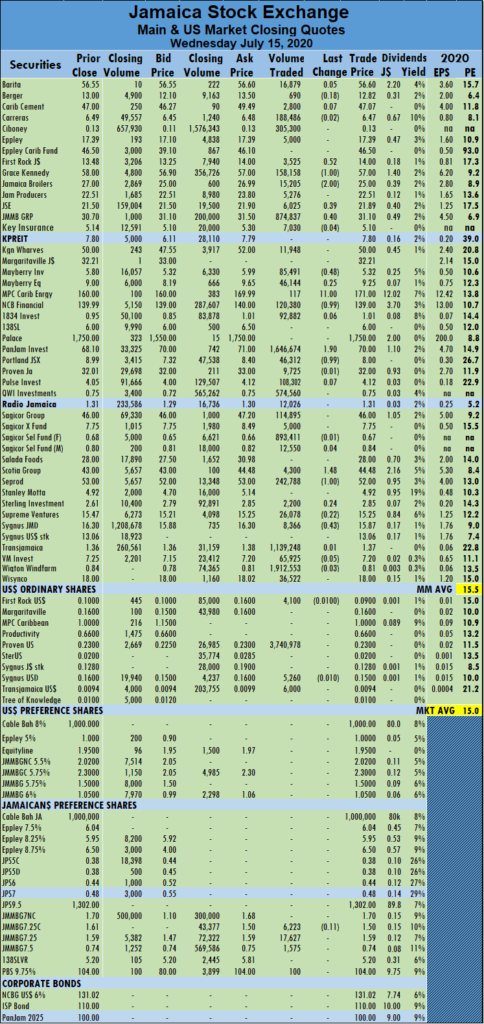

Wigton Windfarm led trading with 1.91 million shares for 21.7 percent of total volume followed by PanJam Investment with 1.65 million units for 18.6 percent of the day’s trade and Transjamaican Highway with 1.14 million units for 13 percent market share.

The average trade for the day ended at 210,313 units at $4,640,218 in contrast to an average of 765,068 at $7,154,149 on Tuesday.  An average of 403,249 units traded for the month to date, at $3,017,962 for each security that traded, in contrast to 422,580 units at $2,855,323. In contrast, trading in June resulted in an average of 818,748 units at $7,498,308.

An average of 403,249 units traded for the month to date, at $3,017,962 for each security that traded, in contrast to 422,580 units at $2,855,323. In contrast, trading in June resulted in an average of 818,748 units at $7,498,308.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the Main market shows six stocks ended with bids higher than their last selling prices and seven with lower offers.

At the close of the market, First Rock Capital rose 52 cents to close at $14 after exchanging 3,525 shares, Grace Kennedy lost $1 to close at $57 with 158,158 shares crossing the exchange, Jamaica Broilers Group lost $2 to settle at $25 in trading 15,205 units. Jamaica Stock Exchange jumped 39 cents to settle at $21.89 with investors switching ownership of 6,025 stock units, JMMB Group rose 40 cents in closing at $31.10 with 874,837 units passing through the market,  Mayberry Investments shed 48 cents after closing at $5.32 trading 85,491 stock units. MPC Caribbean Clean Energy jumped $11 to end at $171 as 117 shares cleared the market, NCB Financial Group fell 99 cents to end at $139 with 120,380 units changing hands, PanJam Investment increased by $1.90 to settle at $70 trading 1,646,674 stock units. Portland JSX declined by 99 cents in closing at $8 and exchanging 46,312 shares, Scotia Group gained $1.48 to close at $44.48 after trading 4,300 stock units, Seprod dropped $1 to end at $52 with an exchange of 242,788 shares and Sygnus Credit Investments fell 43 cents to close at $15.87 in an exchange of 8,366 stock units.

Mayberry Investments shed 48 cents after closing at $5.32 trading 85,491 stock units. MPC Caribbean Clean Energy jumped $11 to end at $171 as 117 shares cleared the market, NCB Financial Group fell 99 cents to end at $139 with 120,380 units changing hands, PanJam Investment increased by $1.90 to settle at $70 trading 1,646,674 stock units. Portland JSX declined by 99 cents in closing at $8 and exchanging 46,312 shares, Scotia Group gained $1.48 to close at $44.48 after trading 4,300 stock units, Seprod dropped $1 to end at $52 with an exchange of 242,788 shares and Sygnus Credit Investments fell 43 cents to close at $15.87 in an exchange of 8,366 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

NCB is out of IC Top 10

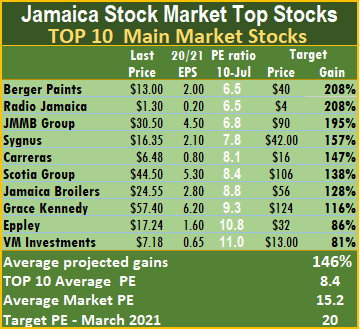

After entering IC Insider.com Main Market TOP 10 last week, NCB Financial Group is out of the top 10 and replaced by Victoria Mutual Investments. These two stocks are the only movement in and out of the TOP 10 for the week. There is no change to the Junior Market TOP 10.

