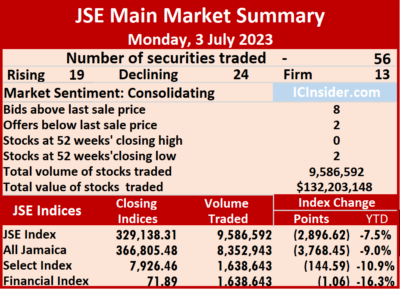

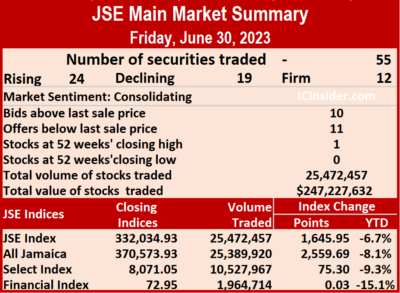

The Jamaica Stock Exchange Main Market suffered its first decline in four days as it started out the new month on a negative footing on Monday, with the volume of stocks traded declining 62 percent and the value 47 percent lower than on Friday and leading to trading in 56 securities compared with 55 on Friday and ended, with 19 rising, 24 declining and 13 ending unchanged.

A total of 9,586,592 shares were traded for $132,203,147 down from 25,472,457 units at $247,227,632 on Friday.

A total of 9,586,592 shares were traded for $132,203,147 down from 25,472,457 units at $247,227,632 on Friday.

Trading averaged 171,189 shares at $2,360,770 compared with 463,136 stock units at $4,495,048 on Friday. June closed with an average of 366,795 stock units at $6,952,581, including trading in the Corporate Bond section.

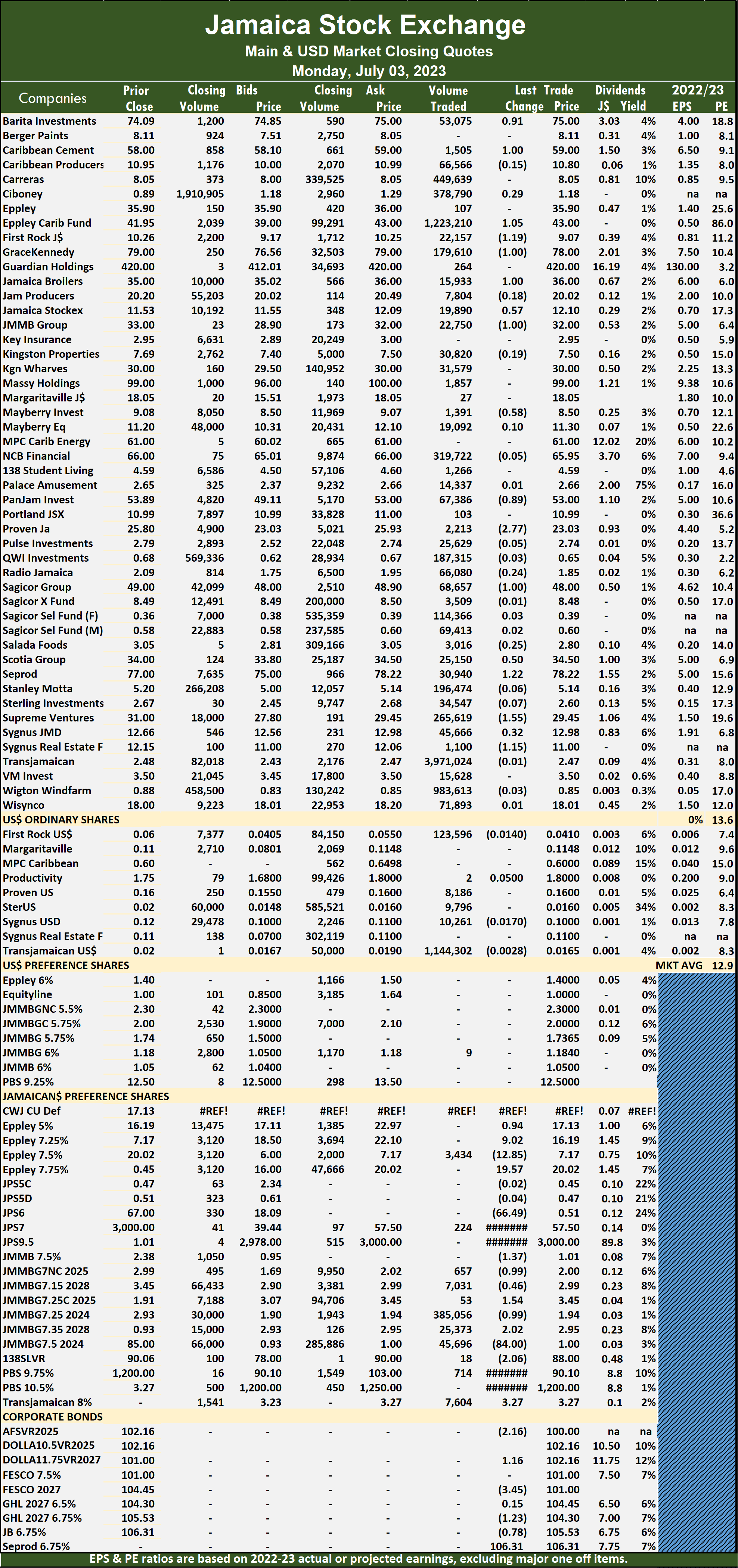

Transjamaican Highway led trading with 3.97 million shares with 41.4 percent of total volume, followed by Eppley Caribbean Property Fund with 1.22 million stock units for 12.8 percent of the day’s trade and Wigton Windfarm with 983,613 units for 10.3 percent market share.

The All Jamaican Composite Index dived 3,768.45 points to 366,805.48, the JSE Main Index dropped 2,896.62 points to 329,138.31 and the JSE Financial Index fell 1.06 points to settle at 71.89.

