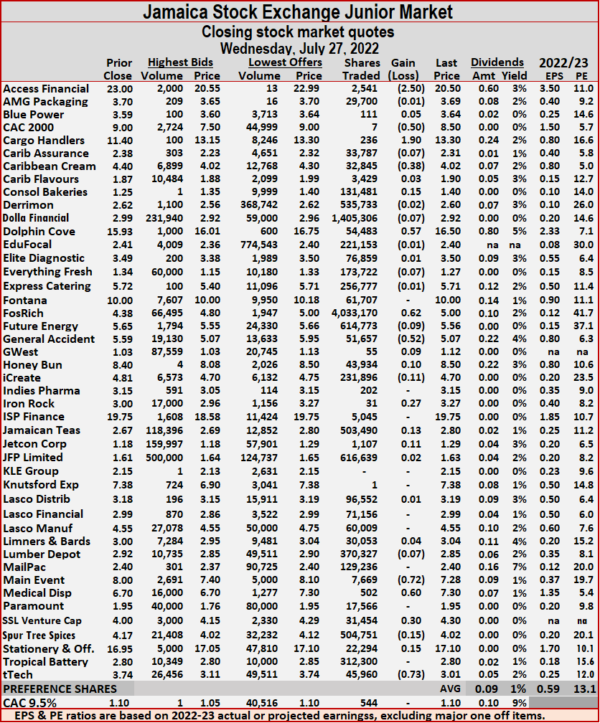

Fosrich remained the outstanding trade on the Junior Market of the Jamaica Stock Exchange on Wednesday, with the 4 million shares traded up to a record high of $5.42 post-split and leading to the volume of stocks traded in the market remaining steady but with the value climbing 28 percent over Tuesday, resulting in 45 securities trading versus 44 on Tuesday and ended with 18 rising, 17 declining and 10 closing unchanged.

A total of 10,822,250 shares traded for $44,295,276 compared to 10,929,588 units at $34,533,161 on Tuesday. Trading averaged 240,494 shares at $984,339 in contrast to 248,400 shares at $784,845 on Tuesday with month to date, averaging 530,105 units at $2,725,686 compared to 547,119 units at $2,827,985 on Tuesday the previous trading day. June closed with an average of 429,016 units at $1,630,104.

A total of 10,822,250 shares traded for $44,295,276 compared to 10,929,588 units at $34,533,161 on Tuesday. Trading averaged 240,494 shares at $984,339 in contrast to 248,400 shares at $784,845 on Tuesday with month to date, averaging 530,105 units at $2,725,686 compared to 547,119 units at $2,827,985 on Tuesday the previous trading day. June closed with an average of 429,016 units at $1,630,104.

The Junior Market Index rose 46.92 points to 4,388.89. The PE Ratio, a measure of computing appropriate stock values, averages 13.1. The Junior Market PE ratios incorporate ICInsider.com projected earnings for companies with financial year end that falls between November this year and August 2023.

Fresh from the ten for one stock split, Fosrich led trading with 4.03 million shares for 37.3 percent of total volume followed by Dolla Financial with 1.41 million units for 13 percent of the day’s trade and JFP Limited with 616,639 units for 5.7 percent market share.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Access Financial shed $2.50 in closing at $20.50 after exchanging 2,541 shares, CAC 2000 fell 50 cents to $8.50 while exchanging seven units, Cargo Handlers increased $1.90 to end at $13.30, with 236 stock units crossing the exchange. Caribbean Cream dropped 38 cents to close at $4.02, with 32,845 stocks crossing the market, Consolidated Bakeries climbed 15 cents in ending at $1.40 after a transfer of 131,481 units, Dolphin Cove advanced 57 cents to close at $16.50 trading 54,483 stocks. Fosrich rallied 62 cents to a record close of $5 with the swapping of 4,033,170 shares, General Accident declined 52 cents to $5.07, with 51,657 stock units clearing the market, Honey Bun gained 10 cents to end at $8.50 in trading 43,934 stocks. iCreate fell 11 cents in closing at $4.70 with an exchange of 231,896 stock units, Iron Rock Insurance rose 27 cents to $3.27 in an exchange of 31 units, Jamaican Teas popped 13 cents to $2.80 in switching ownership of 503,490 shares. Jetcon Corporation gained 11 cents in closing at $1.29, with 1,107 stock units changing hands, Main Event declined 72 cents to $7.28 with an exchange of 7,669 shares, Medical Disposables climbed 60 cents to $7.30 after 502 units crossed the market.

At the close, Access Financial shed $2.50 in closing at $20.50 after exchanging 2,541 shares, CAC 2000 fell 50 cents to $8.50 while exchanging seven units, Cargo Handlers increased $1.90 to end at $13.30, with 236 stock units crossing the exchange. Caribbean Cream dropped 38 cents to close at $4.02, with 32,845 stocks crossing the market, Consolidated Bakeries climbed 15 cents in ending at $1.40 after a transfer of 131,481 units, Dolphin Cove advanced 57 cents to close at $16.50 trading 54,483 stocks. Fosrich rallied 62 cents to a record close of $5 with the swapping of 4,033,170 shares, General Accident declined 52 cents to $5.07, with 51,657 stock units clearing the market, Honey Bun gained 10 cents to end at $8.50 in trading 43,934 stocks. iCreate fell 11 cents in closing at $4.70 with an exchange of 231,896 stock units, Iron Rock Insurance rose 27 cents to $3.27 in an exchange of 31 units, Jamaican Teas popped 13 cents to $2.80 in switching ownership of 503,490 shares. Jetcon Corporation gained 11 cents in closing at $1.29, with 1,107 stock units changing hands, Main Event declined 72 cents to $7.28 with an exchange of 7,669 shares, Medical Disposables climbed 60 cents to $7.30 after 502 units crossed the market.  Spur Tree Spices shed 15 cents in ending at $4.02 and closed after the transfer of 504,751 stocks, SSL Venture advanced 30 cents to close at $4.30 while exchanging 31,454 stock units, Stationery and Office Supplies popped 15 cents to $17.10 in switching ownership of 22,294 shares and tTech lost 73 cents in closing at $3.01, with 45,960 units clearing the market.

