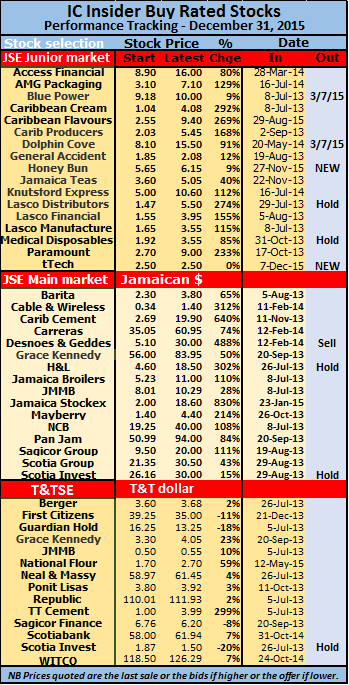

IC BUY RATED stocks were top of the Caribbean markets in Jamaica and Trinidad and Tobago for 2015, with Jamaica Stock Exchange share, chalking up a massive gain of 830 percent since IC Insider elevated it to BUY RATED status.Caribbean Cement followed with gains of 640 percent, Caribbean Cream with 444 percent and Trinidad Cement with a 299 percent increase on the Trinidad market.

While it was easy to make money in Jamaica, with profits rising and interest rates falling, developments in Trinidad went in the opposite direction, with interest rates rising and profits under pressure with the economy ended in recession.

At the beginning of 2015 of the 14 junior market selections, few recorded gains and only Knutsford Express with a 17 percent increase reflecting any meaningful positive movement. Losses were large, with AMG Packaging down 39 percent, Blue Power 31 percent, Caribbean Cream 23 percent, Jamaica Teas 28 percent, Lasco Financial 37 percent and Lasco Manufacturing 32 percent. What a difference a year can make? By the end of 2015, gains were all over the place with the list having 17 companies with two being dropped. There were no losing stocks in the list that had a new addition, tTech which could be listed this week. Honey Bun was added to the listing in November and gained 9 percent since. Eight stocks have more than doubled, four gained 40 percent to 91 percent. Caribbean Cream jumped 292 percent to be the top selection in this market, followed by Lasco Distributors up 274 percent. Blue Power was removed from the list in July with a small gain.

In the JSE main market, at the start of 2015, Hardware and Lumber was the best performing stock with gains of 62 percent followed by Cable & Wireless with 47 percent and Jamaica Broilers had the worst performance with a loss of 24 percent. In all, 7 of the 15 selections were lower than at the time they were BUY RATED.

By year-end, all selections in the JSE main market were up, with Scotia Investments having a mere 15 percent increase, being the poorest performer. This stock is being moved to Market Watch as the 2015 profit performance was far too disappointing to warrant buying now, while Hardware and Lumber remains a hold. The rest, present opportunities for continuing profit making.  JMMB Group ended with just 28 percent gain, but seems undervalued at the current price. While the list had a few lousy performers, the same can’t be said about a 640 percent gain in Caribbean Cement and 830 percent increase for Jamaica Stock Exchange share. In all, 9 stocks posted gains in excess of 100 percent and 4 below 100 percent but with a 50 percent increase and more.

JMMB Group ended with just 28 percent gain, but seems undervalued at the current price. While the list had a few lousy performers, the same can’t be said about a 640 percent gain in Caribbean Cement and 830 percent increase for Jamaica Stock Exchange share. In all, 9 stocks posted gains in excess of 100 percent and 4 below 100 percent but with a 50 percent increase and more.

There were 13 selections in the Trinidad market with Trinidad Cement being the best performer with gains of 150 percent, the next was Point Lisas with 11 percent at the start of 2015. Five stocks suffered losses with the highest being 22 percent and the next 18 percent. For 2015 the price of Trinidad Cement is up 299 percent followed by National Flour with a 59 percent gain.

Looking ahead, the junior stocks should continue to grow, with several of the companies actively expanding resulting in profits climbing at a fast pace. There are a few stocks to be cautious of just now. Lasco Distributors selling at almost 16 times 2016 March earnings. Growth should be strong but unless investors have a long term objective they should be careful buying at current price level, the same applies to Lasco Financial that is selling at 15 times earnings. Dolphin Cove remains a hold at this time.

The Trinidad market needs to be watched at this stage, with the country needing to adjust to the lower price of oil and the recession now being endured.

BUY RATED top Carib markets with 830%

Near 20% tTech shareholders

tTEch’s the technology company that offered shares to the public in December has released details of the successful offer of 25,652,000 ordinary shares at $2.50 each that closed on December 16, 2015.

tTEch’s the technology company that offered shares to the public in December has released details of the successful offer of 25,652,000 ordinary shares at $2.50 each that closed on December 16, 2015.

