Fresh from a successful initial public offering of 250 million shares, Fontana is not expected to start trading until early January on the Junior Market of the Jamaica Stock Exchange.

Fresh from a successful initial public offering of 250 million shares, Fontana is not expected to start trading until early January on the Junior Market of the Jamaica Stock Exchange.

Scotia Investments, the brokers for the offer stated that the offer of Two Hundred and Forty Nine Million Eight Hundred and Seventy Four Thousand Nine Hundred and Sixty Five (249,874,965) ordinary shares opened and closed on Thursday, December 13 and attracted a total of 3,406 applications for a total of 982,194,569 shares.

Applications for the Public Pool received the first 25,000 units applied for, with amounts in excess of 25,000 units allocated approximately 8.82 percent.

The brokers indicated that multiple applications from a single person or entity were removed, except where they were entitled to apply for shares in a reserved and the public pool. Once that process was completed, 2,770 applications remained for 944,150,335 shares.

SIJL advised that the methodology and allotment of the shares as follows: Employee Gift, Company Reserved and Key Customers & Doctors pools applicants were fully allocated. Strategic Partners were received a minimum of 50% of the amounts applied for.

Fontana shares, will only be allowed to trade up to a maximum of $2.44 on the first day of trading or a maximum of 30 percent above the $1.88 the public bought the shares at. Thereafter, the maximum price will be dependent on the highest  closing bid at the end of the previous day.

closing bid at the end of the previous day.

The Company recorded revenues of $3.4 billion in the financial year 2018, representing an increase of $272 million or 8.66 percent over the prior year and an increase of approximately 91 percent from $1.76 billion in 2014. Pretax profit for 2018 declined 6 percent from $322 million in 2017 to $303 million after rising from $237 million in 2016 that was up more than 100 percent over the 2015 profit of $115 million. The slowdown in 2018 is attributed to the state of emergency in Montego Bay and road construction in the Barbican area.

Fontana, is projected to earn around 35 cents for the current fiscal year and that should place the price at just over $5 during the course of the year.

Fontana listing on Tuesday

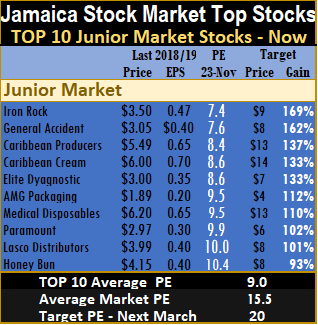

Relative stability descends on IC Top 10

The volatility in the Jamaican stock market seems to have ended with the closure of the very popular Fontana IPO.

The volatility in the Jamaican stock market seems to have ended with the closure of the very popular Fontana IPO.

The main market rose towards the end of the week while the junior market declines have slowed sharply. IC Insider.com expects the usual Christmas rally to take hold and drive prices higher, ahead of 2019.

The attractively underpriced Fontana would be a sure pick for the TOP 10 list but it seems unlikely to be listed before January.

Lasco Financial came re-entered the TOP 10 last week is out having risen from $4.15 to $4.90 at week end. Replacing it is Jamaican Teas that could get a boost from gains in their equity

portfolio. In the main market TOP 10, Sagicor Group that came into the list this past week, is now out and is replaced by Sterling Investments that fell in price at the end of the week to $4 from $4.49 the week before.

portfolio. In the main market TOP 10, Sagicor Group that came into the list this past week, is now out and is replaced by Sterling Investments that fell in price at the end of the week to $4 from $4.49 the week before.

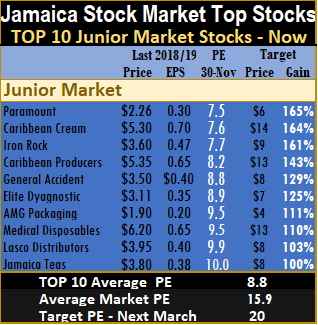

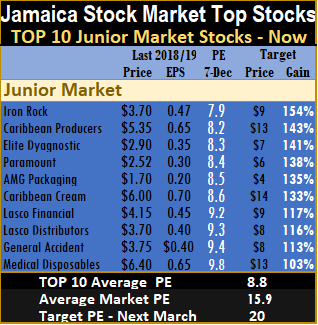

The main market closed the week with the overall PE remains at 15.7, the PE of the Junior Market remains at 15.8. The PE ratio for Junior Market Top 10 stocks average 8.8 and the main market PE is now 9.8. The top Junior Market stocks are selling at a discount of 13 percent to those of the main market stocks even as the overall average PE for both markets are almost equal. This is an indication that there may be more gains to be had from these Junior market stocks than those in the main market.

an indication that there may be more gains to be had from these Junior market stocks than those in the main market.

