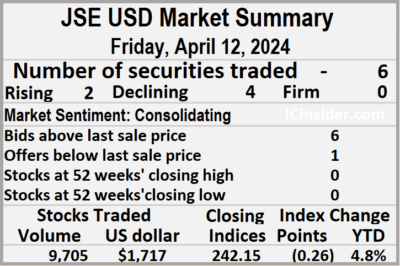

Stocks hardly traded on the Jamaica Stock Exchange US dollar market ended on Friday, with a 97 percent plunge in the volume exchanged following a 90 percent fall in value compared with Thursday and resulted in trading in six securities, down from seven on Thursday with prices of two rising, four declining.

The market closed with an exchange of 9,705 shares for US$1,717 down sharply on 326,941 units at US$17,135 on Thursday.

The market closed with an exchange of 9,705 shares for US$1,717 down sharply on 326,941 units at US$17,135 on Thursday.

Trading averaged 1,618 units at US$286 versus 46,706 shares at US$2,448 on Thursday, with a month to date average of 35,733 shares at US$2,368 compared with 39,263 units at US$2,583 on the previous day and March with an average of 49,394 units for US$3,593.

The US Denominated Equities Index dipped 0.26 points to finish at 242.15.

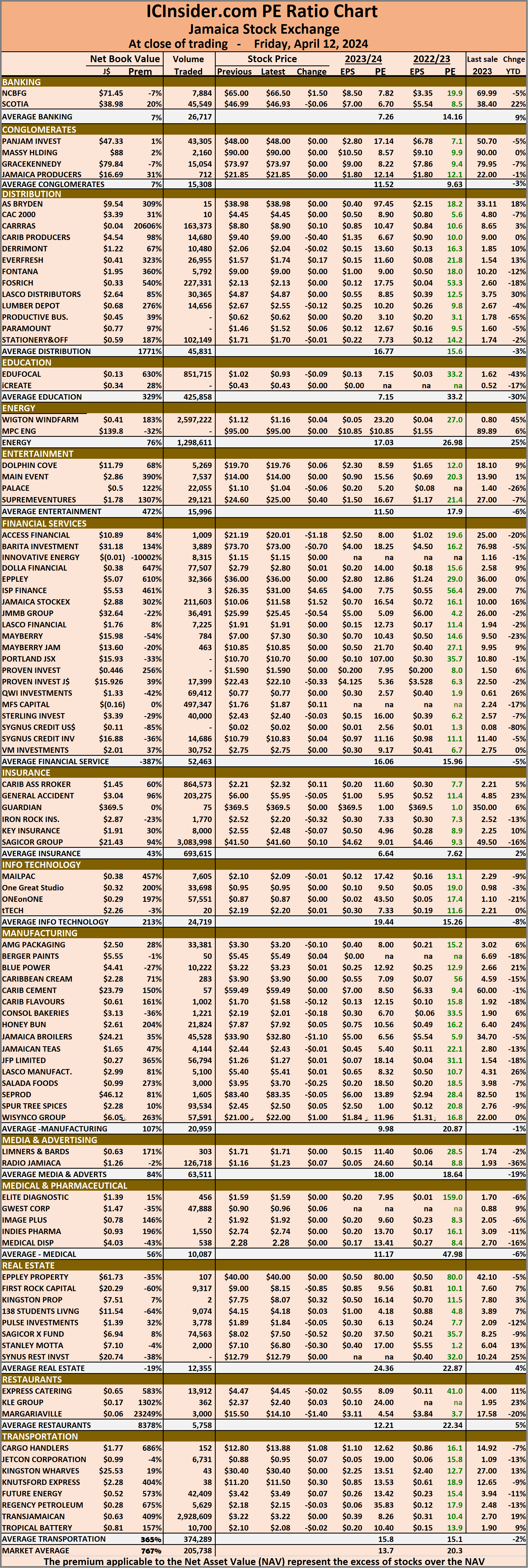

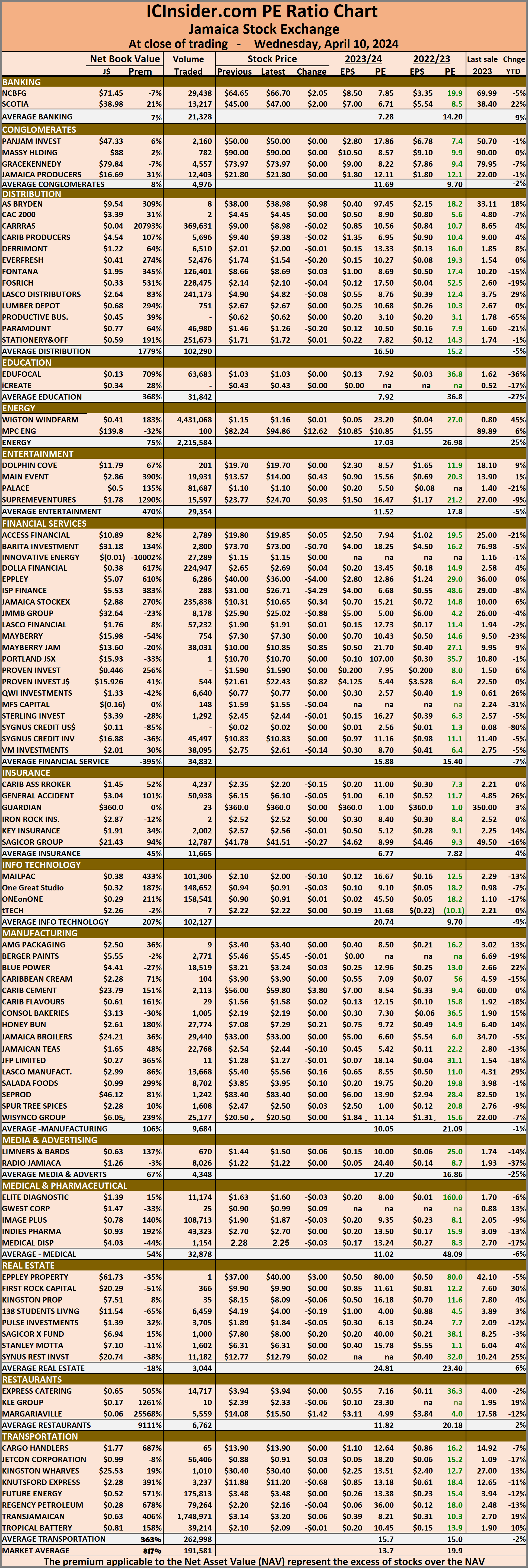

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share dipped 0.8 of one cent to end at 4.1 US cents with a transfer of 3,000 stocks,  Proven Investments lost 0.09 of a cent in closing at 13.91 US cents, with 286 units crossing the market, Sygnus Credit Investments shed 0.09 of a cent to end at 7.87 US cents with trading of 426 shares and Transjamaican Highway declined 0.03 cent to finish at 2.22 US cents with 4,872 stock units clearing the market.

Proven Investments lost 0.09 of a cent in closing at 13.91 US cents, with 286 units crossing the market, Sygnus Credit Investments shed 0.09 of a cent to end at 7.87 US cents with trading of 426 shares and Transjamaican Highway declined 0.03 cent to finish at 2.22 US cents with 4,872 stock units clearing the market.

In the preference segment, JMMB Group US8.5% preference share advanced 0.85 of one cent and ended at US$1.1985 with traders dealing in 1,113 shares and Sygnus Credit Investments E8.5% rose 30 cents to close at US$10.80, with 8 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Muted trading on JSE USD market

Trading climbs on the JSE USD market

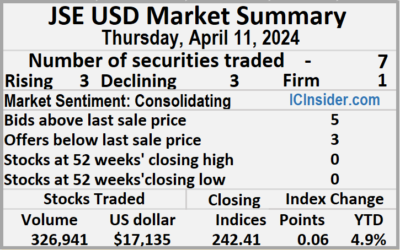

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks changing hands rising 40 percent after 167 percent more US dollars were exchanged than on Wednesday, resulting in trading in seven securities, compared to four on Wednesday with prices of three rising, three declining and one ending unchanged.

