Jamaica’s remittances inflows slowed from the torrid pace experienced between May, last year to May this year, with an increase in June and July of 10 percent each over the record levels of 2020 with increases of 42 percent and 37 percent respectively in 2020 over 2019 and bringing the year to date growth to 30.4 percent, down from 42 percent to May this year.

Jamaica’s remittances inflows slowed from the torrid pace experienced between May, last year to May this year, with an increase in June and July of 10 percent each over the record levels of 2020 with increases of 42 percent and 37 percent respectively in 2020 over 2019 and bringing the year to date growth to 30.4 percent, down from 42 percent to May this year.

According to a release from Jamaica’s Central Bank, June enjoyed inflows of US$303 million versus US$275 million last year and July US$324 million, up from US$293 million in 2020. For the year to July, the country has garnered US$2 billion up from US$1.56 billion for the same period in 2020. Remittances appear on track to hit US$3.5 billion by the end of the year if the recent trend continues which would be US$600 million than last year and US$1.1 billion over 2019.

Remittances slow from torrid pace

Remittances surged 65%

Remittances into Jamaica surged a massive 65 percent in March, this year over the inflows for the same month in 2020 and probably the strongest monthly rise on record. Inflows saw US$328 million flowing into the financial system compared to just US$199 in 2020.

Jamaica’s Central Bank

The highest growth in 202 was June with an increase of 42 percent and inflows of US$275 million, while December with US$301 million was the only month that saw inflows reaching the US$300 million mark after it increased 35 percent over the prior year’s period.

For the year to date, inflows are up 42 percent over 2020, with increases of 33 percent in January and 27 percent for February. The development for the first quarter indicates that the country is on target to exceed US$3 billion in one year, for the first time, in 2021, with 2020 reaching a record US$2.9 billion. The trend suggests that 2021 is on track to reach or exceed US$3.4 billion.

BOJ’s new website

Visitors to Bank of Jamaica’s website will be greeted by a spanking new look that is completely different from the former site.

Visitors to Bank of Jamaica’s website will be greeted by a spanking new look that is completely different from the former site.

A brief look and navigation of the site appear to make it easier to navigate the new one compared to the former, with certain information that appears easier to find. The format for some of the information also looks different and, in cases, more appealing form than the previous ones.

World Bank and CDB funds swell NIR

Net International Reserves surged 10 percent in March with a rise of US$303 to US$3.32 billion from US$3.016 billion at the end of February this year.

The buildup comes against a huge selloff of US dollars by dealers in the market between January and March, but the bulk of the increase did not come from normal inflows, information provided to this publication by Bank of Jamaica (BOJ) indicates. BOJ, in response to ICInsider.com enquiry as to the source for the increase, states “the growth of approximately US$303 million in the NIR for the month of March 2021 was mainly influenced by government-related receipts of approximately US$217 million; of which, US$175 million represented multilateral loan inflows from the World Bank and the CDB. The remainder of the inflows were received from authorised dealers and Cambios, under the Bank’s Surrender Arrangement.”

The buildup comes against a huge selloff of US dollars by dealers in the market between January and March, but the bulk of the increase did not come from normal inflows, information provided to this publication by Bank of Jamaica (BOJ) indicates. BOJ, in response to ICInsider.com enquiry as to the source for the increase, states “the growth of approximately US$303 million in the NIR for the month of March 2021 was mainly influenced by government-related receipts of approximately US$217 million; of which, US$175 million represented multilateral loan inflows from the World Bank and the CDB. The remainder of the inflows were received from authorised dealers and Cambios, under the Bank’s Surrender Arrangement.”

Estimated Reserves represents 53.65 weeks of Goods Imports and 38.71 weeks of Goods & Services Imports. At the end of December, the reserves were $3.13 billion but fell by $148 million in January to $2.98 billion and then increased by marginally to the close of February.

Bank of Jamaica sees contraction & growth

Bank of Jamaica is forecasting a contraction in the economy in the range of 10 to 12 percent in 2020/21 fiscal year before partially recovering with growth in the range of 4 to 8 percent in the 2022 fiscal year to March.