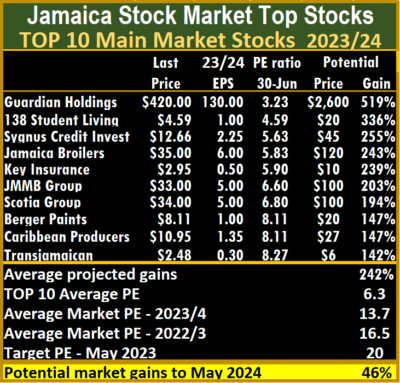

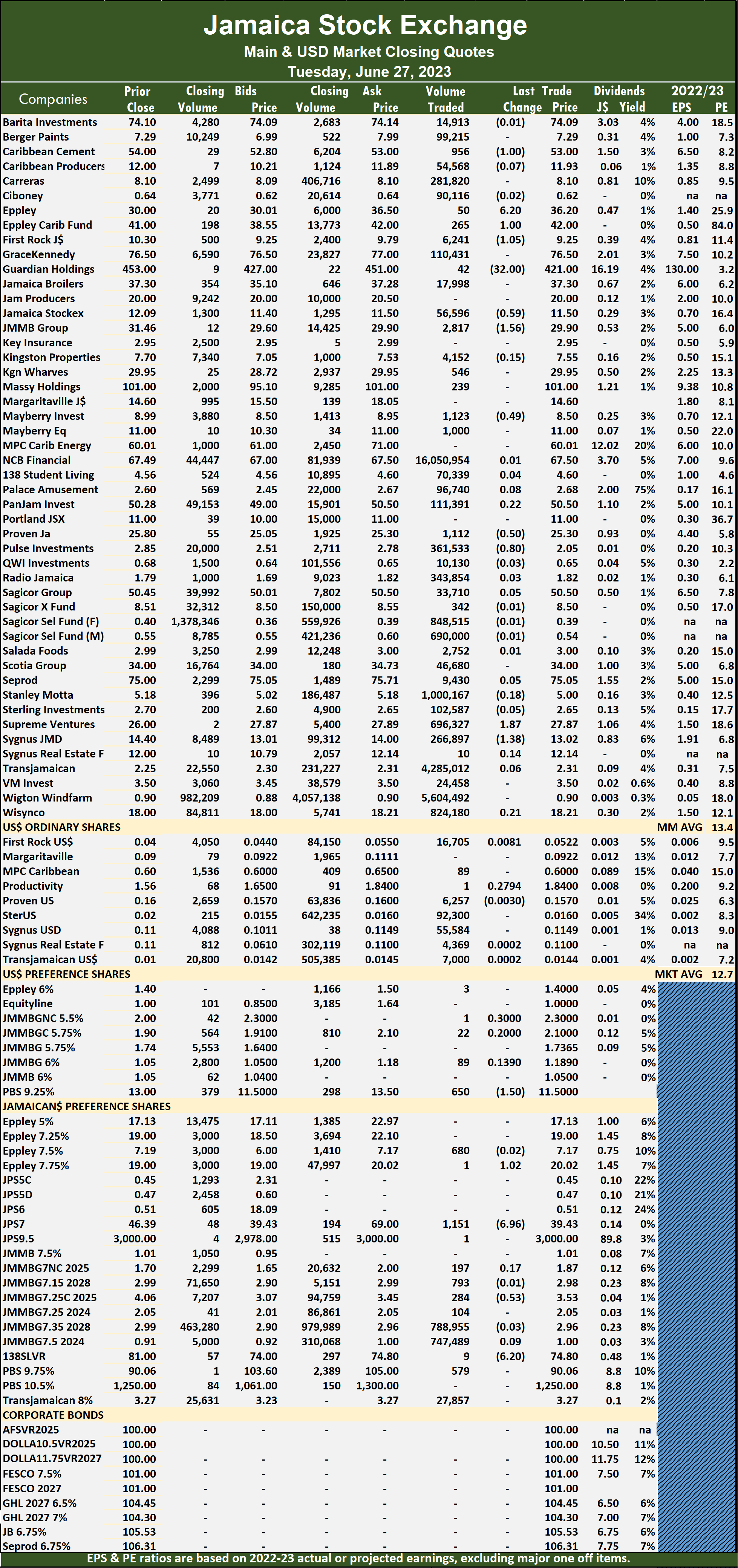

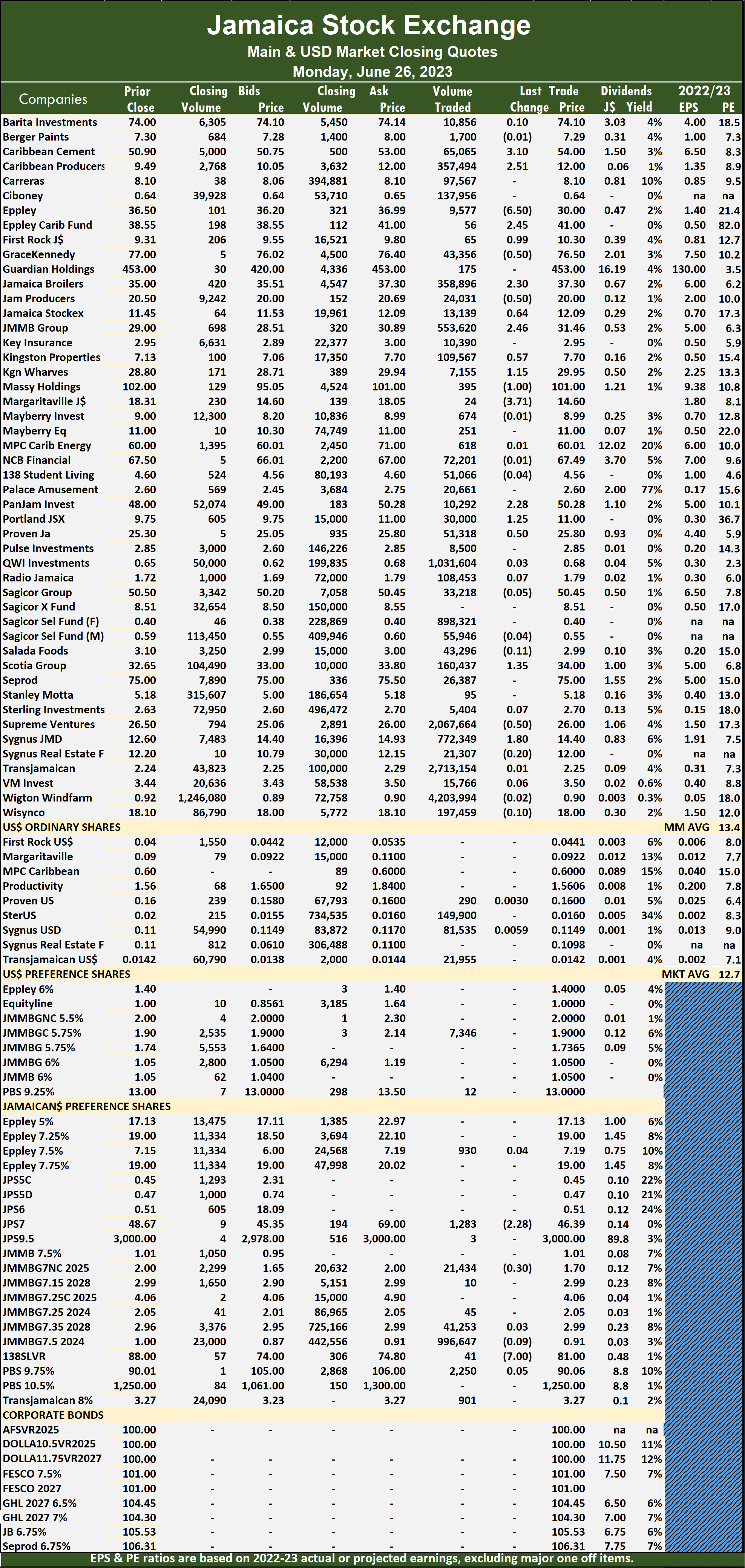

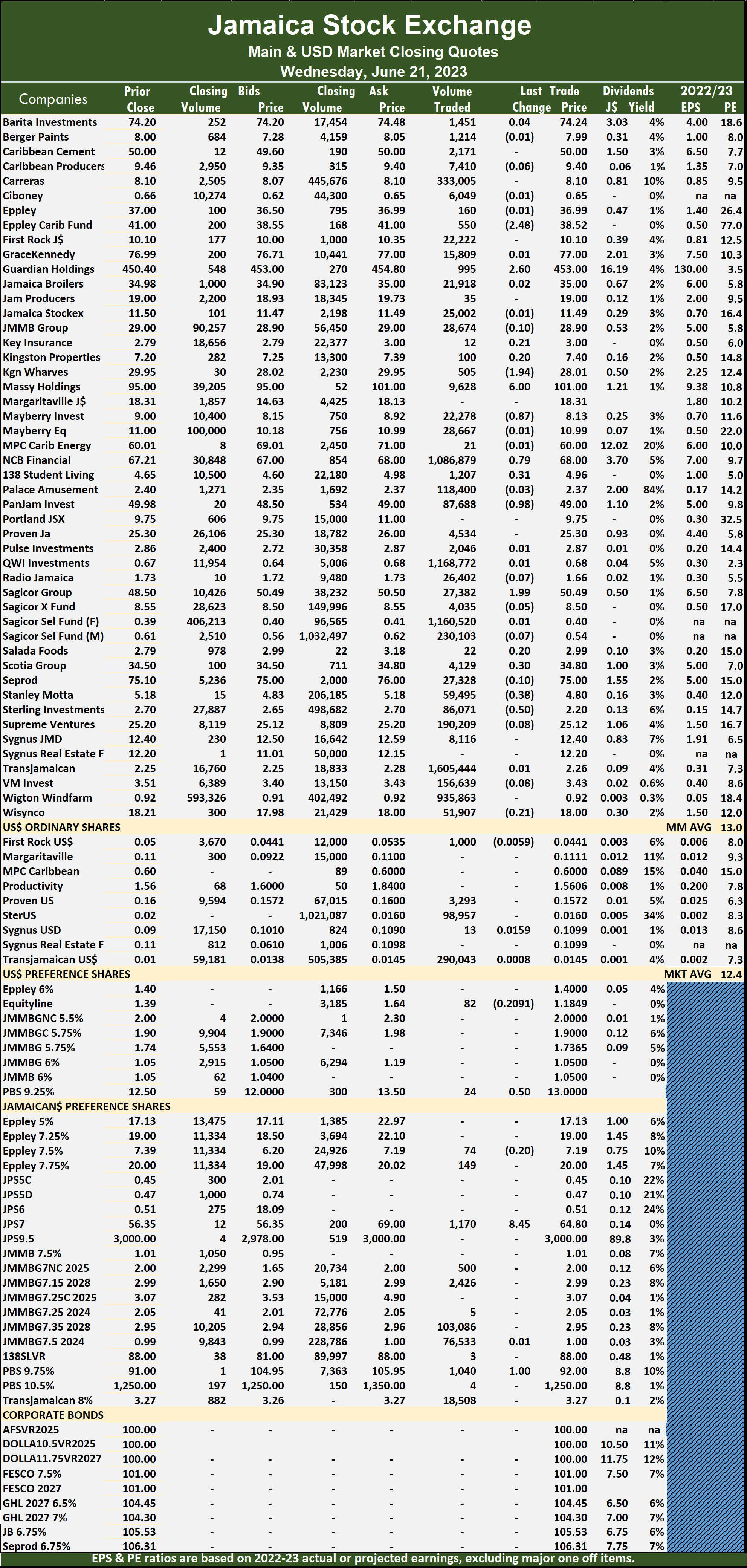

The PE Ratio, a formula used to compute appropriate stock values, averages 13.6 for the Main Market. The JSE  Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and two with lower offers.