The market closed with an exchange of 326,941 shares for US$17,135 compared to 233,494 units at US$6,425 on Wednesday.

The market closed with an exchange of 326,941 shares for US$17,135 compared to 233,494 units at US$6,425 on Wednesday.

Trading averaged 46,706 units at US$2,448 versus 58,374 shares at US$1,606 on Wednesday, with a month to date average of 39,263 shares at US$2,583 compared with 38,241 units at US$2,602 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index popped 0.06 points to close at 242.41.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.5. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, First Rock Real Estate USD share rallied 0.83 of one cent to close at 4.9 US cents in switching ownership of 1,000 stock units,  Proven Investments skidded 0.76 of one cent to 14 US cents as investors exchanged 3,588 shares, Sterling Investments ended at 1.6 US cents with trading taking place in 14,440 units. Sygnus Credit Investments popped 0.86 of one cent in closing at 7.96 US cents crossing the market 100 stocks and Transjamaican Highway increased 0.02 cent to finish at 2.25 US cents in an exchange of 303,149 shares.

Proven Investments skidded 0.76 of one cent to 14 US cents as investors exchanged 3,588 shares, Sterling Investments ended at 1.6 US cents with trading taking place in 14,440 units. Sygnus Credit Investments popped 0.86 of one cent in closing at 7.96 US cents crossing the market 100 stocks and Transjamaican Highway increased 0.02 cent to finish at 2.25 US cents in an exchange of 303,149 shares.

In the preference segment, JMMB Group 5.75% fell 2 cents and ended at US$2.10 after closing with an exchange of 4,650 units and Sygnus Credit Investments E8.5% declined 30 cents to US$10.50 after an exchange of 14 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on JSE USD Market

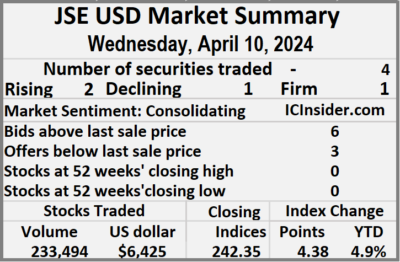

Trading activity fell on the Jamaica Stock Exchange US dollar market on Wednesday, with a 28 percent fall in the volume of stocks changing hands after a 31 percent decline in the value compared with Tuesday, resulting in trading in just four securities, down from seven on Tuesday with prices of two rising, one declining and one ending unchanged.

