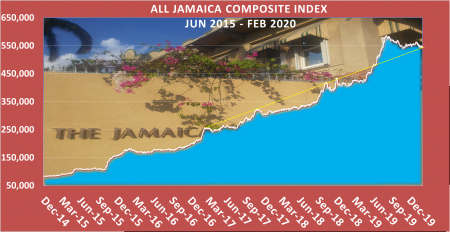

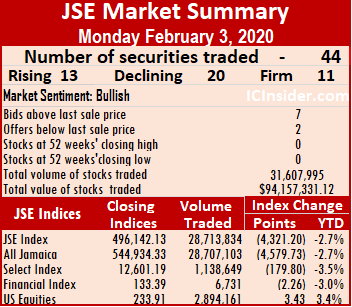

Jamaica Stock Exchange Main Market plunged at the close of trading on Wednesday and, in the process, pulled JSE All Jamaican Composite Index down 16,165 points in three days and the JSE Market Index down by 14,744 points.

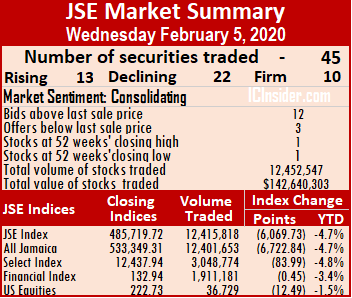

At the close of the market on Wednesday, the JSE All Jamaican Composite Index dived 6,722.84 points to close at 533,349.31, the JSE Market Index declined 6,069.73 points to 485,719.72 and the JSE Financial Index fell 1.22 points to 131.72. At the close, and Portland JSX closed at 52 weeks’ high while 138 Student Living traded at a 52 weeks’ intraday high of $6 and QWI investments closed at a 52 weeks’ low of 88 cents.

At the close of the market on Wednesday, the JSE All Jamaican Composite Index dived 6,722.84 points to close at 533,349.31, the JSE Market Index declined 6,069.73 points to 485,719.72 and the JSE Financial Index fell 1.22 points to 131.72. At the close, and Portland JSX closed at 52 weeks’ high while 138 Student Living traded at a 52 weeks’ intraday high of $6 and QWI investments closed at a 52 weeks’ low of 88 cents.

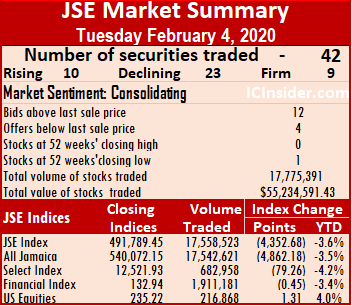

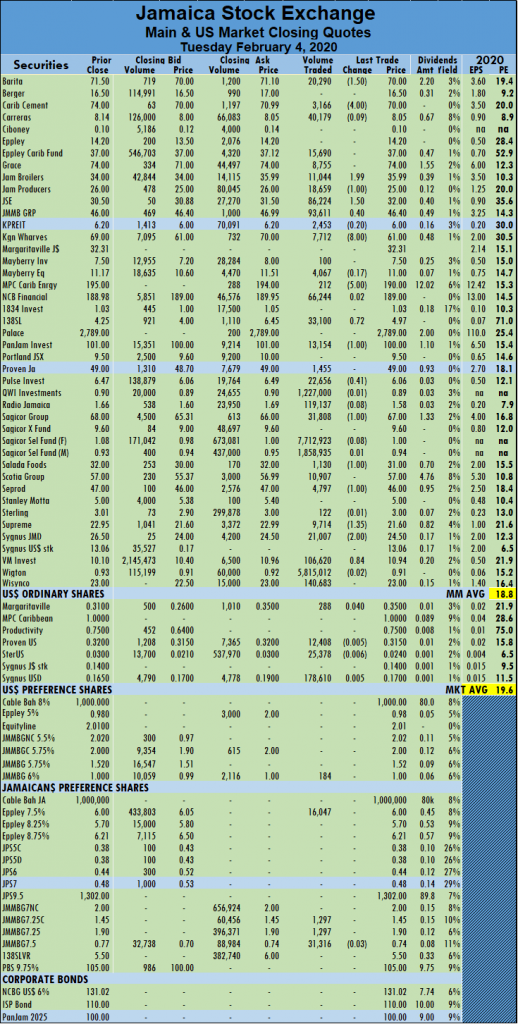

The market closed with 45 securities changing hands in the Main and US dollar markets with the prices of 13 advancing, 22 declining and 10 trading firm. The JSE Main Market activity ended with 43 securities trading and accounting for 12,415,818 units valued at $141,179,331 in contrast to 17,558,523 units valued at $50,385,050 from 37 securities changing hands on Tuesday.

