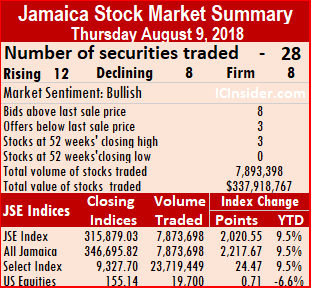

The Jamaica Stock Exchange surged sharply in early trading on Tuesday, with the All Jamaican Composite Index jumping 6,070.62 to an intraday high 356,437.50, after just 17 minutes of trading.

The Jamaica Stock Exchange surged sharply in early trading on Tuesday, with the All Jamaican Composite Index jumping 6,070.62 to an intraday high 356,437.50, after just 17 minutes of trading.

At the same time, the JSE Index jumped 5,531.02 points to a record 324,754.83. Strong gains by Kingston Wharves that traded at $61 up from $53 when it traded previously, NCB Financial that rose by $1 and and Seprod that jumped from $45 to $50 were the main contributors to the gain.

The Junior Market index is showing a huge increase of 557.73 points to 3,797.07 is caused by Blue Power having split into 10 units with the adjusted price being $4.70 but trades were attempted at $47 thus distorting the index. Those trades will be cancelled at the close of the day.

All Jamaica jumps 6,070 points to record 356,437

All Jamaica index jumps to record 352,258 points

The All Jamaican Composite Index of the Jamaica Stock Exchange having cleared the 351,000 points mark after just 5 minutes of opening, with NCB Financial trading at $110 has now broken the 352,000 after 42 minutes of trading.

The All Jamaican Composite Index of the Jamaica Stock Exchange having cleared the 351,000 points mark after just 5 minutes of opening, with NCB Financial trading at $110 has now broken the 352,000 after 42 minutes of trading.

The All Jamaican Composite Index jumped 3,325.45 to a record 352,257.65 and the JSE Index climbed 3,029.87 points to 320,946.53 points while the Junior Market rose 50.08 to cut sharp fall on Thursday of more than 57 points and now sits at 3,227.22 points.

Apart from a sharp rise in the price of NCB shares, Grace Kennedy rose to $60, and JMMB Group climbed to $29. Kingston Wharves has a bid of $60 compared to a last price of $53 and could add quite a bit to the indices when it trades.

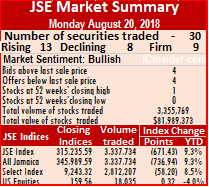

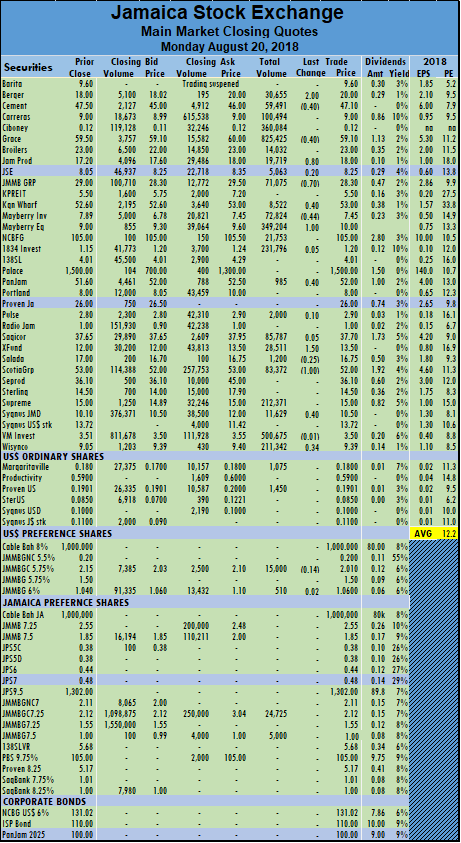

JSE stocks retreat from Thursday’s record

Mayberry Jamaican Equities traded 1M shares & the price hits a new high of $10 but retreated by Friday’s close.

The All Jamaican Composite Index of the Jamaica Stock Exchange and the JSE index fell more than 2,000 points as main market stocks retreated from Thursday’s record close as the market set its sight on breaking through the 350,000 mark this coming week.

