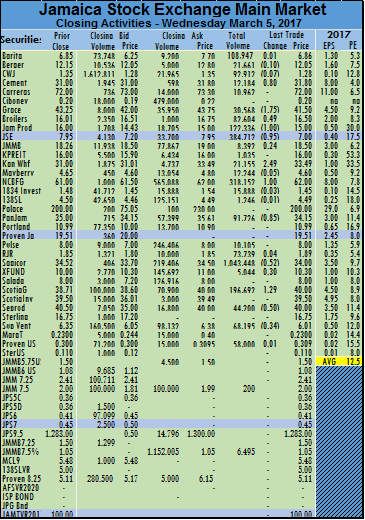

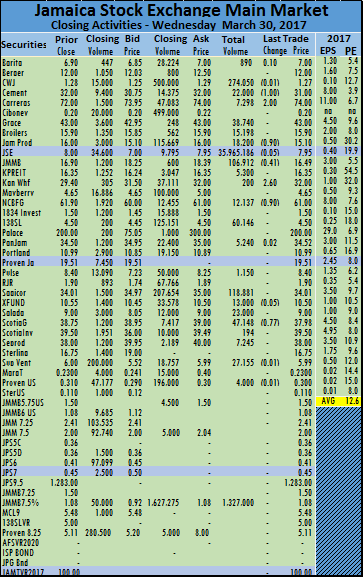

Trading in the main market of the Jamaica Stock Exchange closed on Wednesday with sharp fall in the indices as prices continue to swing in either direction. At the close 27 securities changed hands including 1 trading in the US dollar market. At the close of trading, 10 stocks advanced and 12 declined in the main market.

Trading in the main market of the Jamaica Stock Exchange closed on Wednesday with sharp fall in the indices as prices continue to swing in either direction. At the close 27 securities changed hands including 1 trading in the US dollar market. At the close of trading, 10 stocks advanced and 12 declined in the main market.

Trading levels in main market ended at 2,784,846 units valued at $79,404,060 compared to 2,777,139 units valued at $49,314,132 at the close on Tuesday. Trading in the US dollar market accounted for 58,000 units valued at US$17,945.

The All Jamaica Composite Index dropped 1,831.35 points to close at 248,105.96 the JSE Market Index fell sharply by 1,668.57 points to finish at 226,052.64 but the JSE US dollar market index gained 6 points to close at 222.59.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 13 stocks with bids higher than their last selling prices and 3 with lower offers.

The main market ended trading with an average of 107,109 units valued at 3,054,002 compared to an average of 106,813 units carrying an average value of $1,896,697 on Tuesday. The average volume for the month to date ended at 92,865 units with an average value of $2,358,559 versus 85,743 units with an average value of $2,010,837 on the prior trading day. The average volume and value for March ended at 549,909 units and $8,925,067.

The average volume for the month to date ended at 92,865 units with an average value of $2,358,559 versus 85,743 units with an average value of $2,010,837 on the prior trading day. The average volume and value for March ended at 549,909 units and $8,925,067.

In market activity, Barita Investments gained 1 cent to close at $6.86 with trades of 108,947 shares, Berger Paints closed at $12.05, losing 10 cents with an exchange of 21,661 shares, Cable and Wireless closed 7 cents lower at $1.28 with 92,912 shares changing hands, Caribbean Cement closed at $31.80, with gains of 80 cents trading 12,184 units. Carreras closed at $72 with 10,962 shares being exchanged, Grace Kennedy tumbled $1.75 to $41.50, with 30,568 units traded, Jamaica Broilers gained 49 cents to close at $16.50 exchanging 82,604 shares, Jamaica Producers closed $1 lower to $15, with trades of 122,336 shares, Jamaica Stock Exchange closed at $7, losing 95 cents with an exchange of 384,712 units. JMMB Group added 24 cents to close at $18.50, with 8,392 units changing hands, Kingston Properties closed at $16 trading 1,035 shares, Kingston Wharves closed at $33.49, with gains of $2.49 and an exchange of 21,155 units, Mayberry Investments lost 5 cents to close at $4.60 with trades of 12,244 shares, NCB Financial Group added $1, closing at $62 after exchanging 318,152 shares,  1834 Investments lost 3 cents to close at $1.45 trading 15,888 units, 138 Student Living lost 1 cent to close at $4.49, with an exchange of 1,246 units, Pan Jamaican closed 85 cents lower to $34.15 with 91,726 shares traded. Pulse Investments traded 10,105 shares at $8, Radio Jamaica gained 4 cents to close at $1.89 while trading 73,739 units, Sagicor Group closed at $34, with a loss of 52 cents trading 1,043,448 shares, Sagicor Real Estate Fund added 30 cents, closing at $10.30 with 5,044 shares changing hands, Scotia Group advanced $1.29 cents to $40 trading 196,692 units, Seprod lost 50 cents to close at $40, with 44,200 shares changing hands, Supreme Ventures closed at $6.01, with a loss of 34 cents while swapping 68,195 shares. Proven traded 58,500 ordinary shares at 30.95 US cents, for a gain of almost 1 cent, JMMB 7.5% preference share closed at $2 with trades of 204 units and JMMB Group 7.5% preference share closed at $1.05, with an exchange of 6,495 units.