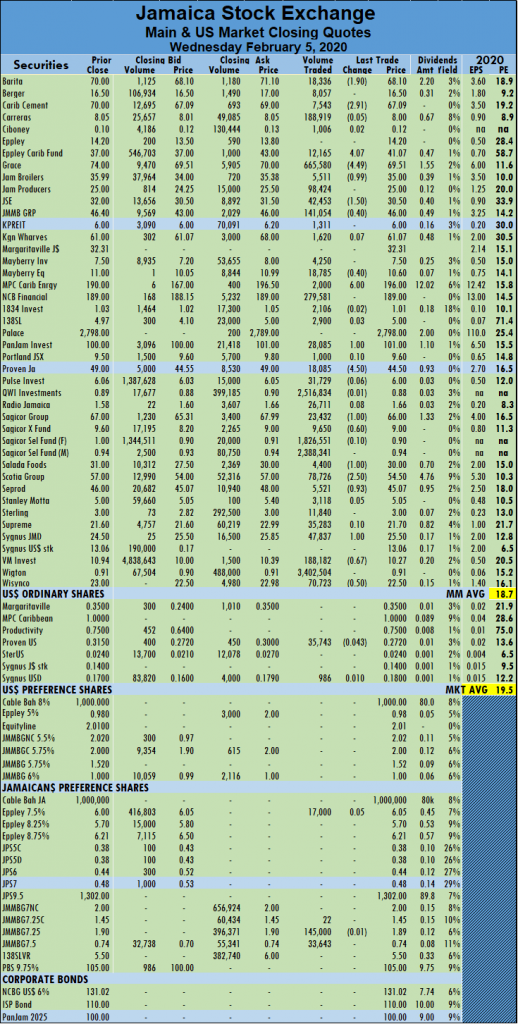

Wigton Windfarm led trading with 3.4 million shares for 27 percent of total volume, followed by QWI Investments Limited with 2.5 million units for 20 percent of the day’s trade and Sagicor Select Manufacturing and Distribution with 2.4 million shares for 19 percent of the market’s volume. Sagicor Select Financial Fund was the sole stock trading more than 1 million units ending the day with 1.8 million shares.

The Market closed with an average of 288,740 units valued at an average of $3,283,240 for each security traded, in contrast to 474,555 units valued at an average of $1,361,758 on Tuesday.  The average volume and value for the month to date amount to 489,068 units valued at 2,376,829 for each security changing hands compared to 600,940 units valued at 1,856,625 for each security traded. Trading in January resulted in an average of 626,134 units valued at $3,511,981 for each security.

The average volume and value for the month to date amount to 489,068 units valued at 2,376,829 for each security changing hands compared to 600,940 units valued at 1,856,625 for each security traded. Trading in January resulted in an average of 626,134 units valued at $3,511,981 for each security.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows twelve stocks ending with bids higher than their last selling prices and three with lower offers. The PE ratio of the market ended at 19.5, while the Main Market ended at 18.7 times 2019 earnings.

In the Main Market, Barita Investments shed $1.90 in settling at $68.10, with 18,336 units changing hands, Caribbean Cement slid to $67.09, losing $2.91 in transferring 7,543 shares, Eppley Caribbean Property Fund climbed $4.07 to $41.07 trading 12,165 shares, Grace Kennedy dropped $4.49 to end at $69.51, after swapping 665,580 shares. Jamaica Broilers lost 99 cents exchanging 5,511 shares in closing at $35, Jamaica Stock Exchange slid to $30.50 with a loss of $1.50 trading 42,453 shares, JMMB Group lost 40 cents to close at $46 while transferring 141,054 shares. Mayberry Jamaican Equities ended at $10.60, after losing 40 cents exchanging 18,785 shares, MPC Caribbean Clean Energy climbed $6 to $196, after swapping 2,000 units,  PanJam Investment closed $1 higher to $101, with 28,085 shares changing hands, Proven Investments dropped $4.50 to settle at $44.50, after trading 18,085 units. Sagicor Group fell by $1 to $66, in exchanging 23,432 shares, Sagicor Real Estate Fund lost 60 cents and closed at $9, after transferring 9,650 units, Salada Foods lost $1 to end at $30, with and exchange of 4,400 shares Scotia. Group moved 78,726 shares at $54.50, after falling $2.50, Seprod lost 93 cents to finish at $45.07 after a swap of 5,521 shares, Sygnus Credit Investments gained $1 to end at $25.50, with 47,837 shares changing hands. Victoria Mutual Investments closed at $10.27, with a loss of 67 cents while trading 188,182 shares and Wisynco Group lost 50 cents, transferring 70,723 units to end the day’s trading at $22.50.

PanJam Investment closed $1 higher to $101, with 28,085 shares changing hands, Proven Investments dropped $4.50 to settle at $44.50, after trading 18,085 units. Sagicor Group fell by $1 to $66, in exchanging 23,432 shares, Sagicor Real Estate Fund lost 60 cents and closed at $9, after transferring 9,650 units, Salada Foods lost $1 to end at $30, with and exchange of 4,400 shares Scotia. Group moved 78,726 shares at $54.50, after falling $2.50, Seprod lost 93 cents to finish at $45.07 after a swap of 5,521 shares, Sygnus Credit Investments gained $1 to end at $25.50, with 47,837 shares changing hands. Victoria Mutual Investments closed at $10.27, with a loss of 67 cents while trading 188,182 shares and Wisynco Group lost 50 cents, transferring 70,723 units to end the day’s trading at $22.50.

Trading in the US dollar market ended with 36,279 units valued at over US$10,361. The market index dropped 12.49 points to close at 222.73. Proven Investments lost 4.3 cents to close at 27.2 US cents exchanging 35,743 shares and Sygnus Credit Investments gained 1 cent trading 986 units, to end at 18 US cents.

Archives for February 2020

More highs & lows ahead for TTSE

Trinidad & Tobago Stock Exchange market index slipped slightly on Wednesday as advancing stocks outnumbered declining ones on a ratio of three to one and leaving the market with more highs and lows ahead.

