The JCSD now has 154,500 shareholders on its registry with the near 12,000 new ones this month.

There are nearly 155 thousand investors listed as shareholders in the Jamaica Central Security Deposit but the Jamaican Stock Exchange (JSE) is planning to double that number in five years.

The number of local share ownership got a big boost from the 11,772 new investors who applied for shares in Jamaica’s recent IPO, Wigton Windfarms recently.

The addition of new investors pulled in by the new stock offer, brings the total to 5.5 percent of the country’s population. According to Marlene Street Forrest, Managing Director of the JSE, “the number based on the adult population is 12 percent. The aim is to get to 20 to 25 percent of the adult population in five years.” The numbers may not sound great deal but Jamaica ranks pretty high globally.

Data gleaned by IC Insider.com shows that just 12.3 percent of UK overall population own shares in public listed companies, stock ownership in India is not more than 2.5-3 percent of the total population. In 2011, Austria had 7 percent rate and Germany was around that of Jamaica at 5.6 percent while France was at 14.5 percent. The data is clearly saying that the world have not done a good job of educating the population about stock ownership.

NCB pulled in more shareholders in 1987 than any other listing on the JSE

The JSE will be using a variety of means to get the numbers up in Jamaica. Government’s divestments have the most telling impact in increasing the numbers of new investors. The major reason is the need for aggressive marketing of IPOs, of government entities, to get full take up of the shares.

According to an article written by Emma Simon of the British Telegraph newspaper, in April 2013,

“One of the lasting legacies of Margaret Thatcher’s administration was to enable and encourage millions of ordinary people to invest in the stock market. In 1979 just 3 million people owned shares, 7pc of the adult population. By the end of the Eighties one in four people – 12 million adults – owned shares. The boom was fuelled by a wave of privatisations in which many state-owned industries were sold to private investors.” The situation was similar in Jamaica, where the number of shareholders, estimated at around 10,000, but National Commercial Bank, Now known as NCB Financial Group, the first government divestment attracted more than 32,000 investors, more than tripling the number of shareholders.

On Tuesday dealers purchased US$39.6 million from the public at $127.50 and sold $44.86 million at an average of $128.63 down from $128.93 on Monday.

On Tuesday dealers purchased US$39.6 million from the public at $127.50 and sold $44.86 million at an average of $128.63 down from $128.93 on Monday.

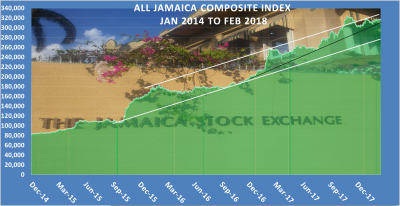

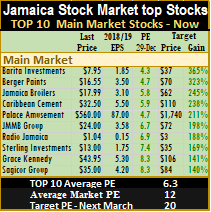

IC Insider.com projects that many of the main market heavy weights will find it tough to repeat the strong gains they enjoyed in 2017, if that is the case, their impact on the market index is likely to be less than for 2017. Another factor that could make a repeat of 2017 tough, is the movement of interest rates. Last year, Treasury bill rates fell 29 percent from 6.56 percent to 4.83 percent, that level of decline, is unlikely to happen in 2018, even as some of the decline in the latter part of 2017 is yet to be fully reflected in the prices of stocks to date and should positively affect prices in 2018. IC Insider.com is forecasting rates on 182 days Treasury bill hitting 3 percent by the end of the 2018 first quarter. New listings could help move the indices in 2018, the likely impact is unknown at this point.

IC Insider.com projects that many of the main market heavy weights will find it tough to repeat the strong gains they enjoyed in 2017, if that is the case, their impact on the market index is likely to be less than for 2017. Another factor that could make a repeat of 2017 tough, is the movement of interest rates. Last year, Treasury bill rates fell 29 percent from 6.56 percent to 4.83 percent, that level of decline, is unlikely to happen in 2018, even as some of the decline in the latter part of 2017 is yet to be fully reflected in the prices of stocks to date and should positively affect prices in 2018. IC Insider.com is forecasting rates on 182 days Treasury bill hitting 3 percent by the end of the 2018 first quarter. New listings could help move the indices in 2018, the likely impact is unknown at this point. Alpart resumption of Alumina production is a big positive for the overall economy, for increased government revenues and more demand for local goods and services, some of which are provided by listed companies. The tourism sector is enjoying strong growth, apart from increasing foreign exchange intake for the country, will have direct impact on

Alpart resumption of Alumina production is a big positive for the overall economy, for increased government revenues and more demand for local goods and services, some of which are provided by listed companies. The tourism sector is enjoying strong growth, apart from increasing foreign exchange intake for the country, will have direct impact on