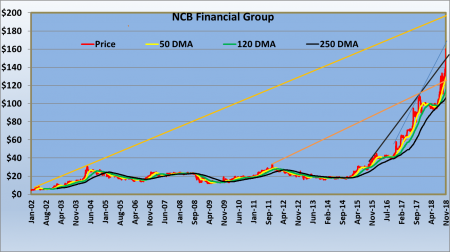

NCB stock closed at $159.05 on Friday.

In November 2014, NCB shares were being sold at $17 on several days but the banking group was about to release record profits of $11.6 billion or earnings per share of $4.73, this compares to EPS of $3.49 in 2013. As late as November 2016, the shares were trading at $46 each, less than 10 times the 2014 profit per share. In just two years since, the stock gained 248 percent plus dividends paid and since late 2014, the capital appreciation is a staggering 941 percent. The truth is that the group is not finished yet delivering for investors. When they take majority ownership in Guardian Holdings investors should see major cost savings from rationalization and increased business with the expanded resources.

NCB Financial hits up on resistance at $160 & may find it difficult to break through to the next level at $200, 25% away.

The stock that traded at $160 this past week is currently trading around resistance level, if it breaks through meaningfully, the next major resistance is at $200 or 25 percent away from current price.

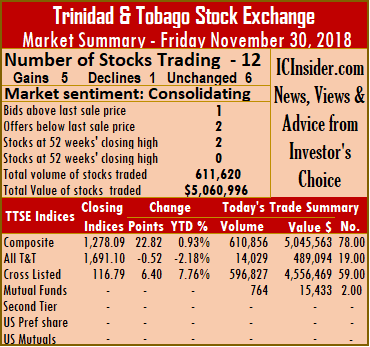

exchanging 251 shares and Sagicor Financial ended trading with a jump of 75 cents and settled at 52 weeks’ high of $10, with 283,131 stock units changing hands.

exchanging 251 shares and Sagicor Financial ended trading with a jump of 75 cents and settled at 52 weeks’ high of $10, with 283,131 stock units changing hands.

accounting policy that will result in gains or losses in investments whether realized or not going straight to the profit and loss account. With growth in the stock market Barita should benefit in two ways, increased value of the portfolio, for example, 48 million JSE shares owned increasing around $100 million in the December quarter so far but Barita is said to also own shares in NCB that has risen sharply in price for the quarter. The equity linked unit trust will garner more fee income based purely on the fact that the portfolio would have grown based on gains in stock price. The other financial stock to be watched is Key Insurance that has traded over 21 million shares so far with the stock having a bid of $4 to buy over 911,000 shares. The movement in the Key shares seems like the start of an aggressive stance an investor, watch developments in this one keenly.

accounting policy that will result in gains or losses in investments whether realized or not going straight to the profit and loss account. With growth in the stock market Barita should benefit in two ways, increased value of the portfolio, for example, 48 million JSE shares owned increasing around $100 million in the December quarter so far but Barita is said to also own shares in NCB that has risen sharply in price for the quarter. The equity linked unit trust will garner more fee income based purely on the fact that the portfolio would have grown based on gains in stock price. The other financial stock to be watched is Key Insurance that has traded over 21 million shares so far with the stock having a bid of $4 to buy over 911,000 shares. The movement in the Key shares seems like the start of an aggressive stance an investor, watch developments in this one keenly.

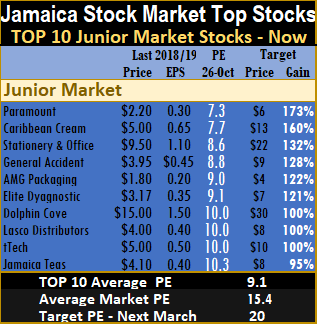

Volatility was the order for the Jamaican stock market for the past week as the market indices bounced around as declining stocks were plentiful as the Junior Market ended with three changes and the main market two.

Volatility was the order for the Jamaican stock market for the past week as the market indices bounced around as declining stocks were plentiful as the Junior Market ended with three changes and the main market two.

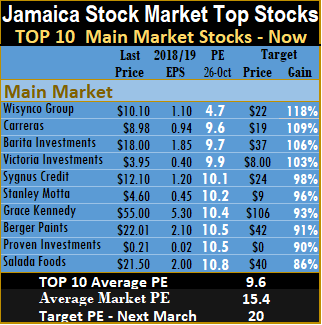

of the year, nevertheless IC insider.com downgraded full year earnings to $3.53 per share, resulting in the stock dropping out of the main market TOP 10 along with

of the year, nevertheless IC insider.com downgraded full year earnings to $3.53 per share, resulting in the stock dropping out of the main market TOP 10 along with  prior week.

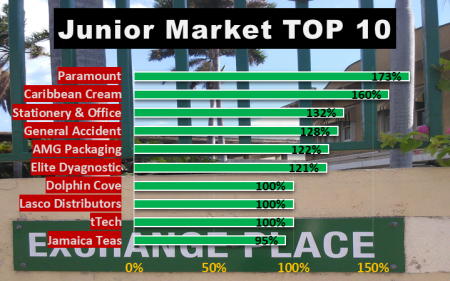

prior week. an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.