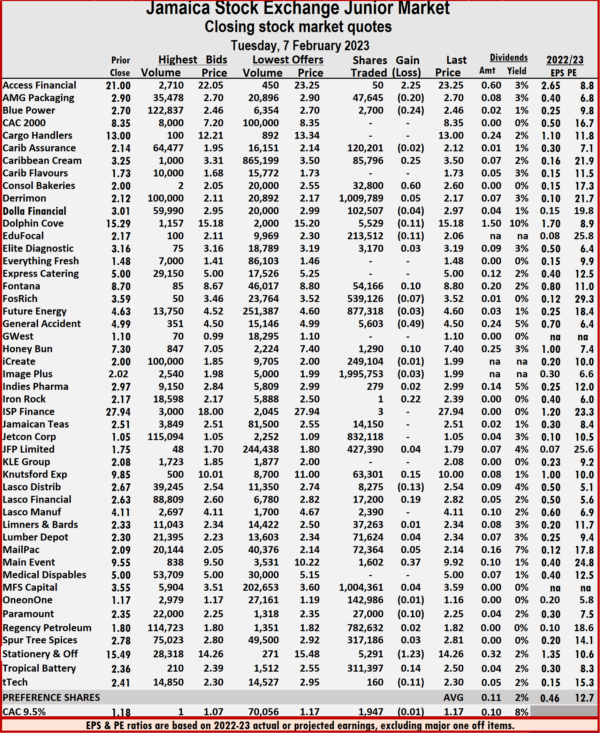

The Junior Market of the Jamaica Stock Exchange closed moderately higher on Tuesday after the market added nearly 90 points up late in the morning session, with the volume of stocks traded declining 21 percent and the value 29 percent lower than on Monday with 40 securities trading down from 47 on Monday and ended with prices of 20 rising, 16 declining and four closing unchanged.

A total of 9,486,819 shares were traded at $24,258,679 compared with 12,032,460 units at $34,094,366 on Monday.

A total of 9,486,819 shares were traded at $24,258,679 compared with 12,032,460 units at $34,094,366 on Monday.

Trading averaged 237,170 shares at $606,467 compared to 256,010 units at $725,412 on Monday. Trading month to date averages 196,347 units at $515,552 versus 187,473 stock units at $495,788 on the previous day. January closed with an average of 239,755 units at $646,375.

Image Plus Consultants led trading with 2 million shares for 21 percent of total volume followed by Derrimon Trading with 1.01 million units for 10.6 percent of the day’s trade and MFS Capital Partners with 1 million units for 10.6 percent market share.

At the close, the Junior Market Index advanced 7.39 points to 3,912.36.

The PE Ratio, a measure of computing appropriate stock values, averages 12.7. The PE ratios of  Junior Market stocks use ICInsider.com’s projected earnings for the financial year ending that fall between November 2022 and August 2023.

Junior Market stocks use ICInsider.com’s projected earnings for the financial year ending that fall between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and three with lower offers.

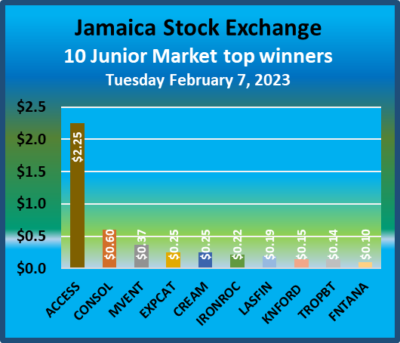

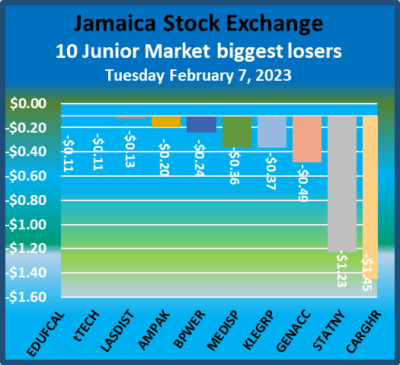

At the close, Access Financial advanced $2.25 to end at $23.25 with an exchange of 50 shares, AMG Packaging lost 20 cents to close at $2.70 after trading 47,645 stock units, Blue Power shed 24 cents to $2.46 in transferring 2,700 units. Caribbean Cream gained 25 cents to close at $3.50 with 85,796 stocks crossing the market, Consolidated Bakeries popped 60 cents in closing at $2.60 with the swapping of 32,800 stock units, Dolphin Cove fell 11 cents to end at $15.18 in switching ownership of 5,529 units.  EduFocal shed 11 cents to close at $2.06 in exchanging 213,512 stocks, Fontana popped 10 cents to finish at $8.80 after 54,166 shares were traded, Fosrich lost 7 cents in ending at $3.52 with investors trading 539,126 shares. General Accident dipped 49 cents to close at $4.50 with 5,603 stock units changing hands, Honey Bun gained 10 cents to end at $7.40 after trading 1,290 stocks, Iron Rock Insurance advanced 22 cents to $2.39 with the swapping of one unit. Knutsford Express rallied 15 cents to close at $10 as investors exchanged 63,301 shares, Lasco Distributors shed 13 cents to end at $2.54 after 8,275 stock units passed through the market, Lasco Financial rose 19 cents to end at $2.82 as investors exchanged 17,200 units. Main Event gained 37 cents to close at $9.92 after a transfer of 1,602 stocks,

EduFocal shed 11 cents to close at $2.06 in exchanging 213,512 stocks, Fontana popped 10 cents to finish at $8.80 after 54,166 shares were traded, Fosrich lost 7 cents in ending at $3.52 with investors trading 539,126 shares. General Accident dipped 49 cents to close at $4.50 with 5,603 stock units changing hands, Honey Bun gained 10 cents to end at $7.40 after trading 1,290 stocks, Iron Rock Insurance advanced 22 cents to $2.39 with the swapping of one unit. Knutsford Express rallied 15 cents to close at $10 as investors exchanged 63,301 shares, Lasco Distributors shed 13 cents to end at $2.54 after 8,275 stock units passed through the market, Lasco Financial rose 19 cents to end at $2.82 as investors exchanged 17,200 units. Main Event gained 37 cents to close at $9.92 after a transfer of 1,602 stocks,  Paramount Trading fell 10 cents to end at $2.25 in trading 27,000 stock units, Stationery and Office Supplies declined $1.23 to $14.26 with the swapping of 5,291 shares and Tropical Battery gained 14 cents in ending at $2.50 after exchanging 311,397 stocks.

Paramount Trading fell 10 cents to end at $2.25 in trading 27,000 stock units, Stationery and Office Supplies declined $1.23 to $14.26 with the swapping of 5,291 shares and Tropical Battery gained 14 cents in ending at $2.50 after exchanging 311,397 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market rally

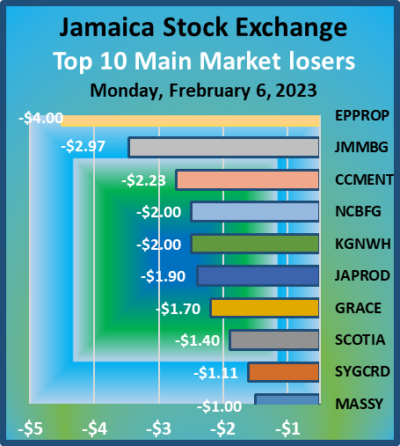

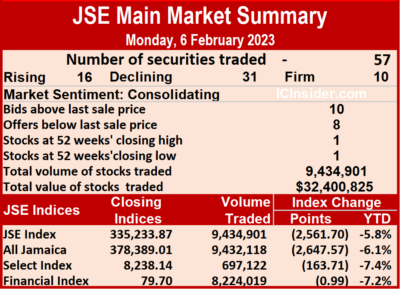

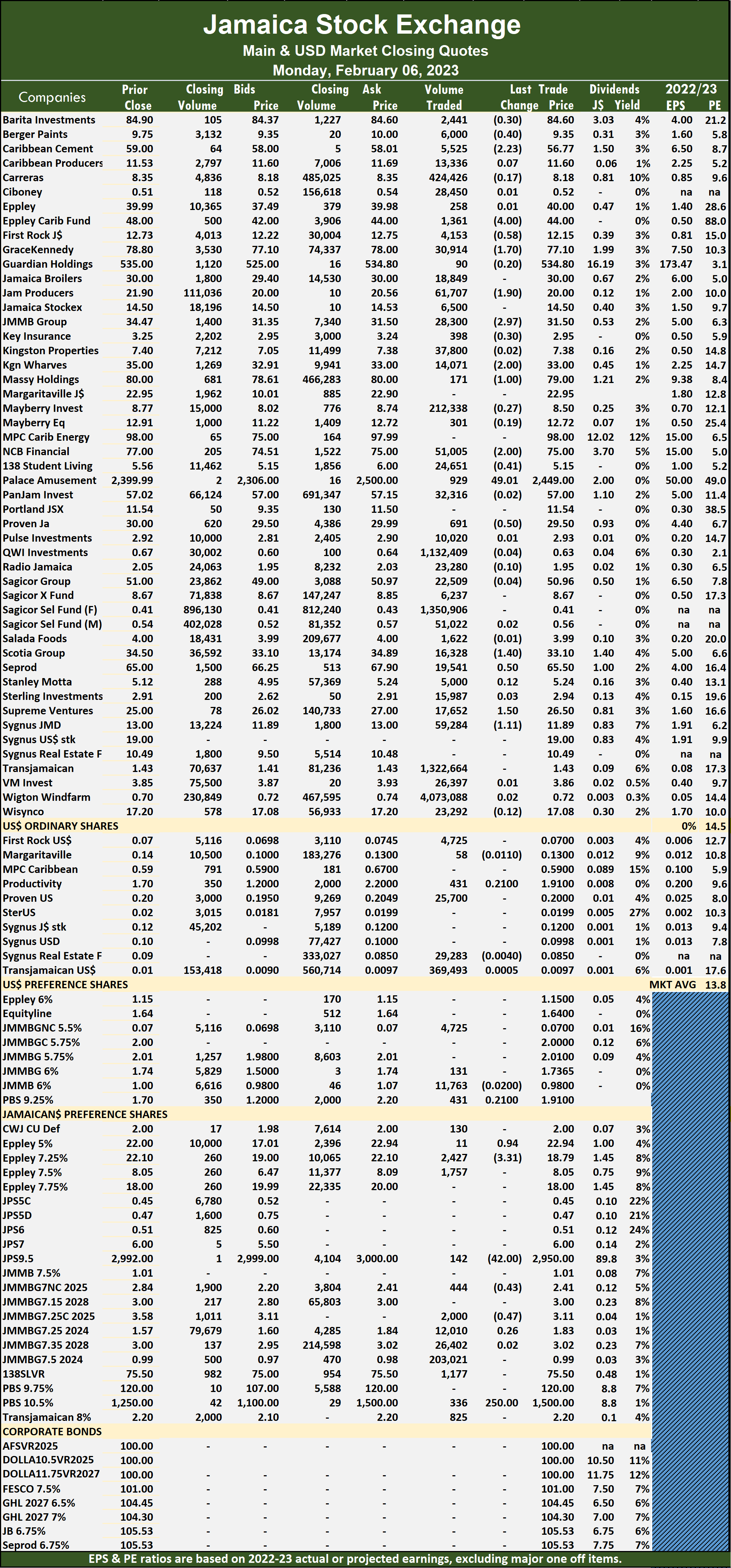

Trading activity drops of the JSE Main market

Trading activity on the Jamaica Stock Exchange Main Market ended on Monday with a 14 percent increase in the volume of stocks traded and the value 68 percent lower than on Friday, from 57 securities trading compared to 60 on Friday, with 16 rising, 31 declining and 10 ending unchanged.

