Sagicor rights grab $5.2b

The additional shares were available to shareholders as shares over and above their provisional allotment. The funds received from the Rights Issue will be invested as equity in a new subsidiary, X Fund Properties LLC established in the USA. X Fund Properties LLC will purchase the DoubleTree Hilton at the Entrance to Universal in Orlando, Florida.

The DoubleTree by Hilton at the entrance to Universal is 742 guest rooms hotel with over 62,800 square feet of meeting and convention space. It is located in Orlando at the entrance to the Universal Theme Park. The purchase price for the Hotel is US$75 million. The balance of the purchase price is expected to be financed by a US institutional lender.

Notwithstanding, the overwhelming support the stock is overvalued at the right issue price of $6.95 each. Sagicor Real Estate Fund reported profit before taxation in the first quarter of $293 million from revenues of $1.19 billion, the net position in the June quarter was only $72 million from just $37 million less income from the hotel.

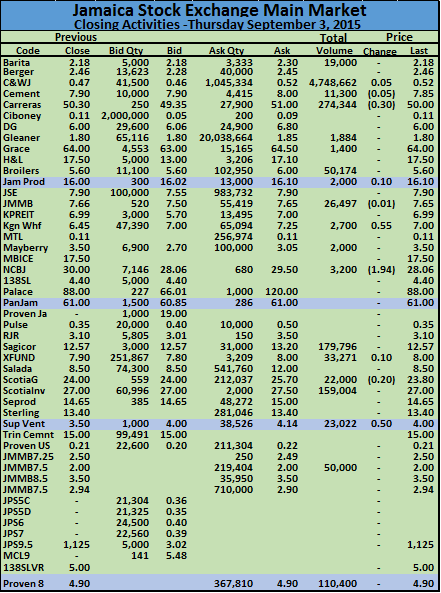

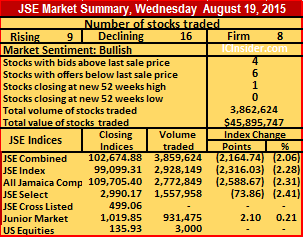

JSE drops back again on Tuesday

The Jamaica Stock Exchange on Tuesday closed with main market indices dropping once more with declining stocks exceeding advancing ones but with a big jump in the amount of money involved in the trades. The market closed with a fairly high participation rate of 32 securities changing hands.

The Jamaica Stock Exchange on Tuesday closed with main market indices dropping once more with declining stocks exceeding advancing ones but with a big jump in the amount of money involved in the trades. The market closed with a fairly high participation rate of 32 securities changing hands.

there were 9,467,807 units trading, valued at $111,559,301 with JMMB Group and National Commercial Bank accounting for the largest trades. At the close 7 stocks rose, 10 declined, in all market segments and the JSE Market Index fell 422.05 points to 98,349.41. The JSE All Jamaican Composite index lost 471.73 points to close at 108,867.21 and the JSE combined index dropped 671.77 points to end at 101,050.04.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator had a reading that reflects continuation of declining stocks having the upper hand over advancing ones with 6 stocks with bids higher than their last selling prices and 12 with offers that were lower.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator had a reading that reflects continuation of declining stocks having the upper hand over advancing ones with 6 stocks with bids higher than their last selling prices and 12 with offers that were lower.

In trading, Cable and Wireless gained 3 cents with 77,930 units and closed at 43 cents, Caribbean Cement had 436,403 units changing hands at $8, Carreras closed with 253,200 shares trading 91 cents lower at $49.50, Grace Kennedy closed with 500,134 shares trading $64, Jamaica Broilers traded at $5.60 with 119,948 shares changing hands. JMMB Group traded 1,957,370 shares to close 2 cents up at $7.52, Mayberry Investments ended with 200,000  shares changing hands to close at $3.40 for a gain of 52 cents, National Commercial Bank traded 980,250 shares to end with a decline of $1.25 at $28.75, Pan Jamaican gained 55 cents to end at $61.25 with 5,500 units changing hands. Radio Jamaica traded 20,000 shares unchanged at $3.01, Sagicor Group with 40,000 shares changing hands, closed 1 cent lower at $12.95, Sagicor Real Estate Fund with 76,290 shares closed 50 cents lower at $7.80. Scotia Group traded 200,000 units to close with a loss of $1.64 at $24.36, Supreme Ventures ended at $3.80 with 112,413 units to be up by 46 cents and Jamaica Money Market Brokers 7.50% preference share traded 499,600 units at $2.

