The impact on the market with the presence of an Initial Public Offer opening was not very pronounced this time around, with the One Great Studio opening and closing this past week with the issue being oversubscribed, but the Junior Market did experience a sharp fall early in the week that could well be related to investors seeking funds to invest in the IPO.

In the Main Market, Key Insurance climbed 14 percent to $2.88 to be the sole winner of note, while 138 Student Living crashed 6 percent to $4.11, just a fraction above the APO price for shareholders of $4.05, that is projected to raise just over $2 billion. JMMB Group shed 5 percent to close the week at $27.40, making for a compelling long term investment and Sygnus Credit Investments fell 4 percent to $11.47.

The Junior Market ICTOP10 closed the week with Caribbean Cream dropping 16 percent to $3.50, this comes against the background of sharply falling cost for milk solids, one of the significant input cost in the production of ice cream. Caribbean Assurance Brokers slipped 7 percent to $2.68 and Everything Fresh dropped 14 percent to $1.37 and Image Plus slipped percent to $2.05. Iron Rock Insurance was the gainer of note, rising 10 percent to $2.30.

The pending additional issue of 138 Student Living shares kept the price depressed and with the offer coming public with 513 million shares with an option to upsize by 318.5 million units, it will satisfy a great deal of demand and, therefore, put a short term lid on price appreciation. The situation will be worse as the company lacks the ability to inform investors about its operations in a manner that is befitting of a company its size.

