%8 Half Way Tree Road owned by Stanley Motta.

According to a release from the brokers to the deal, the offer of reserve shares and those the general public were full allocated.

The Company intends to apply to the Jamaica Stock Exchange for the listing on the main market of the JSE of all the Shares and to make such application as soon as is conveniently possible following the close of the offer. The offer opened on July 6 and was scheduled to close on July 20, but an notice in Friday the 20th in the Daily Gleaner, disclosed that the issue was closed suggesting that the issue was fully taken up with minimal take up by the NCB Capital Markets as underwriters.

The offer covered 757 million shares with 227,348,547 reserved mostly for family members of the majority shareholders of the Musson Group and 529,970,315 units for the General Public for purchase at $5.31 per share, meant to raise $4 billion.

The Company currently services customers across all 14 parishes of the island, including over 400 pharmacies, private and public hospitals and government agencies including the National Health Fund as well as medical practitioners, and directly to individual end users.

The Company currently services customers across all 14 parishes of the island, including over 400 pharmacies, private and public hospitals and government agencies including the National Health Fund as well as medical practitioners, and directly to individual end users. Indies is not the cleanest entity to come public in recent years. The prospectus shows that there are clear areas of management weakness that need sorting out, but they are not alone, Elite Diagnostics exhibited some similar traits in spite of having men with business experience as board members. The promoters and directors should never have allowed the prospectus to be put out with scanned copy of the audited accounts from the book issued by the auditors. It does not telegraph a good message about management.

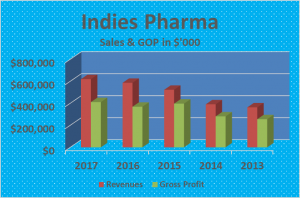

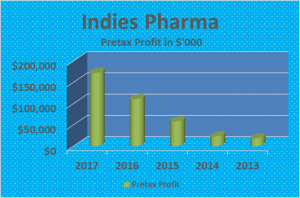

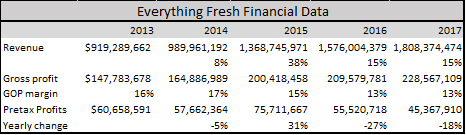

Indies is not the cleanest entity to come public in recent years. The prospectus shows that there are clear areas of management weakness that need sorting out, but they are not alone, Elite Diagnostics exhibited some similar traits in spite of having men with business experience as board members. The promoters and directors should never have allowed the prospectus to be put out with scanned copy of the audited accounts from the book issued by the auditors. It does not telegraph a good message about management. For one Gross profit which has been running between 75 percent to 62 percent between over the past five years with the half year to March coming out at very strong 62 percent, revenues grew an average of 15 percent for the past 4 years but only 6 percent in 2017 but is up by 10 percent for the half year to April. The company has been able to keep cost well under control and this has enable a richness in profitability with pretax profit rising 56 percent in 2017 89 percent in 2016 and 154 percent in 2015 after a 25 percent increase in 2014. The profit for 2016 would have been even better if there was not a loss on sale of fixed asset in the 2017 period amounting to $32 million but the rise in 2017 would likewise be less.

For one Gross profit which has been running between 75 percent to 62 percent between over the past five years with the half year to March coming out at very strong 62 percent, revenues grew an average of 15 percent for the past 4 years but only 6 percent in 2017 but is up by 10 percent for the half year to April. The company has been able to keep cost well under control and this has enable a richness in profitability with pretax profit rising 56 percent in 2017 89 percent in 2016 and 154 percent in 2015 after a 25 percent increase in 2014. The profit for 2016 would have been even better if there was not a loss on sale of fixed asset in the 2017 period amounting to $32 million but the rise in 2017 would likewise be less.

Investors should recognize that not all IPOs are equal. They should also realize that there is a clear pattern that prices then to move up for strongly demanded issues and the undergo some correction. The data shows that the best time to buy after the IPO closes is on the first day or two or a few weeks after when demand falls off and supply increases as short term investors try to offload.

Investors should recognize that not all IPOs are equal. They should also realize that there is a clear pattern that prices then to move up for strongly demanded issues and the undergo some correction. The data shows that the best time to buy after the IPO closes is on the first day or two or a few weeks after when demand falls off and supply increases as short term investors try to offload.

The investment objective of the Company is to generate attractive risk adjusted returns with an emphasis on principal protection by generating current income, and to a lesser extent capital appreciation, through investments primarily in Portfolio Companies using private credit instruments.

The investment objective of the Company is to generate attractive risk adjusted returns with an emphasis on principal protection by generating current income, and to a lesser extent capital appreciation, through investments primarily in Portfolio Companies using private credit instruments.

Operations started in 2008, data provided indicates that revenues hit $919 million in 2013 and generated pretax profit of $61 million. Revenues grew each year reaching $1.8 billion in 2017 with profit of $45 million before taxation of $8 million. The fall in profit for 2017 is due mainly to increase in payment for management team that was previously nominally paid, bringing it more in line with what more normal levels and foreign exchange losses of $4 million. Revenues and profit growth slowed but in 2015 revenues started to rise but lower profit margins resulted in a reduction in profits.

Operations started in 2008, data provided indicates that revenues hit $919 million in 2013 and generated pretax profit of $61 million. Revenues grew each year reaching $1.8 billion in 2017 with profit of $45 million before taxation of $8 million. The fall in profit for 2017 is due mainly to increase in payment for management team that was previously nominally paid, bringing it more in line with what more normal levels and foreign exchange losses of $4 million. Revenues and profit growth slowed but in 2015 revenues started to rise but lower profit margins resulted in a reduction in profits.