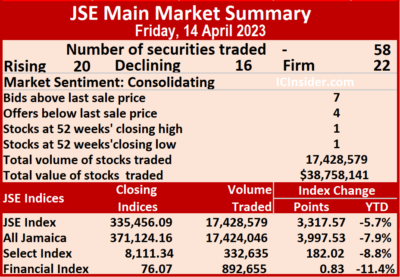

Trading activity on the Jamaica Stock Exchange Main Market ended on Friday after the market indices surged even as the volume of stocks traded declined 13 percent and the value, 54 percent lower than on Thursday, with 58 securities trading compared to 59 on Thursday, with 20 rising, 16 declining and 22 ending unchanged.

A total of 17,428,579 shares were traded for $38,758,141 down from 20,050,275 units at $83,836,104 on Thursday.

A total of 17,428,579 shares were traded for $38,758,141 down from 20,050,275 units at $83,836,104 on Thursday.

Trading averaged 300,493 shares at $668,244 compared with 339,835 shares at $1,420,951 on Thursday and month to date, an average of 230,842 units at $921,077, compared with 220,842 units at $957,374 on the previous day. Trading in March ended with an average of 356,137 units at $3,015,416.

Wigton Windfarm led trading with 5.67 million shares for 32.5 percent of the total volume followed by Sagicor Select Financial Fund with 4.30 million units for 24.7 percent of the day’s trade, Transjamaican Highway ended with 3.21 million units for 18.4 percent market share and JMMB Group 7.5% with 2.10 million units for 12.1 percent of the total volume.

The All Jamaican Composite Index surged 3,997.53 points to 371,124.16, the JSE Main Index jumped 3,317.57 points to 335,456.09 and the JSE Financial Index popped 0.83 points to finish at 76.07.

