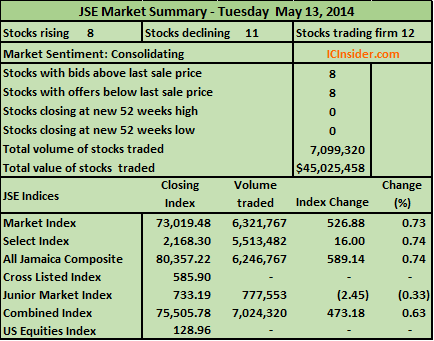

In Tuesday’s trading on the Jamaica Stock Exchange the prices of 8 stocks rose, 11 declined as 31 securities traded resulting in 7,099,320 shares changing hands valued at $45,025,458.

Main Market| Seven (7) companies in the main market rose, 5 declined as the indices moved up with the JSE Market Index gaining 526.88 points to 73,019.48 and the JSE All Jamaican Composite index moving up 589.14 points to close at 80,357.22.

Gains| Stocks recording gains at the end of trading in the main market are Carreras trading 60,623 shares to close with a gain of 75 cents at $34.75, Jamaica Money Market Brokers 5,000 units to close at $7.40 with a 10 cents gain, Radio Jamaica with 4,462 shares to close with a gain of a cent at $1.29, Sagicor Group with 534,732 units to close with a gain of 20 cents at $9.35, Sagicor Real Estate Fund 119,402 shares to close 20 cents higher at $6.50, Scotia Group 357,781 units to close at $19.70 as the price rose by 19 cents and Scotia Investments 9,780 shares to close with a gain of $1.40 at $24.50.

Firm| 7 main market stocks closed without a change in price as Berger Paints with 7,899 shares closed at $1.67, Cable & Wireless with 1,076,240 units closed at 30 cents, Jamaica Broilers 482,878 shares to close at $4.71, Jamaica Money Market Brokers 7.50% preference share 75,000 units and closed at $2, Jamaica Producers 5,201 shares to close at $18.26, Kingston Wharves 8,106 units as the price closed at $5.75 and Mayberry Investments 2,040 shares to close at $1.75.

Declines| The stocks that declined in the main market are Caribbean Cement with 3,036 shares trading while losing 10 cents to end at $3.50, Desnoes & Geddes with 3,002,000 shares in closing at $4.40 for a 9 cents loss, Grace Kennedy 14,320 units to close at $55 with a loss of $1.50, National Commercial Bank 512,600 shares to close at $17.75, down by 35 cents, and Seprod with 40,667 units in closing at $10.75 for a 50 cents decline.

Junior Market| The JSE Junior Market Index declined by 2.45 points to close at 733.19 as 12 stocks traded with 1 advancing and 6 declining.

Gains| Blue Power traded 200,000 shares to close 9 cents higher at $9.10 as was the only junior market stock to rise.

Firm Trades| Stocks in the junior market stocks that traded to close at the same price as the day before are Access Financial with 24,575 units changing hands to close at $11.50, AMG Packaging with 5,558 units at $3.49, Derrimon Trading with 286,000 shares to close at $2.28, Knutsford Express traded 3,020 units to close at $5.17 and Lasco Distributors 41,000 units in closing at $1.35.

Declines| Stocks declining in the junior market at the end of trading are Cargo Handlers with 220 units at $14.31 with a fall of 4 cents, Caribbean Cream with 12,530 units to close with a fall of 7 cents at 72 cents, Caribbean Producers with 32,900 shares to close at $2.99 with an fall of 11 cents, Dolphin Cove 19,700 units at $8.10 for a 10 cents decline, Lasco Manufacturing 128,850 shares to end with a fall of 14 cents at $1 and Medical Disposables with 23,200 units in closing at $2 for a 4 cents fall.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 8 stocks with the bid higher than the last selling price and 8 stocks with offers that were lower.