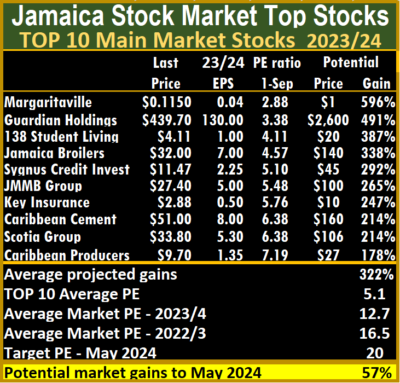

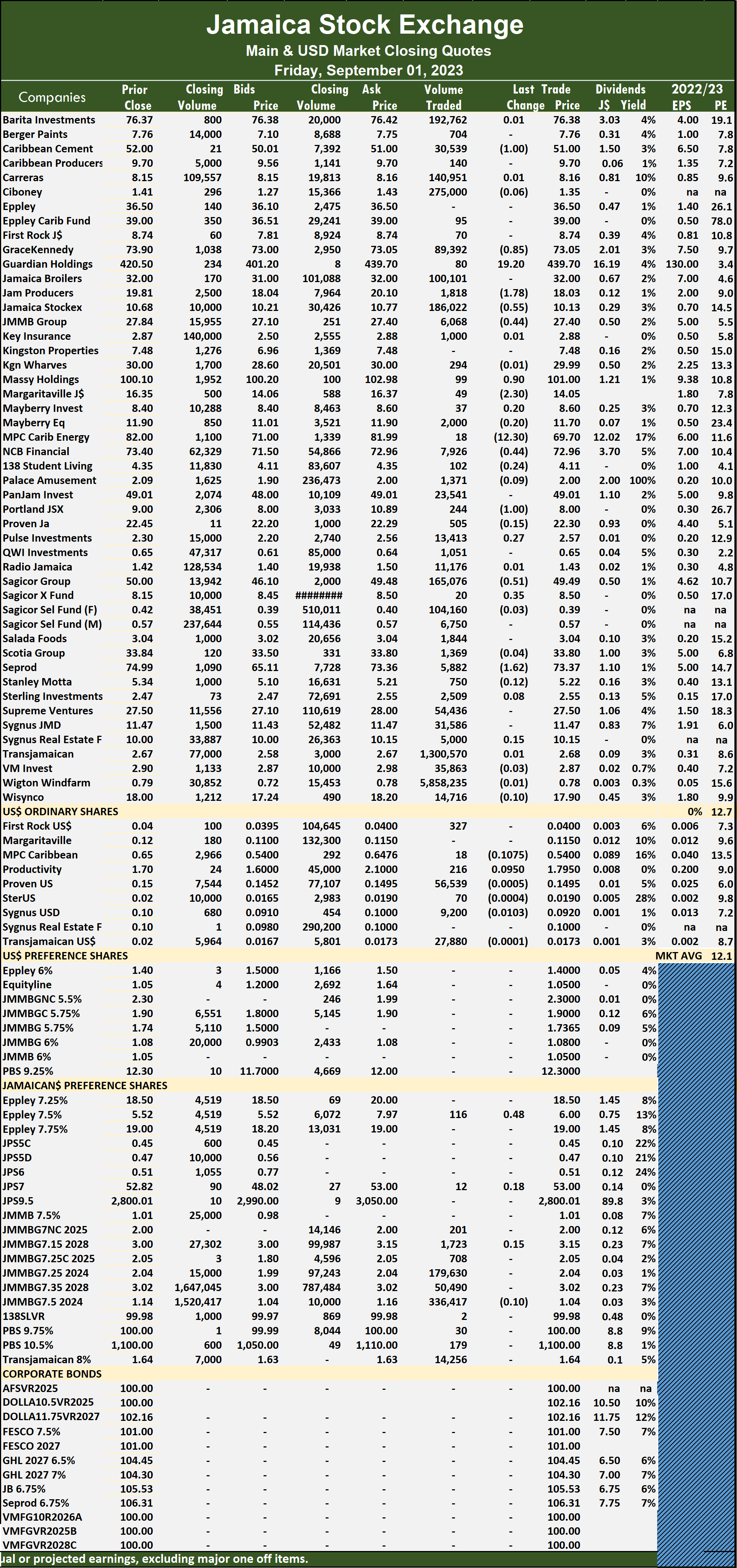

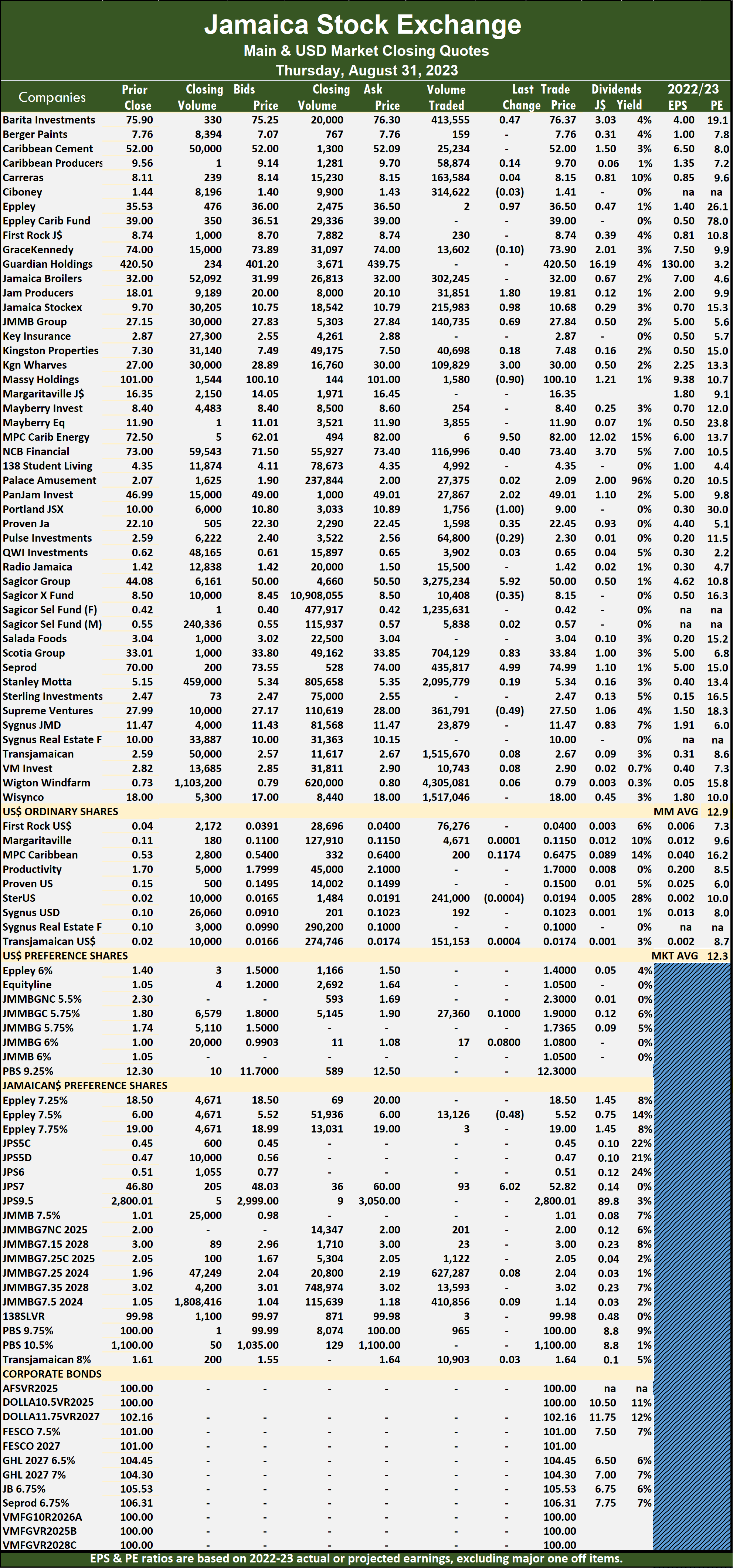

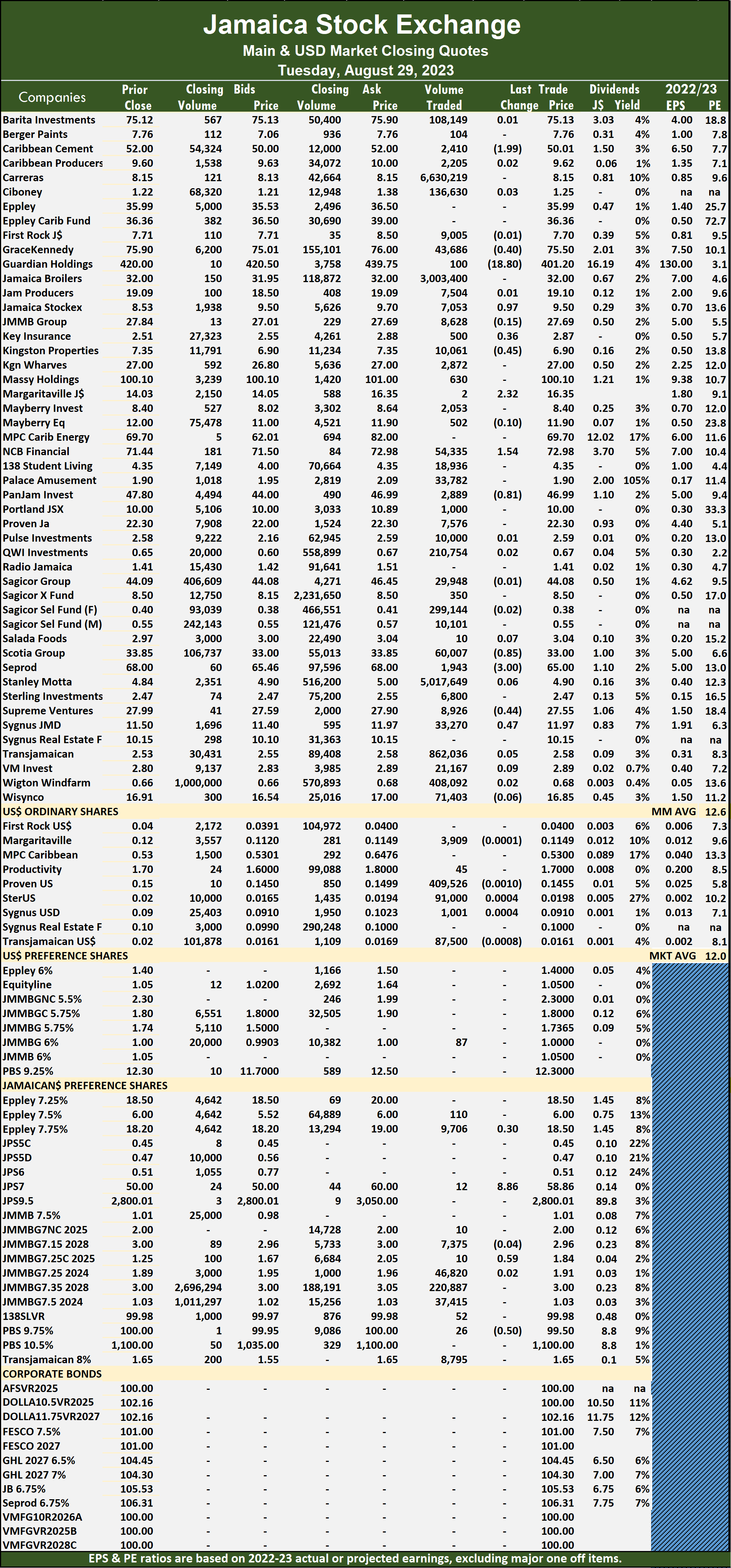

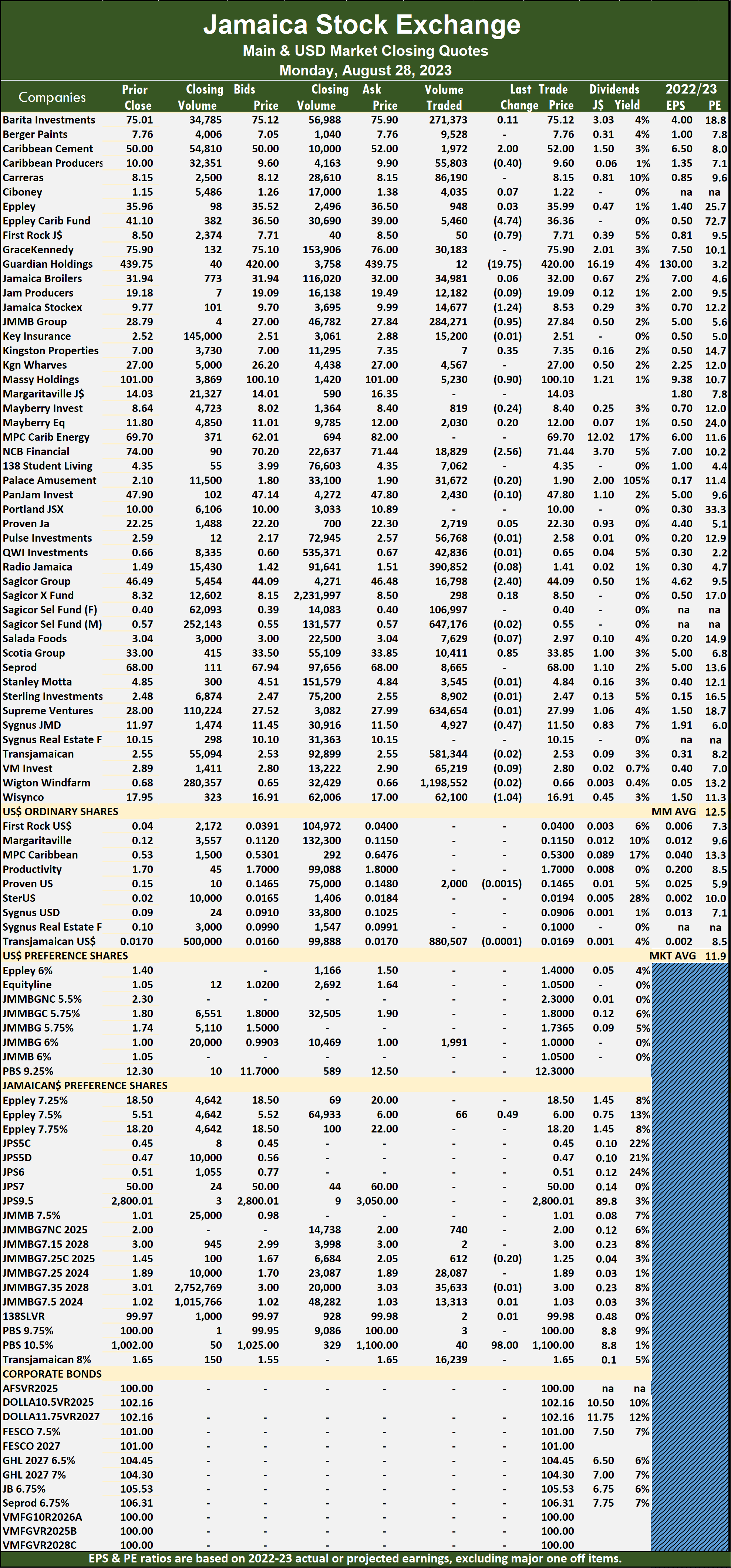

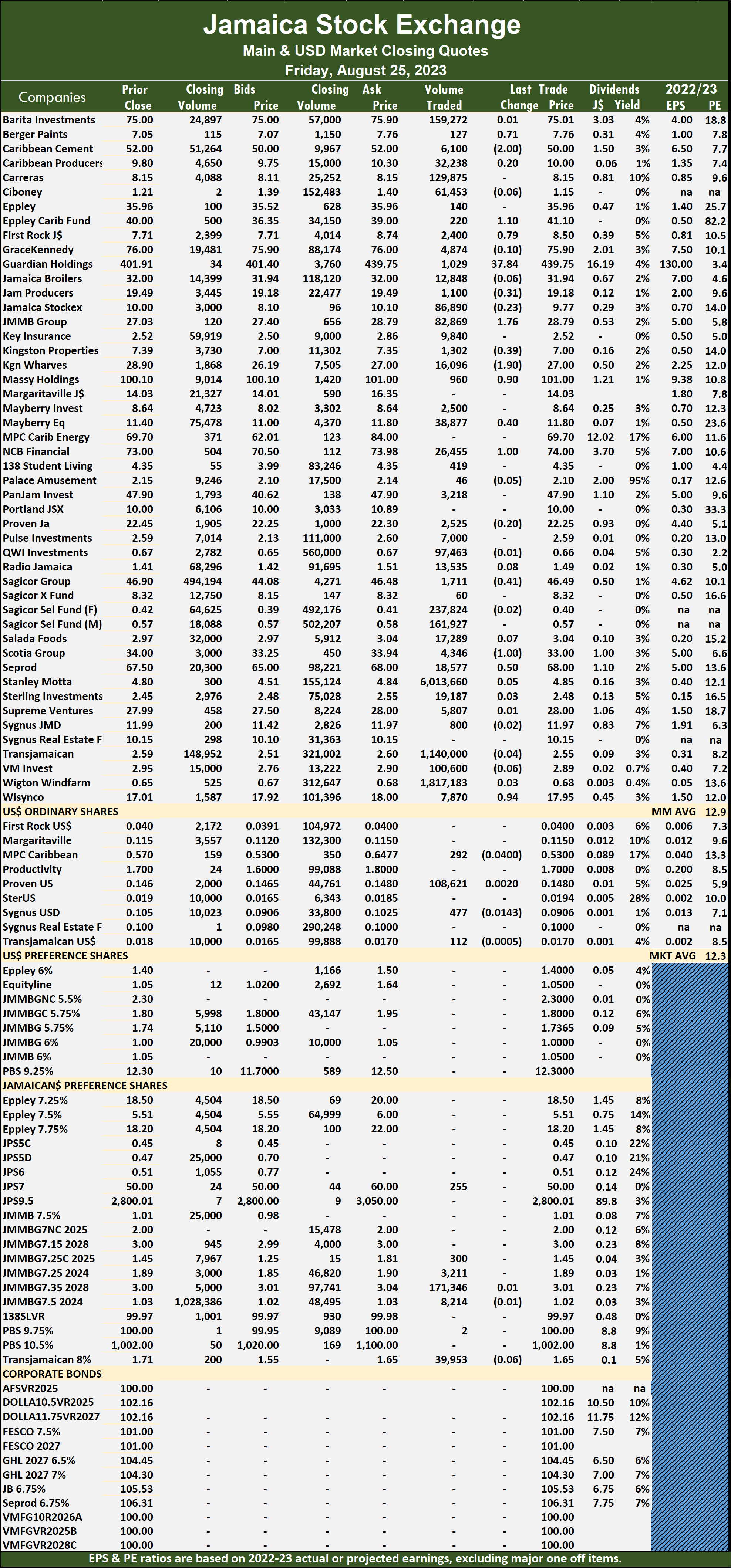