shares changing hands to close at $3.40 for a gain of 52 cents, National Commercial Bank traded 980,250 shares to end with a decline of $1.25 at $28.75, Pan Jamaican gained 55 cents to end at $61.25 with 5,500 units changing hands. Radio Jamaica traded 20,000 shares unchanged at $3.01, Sagicor Group with 40,000 shares changing hands, closed 1 cent lower at $12.95, Sagicor Real Estate Fund with 76,290 shares closed 50 cents lower at $7.80. Scotia Group traded 200,000 units to close with a loss of $1.64 at $24.36, Supreme Ventures ended at $3.80 with 112,413 units to be up by 46 cents and Jamaica Money Market Brokers 7.50% preference share traded 499,600 units at $2.

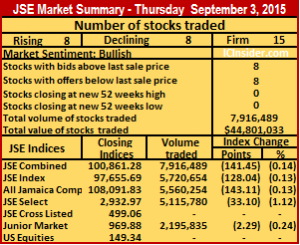

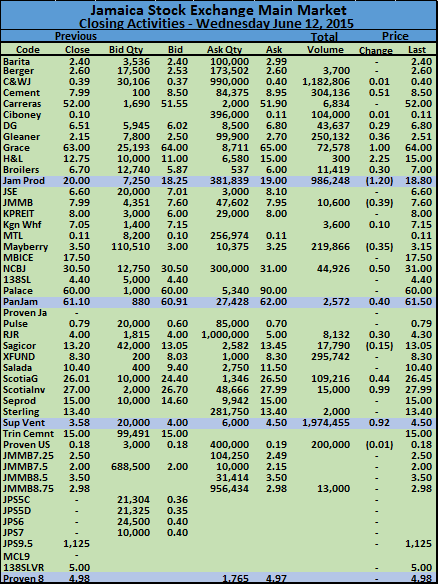

JSE decline continues on Thursday

The Jamaica Stock Exchange on Thursday closed with main market indices recording tripe digit losses, adding to the big losses on Wednesday. The market closed with a fairly high participation rate of 30 securities changing hands but with low activity resulting in just 2,344,156 units trading, valued at only $14,789,149 with 9 stocks rising, 10 declining with 2 stocks closing at 52 weeks high and 1 at a 52 weeks’ low, in all market segments.

The Jamaica Stock Exchange on Thursday closed with main market indices recording tripe digit losses, adding to the big losses on Wednesday. The market closed with a fairly high participation rate of 30 securities changing hands but with low activity resulting in just 2,344,156 units trading, valued at only $14,789,149 with 9 stocks rising, 10 declining with 2 stocks closing at 52 weeks high and 1 at a 52 weeks’ low, in all market segments.

At the close, the JSE Market Index fell 657.55 points to 98,441.76, the JSE All Jamaican Composite index dived 734.97 points to close at 108,970.43 and the JSE combined index dropped 731.14 points to end at 101,943.74.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator had a reading that reflects continuation of declining stocks having the upper hand over advancing one with 6 stocks with bids higher than their last selling prices and 9 with offers that were lower.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator had a reading that reflects continuation of declining stocks having the upper hand over advancing one with 6 stocks with bids higher than their last selling prices and 9 with offers that were lower.

In trading, Cable and Wireless had 214,092 shares changing hands to end at 40 cents, Caribbean Cement had 112,969 units changing hands at $8.01, Desnoes & Geddes traded 212,380 shares at $7 for a gain of 21 cents, Gleaner closed with 17,000 shares and fell 20 cents to $1.80.  Jamaica Broilers traded at $5.85 with 8,550 shares changing hands for a loss of 20 cents, JMMB Group traded 383,750 shares at $7.95, National Commercial Bank traded 26,130 shares to end lower by $1 to $29, Proven Investments ordinary share traded 225,030 units at 19.5 US cents, up 0.50 cents. Sagicor Group with 17,030 shares changing hands, closed 51 cents down at $12.95, Sagicor Real Estate Fund fell 25 cents to close at $8.50 while trading a mere 865 units, Scotia Group traded 11,272 units to close at $23.75, up 5 cents. Supreme Ventures ended at $3.35 with 92,500 units to be down by 15 cents and Jamaica Money Market Brokers 7.50% preference share traded 75,000 units at $2.