1834 Investments lost 3 cents to close at $1.45 trading 15,888 units, 138 Student Living lost 1 cent to close at $4.49, with an exchange of 1,246 units, Pan Jamaican closed 85 cents lower to $34.15 with 91,726 shares traded. Pulse Investments traded 10,105 shares at $8, Radio Jamaica gained 4 cents to close at $1.89 while trading 73,739 units, Sagicor Group closed at $34, with a loss of 52 cents trading 1,043,448 shares, Sagicor Real Estate Fund added 30 cents, closing at $10.30 with 5,044 shares changing hands, Scotia Group advanced $1.29 cents to $40 trading 196,692 units, Seprod lost 50 cents to close at $40, with 44,200 shares changing hands, Supreme Ventures closed at $6.01, with a loss of 34 cents while swapping 68,195 shares. Proven traded 58,500 ordinary shares at 30.95 US cents, for a gain of almost 1 cent, JMMB 7.5% preference share closed at $2 with trades of 204 units and JMMB Group 7.5% preference share closed at $1.05, with an exchange of 6,495 units.

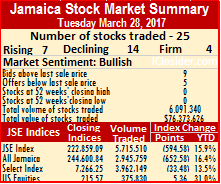

Sharp price moves push stocks down – Tuesday

Berger price closed with a loss of $1.95 on Tuesday.

Trading levels in main market ended at 5,715,510 units valued at $62,017,146 compared to 2,602,058 units valued at $19,772,383 at the close on Monday. Trading in the US dollar market accounted for 375,830 units valued at US$112,160.

The All Jamaica Composite Index declined 652.58 points to close at 244,600.84 the JSE Market Index fell 594.58 points to finish at 222,859.09 and the JSE US dollar market index gained 5.36 points to close at 215.57.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 9 stocks with bids higher than their last selling prices and 5 with lower offers.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 9 stocks with bids higher than their last selling prices and 5 with lower offers.The main market ended trading with an average of 122,740 units, compared to an average of 53,047 units on Monday. The average volume for the month to date ended at 136,817 units versus 150,894 units on the prior trading day. The average volume and value for February ended at 223,938 units and $1,379,459.

In market activity, Berger Paints slid $1.95 to $11.05, with 92,502 shares changing hands, Cable and Wireless lost 1 cent to close at $1.29 with trades of 255,042 shares, Caribbean Cement closed $1.20 lower to $31 with an exchange of 38,790 units. Carreras traded at $72, gaining $3 with 25,245 shares exchanged, Grace Kennedy advanced 90 cents to $43.90 with 170,701 units changing owners, Jamaica Broilers traded 124,547 shares at $15.99, for a loss of 1 cent, Jamaica Producers closed at $16 with 143,221 shares exchanged, Jamaica Stock Exchange closed 53 cents lower at $7, with trades of 861,904 units. JMMB Group closed at $16.81, losing 19 cents with 62,377 units traded, Kingston Properties closed at $16.35 trading 2,250 shares, Kingston Wharves lost 25 cents to close at $31.50, with 133,133 units changing hands, Mayberry Investments closed 10 cents lower at $4.60 with an exchange of 63,659 shares, NCB Financial Group gained 40 cents to close at $61.90, after exchanging 39,418 shares,

1834 Investments closed at $1.50, losing 10 cents trading 24,112 units, Palace traded 900 units at $200, Pan Jamaican closed at $35, with a loss of 1 cent trading 59,159 shares. Pulse Investments closed at $8.40, losing 5 cents with an exchange of 2,654 units, Radio Jamaica gained 30 cents to close at $1.90 exchanging 30,300 shares, Sagicor Group closed at $33.50 trading 151,851 shares, Sagicor Real Estate fund lost 6 cents to close at $10.50 with 184,285 shares traded, Scotia Group was down 99 cents, to close at $38.01, with 513,417 units exchanged, Scotia Investments traded $1.95 higher to $40 with a mere 1,000 units changing hands, Supreme Ventures advanced 35 cents to $6.35 trading 4,710 shares. Proven closed at 30 US cents, gaining 1 cent with an exchange of 375,830 ordinary shares and JMMB Group 7.5% preference share lost 1 cent to close at $1.08 with trades of 2,730,333 units.