First Citizens Bank hits new high and heading higher.

Trading closed with 14 securities changing hands, compared to 20 on Tuesday, with six gaining, two declining and the prices of six remaining unchanged.

The T&T Composite Index slipped 0.27 points to close at 1,500.67. The All T&T Index erased just 0.03 points to 1,907.99, while the Cross Listed Index edged 0.07 points lower to end at 148.12.

Trading resulted in an exchange of 886,493 shares, amounting to $11,155,264 compared to 81,749 shares valued at $3,862,184 on Tuesday.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with the bids of six stocks higher than their last selling prices and two with lower offers.

Gains| First Citizens Bank added 15 cents and settled at a record high of $48.15, as investors continue to drive this undervalued stock higher, after exchanging 320 shares. At the close, traders had a bid to buy 5,884 shares at $48.20. First Caribbean International Bank traded 1,000 shares and rose 5 cents to close at $7.90. The stock ended with over 1.4 million units on offer at $7.90. JMMB Group gained 4 cents and ended at $2.74, with investors exchanging 32,199 stock units, National Flour rose 4 cents with 1,283 units changing hands at $1.49.  One Caribbean Media added 5 cents in transferring 1,000 shares at $8 and Scotiabank ended trading with 18,091 units after rising 27 cents to $61.49.

One Caribbean Media added 5 cents in transferring 1,000 shares at $8 and Scotiabank ended trading with 18,091 units after rising 27 cents to $61.49.

Losses| NCB Financial lost 4 cents trading 799,112 stock units at $11.25 and Prestige Holdings swapped 385 shares and fell 5 cents to close at $8.90.

Firm Trades| Clico Investment closed at $28.48, with 8,484 units crossing the exchange, Grace Kennedy ended at $3.95, with investors exchanging 500 shares, Guardian Holdings traded 391 units and ended at $22. Point Lisas exchanged 100 shares at $3.55, Republic Financial closed at $142, after trading just 10 stock units, but it finished with a bid of $143 for a mere 15 shares on offer to sell 422 shares at $150, Trinidad & Tobago NGL traded 13,915 shares to close at $20.70 after trading as low as $20.47 and ending with the stock on offer at $20.50 and West Indian Tobacco settled at $40, with 9,803 units changing hands and looking a bit weak at the close.

Prices of securities trading are those at which the last trade took place.

52 weeks’ lows highlight TTSE trading

The Trinidad & Tobago Stock Exchange market recorded more gains on Tuesday but closed with four stocks ending at 52 weeks’ lows and just one at a 52 weeks’ high.

First Citizens Bank hitting new highs and heading higher.

Trading closed with 20 securities changing hands, compared to 15 on Monday, with four gaining, seven declining and the prices of nine remaining unchanged.

The T&T Composite Index gained 1.54 points to close at 1,500.94. The All T&T Index rose 3.06 points to 1,908.02, while the Cross Listed Index remained at 148.19.

Trading resulted in an exchange of 81,749 shares, amounting to $3,862,184 compared to 172,952 shares valued at $4,651,869 on Monday.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with the bids of two stocks higher than their last selling prices and none with lower offers.

Gains| Calypso Micro Index Fund rose by 2 cents in trading 1,000 shares at $15.87, Clico Investment gained 3 cents to close at $28.48, with 13,185 units crossing the exchange. First Citizens Bank climbed $1 and settled at a record high of $48, with investors continue to drive this undervalued stock higher after exchanging 2,000 shares and Guardian Holdings traded 7,694 units to close with a rise of 5 cents at $22.

Losses| Ansa Mcal lost 7 cents and completed trading 2,749 units at $55.30,

Ansa Merchant Bank dropped $1.95 to close at $36.05 with an exchange of 38 stock units, One Caribbean Media lost 5 cents in transferred 645 shares in closing at a 52 weeks’ low of $7.95. Scotiabank ended trading with 161 units after falling 7 cents to $61.22, Trinidad Cement fell 6 cents in exchanging 2,900 shares at a 52 weeks’ low of $1.89. Trinidad & Tobago NGL lost 8 cents in trading 4,898 shares to close at a 52 weeks’ low of $20.70 and Unilever Caribbean fell 4 cents and ended at a 52 weeks’ low of $22.01, with investors exchanging 3,004 shares.

Ansa Merchant Bank dropped $1.95 to close at $36.05 with an exchange of 38 stock units, One Caribbean Media lost 5 cents in transferred 645 shares in closing at a 52 weeks’ low of $7.95. Scotiabank ended trading with 161 units after falling 7 cents to $61.22, Trinidad Cement fell 6 cents in exchanging 2,900 shares at a 52 weeks’ low of $1.89. Trinidad & Tobago NGL lost 8 cents in trading 4,898 shares to close at a 52 weeks’ low of $20.70 and Unilever Caribbean fell 4 cents and ended at a 52 weeks’ low of $22.01, with investors exchanging 3,004 shares.Firm Trades| First Caribbean International Bank traded 5,280 shares at $7.85, Grace Kennedy closed at $3.95, with investors exchanging 250 shares, JMMB Group closed at $2.70, with investors exchanging 11,000 stock units. Massy Holdings swapped 10,039 shares at $62, National Enterprises traded 264 stock units at $5.50, National Flour had 500 units changing hands to close at $1.45. Point Lisas exchanged 100 shares at $3.55, Republic Financial closed at $142, after trading 15,000 stock units and West Indian Tobacco settled at $40, with 1,042 units changing hands.

