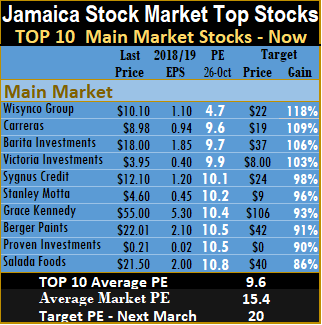

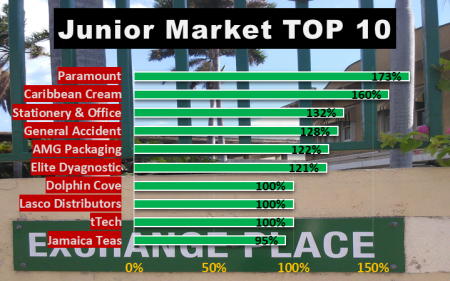

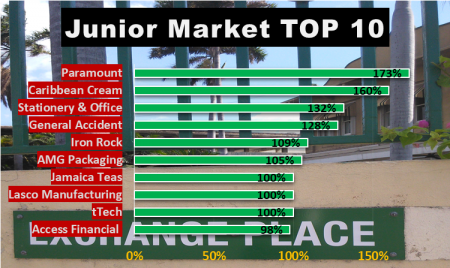

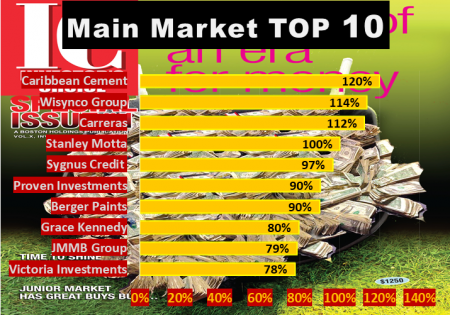

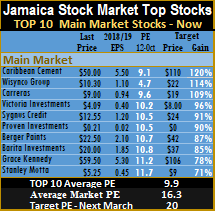

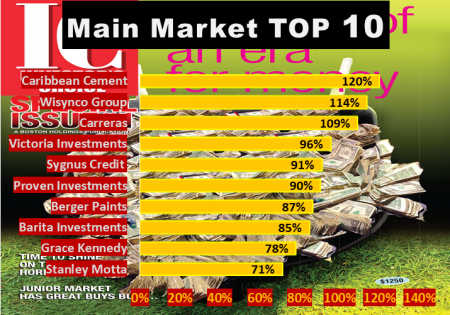

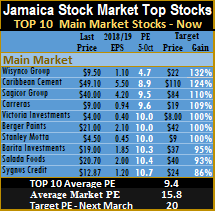

Changes in IC Insider.com Top 10 list were modest for the past week which followed a previous week of volatility.

Changes in IC Insider.com Top 10 list were modest for the past week which followed a previous week of volatility.