1834 Investments closed at $1.50, losing 10 cents trading 24,112 units, Palace traded 900 units at $200, Pan Jamaican closed at $35, with a loss of 1 cent trading 59,159 shares. Pulse Investments closed at $8.40, losing 5 cents with an exchange of 2,654 units, Radio Jamaica gained 30 cents to close at $1.90 exchanging 30,300 shares, Sagicor Group closed at $33.50 trading 151,851 shares, Sagicor Real Estate fund lost 6 cents to close at $10.50 with 184,285 shares traded, Scotia Group was down 99 cents, to close at $38.01, with 513,417 units exchanged, Scotia Investments traded $1.95 higher to $40 with a mere 1,000 units changing hands, Supreme Ventures advanced 35 cents to $6.35 trading 4,710 shares. Proven closed at 30 US cents, gaining 1 cent with an exchange of 375,830 ordinary shares and JMMB Group 7.5% preference share lost 1 cent to close at $1.08 with trades of 2,730,333 units.

JSE climbs on Monday

The Jamaica Stock Exchange corrected Friday’s error in the movement of the market indices to reflect the correct changes based on the close on Thursday and Friday.

The Jamaica Stock Exchange corrected Friday’s error in the movement of the market indices to reflect the correct changes based on the close on Thursday and Friday.

The error in the market indices showed the sharp difference reported for the rise in the indices on Friday. The report shows the indices above the closing levels on Thursday but the official market report shows that main market and composite indices fell by more than 1,200 points and the junior market rising only 7.21 points when the closing index on Thursday and Friday show a rise of 29.39 points.

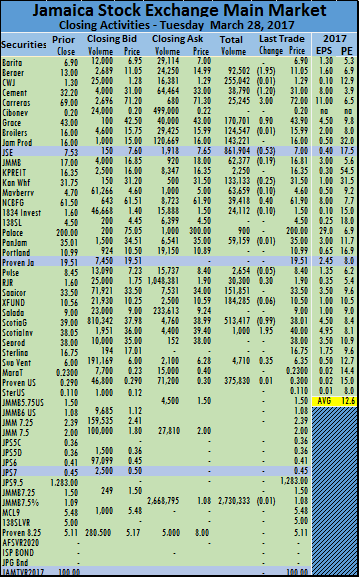

The market closed on Monday with 25 securities changing hands with 2 trading in the US dollar market. In the main market, 9 stocks advanced and 10 declined.

Trading levels in main market ended at 2,602,058 units valued at $79,186,131 compared to 7,683,386 units valued at $59,552,400 at the close on Friday. Trading in the US dollar market accounted for 3,316 units valued at US$962.

The All Jamaica Composite Index advanced 828.57 points to close at 245,253.44 the JSE Market Index gained 754.92 points to finish at 223,453.67 and the JSE US dollar market index remained at 210.21.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids higher than their last selling prices and 4 with lower offers.

The main market ended trading with an average of 282,723 units on Friday, compared to an average of 184,556 units on the previous trading day. The average volume for the month to date, ended at 248,740 units versus 214,756 units on the prior trading day. The average volume and value for February, ended at 223,938 units and $1,379,459.

In market activity, Berger Paints closed at $13, losing $2 with 3,799 shares changing hands, Cable and Wireless lost 4 cents to close at $1.30 with trades of 645,652 shares, and Caribbean Cement closed 20 cents higher to $32.20 with an exchange of 19,345 units. Carreras traded at $69, for a loss of 50 cents with 6,800 shares exchanged, Grace Kennedy closed 50 cents higher to $43 with 6,757 units changing owners, Jamaica Broilers traded 61,027 shares at $16, Jamaica Producers gained 50 cents to close at $16 with 5,209 shares exchanged, and Jamaica Stock Exchange closed 23 cents higher to $7.53 with trades of 23,712 units. JMMB Group lost 50 cents, closing at $17 with 23,836 units traded,  Kingston Properties closed at $16.35 trading 200 shares, Kingston Wharves gained 55 cents to close at $31.75, with 6,034 units changing hands, Mayberry Investments closed 60 cents lower to $4.70 with an exchange of 124,821 shares, NCB Financial Group lost 49 cents to close at $61.50, after exchanging 11,943 shares, 138 Student Living closed at $4.50 with 13,015 units exchanged, Pan Jamaican closed at $35.01, with gains of 76 cents trading 145,770 shares. Pulse Investments was down 5 cents, closing at $8.45 with an exchange of 1,809 units, Sagicor Group closed at $33.50 trading 86,987 shares, Sagicor Real Estate fund added 1 cent to close at $10.56 with 39,600 shares traded, Salada closed at $9, losing 24 cents exchanging 320 shares, Scotia Group added 65 cents to close at $39, with 1,960 units exchanged, Scotia Investments traded $2.05 higher to close at $38.05 with 105,759 units changing hands, Seprod closed at $38, for a loss of 55 cents with trades of 600 shares, and Supreme Ventures closed at $6, losing 29 cents trading 3,175 shares. Proven closed at 29 US cents with an exchange of 3,316 ordinary shares, JMMB 7.5% preference share traded 497,190 units at $2 and JMMB Group 7.5% preference share closed 1 cent lower to $1.09 with trades of 766,738 units.