BOJ interest holds overnight rate.

“A projected decline in real GDP for the March 2021 quarter is expected to be mainly reflected in Hotels & Restaurants, Transport, Storage & Communication and Other Services,” the central bank states. “The overall decline for the quarter, which is expected to be smaller than the contractions of the previous three quarters, is largely based on the adverse, albeit receding, impact of the global COVID-19 pandemic on travel and entertainment activities,” the bank’s release stated. The Bank’s current assessment suggests that the risks to the GDP forecast are balanced.

Monetary Policy

“While the impact of the Covid-19 virus has recently led to an increase in the stringency of measures in Jamaica to control its spread, there remains optimism about future GDP growth as vaccination programmes have commenced both locally and globally. Bank of Jamaica has maintained an accommodative monetary policy stance aimed at supporting a speedy economic recovery once this crisis passes. Bank of Jamaica remains committed to ensuring that inflation remains low and stable, within its target and, at the same time, is prepared to take all necessary actions to ensure that Jamaica’s financial system remains sound”, the release went on to state.

“The Bank intends to maintain this monetary policy stance until there are clear signs that economic activity in Jamaica is returning to pre-COVID-19 levels.” Against this background, the central bank has held the policy rate at the historic low level of 0.50 percent based on its assessment that inflation will generally continue to remain within the target of 4 to 6 percent over the next two years. The bank’s accommodative monetary policy posture is also aimed at supporting a recovery in economic activity in Jamaica, a release from the bank states.

Jamaica’s NIR continues to rise

Net International Reserves (NIR) US$69 to close out November at US$2,963 up from US$2,893 in October. Jamaica’s NIR had a big jump of US$146 million in October from US$2.75 billion at the end of September.

Net International Reserves (NIR) US$69 to close out November at US$2,963 up from US$2,893 in October. Jamaica’s NIR had a big jump of US$146 million in October from US$2.75 billion at the end of September.

Gross reserves rose by $73 million to $3.93 billion that includes US$970 million due to the International Monetary Fund. The October increase was the first major rise in net reserves for 2020. In March, the NIR rose to US$3.24 billion from US$3.13 billion, slipped to US$2.9 billion in May and ended July at a low of US$2.76 billion. The NIR now represents 38 weeks of goods and service imports, the Central Bank states.

Jamaica’s NIR jumps US$146m

Jamaica’s Net International Reserves jumped US$146 million in October to reach US$2.89 billion. The net reserves balance is coming from US$2.75 billion at the end of September.

Gross reserves rose by $146 million to $3.86 billion, including US$966 million due to the International Monetary Fund. The October increase is the first major rise in net reserves for 2020. In March, the NIR rose to US$3.24 billion from US$3.13 billion. By May, it slipped to US$2.9 billion and ended July at US$2.76 billion.

Gross reserves rose by $146 million to $3.86 billion, including US$966 million due to the International Monetary Fund. The October increase is the first major rise in net reserves for 2020. In March, the NIR rose to US$3.24 billion from US$3.13 billion. By May, it slipped to US$2.9 billion and ended July at US$2.76 billion.

The improvement in the NIR comes against the background of foreign exchange Canbio dealers buying US$424 million from the public and selling $373 million in October as Authorized Dealers bought US$628 million and sold $668 million. Cambios and Authorized Dealers must surrender around 10 percent of all foreign exchange funds purchased to the central bank.

Jamaica GDP set to gain in 2020

Economic growth for Jamaica is expected to remain positive in 2020 following increases in 2019, even as the closure of Alpart acts as a drag on the economic growth rate in the first half of the year.

Jamaica will see steady growth with improvements in several areas during the year, with increased output for manufacturing, tourism, finances and other service sectors such as BPO and entertainment. The continuation of major road construction projects and many new buildings going up in the country will also aid the continuation of economic growth during the year.

Jamaica will see steady growth with improvements in several areas during the year, with increased output for manufacturing, tourism, finances and other service sectors such as BPO and entertainment. The continuation of major road construction projects and many new buildings going up in the country will also aid the continuation of economic growth during the year.