After entering IC Insider.com Main Market TOP 10 last week, NCB Financial Group is out of the top 10 and replaced by Victoria Mutual Investments. These two stocks are the only movement in and out of the TOP 10 for the week. There is no change to the Junior Market TOP 10.

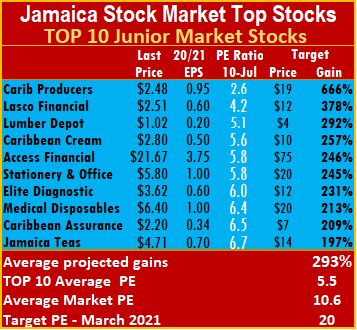

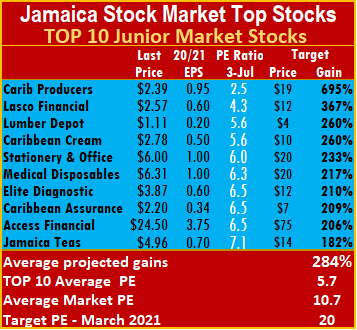

Although the Main and Junior Markets declined during the week, the top three stocks in each market saw little change in the rankings. Accordingly, the top three Junior Market stocks, with the potential to gain between 292 to 666 percent by March 2021 as Caribbean Producers, followed by Lasco Financial and Lumber Depot in the third position.

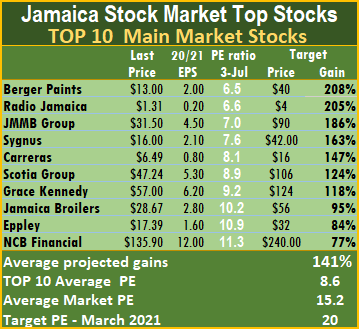

In the Main Market, the top three stocks are Berger Paints, followed by Radio Jamaica and JMMB Group, with expected gains of 195 to 208 percent.

In the Main Market, the top three stocks are Berger Paints, followed by Radio Jamaica and JMMB Group, with expected gains of 195 to 208 percent.

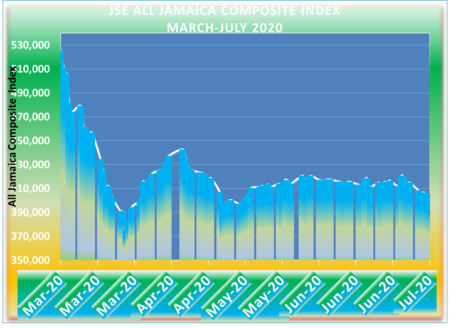

During the early summer months, the local market tends to move sideways as trading levels recede. Investors should not keep their eyes off the market as excellent opportunities can bypass them. A good case is the near 75 percent rise in the price of General Accident since May 7 when the stock traded at $4.02.

The targeted average PE ratio of the market is 20 based on profits of companies reporting full year’s results for the financial year ending after the second quarter of 2020, up to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level. The JSE Main Market ended the week, with an overall PE of 15.2 and the Junior Market at just 10.6, based on IC Insider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks averages a mere 5.5 at just 52 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at 8.4 or 55 percent of the PE of the overall market.

Both the Junior and Main markets are currently trading well below this level. The JSE Main Market ended the week, with an overall PE of 15.2 and the Junior Market at just 10.6, based on IC Insider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks averages a mere 5.5 at just 52 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at 8.4 or 55 percent of the PE of the overall market.

The average projected gain for the IC TOP 10 stocks is 293 percent, for the Junior Market and 146 percent for the JSE Main Market, based on 2020-21 earnings, an indication that there is the potential to make greater gains in the Junior Market than in the Main Market.

IC TOP 10 stocks are likely to deliver some of the best returns up to March 2021. The computation of projected gains is based on earnings and PE ratios for the current fiscal year for each stock. The ranking of stocks is in order of likely increases, with the highest-ranked, being the most attractive. The ranking of stocks is in order of likely increases, with the highest-ranked, being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver some of the best returns up to March 2021. The computation of projected gains is based on earnings and PE ratios for the current fiscal year for each stock. The ranking of stocks is in order of likely increases, with the highest-ranked, being the most attractive. The ranking of stocks is in order of likely increases, with the highest-ranked, being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

NCB is back IC Top 10

NCB Financial Group is back IC Insider.com Main Market TOP 10 stocks as the price slipped slightly by the end of the week to $135.90. There were no changes to the Junior Market TOP 10 lists.