Main indices up but junior eases

More losses for the market

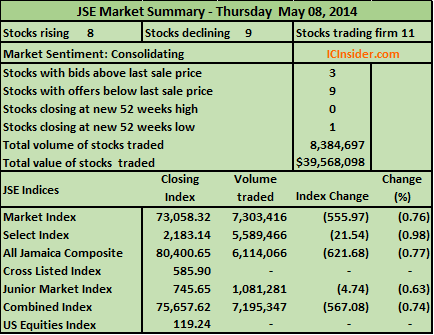

In today’s trading on the Jamaica Stock Exchange the prices of 8 stocks rose and 9 declined as 28 securities traded resulting in 8,384,697 shares trading valued at $39,568,098 but the two main market indices fell a bit to add to the losses on Wednesday. The advance decline ratio at the close was an improvement on Wednesday’s 5 to 9.

Main Market| 6 companies in the main market advanced and 7 declined as the indices moved down with the JSE Market Index shedding 555.97 points to 73,058.32 and the JSE All Jamaican Composite index fell by 621.68 points to close at 80,400.65 just a shade from the low for 2014 of 80,359.75 reached on January 7th.

Main Market| 6 companies in the main market advanced and 7 declined as the indices moved down with the JSE Market Index shedding 555.97 points to 73,058.32 and the JSE All Jamaican Composite index fell by 621.68 points to close at 80,400.65 just a shade from the low for 2014 of 80,359.75 reached on January 7th.

Gains| Stocks recording gains at the end of trading in the main market are Carreras that gained 8 cents to close at $33.65 with only 1,000 units changing hands, Desnoes & Geddes trading 72,966 shares to close with a gain of 20 cents at $4.30, Jamaica Money Market Brokers 73,808 ordinary shares to close at $7.30 with 3 cents gain, Jamaica Money Market Brokers 8.50% preference share 72,000 units to close up a cent at $3.51, Sagicor Group with 415,594 shares to close at $9.10 up by 20 cents and Seprod with 968 units to close at $11 with a 20 cents gain.

Firm| There were 7 stocks in the main market to close without a change in price, with Gleaner trading 548,887 shares in closing at $1.10, Jamaica Broilers with 1,030,997 shares and closed at $4.85, Jamaica Money Market Brokers 8.75% preference share with 1,104,250 units and closed at $3.03, Mayberry Investments 20,560 shares as the price closed at $1.71, Proven Investments 8% preference share, 13,100 units to end at $5.09, Radio Jamaica 10,000 shares and closed at $1.28 and Scotia Investments with 18,790 units and closed at $23.10.

Declines| The number of stocks that declined in the main market are Cable & Wireless with 2,869,910 shares in losing 5 cents to end at 35 cents, Caribbean Cement with 71,784 shares to end at $3.50 with a 50 cents fall, Grace Kennedy 51,906 shares while closing at $56, down by 50 cents, National Commercial Bank 33,961 units as the price ended at $18 with a loss of 50 cents, Pan Jamaican Investment 4,000 units, closing at $48.50 for a fall of a cent, Sagicor Real Estate Fund traded 3,464 units at $6 as it shed 50 cents and Scotia Group with 885,471 shares in closing at $20.06 for a 49 cents drop.

Junior Market| The JSE Junior Market Index declined by only 4.74 points to close at 745.65 as 8 stocks traded with 2 advancing and 2 declining.

Gains| Stocks recording gains at the end of trading in the junior market are Caribbean Producers trading 456,206 units to close at $3.10, up 10 cents and Lasco Distributors with 424,000 shares to close at $1.35 with a gain of 5 cents.

Firm Trades| Stocks in the junior market that traded to close at the same price as the day before are Access Financial with 6,000 units and closed at $11.50, Blue Power 4,000 units and closed at $9.01, General Accident Insurance 53,068 units, closing at $1.50 and Lasco Manufacturing with 77,934 shares as the price closed at $1.20.

Declines| Stocks declining in the junior market at the end of trading are Lasco Financial with 21,800 units at $1.25, down by 5 cents and Paramount Trading in trading 38,273 shares, landed at a 52 weeks low of $2.68 with a decline of 23 cents.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had only 3 stocks with the bid higher than the last selling price and 9 stocks with offers that were lower, continuing to indicate a negative market sentiment.