The issue attracted 289 applications, valued at approximately $172.395 million.

Based on the level of oversubscription, applications for the general pool (57 percent of the shares offered) will receive 100 percent up to 10,000 shares applied for and the remaining shares will be allocated on a proportional basis equivalent to approximately 19.96 percent of the total application amount. Reserve share applicants (35 percent of the shares offered) will receive 100 percent of the number of shares they applied for.

The shares are expected to be listed on the junior market of the Jamaica Stock Exchange in January.

tTech allocation by Monday

The allocation formula for the recent Initial public offering of tTech shares which closed shortly after opening on Wednesday with more than 300 percent over subscription, should be known by Monday coming.

The allocation formula for the recent Initial public offering of tTech shares which closed shortly after opening on Wednesday with more than 300 percent over subscription, should be known by Monday coming.

The likely date was obtained by IC Insider today from a spokesperson at NCB Capital Markets. The recommended formula has been passed on to the company for the approval the spoke person stated. tTech offered more than 25.65 million shares for purchase up to $2.50 each and was well received by investors raising over $50 million that they went to the market.

The spokesperson also indicated that they will be looking into the matter of investor being asked to pay the central depository fee, although it was not included in the prospectus.

Juniors jump, new record for majors

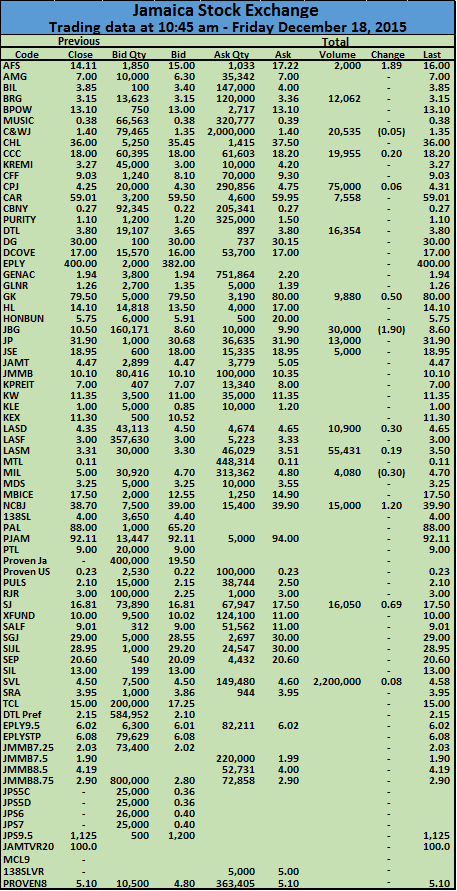

The junior market is enjoying major gain on Friday morning with a 2 percent or 34 point jump to sit just below the record reached in November of 1,676.68 points. The main market of the Jamaica Stock Exchange also recorded gains in early trading pushing the indices to new record high. A total of 17 securities traded as 9 stocks rose and just 3 declined with 2,512,805 units changing hands.

The main market of the Jamaica Stock Exchange also recorded gains in early trading pushing the indices to new record high. A total of 17 securities traded as 9 stocks rose and just 3 declined with 2,512,805 units changing hands.

At 10:45 am, the all Jamaica Composite Index gained 334.81 points to 160,677.66, the JSE Market Index gained by 299.59 points to 144,709.80, the JSE combined index gained 586.44 points to 151,548.54 and the junior market index is up 34 points to 1,670.95.

Interesting trades, with 75 minutes having elapsed are, Supreme Ventures traded 2,200,000 shares at $4.58 for an 8 cents gain, Grace Kennedy traded at a new 52 weeks’ high of $80 and so has Sagicor Group at $17.50, Jamaica Broilers dropped $1.90 to be at $8.60 and National Commercial Bank had gained $1.20 to $39.90.

Feedback from NCB Capital Markets is the tTech allocation should be known for the recently closed IPO by Monday coming.

tTech IPO JCSD fee breaches prospectus terms

The imposition of JCSD processing fee is not only untidy, it is in breach of the terms of the prospectus and must be returned to those investors who paid it. There are no references to JCSD processing fee in the prospectus and under the heading of Statutory and General Information items 6 of the prospectus states, “All Applicants (including Reserved Share Applicants) will be required to pay in full the Subscription Price of $2.50 per Share, subject to discounts, where applicable. No further sum will be payable on allotment”. Most junior market IPOs, are highly anticipated, with several issues closing shortly after opening, leading most investors to apply for shares ahead of the opening day and so ensure that their application are on a timely basis. On Tuesday ahead of the opening of the tTech issue, a statement appeared on the website of the Jamaica Stock Exchange, to indicate that the “application form found in Appendix 1 of IPO Prospectus did not include any mention of the JCSD processing fee of J$134.00 (inclusive of GCT) that each application would be subject to. As such, the application form has been updated to include such commentary”.