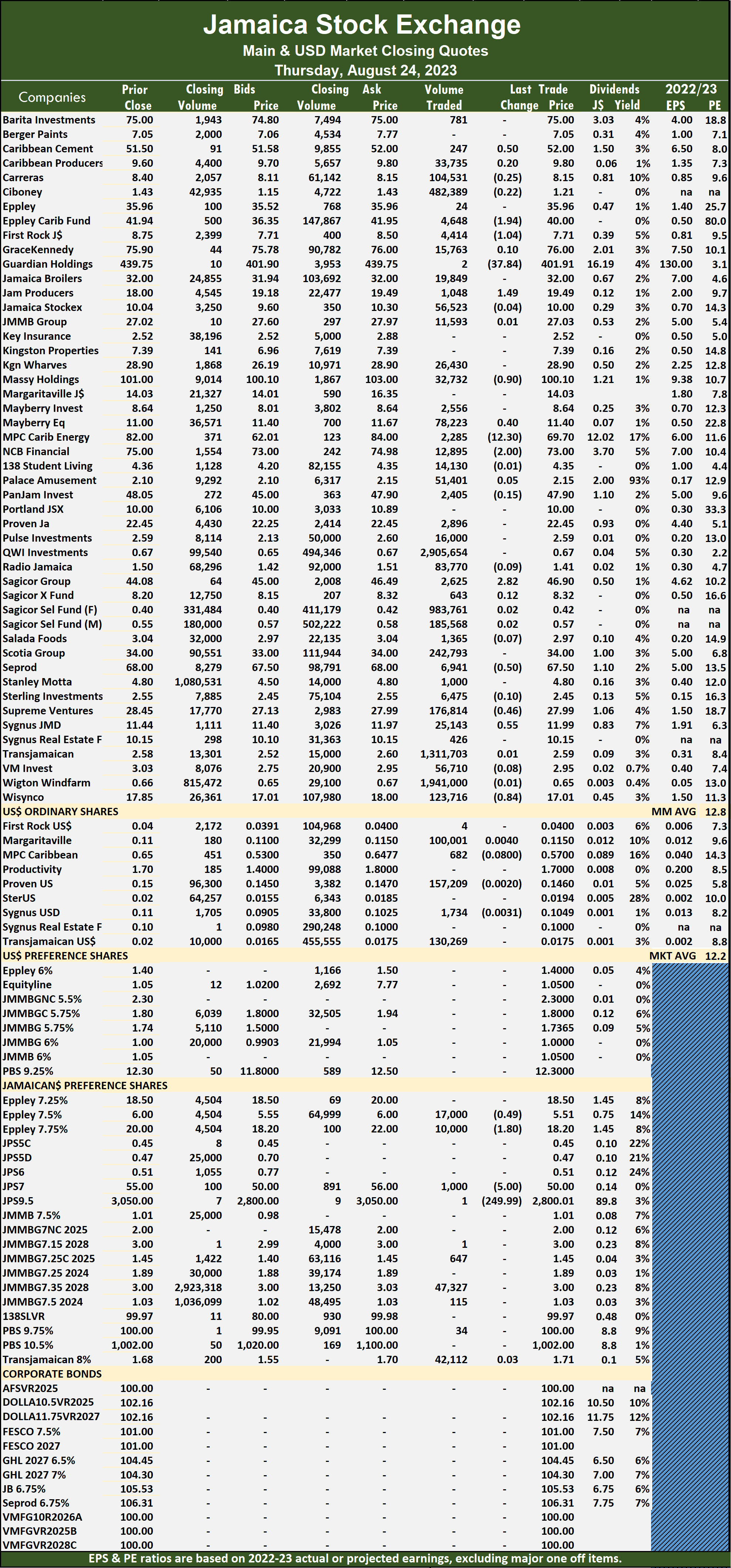

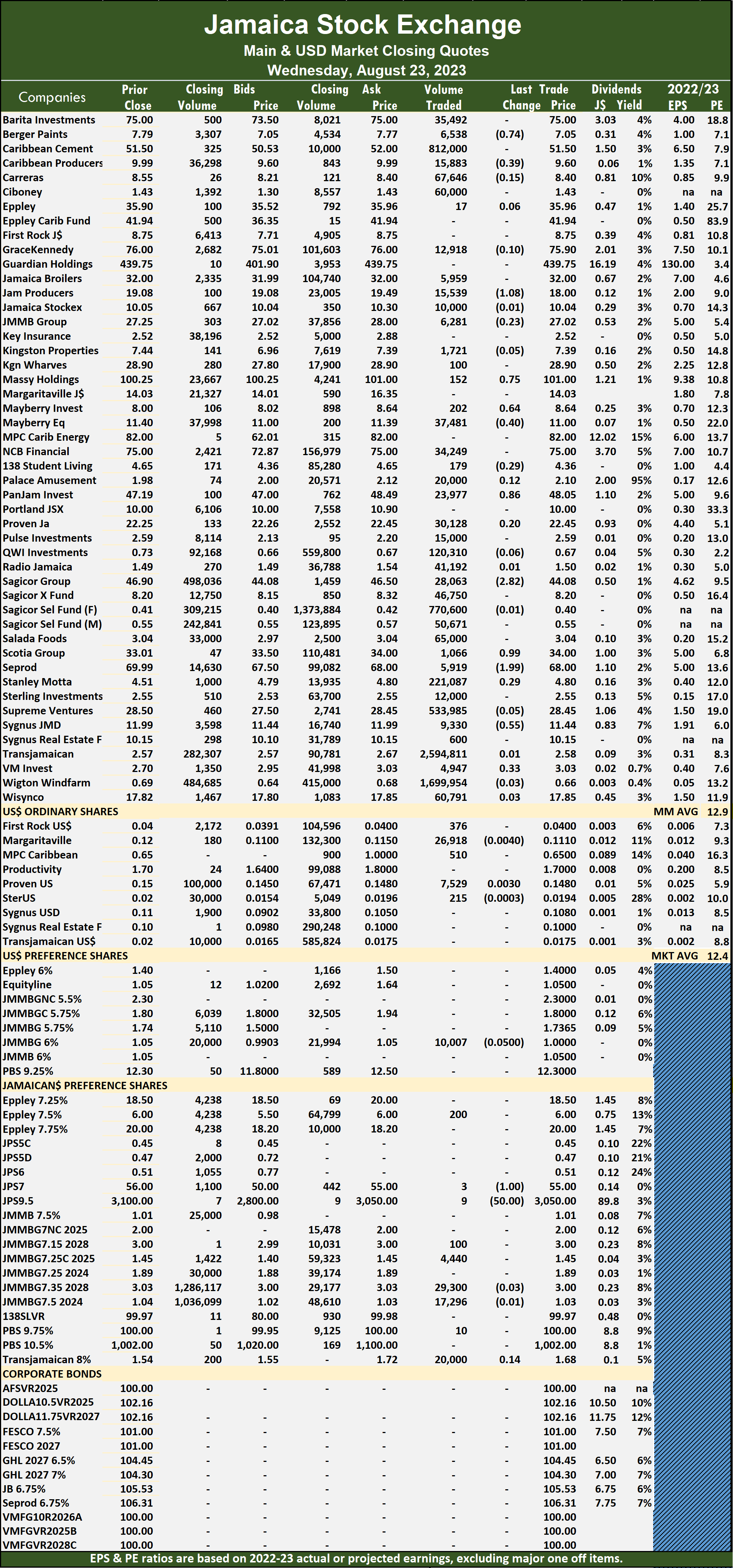

Note that Margaritaville is listed on both the Main Market and the USD Market, with similar values.

Note that Margaritaville is listed on both the Main Market and the USD Market, with similar values.

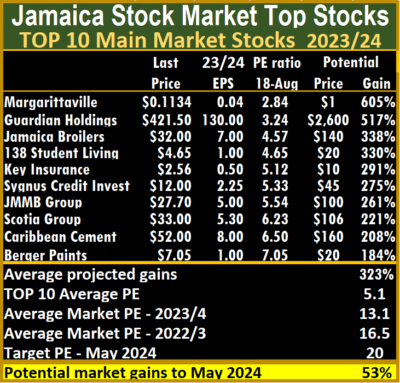

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.1, well below the market average of 12.7. The Main Market TOP10 is projected to have an average of 322 percent to May 2024, based on 2023 forecasted earnings.

The most highly valued Main Market stocks, representing 32 percent of the Main Market, are priced at a PE of 15 to 80, with an average of 29 and 20 excluding the highest PE ratios, with a PE of 22 for the top half and 17 excluding the stocks with the highest PEs.

The Junior Market Top 10 PE sits at 5.3 compared with the market at 10.8. There are 10 stocks representing 21 percent of the market, with PEs from 15 to 40, averaging 21, that is well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently, and projected to rise by 271 percent to May 2024.