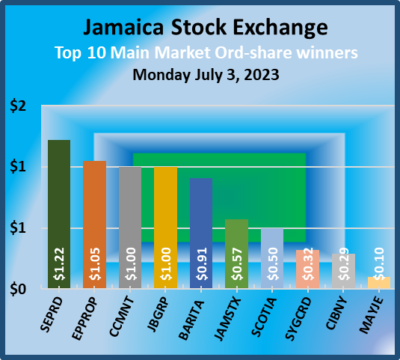

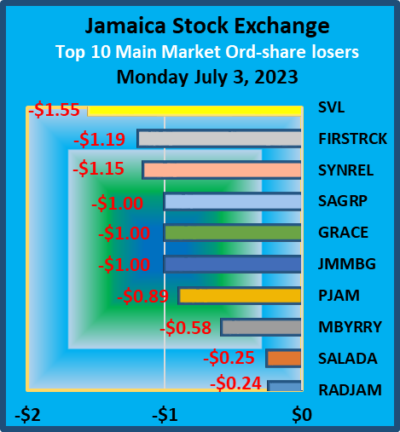

At the close, Barita Investments rose 91 cents in closing at $75 after an exchange of 53,075 shares, Caribbean Cement climbed $1 to $59, with 1,505 units changing hands, Eppley Caribbean Property Fund rallied $1.05 to close at $43 after 1,223,210 stocks passed through the market, First Rock Real Estate dropped $1.19 and ended at a 52 weeks’ low of $9.07 in trading 22,157 stock units. GraceKennedy dipped $1 to $78 with stakeholders exchanging 179,610 shares, Jamaica Broilers climbed $1 in closing at $36, with an exchange of 15,933 stock units, Jamaica Stock Exchange popped 57 cents and ended at $12.10, with 19,890 stocks crossing the market, JMMB Group declined $1 to end at $32 in switching ownership of 22,750 units. Mayberry Investments lost 58 cents to close at $8.50 after an exchange of 1,391 shares,  NCB Financial traded 319,722 shares and lost 5 cents in closing at a 52 weeks’ low of $65.95, Pan Jamaica fell 89 cents to close at $53 as investors traded 67,386 units. Proven Investments shed $2.77 to end at $23.03 after an exchange of 2,213 stock units, Sagicor Group declined $1 to close at $48 with a transfer of 68,657 stocks, Scotia Group increased 50 cents to $34.50, with 25,150 units crossing the market. Seprod gained $1.22 to end at $78.22 while investors traded 30,940 shares, Supreme Ventures fell $1.55 to $29.45 with a transfer of 265,619 stocks, Sygnus Credit Investments rallied 32 cents to close at $12.98 after 45,666 stock units crossed the exchange and Sygnus Real Estate Finance dipped $1.15 to $11 trading 1,100 shares.

NCB Financial traded 319,722 shares and lost 5 cents in closing at a 52 weeks’ low of $65.95, Pan Jamaica fell 89 cents to close at $53 as investors traded 67,386 units. Proven Investments shed $2.77 to end at $23.03 after an exchange of 2,213 stock units, Sagicor Group declined $1 to close at $48 with a transfer of 68,657 stocks, Scotia Group increased 50 cents to $34.50, with 25,150 units crossing the market. Seprod gained $1.22 to end at $78.22 while investors traded 30,940 shares, Supreme Ventures fell $1.55 to $29.45 with a transfer of 265,619 stocks, Sygnus Credit Investments rallied 32 cents to close at $12.98 after 45,666 stock units crossed the exchange and Sygnus Real Estate Finance dipped $1.15 to $11 trading 1,100 shares.

In the preference segment, Jamaica Public Service 7% shed $9.50 and ended at $57.50 in an exchange of 224 stock units, JMMB Group 7% preference share fell 38 cents to $2 with 657 units changing hands and 138 Student Living preference share advanced $3 in closing at $88 with shareholders swapping 18 stocks.

In the preference segment, Jamaica Public Service 7% shed $9.50 and ended at $57.50 in an exchange of 224 stock units, JMMB Group 7% preference share fell 38 cents to $2 with 657 units changing hands and 138 Student Living preference share advanced $3 in closing at $88 with shareholders swapping 18 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big gains for ICTOP10 stocks

Movement in the Junior Market this past week just about wiped out all of 2023 losses and resulted in most ICITOP10 stocks rising, with four recording double digit gains as the Junior Market consolidates around the 3,900 points level before breaking into the 4,000 points level. The Main Market enjoyed five out of 6 days of gains since the previous Friday and delivered four stocks with double digit gains.

Gains for the Junior Market this week occurred even as the price of Stationery and Office Supplies dropped $4.52 from $28 to $23.48 on Friday and former Caribbean Assurance Brokers ICTOP10 stock that fell out of the top tier the prior week pulled back in price to close at $3.30 from $4 as sellers offered stocks for sale below $4, with still more selling at the close of the week. History points to many investors buying into stocks after the split takes effect, usually at far higher prices than if they bought before, as such, it would not be surprising that investors will push the stock to a record valuation post-split. Accordingly, the stock now selling at a PE of 12.4 times current year’s earnings is a compelling buy at Friday’s price of $23.48.

Gains for the Junior Market this week occurred even as the price of Stationery and Office Supplies dropped $4.52 from $28 to $23.48 on Friday and former Caribbean Assurance Brokers ICTOP10 stock that fell out of the top tier the prior week pulled back in price to close at $3.30 from $4 as sellers offered stocks for sale below $4, with still more selling at the close of the week. History points to many investors buying into stocks after the split takes effect, usually at far higher prices than if they bought before, as such, it would not be surprising that investors will push the stock to a record valuation post-split. Accordingly, the stock now selling at a PE of 12.4 times current year’s earnings is a compelling buy at Friday’s price of $23.48.

The Junior Market ended the week with eight stocks rising and one declining, with Iron Rock Insurance the top stock, with a gain of 30 percent, followed by iCreate, up 21 percent to $1.10, and Caribbean Cream, up 18% to $4.70, but the company will be benefitting from lower input cost of some raw material, especially the price of milk solids that have fallen sharply by about 33 percent from peak prices last year March, Consolidated Bakeries popped 15% to end the week at $2.51, with very few stock offered for sale in the market at the close. The gains in Consolidated Bakeries propelled it out of the TOP10 and replaced by Edufocal, while OneonOne seems to be coming into its own with a rise of 9 percent to $1.22. In comparison, Dolphin Cove rose 6 percent to $16.90 but seems to have a seller with an undisclosed amount at that price. Dolla Financial is the only loser, with a decline of 4 percent to $2.25.

The Main Market had Caribbean Producers (CPJ) rising 15 percent to $10.95, JMMB Group climbing 14 percent to $33, with Berger Paints and Transjamaican gaining 11 percent each to close at $8.11 and a record close of $2.48, respectively. Guardian Holdings was the only declining stock, falling 7 percent to $420.

The Main Market had Caribbean Producers (CPJ) rising 15 percent to $10.95, JMMB Group climbing 14 percent to $33, with Berger Paints and Transjamaican gaining 11 percent each to close at $8.11 and a record close of $2.48, respectively. Guardian Holdings was the only declining stock, falling 7 percent to $420.

It is worth noting that Transjamaican US dollar denominated stock traded at 1.93 cents or almost $3 per share on Friday, putting well ahead of the local based issue at $2.48. The gap will close sooner or later, the question will the Jamaican dollar based stock move up to the $3 level or the US based one fall back to match the Jamaican dollar one. There is minimal selling in the US dollar market and much more in the Jamaican market.

CPJ sits at the number 10 position in the Main Market TOP 10, but it has a June year end, with the changeover to earnings per share for the 2023/4 fiscal year of $2.50 by August that will change the outlook for the price markedly above the current level, with the PE ratio at just 4.4.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 6.3, well below the market average of 13.7. The Main Market TOP10 is projected to have an average of 242 percent, to May 2024, based on 2023 forecasted earnings.

The 15 most highly valued Main Market stocks are priced at a PE of 15 to 110, with an average of 29 and 20 excluding the highest PE stocks, 24 for the top half and 19 excluding the stocks with the highest PEs.

The Junior Market Top 10 PE sits at 5.8 compared with the market at 11.7. There are 11 stocks representing 23 percent of the market, with PEs from 15 to 44, averaging 21, well above the market’s average. The top half of the market has an average PE of 17, possibly the lowest fair value for Junior Market stocks currently. Junior Market is projected to rise by 245 percent to May 2024.

The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

In the market generally, Investors continue to nibble away at a number of stocks and, in the process, gradually reduce the supply of several stocks that are attractively priced as the market moves toward the summer months, the start of the stock market year.

ICTOP10 focuses on likely yearly winners. Accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Carib Brokers gains 54% & drops ICTOP10

The Junior Market was buoyed by strong movement in shares of Stationery and Office Supplies following the announcement of a proposed stock split that turned out to be 9 for each outstanding share and following ICInsider.com report last week that the stock was a prime candidate for a stock split, the stock rated stock to watch in January, climbed 100 percent since the start of the year but pulled back on Friday following profit taking.

Elsewhere, Caribbean Assurance Brokers jumped 54 percent to close at $4 following the drying up of selling stocks being offered for sale. The stock dropped out of the ICTOP10 and is replaced by Dolla Financial. In the Main Market, Caribbean Cement dropped out of the TOP10 with a 3 percent rise to $50.90 and was replaced by Transjamaican following a fall in price from $2.39 to close the week at $2.24 after hitting a low for the week at $2.

Elsewhere, Caribbean Assurance Brokers jumped 54 percent to close at $4 following the drying up of selling stocks being offered for sale. The stock dropped out of the ICTOP10 and is replaced by Dolla Financial. In the Main Market, Caribbean Cement dropped out of the TOP10 with a 3 percent rise to $50.90 and was replaced by Transjamaican following a fall in price from $2.39 to close the week at $2.24 after hitting a low for the week at $2.

The Junior Market reclaimed the 3,900 handle, following the reclaiming of the 3,800 at the end of the previous week and in the process is just one percent below the end of December last year and is close to retaking the 4,000 level, as technical indicators pointing to the market now at an early stage of a big rally in the second half of the year, following a 10 percent gain since the low for the year in March, suggesting a possible gain in excess of 30 percent for the year.