The market closed with an exchange of 233,494 shares for US$6,425 compared to 325,197 units at US$9,274 on Tuesday.

The market closed with an exchange of 233,494 shares for US$6,425 compared to 325,197 units at US$9,274 on Tuesday.

Trading for the day averaged 58,374 shares at US$1,606 compared to 46,457 shares at US$1,325 on Tuesday, with a month to date average of 38,241 shares at US$2,602 compared with 36,527 units at US$2,687 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index gained 4.38 points to conclude trading at 242.35.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, First Rock Real Estate USD share rose 0.05 of a cent to finish at 4.07 US cents, with 5,559 shares passing through the exchange, Sygnus Credit Investments lost 0.9 of one cent and ended at 7.1 US cents after a transfer of 24,793 units, Sygnus Real Estate Finance USD share ended at 9 US cents as investors exchanged 100 stocks and Transjamaican Highway climbed 0.23 of one cent to end at 2.23 US cents after 203,042 stock units passed through the market.

At the close, First Rock Real Estate USD share rose 0.05 of a cent to finish at 4.07 US cents, with 5,559 shares passing through the exchange, Sygnus Credit Investments lost 0.9 of one cent and ended at 7.1 US cents after a transfer of 24,793 units, Sygnus Real Estate Finance USD share ended at 9 US cents as investors exchanged 100 stocks and Transjamaican Highway climbed 0.23 of one cent to end at 2.23 US cents after 203,042 stock units passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

3 up 3 down for JSE USD market

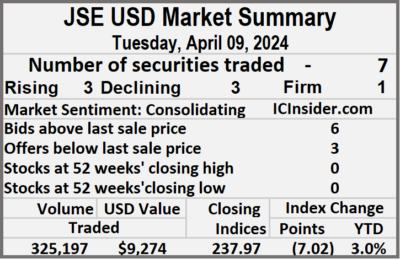

Winners and losers shared the spoils in trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, resulting from trading in seven securities, down from nine on Monday with prices of three rising, three declining and one ending firm, following a 149 percent rise in the number of stocks that were exchanged valued moderately more than on Monday.

The market closed with an exchange of 325,197 shares for US$9,274 up from 130,853 units at US$9,068 on Monday.

The market closed with an exchange of 325,197 shares for US$9,274 up from 130,853 units at US$9,068 on Monday.

Trading averaged 46,457 units at US$1,325 versus 14,539 shares at US$1,008 on Monday, with a month to date average of 36,527 shares at US$2,687 compared with 34,790 units at US$2,925 on the previous day and March with an average of 49,394 units for US$3,593.

The US Denominated Equities Index fell 7.02 points to 237.97.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, MPC Caribbean Clean Energy gained 8 cents in closing at 62 US cents with 15 shares crossing the exchange, Productive Business Solutions skidded 11 cents to US$1.59 with investors trading 214 stocks,  Proven Investments fell 0.11 of a cent to close at 14.76 US cents after a transfer of 324 shares. Sterling Investments ended at 1.6 US cents in switching ownership of 3,466 stocks and Transjamaican Highway dipped 0.17 of a cent to 2 US cents after exchanging 320,975 shares.

Proven Investments fell 0.11 of a cent to close at 14.76 US cents after a transfer of 324 shares. Sterling Investments ended at 1.6 US cents in switching ownership of 3,466 stocks and Transjamaican Highway dipped 0.17 of a cent to 2 US cents after exchanging 320,975 shares.

In the preference segment, Productive Business Solutions 9.25% preference share popped 25 cents to end at US$12.35 with investors swapping 95 stock units and Sygnus Credit Investments E8.5% increased 10 cents in closing at US$10.80 with 108 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

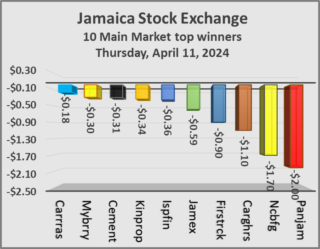

At the close of trading on Friday, the JSE Combined Market Index shed 1,284.91 points to end at 339,745.60, the All Jamaican Composite Index skidded 1,102.99 points to close at 366,500.95, the JSE Main Index fell 1,547.35 points to 326,755.24. The Junior Market Index popped 28.47 points to end trading at 3,804.02 and the JSE USD Market Index slipped 0.26 points to settle at 242.15.

At the close of trading on Friday, the JSE Combined Market Index shed 1,284.91 points to end at 339,745.60, the All Jamaican Composite Index skidded 1,102.99 points to close at 366,500.95, the JSE Main Index fell 1,547.35 points to 326,755.24. The Junior Market Index popped 28.47 points to end trading at 3,804.02 and the JSE USD Market Index slipped 0.26 points to settle at 242.15. In the preference segment, 138 Student Living preference share fell $3 to end at $213 and Sygnus Credit Investments C10.5% gained $4 in closing at $110.