Growth in stopover arrivals bounced to 7.6 percent in the December quarter up from a slightly slower summer months with gains of 4.5 percent, 2019 finished with an overall increase of 6.5 percent in stopover arrivals and bettered the 4.6 percent increase in 2018 over 2017. The increase in 2019 suggests a very strong demand for the Jamaican product. Increased demand for the product provides room for greater revenues per room as hotels do not have to do a deep discount of rates as they did in the early part of the last decade. The sector should continue to grow around 7 to 10 percent for the coming year and bring in addition inflows around US$400 million over 2020. It could do even more with the strong demand for rooms that could see hotels getting average rates that are higher than in 2019.

Concerns regarding the coronavirus are worth watching. If the spread in the west is more broad-based than it currently the case, it could negatively affect visitor arrival numbers to Jamaica.

Data out of Statin indicates a 4.9 percent increased output in the manufacturing sector for the September quarter, helped by gains in PetroJam production. That is faster than the July quarter, with growth of 3.2 percent and the first quarter growth with negative 1.3 percent following a 2.4 percent increase in the December 2018 quarter. The trend is positive for the manufacturing sector and augurs well for a good increase in 2020. Continued growth in loan financing and increasing interest of companies seeking fresh long-term capital through the capital market are big positives for the business sector in 2020 and beyond. The Manufacturing sector’s use of borrowed funds, excluding cement, was consistent with 20 percent increased borrowing in 2019 and 2018.

Data out of Statin indicates a 4.9 percent increased output in the manufacturing sector for the September quarter, helped by gains in PetroJam production. That is faster than the July quarter, with growth of 3.2 percent and the first quarter growth with negative 1.3 percent following a 2.4 percent increase in the December 2018 quarter. The trend is positive for the manufacturing sector and augurs well for a good increase in 2020. Continued growth in loan financing and increasing interest of companies seeking fresh long-term capital through the capital market are big positives for the business sector in 2020 and beyond. The Manufacturing sector’s use of borrowed funds, excluding cement, was consistent with 20 percent increased borrowing in 2019 and 2018.

An important thrust in Jamaica’s economic development is the increasing number of companies raising long-term capital and listing on the Jamaica Stock Exchange. Increased long-term capital is an important move in getting greater productivity and production of goods and services out of local businesses that will help greater economic growth in the current year and beyond. Increased listings provide investors with viable opportunities to invest capital long term and be an integral part of the wealth creation in society. During 2019, there were several new listings on the Jamaica Stock Exchange. The exchange is forecasting 20 new listings in 2020 based on information provided by stockbrokers. The country will see the majority of companies seeking to list, raising fresh capital for business upgrading and expansion.

Growth in the construction sector will pick up, with the start of the Kingston to Port Antonio road construction and demand continues in the BPO sector that will stimulate the need for more space while adding to employment. Data out of the Bank of Jamaica shows a sharp rise in lending to the sector with an increase of 37 percent over the amount lent in 2018 and well ahead of the 27 increase in 2018 over 2017. The increase in 2019 suggests a further rise in growth in the sector, which should continue into 2020.

Growth in the construction sector will pick up, with the start of the Kingston to Port Antonio road construction and demand continues in the BPO sector that will stimulate the need for more space while adding to employment. Data out of the Bank of Jamaica shows a sharp rise in lending to the sector with an increase of 37 percent over the amount lent in 2018 and well ahead of the 27 increase in 2018 over 2017. The increase in 2019 suggests a further rise in growth in the sector, which should continue into 2020.

The new Old Harbor power plant commenced operation on December 17 and uses natural gas that is much more efficient than the oil-powered plant that was 50 years old and was highly inefficient. The South Jamaica Power Centre plant will provide a more reliable and efficient source of electricity and will result in fewer power disruptions and lower electricity cost as the new plant will use less fuel, fewer workers and requires lower maintenance than the old one, that will be closed in early 2020. With capital expenditure of US$300 million, some of the lower operating costs will be eaten up by interest and depreciation costs. JPS quarterly financial gave a glimpse of what to expect from the switch over with a 10 percent drop in fuel cost for the quarter even as the official switch over took place in mid-December.

