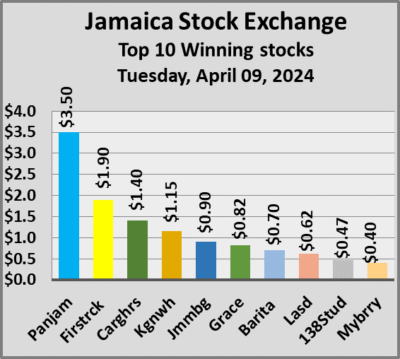

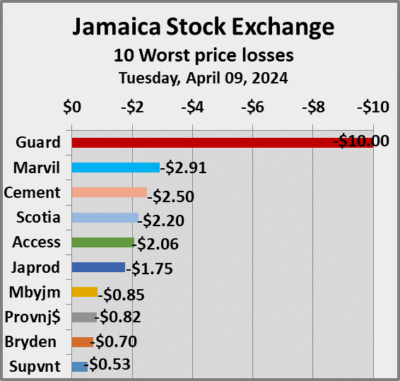

Stocks declined on the Main and US dollar markets of the Jamaica Stock Exchange in trading on Tuesday but the Junior Market closed moderately higher as trading ended with the number of stocks changing hands falling, with the value of stocks traded declining compared with the previous trading day, resulting in prices of 37 shares rising and 37 declining.

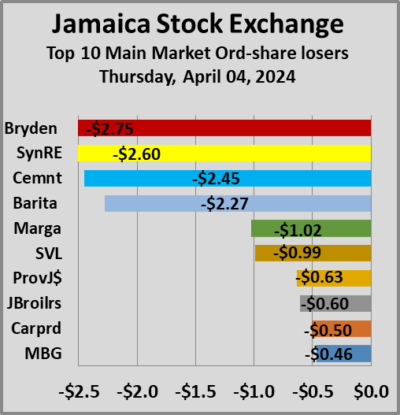

At the close of trading, the JSE Combined Market Index declined by 847.36 points to close at 339,446.27, the All Jamaican Composite Index shed 788.09 points to end trading at 366,509.84, while the JSE Main Index dropped 992.90 points to 326,763.19. The Junior Market Index rallied 14.99 points to 3,759.98 and the JSE USD Market Index skidded 7.02 points to end trading at 237.97.

At the close of trading, the JSE Combined Market Index declined by 847.36 points to close at 339,446.27, the All Jamaican Composite Index shed 788.09 points to end trading at 366,509.84, while the JSE Main Index dropped 992.90 points to 326,763.19. The Junior Market Index rallied 14.99 points to 3,759.98 and the JSE USD Market Index skidded 7.02 points to end trading at 237.97.

At the close of trading, 14,166,946 shares were exchanged in all three markets, down from 21,408,365 units on Monday, with the value of stocks traded on the Junior and Main markets amounted to $51.59 million, well below the $74.87 million on the previous trading day and the JSE USD market closed with an exchange of 325,197 shares for US$9,274 compared to 130,853 units at US$9,068 on Monday.

