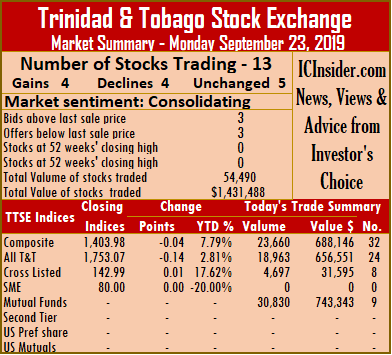

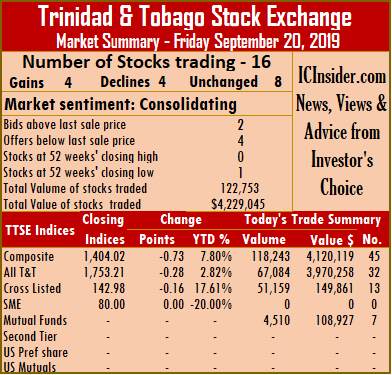

Trinidad & Tobago Stock Exchange closed on Monday with trading in 13 securities against 16 on Friday, with 4 advancing, 4 declining and 5 remaining unchanged as the market indices moved marginally.

Trinidad & Tobago Stock Exchange closed on Monday with trading in 13 securities against 16 on Friday, with 4 advancing, 4 declining and 5 remaining unchanged as the market indices moved marginally.

At close of the market, the Composite Index slipped 0.04 points to 1,403.98. The All T&T Index lost 0.14 points to 1,753.07, while the Cross Listed Index gained 0.01 points to close at 142.99.

Trading ended with 1,431,488 shares at a value of $4,229,045, compared to 122,753 shares at a value of $4,229,045 shares on Friday.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with 3 stocks closing with the bids higher than the last selling prices and 3 with lower offers.

Gains| Guardian Holdings added 5 cents in trading just 100 units at $18.15, Massy Holdings increased 44 cents and completed trading of a mere 10 shares at $54.45, National Flour rose 3 cents to end at $1.68, with 1,295 units crossing the exchange and Republic Financial closed with a gain of 15 cents to conclude the swapping of 1,471 shares at $122.

Losses| Clico Investment Fund shed 4 cents and ended at $24.11, with 30,830 stock units changing hands, First Caribbean International Bank closed at $9.25 with 300 stock units changing hands, Trinidad & Tobago NGL exchanged 6,640 units and lost 10 cents to close at $25.90 and West Indian Tobacco dropped 99 cents and concluded at $105, with 25 units.

Losses| Clico Investment Fund shed 4 cents and ended at $24.11, with 30,830 stock units changing hands, First Caribbean International Bank closed at $9.25 with 300 stock units changing hands, Trinidad & Tobago NGL exchanged 6,640 units and lost 10 cents to close at $25.90 and West Indian Tobacco dropped 99 cents and concluded at $105, with 25 units.

Firm Trades| Angostura Holdings completed trading at $16, swapping of 5,144 shares, First Citizens settled at $40.15, swapping of 1,878 shares, JMMB Group ended at $2.15, after exchanging 2,000 shares and Sagicor Financial completed trading with 2,397 units at $10.22 and Scotiabank settled at $58.50 in swapping of 2,400 shares.

Prices of securities trading are those at which the last trade took place.

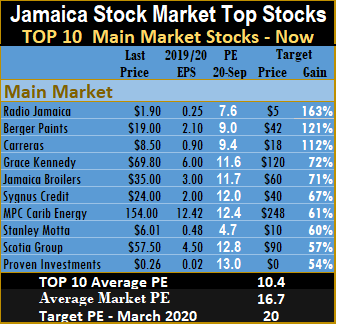

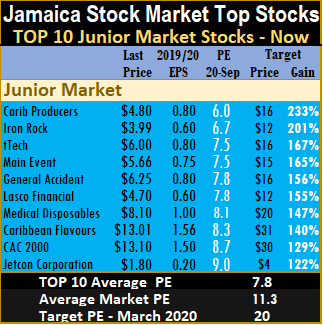

Proven Investments selling half of their holdings in Access Financial stock by way of a public offer, at an attractive price of $32 each. Market conditions resulted in just two changes to IC TOP 10 BUY RATED list as CAC 2000 returned to the top 10 Junior Market list, replacing Caribbean Cream and Scotia Group moved back into the main market listing at the expense of Seprod.

Proven Investments selling half of their holdings in Access Financial stock by way of a public offer, at an attractive price of $32 each. Market conditions resulted in just two changes to IC TOP 10 BUY RATED list as CAC 2000 returned to the top 10 Junior Market list, replacing Caribbean Cream and Scotia Group moved back into the main market listing at the expense of Seprod.  Radio Jamaica

Radio Jamaica

Trading on the main market of the Jamaica Stock Exchange ended on Friday with advancing stocks outnumbering declining ones two to one but the market indices ended down.