JSE Market gives up much ground

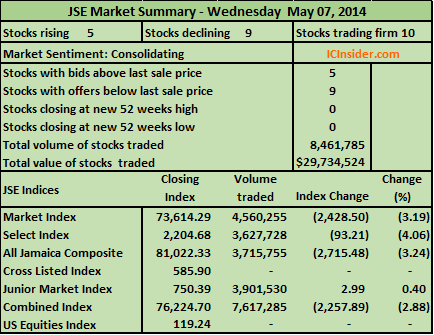

In Wednesday’s trading on the Jamaica Stock Exchange the market slipped more than it gained on Tuesday as big capitalisation stocks, Desnoes & Geddes, Sagicor Group and Cable & Wireless slipped in value with the prices of 5 stocks rising and 9 declining as 24 securities traded resulting in 8,461,785 shares changing hands valued at $29,734,524. At the close market sentiment was reflecting continued negative movements for a while.

Main Market| Only 4 companies in the main market advanced and 8 declined as the indices plummeted with the JSE Market Index dropping by 2,428.50 points to 73,614.29 and the JSE All Jamaican Composite index shedding 2,715.48 points to close at 81,022.33.

Main Market| Only 4 companies in the main market advanced and 8 declined as the indices plummeted with the JSE Market Index dropping by 2,428.50 points to 73,614.29 and the JSE All Jamaican Composite index shedding 2,715.48 points to close at 81,022.33.

Gains| Stocks recording gains at the end of trading in the main market are Hardware & Lumber trading 64,500 shares to close with a gain of $1.30 cents at $11.80, National Commercial Bank with 7,976 units changing hands to close at $18.50and gained 40 cents, Caribbean Cement with 84,939 shares to close at $4, with an increase of 10 cents and Scotia Group only 500 shares to close at $20.55 for a 5 cents gain.

Firm| There were only 6 stocks in the main market to close without a price change as Jamaica Broilers with 22,080 shares closed at $4.85, Jamaica Money Market Brokers 8.50% preference share traded 10,000 units and closed at $3.50, Jamaica Money Market Brokers 8.75% preference share closed at $3.03 while exchanging 221,600 shares, Proven Investments 8% preference share traded 612,900 units at $5.09 followed by Seprod with 171,083 units at $10.80 and Supreme Ventures with 17,000 units to close at $2.10.

Declines| On a day when declining stocks overwhelmed advancing ones, the number of stocks that declined in the main market are Cable & Wireless with 1,903,766 shares as investors tried to get out of the stock as it the closed at 40 cents having slipped by 4 cents, Desnoes & Geddes with 697,860 shares while losing 40 cents to end at $4.10, Gleaner with 8,000 shares to close 5 cents lower at $1.10, Grace Kennedy 40,258 units in closing at $56.50 as the price slipped a cent, Pan Jamaican Investment with 97,716 shares in closing at $48.51 down by 54 cents, Radio Jamaica 24,000 units traded to close 4 cents lower at $1.28 and Sagicor Group with 576,077 shares closed at $8.90 with the fall of 13 cents.

Junior Market| The JSE Junior Market Index declined by 2.99 points to close at 750.39 as 7 stocks traded with only one advancing and 2 declining.

Gains| Lasco Financial traded 41,000 units to close at $1.30, up 10 cents, was the only stock with a gain at the end of trading in the junior market.

Firm Trades| 4 stocks in the junior market traded to close at the same price as the day before with Caribbean Flavours trading 11,121 units at $2.70, Caribbean Producers 121,513 shares to end at $3, Consolidated Bakeries 40,000 units in ending at $1.10 and Lasco Manufacturing with 1,066,000 shares to end at $1.20.

Declines| Stocks declining in the junior market at the end of trading are Dolphin Cove trading 222,681 units at $8.20 for a 3 cents fall and Lasco Distributors 2,399,215 shares at $1.30 down 5 cents.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator flashed negative sentiment showing 5 stocks with the bid higher than the last selling price and 9 stocks with offers that were lower.

JSE Market gains 2,000 points

Scotia Group traded as high as $22.89 before closing at $20.50 and was the main factor in the big jump in the Jamaica Stock Exchange two main indices while the prices of 9 stocks rose and 8 declined as 27 securities traded resulting in 5,724,168 shares trading valued at $32,909,845.

Main Market| The prices of 5 companies in the main market advanced and 6 declined as the indices jumped as the JSE Market Index gained 2,054.10 points to 76,042.79 and the JSE All Jamaican Composite index jumped by 2,296.84 points to close at 83,737.81.