The TOP 10 stocks now trade at an average discount of 44 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings. The main market stocks trade at a discount of 37 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE  for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

Strong food & insurance sales gains at Grace

Grace new HQ close to the end of construction in downtown Kingston

Grace Kennedy reported net profit attributable to shareholders of $3.26 billion for the year to September compared with $3.3 billion in 2017 on strong gains in Food and Insurance segments. For the September quarter, the group earnings of $1.06 billion was realized, down from $1.5 billion.

The current quarter’s result is negatively impacted by one off expenses.

Segment results show declines in the Money transfer business with segment results down to $2.34 billion from $2.46 billion in 2017. Banking was flat with results of $401 million but both Insurance and Food trading recorded healthy increases. Food reported $1.35 billion in 2017 and climbed a strong 12.5 percent to $1.52 billion and Insurance jumped a robust 22.7 percent from $508 million to $734 million.

When adjusted for non-recurring gains in 2017 and one-time expenses of $236 million in the September 2018 quarter, profit for the nine months would have been greater by approximately $600 million.

For the nine-months, the Company revenues rose 7 percent to $73.8 billion but climbed a healthier 11 percent to $25.46 billion for the September quarter, over the same period in 2017. Group Chief Financial Officer, Frank James, informed IC Insider.com that the savings from the rationalisation exercise will generate savings considerable higher than the cost, due partially to some former employees being retired and not incurring separation cost.

Operating cost rose faster than revenues, with an increase of 13 percent to $24.6 billion for the

Group Chief Executive Officer, Don Wehby.

Shareholders’ equity increased of $3.2 billion to $48.4 billion over 2017. Loans receivables remained flat at $26.4 billion compared to $26.58 billion in September 2017 and is down from $27.55 billion at the end of 2017. At the end of the period total assets increased $7.3 billion to $137 billion since September in 2017 and liabilities rose by a smaller $3 billion to $86.44 billion.

In speaking to the recent performance, Group Chief Executive Officer, Don Wehby, affirmed, “The Company is investing strategically for future growth and efficiency to achieve this objective. We are seeing a 12.6 percent increase in profit over prior period, with the one-off adjustments, and we expect continued growth based on our strategy.”

Since 2018, the Group embarked on a programme which aims to improve its return on investment and shareholder value. The process involves a review of its overall organizational design, cost structure, and business processes at all levels resulting in restructuring which affected a number of positions in August. In expounding further Wehby stated, “Although the restructuring costs of $236 million impacted the quarter’s performance, I am confident that the Company will realize the benefits of this in subsequent periods.”

Grace pays an interim dividend of 50 cents per stock unit on December 13, bringing dividends to date to $1.35 per stock unit of more than $1.3 billion.

Wehby and the group’s chairman Gordon Shirley in their report to shareholders stated that Grace Kennedy anticipates continued growth for the fourth quarter, subsequent to the quarterly report the group announced changes in their Florida distribution with an investment in the company that manufactures it patties that will take over Graces distribution and warehousing in that area. The new arrangement will mean less cost and more profits for Grace.

IC Insider.com projects earnings is $4.80 for the current fiscal year to December and $6 for 2019. The stock is listed on the Jamaica Stock Exchange and trades at $60 for a PE of 12.5 times current year’s estimated earnings versus an average for the market in the region of 15, with a premium of a mere 20 percent above net book value per share and seems undervalued, currently. The stock looks like a good long term investment.

Why is Fontana IPO priced so low?

Owners and directors along with their advisors ought to know the value of their company. But this publication must ask the question if Fontana has really done so well and will continue to expand, why is it priced so low?