Jamaica Broilers traded at $5.85 with 8,550 shares changing hands for a loss of 20 cents, JMMB Group traded 383,750 shares at $7.95, National Commercial Bank traded 26,130 shares to end lower by $1 to $29, Proven Investments ordinary share traded 225,030 units at 19.5 US cents, up 0.50 cents. Sagicor Group with 17,030 shares changing hands, closed 51 cents down at $12.95, Sagicor Real Estate Fund fell 25 cents to close at $8.50 while trading a mere 865 units, Scotia Group traded 11,272 units to close at $23.75, up 5 cents. Supreme Ventures ended at $3.35 with 92,500 units to be down by 15 cents and Jamaica Money Market Brokers 7.50% preference share traded 75,000 units at $2.

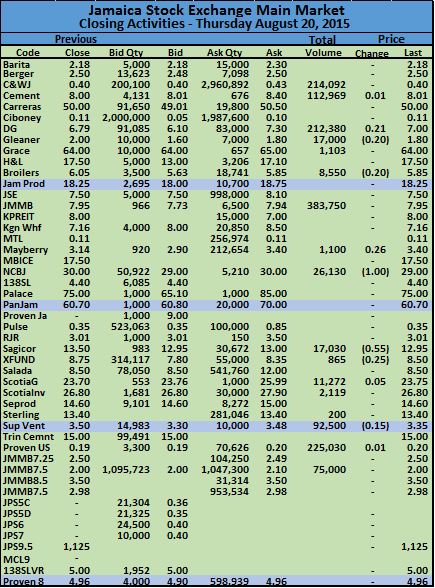

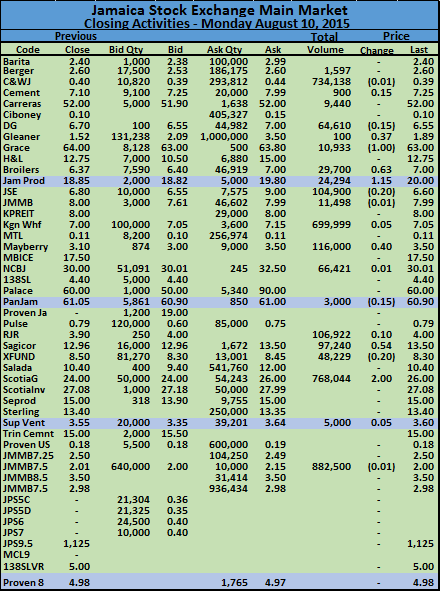

JSE slips slightly at close Monday

The Jamaica Stock Exchange on Monday closed with main market indices undergoing small losses. The Jamaica stock market closed with 8 stocks rising, 12 declining as 28 securities changed hands with 3,402,118 units trading, valued at $40,255,758, in all market segments.

The Jamaica Stock Exchange on Monday closed with main market indices undergoing small losses. The Jamaica stock market closed with 8 stocks rising, 12 declining as 28 securities changed hands with 3,402,118 units trading, valued at $40,255,758, in all market segments.

At the close, the JSE Market Index dropped 80.85 points to 100,727.82, the JSE All Jamaican Composite index shed 90.37 points to close at 111,525.61 and the JSE combined index dipped 54.59 points to end at 104,309.22.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator had a reading of 7 stocks with bids higher than their last selling prices and 6 with offers that were lower.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator had a reading of 7 stocks with bids higher than their last selling prices and 6 with offers that were lower.

In trading, Berger Paints had 27,080 shares changing hands with a gain of 5 cents to end at $2.60, Carreras dropped $1.50 to $50 with 157,969 shares changing hands, Gleaner closed with 70,665 shares and gained 2 cents at $2.73 after the price had fallen in the morning session to $2.30. Hardware & Lumber ended up at $16, after adding $1 with 13,500 units changing hands. Jamaica Producers traded at $19 with 100,000 shares changing ownership.  JMMB Group traded 12,000 shares up to $7.99 to gain 19 cents, with the company reporting strong increase in profit for the first quarter, National Commercial Bank traded 99,530 shares at $30 while losing 10 cents. Pulse Investments lost 10 cents in trading 57,000 shares to end at 35 cents, Radio Jamaica traded 27,440 shares to end at $4, with a gain of 5 cents, Sagicor Group ended trading with 1,770,848 units at $13, Sagicor Real Estate Fund lost 20 cents to close at $8.10 while trading 23,990 units. Scotia Group did not trade but had a bid at $24.51 that is higher than the last selling price of $24 and Scotia Investments traded 9,157 with decline of 69 cents to $27.30.