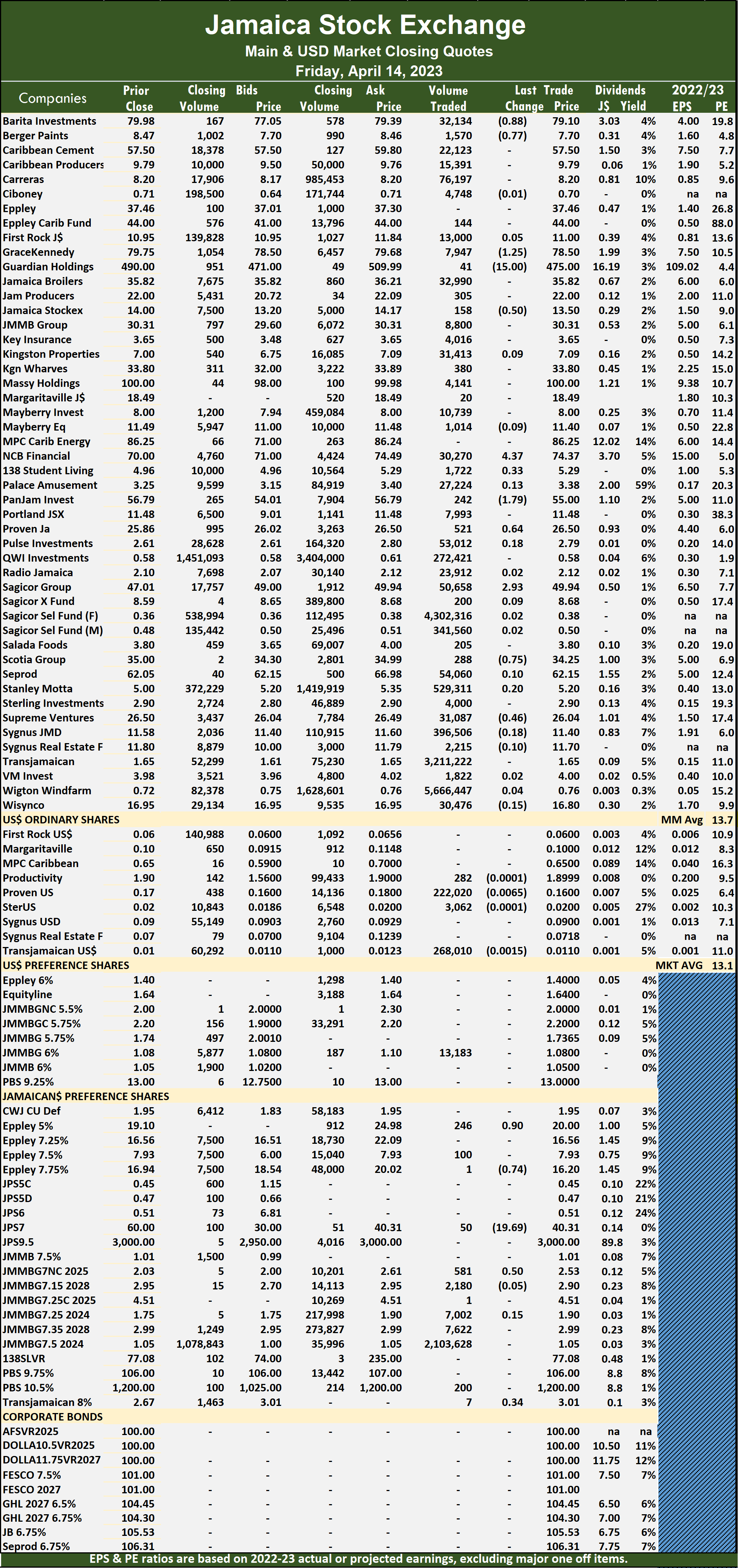

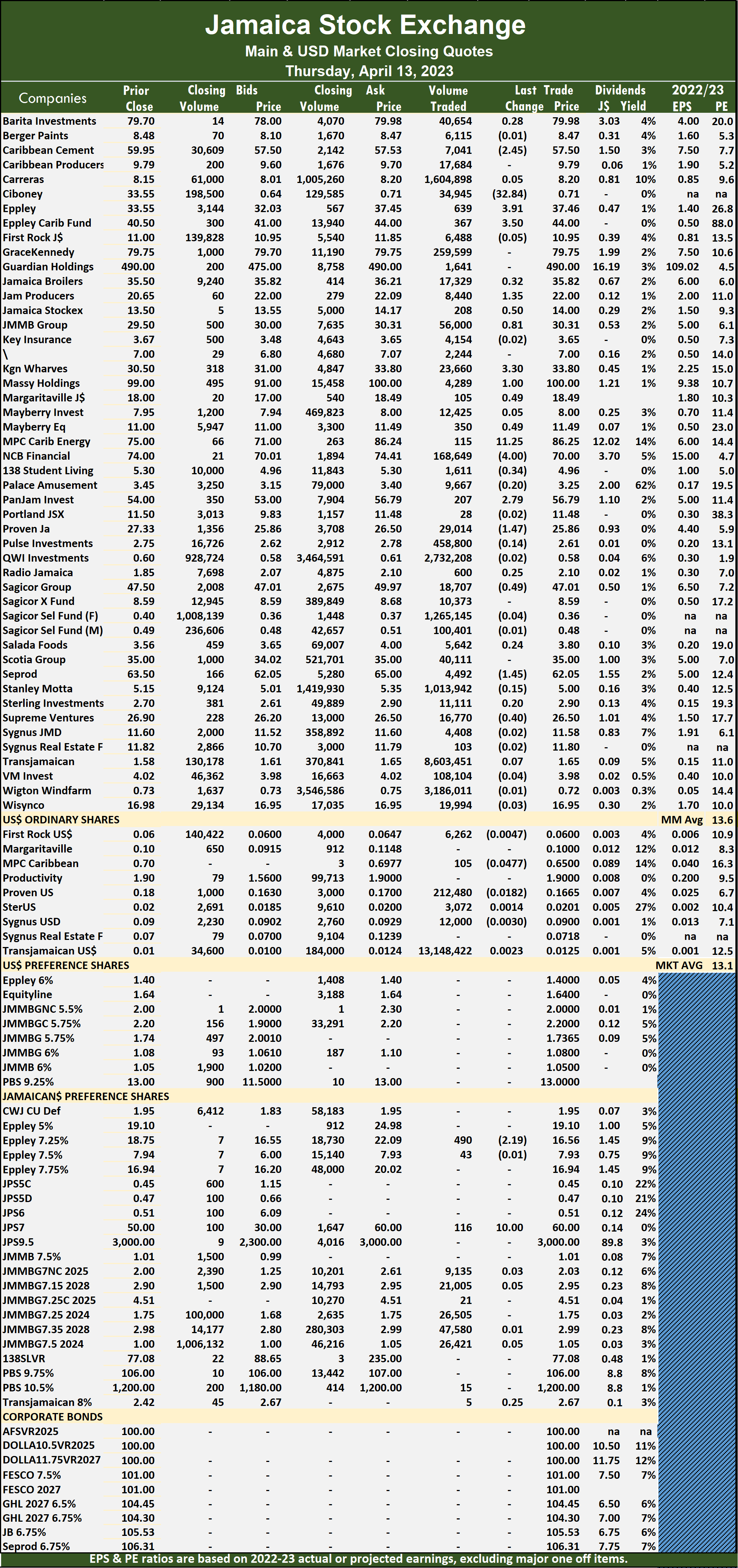

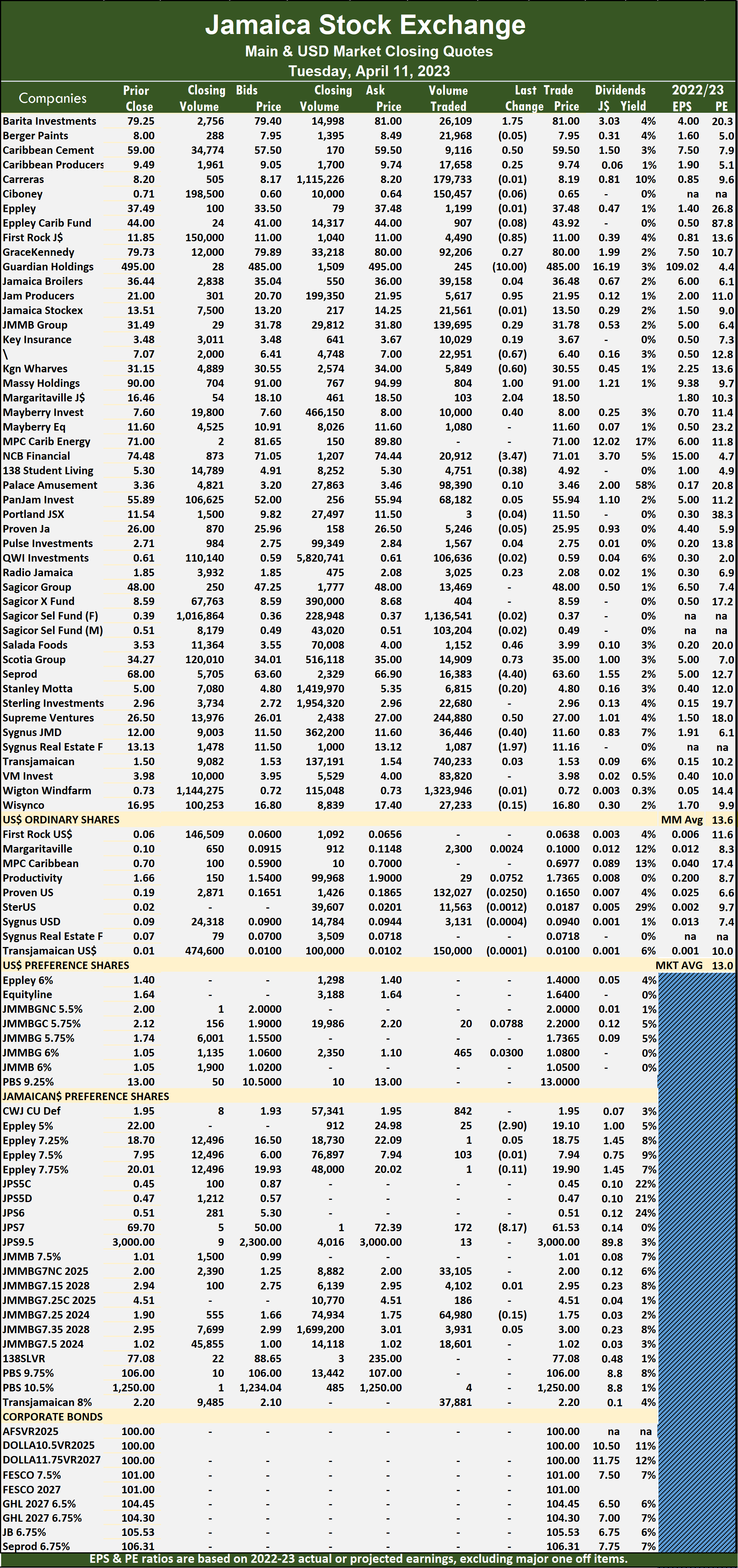

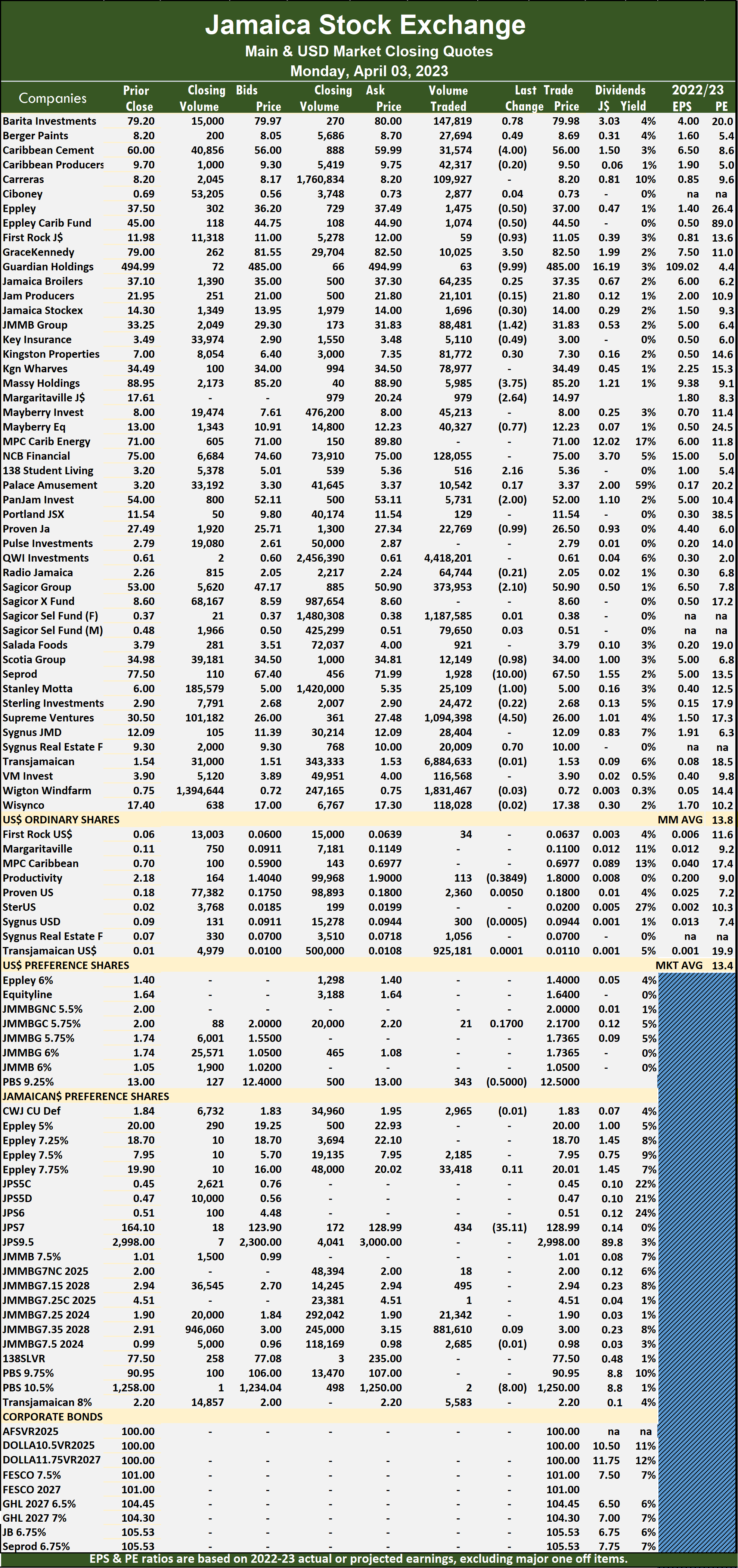

The PE Ratio, a formula used to compute appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last selling prices of stocks and earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows seven stocks ending with bids higher than their last selling prices and four with lower offers.

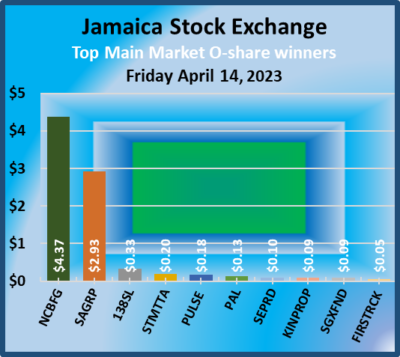

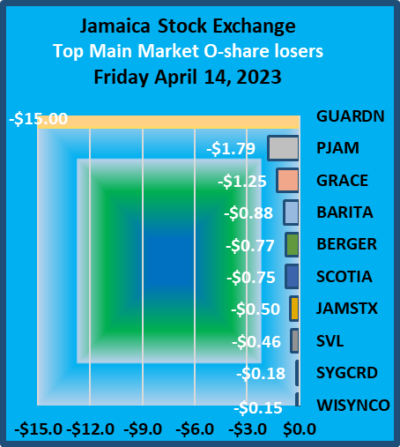

At the close, Barita Investments declined 88 cents in closing at $79.10 in switching ownership of 32,134 shares, Berger Paints fell 77 cents to $7.70 as investors exchanged 1,570 units, GraceKennedy dropped $1.25 to close at $78.50 with investors trading 7,947 stocks, Guardian Holdings lost $15 to end at $475 after trading 41 stock units, Jamaica Stock Exchange dipped 50 cents to $13.50 after closing with trading in 158 shares, NCB Financial rallied $4.37 in closing at $74.37 in an exchange of 30,270 units,  Pan Jamaica Group shed $1.79 after ending at $55 while exchanging 242 stock units, Proven Investments popped 64 cents to end at $26.50 after 521 stocks changed hands, Sagicor Group advanced $2.93 to $49.94 with an exchange of 50,658 units, Scotia Group declined 75 cents to close at $34.25, with 288 stock units crossing the market and Supreme Ventures fell 46 cents to close at $26.04 with a transfer of 31,087 shares.