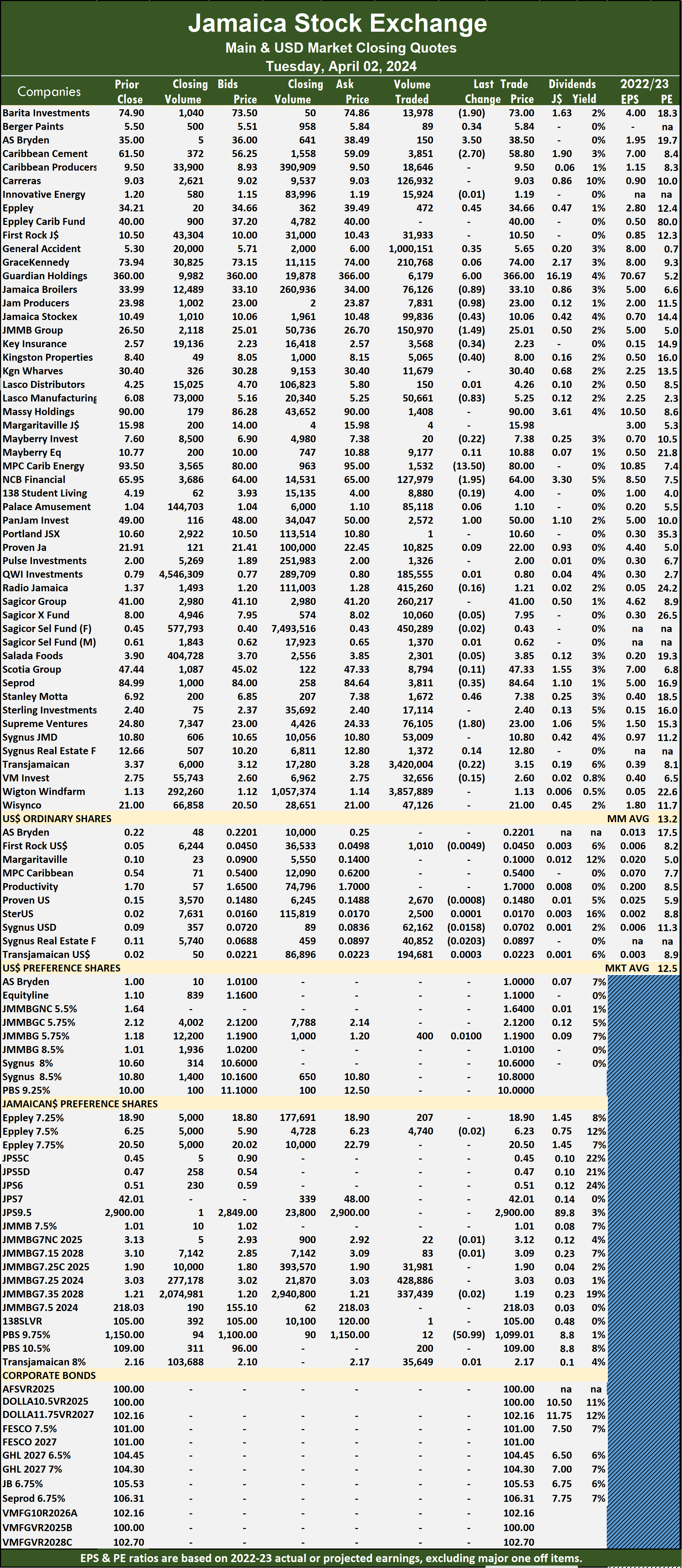

In Main Market activity, Transjamaican Highway led trading with 2.74 million shares followed by Wigton Windfarm with 2.15 million units and JMMB 9.5% preference share with 1.24 million stocks.

In the Junior Market, Spur Tree Spices led trading with 887,601 shares followed by Dolla Financial with 450,473 units and Derrimon Trading with 311,439 stocks.

In the preference segment, Jamaica Public Service 9.5% popped $50 to end at $2,700 and Productive Business Solutions 10.5% preference share fell $10 to $1,100.

In the preference segment, Jamaica Public Service 9.5% popped $50 to end at $2,700 and Productive Business Solutions 10.5% preference share fell $10 to $1,100.