Spur Tree Spices shed 15 cents in ending at $4.02 and closed after the transfer of 504,751 stocks, SSL Venture advanced 30 cents to close at $4.30 while exchanging 31,454 stock units, Stationery and Office Supplies popped 15 cents to $17.10 in switching ownership of 22,294 shares and tTech lost 73 cents in closing at $3.01, with 45,960 units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Another big win for ICTOP10 pick

If investors needed reminders, the stock market showed why severely undervalued stocks should be acquired early, as most investors don’t know when surprises will occur. The announcement this week that IC stock watch pick, Stationery and Office Supplies (SOS), a former ICTOP candidate, that their directors would meet to consider a dividend in August sent the stock to a record high of $19.29, but it closed the week at $15 up 155 percent for the year to date.

Stationery & Office Supplies hits a record high of $19.29 this week.

SOS was last in the TOP10 on the week starting June 13 at $11. It was number 12 on the ICTOP15 chart to start 2022 but climbed to the sixth position on January 11. The dividend to be considered in early August signals that record profit as shown in the first quarter results continues apace. Insider.com forecast is for earnings of $1.70 for the current year, with more to come in 2023. The forecast is for the stock to reach the $30 range by year end. But investors should also consider what a stock split that seems imminent could do to the price.

There were no changes to the TOP10 listings this past week, but there was much volatility in the Junior Market, with CAC 2000 and Jetcon Corporation dropping 13 percent to 8.50 and $1.16, respectively. Caribbean Cream fell 11 percent to $4.30, Dolphin Cove dipped 5 percent and Medical Disposables fell 4 percent to $6.80. The only stock with a rise worth mentioning is Caribbean Assurance Brokers, up 6 percent.

The Main Market enjoyed a better week than the Juniors with no significant declines, while Sterling Investments rose 5 percent to end at $2.88.

Investors should keep a careful watch on Dolphin Cove, Express Catering, General Accident, Jamaica Broilers, Lasco Distributors, Lasco Financial, Lasco Manufacturing, Stationery and Office Supplies and Paramount Trading, Dolphin Cove, Caribbean Producers, Express Catering will be significant beneficiaries of the strong rebound in tourist arrivals. The supply of General Accident has declined sharply over the past few weeks, but investors may be reluctant to lie into the stock ahead of the hurricane season.

Investors should keep a careful watch on Dolphin Cove, Express Catering, General Accident, Jamaica Broilers, Lasco Distributors, Lasco Financial, Lasco Manufacturing, Stationery and Office Supplies and Paramount Trading, Dolphin Cove, Caribbean Producers, Express Catering will be significant beneficiaries of the strong rebound in tourist arrivals. The supply of General Accident has declined sharply over the past few weeks, but investors may be reluctant to lie into the stock ahead of the hurricane season.

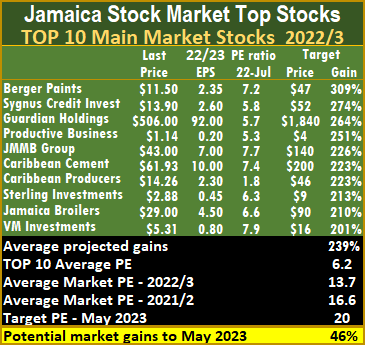

The average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 13.7, while the Junior Market Top 10 PE sits at 5.9 versus the market at 12.8. The Junior Market and the Main Market TOP10 are projected to gain an average of 239 percent each to May 2023.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

RJR jumps 19% out of ICTOP10

Investors mostly remained on the sidelines this past week, ahead of the release of the bulk of second quarter results, of which there were a few in the past week. Main Market VM Investments returns to the Top10 as Radio Jamaica dropped out with a price increase and a downward revision to projected earnings to 30 cents per share.

Investors mostly remained on the sidelines this past week, ahead of the release of the bulk of second quarter results, of which there were a few in the past week. Main Market VM Investments returns to the Top10 as Radio Jamaica dropped out with a price increase and a downward revision to projected earnings to 30 cents per share.

Even as RJR drops out of the TOP10, the stock has much room for more growth but not enough to keep it in the top ranks.

In the Junior Market, Caribbean Cream climbed 4 percent to $4.85, followed by a 5 percent rise for Medical Disposables and Caribbean Assurance Brokers.

Lasco Distributors fell 9 percent to $3.12, Lasco Financial slipped 7 percent to $2.84 and Elite Diagnostic slipped 4 percent to $3.55.

The Main Market, Radio Jamaica rebounded by 19 percent to $2.95, Jamaica Broilers was up 7 percent to $28.94 and Berger Paints rose 6 percent to close at $11.65. Sterling Investments and Sygnus Credit Investments fell by 5 percent to end at $2.75 and $14, respectively.

Investors should watch Dolphin Cove, Express Catering, General Accident, Jamaica Broilers, Lasco Distributors, Lasco Manufacturing and Stationery and Office Supplies. Dolphin Cove, Caribbean Producers, Express Catering will be significant beneficiaries of the strong rebound in tourist arrivals and the supply of General Accident has declined sharply over the past few weeks.

Investors should watch Dolphin Cove, Express Catering, General Accident, Jamaica Broilers, Lasco Distributors, Lasco Manufacturing and Stationery and Office Supplies. Dolphin Cove, Caribbean Producers, Express Catering will be significant beneficiaries of the strong rebound in tourist arrivals and the supply of General Accident has declined sharply over the past few weeks.