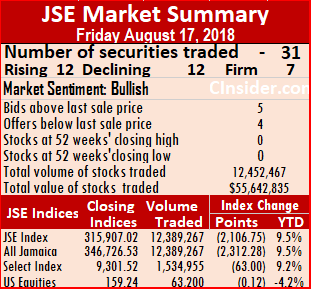

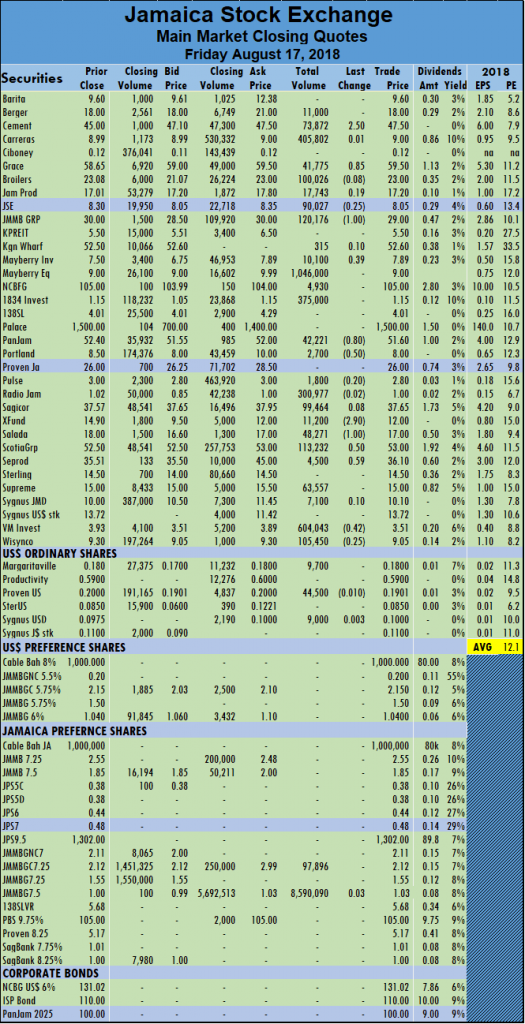

At the close, the All Jamaican Composite Index dropped 2,312.28 points to 346,726.53 and the JSE Index dived 2,106.75 points to 315,907.02. Market activities resulted in 31 securities trading including 3 in the US dollar market compared to 27 securities trading on Thursday.

At the end of trading, the prices of 12 stocks rose, 12 declined and 7 traded unchanged. Trading in the main market ended with 12,389,267 units valued $54,066,117, compared to 7,549,926 units valued at $378,631,059 on Thursday.

The day’s volume was led by, JMMB Group 7.5% preference share concluded trading at $1.03, with 8,590,090 shares with 69.3 percent of the traded volume, followed by Mayberry Equities that closed at $9 in trading 1,046,000 shares,  for just 8.4 percent of the day’s volume after trading at an intraday high of $10 and Supreme Ventures with 604,043 units and 4.9 percent of the main market volume.

for just 8.4 percent of the day’s volume after trading at an intraday high of $10 and Supreme Ventures with 604,043 units and 4.9 percent of the main market volume.

Stocks with major price changes| Caribbean Cement jumped $2.50 and finished at $47.50, trading 73,872 shares, Grace Kennedy rose 85 cents and ended trading at $59.50, with 41,775 shares, JMMB Group lost $1 and ended at $29, exchanging 120,176 shares, Mayberry Investments gained 39 cents to settle at $7.89, with 10,100 units, PanJam Investment fell 80 cents and concluded trading 42,221 shares and closed at $51.60, Portland JSX lost 50 cents and ended at $8 trading 2,700 units, Sagicor Real Estate Fund dived $2.90 to $12, with 11,200 shares, Salada Foods shed $1 to close at $17, in exchanging 48,271 units, Scotia Group rose 50 cents in traded 113,232 shares to close at $53, Seprod finished trading 4,500 shares, and gained 59 cents to close at $36.10, ended at $15, with 21,164 shares after losing 30 cents,  Victoria Mutual Investments lost 42 cents in concluding trading at $3.51, with 604,043 stock units and Wisynco Group fell 25 cents and finished trading 105,450 shares to end at $9.05.

Victoria Mutual Investments lost 42 cents in concluding trading at $3.51, with 604,043 stock units and Wisynco Group fell 25 cents and finished trading 105,450 shares to end at $9.05.

Trading in the US dollar market closed with Margaritaville traded 9,700 shares and ended at 18 US cents Proven Investments trading 44,500 shares, falling 0.09 cent and closed at 19.01 US cents and Sygnus Credit Investments traded 9,000 shares and rose 0.03 cent to 10 US cents. The JSE USD Equities Index slipped 0.12 points to end at 159.24.