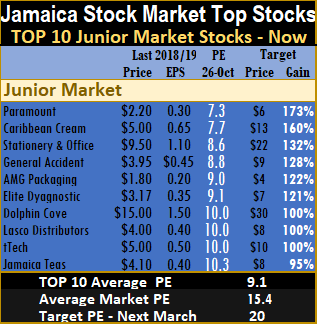

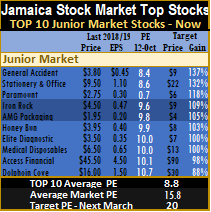

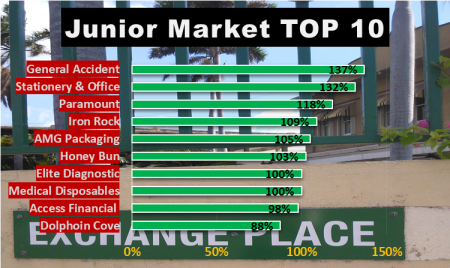

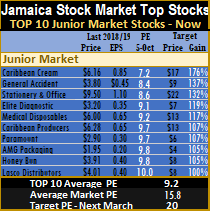

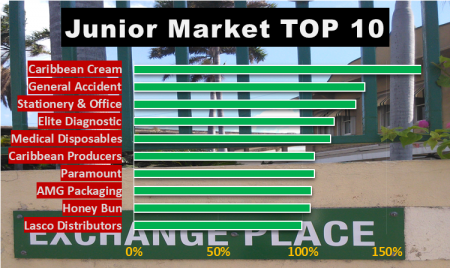

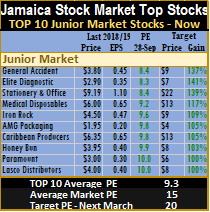

tTech moved back in price to $6 from $5 and moved out of the Junior Market TOP stocks to be replaced by Caribbean Producers that fell to $6 from $6.80 at the end of the previous week. These were the only movement in and out of the TOP 10.

Investors should keep an eye open for former Top stock, NCB Financial that should be releasing full year results and announcing final dividend for 2018, on Thursday

The main market closed the week with the overall PE slipping to 15.6 from 15.4 from the previous week, the PE of the Junior market moved up to 15.4 from 15.4 at the close of the prior week.

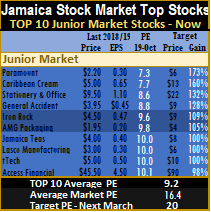

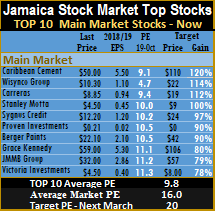

The PE ratio for Junior Market Top 10 stocks average 9.2 and the main market PE is now 9.9.

The PE ratio for Junior Market Top 10 stocks average 9.2 and the main market PE is now 9.9.

The TOP 10 stocks now trade at an average discount of 41 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings. The main market stocks trade at a discount of 37 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential  gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

There will be no Market Watch report for this week.

Carib Cement hit by exchange loss

Caribbean Cement traded at $45.200 on Tuesday.

Sale revenues at Caribbean Cement rose 6.7 percent for the quarter, to $4.46 billion from $4.18 billion in 2017 and rose 7.9 percent for the year to date, to $13.2 billion from $12.25 billion in 2017.

A $464 million foreign exchange loss hit the results for the September quarter pulling the strong 44 percent increase in operating profit to $1.2 billion from $836 million, into lower net profit of $305 million than $748 million for the prior year’s period. For the nine months to September, profit fell 28 percent to $1.3 billion from $1.8 million in 2017.

Energy cost climbed by $233 million in the quarter and $342 million year to date but other operating cost declined, with the repurchase of the mill and kiln, previously leased from Trinidad Cement with only $213 million was incurred in the third quarter versus $1.1 million in 2017. For the nine months $1.57 million was incurred compared to $3.3 billion. On-the-other-hand finance cost excluding foreign exchange loss rose to $227 million up sharply from just $11 million in 2017 in the quarter and $299 million versus $4 million year to date. Depreciation and amortisation cost rose to $342 million from $132 million in 2017 and for the nine months to $808 million from $400 million in 2017. The net effect is that the company enjoyed a savings of $500 million per quarter or $2 billion per annum as a result of the buy of the lease, but virtually none of this, benefited shareholders.

Earnings per share came out at 39 cents for the quarter and $1.54 for the nine months and should end the fiscal year ending to around $3.50, as the company reverses the foreign exchange loss in the December quarter and picks up some gains, as well as increased revenues resulting from a price increase of just over 4 percent, effective on October 22.

Carib Cement could earn $5.30 in 2019.

But IC Insider.com is forecasting a jump in earnings for 2019 around $5.30 per shares, as the plant upgrades is completed and commissioned, allowing for the elimination of costly imports that negatively impacted cost in 2018 and will see them moving back into exports.

Gross cash flow brought in $849 million but growth in receivables, inventories, addition to fixed assets, loan repayment and increased payables resulted in negative total flows thus reducing the cash on hand to $468 million. For the nine months the operations brought in $2.6 billion but working capital needs and capital transactions saw cash funds reduced from $1.67 billion to $468 million.

The sharp changes in funds is due to the repurchase of equipment that was previously leased that drove fixed assets to $23 billion from $7.7 million in 2017 and borrowing to $12 billion.

Shareholders’ equity stood at $10.26 billion with borrowings at just $12 billion and net current assets ended the period was negative $1 billion.