JMMB Group traded 12,000 shares up to $7.99 to gain 19 cents, with the company reporting strong increase in profit for the first quarter, National Commercial Bank traded 99,530 shares at $30 while losing 10 cents. Pulse Investments lost 10 cents in trading 57,000 shares to end at 35 cents, Radio Jamaica traded 27,440 shares to end at $4, with a gain of 5 cents, Sagicor Group ended trading with 1,770,848 units at $13, Sagicor Real Estate Fund lost 20 cents to close at $8.10 while trading 23,990 units. Scotia Group did not trade but had a bid at $24.51 that is higher than the last selling price of $24 and Scotia Investments traded 9,157 with decline of 69 cents to $27.30.

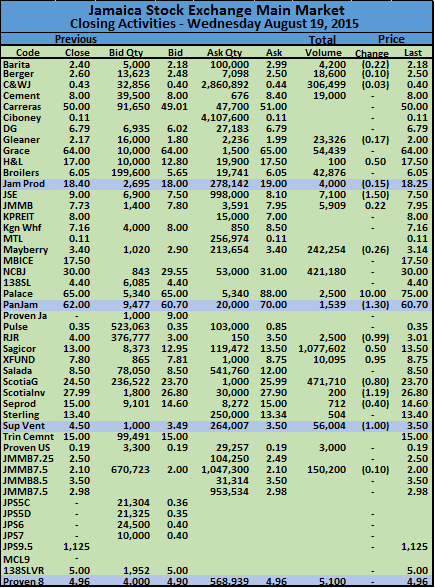

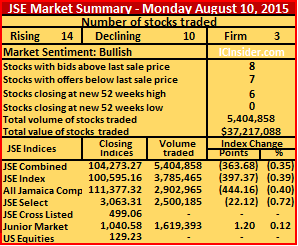

Bulls rampant with 6 new highs on Monday

At the close, the JSE Market Index slipped 397.37 points to 100,596.16, the JSE All Jamaican Composite index fell 444.16 points to close at 111,377.32 and the JSE combined index declined 363.68 points to end at 104,273.27.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator had a reading of 8 stocks with bids higher than their last selling prices and 7 with offers that were lower.

In trading, Cable and Wireless ended with 734,138 units changing hands and lost 1 cent to

end at 39 cents, Carreras traded 9,440 units to close at $52, Desnoes & Geddes had 64,610 shares changing hands at $6.55, down 15 cents. Gleaner traded at $1.89, and gained 37 cents after just 100 shares changed hands, in continued response to the merger of the company’s media operations, with that of Radio Jamaica. At the close, Gleaner closed with the bids above the last traded price at $2.09 with 6,238 shares for a new 52 weeks high. Grace Kennedy lost $1 in trading 10,933 shares to end at $63,

end at 39 cents, Carreras traded 9,440 units to close at $52, Desnoes & Geddes had 64,610 shares changing hands at $6.55, down 15 cents. Gleaner traded at $1.89, and gained 37 cents after just 100 shares changed hands, in continued response to the merger of the company’s media operations, with that of Radio Jamaica. At the close, Gleaner closed with the bids above the last traded price at $2.09 with 6,238 shares for a new 52 weeks high. Grace Kennedy lost $1 in trading 10,933 shares to end at $63,

had 29,700 shares changing hands, in closing at $7 for a rise of 63 cents. Jamaica Producers traded 24,294 shares to end at $20 by gaining $1.15, The Jamaica Stock Exchange stock traded 104,900 units at $6.60, for a loss of 20 cents, Kingston Wharves ended with 699,999 shares changing hands at $7.05, to gain 5 cents. Mayberry Investments had 116,000 shares trading at $3.50 to gain 40 cents, for a new 52 weeks’ high, National Commercial Bank traded 66,421 shares at $30.01 after it traded earlier in the day at $30.50. At the close theJamaica Broilers

stock was offered at $32.50 to sell 245 units, the only other offers posted are, at $33 to sell 503 units and at $60 to sell 2,000 shares, the bid was at $30.01 to buy 51,091 units. Radio Jamaica traded just 106,922 shares to end at a 52 weeks’ high of $4 as the price gained 10 cents, Sagicor Group ended trading with 97,240 units at $13.50, to gain 54 cents. Sagicor Real Estate Fund lost 20 cents and closed at $8.30 while trading 48,229 units, Scotia Group ended with 768,044 units trading at $26 but traded as low as $23.66 during the day and Jamaica Money Market Brokers 7.50% preference traded 882,500 units at $2 after shedding 1 cent.