Pan Jamaica Group shed $1.79 after ending at $55 while exchanging 242 stock units, Proven Investments popped 64 cents to end at $26.50 after 521 stocks changed hands, Sagicor Group advanced $2.93 to $49.94 with an exchange of 50,658 units, Scotia Group declined 75 cents to close at $34.25, with 288 stock units crossing the market and Supreme Ventures fell 46 cents to close at $26.04 with a transfer of 31,087 shares.

In the preference segment, Eppley 5% preference share increased 90 cents to end at $20 in trading 246 stocks, Eppley 7.75% preference share lost 74 cents in closing at a 52 weeks’ low of $16.20 after a transfer of one stock unit,  Jamaica Public Service 7% dropped $19.69 to $40.31, with 50 stocks crossing the exchange and JMMB Group 7% preference share rose 50 cents after ending at $2.53 with an exchange of 581 units.

Jamaica Public Service 7% dropped $19.69 to $40.31, with 50 stocks crossing the exchange and JMMB Group 7% preference share rose 50 cents after ending at $2.53 with an exchange of 581 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Nice gains for ICTOP10 stocks, Purity returns

The Main and Junior Markets did not maintain the sharp bounce of the previous week, but most ICTOP10 Junior Market stocks ended with gains. In contrast, the Main Market ended with mostly modest losses, with 138 Student Living rising 5 percent to $5.30 and JMMB Group declining by 5 percent to $31.49, all other changes in the Main Market were two percent or less.

Dr Karlene McDonnough – Chairman of Image Consultants Ltd. The stock came in for increased demand during the week ahead of the release of full-year results.

The Junior Market had one change in its TOP10 list as Iron Rock Insurance and Image Plus climbed 13 percent to $2.27 and $2.03, respectively, while Main Event and Honey Bun rose 5 percent to $12.26 and $6.75, respectively, with the only sizable decline being a 9 percent fall for Tropical Battery to $1.90.

Image Plus never benefitted from any serious IPO bounce seems to be finally finding buying interest and closed the past week with 159,904 shares on the bid at $2.02, 160,746 at $2 and just over 800,000 between $1.90 and $1.95, with 25,987 stocks on offer at $2.03, 81,709 at $2.05 with one big offer of 1.72 million units at S2.50 with smaller offers before the this. There has been healthy trading in the stock recently, with trading of 824,526 units on Thursday. Trading on Wednesday saw 1,153,255 shares changing hands in the stock, with 910,000 units on Tuesday and 1.75 million shares on Monday, which seems to have cleared out a great deal of overhang in the market.

Update on interest rate developments. A number of developments taking place in the economy are worth watching. Following last week’s $35 billion Bank of Jamaica CD auction that saw the average rate coming in at 8.49 percent, this week’s auction saw an offer of $34 billion, with the average rate remaining the same as the previous week with fewer funds chasing the offered amount.  Another positive development is the average inflation rate running at 45 percent less than the same time last year and averaging 2.4 percent per annum since November last year. Foreign exchange inflows have been strong, with the NIR growing at $66 million in February and 220 million in March, putting it at a record end of month level as initial data suggest that tourism arrivals and foreign exchange generated by that industry exceed the similar period in 2019, the last year without the impact of covid-19 negatively affecting the sector. On top of those positive developments, corporate profits are expected to enjoy a good bounce for the majority of companies for the first quarter.

Another positive development is the average inflation rate running at 45 percent less than the same time last year and averaging 2.4 percent per annum since November last year. Foreign exchange inflows have been strong, with the NIR growing at $66 million in February and 220 million in March, putting it at a record end of month level as initial data suggest that tourism arrivals and foreign exchange generated by that industry exceed the similar period in 2019, the last year without the impact of covid-19 negatively affecting the sector. On top of those positive developments, corporate profits are expected to enjoy a good bounce for the majority of companies for the first quarter.

The Junior Market has a long term pattern, with the market starting to rise around a month before quarterly results are due and declining shortly after results are released. This is a pattern worth noting that can be built into investment decisions to improve returns.

Consolidated Bakeries Miss Birdie Easter bun. The stock is back in the ICTOP10

Dropping from the TOP10 Junior Market list this past week was Honey Bun, but investors should expect a big jump in revenues and profits for the first quarter, with the Easter coming at the beginning of April versus the 17th of April last year, as well as an improvement of gross profit margin that slipped up last year.

Returning to the TOP10 is Consolidated Bakeries in the number 3 spot. The company is projected to report a solid first quarter profit, with the Easter holidays coming at the start of April compared with April 17 last year and ensuring that mostly all Easter bun sales will be reported in the March quarter unlike 2022. The company reported a profit in 2022 a big improvement over a loss in the previous three years. ICInsider.com projects earnings of 40 cents for 2023 and 75 cents for 2024 with the company benefitting from a full recovery of the local economy and increase efficiency and reduction in borrowings. At the end of the week, the average PE for the JSE

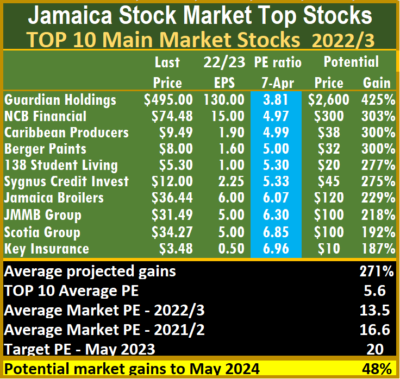

Main Market TOP 10 is 5.6, well below the market average of 13.5, while the Junior Market Top 10 PE sits at 5.7 compared with the market at 11.1. The differences are important indicators of the likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 256 percent and the Main Market TOP10, an average of 271 percent, to May 2024, based on 2023 forecasted earnings.

Main Market TOP 10 is 5.6, well below the market average of 13.5, while the Junior Market Top 10 PE sits at 5.7 compared with the market at 11.1. The differences are important indicators of the likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 256 percent and the Main Market TOP10, an average of 271 percent, to May 2024, based on 2023 forecasted earnings.

The Junior Market has 10 stocks representing 21 percent of the market, with PEs from 15 to 29, averaging 19, well above the market’s average. The top half of the market has an average PE of 15, suggesting this may be a logical value for junior market stocks.

The 16 stocks with the highest value in the Main Market stocks are priced at a PE of 15 to 115, with an average of 30 and 19 excluding the highest PE stocks and 19 for the top half excluding the stocks with the highest valuation.

The above average shows the extent of potential gains for the TOP 10 stocks.

The above average shows the extent of potential gains for the TOP 10 stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

ICTOP10 rides big weekly JSE rally

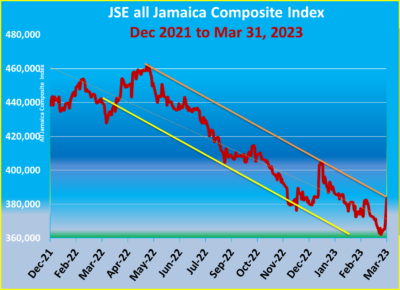

The JSE Main market surged sharply in the past week.

While the Main and Junior Markets rebounded sharply during last week, ICTOP10 stocks ended with varying movements, with gains and losses in both markets hitting 16 percent. It was an interesting week in which the main market gained over 18,000 points for the week with all days closing with gains including the Friday of the previous week, but it sits at a resistance level and is a signal worth watching.

The Junior Market put on 200 points since Thursday, March 23 and had one minor negative trading day during the period, however, the last day accounted for nearly half of the above gains.

While Bank of Jamaica held their overnight rates at 7 percent, their CD rate that fell 16 percent in the previous week to an average of 8.85 percent from over 10 percent where it stood for several months, BOJ offered a huge $35 billion this past week, but the average rate fell to 8.49 percent after $70 billion chased the amount offered. Importantly, the central bank cut the stock of CDS it holds from a peak of $109.5 billion on March 3, but at the latest auction, it amounted to $88.85 billion, marginally up from $82 billion on the 17th.

At the end of the past week, in the Junior Market TOP10 four stocks gained and five declined. KLE Group jumped 16 percent to $1.69 and Tropical Battery rose 7 percent to close at $2.08. General Accident dropped 16 percent to $5 and Everything Fresh fell 6 percent to close at $1.45.

At the end of the past week, in the Junior Market TOP10 four stocks gained and five declined. KLE Group jumped 16 percent to $1.69 and Tropical Battery rose 7 percent to close at $2.08. General Accident dropped 16 percent to $5 and Everything Fresh fell 6 percent to close at $1.45.

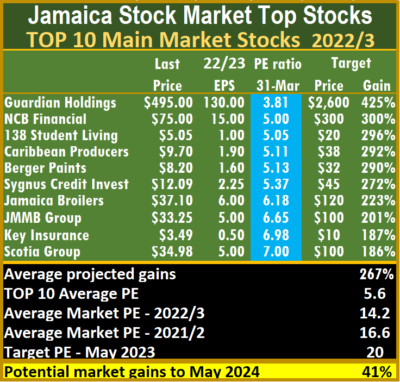

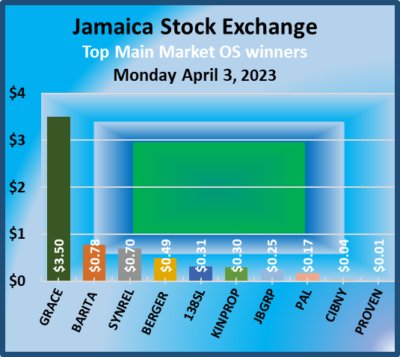

The Main Market TOP10 JMMB Group climbed 15 percent to $33.25, Jamaica Broilers gained 12 percent to $37.10, Caribbean Producers popped 7 percent to $9.70 and NCB Financial with a rise of 6 percent to $75. Berger Paints fell 10 percent to $8.20 and 138 Student Living with a fall of 6 percent to $5.05.