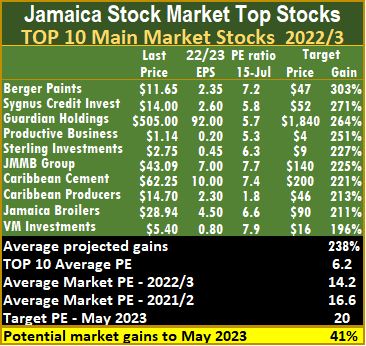

The average PE for the JSE Main Market TOP 10 is 6.2, well below the market average of 14.2, while the Junior Market Top 10 PE sits at 6.2 versus the market at 12.9. The Junior Market TOP10 is projected to gain an average of 225 percent to May 2023 and the Main Market 238 percent.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotions in selecting stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotions in selecting stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

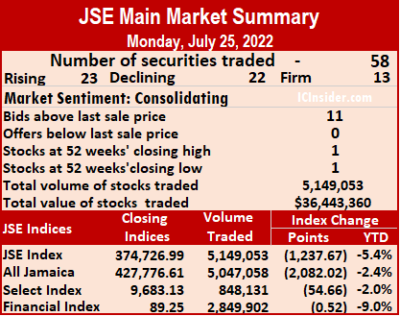

Trading ended with 57 securities against 58 on Monday, with 22 rising, 23 declining and 12 ending unchanged.

Trading ended with 57 securities against 58 on Monday, with 22 rising, 23 declining and 12 ending unchanged. At the close, Barita Investments declined 70 cents to end at $88.06 with an exchange of 29,688 shares, Berger Paints gained 69 cents after finishing at $12.19 with five stock units crossing the exchange, Caribbean Cement rallied 51 cents to $63.49 with the swapping of 2,645 units. Jamaica Broilers rallied 50 cents to close at $29 in an exchange of 1,908,234 stocks, Jamaica Producers shed 49 cents in closing at $22 with 20,587 shares clearing the market, Jamaica Stock Exchange rose 95 cents in closing at $17.95 after exchanging 2,204 stocks. JMMB Group fell 54 cents to $42.91, with 405,966 stock units changing hands, Massy Holdings advanced 50 cents to close at $91 in trading 44,934 units, Mayberry Investments popped 59 cents to $10.59 after an exchange of 4,056 units. Mayberry Jamaican Equities fell 49 cents to end at $15.50, with 34,029 stock units crossing the market, but only after hitting a record high of $16. MPC Caribbean Clean Energy dropped $4 after ending at $81 in switching ownership of 173 stocks, NCB Financial shed $1.93 to close at $95.07, with 43,592 shares crossing the market. Palace Amusement climbed $136.63 to $890 after exchanging three units, PanJam Investment declined 50 cents in closing at $63.50 while exchanging 3,503 stock units, Portland JSX rose 50 cents to end at $8.50 trading 20 stocks. Proven Investments gained 64 cents after ending at $33.99 and finishing trading 12,649 shares, Salada Foods dropped 35 cents to close at a 52 weeks’ low of $5 in exchanging 28,295 units and is poised to fall further. Seprod advanced $2.90 to $71, with 8,519 stocks clearing the market.

At the close, Barita Investments declined 70 cents to end at $88.06 with an exchange of 29,688 shares, Berger Paints gained 69 cents after finishing at $12.19 with five stock units crossing the exchange, Caribbean Cement rallied 51 cents to $63.49 with the swapping of 2,645 units. Jamaica Broilers rallied 50 cents to close at $29 in an exchange of 1,908,234 stocks, Jamaica Producers shed 49 cents in closing at $22 with 20,587 shares clearing the market, Jamaica Stock Exchange rose 95 cents in closing at $17.95 after exchanging 2,204 stocks. JMMB Group fell 54 cents to $42.91, with 405,966 stock units changing hands, Massy Holdings advanced 50 cents to close at $91 in trading 44,934 units, Mayberry Investments popped 59 cents to $10.59 after an exchange of 4,056 units. Mayberry Jamaican Equities fell 49 cents to end at $15.50, with 34,029 stock units crossing the market, but only after hitting a record high of $16. MPC Caribbean Clean Energy dropped $4 after ending at $81 in switching ownership of 173 stocks, NCB Financial shed $1.93 to close at $95.07, with 43,592 shares crossing the market. Palace Amusement climbed $136.63 to $890 after exchanging three units, PanJam Investment declined 50 cents in closing at $63.50 while exchanging 3,503 stock units, Portland JSX rose 50 cents to end at $8.50 trading 20 stocks. Proven Investments gained 64 cents after ending at $33.99 and finishing trading 12,649 shares, Salada Foods dropped 35 cents to close at a 52 weeks’ low of $5 in exchanging 28,295 units and is poised to fall further. Seprod advanced $2.90 to $71, with 8,519 stocks clearing the market.  Stanley Motta popped 50 cents in closing at $5.50, with 10,000 stock units crossing the exchange, Supreme Ventures climbed $1.60 to $30.60 after trading 151,914 shares and Sygnus Credit Investments lost 43 cents to $13.52, with 37,100 shares changing hands.

Stanley Motta popped 50 cents in closing at $5.50, with 10,000 stock units crossing the exchange, Supreme Ventures climbed $1.60 to $30.60 after trading 151,914 shares and Sygnus Credit Investments lost 43 cents to $13.52, with 37,100 shares changing hands. The average trade on Monday was 88,777 units at $628,334, down from 165,836 shares at $2,086,009 on Friday and month to date, an average of 165,057 units at $1,534,877, compared to 170,079 units at $1,594,558 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