Kingston Properties closed at $16.35 trading 200 shares, Kingston Wharves gained 55 cents to close at $31.75, with 6,034 units changing hands, Mayberry Investments closed 60 cents lower to $4.70 with an exchange of 124,821 shares, NCB Financial Group lost 49 cents to close at $61.50, after exchanging 11,943 shares, 138 Student Living closed at $4.50 with 13,015 units exchanged, Pan Jamaican closed at $35.01, with gains of 76 cents trading 145,770 shares. Pulse Investments was down 5 cents, closing at $8.45 with an exchange of 1,809 units, Sagicor Group closed at $33.50 trading 86,987 shares, Sagicor Real Estate fund added 1 cent to close at $10.56 with 39,600 shares traded, Salada closed at $9, losing 24 cents exchanging 320 shares, Scotia Group added 65 cents to close at $39, with 1,960 units exchanged, Scotia Investments traded $2.05 higher to close at $38.05 with 105,759 units changing hands, Seprod closed at $38, for a loss of 55 cents with trades of 600 shares, and Supreme Ventures closed at $6, losing 29 cents trading 3,175 shares. Proven closed at 29 US cents with an exchange of 3,316 ordinary shares, JMMB 7.5% preference share traded 497,190 units at $2 and JMMB Group 7.5% preference share closed 1 cent lower to $1.09 with trades of 766,738 units.

JSE climbs again on Friday

The Jamaica Stock Exchange continues to have challenges with their new trading system that was implemented in February. Making matters worse is that personnel at the exchange have refused to vet reports they put out in the public’s domain.

The Jamaica Stock Exchange continues to have challenges with their new trading system that was implemented in February. Making matters worse is that personnel at the exchange have refused to vet reports they put out in the public’s domain.

The end result is that indices changes are sometimes wrong or can’t be relied and some stocks are left off the trading reports.

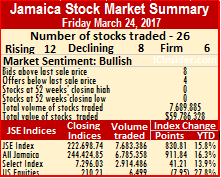

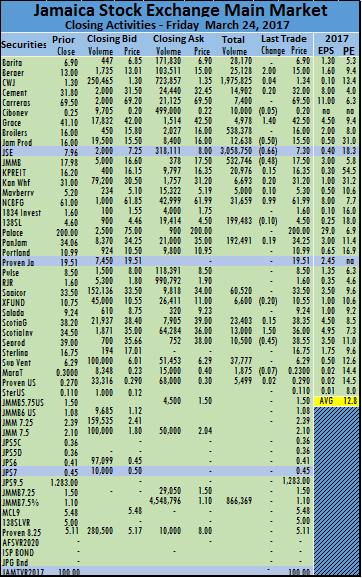

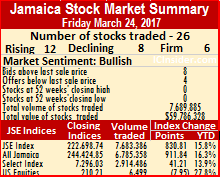

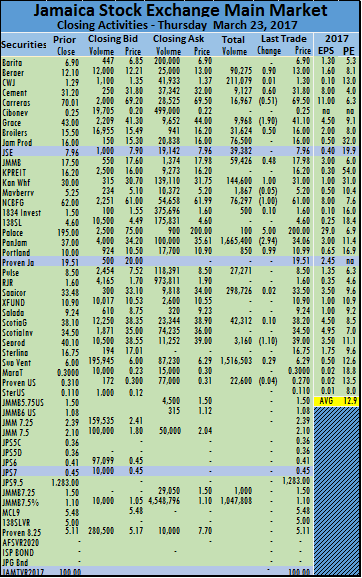

The market closed on Friday with 24 securities changing hands with 2 trading in the US dollar market. In the main market, 12 stocks advanced and 8 declined.

The All Jamaica Composite Index advanced 911.85 points to close at 244,424.85 the JSE Market Index gained 830.80 points to finish at 222,698.74 and the JSE US dollar market index lost 7.95 points to 210.21.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids higher than their last selling prices and 4 with lower offers.

The main market ended trading with an average of 282,723 units on Friday, compared to an average of 184,556 units on the previous trading day. The average volume for the month to date, ended at 248,740 units versus 214,756 units on the prior trading day. The average volume and value for February, ended at 223,938 units and $1,379,459.