The Junior Market has a long term pattern, with the market starting to rise around a month before quarterly results are due and declining shortly after results are released. This is a pattern worth noting that can be built into investment decisions that can improve returns.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 14.2, while the Junior Market Top 10 PE sits at 5.8 compared with the market at 11.4. The differences are important indicators of the level of likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 248 percent and the Main MarketTOP10 by an average of 267 percent, by May 2024, based on 2023 forecasted earnings.

The Junior Market has 11 stocks representing 23 percent of the market, with PEs from 15 to 28, averaging 20.4, well above the average of the market. The top half of the market has an average PE of 16, suggesting that this may be a logical value for junior market stocks currently.

The Main Market 19 highest valued stocks are priced at a PE of 15 to 115, with an average of 29 and 21 excluding the most valued stocks and 20.5 for the top half excluding the stocks with the highest valuation.

The Main Market 19 highest valued stocks are priced at a PE of 15 to 115, with an average of 29 and 21 excluding the most valued stocks and 20.5 for the top half excluding the stocks with the highest valuation.

The above average shows the extent of potential gains for the TOP 10 stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

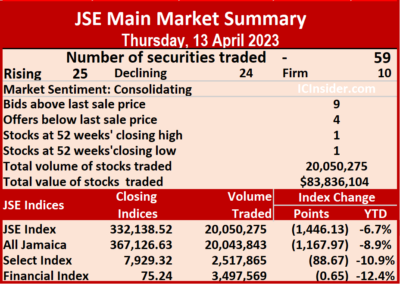

A total of 20,050,275 shares were traded for $83,836,104 compared to 12,894,594 units at $48,653,770 on Wednesday.

A total of 20,050,275 shares were traded for $83,836,104 compared to 12,894,594 units at $48,653,770 on Wednesday. The All Jamaican Composite Index lost 1,167.97 points to finish at 367,126.63, the JSE Main Index declined 1,446.13 points to conclude trading at 332,138.52 and the JSE Financial Index dipped 0.65 points to settle at 75.24.

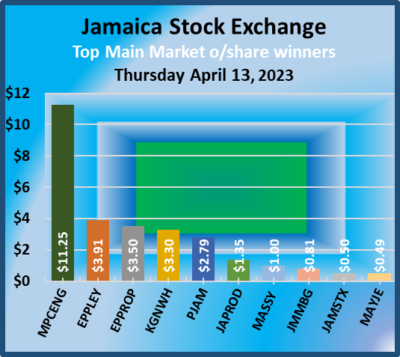

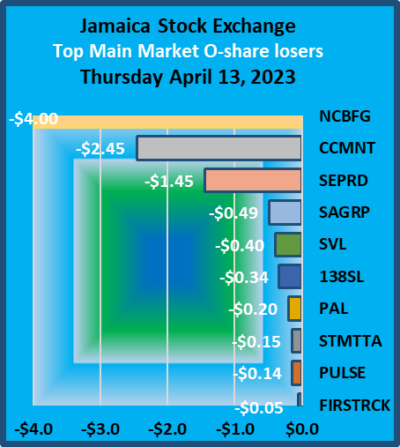

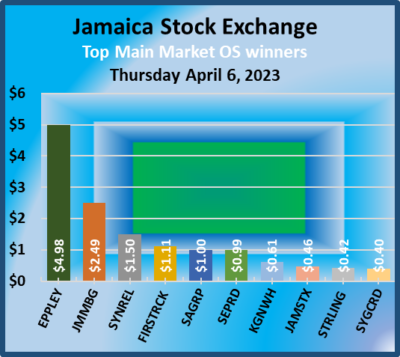

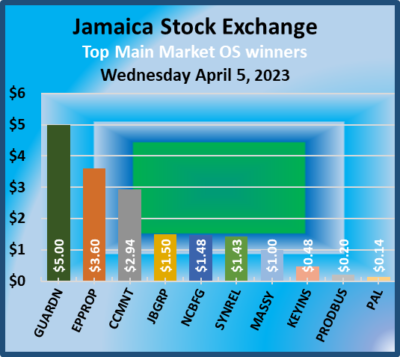

The All Jamaican Composite Index lost 1,167.97 points to finish at 367,126.63, the JSE Main Index declined 1,446.13 points to conclude trading at 332,138.52 and the JSE Financial Index dipped 0.65 points to settle at 75.24. Jamaica Producers rose $1.35 to $22 with 8,440 stocks crossing the market, Jamaica Stock Exchange gained 50 cents after ending at $14 after 208 stock units passed through the market, JMMB Group rose 81 cents to $30.31 after an exchange of 56,000 shares, Kingston Wharves advanced $3.30 in closing at $33.80 with the swapping of 23,660 units, Margaritaville rallied 49 cents to close at $18.49, with 105 stocks crossing the exchange, Massy Holdings rallied $1 to $100, with investors trading 4,289 units, Mayberry Jamaican Equities popped 49 cents to end at $11.49 in an exchange of 350 stocks, MPC Caribbean Clean Energy climbed $11.25 to $86.25 after a transfer of 115 stock units, NCB Financial dipped $4 in closing at $70 after investors exchanged 168,649 shares, Pan Jamaica Group increased $2.79 after ending at $56.79 and closed with 207 stock units changing hands, Proven Investments shed $1.47 to close at $25.86 in switching ownership of 29,014 units, Sagicor Group dropped 49 cents to end at $47.01 with a transfer of 18,707 stocks, Seprod declined $1.45 to close at $62.05 in an exchange of 4,492 shares and Supreme Ventures fell 40 cents in closing at $26.50 after an exchange of 16,770 stocks.

Jamaica Producers rose $1.35 to $22 with 8,440 stocks crossing the market, Jamaica Stock Exchange gained 50 cents after ending at $14 after 208 stock units passed through the market, JMMB Group rose 81 cents to $30.31 after an exchange of 56,000 shares, Kingston Wharves advanced $3.30 in closing at $33.80 with the swapping of 23,660 units, Margaritaville rallied 49 cents to close at $18.49, with 105 stocks crossing the exchange, Massy Holdings rallied $1 to $100, with investors trading 4,289 units, Mayberry Jamaican Equities popped 49 cents to end at $11.49 in an exchange of 350 stocks, MPC Caribbean Clean Energy climbed $11.25 to $86.25 after a transfer of 115 stock units, NCB Financial dipped $4 in closing at $70 after investors exchanged 168,649 shares, Pan Jamaica Group increased $2.79 after ending at $56.79 and closed with 207 stock units changing hands, Proven Investments shed $1.47 to close at $25.86 in switching ownership of 29,014 units, Sagicor Group dropped 49 cents to end at $47.01 with a transfer of 18,707 stocks, Seprod declined $1.45 to close at $62.05 in an exchange of 4,492 shares and Supreme Ventures fell 40 cents in closing at $26.50 after an exchange of 16,770 stocks. In the preference segment, Eppley 7.25% preference share lost $2.19 to close at a 52 weeks’ low of $16.56 with 490 units clearing the market and Jamaica Public Service 7% gained $10 in ending at $60, with 116 stock units changing hands and Transjamaican Highway 8% rose 25 cents to 52 weeks’ high of $2.67 after just 5 shares were traded.

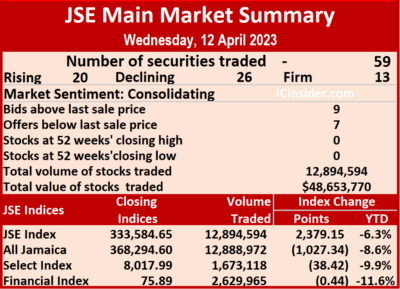

In the preference segment, Eppley 7.25% preference share lost $2.19 to close at a 52 weeks’ low of $16.56 with 490 units clearing the market and Jamaica Public Service 7% gained $10 in ending at $60, with 116 stock units changing hands and Transjamaican Highway 8% rose 25 cents to 52 weeks’ high of $2.67 after just 5 shares were traded. A total of 12,894,594 shares were exchanged for $48,653,770 up from 5,006,796 units at $37,626,082 on Tuesday.