Trading resulted in an average of 492,474 units valued at over $1,930,933, in contrast to 290,382 shares valued at $14,562,733 on Thursday. For the month to date an average of 231,530 shares valued at an average of $4,665,985 versus 211,092 shares valued at an average of $4,956,066 on Thursday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading shows 5 stocks ended with bids higher than their last selling prices and 4 closing with lower offers.

New closing high for JSE – Friday

The Jamaica Stock Exchange took another sizable jump to end at a record close on Friday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.

The Jamaica Stock Exchange took another sizable jump to end at a record close on Friday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.

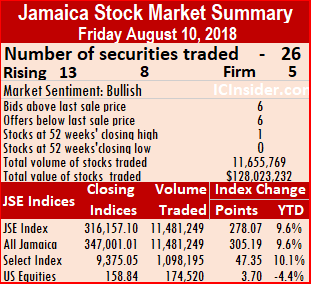

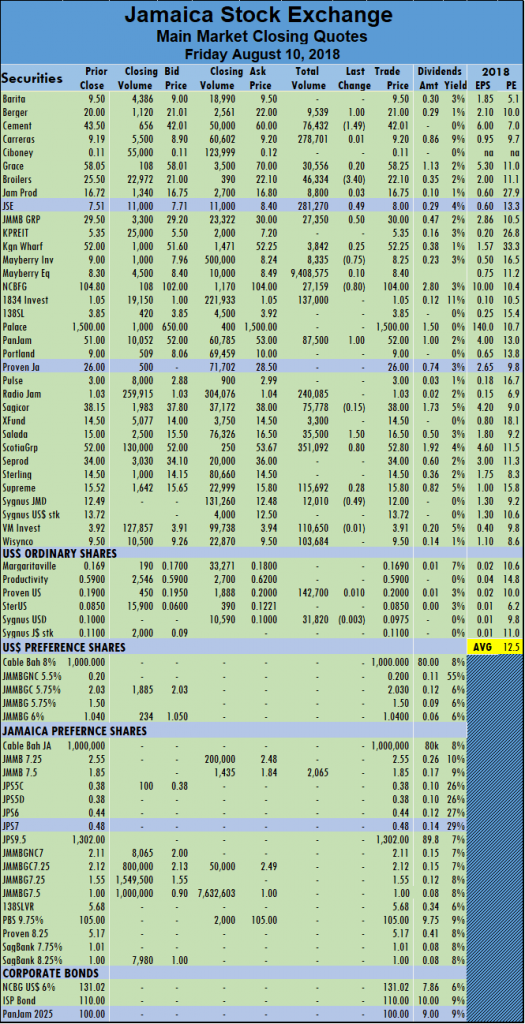

At the close trading, the All Jamaican Composite Index rose 305.19 points to 347,001.01, the first time it closed above 347,000 points and the JSE Index climbed 278.07 points to end at a record close of 316,157.10. The market has gained 9.6 percent for the year to date, the shortage of stocks and low interest rates suggest that the gain for the rest of the year should exceed that of the first 7 months.

Trading in the main market ended with 11,481,249 units valued $123,719,859 compared to 7,873,698 units valued at $335,479,879 on Thursday.

Market activities resulted in 26 securities trading including 2 in the US dollar market compared to 28 securities trading on Thursday. At the end of trading, the prices of 13 stocks rose, 8 declined and 5 traded unchanged, including Caribbean Cement trading at an intraday high of $50 and Salada Foods trading at an all-time high of $17 before pulling back at the close, to a 52 weeks’ high of $16.50.

The day’s volume was led by, Mayberry Jamaican Equities with 9,408,575 units 81.95 percent of the main market volume, followed by Scotia Group with juts 351,092 units and Jamaica Stock Exchange with 281,270 units.