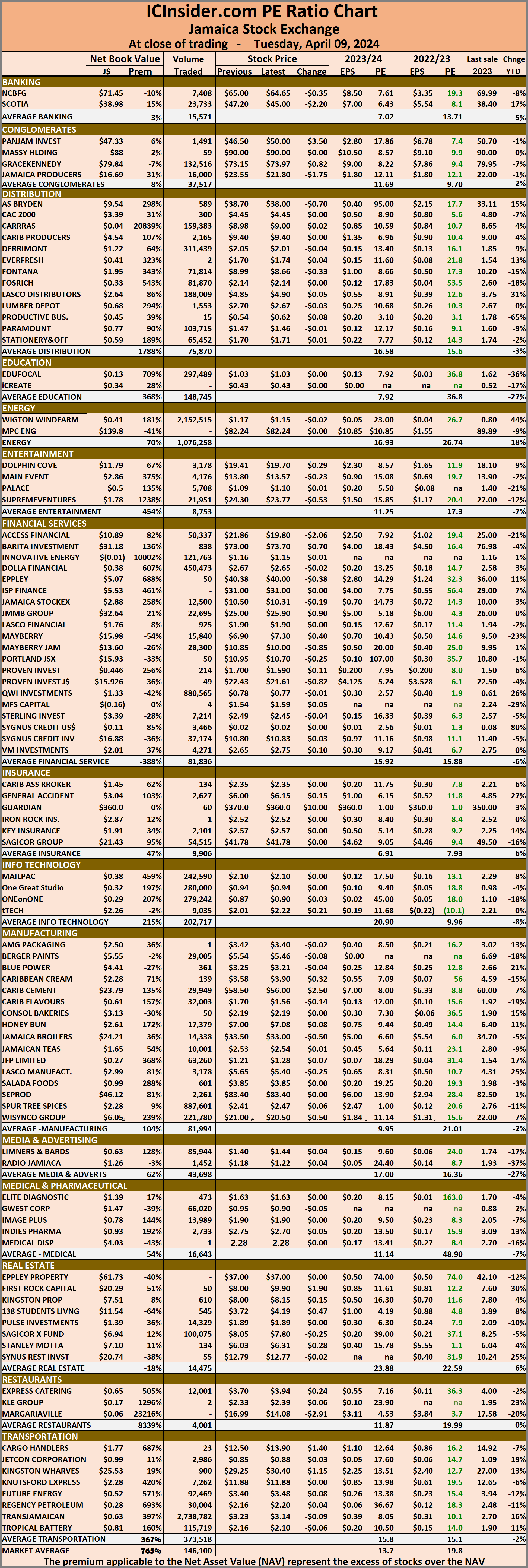

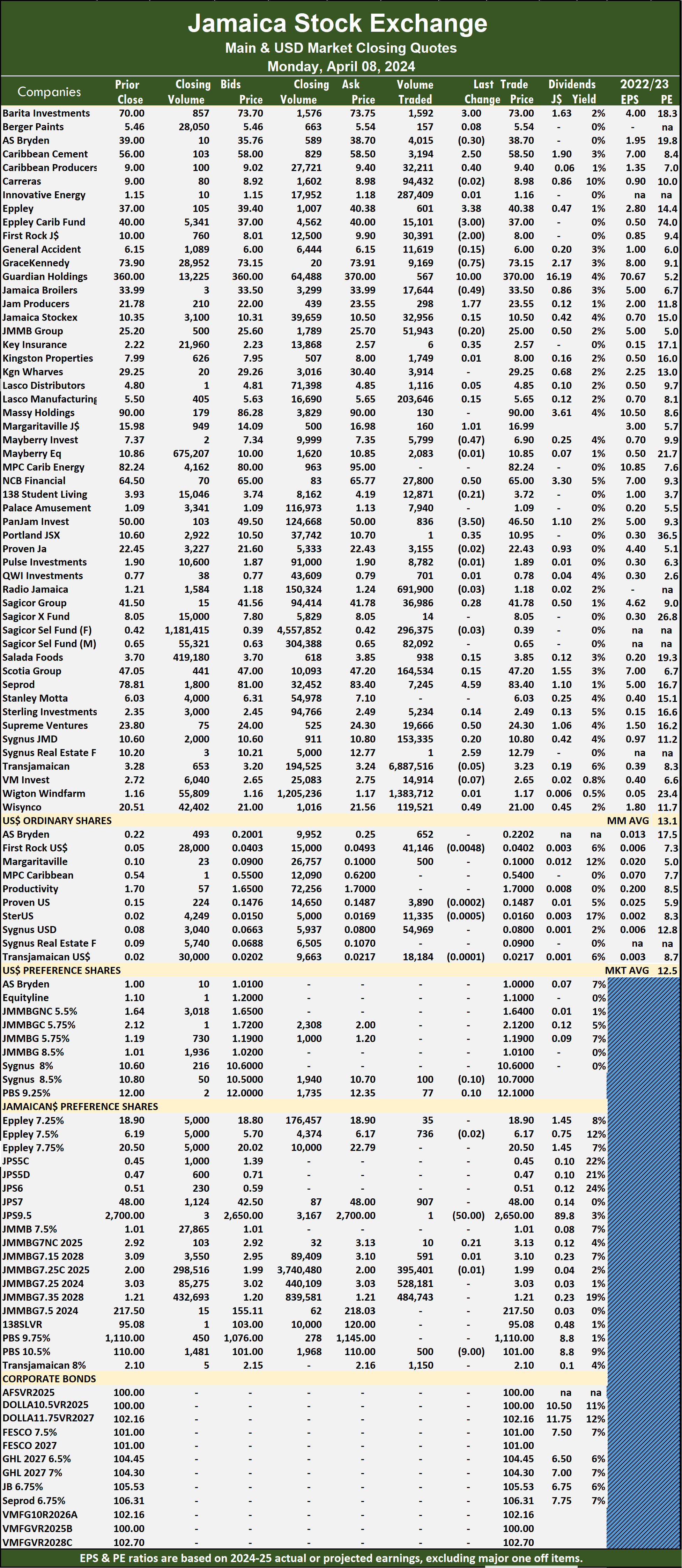

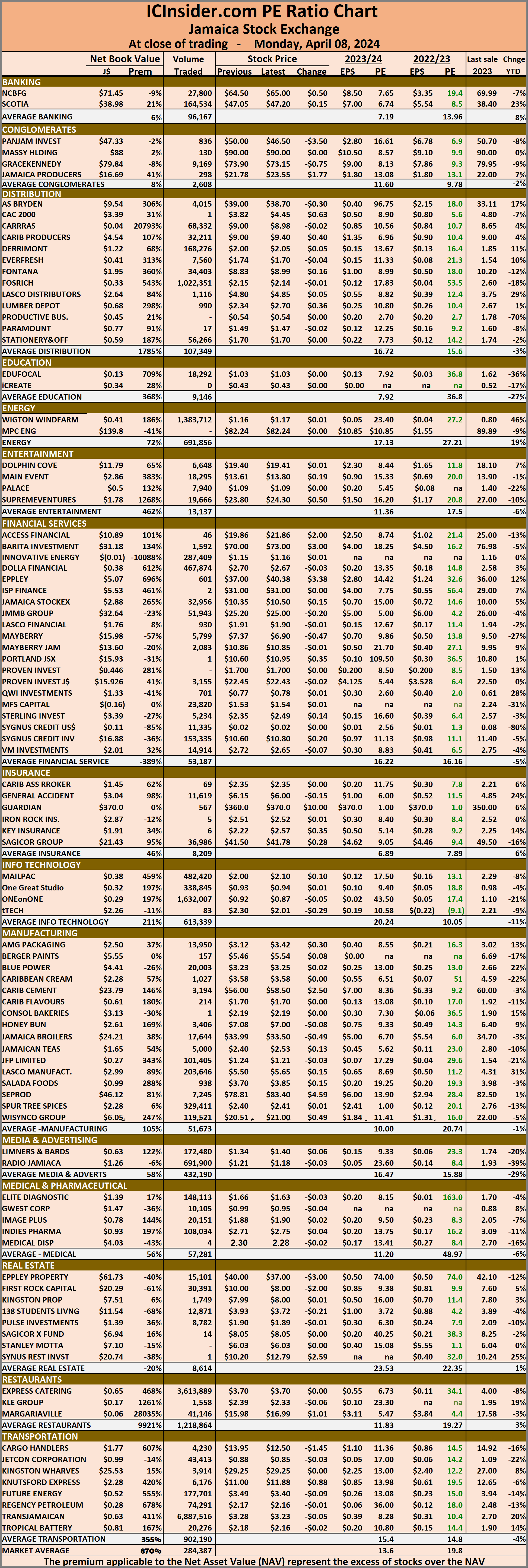

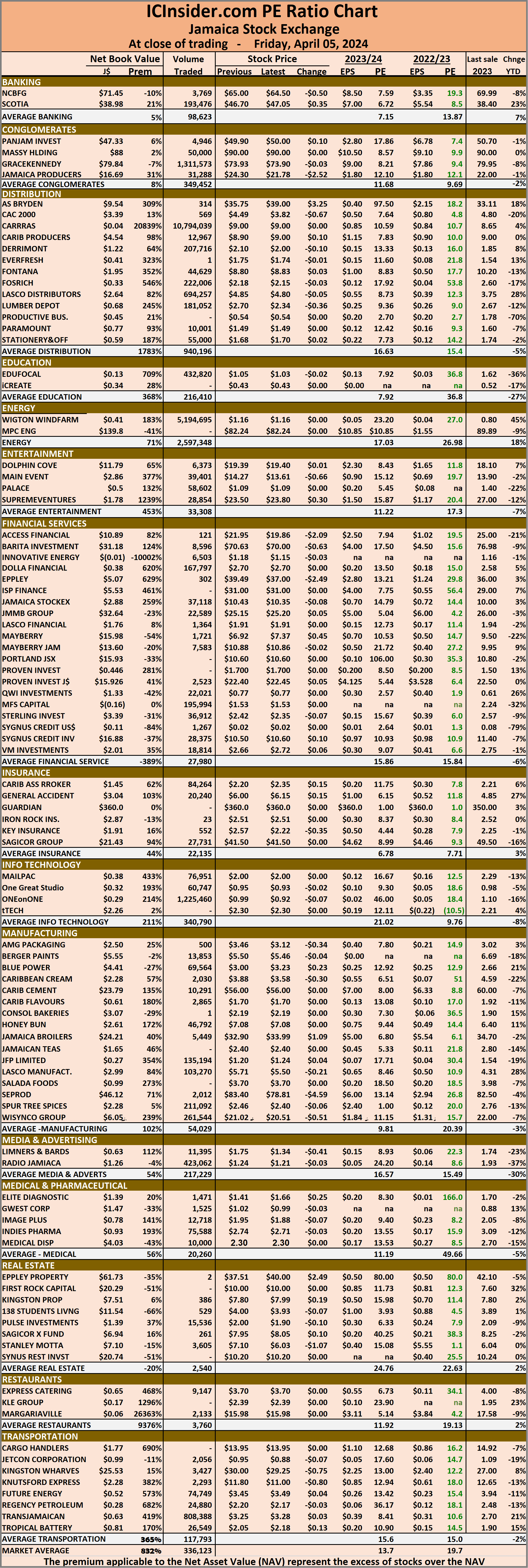

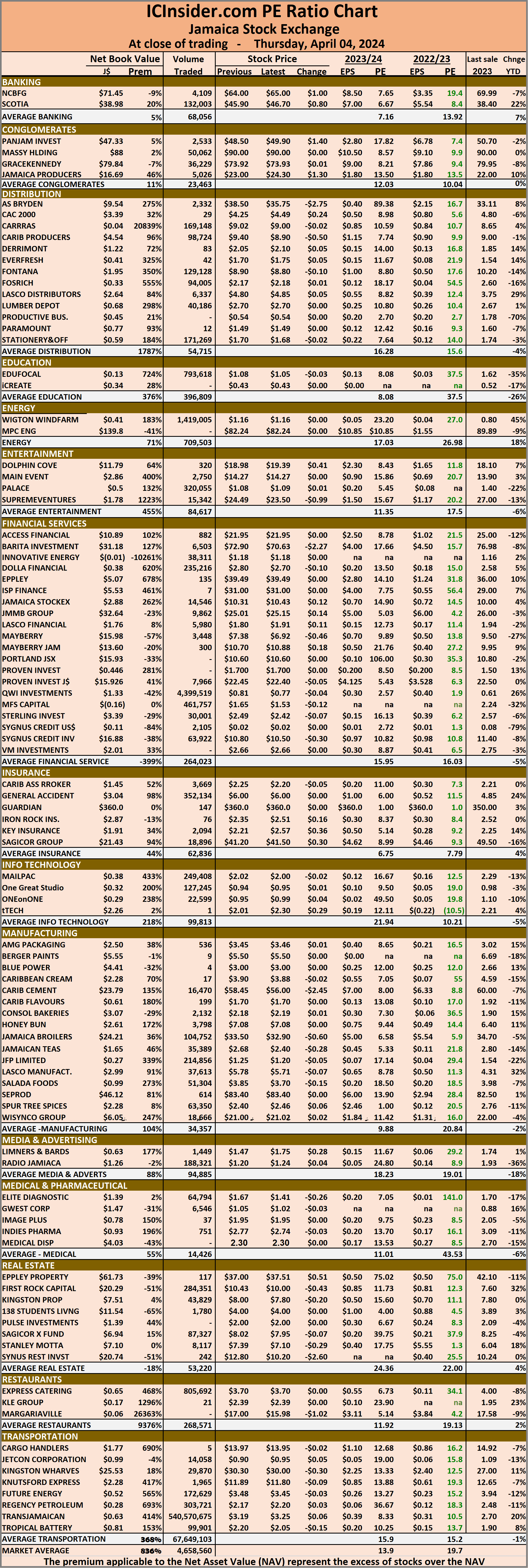

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.8 on 2023-24 earnings and 13.7 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so.  This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Falling prices dominates the JSE USD Market

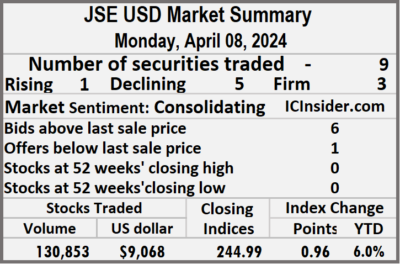

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with a 38 percent drop in the volume of stocks being exchanged after a 68 percent fall in value from that of Friday, resulting in trading in nine securities, compared to eight on Friday with prices of one rising, five declining and three ending unchanged.

The market closed with an exchange of 130,853 shares for US$9,068 down from 209,773 units at US$28,768 on Friday.

The market closed with an exchange of 130,853 shares for US$9,068 down from 209,773 units at US$28,768 on Friday.

Trading averaged 14,539 units at US$1,008 versus 26,222 shares at US$3,596 on Friday, with a month to date average of 34,790 shares at US$2,925 compared with 40,669 units at US$3,482 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index increased 0.96 points to settle at 244.99.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden ended at 22.02 US cents in an exchange of 652 stocks, First Rock Real Estate USD share lost 0.48 of one cent to close at 4.02 US cents with investors dealing in 41,146 units, Margaritaville ending at 10 US cents in switching ownership of 500 shares. Proven Investments slipped 0.02 of a cent in closing at 14.87 US cents as investors exchanged 3,890 stock units, Sterling Investments sank 0.05 of a cent and ended at 1.6 US cents after trading 11,335 shares, Sygnus Credit Investments ended at 8 US cents with 54,969 stocks clearing the market and Transjamaican Highway dipped 0.01 of a cent to 2.17 US cents after an exchange of 18,184 units.