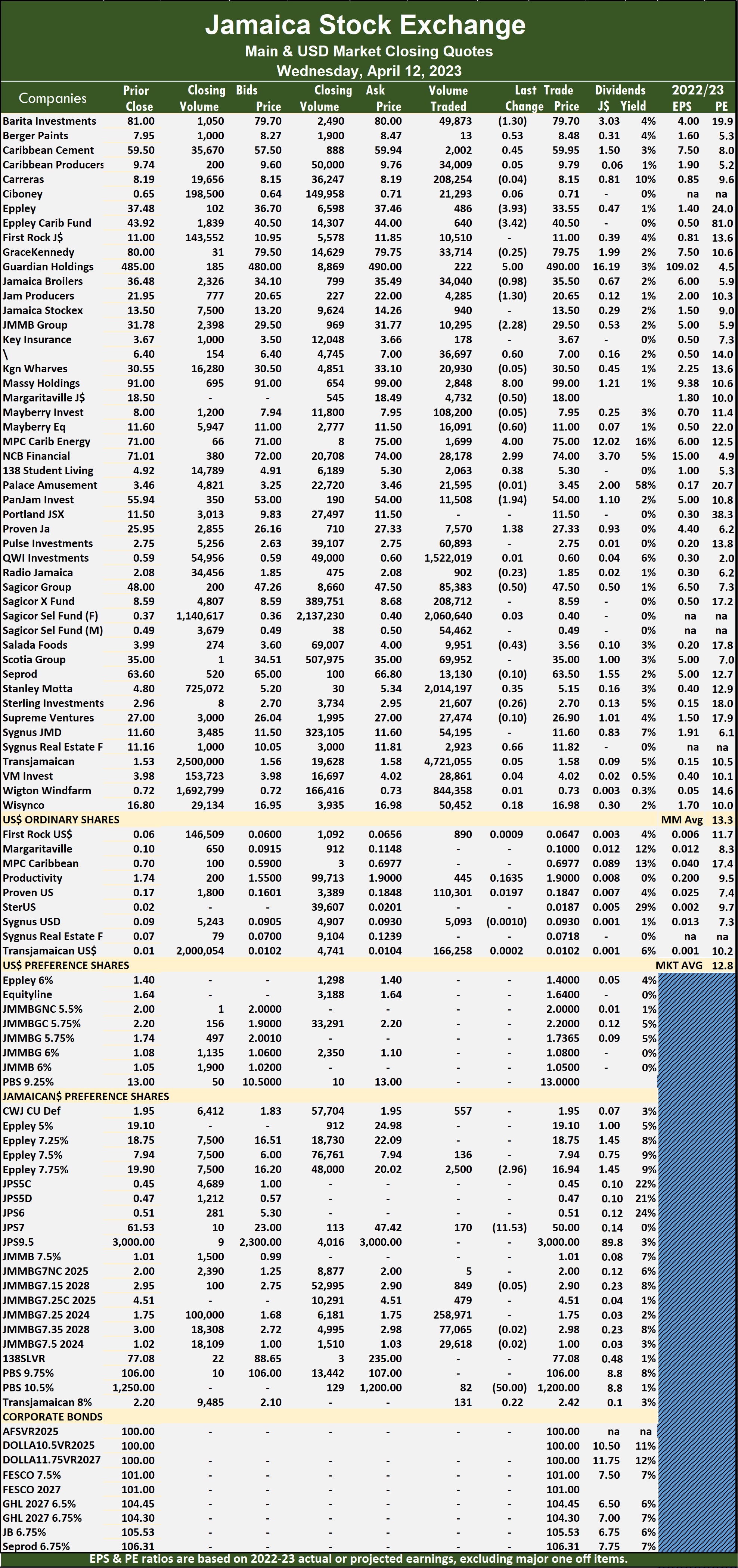

A total of 12,894,594 shares were exchanged for $48,653,770 up from 5,006,796 units at $37,626,082 on Tuesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

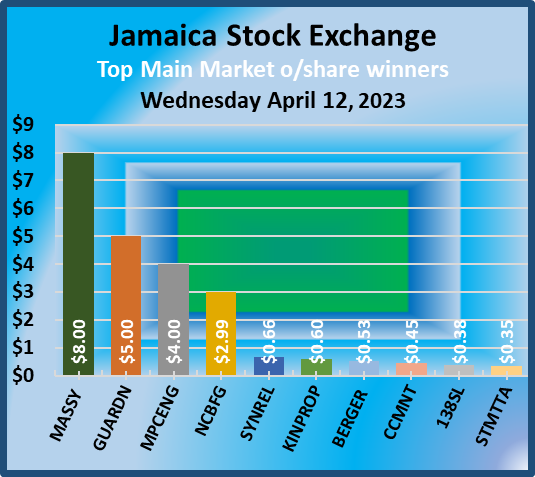

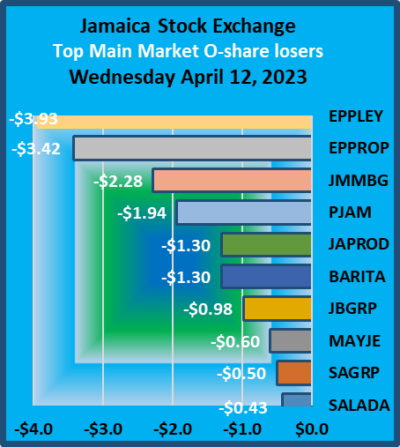

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Kingston Properties gained 60 cents in closing at $7, with 36,697 units changing hands, Margaritaville shed 50 cents to end at $18 after closing with an exchange of 4,732 shares, Massy Holdings popped $8 after ending at $99, with 2,848 stocks crossing the market, Mayberry Jamaican Equities lost 60 cents in closing at $11 in switching ownership of 16,091 stock units, MPC Caribbean Clean Energy rose $4 to close at $75 with investors transferring 1,699 shares, NCB Financial climbed $2.99 to $74, with 28,178 stocks crossing the market, Pan Jamaica Group fell $1.94 to $54 after an exchange of 11,508 units, Proven Investments increased $1.38 to close at $27.33 as 7,570 shares passed through the market, Sagicor Group declined 50 cents after ending at $47.50 with a transfer of 85,383 stock units, Salada Foods dropped 43 cents in closing at $3.56, with 9,951 stocks crossing the exchange and Sygnus Real Estate Finance gained 66 cents to end at $11.82 with 2,923 units clearing the market.

Kingston Properties gained 60 cents in closing at $7, with 36,697 units changing hands, Margaritaville shed 50 cents to end at $18 after closing with an exchange of 4,732 shares, Massy Holdings popped $8 after ending at $99, with 2,848 stocks crossing the market, Mayberry Jamaican Equities lost 60 cents in closing at $11 in switching ownership of 16,091 stock units, MPC Caribbean Clean Energy rose $4 to close at $75 with investors transferring 1,699 shares, NCB Financial climbed $2.99 to $74, with 28,178 stocks crossing the market, Pan Jamaica Group fell $1.94 to $54 after an exchange of 11,508 units, Proven Investments increased $1.38 to close at $27.33 as 7,570 shares passed through the market, Sagicor Group declined 50 cents after ending at $47.50 with a transfer of 85,383 stock units, Salada Foods dropped 43 cents in closing at $3.56, with 9,951 stocks crossing the exchange and Sygnus Real Estate Finance gained 66 cents to end at $11.82 with 2,923 units clearing the market. In the preference segment, Productive Business Solutions 10.50% preference share dropped $50 to $1200 as investors exchanged 82 shares, Eppley 7.75% preference share fell $2.96 to close at $16.94 with an exchange of 2,500 units and Jamaica Public Service 7% shed $11.53 in ending at $50, with 170 stock units crossed the market.

In the preference segment, Productive Business Solutions 10.50% preference share dropped $50 to $1200 as investors exchanged 82 shares, Eppley 7.75% preference share fell $2.96 to close at $16.94 with an exchange of 2,500 units and Jamaica Public Service 7% shed $11.53 in ending at $50, with 170 stock units crossed the market. A total of 5,006,796 shares were traded for $37,626,082, compared to 10,510,147 units at $39,934,059 on Thursday.

A total of 5,006,796 shares were traded for $37,626,082, compared to 10,510,147 units at $39,934,059 on Thursday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasts by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

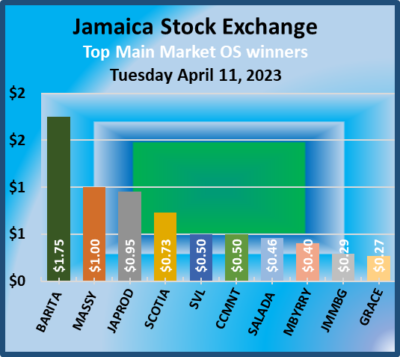

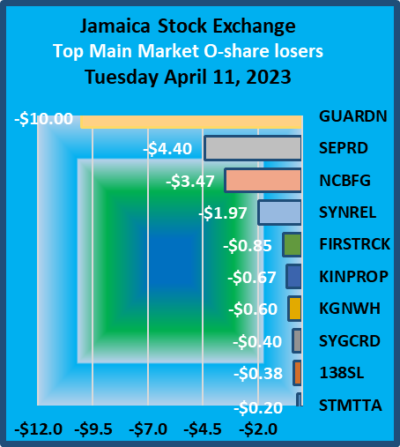

The PE Ratio, a formula used to compute appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasts by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Massy Holdings climbed $1 after ending at $91 with the swapping of 804 shares, Mayberry Investments increased 40 cents to $8 with an exchange of 10,000 units, NCB Financial lost $3.47 after ending at $71.01 as 20,912 stock units passed through the market, Salada Foods advanced 46 cents in closing at $3.99 in an exchange of 1,152 stocks. Scotia Group increased 73 cents to end at $35 after an exchange of 14,909 shares, Seprod declined $4.40 to $63.60, with 16,383 stock units clearing the market, Supreme Ventures advanced 50 cents to close at $27 in switching ownership of 244,880 units. Sygnus Credit Investments lost 40 cents to close at $11.60 as 36,446 stocks cleared the market and Sygnus Real Estate Finance dropped $1.97 in closing at $11.16 after 1,087 shares crossed the market.