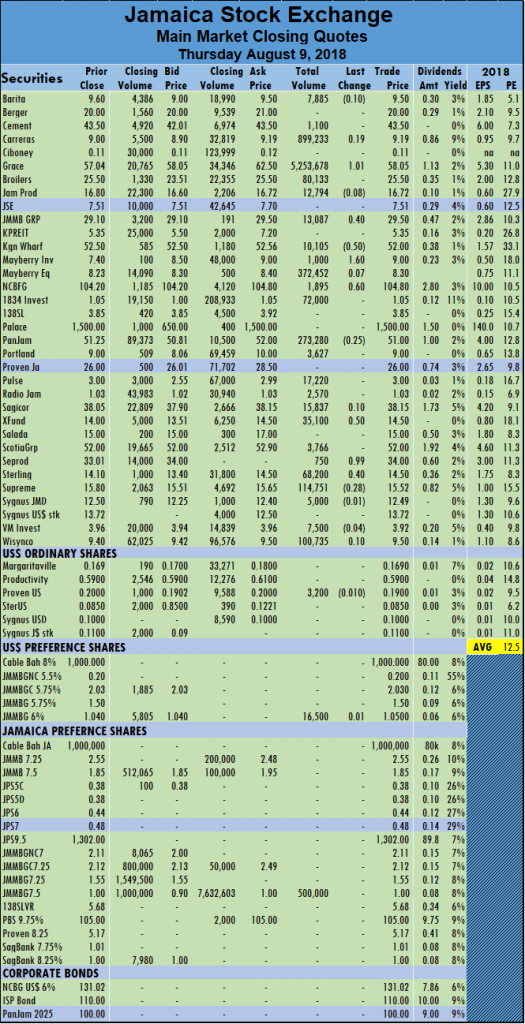

Stocks with major price changes| Berger Paints rose $1 and ended at $21, trading 9,539 stock units, Caribbean Cement fell $1.49 to $42.01 exchanging 76,432 shares, Jamaica Broilers traded 46,334 stock units and dropped $3.40 to end at $22.10, Jamaica Stock Exchange rose 49 cents to close at $8, with 281,270 shares changing hands, JMMB Group rose 50 cents and ended at $30, trading 27,350 shares. Mayberry Investments lost 75 cents to end at $8.25 trading just 8,335 shares, Kingston Wharves finished at $52.25, after rising 25 cents with 3,842 stock units, NCB Financial Group lost 80 cents and ended trading at $104, exchanging 27,159 shares, PanJam Investment jumped $1 to $52 trading 87,500 stock units. Salada Foods jumped $1.50 and ended trading at 52 weeks’ closing high of $16.50, with 35,500 stock units, Scotia Group traded 351,092 units and gained 80 cents to end at $52.80 and Sygnus Credit Investments fell 49 cents in trading 12,010 at $12.

Trading in the US dollar market closed with 174,520 units valued at US$31,642 as  Proven Investments fell 1 cent and closed at 19 US cents trading 3,200 shares and Sygnus Credit Investments fell 0.25 cents in trading 12,010 at 0.0975 US cents. The JSE USD Equities Index rose 3.70 and closed at 154.43

Proven Investments fell 1 cent and closed at 19 US cents trading 3,200 shares and Sygnus Credit Investments fell 0.25 cents in trading 12,010 at 0.0975 US cents. The JSE USD Equities Index rose 3.70 and closed at 154.43

Trading resulted in an average of 478,385 units valued at an average of $5,154,994 for each security traded. In contrast to 302,835 units for an average of $12,903,072 on Thursday. For the month to date an average of 198,469 shares valued at an average of $4,438,731 versus 185,362 shares valued at an average of $5,398,127 on Thursday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading shows 6 stocks ended with bids higher than their last selling prices and 6 closing with lower offers.