NCB Financial Group is back IC Insider.com Main Market TOP 10 stocks as the price slipped slightly by the end of the week to $135.90. There were no changes to the Junior Market TOP 10 lists.

This week’s focus: NCB shares have been under selling pressure, with the group reporting lower second-quarter profit than the prior year and concerns about losses that can occur from their loan portfolio. They announced measures to continue their focus on cost-cutting, with a proposed restructuring of the insurance arms that will lead to lower costs. In addition, they announced the cutting of 121 staff members that will lower operating costs, going forward. Investors can expect more adjustments in the group that will flow from the acquisition of the majority shareholding of the Guardian group.

The top three Junior Market stocks this week, with the potential to gain between 260 to 695 percent by March 2021, are Caribbean Producers, followed by Lasco Financial, while Caribbean Cream and Lumber Depot share the third position. In the Main Market, the top three stocks continue to be Radio Jamaica continues to lead, followed by Berger Paints and JMMB Group with expected gains of 186 to 208 percent.

The top three Junior Market stocks this week, with the potential to gain between 260 to 695 percent by March 2021, are Caribbean Producers, followed by Lasco Financial, while Caribbean Cream and Lumber Depot share the third position. In the Main Market, the top three stocks continue to be Radio Jamaica continues to lead, followed by Berger Paints and JMMB Group with expected gains of 186 to 208 percent.

The targeted average PE ratio of the market is 20 based on profits of companies reporting full year’s results for the financial year ending after the second quarter of 2020, up to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level.  The JSE Main Market ended the week, with an overall PE of 15.2 and the Junior Market at just 10.7, based on IC Insider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks averages a mere 5.7 at just 53 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at 8.6 or 57 percent of the PE of the overall market.

The JSE Main Market ended the week, with an overall PE of 15.2 and the Junior Market at just 10.7, based on IC Insider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks averages a mere 5.7 at just 53 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at 8.6 or 57 percent of the PE of the overall market.

The average projected gain for the IC TOP 10 stocks is 284 percent, for the Junior Market and 141 percent for the JSE Main Market, based on 2020-21 earnings, an indication that there is the potential to make greater gains in the Junior Market than in the Main Market.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021. The expected gain for each stock is based on earnings and PE ratios for the current fiscal year. The ranking of stocks is done in order of likely increases. The highest-ranked stock is the most attractive. The ranking of stocks is in order of likely increases, with the highest-ranked, being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021. The expected gain for each stock is based on earnings and PE ratios for the current fiscal year. The ranking of stocks is done in order of likely increases. The highest-ranked stock is the most attractive. The ranking of stocks is in order of likely increases, with the highest-ranked, being the most attractive. Expected values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

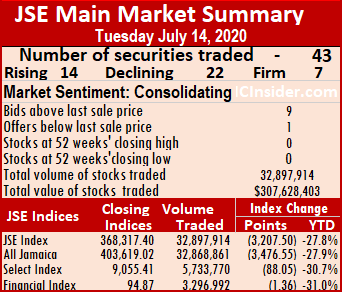

At the close, the All Jamaican Composite Index declined 3,476.55 points to close at 403,619.02, the Main Index dived 3,207.50 points to 368,317.40 and the JSE Financial Index lost 1.36 to end at 94.87.

At the close, the All Jamaican Composite Index declined 3,476.55 points to close at 403,619.02, the Main Index dived 3,207.50 points to 368,317.40 and the JSE Financial Index lost 1.36 to end at 94.87. The average trade for the previous month ended at 856,725 units at $7,148,772.