In the preference segment, 138 Student Living preference share fell $3 to end at $213 and Sygnus Credit Investments C10.5% gained $4 in closing at $110. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

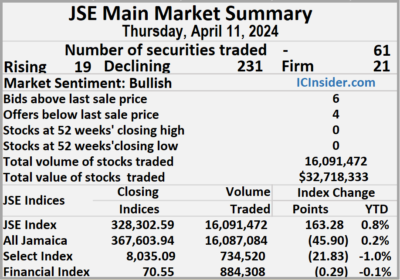

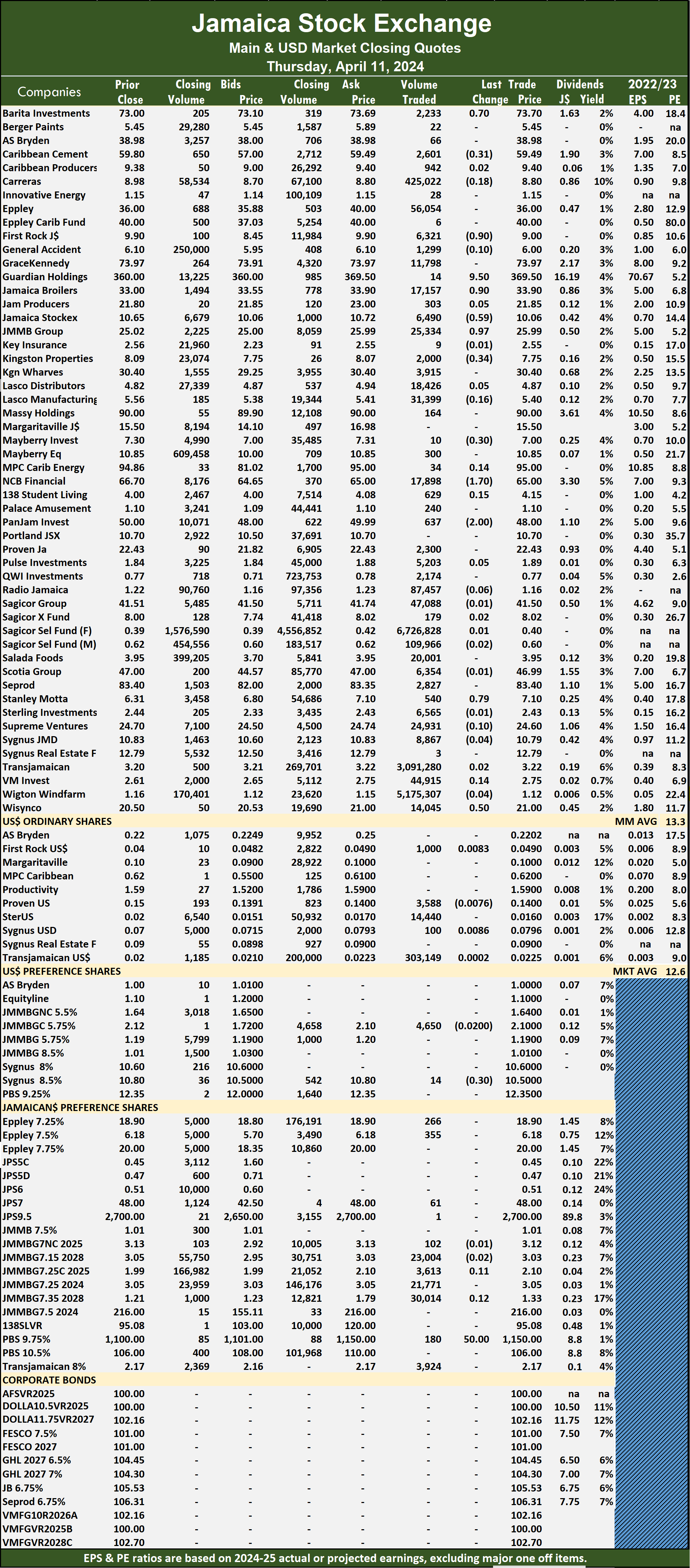

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed with trading of 16,091,472 shares for $32,718,333 up from 8,771,865 units at $27,969,713 on Wednesday.