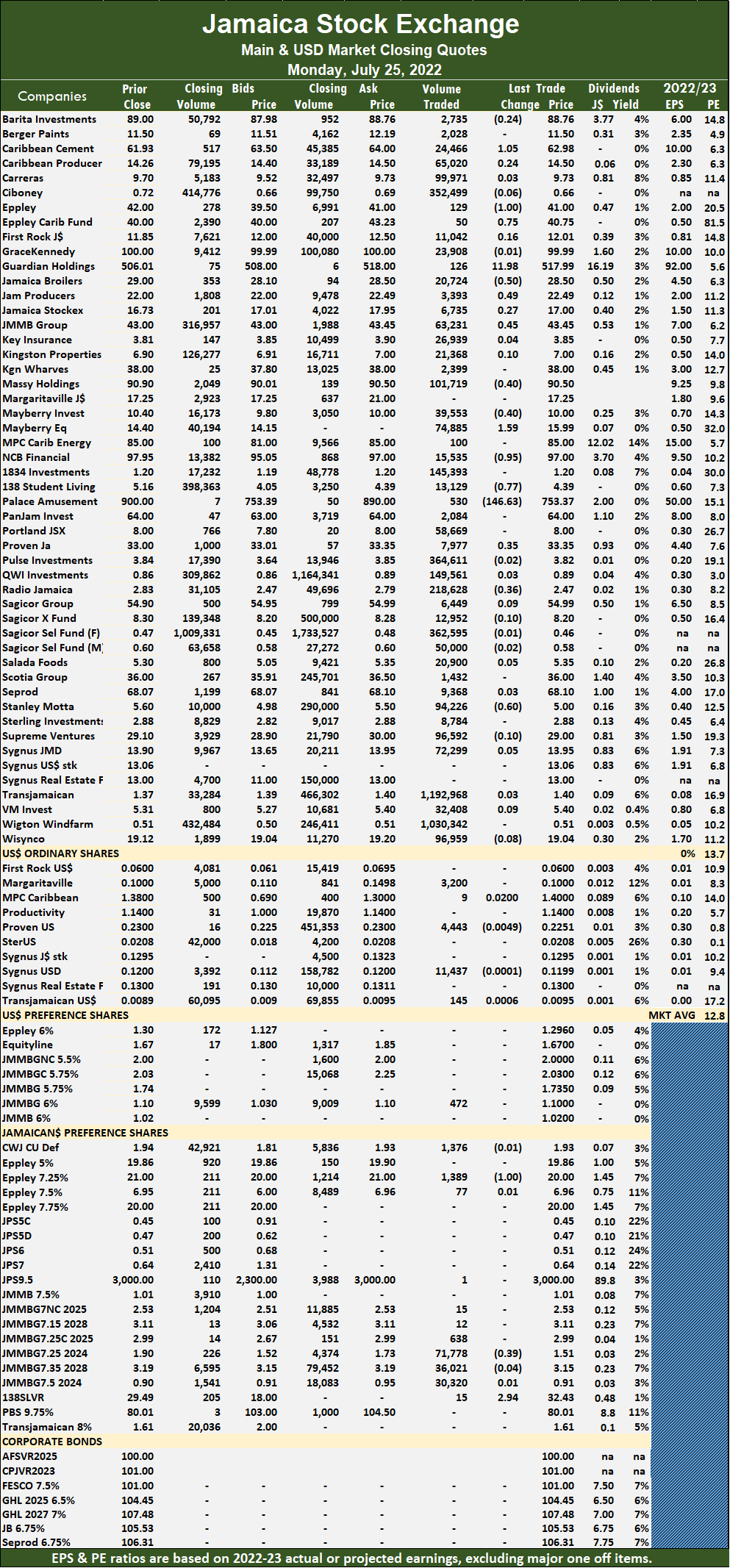

The average trade on Monday was 88,777 units at $628,334, down from 165,836 shares at $2,086,009 on Friday and month to date, an average of 165,057 units at $1,534,877, compared to 170,079 units at $1,594,558 on the previous trading day. June closed with an average of 281,913 units at $5,309,050. At the close, Caribbean Cement gained $1.05 in closing at $62.98 after exchanging 24,466 shares, Eppley dropped $1 to $41, with 129 units clearing the market, Eppley Caribbean Property Fund rallied 75 cents to $40.75 in exchanging 50 stock units. Guardian Holdings jumped $11.98 to close at $517.99 after trading 126 stocks, Jamaica Broilers lost 50 cents to end at $28.50 with an exchange of 20,724 stock units, Jamaica Producers advanced 49 cents to close at $22.49 with the swapping of 3,393 stocks. JMMB Group popped 45 cents to end at $43.45, with 63,231 units crossing the market, Massy Holdings fell 40 cents in ending at $90.50 in exchanging 101,719 shares, Mayberry Investments shed 40 cents to $10, with 39,553 shares crossing the market. Mayberry Jamaican Equities climbed $1.59 in closing at $15.99, with an exchange of 74,885 stock units, NCB Financial declined 95 cents in closing at $97 after exchanging 15,535 stocks, 138 Student Living fell 77 cents to close at $4.39 in switching ownership of 13,129 units. Palace Amusement dived $146.63 to a 52 weeks’ low of $753.37, with 530 units crossing the exchange, Proven Investments increased 35 cents to end at $33.35, with 7,977 stocks changing hands, Radio Jamaica dropped 36 cents to $2.47 in exchanging 218,628 shares and Stanley Motta lost 60 cents to $5 in trading 94,226 stock units.

At the close, Caribbean Cement gained $1.05 in closing at $62.98 after exchanging 24,466 shares, Eppley dropped $1 to $41, with 129 units clearing the market, Eppley Caribbean Property Fund rallied 75 cents to $40.75 in exchanging 50 stock units. Guardian Holdings jumped $11.98 to close at $517.99 after trading 126 stocks, Jamaica Broilers lost 50 cents to end at $28.50 with an exchange of 20,724 stock units, Jamaica Producers advanced 49 cents to close at $22.49 with the swapping of 3,393 stocks. JMMB Group popped 45 cents to end at $43.45, with 63,231 units crossing the market, Massy Holdings fell 40 cents in ending at $90.50 in exchanging 101,719 shares, Mayberry Investments shed 40 cents to $10, with 39,553 shares crossing the market. Mayberry Jamaican Equities climbed $1.59 in closing at $15.99, with an exchange of 74,885 stock units, NCB Financial declined 95 cents in closing at $97 after exchanging 15,535 stocks, 138 Student Living fell 77 cents to close at $4.39 in switching ownership of 13,129 units. Palace Amusement dived $146.63 to a 52 weeks’ low of $753.37, with 530 units crossing the exchange, Proven Investments increased 35 cents to end at $33.35, with 7,977 stocks changing hands, Radio Jamaica dropped 36 cents to $2.47 in exchanging 218,628 shares and Stanley Motta lost 60 cents to $5 in trading 94,226 stock units. In the preference segment, Eppley 7.25% preference share shed $1 to close at $20 in trading 1,389 shares, JMMB Group 7.25% due 2024 preference share lost 39 cents to end at $1.51 in trading 71,778 stock units and 138 Student Living s preference share jumped $2.94 in closing at a record $32.43 while exchanging 15 units, as the price defiles logic with a dividend yield of around three percent at the current price.

