Elite Diagnostics is the first 2018 IPO out of 9, that is expected this year.

The initial public offer for Elite Diagnostics will open on January 22 at $2 per share and is scheduled to close on January 29, the prospectus which is now out states.

A total of 70.68 million shares are offered to raise $141 million. The shares to be listed on the Junior Market of the Jamaica Stock Exchange, if the issue is successful and will bring the total company listings on the Junior Market to 35 and the total listings to 39 and the total listings on the entire exchange to 96. Elite will be the second medical related company expected to list on the market and the second within two months.

Based on interim first quarter results to September last year the stock is attractively price and seems set to be heavily oversubscribed to be followed by a big bounce after listing. Elite has done well in just 5 years and seems set to expand at a nice pace going forward.

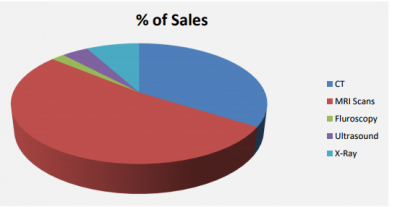

The company operates from Holburn Road in Kingston and now have a new office on 164½ Old Hope Road. The 4 year old company provides imaging and Diagnostic Medical Facility offers services such as MRI, CT Scan, X-Ray, Ultrasound & Fluoroscopy.

Of the shares available for subscription in the IPO, 18 million units are reserved for subscription at $2 each. The company has 282 million issued shares. The proceeds of the IPO will put the company in a position to repay a substantial part of the debt due lenders amounting to $202 million.

A number of Imaging diagnostic service providers operate in Kingston and Saint Andrew. These providers compete with the company for the provision of services in the Kingston and Saint Andrew market.

A number of Imaging diagnostic service providers operate in Kingston and Saint Andrew. These providers compete with the company for the provision of services in the Kingston and Saint Andrew market.

For the September quarter 2017, the company had net profits of $23 million on revenues of $69.8 million compared to revenues of $56.9 million in 2016 and profits of $14.4 million. Annualised, net profits would be $92 million or an increase of 108 percent over the previous financial year, if the current trend continues and would result in earnings per share of 30 cents for a PE ratio of 6.7 times earnings.

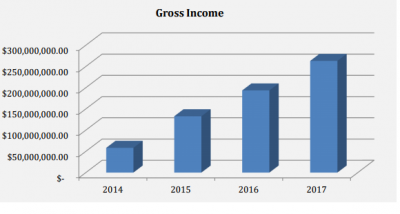

In the first year of operations in 2014 a loss of J$48.7 million was realized on revenues of $58.3 million. For 2015, revenues increased 127 percent and profit of $498,079 was realised. For the financial year ended June last year, revenues increased to J$263 million and net profits moved to J$44.2 million from $29 million in 2016. Gross Profit margin is very high at 67 percent for the 2017 fiscal year with administrative expenses at 31 percent of revenues, excluding depreciation.

In 2017, a new office was set up at 164½ Old Hope Road, opening in November 2017 and is expected to generate additional income for the benefit of the company commencing the current financial year, the company says.

In 2017, a new office was set up at 164½ Old Hope Road, opening in November 2017 and is expected to generate additional income for the benefit of the company commencing the current financial year, the company says.

Directors are, Steven Gooden, B.Sc., M.Sc., CFA, Chairman, Warren Chung, B.Sc. Executive Director, Dr. Neil Fong, B.Sc., M.B.B.S Executive Director, Andre Ho Lung, FCCA, M.Sc. Non-executive Directors are Kevin Donaldson, B.Sc., M.B.A, Paula Kerr-Jarrett, B.A., LL.M., Quentin Hugh Sam, B.Sc., Peter D. Chin, B.Sc., M.B.A., William Mahfood, B.Sc.

The company believes that its principal competitive advantage lies in using state of the art diagnostic equipment. “It 64-Slice or Multi-Slice CT Scanner is one example. It produces clearer images compared to older models by allowing technicians and radiologist to acquire thinner slices and 3D images at lower doses of radiation leading to a more detailed view of the patients’ anatomy. This leads to faster and more accurate diagnosis. 10.20 The Company has recently acquired a 3 Tesla (3T) MRI scanner – to the company’s knowledge only one of two in the Caribbean, the other being located in the Cayman Islands. The strength of the magnetic field generated by a 3T MRI scanner is twice that of the current industry standard 1.5T MRI scanners. The image quality of an MRI scanner is generally dependent on the strength of the magnetic field it is able to generate, the higher the magnetic field the better the image clarity. This increased image clarity aids Radiologists in their interpretations of diagnostic images. In certain circumstances the more powerful scanner is also capable of reducing scan times thereby reducing patient turnaround time.”

NCB Capital Markets and Sagicor Investments are brokers for the issue.

The initial public offer for

The initial public offer for

Yet another Initial Public Offering crossed the line with demand exceeding supply as the latest issue by

Yet another Initial Public Offering crossed the line with demand exceeding supply as the latest issue by

The general public in the

The general public in the

If the general pool is not boosted by much than the general public will end up only a very small sum.

If the general pool is not boosted by much than the general public will end up only a very small sum.