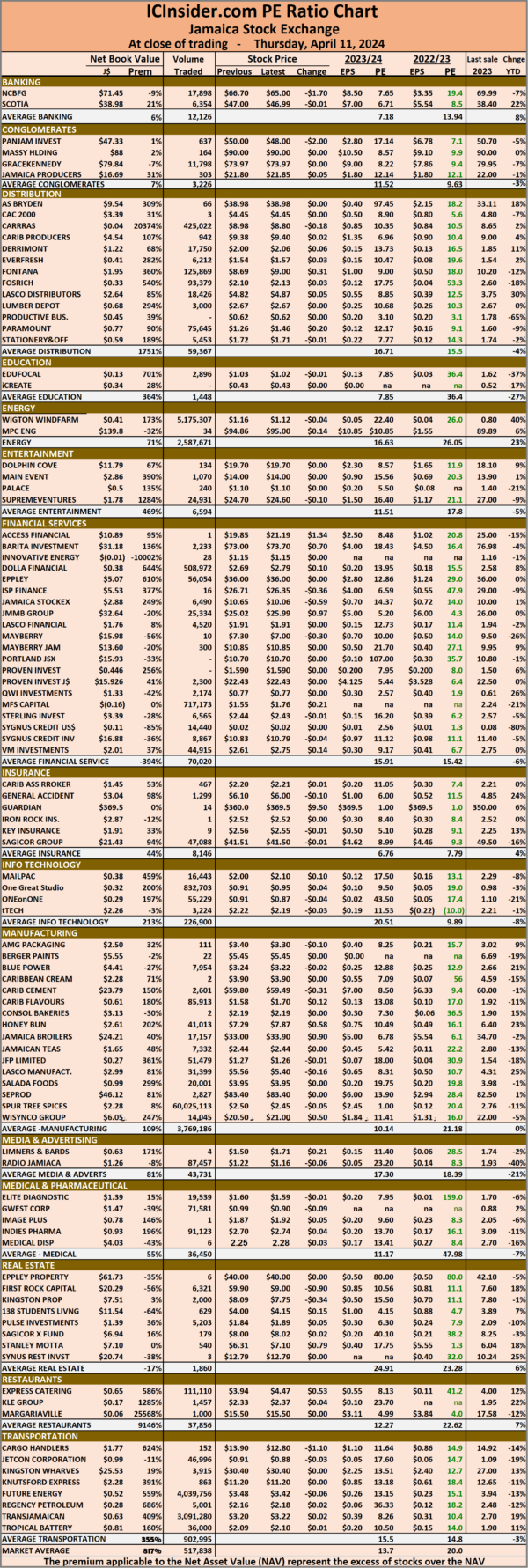

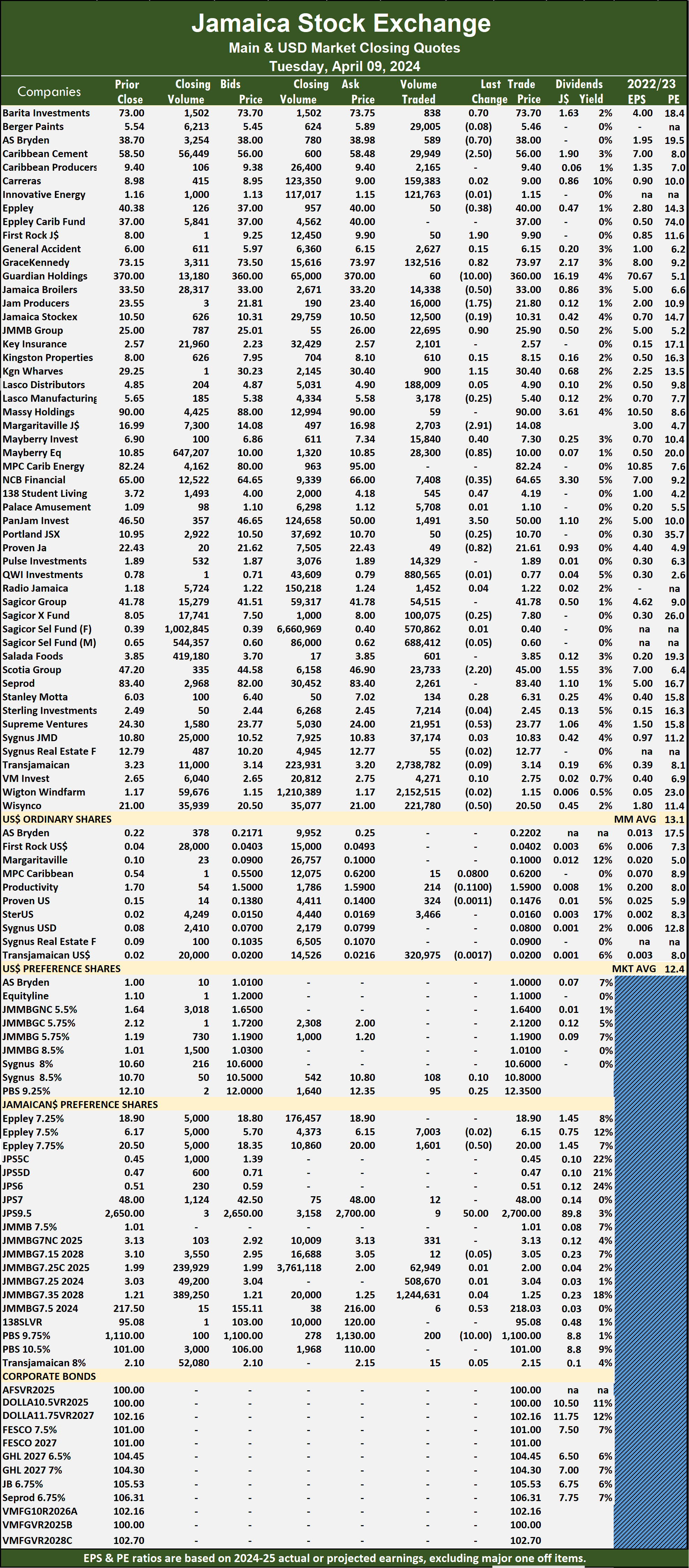

The market closed with trading of 16,091,472 shares for $32,718,333 up from 8,771,865 units at $27,969,713 on Wednesday. The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

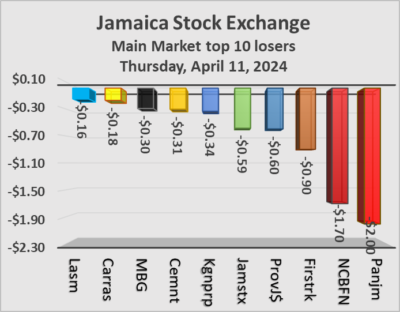

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. JMMB Group rose 97 cents to $25.99 after a transfer of 25,334 stocks, Kingston Properties skidded 34 cents in closing at $7.75 after 2,000 stock units passed through the market, Mayberry Group fell 30 cents to end at $7, with 10 shares changing hands. NCB Financial declined by $1.70 and ended at $65 in an exchange of 17,898 stocks, Pan Jamaica lost $2 to finish at $48 with investors transferring 637 units, Stanley Motta advanced 79 cents to close at $7.10 after closing with an exchange of 540 stock units and Wisynco Group increased 50 cents to $21 with a transfer of 14,045 shares.