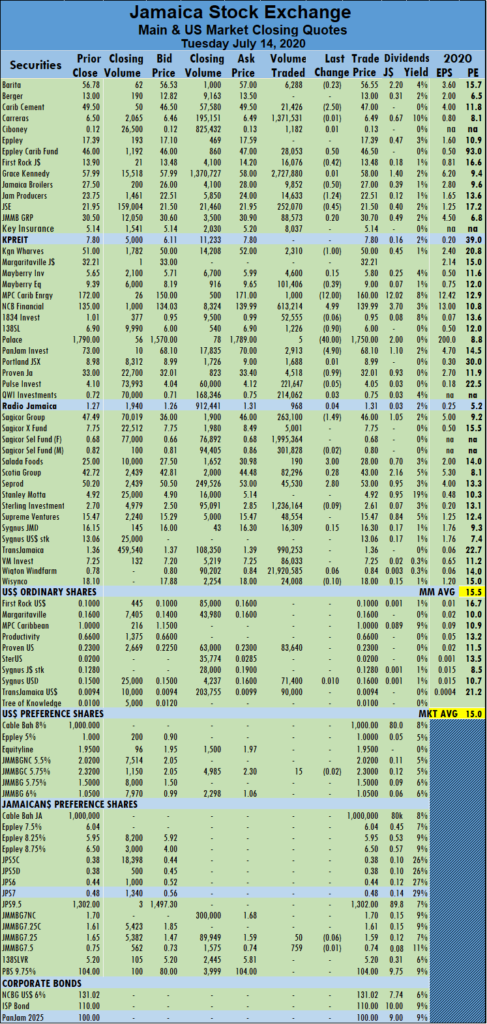

The average trade for the previous month ended at 856,725 units at $7,148,772. MPC Caribbean Clean Energy carved out a loss $12, in closing at $160 with an exchange of 1,000 stock units, NCB Financial Group jumped $4.99 to settle at $139.99 with investors swapping 613,214 stock units, 138 Student Living lost 90 cents to settle at $6 trading 1,226 units. Palace Amusement fell $40 in closing at $1,750 with an exchange of a mere five units, PanJam Investment lost $4.90 to close at $68.10 with an exchange of 2,913 stock units, Proven Investments fell 99 cents in ending at $32.01 after trading 4,518 shares. Sagicor Group shed $1.49 to $46 with an exchange of 263,100 stock units, after trading at a 52 weeks’ intraday low of $34. Salada Foods gained $3 to close at $28 with 190 stock units changing hands and Seprod jumped $2.80 to end at $53 trading 45,530 shares.

MPC Caribbean Clean Energy carved out a loss $12, in closing at $160 with an exchange of 1,000 stock units, NCB Financial Group jumped $4.99 to settle at $139.99 with investors swapping 613,214 stock units, 138 Student Living lost 90 cents to settle at $6 trading 1,226 units. Palace Amusement fell $40 in closing at $1,750 with an exchange of a mere five units, PanJam Investment lost $4.90 to close at $68.10 with an exchange of 2,913 stock units, Proven Investments fell 99 cents in ending at $32.01 after trading 4,518 shares. Sagicor Group shed $1.49 to $46 with an exchange of 263,100 stock units, after trading at a 52 weeks’ intraday low of $34. Salada Foods gained $3 to close at $28 with 190 stock units changing hands and Seprod jumped $2.80 to end at $53 trading 45,530 shares. The average volume for the month to date amounts to 383,412 units at $2,363,701 in contrast to 452,787 units at $2,546,266. In contrast, the average for June ended at 856,725 units valued at $7,148,772 for each security.

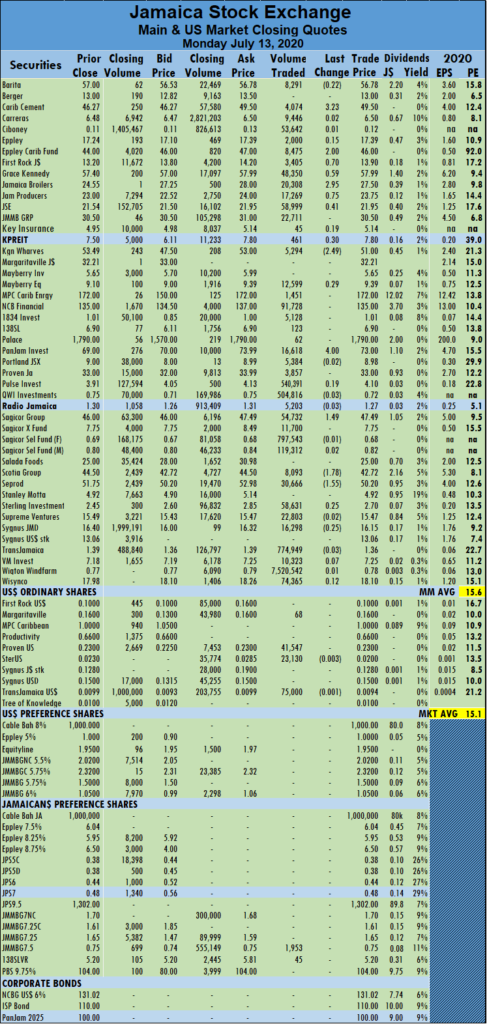

The average volume for the month to date amounts to 383,412 units at $2,363,701 in contrast to 452,787 units at $2,546,266. In contrast, the average for June ended at 856,725 units valued at $7,148,772 for each security. Jamaica Producers gained 75 cents in ending at $23.75 trading 17,269 units. Jamaica Stock Exchange climbed 41 cents closing at $21.95, after exchanging 58,999 stock units, Kingston Properties rose 30 cents to end at $7.80 in exchange of 461 units, Kingston Wharves shed $2.49 to settle at $51 with 5,294 stock units changing hands. Mayberry Jamaican Equities added 29 cents to close at $9.39 after trading 12,599 units, PanJam Investment jumped $4 to settle at $73 after 16,618 units changed hands, Sagicor Group rose $1.49 to end at $47.49 with 54,732 units crossing the exchange. Scotia Group lost $1.78 to settle at $42.72 in trading 8,093 units and Seprod fell $1.55 after closing at $50.20 and exchanging 30,666 shares.