stock was offered at $32.50 to sell 245 units, the only other offers posted are, at $33 to sell 503 units and at $60 to sell 2,000 shares, the bid was at $30.01 to buy 51,091 units. Radio Jamaica traded just 106,922 shares to end at a 52 weeks’ high of $4 as the price gained 10 cents, Sagicor Group ended trading with 97,240 units at $13.50, to gain 54 cents. Sagicor Real Estate Fund lost 20 cents and closed at $8.30 while trading 48,229 units, Scotia Group ended with 768,044 units trading at $26 but traded as low as $23.66 during the day and Jamaica Money Market Brokers 7.50% preference traded 882,500 units at $2 after shedding 1 cent.

Sagicor funds unmasked

The best way to make money in the stock market or to minimise losses is to understand what is being invested in an avoid overpriced stocks. Investors have bought heavily into the concept of tourism industry being a winner in Jamaica but they need to know that it is highly seasonal with the bulk of the income earned in the period from Christmas Eve to somewhere in April and again between July and August.

The best way to make money in the stock market or to minimise losses is to understand what is being invested in an avoid overpriced stocks. Investors have bought heavily into the concept of tourism industry being a winner in Jamaica but they need to know that it is highly seasonal with the bulk of the income earned in the period from Christmas Eve to somewhere in April and again between July and August.

Entities involved in the hotel traded will note that earnings slump sharply for the rest of the year but cost fall much more slowly. Against this factor is not surprising to see the Sagicor Real Estate Fund’s highly inflated first quarter profit, gave way to more realistic results in the company’s second quarter, with profit of 8 cents per share in the June quarter down from 11 cents in the June 2014 quarter. Buoyed by an abnormal first quarter results, earnings ended at 46 cents per share to June versus 27 cents for the six months to June last year. As the year progresses earnings per share should fall, with the lower tourism inflows for the remainder of the year.

The fund acquired the Hilton Rose Hall in January 2015, adding 489 hotel rooms directly under its ownership. The acquisition helped the fund to report $570 million in profit after tax for the March quarter. Not disclosed to investors, is the fact that the expenses reflected in the March interim results were not the normal amount one would expect from the level of business attained. While the income in both the June and the  March quarters were virtually the same, operating expenses were nearly $200 million more in the June quarter than in March. Why is this so? In all probability the former operators of the hotel would have spent on marketing and refurbishing that would have helped to generate the income without some of the attendance cost, not so in the June quarter. While profit before taxation in the first quarter was $293 million from revenues of $1.19 billion, the net position in the June quarter was only $72 million from just $37 million less income from the hotel.

March quarters were virtually the same, operating expenses were nearly $200 million more in the June quarter than in March. Why is this so? In all probability the former operators of the hotel would have spent on marketing and refurbishing that would have helped to generate the income without some of the attendance cost, not so in the June quarter. While profit before taxation in the first quarter was $293 million from revenues of $1.19 billion, the net position in the June quarter was only $72 million from just $37 million less income from the hotel.

What can be expected is that revenues could be down by about 30-40 percent while expenses won’t fall much, resulting in large losses for the rest of the year. With the rate of exchange of the local dollar stabilizing, appreciation from the units held in the Sagicor Unit Trust is unlikely to show much gain. What now exist is a company whose earnings, at best may have peaked and at worse, could end up being lower than the 46 cents per share reported to date, then there is 2016 when the hotel expenses will reflect a full year’s expenditure and profits from it won’t be as robust as in the March quarter. Where will the profits come from to justify the high stock price? These are questions that investor should be asking themselves and management.

The FSC and the Stock Exchange need to ask themselves if allowing companies to leave inadequate information in the market place is the best way to protect investors and the integrity of the capital market?