Owners and directors along with their advisors ought to know the value of their company. But this publication must ask the question if Fontana has really done so well and will continue to expand, why is it priced so low?

At a premium over net book value of 88 percent, the stock is one of the cheapest of Junior Market listings, with the vast majority selling at a premium of 3 to 4 net book and an average PE of around 13 excluding the extreme highs and lows. One would expect the stock to be priced closer to 10 times earnings before tax, that would put the price closer to $3 than $1.88 and that would place price to net asset value at a premium of 200 percent, still below the market average. The fact that the company is setting up a new branch and looking for more expansion, makes the case for a higher price more compelling as investors are most likely going to rake in much profit from this stock. The only problem the general public will not get many shares to buy up front as it is set tobe heavily oversubscribed. Investors can expect this one to at least double shortly after listing.From where we sit we think the brokers did the owners out of several million dollars on this issue but then the owners may want Jamaicans to party with them on the 50th anniversary.

Fontana IPO set for heavy oversubscription

Fontana’s prospectus initial public offer, first mentioned by IC Insider.com is now out but with confusion as to the pricing. The price seems to be $1.88 except for reserved shares at $1.69 each.

Fontana’s prospectus initial public offer, first mentioned by IC Insider.com is now out but with confusion as to the pricing. The price seems to be $1.88 except for reserved shares at $1.69 each.

Whether the price is 1.88 or $2 the stock is priced very attractively priced for investors at a PE that is well below that of the Junior Market that it will be listed on and is expected to be heavily oversubscribed. The general public has been allocated 113,434,802 shares at a PE ratio of just 6.4 times 2018 earnings, well below the market average of more than 15, but things get even better as the interim results to September this year show a huge jump in profit from $11.5 million to $51 million before tax, with sale revenues up just 5.5 percent to $936 million while cost of sales declined from $650 million to $640 million, thus improving gross profit margin. While revenues grew just 5.5 percent in the quarter administrative cost climbed faster by nearly 10 percent to $223 million. At the same time inventories rose 19 percent to $680 million over the levels at September 2017 and are up 15 percent from June 2018 figure, a development that requires clarification. The PE ratio based on the interim figures suggest that the PE will fall to around 6 or less for the 2019 fiscal year, with good prospects for continued growth in the business.

The Company, in March 2013 acquired the former Azmart location in Barbican Square, Kingston and opened its Ocho Rios location in November 2013. There has been significant growth in sales from these locations. Kingston and Ocho Rios branches now represent 27 percent and 16 percent of the total sales, respectively, the Company stated. Revenues from the Ocho Rios branch increased from $113 million in 2014 to $536 million in 2018, while revenues at the Kingston branch grew from $508 million in the 2014 fiscal year to $871 million in 2017 with growth slowing to 5 percent in the financial year 2018.

The new Waterloo Square location which will open in financial year 2019, is expected to add 28,000 square feet of retail space, an increase of over 40 percent and bolster sales. It is expected that the Waterloo Square store will provide greater buying power to negotiate more favourable terms and rebates with key pharmaceutical partners on the local market. The company is seeking further opportunities to expand its branch network in growing communities such as Montego Bay and Portmore. The anticipated increase in sales will provide greater critical mass to support the sourcing of higher volumes of inventory directly from China with greater margins.

The Company invites Applications for 124,937,565 Subscription Shares, which are to be newly issued. The Company is also inviting Applications on behalf of the Selling Shareholder for 124,937,400 shares. A total of 136,440,163 shares that are initially reserved for priority applications. The minimum amount to be raised by the Company from the sale of the Subscription Shares is $234,040,086.

The Company was established in 1968 at the Manchester Shopping Centre in Mandeville by Shinque “Bobby” Chang and Angela Chang. Today, the Company is run by Kevin O’Brien Chang (Chairman), Anne Chang (Chief Executive Officer) and Raymond Therrien (Chief Operating Officer) with the support of Independent Directors. The Company operates pharmacies and retail stores in Jamaica with 5 locations across the island and 330 employees. Its core business is the sale of pharmaceutical products through licensed pharmacies, and a range of beauty and cosmetic items, housewares, home décor, toys, baby items, electronic, school and souvenir products.