The main market ended trading with an average of 282,723 units on Friday, compared to an average of 184,556 units on the previous trading day. The average volume for the month to date, ended at 248,740 units versus 214,756 units on the prior trading day. The average volume and value for February, ended at 223,938 units and $1,379,459.

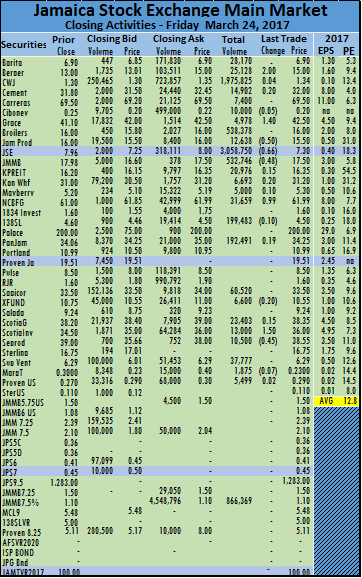

In market activity, Barita Investments traded 28,170 shares at $6.90, Berger Paints advanced $2 to close at $15, trading 25,128 shares, Cable and Wireless closed at $1.34, adding 4 cents with trades of 1,975,825 shares, Caribbean Cement closed 20 cents higher to $32 with an exchange of 14,902 units. Carreras traded at $69.50 with 7,400 shares changing hands, Grace Kennedy closed $1.40 higher to $42.50 with trades of 4,978 units, Jamaica Broilers exchanged 538,378 shares at $16, Jamaica Producers traded 50 cents lower to $15.50 with 12,638 shares changing owners, Jamaica Stock Exchange closed at $7.30, for a loss of 66 cents with an exchange of 3,058,750 units. JMMB Group slid 48 cents, closing at $17.50 with trades of 532,746 units, Kingston Properties closed at $16.35, rising 15 cents in trading 20,976 shares, Kingston Wharves gained 20 cents to close at $31.20, with 6,693 units changing owners, Mayberry Investments added 10 cents, closing at $5.30 with an exchange of 5,000 shares, NCB Financial Group closed with gains of 99 cents to $61.99, after exchanging 31,659 shares, 138 student Living closed 10 cents lower to $4.50, with 199,483 units being exchanged, Pan Jamaican rose 19 cents higher to $34.25, trading 192,491 shares. Sagicor Group closed at $33.50 trading 60,520 shares, Sagicor Real Estate Fund lost 20 cents to close at $10.55 with an exchange of 6,600 shares, Scotia Group added 15 cents to close at $38.35, with 23,403 units traded, Scotia Investments climbed $1.50 in trading 13,000 shares at $36, Seprod closed at $38.55, for a loss of 45 cents with 10,500 shares, Supreme Ventures closed at $6.29, with 37,777 shares changing hands. Margaritaville Turks traded 7 US cents lower to close at 23 US cents with 1,875 units exchanged, Proven Investments gained 2 US cents to close at 29 US cents trading 5,499 ordinary shares and JMMB Group 7.5% preference share closed at $1.10 with trades of 866,369 units.

Kingston Properties closed at $16.35, rising 15 cents in trading 20,976 shares, Kingston Wharves gained 20 cents to close at $31.20, with 6,693 units changing owners, Mayberry Investments added 10 cents, closing at $5.30 with an exchange of 5,000 shares, NCB Financial Group closed with gains of 99 cents to $61.99, after exchanging 31,659 shares, 138 student Living closed 10 cents lower to $4.50, with 199,483 units being exchanged, Pan Jamaican rose 19 cents higher to $34.25, trading 192,491 shares. Sagicor Group closed at $33.50 trading 60,520 shares, Sagicor Real Estate Fund lost 20 cents to close at $10.55 with an exchange of 6,600 shares, Scotia Group added 15 cents to close at $38.35, with 23,403 units traded, Scotia Investments climbed $1.50 in trading 13,000 shares at $36, Seprod closed at $38.55, for a loss of 45 cents with 10,500 shares, Supreme Ventures closed at $6.29, with 37,777 shares changing hands. Margaritaville Turks traded 7 US cents lower to close at 23 US cents with 1,875 units exchanged, Proven Investments gained 2 US cents to close at 29 US cents trading 5,499 ordinary shares and JMMB Group 7.5% preference share closed at $1.10 with trades of 866,369 units.