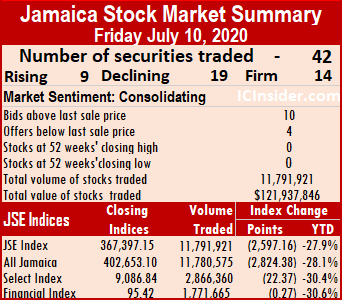

Jamaica Producers gained 75 cents in ending at $23.75 trading 17,269 units. Jamaica Stock Exchange climbed 41 cents closing at $21.95, after exchanging 58,999 stock units, Kingston Properties rose 30 cents to end at $7.80 in exchange of 461 units, Kingston Wharves shed $2.49 to settle at $51 with 5,294 stock units changing hands. Mayberry Jamaican Equities added 29 cents to close at $9.39 after trading 12,599 units, PanJam Investment jumped $4 to settle at $73 after 16,618 units changed hands, Sagicor Group rose $1.49 to end at $47.49 with 54,732 units crossing the exchange. Scotia Group lost $1.78 to settle at $42.72 in trading 8,093 units and Seprod fell $1.55 after closing at $50.20 and exchanging 30,666 shares. At the close, the All Jamaican Composite Index dropped 2,824.38 points to 402,653.10, the JSE Market Index declined by 2,597.16 points to 367,397.15 and the JSE Financial Index lost 0.27 points to 95.42. The average PE Ratio of the Main Market ended at 15.4 based on IC Insider.com’s forecasted 2020-21 earnings.

At the close, the All Jamaican Composite Index dropped 2,824.38 points to 402,653.10, the JSE Market Index declined by 2,597.16 points to 367,397.15 and the JSE Financial Index lost 0.27 points to 95.42. The average PE Ratio of the Main Market ended at 15.4 based on IC Insider.com’s forecasted 2020-21 earnings. The average trade for the day ended at 280,760 units at $2,903,282 in contrast to an average of 399,757 at $2,435,173 on Thursday. An average of 1,048,185 units at $3,935,208 each traded for July to date in contrast to 483,377 units at $2,494,914 for each security. In contrast, June closed with an average of 818,748 units valued at $7,498,303 for each security traded.