JMMB Group rose 97 cents to $25.99 after a transfer of 25,334 stocks, Kingston Properties skidded 34 cents in closing at $7.75 after 2,000 stock units passed through the market, Mayberry Group fell 30 cents to end at $7, with 10 shares changing hands. NCB Financial declined by $1.70 and ended at $65 in an exchange of 17,898 stocks, Pan Jamaica lost $2 to finish at $48 with investors transferring 637 units, Stanley Motta advanced 79 cents to close at $7.10 after closing with an exchange of 540 stock units and Wisynco Group increased 50 cents to $21 with a transfer of 14,045 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

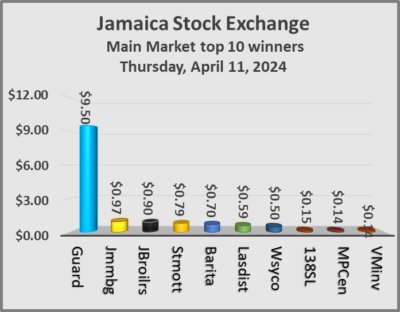

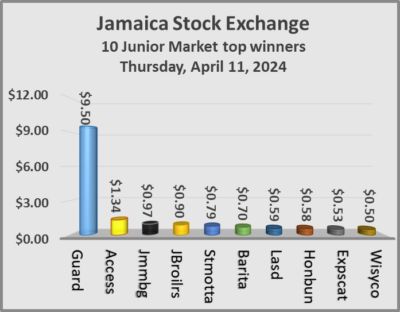

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index rose 442.69 points to close at 341,030.51, the All Jamaican Composite Index slipped 45.90 points to 367,603.94, the JSE Main Index rallied just 163.28 points to close at 328,302.59. The Junior Market Index rallied 41.06 points to end the day at 3,775.55 and the JSE USD Market Index popped 0.06 points to end the day at 242.41.

At the close of trading, the JSE Combined Market Index rose 442.69 points to close at 341,030.51, the All Jamaican Composite Index slipped 45.90 points to 367,603.94, the JSE Main Index rallied just 163.28 points to close at 328,302.59. The Junior Market Index rallied 41.06 points to end the day at 3,775.55 and the JSE USD Market Index popped 0.06 points to end the day at 242.41. In the preference segment, Productive Business Solutions 10.5 % preference share gained $50 to end at $1,150.

In the preference segment, Productive Business Solutions 10.5 % preference share gained $50 to end at $1,150. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