The Junior Market ended with 4 stocks rising and three declining during the week, with Caribbean Assurance Brokers the lead the stock, followed by One and One, that is up 8 percent to $1.12 and Caribbean Cream up 3% to $4, while iCreate dropped 24% to 91 cents and Consolidated Bakeries dropped 10% to end the week at $2.19. The Main Market had only moderate price movement with none exceeding 3%.

At the end of the week, the average PE for the JSE Main MarketTOP 10 is 5.8, well below the market average of 13.1. The Main Market TOP10 is projected to have an average of 253 percent, by May 2024, based on 2023 forecasted earnings.

At the end of the week, the average PE for the JSE Main MarketTOP 10 is 5.8, well below the market average of 13.1. The Main Market TOP10 is projected to have an average of 253 percent, by May 2024, based on 2023 forecasted earnings.

The 15 most highly valued Main Market stocks are priced at a PE of 15 to 98, with an average of 28 and 19 excluding the highest PE stocks, 23 for the top half and 18 excluding the stocks with the highest PEs.

The Junior Market Top 10 PE sits at 5.8 compared with the market at 11.3. There are 11 stocks representing 23 percent of the market, with PEs from 15 to 44, averaging 20 that are well above the average of the market. The top half of the market has an average PE of 16, possibly the lowest fair value for Junior Market stocks currently. Junior Market is projected to rise by 276 percent to May 2024.

The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the level of likely gains for ICTOP10 stocks.

In the market generally, Investors continue to nibble away at a number of stocks and in the process gradually reduce the supply of several stocks that are attractively priced as the market moves toward the summer months, the start of the stock market year.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

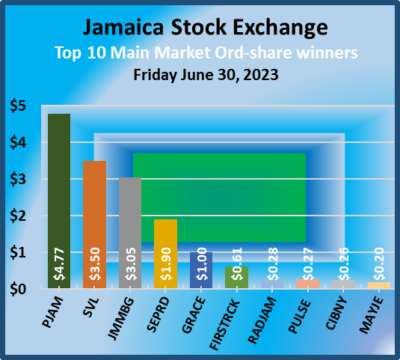

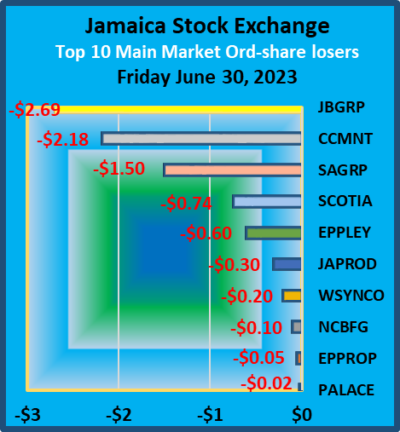

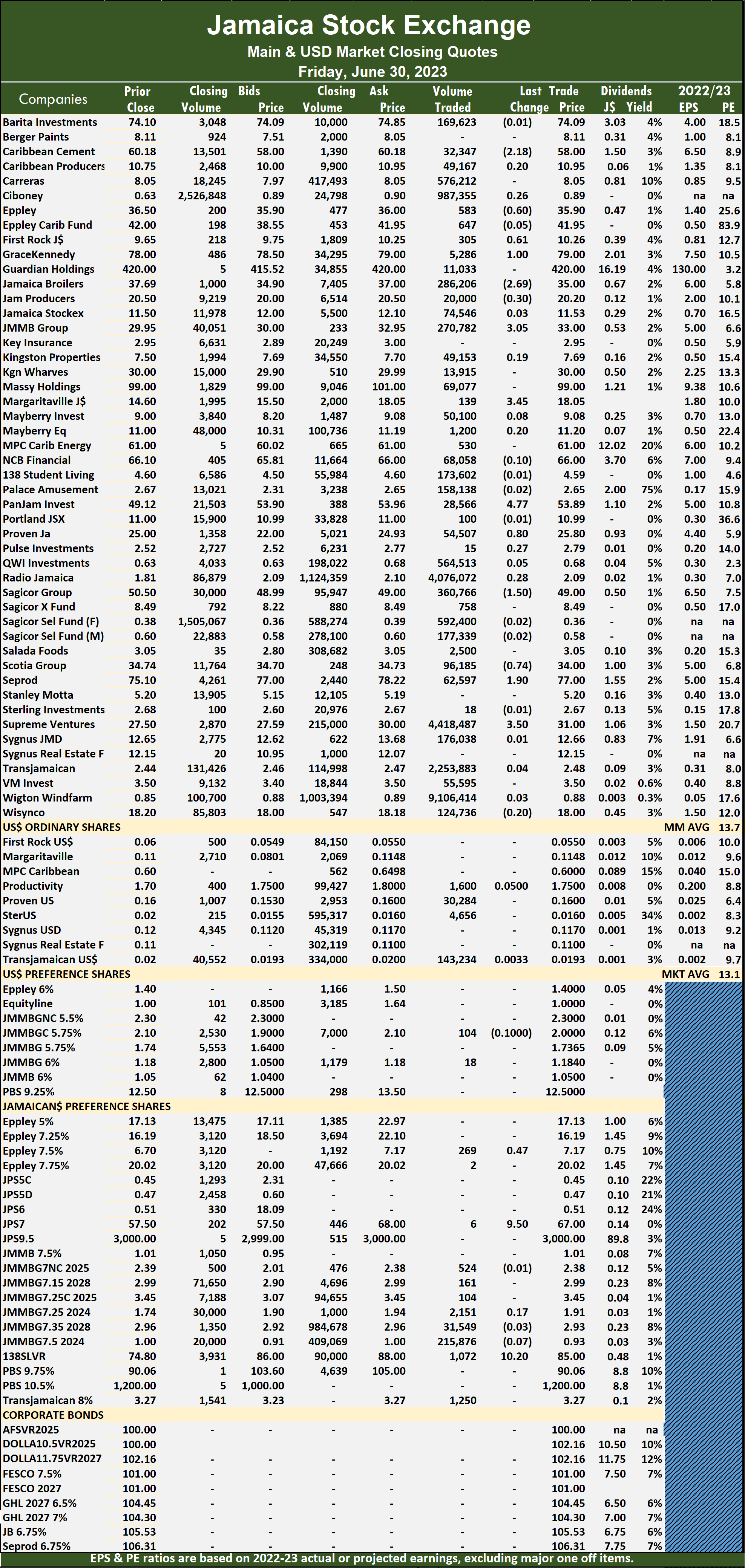

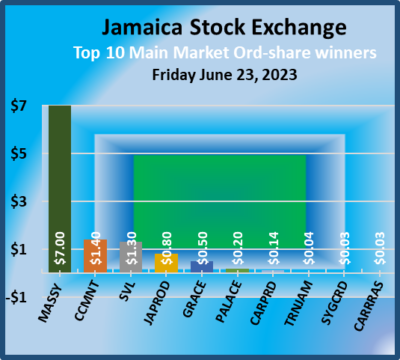

A total of 25,472,457 shares were traded for $247,227,632 compared to 22,306,090 units at $206,410,617 on Thursday.

A total of 25,472,457 shares were traded for $247,227,632 compared to 22,306,090 units at $206,410,617 on Thursday. The All Jamaican Composite Index jumped 2,559.69 points to 370,573.93, the JSE Main Index climbed 1,645.95 points to settle at 332,034.93 and the JSE Financial Index popped 0.03 points to close at 72.95.

The All Jamaican Composite Index jumped 2,559.69 points to 370,573.93, the JSE Main Index climbed 1,645.95 points to settle at 332,034.93 and the JSE Financial Index popped 0.03 points to close at 72.95. GraceKennedy rose $1 to end at $79 after 5,286 stock units changed hands, Jamaica Broilers lost $2.69 and ended at $35 as 286,206 units passed through the market, Jamaica Producers declined 30 cents and closed at $20.20, with trading in 20,000 shares, JMMB Group climbed $3.05 to $33 in an exchange of 270,782 stock units, Margaritaville rallied $3.45 to $18.05 in an exchange of 139 stocks, Pan Jamaica gained $4.77 to close at $53.89 after a transfer of 28,566 stocks, Proven Investments increased 80 cents to end at $25.80 with an exchange of 54,507 shares, Sagicor Group shed $1.50 in closing at $49 with 360,766 units clearing the market, Scotia Group dipped 74 cents to $34, with stakeholders exchanging 96,185 stock units, Seprod advanced $1.90 to $77 as investors exchanged 62,597 stocks, Supreme Ventures jumped $3.50 to end at $31 after 4,418,487 stock units crossed the exchange.

GraceKennedy rose $1 to end at $79 after 5,286 stock units changed hands, Jamaica Broilers lost $2.69 and ended at $35 as 286,206 units passed through the market, Jamaica Producers declined 30 cents and closed at $20.20, with trading in 20,000 shares, JMMB Group climbed $3.05 to $33 in an exchange of 270,782 stock units, Margaritaville rallied $3.45 to $18.05 in an exchange of 139 stocks, Pan Jamaica gained $4.77 to close at $53.89 after a transfer of 28,566 stocks, Proven Investments increased 80 cents to end at $25.80 with an exchange of 54,507 shares, Sagicor Group shed $1.50 in closing at $49 with 360,766 units clearing the market, Scotia Group dipped 74 cents to $34, with stakeholders exchanging 96,185 stock units, Seprod advanced $1.90 to $77 as investors exchanged 62,597 stocks, Supreme Ventures jumped $3.50 to end at $31 after 4,418,487 stock units crossed the exchange. In the preference segment, Eppley 7.50% preference share gained 47 cents to close at $7.17 in trading 269 shares, Jamaica Public Service 7% advanced $9.50 to close at $67 with investors transferring 6 units and 138 Student Living preference share rallied $10.20 ended at $85 with trading in 1,072 shares.