Most persons would not have been aware of the charge and so put in their applications without it while some included it, having seen the change. This places some applicants at a disadvantage small though it may be. Some investors are shocked that, the company and the broker did not absorb the charge for the cess and that the Financial Services Commission and the Jamaica Stock Exchange have permitted the late imposition of it. The charging of the JCSD processing fee inclusive of GCT is an irritant for investors and there are few solid reasons why companies are not treating the cess as a part of the cost of listing rather than asking investors to pay for it directly.

Most persons would not have been aware of the charge and so put in their applications without it while some included it, having seen the change. This places some applicants at a disadvantage small though it may be. Some investors are shocked that, the company and the broker did not absorb the charge for the cess and that the Financial Services Commission and the Jamaica Stock Exchange have permitted the late imposition of it. The charging of the JCSD processing fee inclusive of GCT is an irritant for investors and there are few solid reasons why companies are not treating the cess as a part of the cost of listing rather than asking investors to pay for it directly.

tTech is BUY RATED for strong growth

tTech is going to the capital market this month to raise approximately $50 million by the issuing for subscription 25,652,000 shares to the general public and special interest group with the general public being asked to pay $2.50 each for 16.4 million being made available to them.

tTech is going to the capital market this month to raise approximately $50 million by the issuing for subscription 25,652,000 shares to the general public and special interest group with the general public being asked to pay $2.50 each for 16.4 million being made available to them.

IC Insider assessed the company’s record and forecast increased earnings for 2016 and 2016 and accorded it the BUY RATED honour.

Edward Alexander, Chief Executive Officer, in an interview with IC Insider stated that the staff of the company indicates that they will all be taking up their full allotment, if so there will be few of these shares available for the public to acquire at the IPO stage.

The Company was incorporated in Jamaica on December 1st, 2006, and is a managed information technology (“IT”) service provider, or what industry insiders refer to as a “Managed Services Provider”. That is, for the most part, the Company’s main service offering is the management of other businesses’ IT infrastructure remotely and on a pre-paid basis.

The company is growing at an attractive rate with revenues that are up 28 percent for the half year to June to $81.4 million versus expenses increasing 18 percent and only 14 percent when technical fees, services and products that are part of direct expenses are excluded.

From Left: Mr. Hugh Allen, Resolution Manager and Executive Director; Mrs. Natalya Petrekin, Service Desk

Manager; Mr. Norman Chen, Technical Services Director; Mr. John Gibson, Senior IT Security Officer; Mr.

Edward Alexander, CEO; Mrs. Hortense Gregory-Nelson, Finance and Administrative Manager; Mr. G.

Christopher Reckord, Sales and Marketing Director. Mr. Omar Bell.

IC Insiders’ forecast, based on continuation of good revenue growth, is for profit before tax for 2015 to end at $36 million or 45 cents per share and $27 million or 35 cents per share after tax and $64 million or 60 cents per share for 2016. This gives it a PE based on 2015 earnings before tax of 5.5 and for 2016 of 4 and compares with junior market stocks with PE of 8, with half of the market selling above the average, suggesting that the stock should enjoy a nice bounce over the next twelve months or less. The company has $51 million in cash and no borrowed funds with current liability of just $27 million, so why do they need to raise the funds? “Expansion into security services will require added equipment, software working capital for continued expansion” Alexander stated, in addition listing allows the staff to be part owners and benefit from future growth.

There are a number of positives for the company it is in a good growth industry with potential for regional expansion, the Grace Kennedy contract and relationship could provide them the experience to take on other large regional conglomerates. They are a service-based business with high gross profit margin which is a big positive and if growth continues at current levels would contribute to a big increase in profit. A lot of the business is recurring, providing stability to the operation. The founders’ vested interest will remain strong as they will still hold relatively large percentage of the company after the IPO.

There are a number of positives for the company it is in a good growth industry with potential for regional expansion, the Grace Kennedy contract and relationship could provide them the experience to take on other large regional conglomerates. They are a service-based business with high gross profit margin which is a big positive and if growth continues at current levels would contribute to a big increase in profit. A lot of the business is recurring, providing stability to the operation. The founders’ vested interest will remain strong as they will still hold relatively large percentage of the company after the IPO.Only about 15% shares being offered to the general public the stock almost guaranteeing that it will be in relatively short supply which could drive price up quickly after listing, this is especially so being the first tech company on the JSE.