Massy Holdings climbed $1 after ending at $91 with the swapping of 804 shares, Mayberry Investments increased 40 cents to $8 with an exchange of 10,000 units, NCB Financial lost $3.47 after ending at $71.01 as 20,912 stock units passed through the market, Salada Foods advanced 46 cents in closing at $3.99 in an exchange of 1,152 stocks. Scotia Group increased 73 cents to end at $35 after an exchange of 14,909 shares, Seprod declined $4.40 to $63.60, with 16,383 stock units clearing the market, Supreme Ventures advanced 50 cents to close at $27 in switching ownership of 244,880 units. Sygnus Credit Investments lost 40 cents to close at $11.60 as 36,446 stocks cleared the market and Sygnus Real Estate Finance dropped $1.97 in closing at $11.16 after 1,087 shares crossed the market. In the preference segment, Eppley 5% crossing the market preference share, fell $2.90 to $19.10 t 25 units and Jamaica Public Service 7%, with 172 stock units dipping $8.17 after ending at $61.53 changing hands.

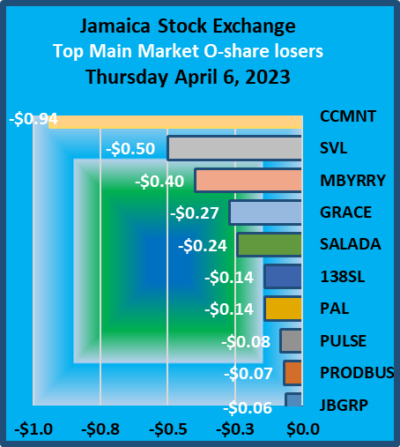

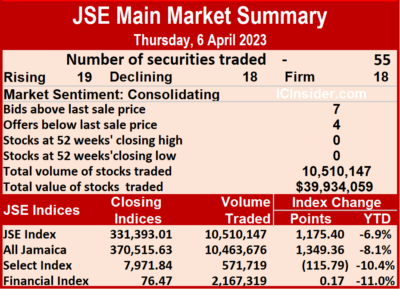

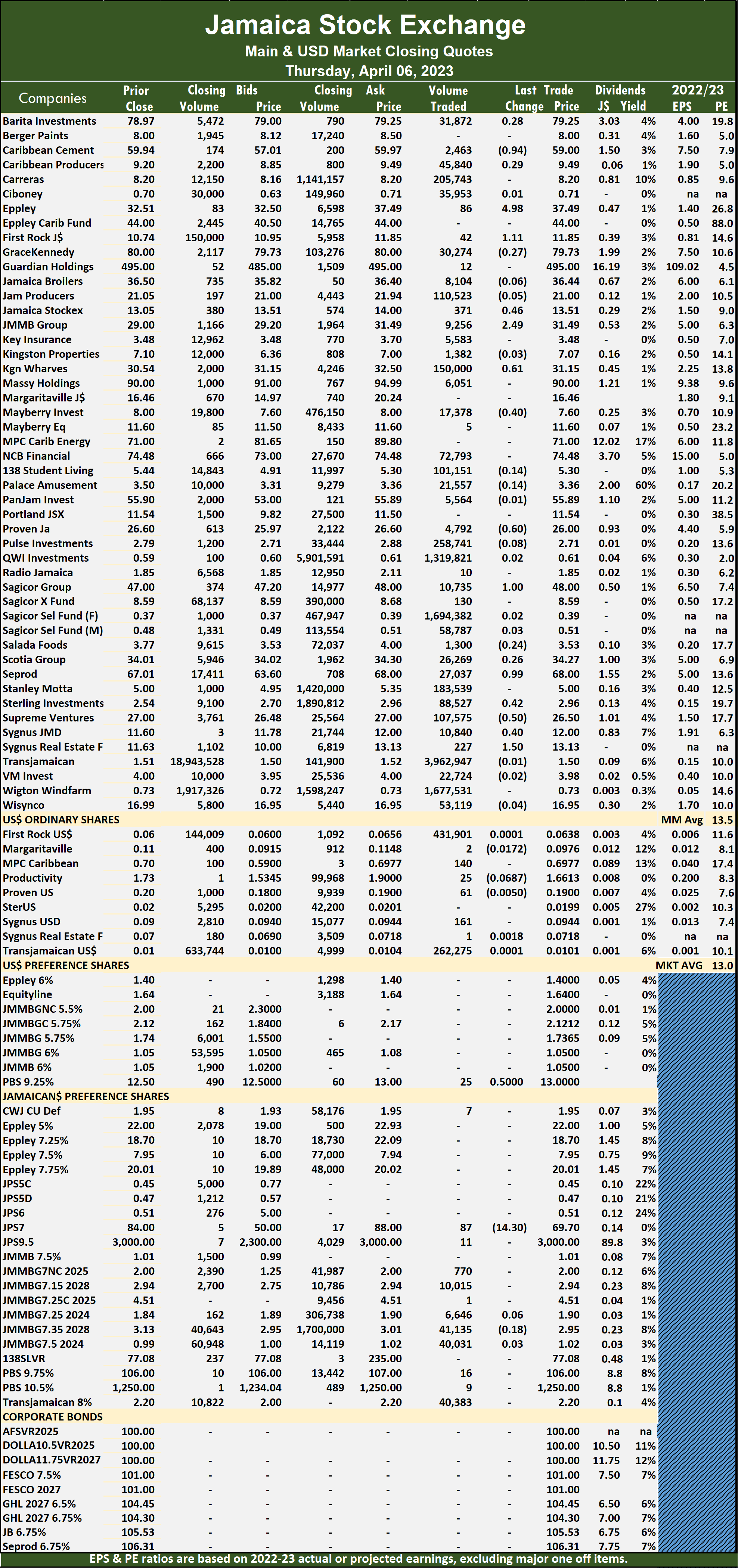

In the preference segment, Eppley 5% crossing the market preference share, fell $2.90 to $19.10 t 25 units and Jamaica Public Service 7%, with 172 stock units dipping $8.17 after ending at $61.53 changing hands. A total of 10,510,147 shares were traded for $39,934,059 compared to 12,992,157 units at $42,746,105 on Wednesday.