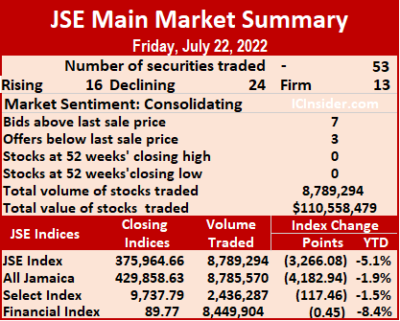

In the preference segment, Eppley 7.25% preference share shed $1 to close at $20 in trading 1,389 shares, JMMB Group 7.25% due 2024 preference share lost 39 cents to end at $1.51 in trading 71,778 stock units and 138 Student Living s preference share jumped $2.94 in closing at a record $32.43 while exchanging 15 units, as the price defiles logic with a dividend yield of around three percent at the current price. The All Jamaican Composite Index shed 4,182.94 points to 429,858.63, the JSE Main Index declined by 3,266.08 points to 375,964.66 and the JSE Financial Index lost 0.45 points to settle at 89.77.

The All Jamaican Composite Index shed 4,182.94 points to 429,858.63, the JSE Main Index declined by 3,266.08 points to 375,964.66 and the JSE Financial Index lost 0.45 points to settle at 89.77. Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and three with lower offers. Proven Investments declined 98 cents in closing at $33, with 6,322 stock units crossing the market, Scotia Group shed $1 to end at $36 after exchanging 35,370 units and Supreme Ventures dropped $2.90 to close at $29.10 crossing the market 865,493 units.

Proven Investments declined 98 cents in closing at $33, with 6,322 stock units crossing the market, Scotia Group shed $1 to end at $36 after exchanging 35,370 units and Supreme Ventures dropped $2.90 to close at $29.10 crossing the market 865,493 units. The average trade for the day was 122,956 units at $1,198,987, in contrast to 137,769 units valued at $1,029,830 on Wednesday. The average volume and value for the month to date amounts to 170,350 units valued at $1,563,101 and previously, an average of 173,592 at $1,588,001. In contrast, June closed with an average of 281,913 units at $5,309,050.

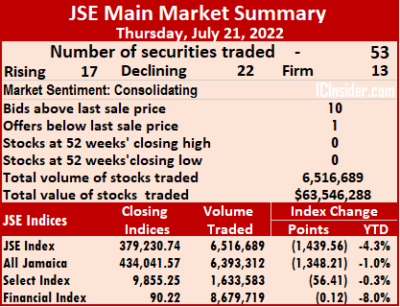

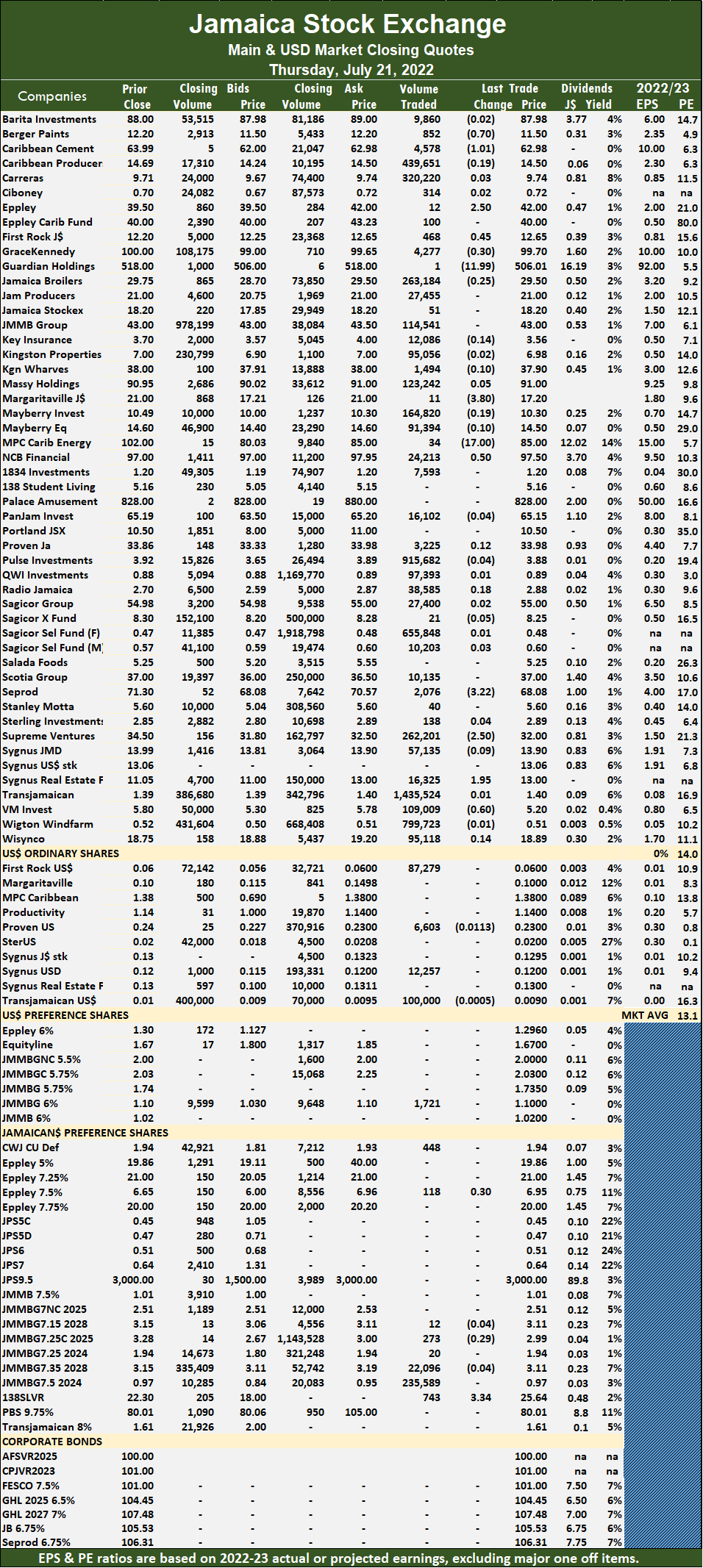

The average trade for the day was 122,956 units at $1,198,987, in contrast to 137,769 units valued at $1,029,830 on Wednesday. The average volume and value for the month to date amounts to 170,350 units valued at $1,563,101 and previously, an average of 173,592 at $1,588,001. In contrast, June closed with an average of 281,913 units at $5,309,050. The average PE ratio of the Main Market ended at 14 based on projected earnings for the current fiscal year.