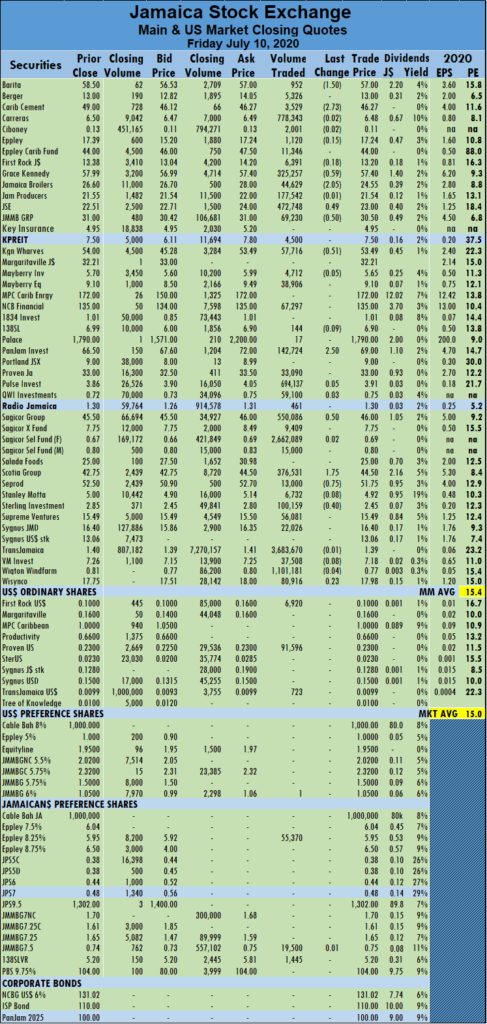

The average trade for the day ended at 280,760 units at $2,903,282 in contrast to an average of 399,757 at $2,435,173 on Thursday. An average of 1,048,185 units at $3,935,208 each traded for July to date in contrast to 483,377 units at $2,494,914 for each security. In contrast, June closed with an average of 818,748 units valued at $7,498,303 for each security traded. Jamaica Broilers ended $2.05 lower at $24.55, in trading 44,629 stock units, Jamaica Stock Exchange gained 49 cents to close at $23, in exchanging 472,748 shares, JMMB Group shed 50 cents to end at $30.50, with a transfer of 69,230 stock units. Kingston Wharves finished 51 cents lower at $53.49, after trading 57,716 stock units, PanJam Investment climbed $2.50 to settle at $69, with 142,724 shares changing hands, Sagicor Group gained 50 cents in transferring 550,086 shares and ended at $46. Scotia Group closed $1.75 higher at $44.50 as investors traded 376,531 shares, Seprod dipped 75 cents to $51.75, with an exchange of 13,000 units and Sterling Investments ended at $2.45, having lost 40 cents trading 100,159 shares.

Jamaica Broilers ended $2.05 lower at $24.55, in trading 44,629 stock units, Jamaica Stock Exchange gained 49 cents to close at $23, in exchanging 472,748 shares, JMMB Group shed 50 cents to end at $30.50, with a transfer of 69,230 stock units. Kingston Wharves finished 51 cents lower at $53.49, after trading 57,716 stock units, PanJam Investment climbed $2.50 to settle at $69, with 142,724 shares changing hands, Sagicor Group gained 50 cents in transferring 550,086 shares and ended at $46. Scotia Group closed $1.75 higher at $44.50 as investors traded 376,531 shares, Seprod dipped 75 cents to $51.75, with an exchange of 13,000 units and Sterling Investments ended at $2.45, having lost 40 cents trading 100,159 shares. Transjamaican Highway with 4.43 million units for 26 percent of the day’s trade and Pulse Investments with 913,284 units for 5.4 percent market share.

Transjamaican Highway with 4.43 million units for 26 percent of the day’s trade and Pulse Investments with 913,284 units for 5.4 percent market share. NCB Financial Group advanced by $2 to $135, with investor having transferred 107,228 shares, 138 Student Living closed $1 higher at $6.99, with 2,000 stock units changing hands, PanJam Investment tumbled $6.50 and settled at $66.50, after trading 31,900 shares, Portland JSX climbed $1 to close at $9 trading 80 shares. Proven Investments slipped 95 cents to end at $33, in transferring 212,681 shares, Seprod gained 75 cents and closed at $52.50, with investors switching over 16,681 stock units. Sygnus Credit Investments gained 40 cents to finish at $16.40 with transfers of 18,009 stock units and Victoria Mutual Investments closed 34 cents lower to end at $7.26, in 62,150 shares changing hands.