A total of 9,434,901 shares were exchanged for $32,400,825 versus 8,306,314 units at $100,793,32 on Friday.

A total of 9,434,901 shares were exchanged for $32,400,825 versus 8,306,314 units at $100,793,32 on Friday.

Trading averaged 165,525 units at $568,436 versus 138,439 shares at $1,679,857 on Friday and month to date, an average of 143,252 units at $1,060,336 compared to 135,871 units at $1,223,350 on the previous trading day. January closed with an average of 205,236 units at $1,805,558.

Wigton Windfarm led trading with 4.07 million shares for 43.2 percent of total volume followed by Sagicor Select Financial Fund with 1.35 million units for 14.3 percent of the day’s trade, Transjamaican Highway with 1.32 million units for 14 percent of market share and QWI Investments with 1.13 million units for 12 percent market share.

The All Jamaican Composite Index dropped 2,647.57 points to 378,389.01, the JSE Main Index fell 2,561.70 points to end at 335,233.87 and the JSE Financial Index lost 0.99 points to settle at 79.70.

The All Jamaican Composite Index dropped 2,647.57 points to 378,389.01, the JSE Main Index fell 2,561.70 points to end at 335,233.87 and the JSE Financial Index lost 0.99 points to settle at 79.70.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.5 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows 10 stocks ending with bids higher than their last selling prices and eight with lower offers.

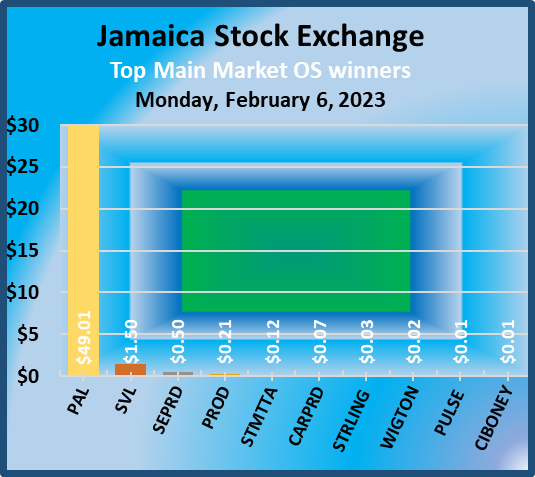

At the close, Berger Paints lost 40 cents to close at $9.35 in trading 6,000 shares, Caribbean Cement declined $2.23 to end at $56.77 with 5,525 stocks crossing the exchange, Eppley Caribbean Property Fund dropped $4 to close at $44 with a transfer of 1,361 stock units. First Rock Real Estate dipped 58 cents in closing at $12.15 with 4,153 units changing hands,  GraceKennedy shed $1.70 in ending at $77.10 in switching ownership of 30,914 units, Jamaica Producers fell $1.90 to $20 in exchanging 61,707 stocks. JMMB Group declined $2.97 in closing at $31.50 with the swapping of 28,300 shares, Kingston Wharves shed $2 to end at $33 as investors exchanged 14,071 stock units, Massy Holdings fell $1 to close at $79 with a transfer of 171 units. NCB Financial shed $2 to end at a 52 weeks’ low of $75 after 51,005 stocks cleared the market, 138 Student Living dipped 41 cents to end at $5.15 in exchanging 24,651 stock units, Palace Amusement climbed $49.01 to $2,449 in switching ownership of 929 shares. Proven Investments lost 50 cents to end at $29.50 after an exchange of 691 stock units, Scotia Group shed $1.40 to close at $33.10 after trading 16,328 units, Seprod gained 50 cents in closing at $65.50 with investors transferring 19,541 stocks. Supreme Ventures advanced $1.50 to $26.50 after trading 17,652 shares and Sygnus Credit Investments fell $1.11 to end at $11.89 with an exchange of 59,284 shares.

GraceKennedy shed $1.70 in ending at $77.10 in switching ownership of 30,914 units, Jamaica Producers fell $1.90 to $20 in exchanging 61,707 stocks. JMMB Group declined $2.97 in closing at $31.50 with the swapping of 28,300 shares, Kingston Wharves shed $2 to end at $33 as investors exchanged 14,071 stock units, Massy Holdings fell $1 to close at $79 with a transfer of 171 units. NCB Financial shed $2 to end at a 52 weeks’ low of $75 after 51,005 stocks cleared the market, 138 Student Living dipped 41 cents to end at $5.15 in exchanging 24,651 stock units, Palace Amusement climbed $49.01 to $2,449 in switching ownership of 929 shares. Proven Investments lost 50 cents to end at $29.50 after an exchange of 691 stock units, Scotia Group shed $1.40 to close at $33.10 after trading 16,328 units, Seprod gained 50 cents in closing at $65.50 with investors transferring 19,541 stocks. Supreme Ventures advanced $1.50 to $26.50 after trading 17,652 shares and Sygnus Credit Investments fell $1.11 to end at $11.89 with an exchange of 59,284 shares.

In the preference segment, Productive Business 10.50% preference share popped $250 to a 52 weeks’ high of $1,500 with 336 stock units changing hands. Eppley 5% preference share rallied 94 cents to close at $22.94 after 11 stocks crossed the market, Eppley 7.25% preference share declined $3.31 in ending at $18.79 after exchanging 2,427 units, Jamaica Public Service 9.5% dropped $42 to $2,950 trading 142 stocks. JMMB Group 7% preference share lost 43 cents to end at $2.41 as 444 shares passed through the market and JMMB Group 7.25% preference share dipped 47 cents to $3.11 with a transfer of 2,000 stock units but after it traded at a 52 weeks’ intraday high of $3.94.

In the preference segment, Productive Business 10.50% preference share popped $250 to a 52 weeks’ high of $1,500 with 336 stock units changing hands. Eppley 5% preference share rallied 94 cents to close at $22.94 after 11 stocks crossed the market, Eppley 7.25% preference share declined $3.31 in ending at $18.79 after exchanging 2,427 units, Jamaica Public Service 9.5% dropped $42 to $2,950 trading 142 stocks. JMMB Group 7% preference share lost 43 cents to end at $2.41 as 444 shares passed through the market and JMMB Group 7.25% preference share dipped 47 cents to $3.11 with a transfer of 2,000 stock units but after it traded at a 52 weeks’ intraday high of $3.94.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

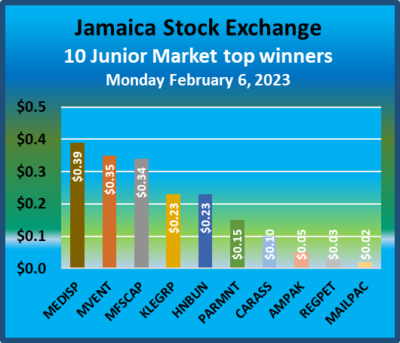

Junior Market trading jumps

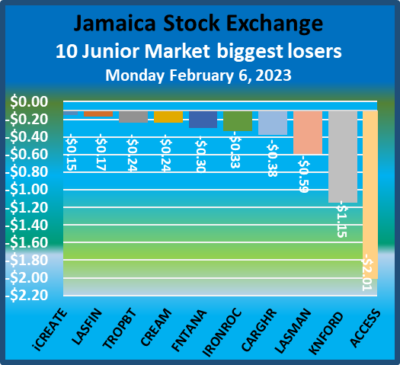

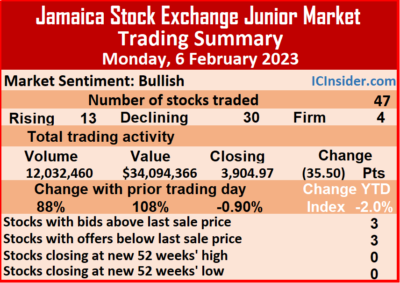

Surging trading on the Junior Market of the Jamaica Stock Exchange on Monday sent the volume of stocks trading up by 88 percent with a value 108 percent higher than on Friday after 47 securities changed hands compared with 45 on Friday and ended with 13 rising, 30 declining and 4 closing unchanged.

A total of 12,032,460 shares were exchanged for $34,094,366 compared to 6,415,297 units at $16,382,248 on Friday.

A total of 12,032,460 shares were exchanged for $34,094,366 compared to 6,415,297 units at $16,382,248 on Friday.

Trading averaged 256,010 shares at $725,412 compared with 142,562 units at $364,050 on Friday, with the month to date averaging 187,473 units at $495,788 compared to 163,960 stock units at $417,012 on the pior trading day. January closed with an average of 239,755 units at $646,375.

MFS Capital Partners led trading with 5.81 million shares for 48.3 percent of total volume followed by JFP Ltd with 1.02 million units for 8.5 percent of the day’s trade and Image Plus Consultants with 826,181 units for 6.9 percent market share.

At the close, the Junior Market Index shed 35.50 points to close at 3,904.97.

The PE Ratio, a measure of computing appropriate stock values, averages 12.6. The PE ratios of Junior Market stocks include ICInsider.com projected earnings for the financial years ending between November 2022 and August 2023.

The PE Ratio, a measure of computing appropriate stock values, averages 12.6. The PE ratios of Junior Market stocks include ICInsider.com projected earnings for the financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and three with lower offers.