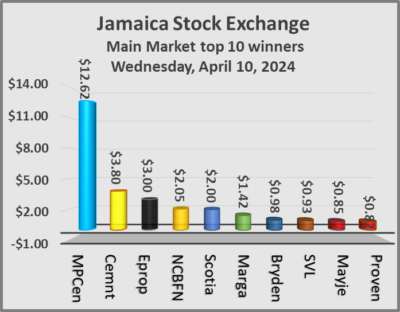

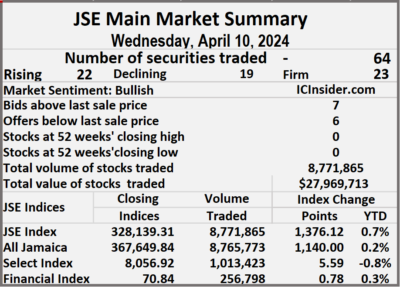

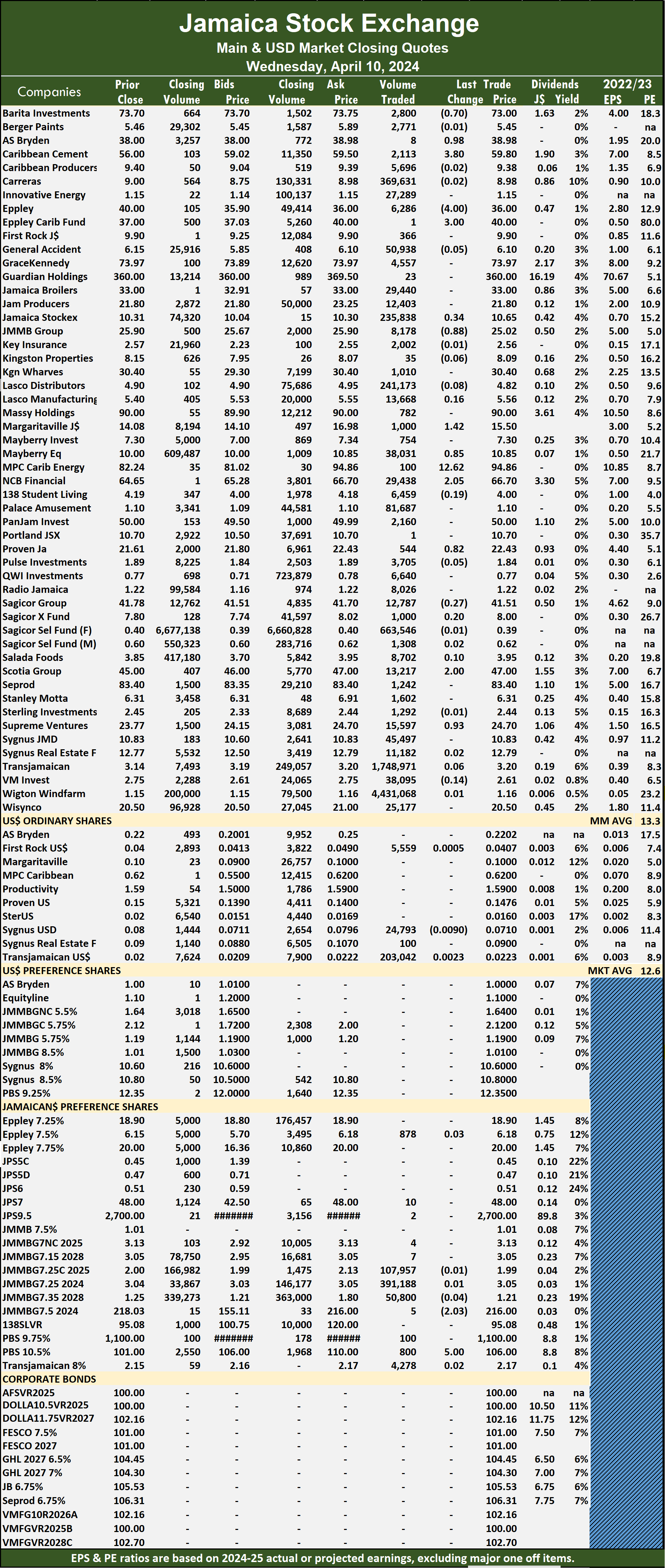

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed after 8,771,865 shares were traded for $27,969,713 compared with 10,147,599 units at $42,871,556 on Tuesday.

The market closed after 8,771,865 shares were traded for $27,969,713 compared with 10,147,599 units at $42,871,556 on Tuesday. The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2025.

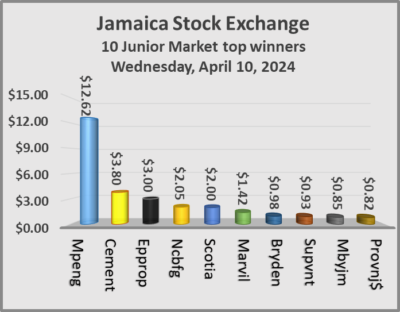

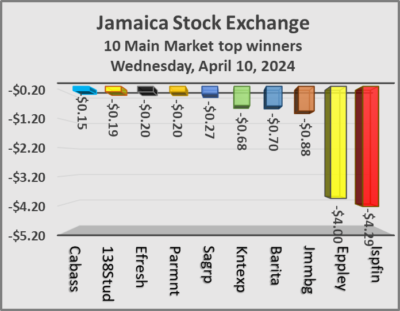

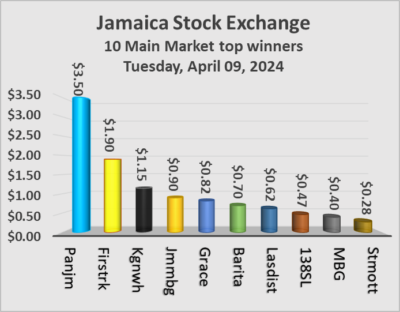

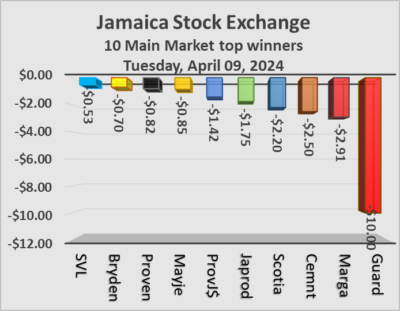

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2025. JMMB Group dropped 88 cents to close trading at $25.02 in swapping 8,178 stocks, Margaritaville rose $1.42 to close at $15.50 with investors trading 1,000 stock units, Mayberry Jamaican Equities advanced 85 cents to finish at $10.85 in an exchange of 38,031 shares. MPC Caribbean Clean Energy rallied $12.62 and ended at $94.86, with 100 units crossing the market, NCB Financial popped $2.05 to end at $66.70 after an exchange of 29,438 stocks, Proven Investments advanced 82 cents to close at $22.43 with a transfer of 544 stock units. Scotia Group rose $2 to $47, with 13,217 shares crossing the exchange and Supreme Ventures rallied 93 cents to end at $24.70 with investors dealing in 15,597 units.