Main Market| The prices of 5 companies in the main market advanced and 6 declined as the indices jumped as the JSE Market Index gained 2,054.10 points to 76,042.79 and the JSE All Jamaican Composite index jumped by 2,296.84 points to close at 83,737.81.

Gains| Stocks recording gains at the end of trading in the main market are Cable & Wireless with 1,290,256 units to close with a 2 cents gain at 44 cents, Carreras traded 3,594 shares to close with a gain of a cent at $33.57, Gleaner gained 5 cents to close at $1.15 with 20,000 units changing hands, Jamaica Money Market Brokers 1,494 units to close at $7.27 up by 5 cents and Supreme Ventures with 79,975 shares to close with a gain of 5 cents at $2.10.

Firm| There were 6 stocks in the main market to close without a change in price with Desnoes & Geddes trading 1,064 shares and closed at $4.50, Jamaica Broilers 715,645 units and closed at $4.85, Jamaica Money Market Brokers 8.75% preference share, 654,081 units to close at $3.03, Jamaica Producers 96,627 units at $18.26, Mayberry Investments 2,040 shares in closing at $1.70 and Scotia Group 868,539 shares to close at $20.50 but traded as high as $22.98.

Declines| The number of stocks that declined in the main market are Berger Paints with 10,000 units in losing a cent to end at $1.67, Caribbean Cement with 25,899 shares to close at $3.90 by falling by a cent, Hardware & Lumber 36,100 shares to close at $10.50 for a $1.20 fall, National Commercial Bank 57,933 shares to close at $18.10 for a 20 drop, Pan Jamaican Investment 2,400 units to end 23 cents lower at $49.05 and Sagicor Group with 23,157 shares in closing at $9.03 for a 47 cents fall.

Junior Market| The JSE Junior Market Index declined by 6.86 points to close at 747.40 as 10 stocks traded with 4 advancing and 2 declining.

Gains| Stocks recording gains at the end of trading in the junior market are Dolphin Cove that traded 1,000 units to close at $8.23 with a gain of 3 cents, Medical Disposables 391,382 shares to close with a one cent gain at $2.05, Jamaican Teas up 29 cents to end at $3.50 for 49,470 shares and Lasco Manufacturing traded 1,035,268 units to close up a cent at $1.20.

Firm Trades| 4 stocks in the junior market that traded to close at the same price as the day before with Access Financial Services trading 4,044 units at $11.50, Caribbean Producers with 200,000 units to close at $3, Consolidated Bakeries 108,000 to close at $1.10 and Lasco Financial Services 31,200 shares at $1.20.

Declines| Stocks declining in the junior market at the end of trading are General Accident that traded 7,000 units at $1.50 as the price lost 10 cents and Lasco Distributors with 8,000 units, closed 5 cents lower at $1.35.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had only 3 stocks with the bid higher than the last selling price and 8 stocks with offers that were lower.

Very moderate market movement

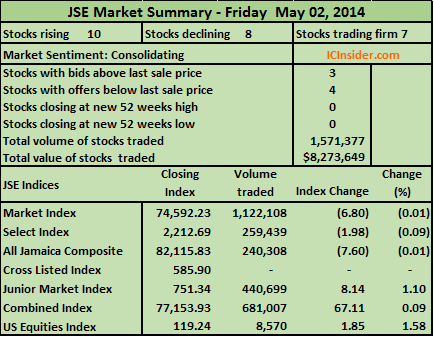

There was very moderate activity on the Jamaica Stock Exchange at the close of the trading week as the prices of 10 stocks rose and 8 declined as only 25 securities traded in a very slow market session resulting in 1,571,377 shares trading valued at a mere $8,273,649.

Main Market| Six companies in the main and US dollar markets advanced and 6 declined as the indices moved down moderately with the JSE Market Index inching down by 6.80 points to 74,592.23 and the JSE All Jamaican Composite index shedding just 7.60 points to close at 82,115.83.

Main Market| Six companies in the main and US dollar markets advanced and 6 declined as the indices moved down moderately with the JSE Market Index inching down by 6.80 points to 74,592.23 and the JSE All Jamaican Composite index shedding just 7.60 points to close at 82,115.83.