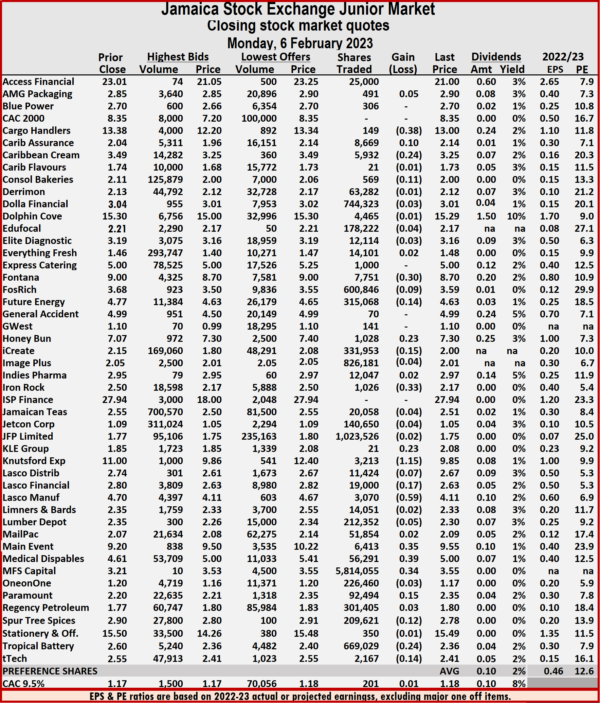

At the close, Access Financial fell $2.01 in closing at $21 after a transfer of 25,000 shares, Cargo Handlers dipped 38 cents to close at $13 in trading 149 stocks, Caribbean Assurance Brokers gained 10 cents to end at $2.14, with 8,669 units clearing the market. Caribbean Cream dipped 24 cents to settle at $3.25 with investors transferring 5,932 stock units, Consolidated Bakeries lost 11 cents after ending at $2 with 569 stocks changing hands, Fontana shed 30 cents to close at $8.70 with the swapping of 7,751 shares.  Fosrich lost 9 cents to end at $3.59 as investors traded 600,846 stock units, Future Energy Source shed 14 cents in ending at $4.63 with an exchange of 315,068 units, Honey Bun rallied 23 cents in closing at $7.30 in switching ownership of 1,028 units. iCreate lost 15 cents to end at $2 with a transfer of 331,953 shares, Iron Rock Insurance fell 33 cents to finish at $2.17 in an exchange of 1,026 stock units, KLE Group rose 23 cents to $2.08 after exchanging 21 stocks. Knutsford Express declined $1.15 in ending at $9.85 as investors traded 3,213 shares, Lasco Distributors lost 7 cents to close at $2.67 after 11,424 stock units passed through the exchange, Lasco Financial dipped 17 cents to $2.63 trading 19,000 stocks. Lasco Manufacturing shed 59 cents to end at $4.11 with 3,070 units changing hands, Main Event rose 35 cents to end at $9.55 after 6,413 shares passed through the market, Medical Disposables advanced 39 cents to close at $5 in trading 56,291 stock units. MFS Capital Partners gained 34 cents in closing at $3.55 in switching ownership of 5,814,055 units,

Fosrich lost 9 cents to end at $3.59 as investors traded 600,846 stock units, Future Energy Source shed 14 cents in ending at $4.63 with an exchange of 315,068 units, Honey Bun rallied 23 cents in closing at $7.30 in switching ownership of 1,028 units. iCreate lost 15 cents to end at $2 with a transfer of 331,953 shares, Iron Rock Insurance fell 33 cents to finish at $2.17 in an exchange of 1,026 stock units, KLE Group rose 23 cents to $2.08 after exchanging 21 stocks. Knutsford Express declined $1.15 in ending at $9.85 as investors traded 3,213 shares, Lasco Distributors lost 7 cents to close at $2.67 after 11,424 stock units passed through the exchange, Lasco Financial dipped 17 cents to $2.63 trading 19,000 stocks. Lasco Manufacturing shed 59 cents to end at $4.11 with 3,070 units changing hands, Main Event rose 35 cents to end at $9.55 after 6,413 shares passed through the market, Medical Disposables advanced 39 cents to close at $5 in trading 56,291 stock units. MFS Capital Partners gained 34 cents in closing at $3.55 in switching ownership of 5,814,055 units,  Paramount Trading popped 15 cents to $2.35 after exchanging 92,494 stocks, Spur Tree Spices lost 12 cents to close at $2.78 with the swapping of 209,621 stock units. Tropical Battery shed 24 cents to end at $2.36 while trading 669,029 shares and tTech declined 14 cents to $2.41 with a transfer of 2,167 stocks.

Paramount Trading popped 15 cents to $2.35 after exchanging 92,494 stocks, Spur Tree Spices lost 12 cents to close at $2.78 with the swapping of 209,621 stock units. Tropical Battery shed 24 cents to end at $2.36 while trading 669,029 shares and tTech declined 14 cents to $2.41 with a transfer of 2,167 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market edged up on trading gains

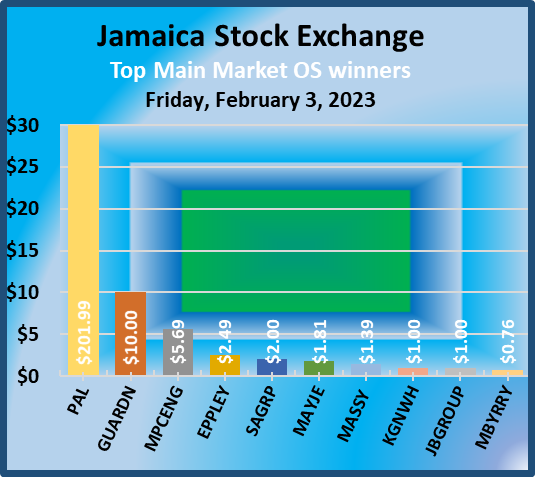

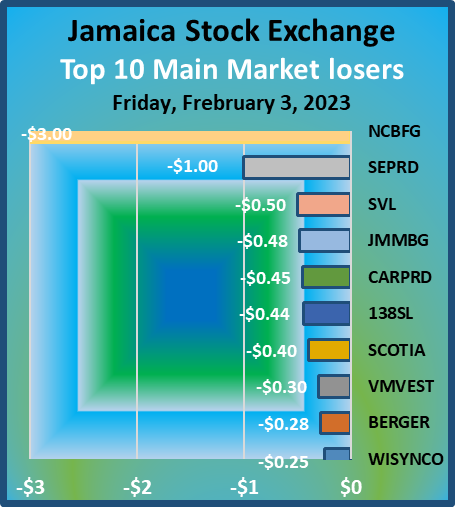

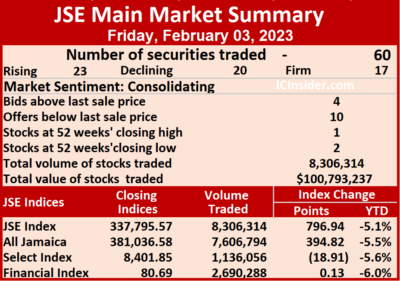

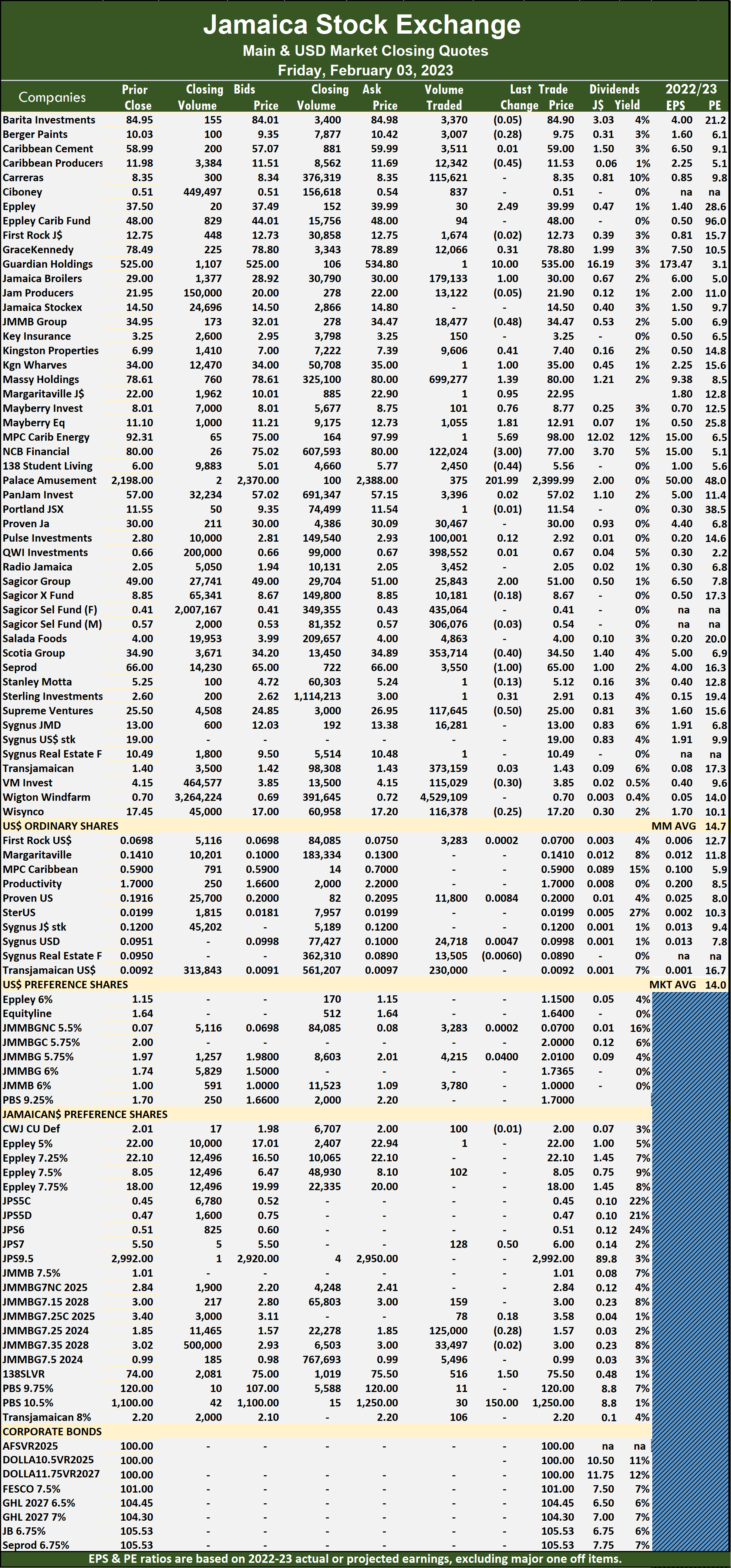

Trading gained strength on the Jamaica Stock Exchange Main Market on Friday with the volume of stocks traded rising 48 percent with a 188 percent rise in value compared to Thursday, after 60 securities changed hands compared to 55 on Thursday, with 23 rising, 20 declining and 17 ending unchanged.

A total of 8,306,314 shares were traded for $100,793,237 compared to 5,605,407 units at $34,963,663 on Thursday.

A total of 8,306,314 shares were traded for $100,793,237 compared to 5,605,407 units at $34,963,663 on Thursday.

Trading averaged 138,439 shares at $1,679,857 compared with 101,916 units at $635,703 on Thursday and month to date, an average of 135,871 units at $1,223,350 compared with 134,495 units at $978,777 on the previous day. January closed with an average of 205,236 units at $1,805,558.