The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

The markets are not in a bullish state, but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results, leading them to quietly nibble away at a number of stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.

The markets are not in a bullish state, but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results, leading them to quietly nibble away at a number of stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

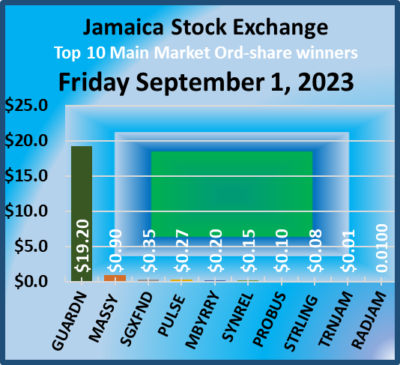

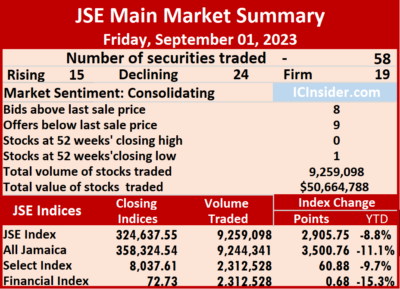

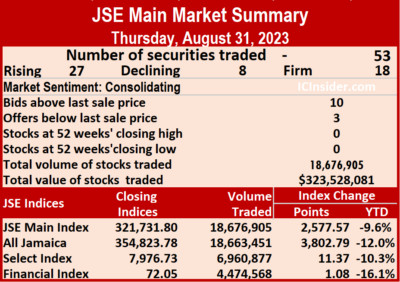

A total of 9,259,098 shares were traded for $50,664,788 versus 18,676,905 units at $323,528,081 on Thursday.

A total of 9,259,098 shares were traded for $50,664,788 versus 18,676,905 units at $323,528,081 on Thursday. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

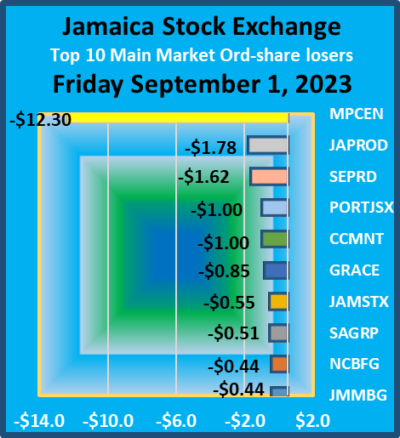

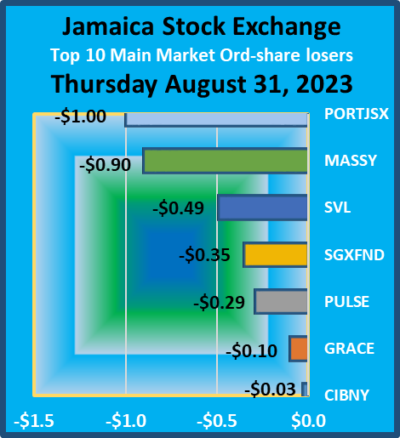

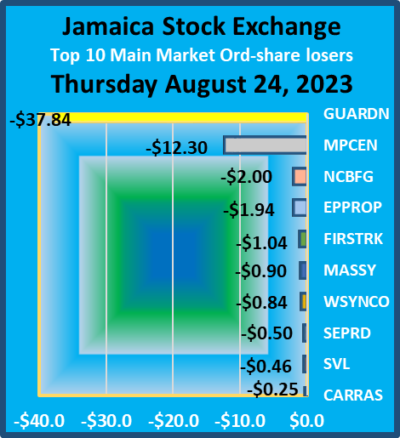

The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. JMMB Group fell 44 cents to $27.40 with 6,068 shares changing hands. Margaritaville dipped $2.30 to end at $14.05 in an exchange of 49 stocks, Massy Holdings advanced 90 cents to $101 with stakeholders exchanging 99 shares, MPC Caribbean Clean Energy skidded $12.30 to close at $69.70 with investors transferring 18 stocks. NCB Financial shed 44 cents and ended at $72.96, with 7,926 shares crossing the market, Portland JSX fell $1 to close at a 52 weeks’ low of $8, with shareholders swapping 244 stock units, Sagicor Group dropped 51 cents and ended at $49.49 with investors dealing in 165,076 units. Sagicor Real Estate Fund gained 35 cents to end at $8.50 in switching ownership of 20 units and Seprod declined $1.62 in closing at $73.37 after exchanging 5,882 shares.

JMMB Group fell 44 cents to $27.40 with 6,068 shares changing hands. Margaritaville dipped $2.30 to end at $14.05 in an exchange of 49 stocks, Massy Holdings advanced 90 cents to $101 with stakeholders exchanging 99 shares, MPC Caribbean Clean Energy skidded $12.30 to close at $69.70 with investors transferring 18 stocks. NCB Financial shed 44 cents and ended at $72.96, with 7,926 shares crossing the market, Portland JSX fell $1 to close at a 52 weeks’ low of $8, with shareholders swapping 244 stock units, Sagicor Group dropped 51 cents and ended at $49.49 with investors dealing in 165,076 units. Sagicor Real Estate Fund gained 35 cents to end at $8.50 in switching ownership of 20 units and Seprod declined $1.62 in closing at $73.37 after exchanging 5,882 shares. In the preference segment, Eppley 7.50%preference share rose 48 cents to $6 with an exchange of 116 stocks.