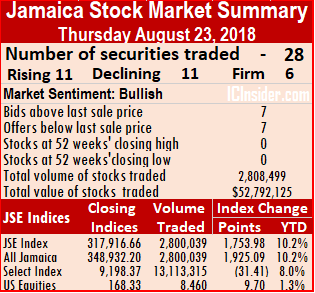

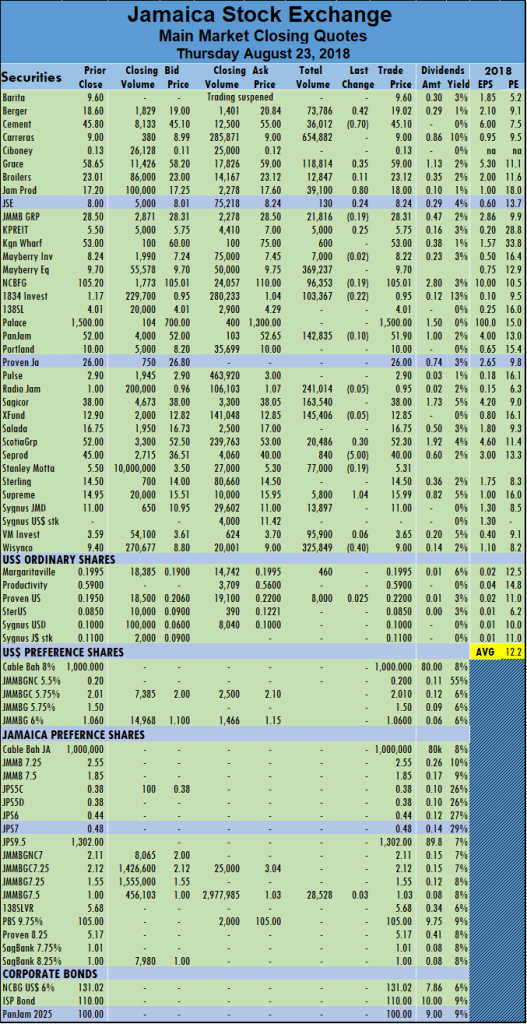

The Jamaica Stock Exchange All Jamaican Composite Index climbed 1,925.09 points to close at 348,932.20 and the JSE Index rose 1,753.98 points to close at 317,916.66 to sit a few hundred points below the record close on August 16.

The Jamaica Stock Exchange All Jamaican Composite Index climbed 1,925.09 points to close at 348,932.20 and the JSE Index rose 1,753.98 points to close at 317,916.66 to sit a few hundred points below the record close on August 16.  Trading resulted in an average of 164,231 units valued at an average of $2,096,732 for each security traded, in contrast to 679,456 units valued at an average of $6,783,172 on Tuesday. For the month to date an average of 246,505 shares valued at an average of $4,497,856 versus 246,505 shares valued at an average of $4,497,856 on Tuesday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

Trading resulted in an average of 164,231 units valued at an average of $2,096,732 for each security traded, in contrast to 679,456 units valued at an average of $6,783,172 on Tuesday. For the month to date an average of 246,505 shares valued at an average of $4,497,856 versus 246,505 shares valued at an average of $4,497,856 on Tuesday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded. Jamaica Stock Exchange rose $1 trading 31,500 units in closing at $8, JMMB Group fell 50 cents and ended at $28.50, exchanging 20,679 shares, Mayberry Investments climbed 75 cents to settle at $8.24, trading 947,406 units, Mayberry Jamaica Equities lost 25 cents to settle at $9.70, trading 115,853 units,

Jamaica Stock Exchange rose $1 trading 31,500 units in closing at $8, JMMB Group fell 50 cents and ended at $28.50, exchanging 20,679 shares, Mayberry Investments climbed 75 cents to settle at $8.24, trading 947,406 units, Mayberry Jamaica Equities lost 25 cents to settle at $9.70, trading 115,853 units,