Wigton Windfarm led trading with 4.53 million shares for 54.5 percent of total volume followed by Massy Holdings with 699,277 units for 8.4 percent of the day’s trade and Sagicor Select Financial Fund with 435,064 units for 5.2 percent market share.

The All Jamaican Composite Index advanced 394.82 points to 381,036.58, the JSE Main Index rallied 796.94 points to 337,795.57 and the JSE Financial Index popped 0.13 points to close at 80.69.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.7 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with financial year ends between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.7 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with financial year ends between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and 10 with lower offers.

At the close, Caribbean Producers lost 45 cents in closing at $11.53 with an exchange of 12,342 shares, Eppley advanced $2.49 to $39.99 after trading 30 units, Guardian Holdings rallied $10 to close at $535 after exchanging one stock unit. Jamaica Broilers popped $1 to $30 with a transfer of 179,133 stocks, JMMB Group fell 48 cents to $34.47 with the swapping of 18,477 units, Kingston Properties gained 41 cents to close at $7.40 in switching ownership of 9,606 shares. Kingston Wharves advanced $1 to $35 with one stock unit changing hands, Margaritaville rose 95 cents to $22.95 with an exchange of one stock unit,  Massy Holdings climbed $1.39 to close at $80 after 699,277 stock units crossed the market. Mayberry Investments rose 76 cents to $8.77 after a transfer of 101 units, Mayberry Jamaican Equities advanced $1.81 to close at $12.91 in an exchange of 1,055 shares, MPC Caribbean Clean Energy climbed $5.69 to $98 after trading one stock. NCB Financial declined $3 to a 52 weeks’ low of $77 after 122,024 units passed through the market, following the release of first quarter results to December with lower profit before other comprehensive income. 138 Student Living shed 44 cents in ending at $5.56 after 2,450 shares were traded, Palace Amusement climbed $201.99 in closing at $2,399.99 after switching ownership of 375 stocks. Sagicor Group rallied $2 to settle at $51 with the swapping of 25,843 stock units, Scotia Group lost 40 cents to finish at $34.50 as investors exchanged 353,714 units, Seprod dipped $1 to end at $65 in transferring 3,550 shares and Supreme Ventures shed 50 cents to close at $25 after 117,645 stock units cleared the market.

Massy Holdings climbed $1.39 to close at $80 after 699,277 stock units crossed the market. Mayberry Investments rose 76 cents to $8.77 after a transfer of 101 units, Mayberry Jamaican Equities advanced $1.81 to close at $12.91 in an exchange of 1,055 shares, MPC Caribbean Clean Energy climbed $5.69 to $98 after trading one stock. NCB Financial declined $3 to a 52 weeks’ low of $77 after 122,024 units passed through the market, following the release of first quarter results to December with lower profit before other comprehensive income. 138 Student Living shed 44 cents in ending at $5.56 after 2,450 shares were traded, Palace Amusement climbed $201.99 in closing at $2,399.99 after switching ownership of 375 stocks. Sagicor Group rallied $2 to settle at $51 with the swapping of 25,843 stock units, Scotia Group lost 40 cents to finish at $34.50 as investors exchanged 353,714 units, Seprod dipped $1 to end at $65 in transferring 3,550 shares and Supreme Ventures shed 50 cents to close at $25 after 117,645 stock units cleared the market.

In the preference segment, Productive Business 10.50% preference share popped $150 after ending at a 52 weeks’ high of $1,250 with 30 stocks changing hands, Jamaica Public Service 7% gained 50 cents in closing at a record high of $6 in exchanging 128 shares and 138 Student Living preference share rose $1.50 to $75.50 with investors transferring 516 units.

In the preference segment, Productive Business 10.50% preference share popped $150 after ending at a 52 weeks’ high of $1,250 with 30 stocks changing hands, Jamaica Public Service 7% gained 50 cents in closing at a record high of $6 in exchanging 128 shares and 138 Student Living preference share rose $1.50 to $75.50 with investors transferring 516 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

More declines for Junior Market

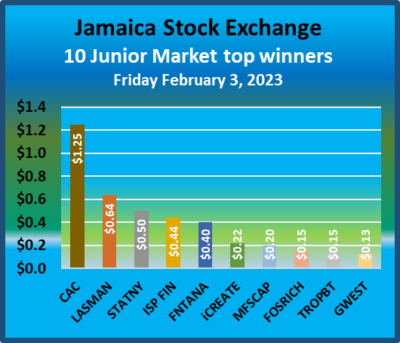

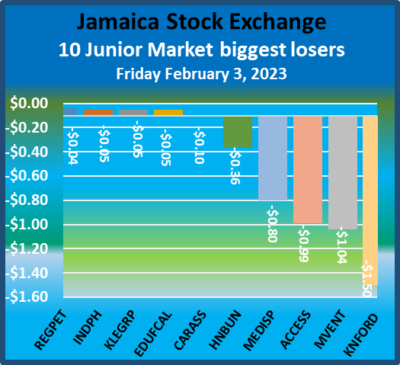

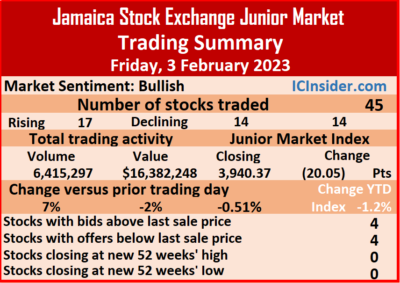

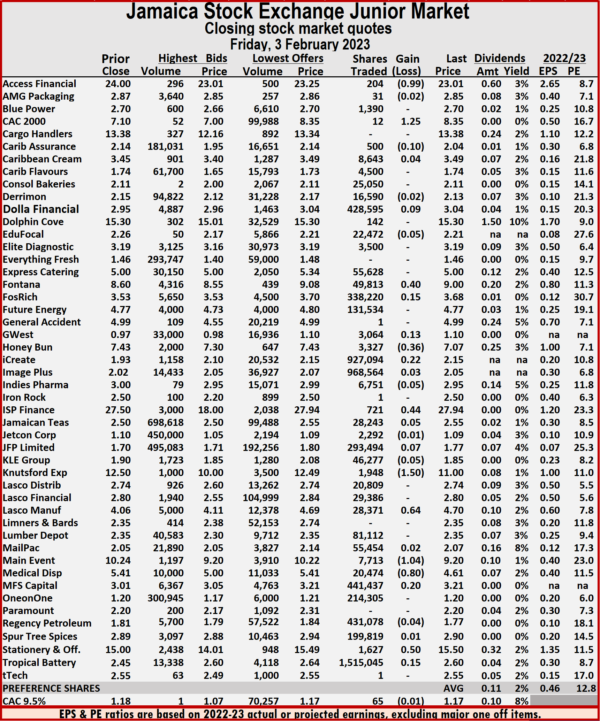

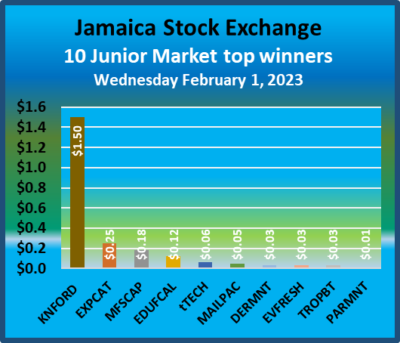

Trading closed on the Junior Market of the Jamaica Stock Exchange on Friday with moderate changes from Thursday after trading took place in 45 securities down from 47 on Thursday, and ended with 17 rising, 14 declining and 14 closing unchanged and resulting in a fall in the market index by 19.95 points to 3,940.47 and ending the week lower than the start of the year.

A total of 6,415,297 shares were exchanged for $16,382,248 against 5,986,665 units at $16,728,284 on Thursday.

A total of 6,415,297 shares were exchanged for $16,382,248 against 5,986,665 units at $16,728,284 on Thursday.

Trading averaged 142,562 shares at $364,050 compared to 127,376 units at $355,921 on Thursday. Trading for the month to date averages 163,960 units at $417,012 compared with 174,426 stock units at $442,917 on the previous day. January closed with an average of 239,755 units at $646,375.

Tropical Battery led trading with 1.52 million shares for 23.6 percent of total volume followed by recently listed Image Plus Consultants, with 968,564 units for 15.1 percent of the day’s trade and iCreate with 927,094 units for 14.5 percent of market share.

The PE Ratio, a measure of computing appropriate stock values, averages 12.8. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for the financial years ending between November 2022 and August 2023.

The PE Ratio, a measure of computing appropriate stock values, averages 12.8. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for the financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and four with lower offers.

At the close, Access Financial dipped 99 cents in closing at $23.01 in an exchange of 204 shares, CAC 2000 advanced $1.25 to close at $8.35 in switching ownership of 12 stock units, Caribbean Assurance Brokers lost 10 cents to finish $2.04 in trading 500 stocks. Fontana rallied 40 cents after ending at $9 and trading 49,813 units, Fosrich gained 15 cents to close at $3.68 as investors exchanged 338,220 units, GWest Corporation popped 13 cents to end at $1.10 after transferring 3,064 stock units. Honey Bun shed 36 cents in ending at $7.07 in switching ownership of 3,327 shares, iCreate rose 22 cents to $2.15 with the swapping of 927,094 stocks, following a release of the company signing an agreement to acquire Visual Ideas Execution Limited, ISP Finance popped 44 cents to $27.94 after exchanging 721 units. JFP Ltd gained 7 cents to settle at $1.77, with 293,494 shares crossing the market, Knutsford Express fell $1.50 to $11 with 1,948 stocks changing hands, Lasco Manufacturing rose 64 cents to $4.70 with a transfer of 28,371 stock units. Main Event fell $1.04 to $9.20 after 7,713 units passed through the market, Medical Disposables shed 80 cents to close at $4.61 after trading 20,474 stocks, MFS Capital Partners gained 20 cents in closing at $3.21 after an exchange of 441,437 stock units.

Honey Bun shed 36 cents in ending at $7.07 in switching ownership of 3,327 shares, iCreate rose 22 cents to $2.15 with the swapping of 927,094 stocks, following a release of the company signing an agreement to acquire Visual Ideas Execution Limited, ISP Finance popped 44 cents to $27.94 after exchanging 721 units. JFP Ltd gained 7 cents to settle at $1.77, with 293,494 shares crossing the market, Knutsford Express fell $1.50 to $11 with 1,948 stocks changing hands, Lasco Manufacturing rose 64 cents to $4.70 with a transfer of 28,371 stock units. Main Event fell $1.04 to $9.20 after 7,713 units passed through the market, Medical Disposables shed 80 cents to close at $4.61 after trading 20,474 stocks, MFS Capital Partners gained 20 cents in closing at $3.21 after an exchange of 441,437 stock units. Stationery and Office Supplies popped 50 cents to end at $15.50 with investors transferring just 1,627 shares and Tropical Battery gained 15 cents in closing at $2.60 after 1,515,045 stock units cleared the market.