The stock traded at $45.20 on the Jamaica Stock Exchange with a PE ratio of 13 times 2018 earnings and sits around the centre of the market valuation. the price could double in 2019. Net asset value is $12 with the stock selling at almost 4 times book value.

Going forward, the company results should be helped from the improvement in the Jamaican economy and growth that is likely to flow from the construction sector including buildings and roads and bridges as well as from increased exports. There is also focus on cost reduction with the high energy cost being the next centre of attention.

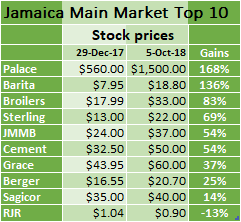

Review of 2018 stock market forecast

Palace hits a new high of $1,500 to be top performer in 2018 so far.

“ Assessment of the market, suggests that 2018 could be a grand year, with overall price gains likely to be in excess of 40 percent”, a quote from IC Insider.com in February, this year.

“Based on projected earnings for 2018, the average PE ratio suggests that main market stocks should grow by 26 percent. Falling interest rates could add another 20 percent to gains during the year, bringing overall gains in excess of 40 percent.”

“Technical readings of the market have the main market heading initially to around 390,000 points or 23 percent ahead of the December close, for the all Jamaica Index, before resistance sets in and then moving much higher, later on’ the IC Insider.com forecast for 2018 stated.

With almost three more months to go, before the year ends, the main market is broken through the 390,000 points mark to be up 31.7 percent for the year to date, there seems no stopping it for now.

The report in February stated that the main market was caught in a wedge formation, trading just below the upper end of channel that can be traced to late 2015. The wedge could hold the market in consolidation mode for a short time, a month or two, before breaking out, most likely to the upside.

IC Insider.com projects that many of the main market heavy weights will find it tough to repeat the strong gains they enjoyed in 2017, if that is the case, their impact on the market index is likely to be less than for 2017. Another factor that could make a repeat of 2017 tough, is the movement of interest rates. Last year, Treasury bill rates fell 29 percent from 6.56 percent to 4.83 percent, that level of decline, is unlikely to happen in 2018, even as some of the decline in the latter part of 2017 is yet to be fully reflected in the prices of stocks to date and should positively affect prices in 2018. IC Insider.com is forecasting rates on 182 days Treasury bill hitting 3 percent by the end of the 2018 first quarter. Treasury bill rates in 2018 at 1.7 percent, have fallen more sharply than in 2017.

The original piece stated that “there are a number of other factors at play that are set to impact the market. Increasing employment is taking place with the highest number of persons employed in the country’s history. Attendant with that is the sharp fall in unemployment from more than 16.3 percent in 2013, to just over 10 percent in 2017. The annual net employment is growing around 30,000 persons per year and that could rise as the economy gains steam. This will mean more spending and increased tax collection for government. Alpart resumption of Alumina production is a big positive for the overall economy, for increased government revenues and more demand for local goods and services, some of which are provided by listed companies. The tourism sector is enjoying strong growth, apart from increasing foreign exchange intake for the country, will have direct impact on Jamaica Producers and Sagicor X Fund. Jamaica seems to be going through a construction boom with several new buildings under construction, Caribbean Cement and Berger Paints should benefit considerably from such developments.”

“More listings on the stock market will result in increased fee income for JSE and brokerage houses, from increased trading volumes.”

The TOP 10 stocks include a few surprises while there are others that sit just outside the top stocks that investors may still want to keep a keen eye on. Investors should be looking beyond 2018 as medium term gains beyond 2018 could be strong for stocks that will benefit from current developments, long term.

The TOP 10 selection is selling well below the average PE of the Main market of the Jamaica Stock Exchange at just over 6.3 versus nearly 12 at the end of 2017.

Barita last traded on the JSE as high as $20 on Friday.

Barita Investments moved more into fee based income and that is working well for them, with sharp growth, while net interest income stagnates. The prospects for continued strong growth in fee income continues with more investors seeking better returns than in the fixed interest market. The company should see a change in ownership soon and that could see a more aggressive approach to management that could optimize returns from exiting business and newer lines. Unrealized gains on investment ought to be factored into its earnings in valuing the stocks and that would boost its value considerably, the market is not paying attention.