In the preference segment, Eppley 7.50% preference share gained 47 cents to close at $7.17 in trading 269 shares, Jamaica Public Service 7% advanced $9.50 to close at $67 with investors transferring 6 units and 138 Student Living preference share rallied $10.20 ended at $85 with trading in 1,072 shares. A total of 22,105,112 shares were traded for $190,093,496, compared to 33,792,800 units at $1,151,873,370 on Tuesday.

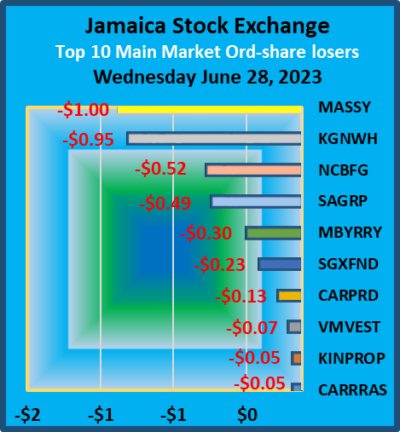

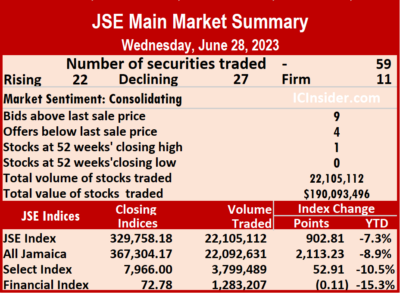

A total of 22,105,112 shares were traded for $190,093,496, compared to 33,792,800 units at $1,151,873,370 on Tuesday. The All Jamaican Composite Index rose 2,113.23 points to end at 367,304.17, the JSE Main Index popped 902.81 points to 329,758.18 and the JSE Financial Index dipped 0.11 points to end at 72.78.

The All Jamaican Composite Index rose 2,113.23 points to end at 367,304.17, the JSE Main Index popped 902.81 points to 329,758.18 and the JSE Financial Index dipped 0.11 points to end at 72.78. Jamaica Producers rose 50 cents in closing at $20.50 with stakeholders trading 889,716 units, Kingston Wharves fell 95 cents to $29, with 3,005,614 stocks changing hands, Massy Holdings declined $1 and ended at $100 after an exchange of 4,001 shares. Mayberry Investments dipped 30 cents to $8.20 in trading 12,349 stocks, MPC Caribbean Clean Energy popped $10.99 to end at $71 with investors transferring 2,479 shares, NCB Financial dropped 52 cents to end at $66.98 with a transfer of 223,094 units, Pan Jamaica increased $3.45 to $53.95 in switching ownership of 33,947 stock units, Proven Investments climbed 48 cents to $25.78 in an exchange of 7,723 stocks. Pulse Investments rallied 47 cents in closing at $2.52 after trading in 136,273 stock units, Sagicor Group fell 49 cents to close at $50.01 after 6,044 shares changed hands, Seprod popped 45 cents to end at $75.50 in trading 3,898 units and Supreme Ventures rose 60 cents and ended at $28.47 after 98,942 units crossed the exchange.

Jamaica Producers rose 50 cents in closing at $20.50 with stakeholders trading 889,716 units, Kingston Wharves fell 95 cents to $29, with 3,005,614 stocks changing hands, Massy Holdings declined $1 and ended at $100 after an exchange of 4,001 shares. Mayberry Investments dipped 30 cents to $8.20 in trading 12,349 stocks, MPC Caribbean Clean Energy popped $10.99 to end at $71 with investors transferring 2,479 shares, NCB Financial dropped 52 cents to end at $66.98 with a transfer of 223,094 units, Pan Jamaica increased $3.45 to $53.95 in switching ownership of 33,947 stock units, Proven Investments climbed 48 cents to $25.78 in an exchange of 7,723 stocks. Pulse Investments rallied 47 cents in closing at $2.52 after trading in 136,273 stock units, Sagicor Group fell 49 cents to close at $50.01 after 6,044 shares changed hands, Seprod popped 45 cents to end at $75.50 in trading 3,898 units and Supreme Ventures rose 60 cents and ended at $28.47 after 98,942 units crossed the exchange. In the preference segment, Productive Business 10.50% preference share lost $50 to close at $1200 in an exchange of 131 stock units, Eppley 7.25% preference share dipped $2.81 to $16.19 with one stock changing hands. Eppley 7.50% preference share lost $1.08 in closing at $6.09 after a transfer of 1,000 shares, Jamaica Public Service 7% advanced $10.57 to close at $50 with an exchange of 8 stock units and JMMB Group 7.25% due 2024 preference share declined 31 cents to $1.74, with 133,290 stocks crossing the market.

In the preference segment, Productive Business 10.50% preference share lost $50 to close at $1200 in an exchange of 131 stock units, Eppley 7.25% preference share dipped $2.81 to $16.19 with one stock changing hands. Eppley 7.50% preference share lost $1.08 in closing at $6.09 after a transfer of 1,000 shares, Jamaica Public Service 7% advanced $10.57 to close at $50 with an exchange of 8 stock units and JMMB Group 7.25% due 2024 preference share declined 31 cents to $1.74, with 133,290 stocks crossing the market. A total of 33,792,800 shares were traded for $1,151,873,370 compared to 15,466,316 units at $140,081,944 on Monday.

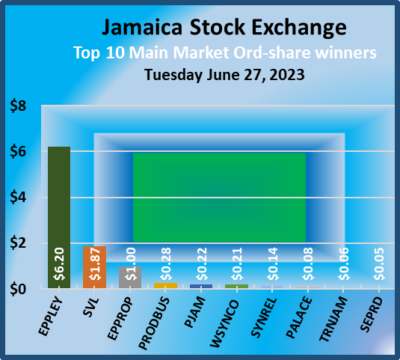

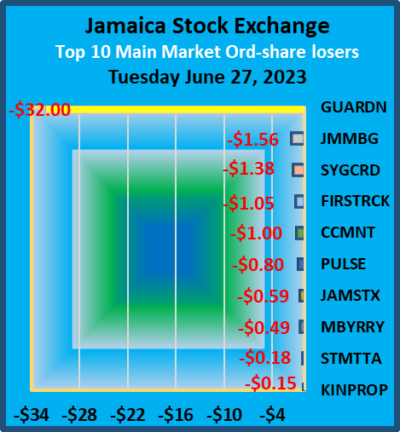

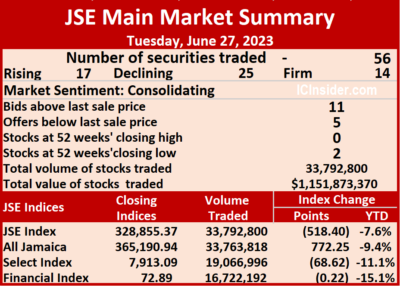

A total of 33,792,800 shares were traded for $1,151,873,370 compared to 15,466,316 units at $140,081,944 on Monday. The All Jamaican Composite Index rose 772.25 points to 365,190.94, the JSE Main Index fell 518.40 points to 328,855.37 and the JSE Financial Index slipped 0.22 points to 72.89.

The All Jamaican Composite Index rose 772.25 points to 365,190.94, the JSE Main Index fell 518.40 points to 328,855.37 and the JSE Financial Index slipped 0.22 points to 72.89. First Rock Real Estate dropped $1.05 to $9.25 with a transfer of 6,241 units, Guardian Holdings dived $32 to a 52 weeks’ closing low of $421 as investors traded 42 shares, Jamaica Stock Exchange lost 59 cents in closing at $11.50 with investors trading 56,596 stock units. JMMB Group dropped $1.56 and ended at $29.90 after an exchange of 2,817 stocks, Mayberry Investments fell 49 cents to close at $8.50 after a transfer of 1,123 units, Proven Investments lost 50 cents in closing at $25.30 while exchanging 1,112 stock units. Pulse Investments dropped 80 cents to end at $2.05 with shareholders swapping 361,533 shares, Supreme Ventures climbed $1.87 to end at $27.87 after exchanging 696,327 units and Sygnus Credit Investments fell $1.38 and ended at $13.02 with an exchange of 266,897 stocks.

First Rock Real Estate dropped $1.05 to $9.25 with a transfer of 6,241 units, Guardian Holdings dived $32 to a 52 weeks’ closing low of $421 as investors traded 42 shares, Jamaica Stock Exchange lost 59 cents in closing at $11.50 with investors trading 56,596 stock units. JMMB Group dropped $1.56 and ended at $29.90 after an exchange of 2,817 stocks, Mayberry Investments fell 49 cents to close at $8.50 after a transfer of 1,123 units, Proven Investments lost 50 cents in closing at $25.30 while exchanging 1,112 stock units. Pulse Investments dropped 80 cents to end at $2.05 with shareholders swapping 361,533 shares, Supreme Ventures climbed $1.87 to end at $27.87 after exchanging 696,327 units and Sygnus Credit Investments fell $1.38 and ended at $13.02 with an exchange of 266,897 stocks. In the preference segment, Eppley 7.75% preference share advanced $1.02 to $20.02 with stakeholders exchanging one stock, Jamaica Public Service 7% declined $6.96 to close at $39.43 in trading 1,151 stock units, JMMB Group 7.25% preference share dipped 53 cents in closing at $3.53 and closed at 284 shares and 138 Student Living preference share shed $6.20 in closing at $74.80 in an exchange of 9 units.