Trading on the main market of the Jamaica Stock Exchange ended on Friday with advancing stocks outnumbering declining ones two to one but the market indices ended down.

Proven Investments lost 50 cents and ending the day’s trade at $37 with 5,940 shares changing hands. Salada Foods climbed $2 to $32, after exchanging 60,276 shares, Scotia Group gained 50 cents to end at $57.50 with trades of 77,639 shares, Seprod advanced $2.59 to settle at $56.10 with 4,900 units changing hands. Supreme Ventures gained 40 cents to end at $28 exchanging 349,173 shares, Sygnus Credit Investments lost 90 cents after trading 13,267 to settle at $23.10 and Victoria Mutual Investments added 50 cents after 401,515 units changed hands to close at $8.

Proven Investments lost 50 cents and ending the day’s trade at $37 with 5,940 shares changing hands. Salada Foods climbed $2 to $32, after exchanging 60,276 shares, Scotia Group gained 50 cents to end at $57.50 with trades of 77,639 shares, Seprod advanced $2.59 to settle at $56.10 with 4,900 units changing hands. Supreme Ventures gained 40 cents to end at $28 exchanging 349,173 shares, Sygnus Credit Investments lost 90 cents after trading 13,267 to settle at $23.10 and Victoria Mutual Investments added 50 cents after 401,515 units changed hands to close at $8. The Junior Market Index slipped 4.73 points to close at 3,449.27 on Friday with 26 securities changing hands, with 11 securities rising, 11 declining as 4 remained unchanged.

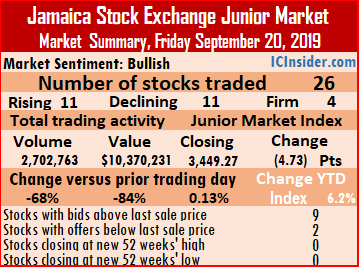

The Junior Market Index slipped 4.73 points to close at 3,449.27 on Friday with 26 securities changing hands, with 11 securities rising, 11 declining as 4 remained unchanged.

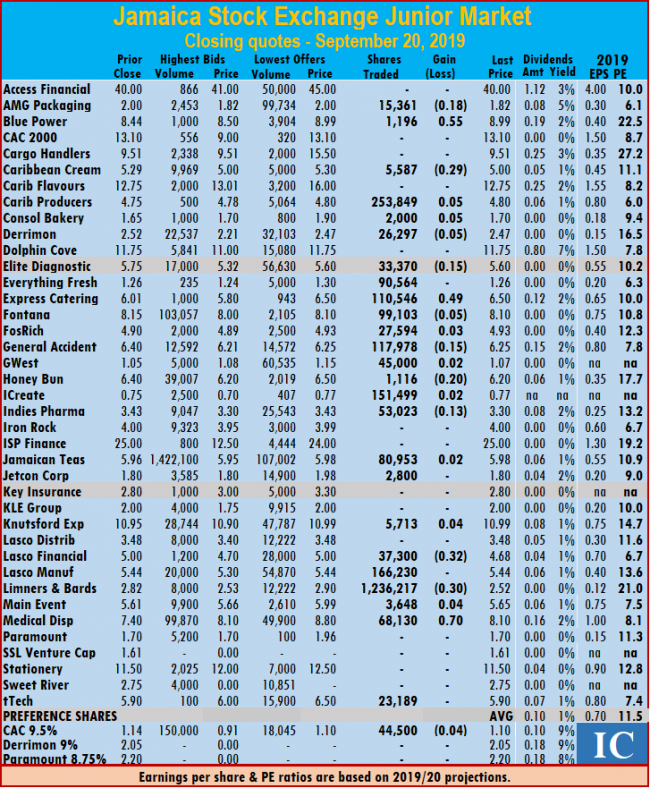

Honey Bun lost 20 cents to close at $6.20, after swapping of 1,116 shares, iCreate closed 2 cents higher at 77 cents, with 151,499 stock units trading, Indies Pharma shed 13 cents trading 53,023 units at $3.30, Jamaican Teas closed trading of 80,953 units and gained 2 cents to end at $5.98. Knutsford Express ended trading with 5,713 shares, after rising 4 cents to end at $10.99, Limners and Bards ended market activity exchanging 1,236,217 shares to close at $2.52 after falling 30 cents, Lasco Financial closed with a loss of 32 cents at $4.68, in swapping of 37,300 shares. Medical Disposables closed trading of 68,130 units and gained 70 cents to end at $8.10 and Main Event closed 4 cents higher at $5.65, with 3,648 stock units trading. In the Junior Market preference segment, CAC 2000 lost 4 cents in trading 44,500 shares to close at $1.10.