Berger Paints is set to be a big winner with increasing sales coming from a buoyant construction sector resulting in increased profit and what IC Insider.com expects to be a healthy dose of dividend payments. It could become the next Carreras from a dividend yield standpoint but with growing profits. The company will benefit from lowering of overhead cost which was evident in 2017.

Jamaica Broilers continues to grow organically and from new business being acquired. Growth will continue as the Haitian market deliver greater returns form a growing market while the poultry demand in Jamaica continues to grow.

Caribbean Cement will benefit from lower operating cost, increased sales and a planned cut in financing of the lease which is said will cut hundreds of millions of dollars out of it cost that could come close to $2 per share per annum.

Palace Amusement Company, currently enjoying sell out cinemas with block buster hit, is one of those unusual choices. It enjoys minimal trading but it could surprise on the upside if all goes well. Growth in the economy and increased employment will help to boost patronage going forward and will aid in profit growth as well.

JMMB Group put out outstanding Q3 results with a 39 percent increase in profit and strong gains in revenues, auguring well for 2019 outcome.

The growth potential remains strong and investors in the stock will reap rich rewards down the road. Just one stock that requires patience. By the way fees and commission income jumped an impressive 71 percent to $512 million in the quarter and 53 percent in the nine months, over the similar period in 2016 and should continue to do so going forward.

Radio Jamaica continues to disappoint with below expected revenues and profit. It could return to favour but needs to generate more income from advertising. This is one to accumulate for a payoff down the road.

The other three stocks, Sterling Investments, Grace Kennedy and Sagicor Group are undervalued and could deliver some decent returns to patient investors.

Below the TOP 10 are strong candidates to deliver decent returns this year and beyond, the list includes NCB Financial that is on a strong growth trajectory and recently listed Wisynco Group that should generate earnings around $1.10 for the 2019 fiscal year that starts in July.

Split & rights issues for Sterling

Sterling Investments coming with split and rights issue.

Sterling Investments is considering a 5 for 1 stock split and a rights issue of ordinary shares to existing shareholders.

The company will hold an Extraordinary General Meeting at the Knutsford Court Hotel, on October 8, to consider the an increase in the authorized share capital by the addition of 1,850,000,000 ordinary shares and to approve the issue up to 2,000,000,000 ordinary shares currently un-issued, by way of a Rights Issue, on terms to be decided by the directors, including the number and price of the shares.

November 14 is the expected date for the commencement of the rights issue, Yanique Leiba-Ebanks advised IC Insider.com.

“Proceeds of the rights will be used to fund private equity and investment in some local stocks. We have been participating in IPO share issues that have done well for the fund,” Leiba-Ebanks said. So it will be more of that, going forward along with the focus on leveraged fixed income investments.

Yanique Leiba-Ebanks – AVP Pensions & Portfolio Investments

Sterling Asset Management

The issues were necessary as the company has just under 300 shareholders with limited interest in trading the stock by the general public. The company was encouraged recently to split the stock and issue more shares to broaden the shareholdings to provide a platform for more liquidity for the stock that trades infrequently.

Sterling’s fortunes will be boosted with net profit that grew by 20.5 percent in the 2018 half year, to $52 million and $27 million in the June quarter, from $25 million, in the similar period in 2017. Sterling has 59.15 million shares issued and enjoyed earnings of 87 cents for each share for the half year.

Others to expect splits from are, Barita Investments and they could well have a rights issue to fund acquisitions and other expansion and new products such a margin facilities. CAC2000 with the stock price rising into the mid-teens, Stationery & Office Supplies with the stock price expected to be priced in the teens sooner or later is expected to split by 2019. At the annual general meeting held earlier this year, shareholders were informed that the board had be looking at it but no decision was make. Access Financial directors and NCB Financial indicates that they don’t see any benefit to their company in doing a split but it only a matter of time that they will be forced to, the same applies to Palace Amusement. Some investors are of the view that with Derrimon Trading splitting when the stock got in the teens that Caribbean Flavours is likely to follow. Investors should not ignore the possibility of Berger Paints and ISP Finance joining the queue in the near future.