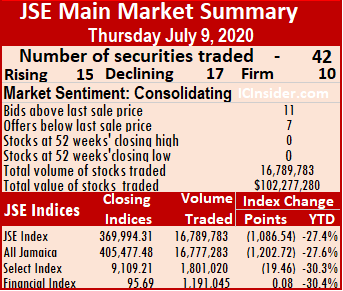

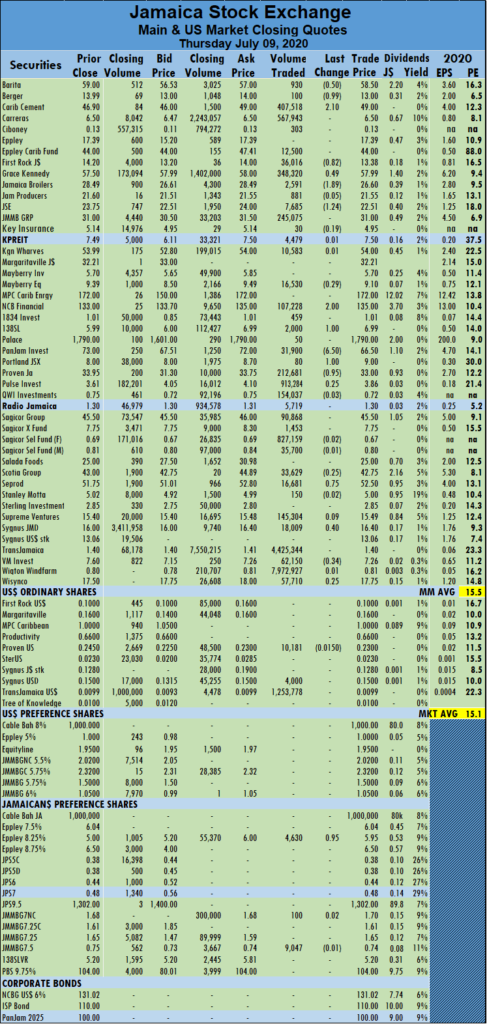

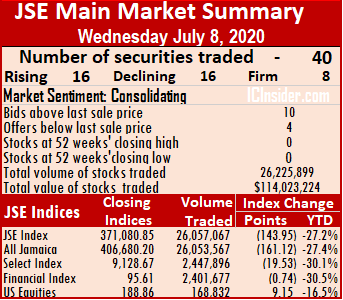

NCB Financial Group advanced by $2 to $135, with investor having transferred 107,228 shares, 138 Student Living closed $1 higher at $6.99, with 2,000 stock units changing hands, PanJam Investment tumbled $6.50 and settled at $66.50, after trading 31,900 shares, Portland JSX climbed $1 to close at $9 trading 80 shares. Proven Investments slipped 95 cents to end at $33, in transferring 212,681 shares, Seprod gained 75 cents and closed at $52.50, with investors switching over 16,681 stock units. Sygnus Credit Investments gained 40 cents to finish at $16.40 with transfers of 18,009 stock units and Victoria Mutual Investments closed 34 cents lower to end at $7.26, in 62,150 shares changing hands. Trading ended with 40 securities changing hands with the prices of 16 stocks rising, 16 declining and eight securities ended unchanged. At the close, the All Jamaican Composite Index fell 161.12 points to 406,680.20, the JSE Market Index shed 143.95 points to 371,080.85 and the JSE Financial Index lost 0.74 points to end at 95.61.

Trading ended with 40 securities changing hands with the prices of 16 stocks rising, 16 declining and eight securities ended unchanged. At the close, the All Jamaican Composite Index fell 161.12 points to 406,680.20, the JSE Market Index shed 143.95 points to 371,080.85 and the JSE Financial Index lost 0.74 points to end at 95.61. Sagicor Select Financial Fund with 1.6 million shares and Wisynco Group with 1.07 million units.

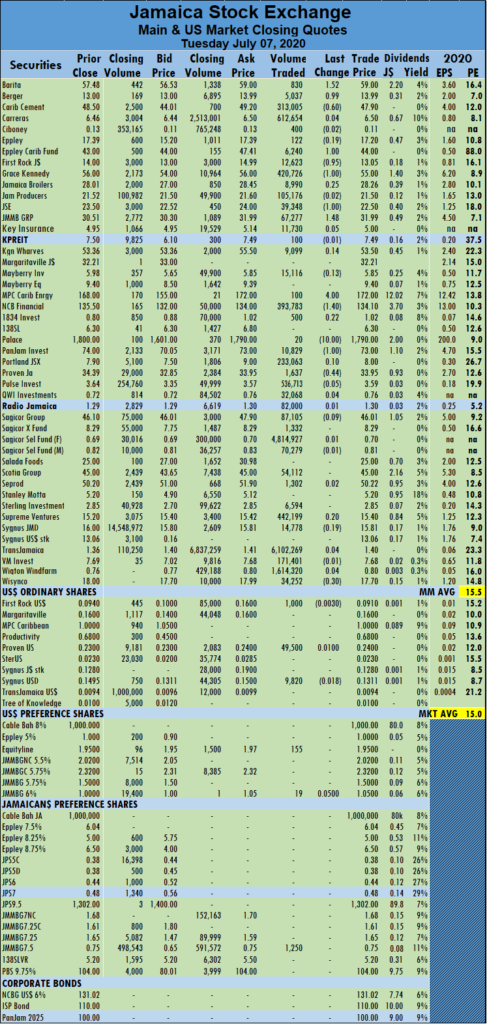

Sagicor Select Financial Fund with 1.6 million shares and Wisynco Group with 1.07 million units. Jamaica Producers Group ended $1.25 higher at $23.75, after exchanging 13,952 units, JMMB Group shed 99 cents to finish at $31, with 75,710 shares crossing the market. Kingston Wharves gained 49 cents to settle at $53.99, in trading 6,202 units, NCB Financial Group fell $1.10 transferring 31,894 stock units and closed at $133, 138 Student Living lost 31 cents to end at $5.99, with 220,446 shares changing hands, Sagicor Group closed 51 cents lower at $45.50 trading 75,759 stock units. Sagicor Real Estate Fund finished at $7.75, after losing 54 cents transferring 258,099 shares, Scotia Group declined $2 to settle at $43, with trades of 131,758 shares and Seprod climbed $1.53 to $51.75, in transferring 21,484 stock units.