Stationery and Office Supplies popped 50 cents to end at $15.50 with investors transferring just 1,627 shares and Tropical Battery gained 15 cents in closing at $2.60 after 1,515,045 stock units cleared the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market Trading drops as rising stocks beat

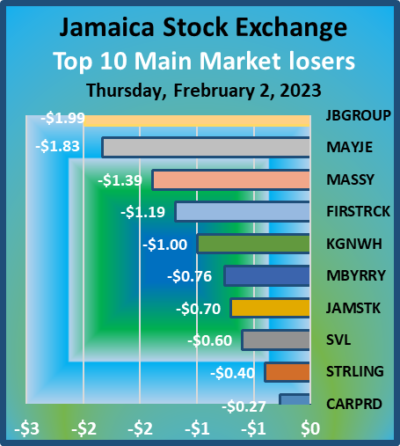

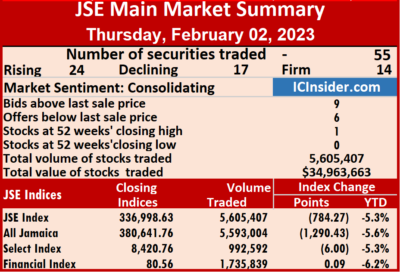

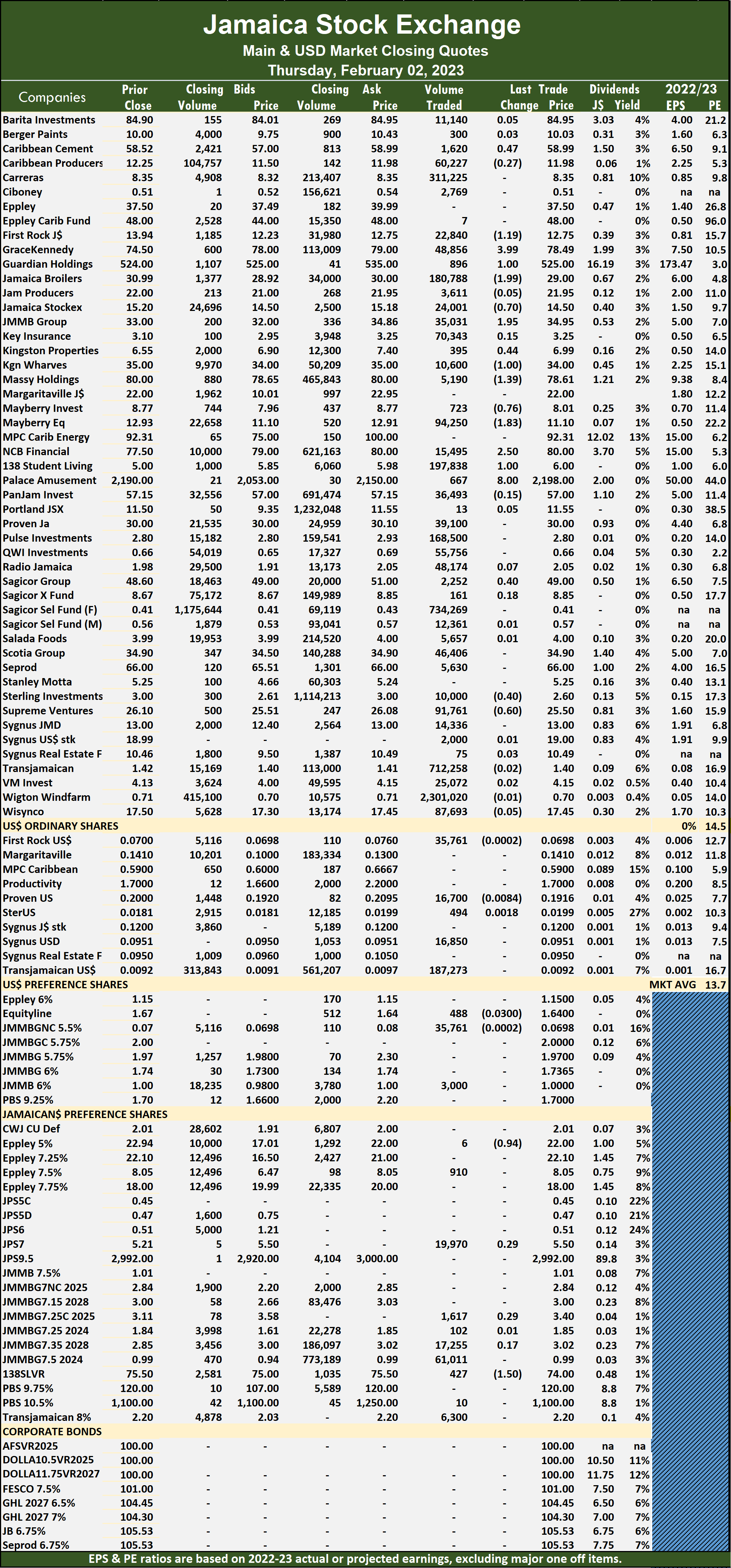

For a second consecutive day, trading on the Jamaica Stock Exchange Main Market fell at the close of market activity on Thursday, flowing from a 41 percent decline in the volume of stocks passing through the market with a 53 percent fall in value compared to Wednesday, resulting from 55 securities trading versus 57 on Wednesday, with 24 rising, 17 declining and 14 ending unchanged.

A total of 5,605,407 shares were exchanged for $34,963,663 versus 9,458,006 units at $74,659,322 on Wednesday.

A total of 5,605,407 shares were exchanged for $34,963,663 versus 9,458,006 units at $74,659,322 on Wednesday.

Trading averaged 101,916 units at $635,703 compared with 165,930 shares at $1,309,813 on Wednesday and month to date, an average of 134,495 units at $978,777 well below the average of 205,236 units at $1,805,558 for January.

Wigton Windfarm led trading with 2.30 million shares for 41.1 percent of total volume, followed by Sagicor Select Financial Fund with 734,269 units for 13.1 percent of the day’s trade and Transjamaican Highway with 712,258 units for 12.7 percent market share.

The All Jamaican Composite Index shed 1,290.43 points to end at 380,641.76, the JSE Main Index dipped 784.27 points to 336,998.63 and the JSE Financial Index popped 0.09 points to close at 80.56.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with their financial year ends between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with their financial year ends between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and six with lower offers.

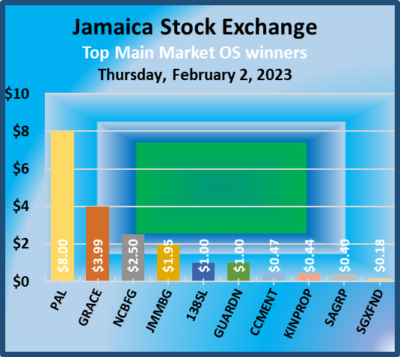

At the close, Caribbean Cement gained 47 cents to end at $58.99 after 1,620 shares were traded, First Rock Real Estate fell $1.19 to $12.75 as investors traded 22,840 stock units, GraceKennedy advanced $3.99 to $78.49 with 48,856 stocks changing hands. Guardian Holdings rose $1 to close at $525 with 896 units crossing the market, Jamaica Broilers fell $1.99 ending at $29 with the transfer of 180,788 shares, Jamaica Stock Exchange shed 70 cents to finish at $14.50 with the swapping of 24,001 units. JMMB Group advanced $1.95 to $34.95 in an exchange of 35,031 stock units,  Kingston Properties rallied 44 cents to $6.99 after 395 stocks cleared the market, Kingston Wharves dipped $1 to $34 trading 10,600 stock units. Massy Holdings declined $1.39 in closing at $78.61 after switching ownership of 5,190 units, Mayberry Investments shed 76 cents to end at $8.01 with investors transferring 723 shares, Mayberry Jamaican Equities declined $1.83 to close at $11.10 after 94,250 stocks passed through the market. NCB Financial advanced $2.50 in closing at $80 in transferring 15,495 units, 138 Student Living popped $1 to $6 with 197,838 shares changing hands, Palace Amusement climbed $8 in ending at $2,198 with a transfer of 667 stocks. Sagicor Group gained 40 cents to settle at $49 trading 2,252 stock units,

Kingston Properties rallied 44 cents to $6.99 after 395 stocks cleared the market, Kingston Wharves dipped $1 to $34 trading 10,600 stock units. Massy Holdings declined $1.39 in closing at $78.61 after switching ownership of 5,190 units, Mayberry Investments shed 76 cents to end at $8.01 with investors transferring 723 shares, Mayberry Jamaican Equities declined $1.83 to close at $11.10 after 94,250 stocks passed through the market. NCB Financial advanced $2.50 in closing at $80 in transferring 15,495 units, 138 Student Living popped $1 to $6 with 197,838 shares changing hands, Palace Amusement climbed $8 in ending at $2,198 with a transfer of 667 stocks. Sagicor Group gained 40 cents to settle at $49 trading 2,252 stock units,  Sterling Investments lost 40 cents to close at $2.60 with the swapping of 10,000 shares and Supreme Ventures shed 60 cents to end at $25.50 after an exchange of 91,761 units.

Sterling Investments lost 40 cents to close at $2.60 with the swapping of 10,000 shares and Supreme Ventures shed 60 cents to end at $25.50 after an exchange of 91,761 units.