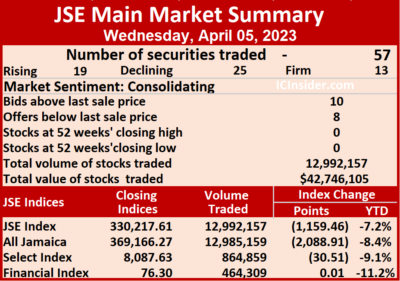

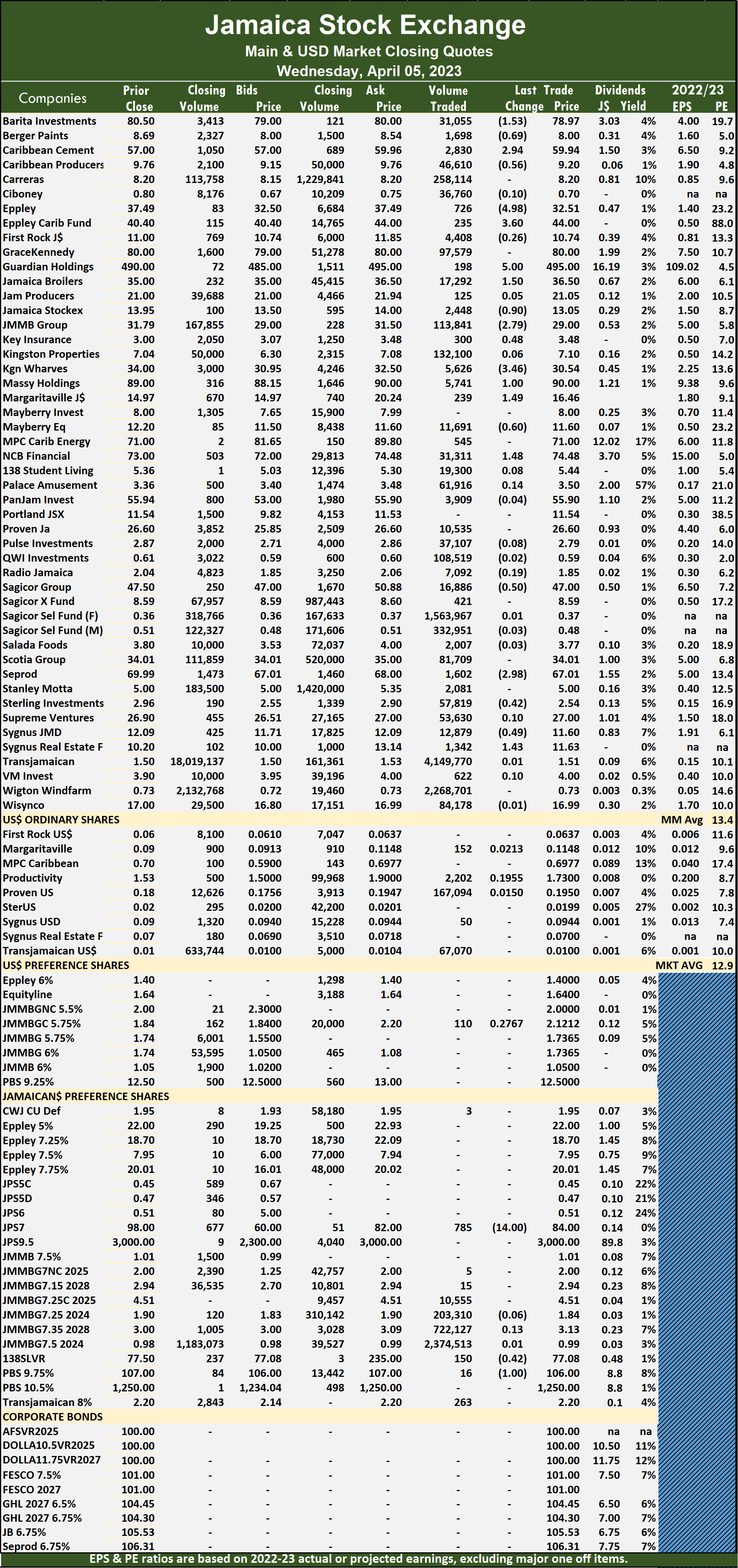

A total of 10,510,147 shares were traded for $39,934,059 compared to 12,992,157 units at $42,746,105 on Wednesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Wharves advanced 61 cents to $31.15 w ith investors exchanging 150,000 units, Mayberry Investments declined 40 cents to close at $7.60 in switching ownership of 17,378 stocks, Proven Investments fell 60 cents in closing at $26 after 4,792 shares crossed the market, Sagicor Group increased by $1 after in ending at $48, with 10,735 stocks crossing the market, Seprod popped 99 cents to end at $68 after trading 27,037 units, Sterling Investments advanced 42 cents to $2.96 as 88,527 shares passed through the market, Supreme Ventures dipped 50 cents to close at $26.50 in trading 107,575 stock units, Sygnus Credit Investments increased 40 cents in closing at $12 after an exchange of 10,840 stock units and Sygnus Real Estate Finance rallied $1.50 to $13.13 after a transfer of 227 stocks.

Wharves advanced 61 cents to $31.15 w ith investors exchanging 150,000 units, Mayberry Investments declined 40 cents to close at $7.60 in switching ownership of 17,378 stocks, Proven Investments fell 60 cents in closing at $26 after 4,792 shares crossed the market, Sagicor Group increased by $1 after in ending at $48, with 10,735 stocks crossing the market, Seprod popped 99 cents to end at $68 after trading 27,037 units, Sterling Investments advanced 42 cents to $2.96 as 88,527 shares passed through the market, Supreme Ventures dipped 50 cents to close at $26.50 in trading 107,575 stock units, Sygnus Credit Investments increased 40 cents in closing at $12 after an exchange of 10,840 stock units and Sygnus Real Estate Finance rallied $1.50 to $13.13 after a transfer of 227 stocks. In the preference segment, Jamaica Public Service 7% lost $14.30 to end at $69.70 after exchanging 87 units.

In the preference segment, Jamaica Public Service 7% lost $14.30 to end at $69.70 after exchanging 87 units. A total of 12,992,157 shares were traded for $42,746,105 compared to 9,556,783 units at $28,842,985 on Tuesday.

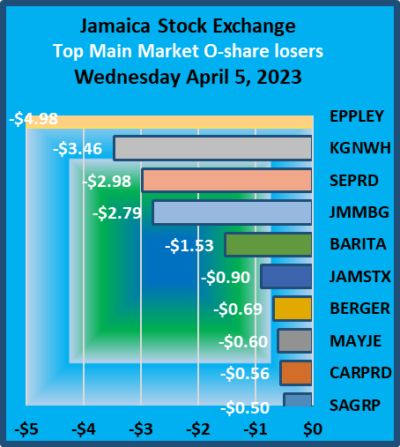

A total of 12,992,157 shares were traded for $42,746,105 compared to 9,556,783 units at $28,842,985 on Tuesday. The All Jamaican Composite Index dropped 2,088.91 points to 369,166.27, the JSE Main Index shed 1,159.46 points to end at 330,217.61 and the JSE Financial Index popped 0.01 points to close at 76.30.

The All Jamaican Composite Index dropped 2,088.91 points to 369,166.27, the JSE Main Index shed 1,159.46 points to end at 330,217.61 and the JSE Financial Index popped 0.01 points to close at 76.30. Guardian Holdings rose $5 to $495 in trading 198 units, Jamaica Broilers increased $1.50 to end at $36.50 after exchanging 17,292 stocks, Jamaica Stock Exchange declined 90 cents in closing at $13.05 in switching ownership of 2,448 shares. JMMB Group shed $2.79 after ending at $29 as investors exchanged 113,841 stocks, Key Insurance advanced 48 cents in closing at $3.48 after a transfer of 300 stock units, Kingston Wharves declined $3.46 to $30.54 and closing with 5,626 units being traded. Margaritaville climbed $1.49 to $16.46 after an exchange of 239 shares, Massy Holdings gained $1 to $90, with 5,741 units crossing the market, Mayberry Jamaican Equities shed 60 cents to close at $11.60 with an exchange of 11,691 stock units. NCB Financial rose $1.48 to end at $74.48 as 31,311 stocks passed through the market, Sagicor Group dipped 50 cents in closing at $47 in an exchange of 16,886 stock units, Seprod dropped $2.98 to close at $67.01 with the swapping of 1,602 stocks.

Guardian Holdings rose $5 to $495 in trading 198 units, Jamaica Broilers increased $1.50 to end at $36.50 after exchanging 17,292 stocks, Jamaica Stock Exchange declined 90 cents in closing at $13.05 in switching ownership of 2,448 shares. JMMB Group shed $2.79 after ending at $29 as investors exchanged 113,841 stocks, Key Insurance advanced 48 cents in closing at $3.48 after a transfer of 300 stock units, Kingston Wharves declined $3.46 to $30.54 and closing with 5,626 units being traded. Margaritaville climbed $1.49 to $16.46 after an exchange of 239 shares, Massy Holdings gained $1 to $90, with 5,741 units crossing the market, Mayberry Jamaican Equities shed 60 cents to close at $11.60 with an exchange of 11,691 stock units. NCB Financial rose $1.48 to end at $74.48 as 31,311 stocks passed through the market, Sagicor Group dipped 50 cents in closing at $47 in an exchange of 16,886 stock units, Seprod dropped $2.98 to close at $67.01 with the swapping of 1,602 stocks.  Sterling Investments fell 42 cents to $2.54 in an exchange of 57,819 shares, Sygnus Credit Investments fell 49 cents after ending at $11.60 with investors transferring 12,879 units, Sygnus Real Estate Finance popped $1.43 to end at $11.63, with 1,342 units clearing the market.

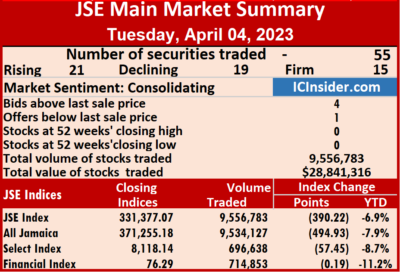

Sterling Investments fell 42 cents to $2.54 in an exchange of 57,819 shares, Sygnus Credit Investments fell 49 cents after ending at $11.60 with investors transferring 12,879 units, Sygnus Real Estate Finance popped $1.43 to end at $11.63, with 1,342 units clearing the market. A total of 9,556,783 shares were traded for $28,842,985 compared to 18,209,479 units at $105,140,128 on Monday.

A total of 9,556,783 shares were traded for $28,842,985 compared to 18,209,479 units at $105,140,128 on Monday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