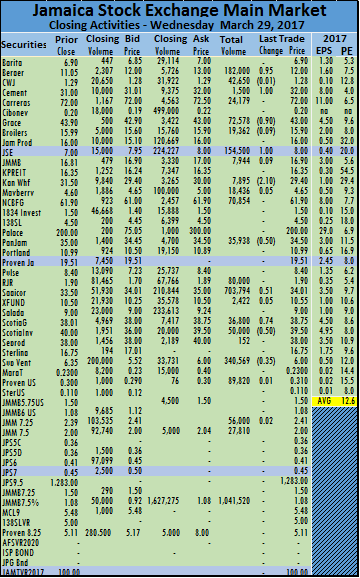

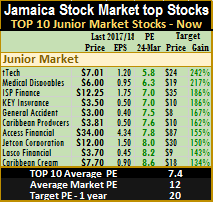

After dropping out of the TOP 10 for the last week Lasco Distributors returned during the end of past week while Lasco Financial Services that entered the list for the start of the past week has been squeezed out with prices declining elsewhere and Access Finance ending the week with the bid of 1,500 shares at $39, to be out of the top listing and Blue Power closing the week at $35 is back in the list. Overall bid volumes for junior and main market stocks remain low with the only ones of the Top 10 with decent volumes on the bid for junior stocks being Caribbean Producers with 60,712 units on the bid at $3.75, General Accident with 53,426 units at $3 and Medical Disposables with 103,417 units with the bid price ending at $6. Offers that are well about the bid volumes include AMG Packaging with an offer to sell 99,723 units at $5.95, Jetcon Corporation with 435,207 units at $12.99 and Lasco Distributors with 973,036 units at $6.70.

After dropping out of the TOP 10 for the last week Lasco Distributors returned during the end of past week while Lasco Financial Services that entered the list for the start of the past week has been squeezed out with prices declining elsewhere and Access Finance ending the week with the bid of 1,500 shares at $39, to be out of the top listing and Blue Power closing the week at $35 is back in the list. Overall bid volumes for junior and main market stocks remain low with the only ones of the Top 10 with decent volumes on the bid for junior stocks being Caribbean Producers with 60,712 units on the bid at $3.75, General Accident with 53,426 units at $3 and Medical Disposables with 103,417 units with the bid price ending at $6. Offers that are well about the bid volumes include AMG Packaging with an offer to sell 99,723 units at $5.95, Jetcon Corporation with 435,207 units at $12.99 and Lasco Distributors with 973,036 units at $6.70. In the Main market, Barita Investments has limited buying interest at the current price with just 447 units on the bid at $6.85 and 28,224 units on the offer at $7. Berger Paints ended with 237 units on the bid at $12 with 49,894 on offer at $12.01. Carreras currently, has 38,619 shares on offer at $74 and buying of 3,000 shares at $73.95. Caribbean Cement’s weak demand continues in the mid-thirty dollar range, with the stock closing with only 2,340 units on the bid to buy at $31.50 while offers are at $32 to sell 53,579 units. JMMB Group’s buying is at $16.30 for 50,000 units on the bid and only 100 units offered at $18.24, Pulse Investments has offers for 150,000 units at $8 and buying at $7 for 1,005 shares.

In the Main market, Barita Investments has limited buying interest at the current price with just 447 units on the bid at $6.85 and 28,224 units on the offer at $7. Berger Paints ended with 237 units on the bid at $12 with 49,894 on offer at $12.01. Carreras currently, has 38,619 shares on offer at $74 and buying of 3,000 shares at $73.95. Caribbean Cement’s weak demand continues in the mid-thirty dollar range, with the stock closing with only 2,340 units on the bid to buy at $31.50 while offers are at $32 to sell 53,579 units. JMMB Group’s buying is at $16.30 for 50,000 units on the bid and only 100 units offered at $18.24, Pulse Investments has offers for 150,000 units at $8 and buying at $7 for 1,005 shares. Jamaica Stock Exchange traded nearly 37 million shares one day after the Stock Exchange advised Sagicor Group that their holdings exceeded the limit of 10 percent stipulated in the company’s bye laws. The group bought nearly 36 million units in early March.

Jamaica Stock Exchange traded nearly 37 million shares one day after the Stock Exchange advised Sagicor Group that their holdings exceeded the limit of 10 percent stipulated in the company’s bye laws. The group bought nearly 36 million units in early March.  IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 13 stocks with bids higher than their last selling prices and 4 with lower offers.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 13 stocks with bids higher than their last selling prices and 4 with lower offers. NCB Financial Group slid 90 cents to close at $61, after exchanging 12,137 shares, 138 Student Living traded 60,146 shares at $4.50, Pan Jamaican gained 2 cents, closing at $34.52 while trading 5,240 shares. Pulse Investments traded 1,150 shares at $8.40, Sagicor Group closed at $34.01 with trades of 118,881 shares, Sagicor Real Estate Fund lost 5 cents, closing at $10.50 with 13,000 shares, Salada Foods closed at $9 trading 23,000 units, Scotia Group closed 77 cents lower to $37.98 with trades of 47,148 units, Scotia Investments traded at $39.50 with a mere 194 units changing hands, Seprod exchanged 7,245 shares at $38, Supreme Ventures lost 1 cent to close at $5.99 trading 27,155 shares. Proven fell 0.95 cent and closed at 30 US cents, with an exchange of 4,000 ordinary shares and JMMB Group 7.5% preference share closed at $1.08 with trades of 1,327,000 units.