Prices of securities trading are those at which the last trade took place.

Sharp rise in Republic pushes TTSE index

The Trinidad & Tobago Stock Exchange market recorded more gains on Monday following increases on the previous two trading days after republic Holdings surged $5.46 to close at a new high.

The market closed with 15 securities changing hands, compared to 18 on Friday, with three gaining, five declining and the prices of seven remaining unchanged. Two stocks closed at 52 weeks’ high and one at a low.

The market closed with 15 securities changing hands, compared to 18 on Friday, with three gaining, five declining and the prices of seven remaining unchanged. Two stocks closed at 52 weeks’ high and one at a low.

he T&T Composite Index gained 4.72 points on Monday to 1,499.40. The All T&T Index rose 7.89 points to 1,904.96, while the Cross Listed Index inched by 0.07 points to close at 148.19.

Trading resulted in an exchange of 172,952 shares, amounting to $4,651,869 compared to 180,282 shares, amounting to $5,149,858 on Friday.

IC bid-offer Indicator| The Investor’s Choice bid-offer indicator ended with the bids of four stocks higher than their last selling prices and one with a lower offer.

Gains| Agostini’s rose 45 cents to close at a 52 weeks’ high of $25.45 with an exchange of just 50 shares, Ansa Merchant Bank climbed $2.14 to close at $38 with an exchange of 906 stock units and Republic Financial climbed $5.46 to end at a 52 weeks high of $142, after exchanging 14,840 shares.

Losses| Clico Investment lost 3 cents to close at $28.45, with 10,692 units crossing the exchange, First Citizens Bank shed 1 cent and settled at $47, with investors exchanging 2,228 shares, Scotiabank ended trading with 3,885 units after falling 11 cents to $61.29. Trinidad & Tobago NGL lost 3 cents with 31,407 shares changing hands to close at a 52 weeks’ low of $20.78 and Unilever Caribbean fell 4 cents and ended at $22.01, with investors exchanging 100 shares.

Losses| Clico Investment lost 3 cents to close at $28.45, with 10,692 units crossing the exchange, First Citizens Bank shed 1 cent and settled at $47, with investors exchanging 2,228 shares, Scotiabank ended trading with 3,885 units after falling 11 cents to $61.29. Trinidad & Tobago NGL lost 3 cents with 31,407 shares changing hands to close at a 52 weeks’ low of $20.78 and Unilever Caribbean fell 4 cents and ended at $22.01, with investors exchanging 100 shares.

Firm Trades| Ansa Mcal completed trading 586 units at $55.37, Grace Kennedy closed at $3.95, with investors exchanging 3,000 shares, JMMB Group closed at $2.70, with investors exchanging 43,798 stock units. Massy Holdings swapped 4,000 shares at $62, NCB Financial settled at $11.29, after trading 18,885 shares, Trinidad Cement exchanged 25,025 shares at $1.95 and West Indian Tobacco settled at $40, with 10,311 units changing hands.

Prices of securities trading are those at which the last trade took place.

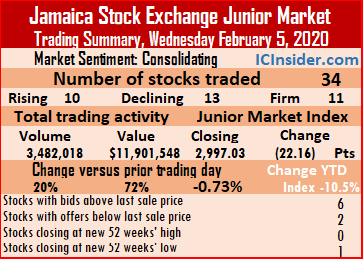

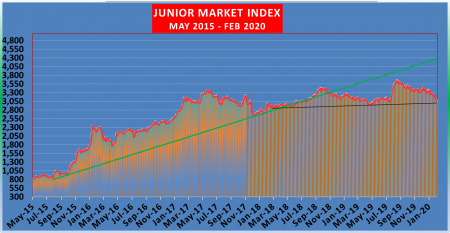

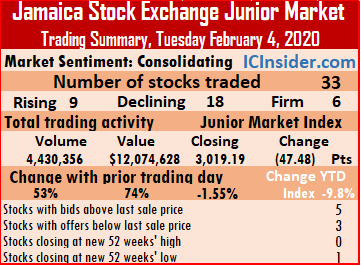

At the close of the market, the index is down 10.5 percent for 2020 to date and 18.2 percent since it peaked in August 2019.