Proven Investments slipped 0.02 of a cent in closing at 14.87 US cents as investors exchanged 3,890 stock units, Sterling Investments sank 0.05 of a cent and ended at 1.6 US cents after trading 11,335 shares, Sygnus Credit Investments ended at 8 US cents with 54,969 stocks clearing the market and Transjamaican Highway dipped 0.01 of a cent to 2.17 US cents after an exchange of 18,184 units.

In the preference segment, Productive Business Solutions 9.25% preference share gained 10 cents in closing at US$12.10 with 77 stock units crossing the market and Sygnus Credit Investments E8.5% fell 10 cents to finish at US$10.70 in an exchange of 100 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

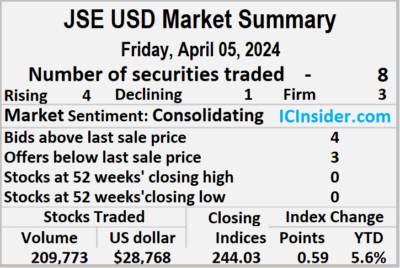

Lacklustre trading on JSE USD market

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks exchanged rising 12 percent, with 38 percent lower value than on Thursday, resulting in trading in eight securities, compared to nine on Thursday with prices of four rising, one declining and three ending unchanged.

The market closed with an exchange of 209,773 shares for US$28,768 compared to 186,609 units at US$46,047 on Thursday.

The market closed with an exchange of 209,773 shares for US$28,768 compared to 186,609 units at US$46,047 on Thursday.

Trading averaged 26,222 units at US$3,596 versus 20,734 shares at US$5,116 on Thursday, with a month to date average of 40,669 shares at US$3,482 compared to 45,694 units at US$3,442 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index rallied 0.59 points to cease trading at 244.03.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden rallied 0.01 of a cent to finish at 22.02 US cents with investors trading 8,914 units, First Rock Real Estate USD share increased 0.49 of one cent and ended at 4.5 US cents after an exchange of 2,133 stocks,  Margaritaville ended at 10 US cents in trading 3,335 shares. Proven Investments popped 0.99 of one cent to 14.89 US cents, with 181,504 stocks crossing the exchange, Sterling Investments fell 0.05 of a cent to end at 1.65 US cents in switching ownership of 1,267 shares, Sygnus Credit Investments rose 0.7 of a cent to 8 US cents as investors traded 2,983 stock units and Transjamaican Highway remained at 2.18 US cents after trading 9,137 stocks.

Margaritaville ended at 10 US cents in trading 3,335 shares. Proven Investments popped 0.99 of one cent to 14.89 US cents, with 181,504 stocks crossing the exchange, Sterling Investments fell 0.05 of a cent to end at 1.65 US cents in switching ownership of 1,267 shares, Sygnus Credit Investments rose 0.7 of a cent to 8 US cents as investors traded 2,983 stock units and Transjamaican Highway remained at 2.18 US cents after trading 9,137 stocks.

In the preference segment, JMMB Group US8.5% preference share remained at US$1.19 after an exchange of 500 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading volume drops on JSE USD market

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with a 67 percent drop in the volume of stocks changing hands after a 133 percent jump in value than on Wednesday, resulting in trading in nine securities, compared to seven on Wednesday with prices of one rising, three declining and five ending unchanged.

The market closed with an exchange of 186,609 shares for US$46,047 compared to 560,085 units at US$19,785 on Wednesday.

The market closed with an exchange of 186,609 shares for US$46,047 compared to 560,085 units at US$19,785 on Wednesday.

Trading averaged 20,734 units at US$5,116 versus 80,012 shares at US$2,826 on Wednesday, with a month to date average of 45,694 shares at US$3,442 compared with 61,740 units at US$2,366 on the previous day and March that ended with an average of 49,394 stock units for US$3,593.

The US Denominated Equities Index popped 2.61 points to end at 243.44.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Margaritaville ended at 10 US cents in trading 2,103 stock units, Proven Investments dipped 2 cents and ended at 13.9 US cents after an exchange of 110,431 shares, Sterling Investments popped 0.1 of a cent to finish at 1.7 US cents with investors transferring 2,105 stocks.  Sygnus Credit Investments shed 0.7 of one cent in closing at 7.3 US cents, following 51,168 units changing hands and Transjamaican Highway declined 0.02 of a cent to close at 2.18 US cents with a transfer of 2,375 shares.

Sygnus Credit Investments shed 0.7 of one cent in closing at 7.3 US cents, following 51,168 units changing hands and Transjamaican Highway declined 0.02 of a cent to close at 2.18 US cents with a transfer of 2,375 shares.

In the preference segment, JMMB Group US8.5% preference share remained at US$1.19 after an exchange of 14,317 units. JMMB Group 5.75% ended at US$2.12 after 4,002 stocks crossed the market, Productive Business Solutions 9.25% preference share remained at US$12 after a transfer of 10 stock units and Sygnus Credit Investments US 8% remained at US$10.60 with 98 shares clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

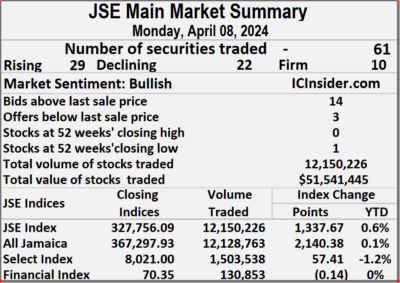

The market closed with trading of 12,150,226 shares for $51,541,445 compared with 25,126,154 units at $233,060,092 on Friday.

The market closed with trading of 12,150,226 shares for $51,541,445 compared with 25,126,154 units at $233,060,092 on Friday. Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and three with lower offers.