Subscription opens at 9 am on December 16th, 2015 and closes at 4:30 p.m. on the December 18th, 2015, subject to the right of the Company to shorten or extend the time for closing. All completed Application Forms must be delivered to NCB Capital Markets.

tTech offer seems a buy

tTech a company most investors would hardly have heard about, will be going to the capital market this month, to raise approximately $50,263,900, by the issuing for subscription 25,652,000 ordinary shares to the general public and special persons related to the company at $2.50 each.

tTech a company most investors would hardly have heard about, will be going to the capital market this month, to raise approximately $50,263,900, by the issuing for subscription 25,652,000 ordinary shares to the general public and special persons related to the company at $2.50 each.

In reality only 16.4 million are allocated for the general public, a relatively small number. The Company that was formed in 2006 currently provides outsourced IT solutions to businesses currently in Jamaica. IC Insider’s preliminary assessment indicates earnings per share around 40 cents before taxation for a PE of 6.3 and would make the stock a buy.

The purpose of the offer is to provide working capital support to its operations and in order to allow the Company to augment its productive capacity and thereby to take advantage of new business opportunities as well as benefit from listing on the stock exchange and improve staff compensation by allowing them to buy the shares that are bound to increase sharply in price after listing.

The Company estimates that the expenses in the Invitation will not exceed $10 million. Subscription opens at 9 am on December 16th, 2015 and closes at 4:30 p.m. on the December 18th, 2015, subject to the right of the Company to shorten or extend the time for closing. If the Invitation is fully subscribed and is successful in raising $50,263,900, the Company will make an application to the JSE for the Shares to be admitted to the Junior Market. The company has been profitable with revenues growing at an attractive rate. The Company has adopted a dividend policy of paying 25 percent of profits each year.

All completed Application Forms must be delivered to NCB Capital Markets.

IC Insider will have a fuller report at a later date.

Poor Carib capital market regulation

The glaring case of the abuse of power exercised by the Trinidad Cement board in the handling of the company’s right issue earlier this year, stands out as a clear case for regulatory action to protect investors. In this matter the company failed to properly inform shareholders of a strong improvement in the profit of the a for the first quarter and made it worse with Price Waterhouse Coopers signing a report that gave the impression that there was no profit for the quarter.

In Jamaica, we have a Financial Services Commission (FSC) that is said to be the regulator for the financial entities not regulated by Bank of Jamaica, much is lacking from them, their inaction in matters of critical import makes one wonder what taxpayers money given to them is really being used for?

When it comes to the FSC, one is reminded of a police station located across from a house of crime but does nothing, unless the neighbours complain about it. Here is a case be it small. One of the FSC regulated entities is late with its 2015 results, the company issued a statement to the stock exchange to say they would be late in releasing the audited statements and the audited figures would be released on December 4. They also had the lateness of the audited accounts in 2014, with December 5th being the promised date. Now the public is being told that Barita Investments Limited (BIL) the entity involved has advised that the Audited Financial Statements for the financial year-end 2014/2015 will be submitted to the Jamaica Stock Exchange (JSE)on or before December 29, 2015. That is a major shift in the time frame. No reason was given in the notice on the stock exchange site. The investing public has a right to know the reason for the lateness. The FSC that regulates the market, should be interested in knowing what the reasons are as well, but there is not even a peep out of them?

IC Insider spoke with Mrs Rita Humphries, Chairman of the company on Wednesday December 9, about the issues affecting the release and subsequently, the last posting was made on the JSE website. According to the Chairman, there were issues relating to reconciliation of a few accounts which required adjusting entries to be made. Barita had them reconciled and the auditors needed to go through the information and transactions to satisfy themselves that the end result is correct. Additionally, the auditors advised of none receipt of confirmation from clients some of which had already been sent on to the auditors we are advised. Last year the audit was held up by a difference of opinion between the auditors and the Barita over the issue of fully providing for the value of shares Barita held in Scotia Group on the basis the auditors said was the impairment of the investment. This was after they fully provided for the value of Barita’s investment in National Commercial Bank shares.

All this bring one back to the glaring errors in the audited accounts for Knutsford Express audited accounts for 2014 and 2015 for which there have been no request for revision of the reports, why? Are these regulators really serious in protecting investors? Take the most recent case of tTech. The prospectus for the company’s shares, made no mention of subscribers being asked to pay the JCSD fees. One day before the issue opens, a note is placed on the JSE website that the fee is to be paid by subscribers, even as the prospectus states that investors would not be paying any more than the $2.50, the shares were offered to the general public at. The JSE clearly did not intervene to prevent a chaotic situation from happening with some applicant including the fee and others did not as they were unaware of it. Thankfully, the management and brokers were sensitive to the issue and agreed to refund those who paid.

The FSC and the Stock Exchange police the system when companies are going to the public to raise money, but what happens after, very little? Goodyear was delisted from the JSE, shareholders got two payments form liquidation of the assets but about three years after, no information but there are no regulators dealing with the issue anymore, leaving many small investors to fend for themselves. That is not good enough.