The average PE ratio of the Main Market ended at 14 based on projected earnings for the current fiscal year. Supreme Ventures shed $2.50 to $$32 in an exchange of 262,201 stocks, Sygnus Real Estate Finance increased $1.95 in closing at $$13 with 16,325 stock units traded, Victoria Mutual Investments shed 60 cents in closing at $$5.20 with the swapping of 109,009 stocks and 138 Student Living preference shares popped $3.34 to end at $$25.64 in an exchange of 743 stock units.

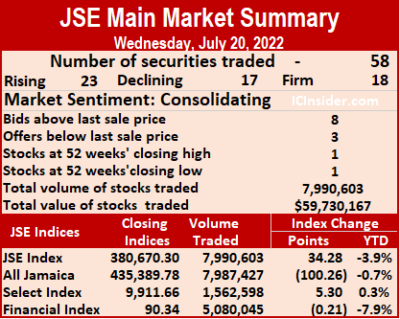

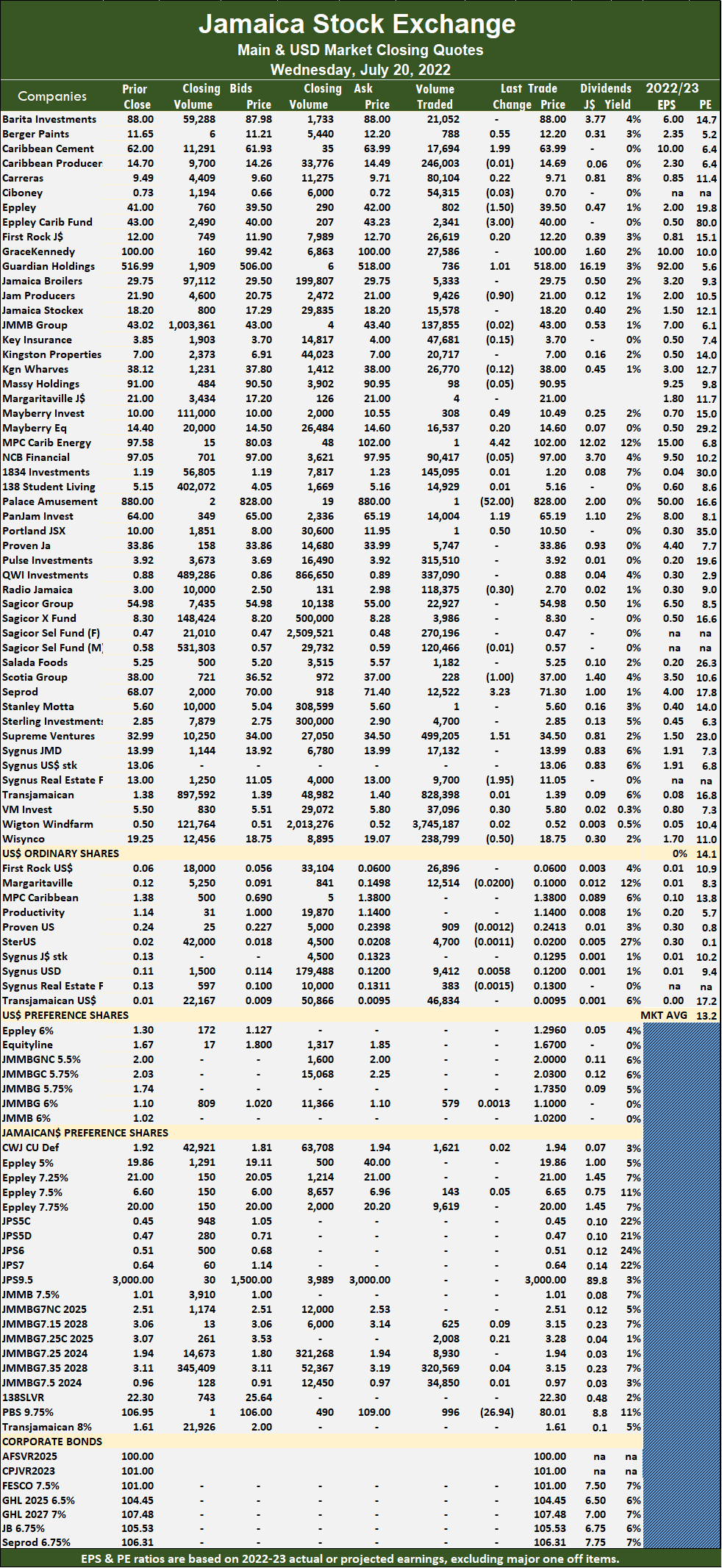

Supreme Ventures shed $2.50 to $$32 in an exchange of 262,201 stocks, Sygnus Real Estate Finance increased $1.95 in closing at $$13 with 16,325 stock units traded, Victoria Mutual Investments shed 60 cents in closing at $$5.20 with the swapping of 109,009 stocks and 138 Student Living preference shares popped $3.34 to end at $$25.64 in an exchange of 743 stock units. Investor’s Choice bid-offer indicator shows eight stocks ended with a bid higher than their last selling prices and three stocks with lower offers.

Investor’s Choice bid-offer indicator shows eight stocks ended with a bid higher than their last selling prices and three stocks with lower offers. Seprod gained $3.23 at $71.30, with 12,522 shares crossing the exchange, Supreme Ventures increased $1.51 to close at a 52 week s’ high of $34.50 with an exchange of 499,205 stock units, Sygnus Real Estate Finance dropped $1.95 in closing at a 52 week s’ low of $11.05, with 9,700 units crossing the market and Wisynco Group declined 50 cents in closing at $18.75 with 238,799 stocks changing hands.