In the preference segment, Eppley 5% preference share lost 94 cents to end at $22 after a transfer of 6 stocks and 138 Student Living preference share fell $1.50 in closing at $74 in switching ownership of 427 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market Index drops for a second day

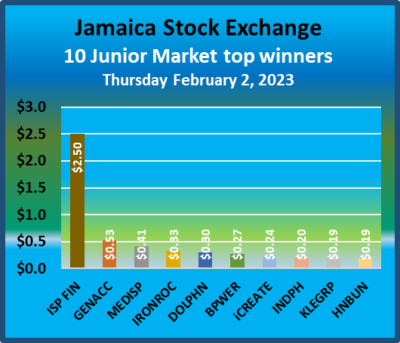

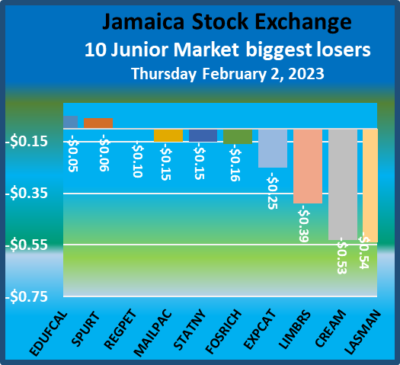

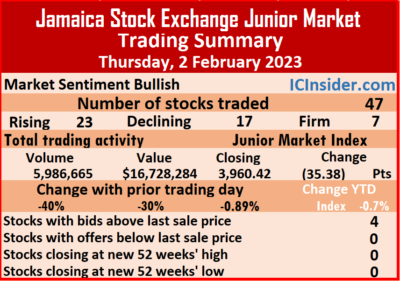

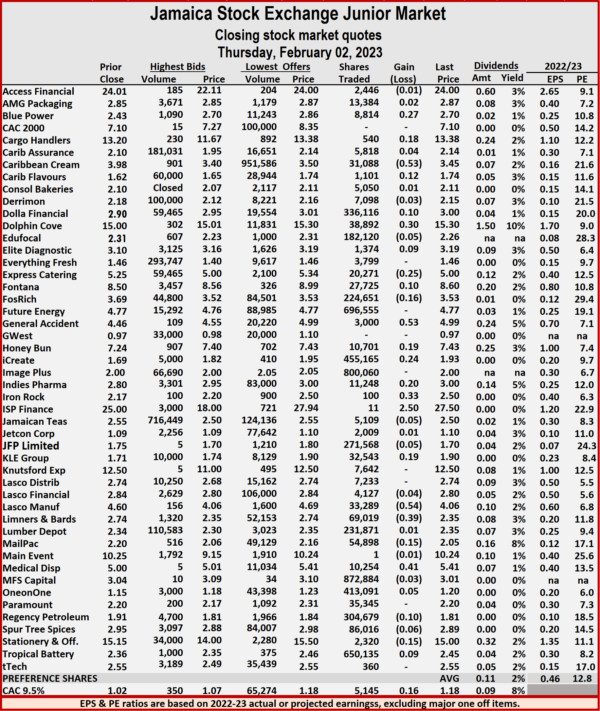

Investors were less active in Trading levels dropped the Junior Market of the Jamaica Stock Exchange on Thursday, resulting in a 40 percent fall in the volume of stocks traded, with the value slipping by 30 percent compared to trading on Wednesday, with trading in 47 securities compared with 45 on Wednesday and ending with 23 rising, 17 declining and seven unchanged.

A total of 5,986,665 shares were traded for $16,728,284 versus 10,060,543 units at $24,020,110 on Wednesday.

A total of 5,986,665 shares were traded for $16,728,284 versus 10,060,543 units at $24,020,110 on Wednesday.

Trading averaged 127,376 shares at $355,921 compared with 223,568 units at $533,780 on Wednesday, with the month to date averaging 174,426 stock units at $442,917. January closed with an average of 239,755 units at $646,375.

MFS Capital Partners led trading with 872,884 shares for 14.6 percent of total volume, followed by Image Plus Consultants with 800,060 units for 13.4 percent of the day’s trade and Future Energy Source with 696,555 units for 11.6 percent market share.

At the close, the Junior Market Index fell 35.38 points to settle at 3,960.42, giving back all of Tuesday’s substantial gains and a bit more.

The PE Ratio, a measure of computing appropriate stock values, averages 12.8. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for the financial years that end between November 2022 and August 2023.

The PE Ratio, a measure of computing appropriate stock values, averages 12.8. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for the financial years that end between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and none with a lower offer.

At the close, Blue Power rose 27 cents in closing at $2.70 after 8,814 shares were traded, Cargo Handlers rallied 18 cents ending at $13.38 with investors transferring 540 stocks, Caribbean Cream fell 53 cents to $3.45 after an exchange of 31,088 stock units. Caribbean Flavours gained 12 cents to end at $1.74 as investors switched ownership of 1,101 units, Dolla Financial popped 10 cents to close at $3 with a transfer of 336,116 shares, Dolphin Cove rose 30 cents in closing at $15.30, with 38,892 stocks crossing the market.  Elite Diagnostic popped 9 cents to close at $3.19 with 1,374 units changing hands, Express Catering lost 25 cents to end at $5 in switching ownership of 20,271 stock units, Fontana gained 10 cents to settle at $8.60 after swapping of 27,725 stocks. Fosrich dipped 16 cents to end at $3.53 in trading 224,651 shares, General Accident popped 53 cents to finish at $4.99 after 3,000 stock units cleared the market, Honey Bun advanced 19 cents to $7.43 after an exchange of 10,701 units, iCreate rallied 24 cents to $1.93 after trading 455,165 stocks, Indies Pharma gained 20 cents in ending at $3 with 11,248 units changing hands, Iron Rock Insurance rose 33 cents to close at $2.50 as investors exchanged 100 shares. ISP Finance climbed $2.50 in closing at $27.50 after a transfer of 11 stock units, KLE Group gained 19 cents to settle at $1.90 after an exchange of 32,543 units, Lasco Manufacturing declined 54 cents to end at $4.06 after 33,289 stock units passed through the market.

Elite Diagnostic popped 9 cents to close at $3.19 with 1,374 units changing hands, Express Catering lost 25 cents to end at $5 in switching ownership of 20,271 stock units, Fontana gained 10 cents to settle at $8.60 after swapping of 27,725 stocks. Fosrich dipped 16 cents to end at $3.53 in trading 224,651 shares, General Accident popped 53 cents to finish at $4.99 after 3,000 stock units cleared the market, Honey Bun advanced 19 cents to $7.43 after an exchange of 10,701 units, iCreate rallied 24 cents to $1.93 after trading 455,165 stocks, Indies Pharma gained 20 cents in ending at $3 with 11,248 units changing hands, Iron Rock Insurance rose 33 cents to close at $2.50 as investors exchanged 100 shares. ISP Finance climbed $2.50 in closing at $27.50 after a transfer of 11 stock units, KLE Group gained 19 cents to settle at $1.90 after an exchange of 32,543 units, Lasco Manufacturing declined 54 cents to end at $4.06 after 33,289 stock units passed through the market.  Limners and Bards dipped 39 cents to close at $2.35 in an exchange of 69,019 stocks, Mailpac Group shed 15 cents to $2.05 with a transfer of 54,898 shares, Medical Disposables rose 41 cents to $5.41 with the swapping of 10,254 stocks. Regency Petroleum lost 10 cents ending at $1.81, trading 304,679 shares, Stationery and Office Supplies shed 15 cents to close at $15 in exchanging 2,320 units and Tropical Battery gained 9 cents to end at $2.45 with the swapping of 650,135 stock units.

Limners and Bards dipped 39 cents to close at $2.35 in an exchange of 69,019 stocks, Mailpac Group shed 15 cents to $2.05 with a transfer of 54,898 shares, Medical Disposables rose 41 cents to $5.41 with the swapping of 10,254 stocks. Regency Petroleum lost 10 cents ending at $1.81, trading 304,679 shares, Stationery and Office Supplies shed 15 cents to close at $15 in exchanging 2,320 units and Tropical Battery gained 9 cents to end at $2.45 with the swapping of 650,135 stock units.

In the preference segment, CAC 2000 9.5% preference share gained 16 cents in closing at $1.18 in an exchange of 5,145 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market still 2023 positive after sharp fall

Stocks mostly dropped in trading on the Junior Market of the Jamaica Stock Exchange on Wednesday with the market index diving 62.44 points to 3,995.80, leaving the market in positive territory for the year to date, following a 42 percent fall in the volume of stocks traded, with 71 percent lower value than on Tuesday with trading of 45 securities similar to trading on Tuesday and ended with 11 rising, 25 declining and 9 closing unchanged.

A total of 10,060,543 shares were traded for $24,020,110 compared to 17,230,599 units at $84,183,965 on Tuesday.

A total of 10,060,543 shares were traded for $24,020,110 compared to 17,230,599 units at $84,183,965 on Tuesday.

Trading averaged 223,568 shares at $533,780 compared with 382,902 units at $1,870,755 on Tuesday. January closed with an average of 239,755 units at $646,375.

ONE on ONE Educational led trading with 3.74 million shares for 37.2 percent of the total volume, Regency Petroleum followed with 998,836 units for 9.9 percent of the day’s trade and MFS Capital Partners with 909,926 units for 9 percent market share. The PE Ratio, a measure used in computing appropriate stock values, averages 13. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for the financial year endings that fall between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and two with lower offers.

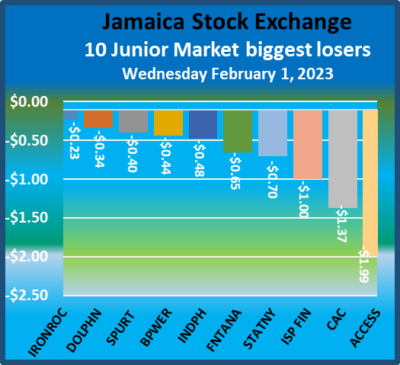

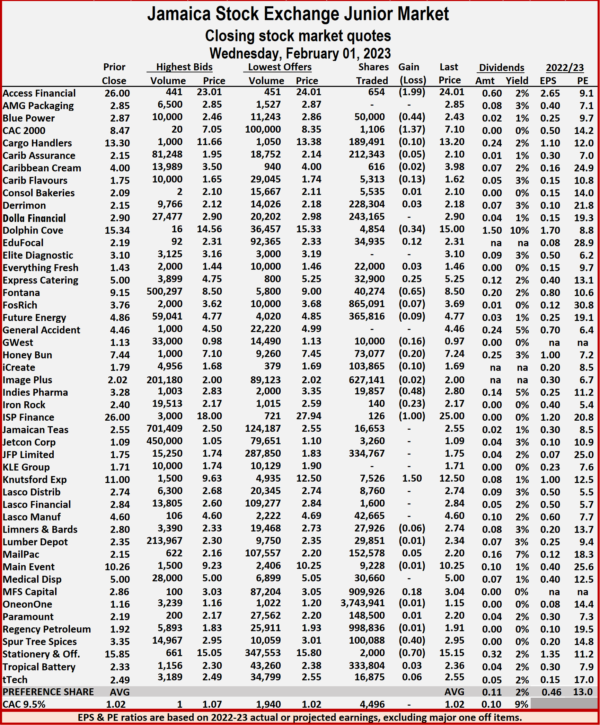

At the close, Access Financial declined $1.99 in closing at $24.01 after trading 654 shares, Blue Power fell 44 cents to end at $2.43 in an exchange of 50,000 units, CAC 2000 shed $1.37 to $7.10 with a transfer of 1,106 stock units. Cargo Handlers lost 10 cents in ending at $13.20 with 189,491 stocks changing hands, Caribbean Flavours dipped 13 cents to $1.62 in switching ownership of 5,313 stock units, Dolphin Cove dropped 34 cents to $15 in an exchange of 4,854 stocks. EduFocal gained 12 cents in ending at $2.31 after 34,935 shares cleared the market, Express Catering popped 25 cents to close at $5.25 in trading 32,900 units, Fontana fell 65 cents to end at $8.50 as investors switched ownership of 40,274 units. Fosrich dipped 7 cents in closing at $3.69 with the swapping of 865,091 stocks,  Future Energy Source lost 9 cents in ending at $4.77 afte365,816 stock units were traded, GWest Corporation fell 16 cents to end at 97 cents with 10,000 shares crossing the market. Honey Bun dipped 20 cents to $7.24 as investors exchanged 73,077 stocks, iCreate lost 10 cents to close at $1.69 after a transfer of 103,865 units, Indies Pharma shed 48 cents in closing at $2.80 with 19,857 shares changing hands. Iron Rock Insurance fell 23 cents to finish at $2.17 trading 140 stock units, ISP Finance declined $1 ending at $25 after clearing the market with 126 stocks, Knutsford Express advanced $1.50 to $12.50 with investors transferring 7,526 stock units. MFS Capital Partners gained 18 cents to end at $3.04 with 909,926 shares changing hands,

Future Energy Source lost 9 cents in ending at $4.77 afte365,816 stock units were traded, GWest Corporation fell 16 cents to end at 97 cents with 10,000 shares crossing the market. Honey Bun dipped 20 cents to $7.24 as investors exchanged 73,077 stocks, iCreate lost 10 cents to close at $1.69 after a transfer of 103,865 units, Indies Pharma shed 48 cents in closing at $2.80 with 19,857 shares changing hands. Iron Rock Insurance fell 23 cents to finish at $2.17 trading 140 stock units, ISP Finance declined $1 ending at $25 after clearing the market with 126 stocks, Knutsford Express advanced $1.50 to $12.50 with investors transferring 7,526 stock units. MFS Capital Partners gained 18 cents to end at $3.04 with 909,926 shares changing hands,  Spur Tree Spices lost 40 cents in closing at $2.95 with the swapping of 100,088 units and Stationery and Office Supplies fell 70 cents to $15.15 after transferring 2,000 units.