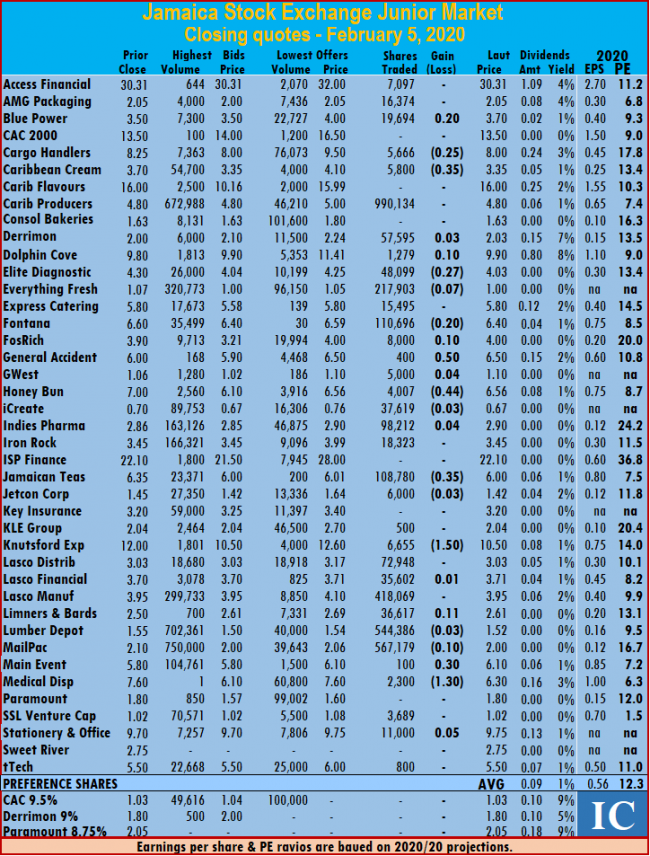

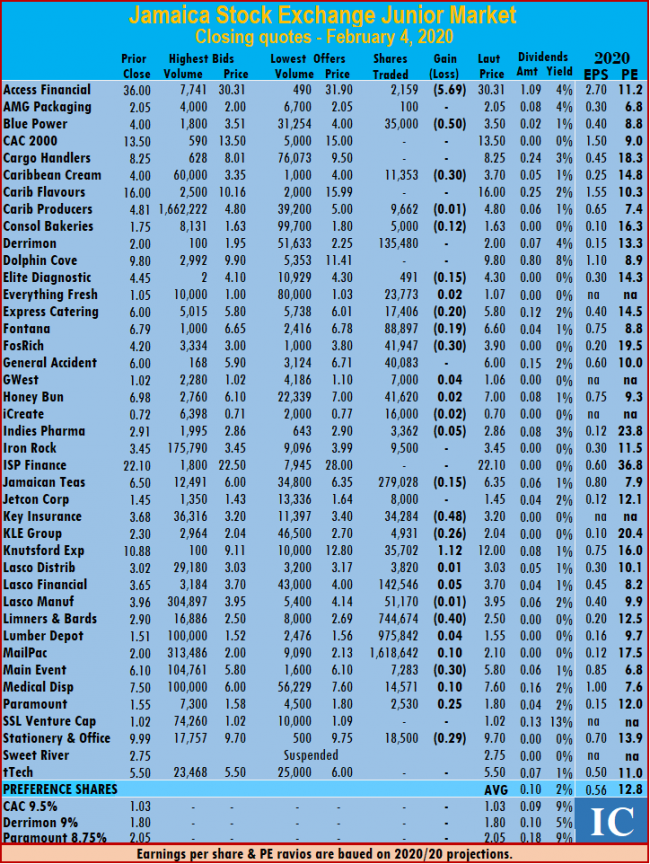

At the close of the market, the index is down 10.5 percent for 2020 to date and 18.2 percent since it peaked in August 2019. At the close of the market, Blue Power climbed 20 cents in exchanging 19,694 shares at $3.70, Caribbean Cream dipped 35 cents in trading of 5,800 units at a 52 weeks’ low of $3.35, Cargo Handlers declined by 25 cents to settle at $8 with an exchange of 5,666 shares. Derrimon Trading ended the day with 57,595 shares changing hands after rising 3 cents to end at $2.03, Dolphin Cove closed 10 cents higher at $9.90, with 1,279 stock units traded, Elite Diagnostic fell 27 cents in trading of 48,099 units at $4.03. Everything Fresh declined 7 cents, swapping 217,903 units at $1, Fontana declined by 2 cents to settle at $6.40 with 110,646 shares changing hands, Fosrich closed trading of 8,000 units and gained 10 cents to end at $4. General Accident climbed 50 cents and exchanged 400 shares at $6.50, GWest Corporation closed trading of 5,000 units and gained 4 cents to end at $1.10, Honey Bun ended market activity exchanging 4,007 shares to close at $6.56 after falling 44 cents. iCreate settled at 52 weeks’ low of 67 cents after shedding 3 cents in the swapping of 37,619, Indies Pharma closed trading of 98,212 units and gained 4 cents to end at $2.90, Jamaican Teas ended the day with a loss of 35 cents at $6 in the swapping of 108,780 shares.

At the close of the market, Blue Power climbed 20 cents in exchanging 19,694 shares at $3.70, Caribbean Cream dipped 35 cents in trading of 5,800 units at a 52 weeks’ low of $3.35, Cargo Handlers declined by 25 cents to settle at $8 with an exchange of 5,666 shares. Derrimon Trading ended the day with 57,595 shares changing hands after rising 3 cents to end at $2.03, Dolphin Cove closed 10 cents higher at $9.90, with 1,279 stock units traded, Elite Diagnostic fell 27 cents in trading of 48,099 units at $4.03. Everything Fresh declined 7 cents, swapping 217,903 units at $1, Fontana declined by 2 cents to settle at $6.40 with 110,646 shares changing hands, Fosrich closed trading of 8,000 units and gained 10 cents to end at $4. General Accident climbed 50 cents and exchanged 400 shares at $6.50, GWest Corporation closed trading of 5,000 units and gained 4 cents to end at $1.10, Honey Bun ended market activity exchanging 4,007 shares to close at $6.56 after falling 44 cents. iCreate settled at 52 weeks’ low of 67 cents after shedding 3 cents in the swapping of 37,619, Indies Pharma closed trading of 98,212 units and gained 4 cents to end at $2.90, Jamaican Teas ended the day with a loss of 35 cents at $6 in the swapping of 108,780 shares.  Jetcon Corporation dropped 3 cents trading of 6,000 units at $1.42, Knutsford Express fell $1.50 to close at $10.50 with 6,655 units crossing the exchange, Lasco Financial ended trading with 35,602 shares, after rising 1 cent to end at $3.71. The Limners and Bards gained 11 cents to end the day at $2.61 with 36,617 shares traded, Lumber Depot ended market activity exchanging 544,386 shares to close at $1.52 after falling 3 cents, Main Event closed 30 cents higher at $6.10, with 100 stock units trading. Mailpac Group fell 10 cents in exchanging 567,179 units at $2, Medical Disposables closed with a loss of $1.30 to finish at $6.30 in the swapping of 2,300 shares and Stationery and Office Supplies climbed 5 cents to end at $9.75 with 11,000 shares changing hands.