In the preference segment, Eppley 7.75% preference share advanced $1.02 to $20.02 with stakeholders exchanging one stock, Jamaica Public Service 7% declined $6.96 to close at $39.43 in trading 1,151 stock units, JMMB Group 7.25% preference share dipped 53 cents in closing at $3.53 and closed at 284 shares and 138 Student Living preference share shed $6.20 in closing at $74.80 in an exchange of 9 units. The All Jamaican Composite Index advanced 2,765.06 points to end at 364,418.69, the JSE Main Index rose 1,421.14 points to 329,373.77 and the JSE Financial Index inched 0.18 points higher to 73.11.

The All Jamaican Composite Index advanced 2,765.06 points to end at 364,418.69, the JSE Main Index rose 1,421.14 points to 329,373.77 and the JSE Financial Index inched 0.18 points higher to 73.11. The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

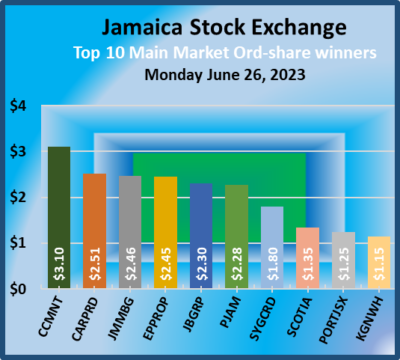

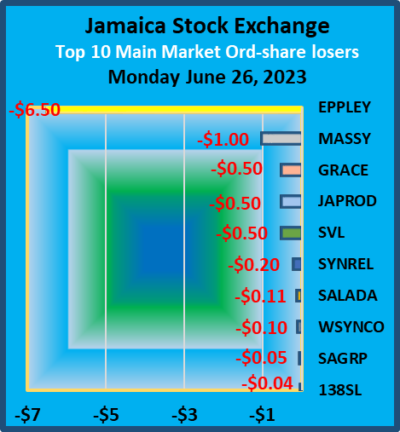

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. Jamaica Stock Exchange advanced 64 cents to $12.09 after a transfer of 13,139 stock units, JMMB Group rose $2.46 to end at $31.46 in an exchange of 553,620 stocks, Kingston Properties climbed 57 cents to close at $7.70 while exchanging 109,567 units. Kingston Wharves rose $1.15 in closing at $29.95 as 7,155 shares passed through the market, Margaritaville dropped $3.71 and ended at $14.60 with investors trading 24 stocks, Massy Holdings dipped $1 to $101, with 395 stock units crossing the market. Pan Jamaica popped $2.28 to end at $50.28 as investors exchanged 10,292 units, Portland JSX rose $1.25 in closing at $11 in an exchange of 30,000 shares. Proven Investments gained 50 cents to $25.80 with stakeholders exchanging 51,318 shares, Scotia Group rallied $1.35 to end at $34 after an exchange of 160,437 stocks, Supreme Ventures lost 50 cents in ending at $26, with 2,067,664 units crossing the market and Sygnus Credit Investments increased $1.80 to close at $14.40 changing hands 772,349 stock units.

Jamaica Stock Exchange advanced 64 cents to $12.09 after a transfer of 13,139 stock units, JMMB Group rose $2.46 to end at $31.46 in an exchange of 553,620 stocks, Kingston Properties climbed 57 cents to close at $7.70 while exchanging 109,567 units. Kingston Wharves rose $1.15 in closing at $29.95 as 7,155 shares passed through the market, Margaritaville dropped $3.71 and ended at $14.60 with investors trading 24 stocks, Massy Holdings dipped $1 to $101, with 395 stock units crossing the market. Pan Jamaica popped $2.28 to end at $50.28 as investors exchanged 10,292 units, Portland JSX rose $1.25 in closing at $11 in an exchange of 30,000 shares. Proven Investments gained 50 cents to $25.80 with stakeholders exchanging 51,318 shares, Scotia Group rallied $1.35 to end at $34 after an exchange of 160,437 stocks, Supreme Ventures lost 50 cents in ending at $26, with 2,067,664 units crossing the market and Sygnus Credit Investments increased $1.80 to close at $14.40 changing hands 772,349 stock units. In the preference segment, Jamaica Public Service 7% dropped $2.28 in closing at $46.39 while trading 1,283 stocks, JMMB Group 7% preference share fell 30 cents to $1.70 with shareholders swapping 21,434 shares and 138 Student Living preference share lost $7 to end at $81 after 41 stock units passed through the market.

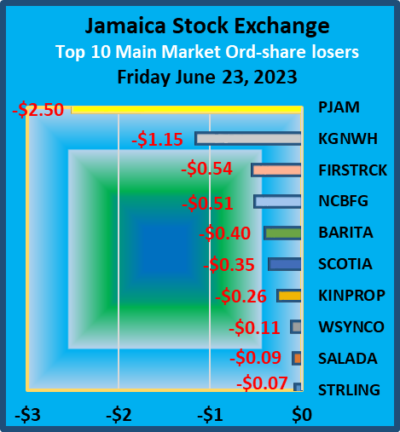

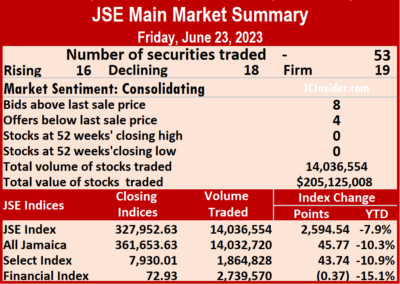

In the preference segment, Jamaica Public Service 7% dropped $2.28 in closing at $46.39 while trading 1,283 stocks, JMMB Group 7% preference share fell 30 cents to $1.70 with shareholders swapping 21,434 shares and 138 Student Living preference share lost $7 to end at $81 after 41 stock units passed through the market. A total of 14,036,554 shares were traded for $205,125,008 compared to 24,710,357 units at $217,998,595 on Thursday.