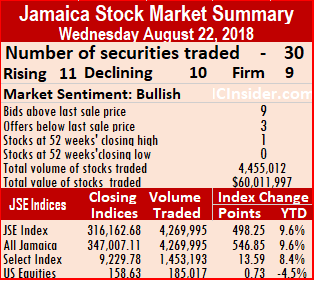

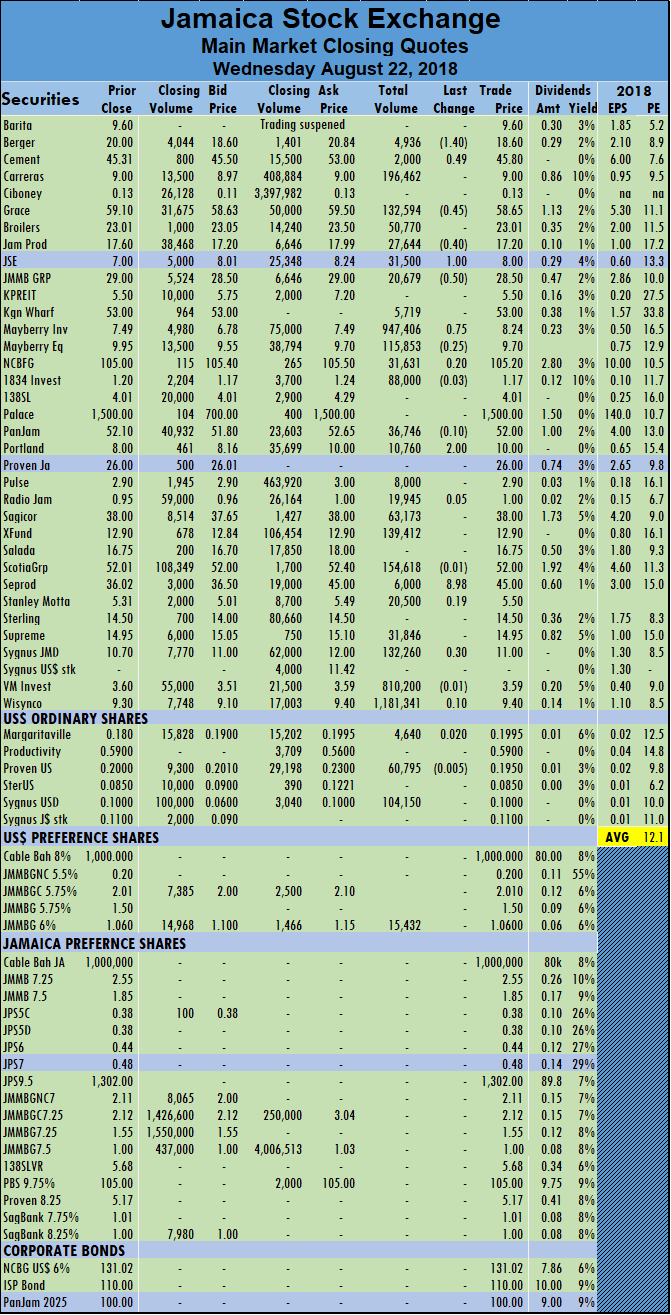

The day’s volume was led by, WISYNCO Group with 1,181,341 units accounting for 27.7 percent of the traded volume, followed by Mayberry Investments with 947,406 units and 22.2 percent of the day’s volume and Victoria Mutual Investments with 810,200 units and 18.97 percent of the main market volume.

The day’s volume was led by, WISYNCO Group with 1,181,341 units accounting for 27.7 percent of the traded volume, followed by Mayberry Investments with 947,406 units and 22.2 percent of the day’s volume and Victoria Mutual Investments with 810,200 units and 18.97 percent of the main market volume. Mayberry Jamaica Equities lost 25 cents to settle at $9.70, trading 115,853 units, Portland JSX jumped $2 to closed at $10, with 10,760 shares, Seprod jumped $8.98 to $45, trading 6,000 shares and Sygnus Credit Investments rose 30 cent to close at $11 in trading 132,260 shares.

Mayberry Jamaica Equities lost 25 cents to settle at $9.70, trading 115,853 units, Portland JSX jumped $2 to closed at $10, with 10,760 shares, Seprod jumped $8.98 to $45, trading 6,000 shares and Sygnus Credit Investments rose 30 cent to close at $11 in trading 132,260 shares. Trading on the Jamaica Stock Exchange resulted in further declines in the market indices but by less than the approximate 2,000 points decline on Friday, even as advancing stocks outnumbered declining ones.

Trading on the Jamaica Stock Exchange resulted in further declines in the market indices but by less than the approximate 2,000 points decline on Friday, even as advancing stocks outnumbered declining ones.  Trading resulted in an average of 128,374 units valued at an average of $2,989,139 for each security traded. In contrast to 442,474 units for an average of $1,930,933 on Friday. For the month to date an average of 223,710 shares valued at an average of $4,528,884 versus 231,530 shares valued at an average of $4,665,985 on Friday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

Trading resulted in an average of 128,374 units valued at an average of $2,989,139 for each security traded. In contrast to 442,474 units for an average of $1,930,933 on Friday. For the month to date an average of 223,710 shares valued at an average of $4,528,884 versus 231,530 shares valued at an average of $4,665,985 on Friday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded. Mayberry Jamaica Euities jumped $1 to settle at an all-time closing high of $10, trading 349,204 units, PanJam Investment gained 40 cents and concluded trading 985 shares and closed at $52, Sagicor Real Estate Fund jumped $1.50 to $13.50, with 28,511 shares, Salada Foods shed 25 cents to close at $16.75, in exchanging 1,200 units, Scotia Group shed $1 in traded 83,372 shares to close at $52, Sygnus Credit Investments rose 40 cent to close at $10.50 in trading 11,629 shares and Wisynco Group rose 34 cents and finished trading 211,342 shares to end at $9.39.