The Company recorded revenues of $3.4 billion in financial year 2018, representing an increase of $272 million or 8.66% over the prior year and an increase of approximately 91% from $1.76 billion in 2014. Pretax profit for 2018 declined 6 percent from $322 million in 2017 to $303 million after rising from $237 million in 2016 that was up more than 100 percent over the 2015 profit of $115 million. The slowdown in 2018 is attributed to the state of emergency in Montego Bay and road construction in the Barbican area.

The stock has been accorded IC Insider.com critical BUY RATED accolade.

New Elite branch now in black

Elite Diagnostics accounted for 31.7M of Wednesday’s Junior Market trading.

Elite Diagnostic lost money at the Liguanea branch in the first quarter of the 2019 fiscal year but the CEO Warren Chung told shareholders at the company’s annual general meeting held at the Knutsford Court Hotel on Wednesday, that October and November were two very good months at the branch.

The audited financial report on the fiscal year to June 2018 show revenues of $297 million compared to $263 million in 2017 resulting in profit of $45 million after tax credit of $9 million and $44 million in 2017 after tax expense of $15 million.

Liguanea has moved from a loss into profit and will not be a drag on profit from the original operation from now, the CEO confirmed. Data for the first quarter shows profit before tax dipped sharply from $14 million to $1.8 million the direct result of a loss at the Liguanea branch as well some cost involved in the early purchase of MRI machine to be used in the St. Ann Bay branch to be set up in mid-2019.

While revenues rose, a number of categories climbed sharply partially due to the expansion into a new location on Hope Road. Big increases were experienced in legal and professional fees that moved from just $38,000 to $3 million due primarily to the IPO in 2017, rental expense more than doubled to hit $15.8 million from $7.9 million and Utilities moved from $7.3 million to $17.5 million partially as a result of the new branch as well as some cost for storing the MRI machine to be installed in St Ann Bay location.

Elite CEO Warren Chung with a shareholder at the company’s 2018 AGM.

Cost to set up St Ann Bay is put at $20-22 million plus U$375,000 for the MRI machine. The company bought the MRI equipment early because it became available locally, but it comes at a cost as it is being stored and incurring cost as it has to be stored in certain conditions resulting in the consumption of electricity along with rent. The MRI Machine for St Ann is being stored with rental cost being incurred as well as electricity cost to maintain it at a cool temperature.

While the company has 3 other MRI competitors in Kingston, there will be no immediate competitor within 50 miles in St Ann. Operating cost at this location will less than at Liguanea with the former being staffed by 7 employees versus a planned staffing of 4 or 5 for St Ann.

For the Liguanea location to move into profit would require revenues around $36 million per quarter or 50 percent above that of the first quarter and that would likely move the profit in the second quarter well above the $1.8 million earned in the first quarter.

Elite last traded on the Junior Market of the Jamaica Stock Exchange at $2.85.

Scotia & Stanley Motta now in IC Top 10

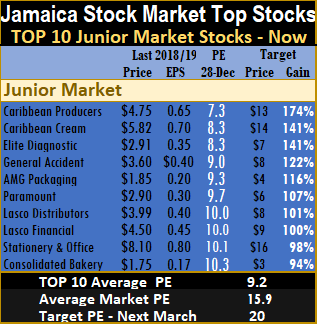

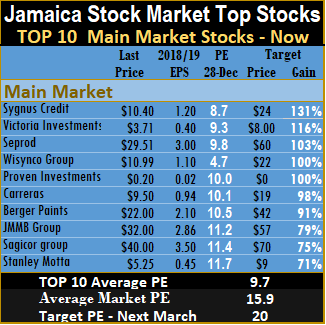

Two changes took place in the main market TOP 10 and one in the Junior Market as market activity pushed out some stocks from the list this past week.

Two changes took place in the main market TOP 10 and one in the Junior Market as market activity pushed out some stocks from the list this past week.

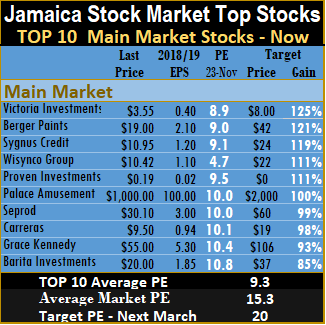

Palace Amusement and Barita Investments had big price gains during the week and exited the main market top list while Honey Bun reported full year profit of 18 cents per share and dropped out of the top tier stocks but it still showed strong signs of better days ahead as it starts the new fiscal year with increased volume sales.