JMMB Group dropped 88 cents to close trading at $25.02 in swapping 8,178 stocks, Margaritaville rose $1.42 to close at $15.50 with investors trading 1,000 stock units, Mayberry Jamaican Equities advanced 85 cents to finish at $10.85 in an exchange of 38,031 shares. MPC Caribbean Clean Energy rallied $12.62 and ended at $94.86, with 100 units crossing the market, NCB Financial popped $2.05 to end at $66.70 after an exchange of 29,438 stocks, Proven Investments advanced 82 cents to close at $22.43 with a transfer of 544 stock units. Scotia Group rose $2 to $47, with 13,217 shares crossing the exchange and Supreme Ventures rallied 93 cents to end at $24.70 with investors dealing in 15,597 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

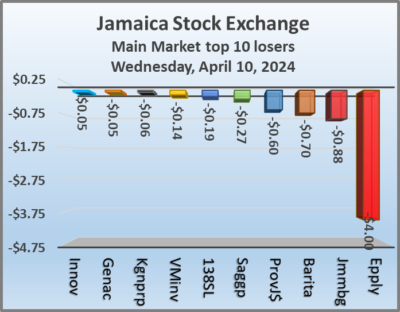

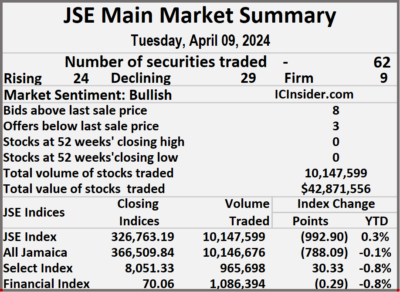

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of the market, the Main and JSE USD markets closed higher but the Junior Market that rose in the morning session continued to decline after a small rise on Tuesday, with trading ended with the number of stocks changing hands falling, with the value of stocks traded jumping sharply over the previous trading day, resulting in prices of 33 shares rising and 33 declining.

At the close of the market, the Main and JSE USD markets closed higher but the Junior Market that rose in the morning session continued to decline after a small rise on Tuesday, with trading ended with the number of stocks changing hands falling, with the value of stocks traded jumping sharply over the previous trading day, resulting in prices of 33 shares rising and 33 declining. In the preference segment, 138 Student Living preference share fell $2.03 in closing at $216 and Sygnus Credit Investments C10.5% increased $5 to finish at $106.

In the preference segment, 138 Student Living preference share fell $2.03 in closing at $216 and Sygnus Credit Investments C10.5% increased $5 to finish at $106. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. Trading ended with the market closed with only 10,147,599 shares trading for a mere $42,871,556 down from 12,150,226 units at $51,541,445 on Monday.

Trading ended with the market closed with only 10,147,599 shares trading for a mere $42,871,556 down from 12,150,226 units at $51,541,445 on Monday. The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. JMMB Group increased 90 cents to finish at $25.90, with 22,695 stocks crossing the market, Kingston Wharves popped $1.15 and ended at $30.40 in an exchange of 900 shares, Margaritaville lost $2.91 to end at $14.08 after investors ended the trading of 2,703 stock units. Mayberry Group advanced 40 cents in closing at $7.30 with an exchange of 15,840 shares, Mayberry Jamaican Equities dipped 85 cents to $10, with 28,300 units changing hands, NCB Financial slipped 35 cents to finish at $64.65 with traders dealing in 7,408 stocks. 138 Student Living rallied 47 cents and ended at $4.19 with 545 stock units clearing the market, Pan Jamaica increased $3.50 to end at $50 after a transfer of 1,491 shares, Proven Investments sank 82 cents to close at $21.61, with 49 stocks crossing the market. Scotia Group declined $2.20 to $45 in trading 23,733 units, Supreme Ventures shed 53 cents to finish at $23.77 after an exchange of 21,951 stock units and Wisynco Group lost 50 cents and ended at $20.50 after 221,780 shares passed through the market.

JMMB Group increased 90 cents to finish at $25.90, with 22,695 stocks crossing the market, Kingston Wharves popped $1.15 and ended at $30.40 in an exchange of 900 shares, Margaritaville lost $2.91 to end at $14.08 after investors ended the trading of 2,703 stock units. Mayberry Group advanced 40 cents in closing at $7.30 with an exchange of 15,840 shares, Mayberry Jamaican Equities dipped 85 cents to $10, with 28,300 units changing hands, NCB Financial slipped 35 cents to finish at $64.65 with traders dealing in 7,408 stocks. 138 Student Living rallied 47 cents and ended at $4.19 with 545 stock units clearing the market, Pan Jamaica increased $3.50 to end at $50 after a transfer of 1,491 shares, Proven Investments sank 82 cents to close at $21.61, with 49 stocks crossing the market. Scotia Group declined $2.20 to $45 in trading 23,733 units, Supreme Ventures shed 53 cents to finish at $23.77 after an exchange of 21,951 stock units and Wisynco Group lost 50 cents and ended at $20.50 after 221,780 shares passed through the market. In the preference segment, Eppley 7.75% preference share skidded 50 cents in closing at $20 with 1,601 units being traded, Jamaica Public Service 9.5% popped $50 to end at $2,700 with investors swapping 9 stocks, 138 Student Living preference share gained 53 cents to close at $218.03, with 6 stock units crossing the market and Productive Business Solutions 10.5% preference share fell $10 to $1,100 with investors swapping 200 shares.

In the preference segment, Eppley 7.75% preference share skidded 50 cents in closing at $20 with 1,601 units being traded, Jamaica Public Service 9.5% popped $50 to end at $2,700 with investors swapping 9 stocks, 138 Student Living preference share gained 53 cents to close at $218.03, with 6 stock units crossing the market and Productive Business Solutions 10.5% preference share fell $10 to $1,100 with investors swapping 200 shares.