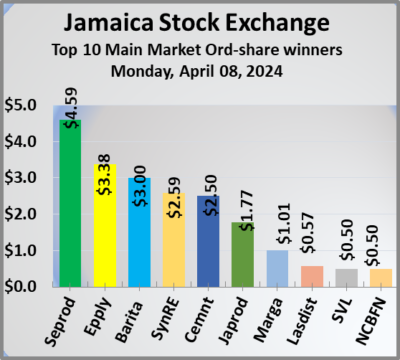

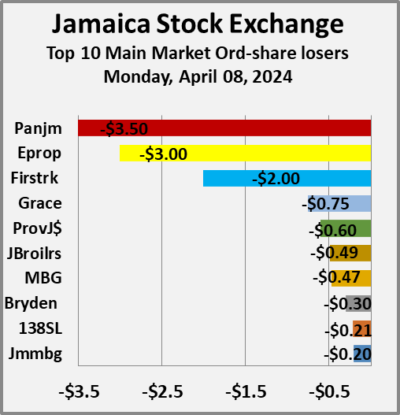

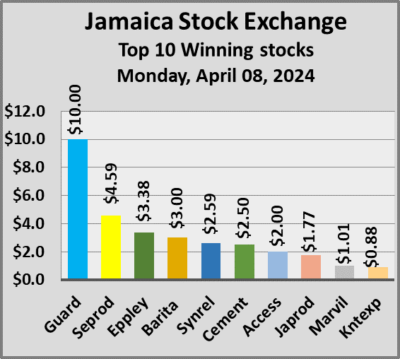

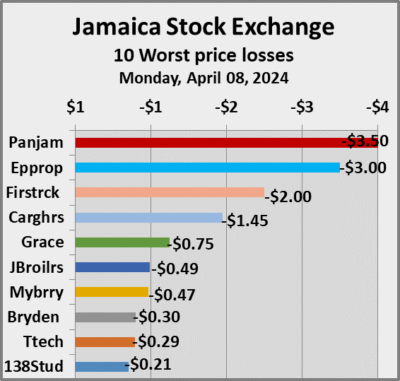

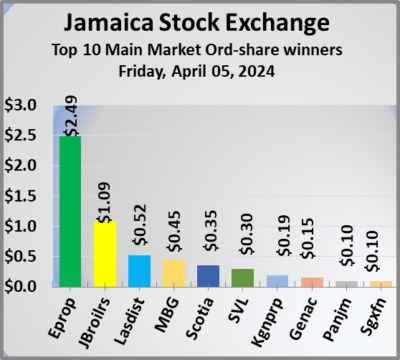

Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and three with lower offers. NCB Financial rallied 50 cents to close at $65, with 27,800 shares crossing the exchange. Pan Jamaica dipped $3.50 and ended at $46.50 with investors transferring 836 stock units, Portland JSX rose 35 cents to finish at $10.95 after one share passed through the market, Seprod climbed $4.59 to end at $83.40 with an exchange of 7,245 stock units. Supreme Ventures increased 50 cents to $24.30 in an exchange of 19,666 units, Sygnus Real Estate Finance advanced $2.59 and ended at $12.79 with investors swapping just one stock and Wisynco Group gained 49 cents in closing at $21 after a transfer of 119,521 shares.

NCB Financial rallied 50 cents to close at $65, with 27,800 shares crossing the exchange. Pan Jamaica dipped $3.50 and ended at $46.50 with investors transferring 836 stock units, Portland JSX rose 35 cents to finish at $10.95 after one share passed through the market, Seprod climbed $4.59 to end at $83.40 with an exchange of 7,245 stock units. Supreme Ventures increased 50 cents to $24.30 in an exchange of 19,666 units, Sygnus Real Estate Finance advanced $2.59 and ended at $12.79 with investors swapping just one stock and Wisynco Group gained 49 cents in closing at $21 after a transfer of 119,521 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading on Monday, the JSE Combined Market Index rallied 1,132.02 points to end at 340,293.63, the All Jamaican Composite Index rose 2,140.38 points to 367,297.93, the JSE Main Index rose 1,337.67 points to close at 327,756.09. The Junior Market Index sank 21.57 points to end the day at 3,744.99 and the JSE USD Market Index popped 0.96 points to settle at 244.99.

At the close of trading on Monday, the JSE Combined Market Index rallied 1,132.02 points to end at 340,293.63, the All Jamaican Composite Index rose 2,140.38 points to 367,297.93, the JSE Main Index rose 1,337.67 points to close at 327,756.09. The Junior Market Index sank 21.57 points to end the day at 3,744.99 and the JSE USD Market Index popped 0.96 points to settle at 244.99. In the preference segment Jamaica Public Service 9.5% dropped $50 to close at $2650 and Sygnus Credit Investments C10.5% declined $9 to finish at $101.

In the preference segment Jamaica Public Service 9.5% dropped $50 to close at $2650 and Sygnus Credit Investments C10.5% declined $9 to finish at $101. The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

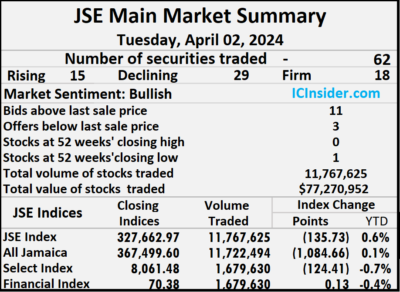

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. The market closed with 11,767,625 shares being traded for $77,270,952 compared with 15,645,101 units at $167,372,295 on Thursday.