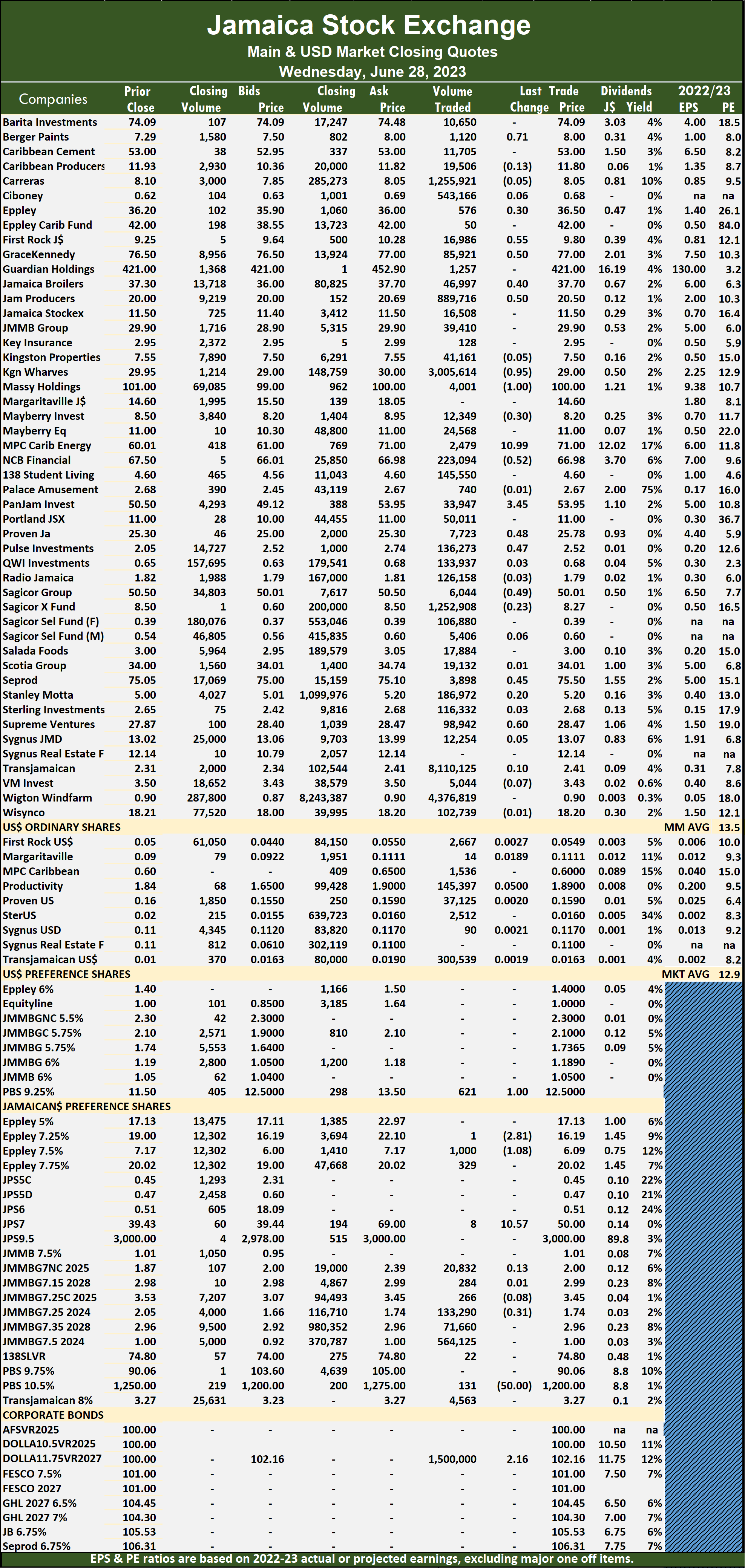

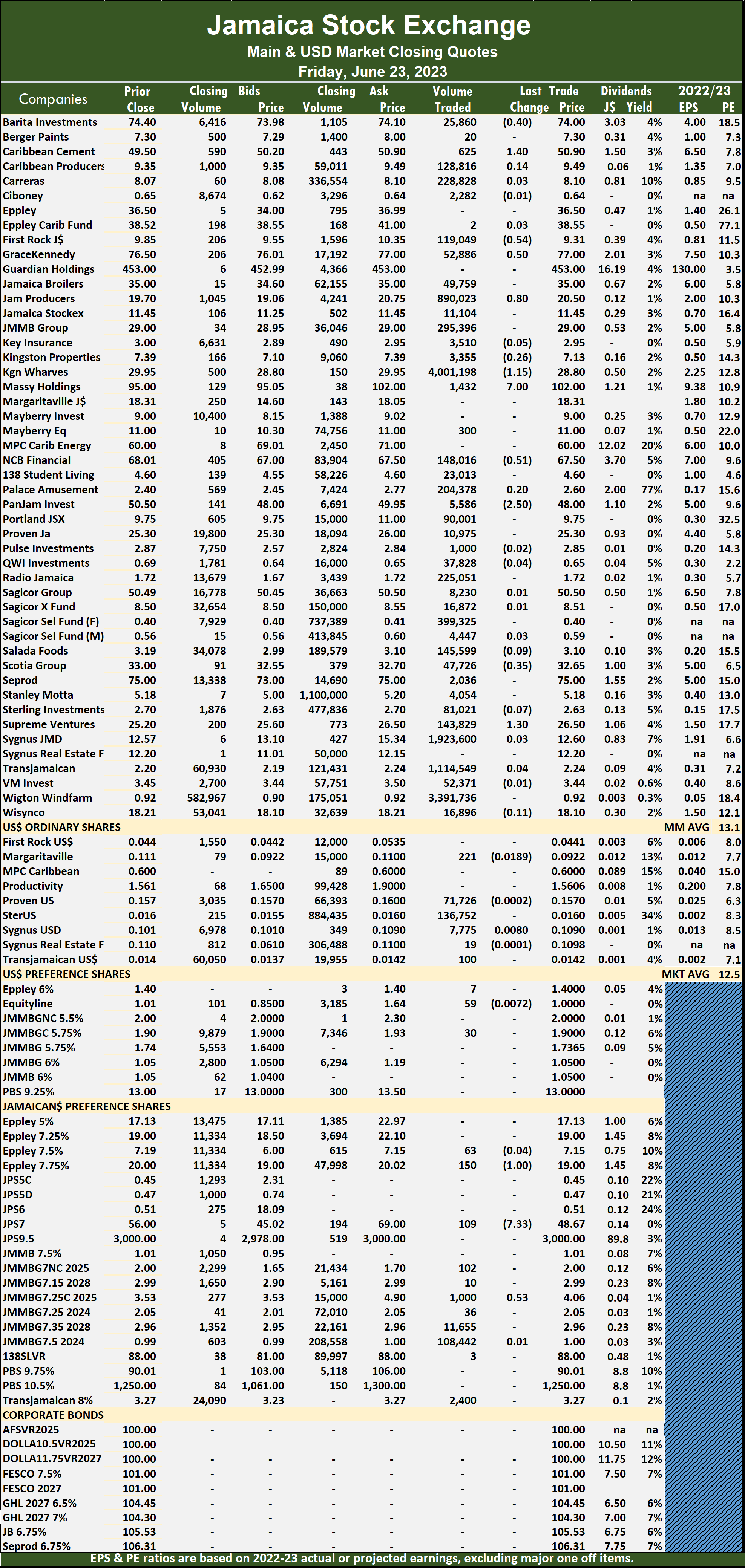

A total of 14,036,554 shares were traded for $205,125,008 compared to 24,710,357 units at $217,998,595 on Thursday. The PE Ratio, a formula used to compute appropriate stock values, averages 12.9 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

The PE Ratio, a formula used to compute appropriate stock values, averages 12.9 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. Kingston Wharves shed $1.15 and ended at $28.80 in an exchange of 4,001,198 shares, Massy Holdings climbed $7 to $102 in trading 1,432 stocks, NCB Financial lost 51 cents to close at $67.50 after an exchange of 148,016 stock units, Pan Jamaica fell $2.50 in closing at $48 with a transfer of 5,586 stock units, Scotia Group declined 35 cents to end at $32.65, with 47,726 shares crossing the market and Supreme Ventures advanced $1.30 in closing at $26.50 after a transfer of 143,829 units.

Kingston Wharves shed $1.15 and ended at $28.80 in an exchange of 4,001,198 shares, Massy Holdings climbed $7 to $102 in trading 1,432 stocks, NCB Financial lost 51 cents to close at $67.50 after an exchange of 148,016 stock units, Pan Jamaica fell $2.50 in closing at $48 with a transfer of 5,586 stock units, Scotia Group declined 35 cents to end at $32.65, with 47,726 shares crossing the market and Supreme Ventures advanced $1.30 in closing at $26.50 after a transfer of 143,829 units. Jamaica Public Service 7% declined $7.33 to $48.67 after stakeholders exchanged 109 units and JMMB Group 7.25% preference share increased 53 cents to close at $4.06 with an exchange of 1,000 shares.

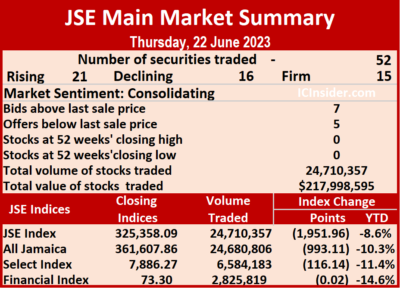

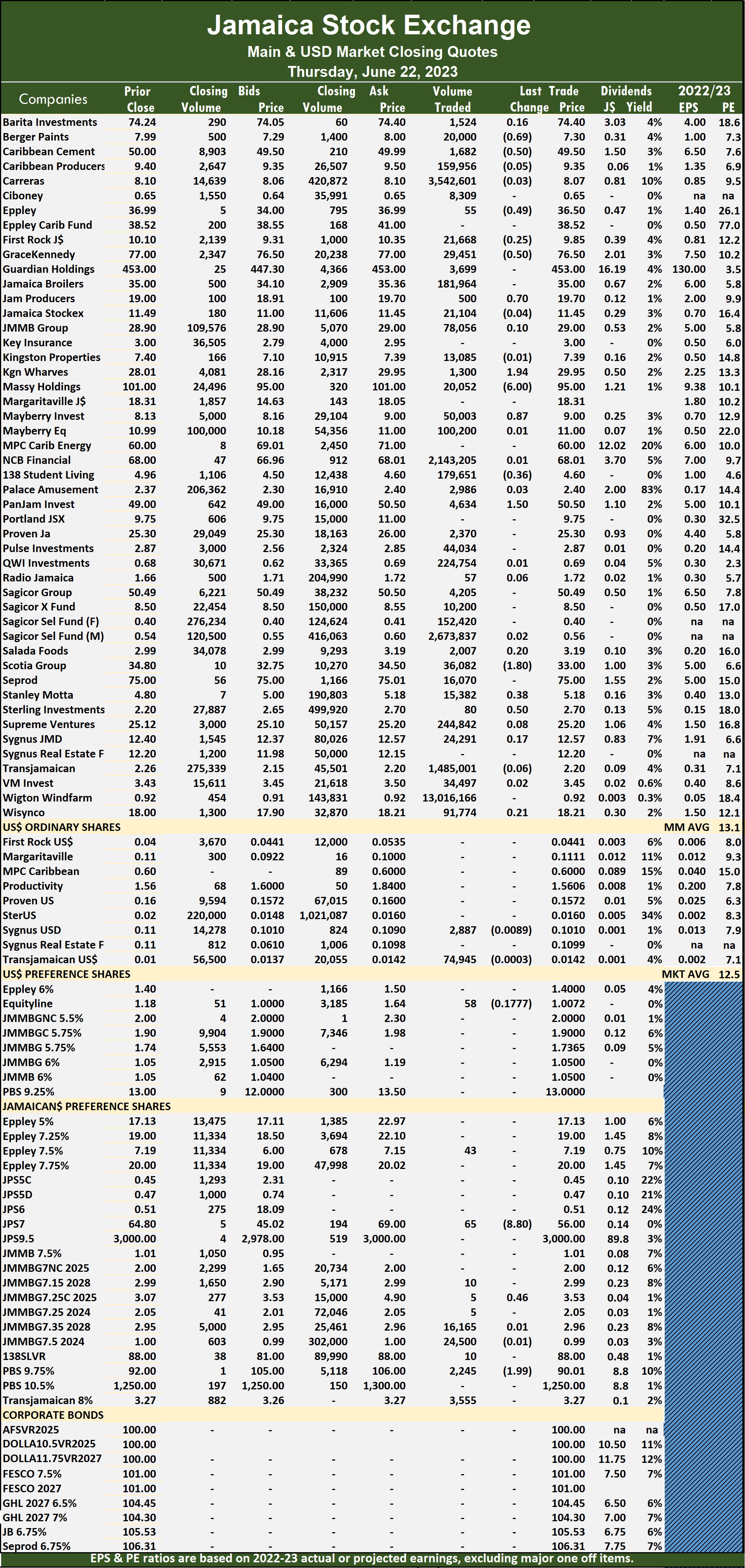

Jamaica Public Service 7% declined $7.33 to $48.67 after stakeholders exchanged 109 units and JMMB Group 7.25% preference share increased 53 cents to close at $4.06 with an exchange of 1,000 shares. A total of 24,710,357 shares were traded for $217,998,595 compared with 7,774,565 units at $103,833,504 on Wednesday.