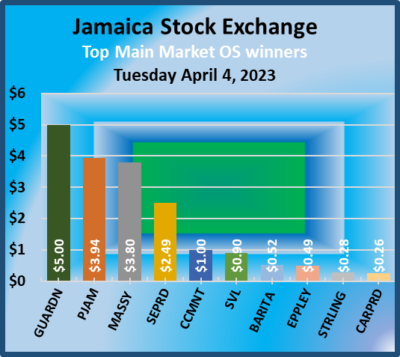

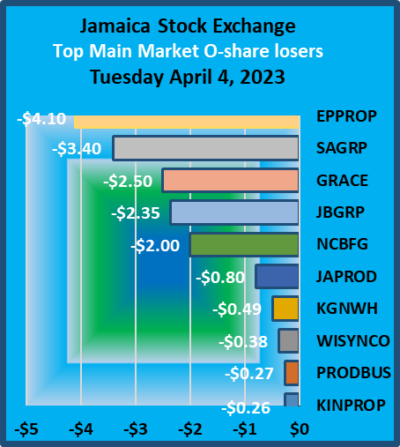

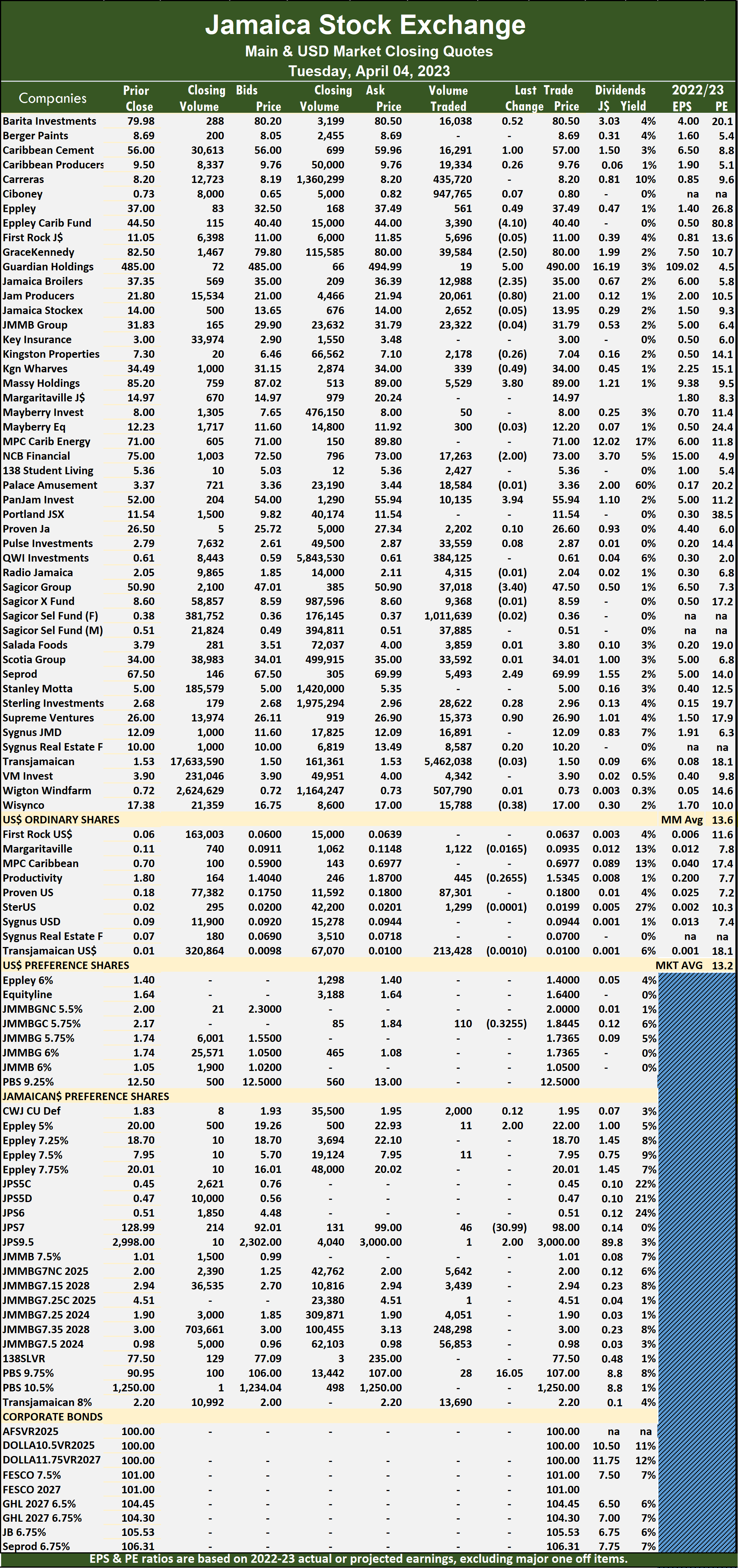

The PE Ratio, a formula used to compute appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Guardian Holdings climbed $5 after ending at $490 as investors exchanged 19 stocks. Jamaica Broilers dipped $2.35 to end at $35, with 12,988 shares changing hands, Jamaica Producers dropped 80 cents to $21 with investors transferring 20,061 stock units, Kingston Wharves lost 49 cents to close at $34 with an exchange of 339 stocks. Massy Holdings popped $3.80 in closing at $89 after an exchange of 5,529 units, NCB Financial dropped $2 to $73 after 17,263 shares passed through the market, Pan Jamaica Group increased $3.94 to end at $55.94 after a transfer of 10,135 stock units. Sagicor Group fell $3.40 in closing at $47.50 in an exchange of 37,018 shares, Seprod rose $2.49 after ending at $69.99 with a transfer of 5,493 stock units and Supreme Ventures gained 90 cents to close at $26.90, with 15,373 stocks crossing the exchange.

Guardian Holdings climbed $5 after ending at $490 as investors exchanged 19 stocks. Jamaica Broilers dipped $2.35 to end at $35, with 12,988 shares changing hands, Jamaica Producers dropped 80 cents to $21 with investors transferring 20,061 stock units, Kingston Wharves lost 49 cents to close at $34 with an exchange of 339 stocks. Massy Holdings popped $3.80 in closing at $89 after an exchange of 5,529 units, NCB Financial dropped $2 to $73 after 17,263 shares passed through the market, Pan Jamaica Group increased $3.94 to end at $55.94 after a transfer of 10,135 stock units. Sagicor Group fell $3.40 in closing at $47.50 in an exchange of 37,018 shares, Seprod rose $2.49 after ending at $69.99 with a transfer of 5,493 stock units and Supreme Ventures gained 90 cents to close at $26.90, with 15,373 stocks crossing the exchange. In the preference segment, Eppley 5% preference share rose $2 in closing at $22 after 11 units crossed the market, Jamaica Public Service 7% dropped $30.99 to $98, with 46 units crossing the market, Jamaica Public Service 9.5% climbed $2 to end at $3000 after exchanging one stock unit and Productive Business Solutions 9.75% preference share increased $16.05 in ending at $107 while exchanging 28 stocks.

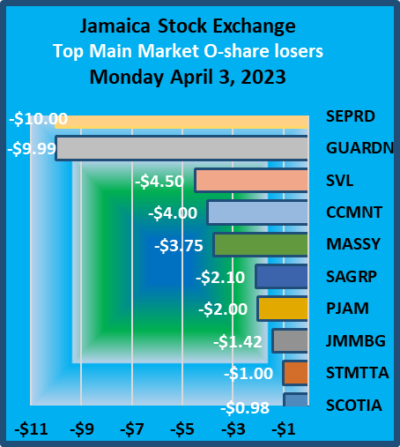

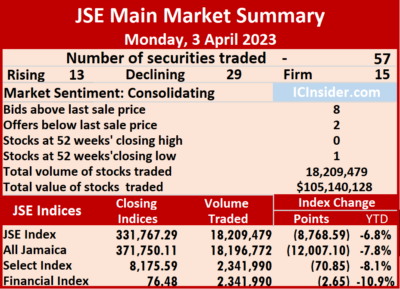

In the preference segment, Eppley 5% preference share rose $2 in closing at $22 after 11 units crossed the market, Jamaica Public Service 7% dropped $30.99 to $98, with 46 units crossing the market, Jamaica Public Service 9.5% climbed $2 to end at $3000 after exchanging one stock unit and Productive Business Solutions 9.75% preference share increased $16.05 in ending at $107 while exchanging 28 stocks. At the close of trading, after a 26 percent fall in the volume of stocks traded with an 82 percent lower value than on Friday, resulting from trading in 57 securities compared to 60 on Friday, with 13 rising, 29 declining and 15 ending unchanged and ended with the JSE Financial Index losing 2.65 points to close at 76.48.

At the close of trading, after a 26 percent fall in the volume of stocks traded with an 82 percent lower value than on Friday, resulting from trading in 57 securities compared to 60 on Friday, with 13 rising, 29 declining and 15 ending unchanged and ended with the JSE Financial Index losing 2.65 points to close at 76.48. The PE Ratio, a formula used to compute appropriate stock values, averages 13.8 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.8 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Key Insurance shed 49 cents to end at $3 in trading 5,110 stocks, Margaritaville lost $2.64 to close at a 52 weeks’ low of $14.97 with 979 shares clearing the market, Massy Holdings dropped $3.75 to end at $85.20 after a transfer of 5,985 stock units. Mayberry Jamaican Equities fell 77 cents in closing at $12.23 while exchanging 40,327 stocks, Pan Jamaica Group, with an expanded portfolio of companies following the acquisition of companies that were part of Jamaica Producers, declined $2 to $52 with an exchange of 5,731 units, Proven Investments dipped 99 cents after ending at $26.50 with investors transferring 22,769 stock units. Sagicor Group dropped $2.10 in closing at $50.90, with 373,953 shares crossing the market, Scotia Group declined 98 cents to close at $34 in trading 12,149 stocks, Seprod dipped $10 to $67.50 as investors exchanged 1,928 units. Stanley Motta lost $1 after ending at $5 after 25,109 stock units passed through the market, Supreme Ventures shed $4.50 to end at $26 with the swapping of 1,094,398 shares and Sygnus Real Estate Finance gained 70 cents to close at $10, with 20,009 stocks changing hands.

Key Insurance shed 49 cents to end at $3 in trading 5,110 stocks, Margaritaville lost $2.64 to close at a 52 weeks’ low of $14.97 with 979 shares clearing the market, Massy Holdings dropped $3.75 to end at $85.20 after a transfer of 5,985 stock units. Mayberry Jamaican Equities fell 77 cents in closing at $12.23 while exchanging 40,327 stocks, Pan Jamaica Group, with an expanded portfolio of companies following the acquisition of companies that were part of Jamaica Producers, declined $2 to $52 with an exchange of 5,731 units, Proven Investments dipped 99 cents after ending at $26.50 with investors transferring 22,769 stock units. Sagicor Group dropped $2.10 in closing at $50.90, with 373,953 shares crossing the market, Scotia Group declined 98 cents to close at $34 in trading 12,149 stocks, Seprod dipped $10 to $67.50 as investors exchanged 1,928 units. Stanley Motta lost $1 after ending at $5 after 25,109 stock units passed through the market, Supreme Ventures shed $4.50 to end at $26 with the swapping of 1,094,398 shares and Sygnus Real Estate Finance gained 70 cents to close at $10, with 20,009 stocks changing hands. In the preference segment, Productive Business 10.50% preference share fell $8 to end at $1250 in an exchange of two stock units and Jamaica Public Service 7% shed $35.11 to $128.99 with a transfer of 434 shares.

In the preference segment, Productive Business 10.50% preference share fell $8 to end at $1250 in an exchange of two stock units and Jamaica Public Service 7% shed $35.11 to $128.99 with a transfer of 434 shares.