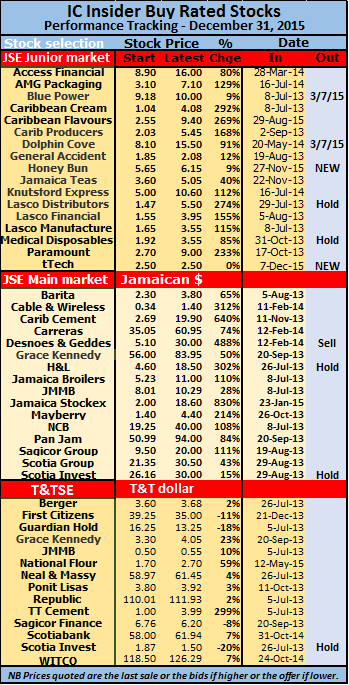

IC BUY RATED stocks were top of the Caribbean markets in Jamaica and Trinidad and Tobago for 2015, with Jamaica Stock Exchange share, chalking up a massive gain of 830 percent since IC Insider elevated it to BUY RATED status.Caribbean Cement followed with gains of 640 percent, Caribbean Cream with 444 percent and Trinidad Cement with a 299 percent increase on the Trinidad market.

While it was easy to make money in Jamaica, with profits rising and interest rates falling, developments in Trinidad went in the opposite direction, with interest rates rising and profits under pressure with the economy ended in recession.

At the beginning of 2015 of the 14 junior market selections, few recorded gains and only Knutsford Express with a 17 percent increase reflecting any meaningful positive movement. Losses were large, with AMG Packaging down 39 percent, Blue Power 31 percent, Caribbean Cream 23 percent, Jamaica Teas 28 percent, Lasco Financial 37 percent and Lasco Manufacturing 32 percent. What a difference a year can make? By the end of 2015, gains were all over the place with the list having 17 companies with two being dropped. There were no losing stocks in the list that had a new addition, tTech which could be listed this week. Honey Bun was added to the listing in November and gained 9 percent since. Eight stocks have more than doubled, four gained 40 percent to 91 percent. Caribbean Cream jumped 292 percent to be the top selection in this market, followed by Lasco Distributors up 274 percent. Blue Power was removed from the list in July with a small gain.

In the JSE main market, at the start of 2015, Hardware and Lumber was the best performing stock with gains of 62 percent followed by Cable & Wireless with 47 percent and Jamaica Broilers had the worst performance with a loss of 24 percent. In all, 7 of the 15 selections were lower than at the time they were BUY RATED.

By year-end, all selections in the JSE main market were up, with Scotia Investments having a mere 15 percent increase, being the poorest performer. This stock is being moved to Market Watch as the 2015 profit performance was far too disappointing to warrant buying now, while Hardware and Lumber remains a hold. The rest, present opportunities for continuing profit making.  JMMB Group ended with just 28 percent gain, but seems undervalued at the current price. While the list had a few lousy performers, the same can’t be said about a 640 percent gain in Caribbean Cement and 830 percent increase for Jamaica Stock Exchange share. In all, 9 stocks posted gains in excess of 100 percent and 4 below 100 percent but with a 50 percent increase and more.

JMMB Group ended with just 28 percent gain, but seems undervalued at the current price. While the list had a few lousy performers, the same can’t be said about a 640 percent gain in Caribbean Cement and 830 percent increase for Jamaica Stock Exchange share. In all, 9 stocks posted gains in excess of 100 percent and 4 below 100 percent but with a 50 percent increase and more.

There were 13 selections in the Trinidad market with Trinidad Cement being the best performer with gains of 150 percent, the next was Point Lisas with 11 percent at the start of 2015. Five stocks suffered losses with the highest being 22 percent and the next 18 percent. For 2015 the price of Trinidad Cement is up 299 percent followed by National Flour with a 59 percent gain.

Looking ahead, the junior stocks should continue to grow, with several of the companies actively expanding resulting in profits climbing at a fast pace. There are a few stocks to be cautious of just now. Lasco Distributors selling at almost 16 times 2016 March earnings. Growth should be strong but unless investors have a long term objective they should be careful buying at current price level, the same applies to Lasco Financial that is selling at 15 times earnings. Dolphin Cove remains a hold at this time.

The Trinidad market needs to be watched at this stage, with the country needing to adjust to the lower price of oil and the recession now being endured.

BUY RATED top Carib markets with 830%

January 4, 2016 by

[…] Jetcon Corporation coming on the heels of a successful issue of shares to the public that opened on Monday March 14, in respect of 44,500,000 ordinary shares is expected to start trading on Tuesday, March 22. The offer closed shortly after opening on Monday after it was oversubscribed. A total of 256 applications covering $113 million were received. Applications of all reserved shares were fully satisfied while the general public got the first 5,000 Shares applied plus 83.11 percent of the balance. The shares were sold to the public at $2.25 each. the closure left some investors out in the cold as they missed the early closing time of the offer. Listing on the junior market will result in no corporate taxes being paid for 5 years from the time of listing. Jetcon reported profit of $50.6 million for the 2015 year and enjoyed 45 percent increased revenues for the first two months of 2016 ahead of the similar period in 2015, accordingly, IC Insider rate the stock Buy Rated. […]