New Entrants this week are, Stanley Motta and Scotia Group for the main market and Jamaican Teas for the Junior Market. Barita Investments jumped to a record $28 on Friday as investors continue to bid up the stock with talk on the road of positive developments surrounding the company. This publication expects good gains from the company’s investment portfolio and the performance of the stock market should also result in growth in the equity-based unit trust and therefo

New Entrants this week are, Stanley Motta and Scotia Group for the main market and Jamaican Teas for the Junior Market. Barita Investments jumped to a record $28 on Friday as investors continue to bid up the stock with talk on the road of positive developments surrounding the company. This publication expects good gains from the company’s investment portfolio and the performance of the stock market should also result in growth in the equity-based unit trust and therefo re boost fee income. In addition, word out is that they have acquired an investment portfolio that will add to revenues. At the current price, a stock split also seems assured for 2019.

re boost fee income. In addition, word out is that they have acquired an investment portfolio that will add to revenues. At the current price, a stock split also seems assured for 2019.

During the week news broke that Scotia Group had entered into an agreement to sell their insurance arm to Sagicor Financial, the news helped to drive prices of Scotia Group, Sagicor Group and PanJam Investment up and created excitement in the market.

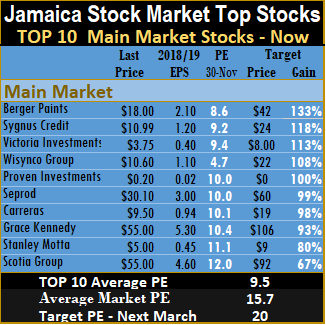

The main market closed the week with the overall PE remains at 15.7, the PE of the Junior market is at 15.9. The PE ratio for Junior Market Top 10 stocks average 8.8 and the main market PE is now 9.5.

The TOP 10 stocks now trade at an average discount of 45 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings. The main market stocks trade at a discount of 39 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

Derrimon Trading was on the TOP 10 list on November 17, last year, but moved to $8 from $6.50 at the end of the following week and then exited the list and climbed in 2018 after a stock split and acquisition of new business.

Derrimon Trading was on the TOP 10 list on November 17, last year, but moved to $8 from $6.50 at the end of the following week and then exited the list and climbed in 2018 after a stock split and acquisition of new business.

for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well. The Jamaican stock market saw quite a bit of volatility during the past week resulting from some sharp price movement of some stocks.

The Jamaican stock market saw quite a bit of volatility during the past week resulting from some sharp price movement of some stocks.

displaced Jamaican Teas TOP 10 last week. In the main market TOP 10 two changes took place with Sagicor Group having fallen to $41 and JMMB Group trading at $34 replacing

displaced Jamaican Teas TOP 10 last week. In the main market TOP 10 two changes took place with Sagicor Group having fallen to $41 and JMMB Group trading at $34 replacing  now 9.9. The top Junior market stocks are selling at a discount of 13 percent to those of the main market stocks even as the overall average PE for both markets are almost equal. This is an indication that there may be more gains to be had from these Junior Market stocks than those in the main market.

now 9.9. The top Junior market stocks are selling at a discount of 13 percent to those of the main market stocks even as the overall average PE for both markets are almost equal. This is an indication that there may be more gains to be had from these Junior Market stocks than those in the main market. on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

cents from 38 cents in 2017.

cents from 38 cents in 2017.  For the full year earnings could hit $3 per share. That should put the stock back in the $40 range before too long.

For the full year earnings could hit $3 per share. That should put the stock back in the $40 range before too long. preventing same. That should result in better sales and profit than in the 2017 final quarter. In the final quarter of 2016 pretax profit was $233 million compared to just $67 million for the similar period in 2017, when the disruptions occurred.

preventing same. That should result in better sales and profit than in the 2017 final quarter. In the final quarter of 2016 pretax profit was $233 million compared to just $67 million for the similar period in 2017, when the disruptions occurred.