Jetcon Corporation dropped 3 cents trading of 6,000 units at $1.42, Knutsford Express fell $1.50 to close at $10.50 with 6,655 units crossing the exchange, Lasco Financial ended trading with 35,602 shares, after rising 1 cent to end at $3.71. The Limners and Bards gained 11 cents to end the day at $2.61 with 36,617 shares traded, Lumber Depot ended market activity exchanging 544,386 shares to close at $1.52 after falling 3 cents, Main Event closed 30 cents higher at $6.10, with 100 stock units trading. Mailpac Group fell 10 cents in exchanging 567,179 units at $2, Medical Disposables closed with a loss of $1.30 to finish at $6.30 in the swapping of 2,300 shares and Stationery and Office Supplies climbed 5 cents to end at $9.75 with 11,000 shares changing hands. At the close, the JSE All Jamaican Composite Index declined 4,862.18 points to close at 540,072.15, the JSE Market Index fell 4,352.68 points to 491,789.45 and the JSE Financial Index lost 0.45 points to 132.94.

At the close, the JSE All Jamaican Composite Index declined 4,862.18 points to close at 540,072.15, the JSE Market Index fell 4,352.68 points to 491,789.45 and the JSE Financial Index lost 0.45 points to 132.94.

Scotia Group transferred 4,797 units at $46, after losing $1, Seprod closed $1 lower at $46 after exchanging 4,797 shares. Supreme Ventures declined $1.35 to end at $21.60, in swapping 9,714 units, Sygnus Credit Investments shed $2 to $24.50, with 21,007 shares changing hands and Victoria Mutual Investments gained 84 cents to end at $10.94, in trading 106,620 shares.

Scotia Group transferred 4,797 units at $46, after losing $1, Seprod closed $1 lower at $46 after exchanging 4,797 shares. Supreme Ventures declined $1.35 to end at $21.60, in swapping 9,714 units, Sygnus Credit Investments shed $2 to $24.50, with 21,007 shares changing hands and Victoria Mutual Investments gained 84 cents to end at $10.94, in trading 106,620 shares. Market activity ended with 33 securities changing hands, with the prices of nine advancing, 18 declining and five remaining unchanged. Trading resulted in an exchange of 4,430,356 units valued at $12,074,628 compared to 2,894,161 units valued at $6,925,513 on Monday. The average PE Ratio for the Junior Market stocks declined to 12.8 times, 2019 earnings.

Market activity ended with 33 securities changing hands, with the prices of nine advancing, 18 declining and five remaining unchanged. Trading resulted in an exchange of 4,430,356 units valued at $12,074,628 compared to 2,894,161 units valued at $6,925,513 on Monday. The average PE Ratio for the Junior Market stocks declined to 12.8 times, 2019 earnings. Blue Power lost 50 cents with an exchange of 35,000 units to settle at $3.50, Caribbean Cream declined by 30 cents to close at $3.70 after trading 11,353 shares. Caribbean Producers ended with a loss of 1 cent at $4.80 with 9,662 stock units changing hands, Consolidated Bakeries finished the day exchanging 5,000 shares to close at $1.63 after falling 12 cents, Elite Diagnostic lost 15 cents in trading 491 units to close at $4.30. Everything Fresh ended the market activity with 23,773 shares crossing the exchange after rising 2 cents to end at $1.07, Express Catering lost 20 cents in trading of 17,406 units at $5.80, Fontana declined by 19 cents in swapping 88,897 units at $6.60. Fosrich dipped 30 cents in trading of 41,947 shares at $3.90, GWest Corporation closed trading of 7,000 units and gained 4 cents to end at $1.06, Honey Bun ended the day at $7 after rising 2 cents and trading 41,620 stock units. iCreate declined by 2 cents to settle at 70 cents with an exchange of 16,000 shares, Indies Pharma shed 5 cents in trading of 3,362 units at $2.86, Jamaican Teas declined by 15 cents trading 279,028 units at $6.35. Key Insurance lost 48 cents in exchanging 34,284 shares to close at $3.20, KLE Group shed 26 cents after swapping 4,931 at $2.04, Knutsford Express gained $1.12 to end at $12, after trading 35,702 shares. Lasco Distributors added 1 cent and exchanged 3,820 shares at $3.03, Lasco Financial gained 5 cents to finish at $3.70 with 142,546 crossing the exchange,