The market closed with 11,767,625 shares being traded for $77,270,952 compared with 15,645,101 units at $167,372,295 on Thursday. Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

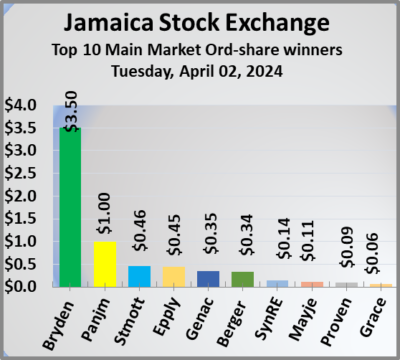

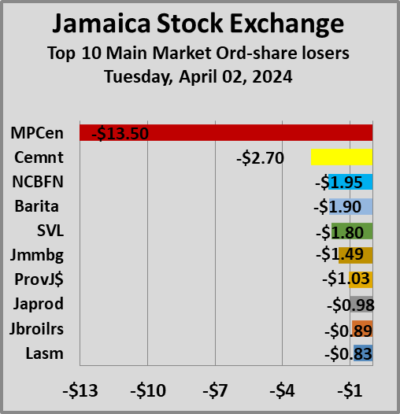

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers. Lasco Manufacturing sank 83 cents to end at $5.25 as investors traded 50,661 stocks. MPC Caribbean Clean Energy dropped $13.50 to $80 with an exchange of 1,532 units, NCB Financial lost $1.95 to end at $64 with investors trading 127,979 shares, Pan Jamaica gained $1 in closing at $50, with 2,572 units crossing the exchange. Seprod skidded 35 cents to close at $84.64 with investors transferring 3,811 stocks, Stanley Motta rose 46 cents and ended at $7.38 with 1,672 stock units clearing the market and Supreme Ventures fell $1.80 to $23 while exchanging 76,105 shares.

Lasco Manufacturing sank 83 cents to end at $5.25 as investors traded 50,661 stocks. MPC Caribbean Clean Energy dropped $13.50 to $80 with an exchange of 1,532 units, NCB Financial lost $1.95 to end at $64 with investors trading 127,979 shares, Pan Jamaica gained $1 in closing at $50, with 2,572 units crossing the exchange. Seprod skidded 35 cents to close at $84.64 with investors transferring 3,811 stocks, Stanley Motta rose 46 cents and ended at $7.38 with 1,672 stock units clearing the market and Supreme Ventures fell $1.80 to $23 while exchanging 76,105 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

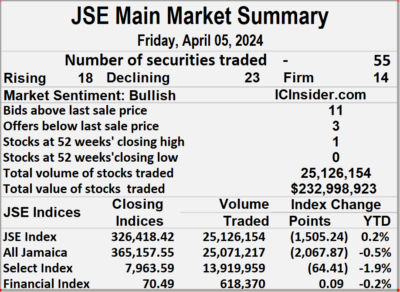

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with an exchange of 25,126,154 shares for $233,060,092, well down from 551,681,523 units at $1,798,734,217 on Thursday.

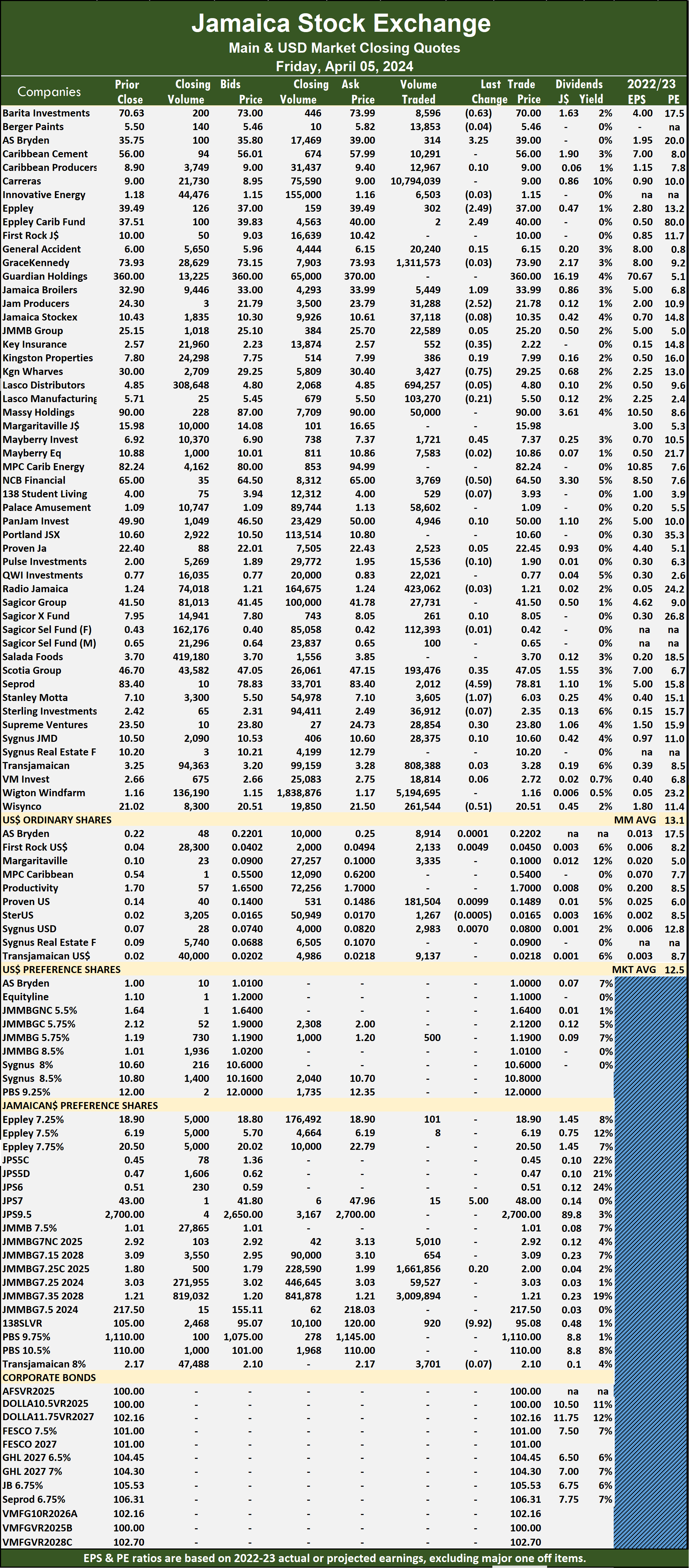

The market closed with an exchange of 25,126,154 shares for $233,060,092, well down from 551,681,523 units at $1,798,734,217 on Thursday. The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