Gains| Stocks recording gains at the end of trading in the main market are Kingston Wharves with 9,534 shares to close with a gain of 48 cents at $5.99, National Commercial Bank gained 10 cents to close at $18.10 with 9,100 units changing hands, Proven Investments ordinary share, with 8,570 units to close up 0.02 us cents at 18 US cents, Sagicor Group 18,000 units closing at $9.80 for a 30 cents gain, Salada Foods 5,000 shares to close at $8 as the price gained 50 cents and Scotia Investments with only 700 shares to end at $23.10 for a gain of 10 cents.

Firm| There were only 4 stocks in the main market to close without a change in price as Cable & Wireless with 43,699 shares closed at 40 cents, Carreras with 5,000 units closed at $33.56, Jamaica Money Market Brokers 7.50% preference share traded 500,000 and closed at $2 and Proven Investments 8% preference share with 381,800 units closed at $5.07.

Declines| The stocks declining in the main market are Gleaner with 2,500 shares while falling a cent to close at $1.10, Grace Kennedy lost $1.49 to end at $56.51 with 1,600 shares, Jamaica Broilers exchanged 20,538 units to close down a cent at $4.85. Pan Jamaican Investment 10,529 shares to end 55 cents lower at $49.05, Scotia Group had 110,308 units at $20.50 at the close as the price shed 12 cents and Supreme Ventures 3,800 shares to close with a 5 cents decline at $2.05.

Junior Market| The JSE Junior Market Index declined by 8.14 points to close at 751.34 as 9 stocks traded with 4 advancing and only 2 declining.

Gains| Stocks recording gains at the end of trading in the junior market are AMG Packaging that traded 5,560 units to close at $3.50, up by a cent, Access Financial with 72,600 units to close at $11.50 with a gain of $1.50, Caribbean Cream 3,000 units to close at 79 cents with a 4 cents increase and Caribbean Producers with 90,000 units in closing at $3, up 2 cents.

Firm Trades| The 3 stocks in the junior market traded to close at the same price as the day before are Blue Power with 3,400 shares in closing at $9.01, Lasco Financial 3,000 shares while closing at $1.20 and Medical Disposables 94,700 units, closing at $2.04.

Declines| Stocks declining in the junior market at the end of trading are General Accident with 2,000 units a $1.60, down 10 cents and Lasco Manufacturing with 166,439 shares to end down by 10 cents at $1.10.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 3 stocks with the bid higher than the last selling price and 4 stocks with offers that were lower.

Market directionless

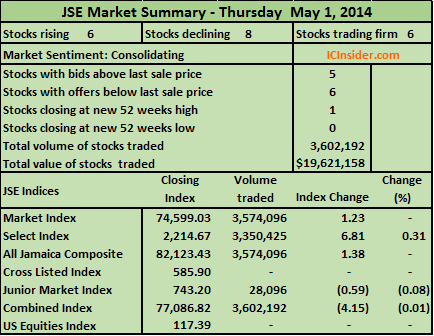

In Thursday’s trading on the Jamaica Stock Exchange, the market was directionless with advancing stocks numbering just below declining ones and the IC market indicator showing investors in a tussle over the immediate future direction of the market. Prices of 6 stocks rose and 8 declined as 20 securities traded resulting in 3,602,192 shares changing hands valued at $19,621,158 in another lacklustre session.

Main Market| All advancing shares in the market was in the main market and all but one stock that declined was also in this market, but the indices moved up slightly, with the JSE Market Index inching up by just 1.23 points to 74,599.03 and the JSE All Jamaican Composite index edging up by only 1.38 points to close at 82,123.43.

Main Market| All advancing shares in the market was in the main market and all but one stock that declined was also in this market, but the indices moved up slightly, with the JSE Market Index inching up by just 1.23 points to 74,599.03 and the JSE All Jamaican Composite index edging up by only 1.38 points to close at 82,123.43.

Gains| Stocks recording gains at the end of trading in the main market are Berger Paints trading 89,657 unitss to close with a gain of a cent at $1.68, Caribbean Cement gained 21 cents to close at $3.91 with 20,500 units changing hands, Carreras traded 443 shares to close 6 cents higher at $33.56, Ciboney with 50,000 shares by increasing by a cent to close at 12 cents for a new 52 weeks high, Grace Kennedy 7,439 shares with a gain of $1 to close at $58 and Jamaica Money Market Brokers with 451,214 ordinary shares to close up by 4 cents at $7.24.