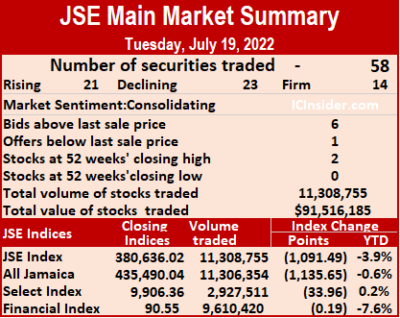

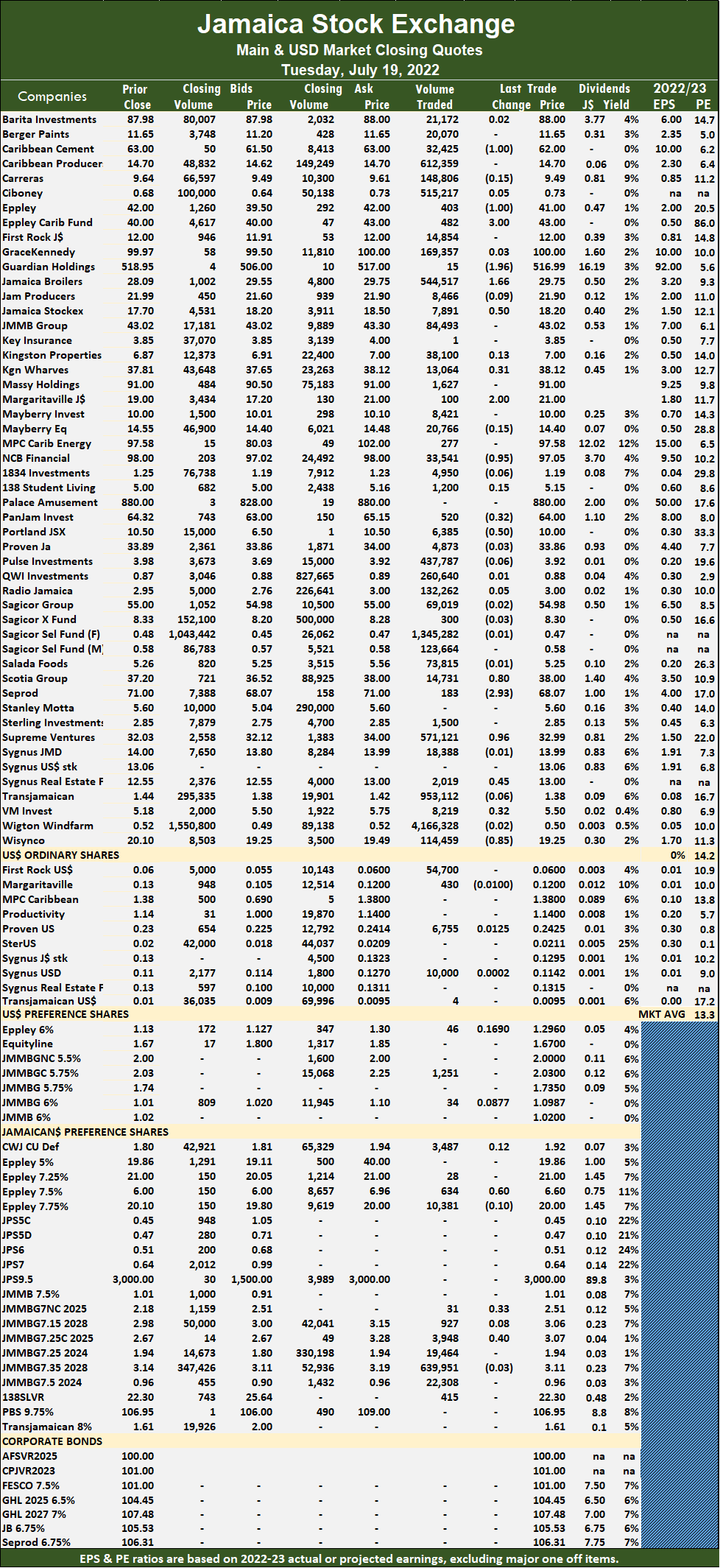

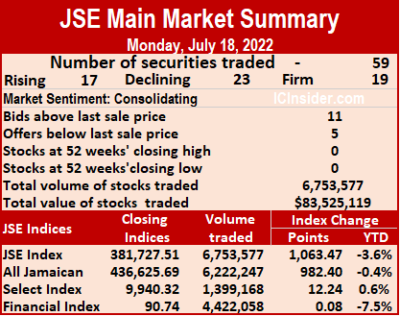

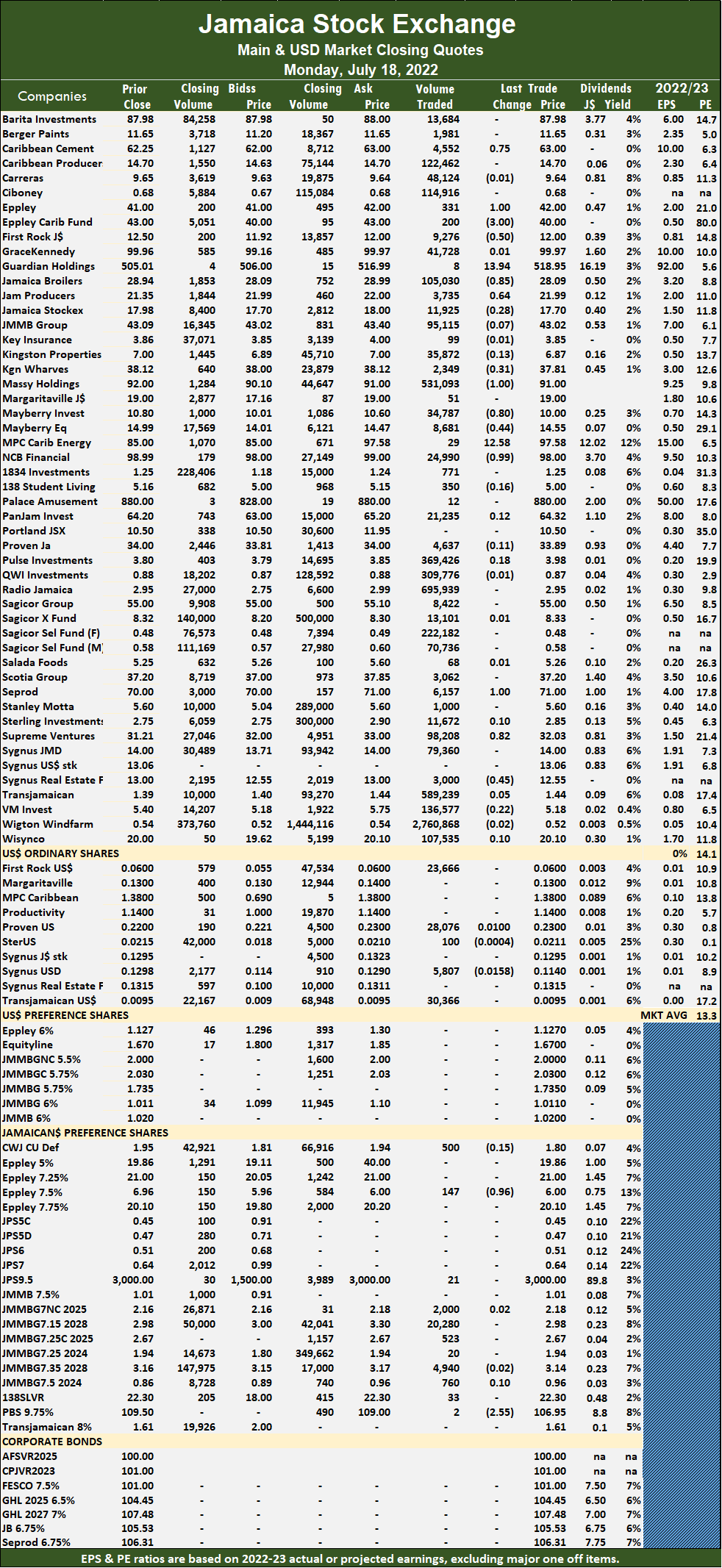

Seprod gained $3.23 at $71.30, with 12,522 shares crossing the exchange, Supreme Ventures increased $1.51 to close at a 52 week s’ high of $34.50 with an exchange of 499,205 stock units, Sygnus Real Estate Finance dropped $1.95 in closing at a 52 week s’ low of $11.05, with 9,700 units crossing the market and Wisynco Group declined 50 cents in closing at $18.75 with 238,799 stocks changing hands. Overall, 11,308,755 shares were traded for $91,516,185 versus 6,753,577 units at $83,525,119 on Monday. Trading averages 194,979 units at $1,577,865, compared to 114,467 shares at $1,415,680 on Monday and month to date, an average of 176,489 units at $1,633,153, versus 174,862 units at $1,638,019 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Overall, 11,308,755 shares were traded for $91,516,185 versus 6,753,577 units at $83,525,119 on Monday. Trading averages 194,979 units at $1,577,865, compared to 114,467 shares at $1,415,680 on Monday and month to date, an average of 176,489 units at $1,633,153, versus 174,862 units at $1,638,019 on the previous trading day. June closed with an average of 281,913 units at $5,309,050. The All Jamaican Composite Index fell 1,135.65 points to 435,490.04, the JSE Main Index shed 1,091.49 points to 380,636.02 and the JSE Financial Index fell 0.19 points to settle at 90.55.

The All Jamaican Composite Index fell 1,135.65 points to 435,490.04, the JSE Main Index shed 1,091.49 points to 380,636.02 and the JSE Financial Index fell 0.19 points to settle at 90.55. Supreme Ventures rose 96 cents to close at a 52 weeks’ closing high at $32.99 with 571,121 shares changing hands after trading at an intraday 52 weeks’ high. Sygnus Real Estate Finance popped 45 cents to close at $13 after trading 2,019 stocks and Wisynco Group dropped 85 cents to finish at $19.25 in an exchange of 114,459 units.