Mayberry Jamaica Euities jumped $1 to settle at an all-time closing high of $10, trading 349,204 units, PanJam Investment gained 40 cents and concluded trading 985 shares and closed at $52, Sagicor Real Estate Fund jumped $1.50 to $13.50, with 28,511 shares, Salada Foods shed 25 cents to close at $16.75, in exchanging 1,200 units, Scotia Group shed $1 in traded 83,372 shares to close at $52, Sygnus Credit Investments rose 40 cent to close at $10.50 in trading 11,629 shares and Wisynco Group rose 34 cents and finished trading 211,342 shares to end at $9.39. At the close of trading on Thursday, the Jamaica Stock Exchange jumped more than 3,900 points to new record close with the All Jamaican Composite Index sitting less than 1,000 from the 350,000 mark.

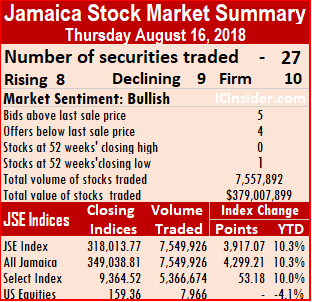

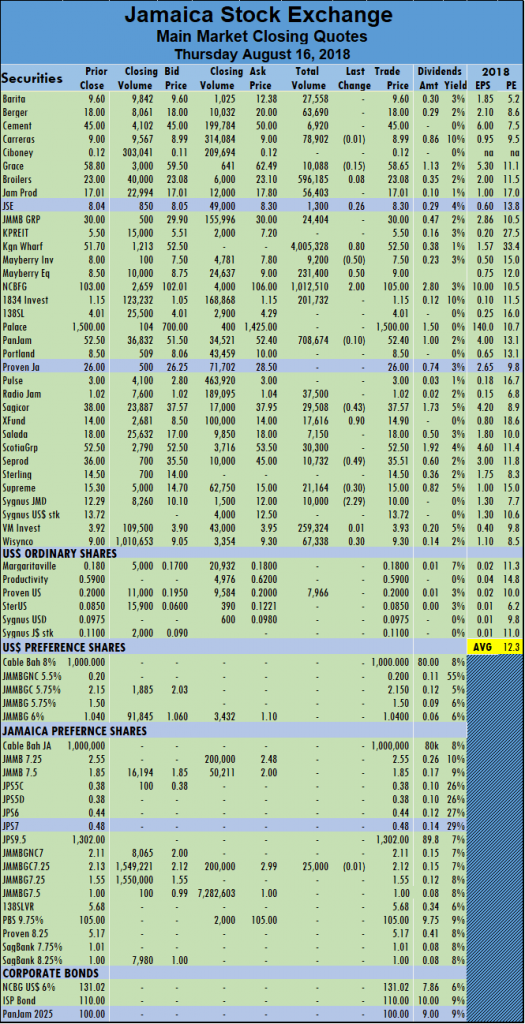

At the close of trading on Thursday, the Jamaica Stock Exchange jumped more than 3,900 points to new record close with the All Jamaican Composite Index sitting less than 1,000 from the 350,000 mark.

The day’s volume was led by,

The day’s volume was led by,  Trading in the US dollar market closed with 35,200 units valued at US$65,830 as JMMB Group 5.75% preference share rose 12 cents and closed at US$2.15 trading 35,200 shares and Margaritaville rose 1 cent in trading 5,000 shares at 18 US cents. The JSE USD Equities Index rose 0.47 points to 159.31.

Trading in the US dollar market closed with 35,200 units valued at US$65,830 as JMMB Group 5.75% preference share rose 12 cents and closed at US$2.15 trading 35,200 shares and Margaritaville rose 1 cent in trading 5,000 shares at 18 US cents. The JSE USD Equities Index rose 0.47 points to 159.31. The Jamaica Stock Exchange took another sizable jump to end at a record close on Thursday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.

The Jamaica Stock Exchange took another sizable jump to end at a record close on Thursday as advancing stocks out-numbered declining stocks in continuation of the market’s record bull run.  followed by Carreras with 899,233 units or just 11.42 percent of the day’s volume and JMMB Group 7.50% preference share with 500,000 units and 6.35 percent of the day’s volume.

followed by Carreras with 899,233 units or just 11.42 percent of the day’s volume and JMMB Group 7.50% preference share with 500,000 units and 6.35 percent of the day’s volume. completed trading of 16,500 stock units and rose 1 cent to end at $1.05,

completed trading of 16,500 stock units and rose 1 cent to end at $1.05,