Firm| There were only 5 stocks in the main market to close without a change in price as Gleaner with 228,484 shares closed at $1.10, Hardware & Lumber traded 3,300 units and closed at $11.70, Mayberry Investments with 3,060 units closed at $1.70, Scotia Group had 59,888 units changing hands to close at $20.62 and Seprod traded 685 shares in closing at $10.84.

Declines| The number of stocks that declined in the main market are Cable & Wireless with 1,500,888 units while losing a cent to end at 40 cents, Desnoes & Geddes with 76,472 shares to end at $4.30 as the price lost 30 cents, Jamaica Broilers with 450,872 shares to close at $4.86, down 4 cents, Jamaica Producers that traded 6,600 units to close at $18.26 while losing 4 cents, National Commercial Bank 571,665 shares as the price closed with a 10 cents lost, at $18, Sagicor Group had 50,529 units changing hands to close with a fall of 71 cents to $9.50 and Salada Foods 2,400 shares to close 45 cents lower, to end at $7.50

Junior Market| The JSE Junior Market Index declined by 0.59 points to close at 743.20 as only 2 junior market stocks traded at the end of the trading session.

Gains| No stock gained at the end of trading in the junior market.

Firm Trades| Lasco Manufacturing was the only stock in the junior market that traded to close at the same price as the previous trading day with 27,096 units to end at $1.20.

Declines| Caribbean Producers was the only stock declining in the junior market at the end of trading as the price fell 9 cents to close at $2.91 as it traded a mere 1,000 units.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 5 stocks with the bid higher than the last selling price and 6 stocks with offers that were lower.

Caribbean Producers results pushes stock

Investors were evidently impressed with the results of Caribbean Producers Jamaica (CPJ) for the half year to December 2013 and pushed the stock price up to $3 on Thursday, February 13th, the first trading day after the release.

The company released second quarter results to December showing profits up by 202 percent to US$1.624 million for the six months and 65 percent for the December quarter to US$1.18 million from US$711,712 in 2012. Earnings per share for the six months amounted to US$0.148 cents.

Sales revenues rose by 24 percent for the December quarter and 22 percent year to December hitting US$37.5 million for the 6 months and US$20.46 for the quarter. Gross profit margins came out at 41 percent for the quarter and 42.4 percent year to December. In the prior year, the margins were 42 percent for the quarter and 39.8 percent for the six months period.

Expenses up | Selling and administrative expenses are up 16.4 percent in the December quarter and 18.2 percent for the six months, while finance cost rose by 19 percent in the latest quarter and 14.4 percent for the year to December. Depreciation charge also rose sharply due mainly to their expansion into meat and juice processing.

Expenses up | Selling and administrative expenses are up 16.4 percent in the December quarter and 18.2 percent for the six months, while finance cost rose by 19 percent in the latest quarter and 14.4 percent for the year to December. Depreciation charge also rose sharply due mainly to their expansion into meat and juice processing.

CPJ’s performance for the next quarter should push profits up quite sharply as historically the March quarter generates the highest amount of sales and profit during the peak winter tourist season. IC Insider has forecast earnings for the full year at 70 cents Jamaican and J$1.35 for 2015 fiscal year.

Finances | The company is still not comfortably funded with borrowed funds of US$25 million at an elevated level and in excess of equity of just US$14.7 million. Short term loans are at $11 million, well in excess of the annual cash flow of approximately US$9 million.

Caribbean Producers is an IC Insider Buy Rated stock.

Related posts | D&G, Carreras & C&WJ now Buy Rated | Caribbean Producers’ impressive profit | CPJ’s new St Lucia venture

CPJ’s new St Lucia venture

The Board of Directors of Caribbean Producers Jamaica advises that the company signed a Shareholders’ Agreement on February 4th, 2014 to form a joint venture with the Du Boulay Bottling Company, the Coca Cola manufacturer operating in Castries, St. Lucia.

The new company will be called CPJ St Lucia Limited and commences operations as a foodservice distributor in Castries, St. Lucia in the near future. Caribbean Producers will retain controlling interest of this company.

Caribbean Producers Jamaica is an IC Insider’s Buy Rated Stock. Click here for the full list of recommended stocks to purchase.

Related posts | CPJ’s big jump in profits | New additions to Buy Rated list