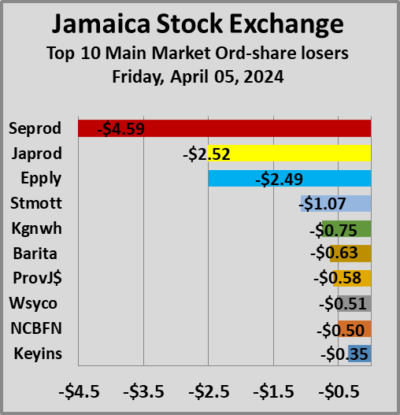

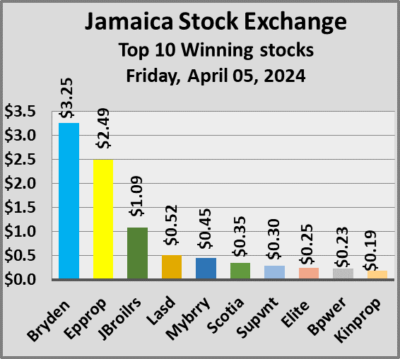

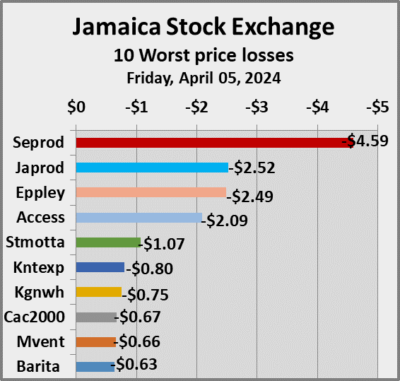

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. NCB Financial skidded 50 cents to end at $64.50 with investors transferring 3,769 units, Scotia Group climbed 35 cents in closing at $47.05 in switching ownership of 193,476 stocks, Seprod shed $4.59 to finish at $78.81 and closed with an exchange of 2,012 stock units. Stanley Motta declined $1.07 to $6.03 after 3,605 shares passed through the market, Supreme Ventures popped 30 cents to finish at $23.80 after an exchange of 28,854 stock units and Wisynco Group dropped 51 cents and ended at $20.51 with investors trading 261,544 stocks.

NCB Financial skidded 50 cents to end at $64.50 with investors transferring 3,769 units, Scotia Group climbed 35 cents in closing at $47.05 in switching ownership of 193,476 stocks, Seprod shed $4.59 to finish at $78.81 and closed with an exchange of 2,012 stock units. Stanley Motta declined $1.07 to $6.03 after 3,605 shares passed through the market, Supreme Ventures popped 30 cents to finish at $23.80 after an exchange of 28,854 stock units and Wisynco Group dropped 51 cents and ended at $20.51 with investors trading 261,544 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index dropped 1,798.83 points to 339,161.61, the All Jamaican Composite Index sank 2,067.87 points to end at 365,157.55, the JSE Main Index shed 1,505.24 points to end at 326,418.42. The Junior Market Index plunged 51.06 points to 3,766.56 and the JSE USD Market Index rallied 0.63 points to finish at 244.03.

At the close of trading, the JSE Combined Market Index dropped 1,798.83 points to 339,161.61, the All Jamaican Composite Index sank 2,067.87 points to end at 365,157.55, the JSE Main Index shed 1,505.24 points to end at 326,418.42. The Junior Market Index plunged 51.06 points to 3,766.56 and the JSE USD Market Index rallied 0.63 points to finish at 244.03. In the Junior Market, ONE on ONE Educational led trading with 1.23 million shares followed by EduFocal with 432,820 stock units and Fosrich with 222,006 units.

In the Junior Market, ONE on ONE Educational led trading with 1.23 million shares followed by EduFocal with 432,820 stock units and Fosrich with 222,006 units. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

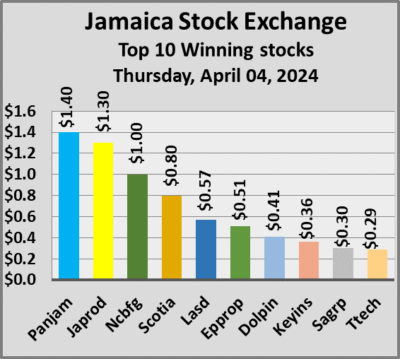

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. At the close of trading, the JSE Combined Market Index climbed 1,326.81 points to 340,960.44, the All Jamaican Composite Index gained 1,625.36 points to 367,225.42, the JSE Main Index rallied 1,510.99 points to 327,923.66. The Junior Market Index declined 17.46 points to end the day at 3,817.62 and the JSE USD Market Index rose 2.55 points to close at 243.40.

At the close of trading, the JSE Combined Market Index climbed 1,326.81 points to 340,960.44, the All Jamaican Composite Index gained 1,625.36 points to 367,225.42, the JSE Main Index rallied 1,510.99 points to 327,923.66. The Junior Market Index declined 17.46 points to end the day at 3,817.62 and the JSE USD Market Index rose 2.55 points to close at 243.40. The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21.93 on 2022-23 earnings and 14.3 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21.93 on 2022-23 earnings and 14.3 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making. The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.