The Foreign exchange market went through a number of changes as the central bank reduced the compulsory take from the market from 25 percent down to 20 percent for dealers and 15 percent for Cambios. In effect, the central bank bought no funds from the market through its weekly intervention tool and had no scheduled sale to the market. About four bouts of strong demand resulted in BOJ intervening by selling funds to the market. Notwithstanding, the interventions, the central bank ended the year with the NIR rising from US$3.005 billion at the end of December 2018 to US$3,16 billion after the NIR sank to US$2.95 billion in July.

The Foreign exchange market went through a number of changes as the central bank reduced the compulsory take from the market from 25 percent down to 20 percent for dealers and 15 percent for Cambios. In effect, the central bank bought no funds from the market through its weekly intervention tool and had no scheduled sale to the market. About four bouts of strong demand resulted in BOJ intervening by selling funds to the market. Notwithstanding, the interventions, the central bank ended the year with the NIR rising from US$3.005 billion at the end of December 2018 to US$3,16 billion after the NIR sank to US$2.95 billion in July.

Over the course of 2019, the exchange rate moved from $127.72 to US$1 at the end of 2018 to end 2019 at J$132.58 to US$1, after it reached its lowest level of J$141.89 to the US dollar on November. The NIR movement for 2019 suggests that the market is in a fairly balanced position. The country has periods when demand and supplies are higher than at other times and the two may not coincide thus creating some disquiet. There are other times when capital flows can impact the market positively or negatively. Unexpected capital flows can create a serious temporary imbalance in the system and may warrant BOJ’s intervention as occurred on a number of occasions over the last twelve months.

Growth in tourism expected in 2020

Money Market rates have been down and “This decline was also related to the increased supply of liquid assets during the quarter, given the maturity of GOJ bonds over the period.” Interest rates have been generally trending downwards from April of 2019, following sharp falls in 2018.

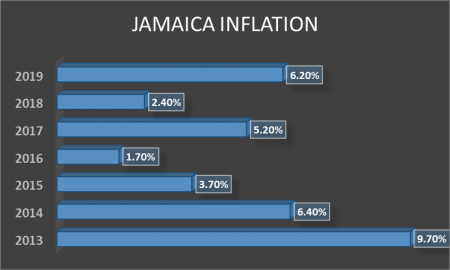

Spike in the exchange rate of the Jamaican dollar to the US dollar in the last quarter of the year put added pressure on prices and pushed inflation rate for the year to 6.2 percent, well above the 4.6 percent for the last 12 months to November 2019. Inflation for January dropped sharply by 1.1 percent as the FX rate impact was not present with the Jamaican dollar appreciated. Movements of the local currency accounted for a large part of increased inflation in 2019. The natural level of inflation is in the two to three percent range. The inflation rate should move back to more moderate levels in 2020 than it ended in 2019.

Government normal revenues up to November were running 7.5 percent ahead of the $373 billion intakes forecasted, with inflows at $400 billion to December 2019. This increase is after the government removed or reduced taxes at the start of the 2020 fiscal year with no new taxes levied. The preliminary guideline for the 2021 fiscal year, is for increased expenditure amounting to $18 billion in non-interest expenditure, but that is likely to be well below a probably $30 billion increase in normal revenues. With interest cost on government debt set to fall below that of the 2020 fiscal year, following the sharp fall in interest rates during 2019. The government will have room to increase spending in an election year. There is likely to be increased in capital spending, to be well ahead of the $75 billion projected for 2020, the Ministry of Finance instructions suggest for fiscal 2021.