NCB Financial Group slid 90 cents to close at $61, after exchanging 12,137 shares, 138 Student Living traded 60,146 shares at $4.50, Pan Jamaican gained 2 cents, closing at $34.52 while trading 5,240 shares. Pulse Investments traded 1,150 shares at $8.40, Sagicor Group closed at $34.01 with trades of 118,881 shares, Sagicor Real Estate Fund lost 5 cents, closing at $10.50 with 13,000 shares, Salada Foods closed at $9 trading 23,000 units, Scotia Group closed 77 cents lower to $37.98 with trades of 47,148 units, Scotia Investments traded at $39.50 with a mere 194 units changing hands, Seprod exchanged 7,245 shares at $38, Supreme Ventures lost 1 cent to close at $5.99 trading 27,155 shares. Proven fell 0.95 cent and closed at 30 US cents, with an exchange of 4,000 ordinary shares and JMMB Group 7.5% preference share closed at $1.08 with trades of 1,327,000 units. Trading in the main market of the Jamaica Stock Exchange ended with moderate gains in the indices at the close on Wednesday as 22 securities changed hands with 1 trading in the US dollar market. A total of 10 stocks advanced and 7 declined in the two markets.

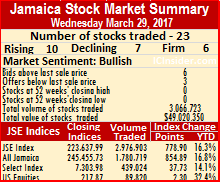

Trading in the main market of the Jamaica Stock Exchange ended with moderate gains in the indices at the close on Wednesday as 22 securities changed hands with 1 trading in the US dollar market. A total of 10 stocks advanced and 7 declined in the two markets. The average volume for the month to date ended at 108,879 units versus 136,817 units on the prior trading day. The average volume and value for February ended at 223,938 units and $1,379,459.

The average volume for the month to date ended at 108,879 units versus 136,817 units on the prior trading day. The average volume and value for February ended at 223,938 units and $1,379,459. Mayberry Investments closed 5 cents higher to $4.65 with trades of 18,436 shares, NCB Financial Group closed at $61.90, after exchanging 70,854 shares, Pan Jamaican lost 50 cents, closing at $34.50 trading 35,938 shares. Radio Jamaica traded 80,000 shares at $1.90, Sagicor Group gained 51 cents to close at $34.01 with trades of 703,794 shares, Sagicor Real Estate fund closed at $10.55 with gains of 5 cents and 2,422 shares being exchanged, Scotia Group added 74 cents, closing at $38.75 trading 36,800 units, Scotia Investments traded 50 cents lower to $39.50 with 50,000 units changing hands, Seprod exchanged 152 shares at $38, Supreme Ventures lost 35 cents to close at $6 trading 340,569 shares. Proven closed at 30.95 US cents, gaining 0.95 cent with an exchange of 89,820 ordinary shares, JMMB 7.25% preference share rose 2 cents in trading 56,000 units at $2.41, JMMB 7.5% preference share exchanged 27,810 units at $2, and JMMB Group 7.5% preference share closed at $1.08 with trades of 1,041,520 units.

Mayberry Investments closed 5 cents higher to $4.65 with trades of 18,436 shares, NCB Financial Group closed at $61.90, after exchanging 70,854 shares, Pan Jamaican lost 50 cents, closing at $34.50 trading 35,938 shares. Radio Jamaica traded 80,000 shares at $1.90, Sagicor Group gained 51 cents to close at $34.01 with trades of 703,794 shares, Sagicor Real Estate fund closed at $10.55 with gains of 5 cents and 2,422 shares being exchanged, Scotia Group added 74 cents, closing at $38.75 trading 36,800 units, Scotia Investments traded 50 cents lower to $39.50 with 50,000 units changing hands, Seprod exchanged 152 shares at $38, Supreme Ventures lost 35 cents to close at $6 trading 340,569 shares. Proven closed at 30.95 US cents, gaining 0.95 cent with an exchange of 89,820 ordinary shares, JMMB 7.25% preference share rose 2 cents in trading 56,000 units at $2.41, JMMB 7.5% preference share exchanged 27,810 units at $2, and JMMB Group 7.5% preference share closed at $1.08 with trades of 1,041,520 units.

by

by

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids higher than their last selling prices and 4 with lower offers.