Sales jump sharply at Main Event

Main Event backed with IC BUY RATED status

Growth in revenues while not an exact proxy for increased profits, is often a very good indicator of greater gains ahead. That may be exactly what is happening at the Junior market listed Main Event.

The results for the nine months to July show strong sales growth but flat profits. Revenues for the July quarter surged nearly 26 percent to $364 million, but profit fell 7 percent to $24.5 million from $26.3 million in 2017. For the nine months to July, profit was up just 4 percent to $105.5 million that flowed from a 13 percent rise in revenues to $1.07 billion, compared to net income of $101 million in 2017.

The company incurred increased cost as it seeks to expand its service offerings. The results to date suggest that the full year earnings will not vary much from the 2017 full year results of 37 cents. But 2019 could be a blow out year for them, if revenue growth seen so far for this year, continues into 2019.

Profit margin in the first half of the year, was held to the same level as in 2017, at 48 percent and declined in the July quarter to 45 percent from 49 percent in the 2017, the impact, operating profit rose just 15 percent in the quarter to $164 million from $143 million but fell to 14 percent for the year to date, to $512 million from $447 million in 2017.

Administrative expenses rose 20 percent to $111 million in the quarter and increased 15 percent in the nine months period to $311 million. Marketing and sales expenses increased by 44 percent to $15 million for the nine months. Depreciation rose 49 percent to $24 million in the quarter and increased 29 percent in the nine months to $69 million, an indication of increased capital spend to accommodate expansion and increased income. Finance cost was flat in the quarter, at $5.2 million and rose just 5 percent to $13.6 million for the nine months.

Earnings per share came out at 9 cents for the quarter and 37 cents for the nine months and should end the fiscal year around 40 cents. For 2019 earnings should be in the order of a string increase to 75 cents.

“Performance has been negatively impacted by write downs on trade receivables to align to reporting standard, IFRS 9, continued start up expenditure for new service offerings and cost with higher head counts and incentive compensation,” the Chairman Ian Blair and Chief Executive Officer reported to shareholders in their commentary accompanying the quarterly.

Gross cash flow brought in $175 million but growth in receivables, inventories, addition to fixed assets of $160 million, offset by net loan inflows and increased payables resulted in net cash flow ended at a negative $63 million and leaving $29 million in cash at the end of July. Shareholders’ equity stood at $551 million with borrowings at just $185 million, including amounts due to related parties. Net current assets ended the period at $141 million, inclusive of trade and other receivables of $304 million, cash and bank balances of $29 million. Current liabilities amounted to $209 million inclusive of short term borrowings.

The stock traded at $5.50 on the Junior Market of the Jamaica Stock Exchange with a relatively low PE ratio of 7.3 times 2018 earnings and is elevated to BUY RATED status.

Volatility was the order for the Jamaican stock market for the past week as the market indices bounced around as declining stocks were plentiful as the Junior Market ended with three changes and the main market two.

Volatility was the order for the Jamaican stock market for the past week as the market indices bounced around as declining stocks were plentiful as the Junior Market ended with three changes and the main market two.

of the year, nevertheless IC insider.com downgraded full year earnings to $3.53 per share, resulting in the stock dropping out of the main market TOP 10 along with

of the year, nevertheless IC insider.com downgraded full year earnings to $3.53 per share, resulting in the stock dropping out of the main market TOP 10 along with  prior week.

prior week. an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

65

65  cents per share, fell out of the top list and Caribbean Producers climbed to $7 and is also out.

cents per share, fell out of the top list and Caribbean Producers climbed to $7 and is also out. The PE ratio for Junior Market Top 10 stocks average 9.5 and the main market PE is now 9.9, marginally higher than the prior week’s level, as the market continues to see an upward revaluation of the multiple.

The PE ratio for Junior Market Top 10 stocks average 9.5 and the main market PE is now 9.9, marginally higher than the prior week’s level, as the market continues to see an upward revaluation of the multiple. the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

higher this week with buying orders in for 139,000 shares at $15. The price of Stanley Motta climbed to $5.27 during the week from $4.81 in the previous week and exited the main market list.

higher this week with buying orders in for 139,000 shares at $15. The price of Stanley Motta climbed to $5.27 during the week from $4.81 in the previous week and exited the main market list.

for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.