Unemployment rates continue to fall, with the October 2019 unemployment rate down to 7.2 percent, the lowest on record. Labour Market conditions are projected to continue improving for the next eight quarters, the country’s central bank contends “the expected improvement reflects employment growth in manufacturing, finance & insurance, and business process outsourcing.” The Statistical Institute of Jamaica data shows the number of unemployed dropped to 96,700 persons in October with the number employed rising to 1.248 million persons. Based on the trend seen over the last three years, the unemployment rate should drop a possible one-percentage-point in 2020 compared to 2019 putting the unemployment around 6 to 6.5 percent. What is important about this improvement is the increase in the number of employed persons that will lead to increased demand in the economy, helping to stimulate increased growth levels.

Crime continues to be a major negative on the country acting as additional taxes on the wider economy, unfortunately, this major negative will continue to be present for some time to come.

Big inflation spike in 2019

The Statistical Institute of Jamaica (STATIN) reported that the annual inflation rate in Jamaica to December 2019, was 6.2 percent, a sharp increase from inflation over the last four years.

According to data from the Statin, inflation in 2018 was 2.4 percent, down from 5.2 percent in 2017. In 2016 the inflation rate ended at 1.7 percent and 3.7 percent in 2015, 6.4 in 2014 and 9.7 percent in 2013.

According to data from the Statin, inflation in 2018 was 2.4 percent, down from 5.2 percent in 2017. In 2016 the inflation rate ended at 1.7 percent and 3.7 percent in 2015, 6.4 in 2014 and 9.7 percent in 2013.

Jamaica’s Central Bank, in response to the sharp rise in the inflation for the year, stated, the outturn “represents a sharp jump when compared with the 3.4 percent recorded in September 2019. This inflation outturn was not anticipated and was higher than the Bank of Jamaica’s target of 4.0 to 6.0 percent.”

The release from Bank of Jamaica, stated, “the higher inflation rate was primarily influenced by faster increases in food and energy-related prices in the consumer price index (CPI). The heavily weighted Food & Non-Alcoholic Beverages division of the CPI increased over the year to December by 10.7 percent, when compared with 6.7 percent in September 2019. This was primarily related to higher prices for vegetables and starchy foods, the consequence of adverse weather conditions (drought followed by heavy rains) that affected the Island between June and October 2019.

BOJ interest cuts overnight rate.

There was also news of crop-related diseases affecting some items. Housing, Water, Electricity, Gas & Other Fuels reflected higher rates for electricity and water, which was partly related to increases in international oil prices in the December 2019 quarter. This division increased over the year to December to 1.5 percent, compared with a decline of 3.2 percent in September 2019.”

The release continues, “despite the higher headline inflation, underlying inflation, which excludes the immediate influence of agriculture and energy prices, remained stable and below 3.0 percent. At the end of December 2019, the annual rate for this measure was 2.9 percent, which was unchanged compared with the rate in September 2019. This underscores that the Jamaican economy continues to reflect some slack with economic growth below its potential. It also highlights that the jump in inflation is likely to be temporary as expected tempered movements in agricultural prices dampen inflation over the next three to six months.”

BOJ sells US$40m into forex market

Bank of Jamaica sold US$40 million via B-FXITT to authorized dealers and Cambios to augment supply in the market on Tuesday.

Bank of Jamaica sold US$40 million via B-FXITT to authorized dealers and Cambios to augment supply in the market on Tuesday.

“The factors behind the recent depreciation in the exchange rate are well known and Bank of Jamaica expects that these impulses will subside and that normalcy will return to the market. There has been an increase in demand for foreign currency due to the regular re-stocking by retailers for the Christmas season. Further, there has been extraordinary demand relating to portfolio transactions,” the central bank stated in a release today.

“Notwithstanding the recent depreciation, inflows into the foreign exchange market remained healthy. For October 2019, average daily inflow from earners was approximately US$31 million, in line with October 2018. However, driven by the factors noted above, demand has outstripped this supply,” the release went on to say.

The local currency moved in recent weeks and traded at $141.96 to one US dollar on average on Monday as dealers bought US$30.7 million at an average rate of $138.89 and sold $31.5 million at J$141.96 each. On Friday, dealers bought US$33 million at an average price of J$139.49 and bought US$30.2 million at J$141.89.