IC bid-offer Indicator| At the end of trading in the main and US dollar markets, the Investor’s Choice bid-offer indicator reading shows 8 stocks with bids higher than their last selling prices and 4 with lower offers. 138 student Living closed 10 cents lower to $4.50, with 199,483 units being exchanged, Pan Jamaican rose 19 cents higher to $34.25, trading 192,491 shares. Sagicor Group closed at $33.50 trading 60,520 shares, Sagicor Real Estate fund lost 20 cents to close at $10.55 with an exchange of 6,600 shares, Scotia Group added 15 cents to close at $38.35, with 23,403 units traded, Scotia Investments climbed $1.50 in trading 13,000 shares at $36, Seprod closed at $38.55, for a loss of 45 cents with trades of 10,500 shares, Supreme Ventures closed at $6.29, with 37,777 shares changing hands. Margaritaville Turks traded 7 US cents lower to close at 23 US cents with 1,875 units exchanged, Proven Investments gained 2 US cents to close at 29 US cents trading 5,499 ordinary shares and JMMB Group 7.5% preference share closed at $1.10 with trades of 866,369 units.

138 student Living closed 10 cents lower to $4.50, with 199,483 units being exchanged, Pan Jamaican rose 19 cents higher to $34.25, trading 192,491 shares. Sagicor Group closed at $33.50 trading 60,520 shares, Sagicor Real Estate fund lost 20 cents to close at $10.55 with an exchange of 6,600 shares, Scotia Group added 15 cents to close at $38.35, with 23,403 units traded, Scotia Investments climbed $1.50 in trading 13,000 shares at $36, Seprod closed at $38.55, for a loss of 45 cents with trades of 10,500 shares, Supreme Ventures closed at $6.29, with 37,777 shares changing hands. Margaritaville Turks traded 7 US cents lower to close at 23 US cents with 1,875 units exchanged, Proven Investments gained 2 US cents to close at 29 US cents trading 5,499 ordinary shares and JMMB Group 7.5% preference share closed at $1.10 with trades of 866,369 units.

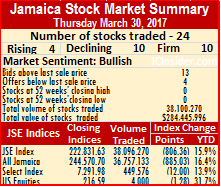

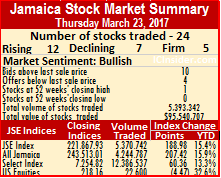

Trading in the main market of the Jamaica Stock Exchange closed Thursday with 23 securities changing hands and 1 trading in the US dollar market. In the main market, 12 stocks advanced and 7 declined in the main market.

Trading in the main market of the Jamaica Stock Exchange closed Thursday with 23 securities changing hands and 1 trading in the US dollar market. In the main market, 12 stocks advanced and 7 declined in the main market. The main market ended trading with an average of 184,556 units on Thursday, compared to an average of 189,413 units on the previous trading day. The average volume and value for February, ended at 223,938 units and $1,379,459.

The main market ended trading with an average of 184,556 units on Thursday, compared to an average of 189,413 units on the previous trading day. The average volume and value for February, ended at 223,938 units and $1,379,459. 1834 Investments gained 10 cents, closing at $1.60 with 500 shares changing hands, Palace Amusement jumped $5 in closing at an all-time high of $200, with just 100 units being exchanged, Pan Jamaican dropped $2.94 to close at $34.06 trading 1,665,400 shares, Portland JSX closed 99 cents higher to $10.99 in exchanging 850 units, Pulse Investments traded 27,271 units at $8.50. Sagicor Group closed at $33.50 with gains of 2 cents trading 298,726 shares, Scotia Group added 10 cents to close at $38.20, with 42,312 units traded, Seprod closed at $39 with trades of 3,160 shares, Supreme Ventures closed 29 cents higher to $6.29, with 1,516,503 shares changing hands. Proven Investments lost 4 US cents to close at 27 US cents trading 22,600 ordinary shares, JMMB Group 7.25% preference share exchanged 1,000 units at $1.50, and JMMB Group 7.5% preference share closed at $1.10 with trades of 1,047,808 units.

1834 Investments gained 10 cents, closing at $1.60 with 500 shares changing hands, Palace Amusement jumped $5 in closing at an all-time high of $200, with just 100 units being exchanged, Pan Jamaican dropped $2.94 to close at $34.06 trading 1,665,400 shares, Portland JSX closed 99 cents higher to $10.99 in exchanging 850 units, Pulse Investments traded 27,271 units at $8.50. Sagicor Group closed at $33.50 with gains of 2 cents trading 298,726 shares, Scotia Group added 10 cents to close at $38.20, with 42,312 units traded, Seprod closed at $39 with trades of 3,160 shares, Supreme Ventures closed 29 cents higher to $6.29, with 1,516,503 shares changing hands. Proven Investments lost 4 US cents to close at 27 US cents trading 22,600 ordinary shares, JMMB Group 7.25% preference share exchanged 1,000 units at $1.50, and JMMB Group 7.5% preference share closed at $1.10 with trades of 1,047,808 units.