Supreme Ventures rose 96 cents to close at a 52 weeks’ closing high at $32.99 with 571,121 shares changing hands after trading at an intraday 52 weeks’ high. Sygnus Real Estate Finance popped 45 cents to close at $13 after trading 2,019 stocks and Wisynco Group dropped 85 cents to finish at $19.25 in an exchange of 114,459 units. The All Jamaican Composite Index added 982.40 points to 436,625.69, the JSE Main Index rose 1,063.47 to 381,727.51 and the JSE Financial Index popped 0.08 points to 90.74.

The All Jamaican Composite Index added 982.40 points to 436,625.69, the JSE Main Index rose 1,063.47 to 381,727.51 and the JSE Financial Index popped 0.08 points to 90.74. Wigton Windfarm led trading with 2.76 million shares for 40.9 percent of total volume, followed by Radio Jamaica with 695,939 units for 10.3 percent of the day’s trade and Transjamaican Highway with 589,239 units for 8.7 percent market share.

Wigton Windfarm led trading with 2.76 million shares for 40.9 percent of total volume, followed by Radio Jamaica with 695,939 units for 10.3 percent of the day’s trade and Transjamaican Highway with 589,239 units for 8.7 percent market share. NCB Financial shed 99 cents to end at $98 with an exchange of 24,990 shares. Seprod gained $1 in closing at $71 as 6,157 stocks changed hands, Supreme Ventures popped 82 cents to $32.03 after exchanging 98,208 shares and Sygnus Real Estate Finance lost 45 cents in ending at $12.55, with 3,000 units crossing the market.

NCB Financial shed 99 cents to end at $98 with an exchange of 24,990 shares. Seprod gained $1 in closing at $71 as 6,157 stocks changed hands, Supreme Ventures popped 82 cents to $32.03 after exchanging 98,208 shares and Sygnus Real Estate Finance lost 45 cents in ending at $12.55, with 3,000 units crossing the market.