Spur Tree Spices lost 40 cents in closing at $2.95 with the swapping of 100,088 units and Stationery and Office Supplies fell 70 cents to $15.15 after transferring 2,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Rising Main Market stocks beat decliners 2 to 1

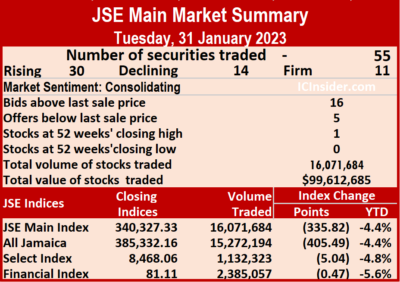

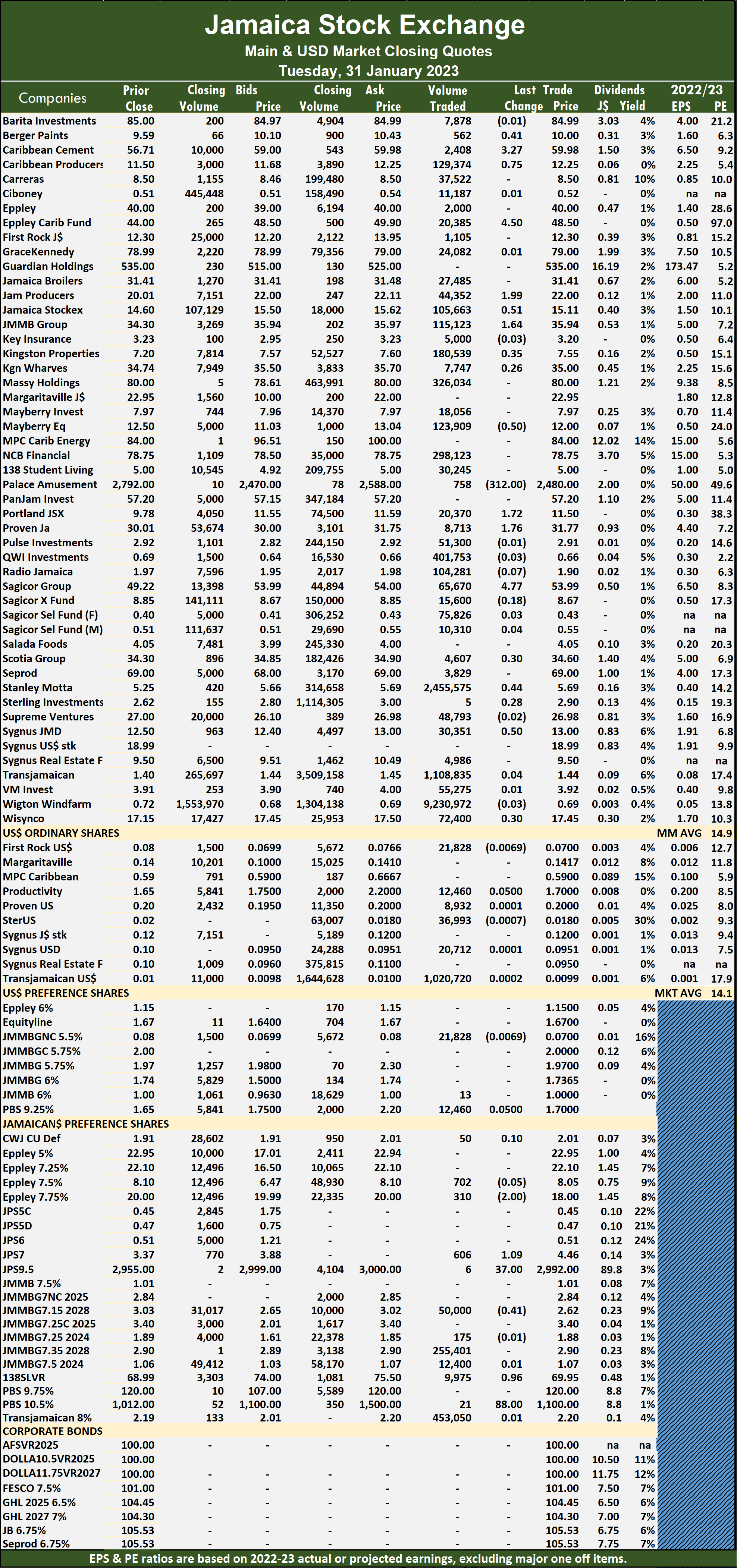

Trading activity ended with prices of 30 rising, 14 declining and 11 ending unchanged on the Jamaica Stock Exchange Main Market on Tuesday from trading in 55 securities compared to 59 on Monday with a 12 percent decline in the volume of stocks traded, with the value 69 percent lower than on Monday and sending the Main Market Index into decline for the day and month, with a 4.4 percent slippage, with a month gone in the new year.

A total of 16,071,684 shares were exchanged for $99,612,685 versus 18,191,600 units at $322,436,055 on Monday.

A total of 16,071,684 shares were exchanged for $99,612,685 versus 18,191,600 units at $322,436,055 on Monday.

Trading averaged 292,212 units at $1,811,140 versus 308,332 shares at $5,465,018 on Monday and month to date, an average of 205,062 units at $1,804,332 compared with 200,806 shares at $1,803,685 on the previous day. Trading in December averaged 604,110 units at $4,072,598.

Wigton Windfarm led trading with 9.23 million shares for 57.5 percent of total volume followed by Stanley Motta with 2.46 million units for 15.3 percent of the day’s trade and Transjamaican Highway with 1.11 million units for 6.9 percent market share.

The All Jamaican Composite Index declined 405.49 points to 385,332.16, the JSE Main  Market Index fell 335.82 points to 340,327.33 and the JSE Financial Index shed 0.47 points to close at 81.11.

Market Index fell 335.82 points to 340,327.33 and the JSE Financial Index shed 0.47 points to close at 81.11.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.9 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The Investor’s Choice bid-offer indicator shows 16 stocks ending with bids higher than their last selling prices and five with lower offers.

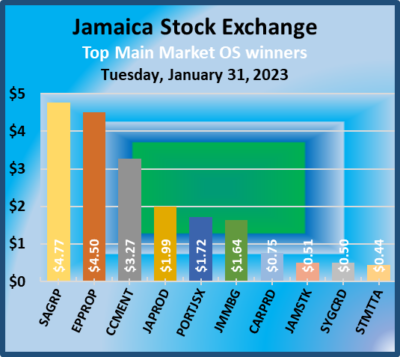

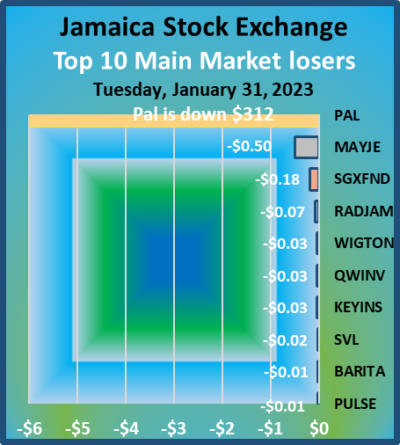

At the close, Berger Paints gained 41 cents in ending at $10 with an exchange of 562 shares, Caribbean Cement rallied $3.27 in closing at $59.98 after trading 2,408 stocks, Caribbean Producers gained 75 cents to close at $12.25 with investors transferring 129,374 units. Eppley Caribbean Property Fund climbed $4.50 to $48.50 in switching ownership of 20,385 stock units, Jamaica Producers popped $1.99 to close at $22 after a transfer of 44,352 units, Jamaica Stock Exchange rose 51 cents to finish at $15.11 with 105,663 stocks clearing the market.  JMMB Group advanced $1.64 to end at $35.94 in an exchange of 115,123 stock units, Mayberry Jamaican Equities dipped 50 cents to close at $12 with 123,909 shares changing hands, Palace Amusement dropped $312 to $2,480 with the swapping of 758 units. Portland JSX rose $1.72 to $11.50 after an exchange of 20,370 stocks, Proven Investments advanced $1.76 to $31.77 in trading 8,713 shares, Sagicor Group climbed $4.77 to t $53.99 in transferring 65,670 stock units. Stanley Motta popped 44 cents in closing at $5.69, with 2,455,575 stock units crossing the market and Sygnus Credit Investments gained 50 cents ending at $13 in trading 30,351 units.

JMMB Group advanced $1.64 to end at $35.94 in an exchange of 115,123 stock units, Mayberry Jamaican Equities dipped 50 cents to close at $12 with 123,909 shares changing hands, Palace Amusement dropped $312 to $2,480 with the swapping of 758 units. Portland JSX rose $1.72 to $11.50 after an exchange of 20,370 stocks, Proven Investments advanced $1.76 to $31.77 in trading 8,713 shares, Sagicor Group climbed $4.77 to t $53.99 in transferring 65,670 stock units. Stanley Motta popped 44 cents in closing at $5.69, with 2,455,575 stock units crossing the market and Sygnus Credit Investments gained 50 cents ending at $13 in trading 30,351 units.