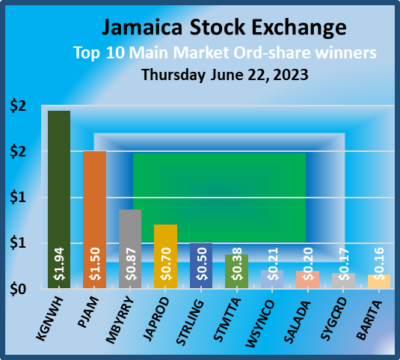

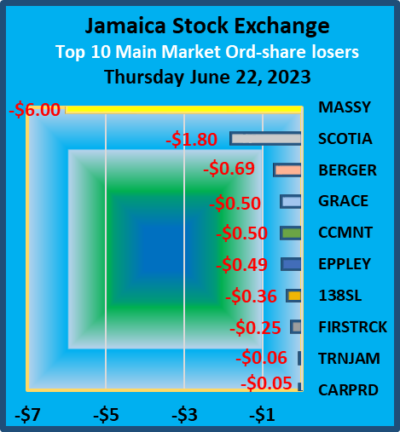

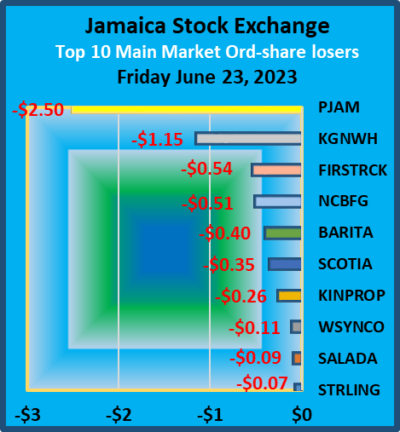

A total of 24,710,357 shares were traded for $217,998,595 compared with 7,774,565 units at $103,833,504 on Wednesday. The All Jamaican Composite Index fell 993.11 points to 361,607.86, the JSE Main Index shed 1,951.96 points to 325,358.09 and the JSE Financial Index shed 0.02 points to end at 73.30.

The All Jamaican Composite Index fell 993.11 points to 361,607.86, the JSE Main Index shed 1,951.96 points to 325,358.09 and the JSE Financial Index shed 0.02 points to end at 73.30. GraceKennedy shed 50 cents to close at $76.50 in an exchange of 29,451 stock units, Jamaica Producers popped 70 cents to $19.70 with an exchange of 500 units, Kingston Wharves advanced $1.94 to end at $29.95 while exchanging 1,300 stock units. Massy Holdings dropped $6 in closing at $95, with 20,052 shares crossing the market, Mayberry Investments gained 87 cents to close at $9 as investors exchanged 50,003 stocks, 138 Student Living lost 36 cents to close at $4.60 with a transfer of 179,651 units. Pan Jamaica Group rallied $1.50 and ended at $50.50 with shareholders swapping 4,634 stock units, Scotia Group fell $1.80 to end at $33 after investors traded 36,082 shares, Stanley Motta climbed 38 cents and ended at $5.18 after a transfer of 15,382 stocks and Sterling Investments rose 50 cents to close at $2.70, with 80 units changing hands.

GraceKennedy shed 50 cents to close at $76.50 in an exchange of 29,451 stock units, Jamaica Producers popped 70 cents to $19.70 with an exchange of 500 units, Kingston Wharves advanced $1.94 to end at $29.95 while exchanging 1,300 stock units. Massy Holdings dropped $6 in closing at $95, with 20,052 shares crossing the market, Mayberry Investments gained 87 cents to close at $9 as investors exchanged 50,003 stocks, 138 Student Living lost 36 cents to close at $4.60 with a transfer of 179,651 units. Pan Jamaica Group rallied $1.50 and ended at $50.50 with shareholders swapping 4,634 stock units, Scotia Group fell $1.80 to end at $33 after investors traded 36,082 shares, Stanley Motta climbed 38 cents and ended at $5.18 after a transfer of 15,382 stocks and Sterling Investments rose 50 cents to close at $2.70, with 80 units changing hands. In the preference segment,Jamaica Public Service 7% declined $8.80 in closing at $56 after 65 stocks were traded, JMMB Group 7.25% preference share increased 46 cents to $3.53 after exchanging 5 stock units and Productive Business Solutions 9.75% preference share shed $1.99 to close at $90.01, with 2,245 shares clearing the market.

In the preference segment,Jamaica Public Service 7% declined $8.80 in closing at $56 after 65 stocks were traded, JMMB Group 7.25% preference share increased 46 cents to $3.53 after exchanging 5 stock units and Productive Business Solutions 9.75% preference share shed $1.99 to close at $90.01, with 2,245 shares clearing the market. A total of 7,774,565 shares were traded for $103,833,504, down from 31,469,005 units at $596,839,341 on Tuesday.

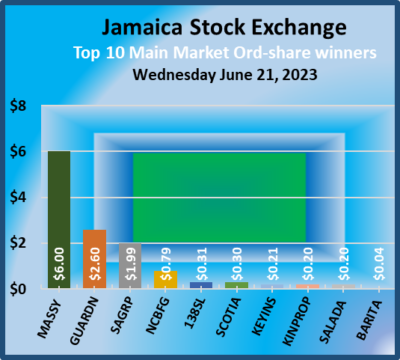

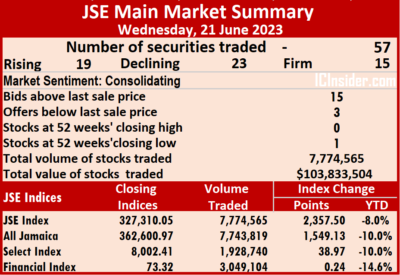

A total of 7,774,565 shares were traded for $103,833,504, down from 31,469,005 units at $596,839,341 on Tuesday. The All Jamaican Composite Index rose 1,549.13 points to settle at 362,600.97, the JSE Main Index increased 2,357.50 points to end at 327,310.05 and the JSE Financial Index rallied 0.24 points to 73.32.

The All Jamaican Composite Index rose 1,549.13 points to settle at 362,600.97, the JSE Main Index increased 2,357.50 points to end at 327,310.05 and the JSE Financial Index rallied 0.24 points to 73.32. Guardian Holdings rallied $2.60 in closing at $453 after traders exchanged 995 stocks, Kingston Wharves dipped $1.94 to end at $28.01 with shareholders swapping 505 stock units. Massy Holdings jumped $6 to end at $101 in an exchange of 9,628 units, Mayberry Investments declined 87 cents and ended at $8.13 with investors transferring 22,278 stock units, NCB Financial rose 79 cents to $68 following the trading of 1,086,879 shares. 138 Student Living advanced 31 cents to end at $4.96 with a transfer of 1,207 shares, Pan Jamaica dipped 98 cents to $49 after trading 87,688 stocks, Sagicor Group climbed $1.99 in closing at $50.49 after an exchange of 27,382 units. Scotia Group gained 30 cents and ended at $34.80 in an exchange of 4,129 shares, Stanley Motta shed 38 cents to $4.80, with 59,495 stocks clearing the market and Sterling Investments fell 50 cents to close at $2.20 while exchanging 86,071 stock units.

Guardian Holdings rallied $2.60 in closing at $453 after traders exchanged 995 stocks, Kingston Wharves dipped $1.94 to end at $28.01 with shareholders swapping 505 stock units. Massy Holdings jumped $6 to end at $101 in an exchange of 9,628 units, Mayberry Investments declined 87 cents and ended at $8.13 with investors transferring 22,278 stock units, NCB Financial rose 79 cents to $68 following the trading of 1,086,879 shares. 138 Student Living advanced 31 cents to end at $4.96 with a transfer of 1,207 shares, Pan Jamaica dipped 98 cents to $49 after trading 87,688 stocks, Sagicor Group climbed $1.99 in closing at $50.49 after an exchange of 27,382 units. Scotia Group gained 30 cents and ended at $34.80 in an exchange of 4,129 shares, Stanley Motta shed 38 cents to $4.80, with 59,495 stocks clearing the market and Sterling Investments fell 50 cents to close at $2.20 while exchanging 86,071 stock units. In the preference segment, Jamaica Public Service 7% popped $8.45 in closing at $64.80, with 1,170 stocks crossing the market and Productive Business Solutions 9.75% preference share popped $1 to end at $92, with 1,040 shares changing hands.

In the preference segment, Jamaica Public Service 7% popped $8.45 in closing at $64.80, with 1,170 stocks crossing the market and Productive Business Solutions 9.75% preference share popped $1 to end at $92, with 1,040 shares changing hands.