Blue Power lost 50 cents with an exchange of 35,000 units to settle at $3.50, Caribbean Cream declined by 30 cents to close at $3.70 after trading 11,353 shares. Caribbean Producers ended with a loss of 1 cent at $4.80 with 9,662 stock units changing hands, Consolidated Bakeries finished the day exchanging 5,000 shares to close at $1.63 after falling 12 cents, Elite Diagnostic lost 15 cents in trading 491 units to close at $4.30. Everything Fresh ended the market activity with 23,773 shares crossing the exchange after rising 2 cents to end at $1.07, Express Catering lost 20 cents in trading of 17,406 units at $5.80, Fontana declined by 19 cents in swapping 88,897 units at $6.60. Fosrich dipped 30 cents in trading of 41,947 shares at $3.90, GWest Corporation closed trading of 7,000 units and gained 4 cents to end at $1.06, Honey Bun ended the day at $7 after rising 2 cents and trading 41,620 stock units. iCreate declined by 2 cents to settle at 70 cents with an exchange of 16,000 shares, Indies Pharma shed 5 cents in trading of 3,362 units at $2.86, Jamaican Teas declined by 15 cents trading 279,028 units at $6.35. Key Insurance lost 48 cents in exchanging 34,284 shares to close at $3.20, KLE Group shed 26 cents after swapping 4,931 at $2.04, Knutsford Express gained $1.12 to end at $12, after trading 35,702 shares. Lasco Distributors added 1 cent and exchanged 3,820 shares at $3.03, Lasco Financial gained 5 cents to finish at $3.70 with 142,546 crossing the exchange,  Lasco Manufacturing ended with a loss of 1 cent at $3.95 with 51,170 stock units changing hands. Limners and Bards lost 40 cents in trading of 744,674 units at $2.50, Lumber Depot climbed 4 cents and exchanged 975,842 shares at $1.55, MailPac ended trading with 1,618,642 shares, after rising 10 cents to end at $2.10. Main Event lost 30 cents in exchanging 7,283 shares to close at $5.80, Medical Disposables ended with 14,571 shares changing hands, after rising 10 cents to end at $7.60, Paramount Trading climbed 25 cents and exchanged 2,530 shares at $1.80 and Stationery and Office Supplies ended market activity with 18,500 shares to close at $9.70 after falling 29 cents.

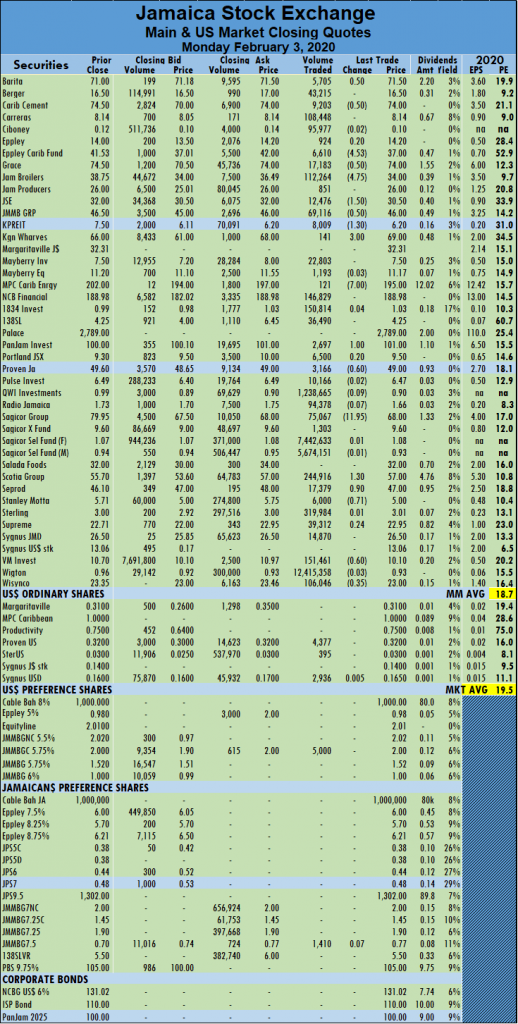

Lasco Manufacturing ended with a loss of 1 cent at $3.95 with 51,170 stock units changing hands. Limners and Bards lost 40 cents in trading of 744,674 units at $2.50, Lumber Depot climbed 4 cents and exchanged 975,842 shares at $1.55, MailPac ended trading with 1,618,642 shares, after rising 10 cents to end at $2.10. Main Event lost 30 cents in exchanging 7,283 shares to close at $5.80, Medical Disposables ended with 14,571 shares changing hands, after rising 10 cents to end at $7.60, Paramount Trading climbed 25 cents and exchanged 2,530 shares at $1.80 and Stationery and Office Supplies ended market activity with 18,500 shares to close at $9.70 after falling 29 cents. At the close, Sagicor Group sustained dropped $11.95 and erased the $10.95 gained of Friday. MPC Caribbean Clean Energy shed $7 followed by Eppley Caribbean Property Fund and Jamaica Broilers with losses of $4.53 and $4.75, respectively.

At the close, Sagicor Group sustained dropped $11.95 and erased the $10.95 gained of Friday. MPC Caribbean Clean Energy shed $7 followed by Eppley Caribbean Property Fund and Jamaica Broilers with losses of $4.53 and $4.75, respectively.