In the preference segment, Productive Business 10.50% preference share rallied $88 to $1,100 after exchanging 21 shares. Eppley 7.75% preference share shed $2 in closing at $18 with 310 stocks changing hands,  Jamaica Public Service 7% gained $1.09 to end at 52 weeks’ high of $4.46 in switching ownership of 606 shares, Jamaica Public Service 9.5% rallied $37 in ending at $2,992 with six stock units crossing the market. JMMB Group 7.15% – 2028 fell 41 cents to close at $2.62 with the swapping of 50,000 stocks and 138 Student Living preference share rose 96 cents to $69.95 with an exchange of 9,975 units.

Jamaica Public Service 7% gained $1.09 to end at 52 weeks’ high of $4.46 in switching ownership of 606 shares, Jamaica Public Service 9.5% rallied $37 in ending at $2,992 with six stock units crossing the market. JMMB Group 7.15% – 2028 fell 41 cents to close at $2.62 with the swapping of 50,000 stocks and 138 Student Living preference share rose 96 cents to $69.95 with an exchange of 9,975 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

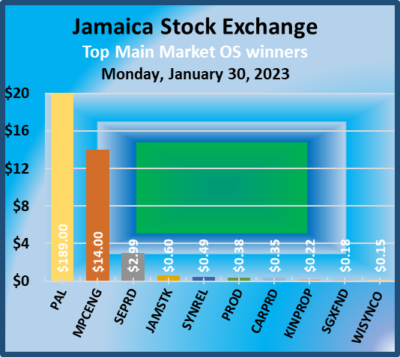

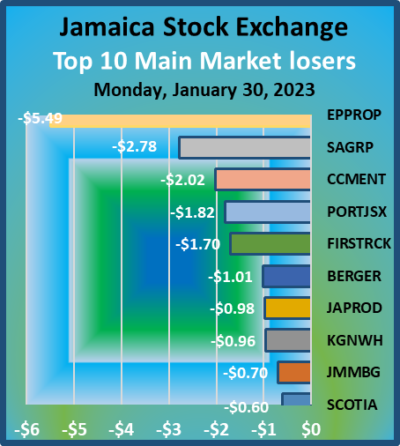

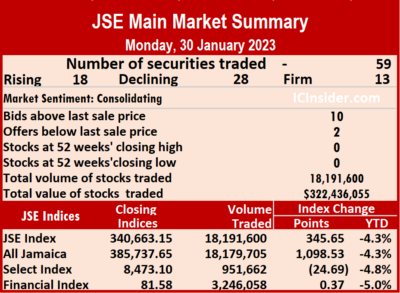

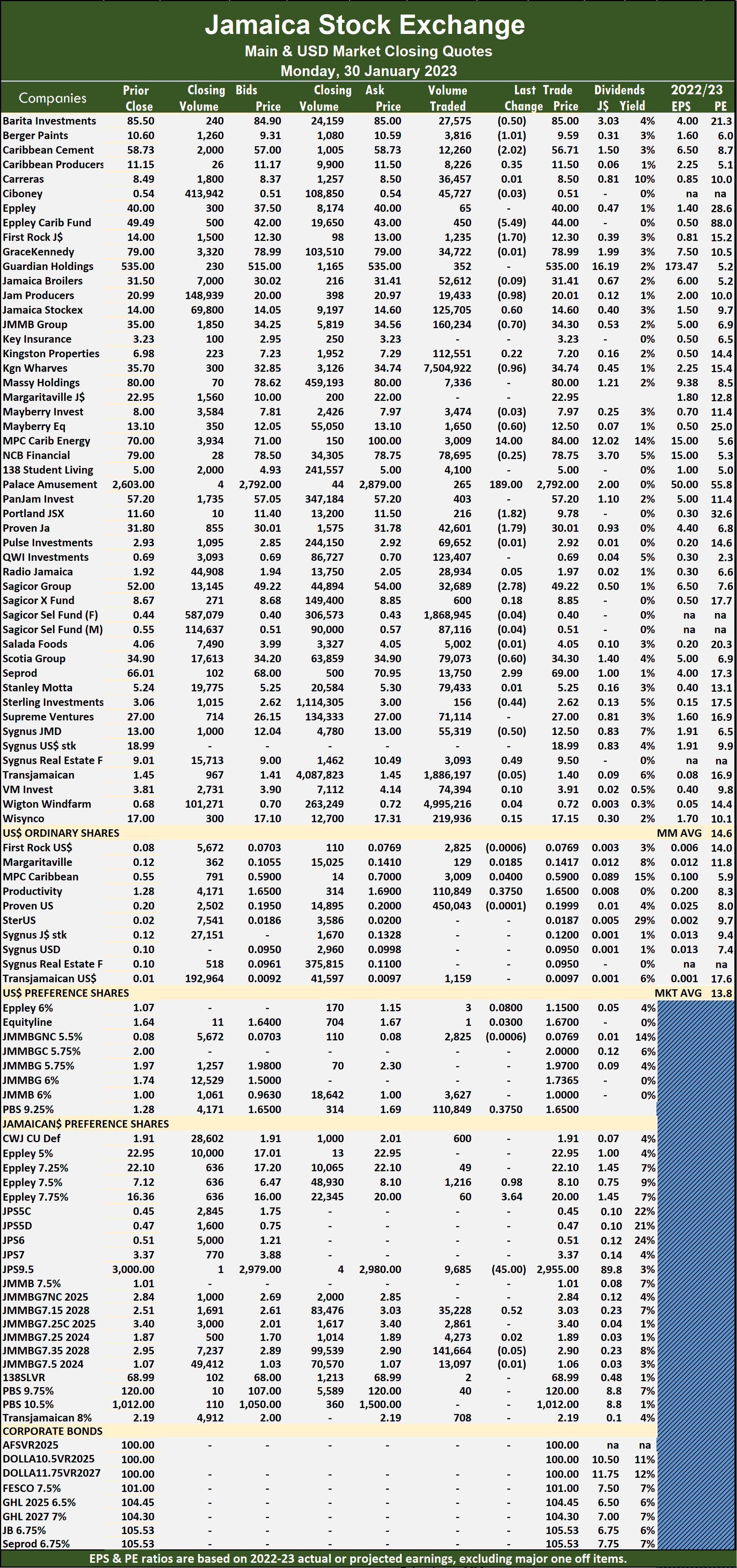

JSE Main Market rally

Activity picked up sharply on the Jamaica Stock Exchange Main Market on Monday after a 68 percent jump in the volume of stocks traded, with the value surging 83 percent more than on Friday, with trading taking place in 59 securities compared to 52 on Friday and resulting in prices of 18 stocks rising, 28 declining and 13 ending unchanged.

A total of 18,191,600 shares were exchanged for $322,436,055, up sharply from 10,834,252 units at $176,431,924 on Friday.

A total of 18,191,600 shares were exchanged for $322,436,055, up sharply from 10,834,252 units at $176,431,924 on Friday.

Trading averaged 308,332 units at $5,465,018, up from 208,351 shares at $3,392,922 on Friday and month to date, an average of 200,984 units for $1,803,685 verusu 194,860 units at $1,601,231 on the previous day. December closed with an average of 604,110 units at $4,072,598

Kingston Wharves led trading with 7.50 million shares for 41.3 percent of total volume, followed by Wigton Windfarm with 5.0 million units for 27.5 percent of the day’s trade, Transjamaican Highway with 1.89 million units for 10.4 percent of market share and Sagicor Select Financial Fund with 1.87 million units for 10.3 percent market share.

The All Jamaican Composite Index popped 1,098.53 points to close at 385,737.65, the JSE Main Market Index advanced 345.65 points to 340,663.15 and the JSE Financial Index popped 0.37 points to end at 81.58.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments shed 50 cents in, ending at $85 with 27,575 shares changing hands, Berger Paints dipped $1.01 to close at $9.59 with a transfer of 3,816 stock units, Caribbean Cement declined $2.02 to $56.71 with 12,260 stocks crossing the market. Eppley Caribbean Property Fund dropped $5.49 in closing at $44 with an exchange of 450 units, First Rock Real Estate fell $1.70 to close at $12.30 with the swapping of 1,235 stocks, Jamaica Producers shed 98 cents to end at $20.01 after an exchange of 19,433 stock units. Jamaica Stock Exchange rallied 60 cents to finish at $14.60 in trading 125,705 shares,  JMMB Group dipped 70 cents to close at $34.30 with a transfer of 160,234 units, Kingston Wharves shed 96 cents to $34.74 in switching ownership of 7,504,922 stock units. Mayberry Jamaican Equities lost 60 cents to settle at $12.50 with 1,650 units changing hands, MPC Caribbean Clean Energy jumped $14 to $84 after a transfer of 3,009 stocks, Palace Amusement surged $189 to close at $2,792 after an exchange of 265 shares. Portland JSX dropped $1.82 to $9.78 with 216 stock units crossing the market, Proven Investments fell $1.79 to $30.01 after 42,601 units passed through the market, Sagicor Group declined $2.78 to close at $49.22 in the trading of 32,689 stocks. Scotia Group lost 60 cents to finish at $34.30 with the swapping of 79,073 shares, Seprod popped $2.99 in closing at $69 in an exchange of 13,750 stock units, Sterling Investments lost 44 cents to close at $2.62 with investors transferring a mere 156 units.

JMMB Group dipped 70 cents to close at $34.30 with a transfer of 160,234 units, Kingston Wharves shed 96 cents to $34.74 in switching ownership of 7,504,922 stock units. Mayberry Jamaican Equities lost 60 cents to settle at $12.50 with 1,650 units changing hands, MPC Caribbean Clean Energy jumped $14 to $84 after a transfer of 3,009 stocks, Palace Amusement surged $189 to close at $2,792 after an exchange of 265 shares. Portland JSX dropped $1.82 to $9.78 with 216 stock units crossing the market, Proven Investments fell $1.79 to $30.01 after 42,601 units passed through the market, Sagicor Group declined $2.78 to close at $49.22 in the trading of 32,689 stocks. Scotia Group lost 60 cents to finish at $34.30 with the swapping of 79,073 shares, Seprod popped $2.99 in closing at $69 in an exchange of 13,750 stock units, Sterling Investments lost 44 cents to close at $2.62 with investors transferring a mere 156 units.  Sygnus Credit Investments shed 50 cents in ending at $12.50 after switching ownership of 55,319 shares and Sygnus Real Estate Finance rose 49 cents to $9.50 in an exchange of 3,093 stocks.

Sygnus Credit Investments shed 50 cents in ending at $12.50 after switching ownership of 55,319 shares and Sygnus Real Estate Finance rose 49 cents to $9.50 in an exchange of 3,093 stocks.

In the preference segment, Eppley 7.50% preference share rose 98 cents to $8.10 after 1,216 shares cleared the market, Eppley 7.75% preference share advanced $3.64 to $20 as investors exchanged 60 units, Jamaica Public Service 9.5 dropped $45 in closing at $2,955 after the trading of 9,685 stocks and JMMB Group 7.15% – 2028 rallied 52 cents to $3.03 with 35,228 stock units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 97

- 98

- 99

- 100

- 101

- …

- 489

- Next Page »