Honey Bun lost 20 cents to close at $6.20, after swapping of 1,116 shares, iCreate closed 2 cents higher at 77 cents, with 151,499 stock units trading, Indies Pharma shed 13 cents trading 53,023 units at $3.30, Jamaican Teas closed trading of 80,953 units and gained 2 cents to end at $5.98. Knutsford Express ended trading with 5,713 shares, after rising 4 cents to end at $10.99, Limners and Bards ended market activity exchanging 1,236,217 shares to close at $2.52 after falling 30 cents, Lasco Financial closed with a loss of 32 cents at $4.68, in swapping of 37,300 shares. Medical Disposables closed trading of 68,130 units and gained 70 cents to end at $8.10 and Main Event closed 4 cents higher at $5.65, with 3,648 stock units trading. In the Junior Market preference segment, CAC 2000 lost 4 cents in trading 44,500 shares to close at $1.10. JMMB Group shed 5 cents and completed trading of 45,000 units at $2.15 and Scotiabank ended with a loss of 15 cents to settle at $58.50, with the trading of 1,734 units.

JMMB Group shed 5 cents and completed trading of 45,000 units at $2.15 and Scotiabank ended with a loss of 15 cents to settle at $58.50, with the trading of 1,734 units.

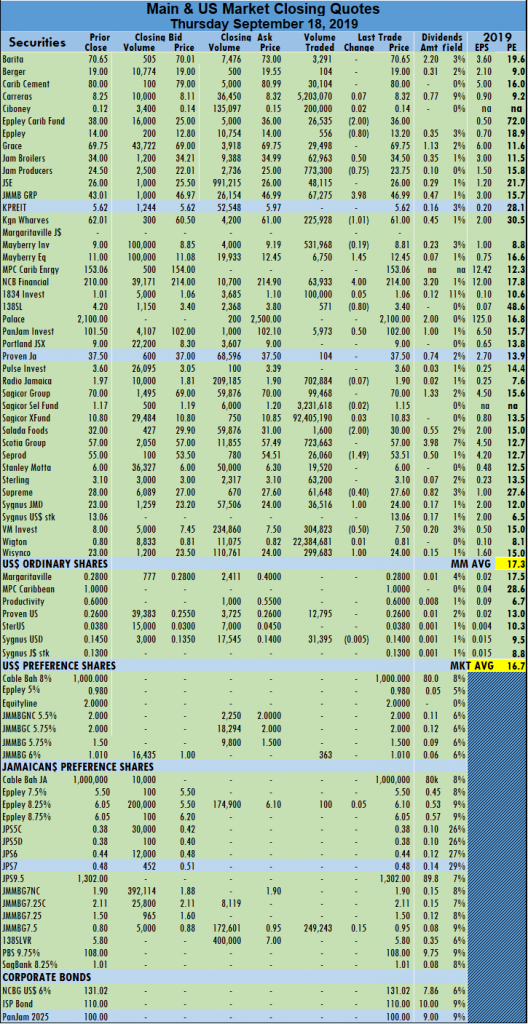

Salada Foods lost $2 to settle at $30 with 1,600 shares changing hands, Seprod fell $1.49 to settle at $53.51 with 26,060 shares changing hands, Supreme Ventures lost 40 cents to close at $27.60 with an exchange of 61,648 shares. Sygnus Credit Investments gained $1 and completed trading of 36,516 shares at $24, Victoria Mutual closed trading of 304,823 units after falling 50 cents to end at $7.50 and Wisynco Group added $1 in trading 299,683 shares to close at $24.

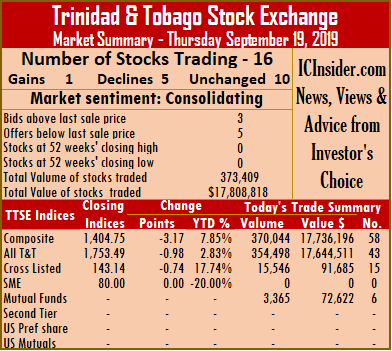

Salada Foods lost $2 to settle at $30 with 1,600 shares changing hands, Seprod fell $1.49 to settle at $53.51 with 26,060 shares changing hands, Supreme Ventures lost 40 cents to close at $27.60 with an exchange of 61,648 shares. Sygnus Credit Investments gained $1 and completed trading of 36,516 shares at $24, Victoria Mutual closed trading of 304,823 units after falling 50 cents to end at $7.50 and Wisynco Group added $1 in trading 299,683 shares to close at $24. Trinidad & Tobago Stock Exchange closed on Thursday with trading in 16 securities against 15 on Wednesday, with just one advancing, 5 declining and 10 remaining unchanged.

Trinidad & Tobago Stock Exchange closed on Thursday with trading in 16 securities against 15 on Wednesday, with just one advancing, 5 declining and 10 remaining unchanged.