PanJam Investment gained $1 in transferring 2,697 shares and closed at $101, Proven Investments closed 60 cents lower at $49, with 3,166 shares changing hands, Sagicor Group plunged to $68, after losing $11.95 trading 75,067 shares, Scotia Group gained $1.30 to settle at $57 transferring 244,916 shares. Seprod closed 90 cents higher at $47, exchanging 17,379 shares. Stanley Motta lost 71 cents to end at $5, in swapping 6,000 units, Victoria Mutual Investments ended at $10.10, with a loss of 60 cents trading 151,461 shares and Wisynco Group closed the day’s trade at $23, after falling 35 cents in transferring 106,046 shares.

PanJam Investment gained $1 in transferring 2,697 shares and closed at $101, Proven Investments closed 60 cents lower at $49, with 3,166 shares changing hands, Sagicor Group plunged to $68, after losing $11.95 trading 75,067 shares, Scotia Group gained $1.30 to settle at $57 transferring 244,916 shares. Seprod closed 90 cents higher at $47, exchanging 17,379 shares. Stanley Motta lost 71 cents to end at $5, in swapping 6,000 units, Victoria Mutual Investments ended at $10.10, with a loss of 60 cents trading 151,461 shares and Wisynco Group closed the day’s trade at $23, after falling 35 cents in transferring 106,046 shares. The decline left the market price-earnings ratio at 13.1 based on 2019 earnings.

The decline left the market price-earnings ratio at 13.1 based on 2019 earnings. At the close of the market, AMG Packaging gained 12 cents to settle at $2.05, trading 6,424 stock units, Blue Power ended the day, 20 cents higher at $4 with 3,877 stock units crossing the exchange, Caribbean Producers climbed 1 cent, swapping 600 shares at $4.81. Dolphin Cove lost 20 cents in trading of 2,393 stock units at $9.80, Elite Diagnostic finished 45 cents higher at $4.45 with 42,851 stock units trading, Express Catering exchanged 7,722 units and gained 5 cents to end at $6. Fontana slipped 1 cent to close at $6.79 with 44,009 stock units changing hands, GWest Corporation ended with a loss of 1 cent at $1.02 in the trading of 30,000 stock units, Honey Bun declined 2 cents, in transferring 33,321 shares to close at $6.98. iCreate dropped 3 cents to settle at 72 cents in exchanging 506,791 stock units, Indies Pharma ended market activity exchanging 57,828 shares to close at $2.91 after falling 4 cents, Jamaican Teas lost 19 cents in trading of 159,866 shares at $6.50. Knutsford Express fell 62 cents with 424 stock units changing hands at $10.88, Lasco Distributors fell 8 cents in exchanging 83,905 units at $3.02, Lasco Financial closed trading of 10,000 units and gained 5 cents to end at $3.65.

At the close of the market, AMG Packaging gained 12 cents to settle at $2.05, trading 6,424 stock units, Blue Power ended the day, 20 cents higher at $4 with 3,877 stock units crossing the exchange, Caribbean Producers climbed 1 cent, swapping 600 shares at $4.81. Dolphin Cove lost 20 cents in trading of 2,393 stock units at $9.80, Elite Diagnostic finished 45 cents higher at $4.45 with 42,851 stock units trading, Express Catering exchanged 7,722 units and gained 5 cents to end at $6. Fontana slipped 1 cent to close at $6.79 with 44,009 stock units changing hands, GWest Corporation ended with a loss of 1 cent at $1.02 in the trading of 30,000 stock units, Honey Bun declined 2 cents, in transferring 33,321 shares to close at $6.98. iCreate dropped 3 cents to settle at 72 cents in exchanging 506,791 stock units, Indies Pharma ended market activity exchanging 57,828 shares to close at $2.91 after falling 4 cents, Jamaican Teas lost 19 cents in trading of 159,866 shares at $6.50. Knutsford Express fell 62 cents with 424 stock units changing hands at $10.88, Lasco Distributors fell 8 cents in exchanging 83,905 units at $3.02, Lasco Financial closed trading of 10,000 units and gained 5 cents to end at $3.65.  Lasco Manufacturing declined by 6 cents after 26,806 stock units crossed the exchange at $3.96, Lumber Depot lost 2 cents to settle at $1.51 with a transfer of 519,559 shares, MailPac Group fell 8 cents in trading of 753,122 units at $2. Main Event gained 30 cents and exchanged 22,578 shares at $6.10, Medical Disposables climbed $1 to end at $7.50 with 85,429 shares trading, SSL Venture declined 6 cents in trading 40,000 stock units at $1.02. Stationery and Office Supplies ended with 1,728 shares crossing the exchange, after rising 19 cents to end at $9.99 and tTech closed down 10 cents to $5.50 with 1,532 units changing hands.

Lasco Manufacturing declined by 6 cents after 26,806 stock units crossed the exchange at $3.96, Lumber Depot lost 2 cents to settle at $1.51 with a transfer of 519,559 shares, MailPac Group fell 8 cents in trading of 753,122 units at $2. Main Event gained 30 cents and exchanged 22,578 shares at $6.10, Medical Disposables climbed $1 to end at $7.50 with 85,429 shares trading, SSL Venture declined 6 cents in trading 40,000 stock units at $1.02. Stationery and Office Supplies ended with 1,728 shares crossing the exchange, after rising 19 cents to end at $9.99 and tTech closed down 10 cents to $5.50 with 1,532 units changing hands.