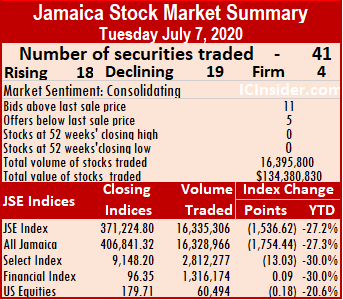

Jamaica Producers Group ended $1.25 higher at $23.75, after exchanging 13,952 units, JMMB Group shed 99 cents to finish at $31, with 75,710 shares crossing the market. Kingston Wharves gained 49 cents to settle at $53.99, in trading 6,202 units, NCB Financial Group fell $1.10 transferring 31,894 stock units and closed at $133, 138 Student Living lost 31 cents to end at $5.99, with 220,446 shares changing hands, Sagicor Group closed 51 cents lower at $45.50 trading 75,759 stock units. Sagicor Real Estate Fund finished at $7.75, after losing 54 cents transferring 258,099 shares, Scotia Group declined $2 to settle at $43, with trades of 131,758 shares and Seprod climbed $1.53 to $51.75, in transferring 21,484 stock units. At the close, the All Jamaican Composite Index dropped 1,754.44 points to 406,841.32, the JSE Market Index sank 1,536.62 points to 371,224.80 and the JSE Financial Index gained 0.09 points to 96.35. The average PE Ratio of the Main Market closed at 15 based on IC Insider.com forecasted 2020-21 earnings.

At the close, the All Jamaican Composite Index dropped 1,754.44 points to 406,841.32, the JSE Market Index sank 1,536.62 points to 371,224.80 and the JSE Financial Index gained 0.09 points to 96.35. The average PE Ratio of the Main Market closed at 15 based on IC Insider.com forecasted 2020-21 earnings. An average of 373,718 units traded for the month to date for $4,445,101 in contrast to 367,724 units at $1,363,982. The average volume and value for June was 818,748 units at $7,498,303.

An average of 373,718 units traded for the month to date for $4,445,101 in contrast to 367,724 units at $1,363,982. The average volume and value for June was 818,748 units at $7,498,303. Jamaica Producers ended at $22.50, having lost $1 in transferring 39,348 units, JMMB Group jumped $1.48 to $31.99, with 67,277 shares crossing the market, MPC Caribbean Clean Energy advanced $4 to close at $172 after trading just 100 units. NCB Financial Group declined $1.40 to $134.10 with an exchange of 393,783 shares, Palace Amusement sustained a loss of $10 to finish at $1,790, after swapping 20 units, PanJam Investment dropped $1 in trading 10,829 stock units and settled at $73. Proven Investments ended with a loss of 44 cents at $33.95, with 1,637 units changing hands and Wisynco Group shed 30 cents to finish at $17.70, in transferring 34,252 shares.

Jamaica Producers ended at $22.50, having lost $1 in transferring 39,348 units, JMMB Group jumped $1.48 to $31.99, with 67,277 shares crossing the market, MPC Caribbean Clean Energy advanced $4 to close at $172 after trading just 100 units. NCB Financial Group declined $1.40 to $134.10 with an exchange of 393,783 shares, Palace Amusement sustained a loss of $10 to finish at $1,790, after swapping 20 units, PanJam Investment dropped $1 in trading 10,829 stock units and settled at $73. Proven Investments ended with a loss of 44 cents at $33.95, with 1,637 units changing hands and Wisynco Group shed 30 cents to finish at $17.70, in transferring 34,252 shares. Friday. In Contrast, trading in June resulted in an average of 818,748 units for $7,498,308 for each security.

Friday. In Contrast, trading in June resulted in an average of 818,748 units for $7,498,308 for each security. Kingston Wharves gained 36 cents and closed at $53.36 in trading 3,673 units, NCB Financial Group declined by 40 cents to end at $135.50 after exchanging 163,040 shares. Portland JSX rose 55 cents to end at $7.90 and trading 20,187 stock units, Sagicor Group declined by $3.89 to $46.10 with a transfer of 23,410 units. Sagicor Real Estate Fund jumped 54 cents to $8.29 with investors trading 69,628 stock units, Salada Foods dropped $3.40 to close at $25 after exchanging 3,775 units, Scotia Group declined by $2.25 to end at $45, in transferring 34,944 stock units and Seprod shed $2.79 to settle at $50.20 with 19,161 units changing hands.

Kingston Wharves gained 36 cents and closed at $53.36 in trading 3,673 units, NCB Financial Group declined by 40 cents to end at $135.50 after exchanging 163,040 shares. Portland JSX rose 55 cents to end at $7.90 and trading 20,187 stock units, Sagicor Group declined by $3.89 to $46.10 with a transfer of 23,410 units. Sagicor Real Estate Fund jumped 54 cents to $8.29 with investors trading 69,628 stock units, Salada Foods dropped $3.40 to close at $25 after exchanging 3,775 units, Scotia Group declined by $2.25 to end at $45, in transferring 34,944 stock units and Seprod shed $2.79 to settle at $50.20 with 19,161 units changing hands.