In the preference segment, Eppley 7.50%preference share rose 48 cents to $6 with an exchange of 116 stocks. A total of 18,676,905 shares were traded at $323,528,081 compared to 8,932,182 units at $64,616,360 on Wednesday.

A total of 18,676,905 shares were traded at $323,528,081 compared to 8,932,182 units at $64,616,360 on Wednesday. The PE Ratio, a formula used to compute appropriate stock values, averages 12.9 for the Main Market. The JSE Main and USD Market PE ratios are calculated based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

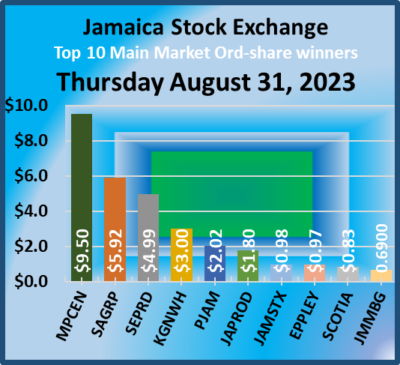

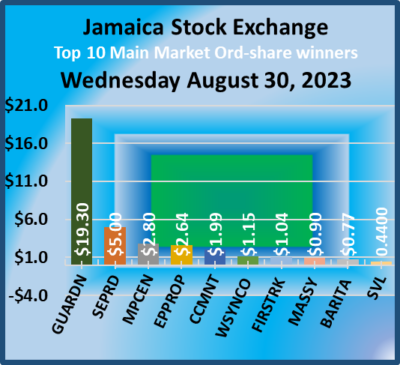

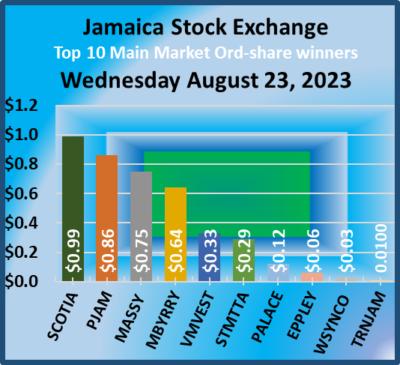

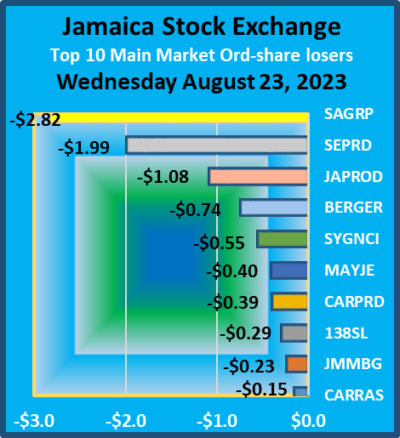

The PE Ratio, a formula used to compute appropriate stock values, averages 12.9 for the Main Market. The JSE Main and USD Market PE ratios are calculated based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. MPC Caribbean Clean Energy advanced $9.50 and ended at $82 as investors exchanged 6 stock units, NCB Financial gained 40 cents to end at $73.40 with investors swapping 116,996 shares, Pan Jamaica rose $2.02 to close at $49.01 after 27,867 stocks were traded, Portland JSX declined $1 and ended at $9 trading 1,756 stock units, Proven Investments advanced 35 cents to close at $22.45 in trading 1,598 units, Sagicor Group increased $5.92 in closing at $50 after investors swapped 3,275,234 stock units, Sagicor Real Estate Fund dropped 35 cents to $8.15 after 10,408 shares passed through the market, Scotia Group climbed 83 cents to end at $33.84 with investors dealing in 704,129 units, Seprod rallied $4.99 in closing at $74.99 with investors transferring 435,817 stocks, Supreme Ventures skidded 49 cents to end at $27.50, with 361,791 units changing hands.

MPC Caribbean Clean Energy advanced $9.50 and ended at $82 as investors exchanged 6 stock units, NCB Financial gained 40 cents to end at $73.40 with investors swapping 116,996 shares, Pan Jamaica rose $2.02 to close at $49.01 after 27,867 stocks were traded, Portland JSX declined $1 and ended at $9 trading 1,756 stock units, Proven Investments advanced 35 cents to close at $22.45 in trading 1,598 units, Sagicor Group increased $5.92 in closing at $50 after investors swapped 3,275,234 stock units, Sagicor Real Estate Fund dropped 35 cents to $8.15 after 10,408 shares passed through the market, Scotia Group climbed 83 cents to end at $33.84 with investors dealing in 704,129 units, Seprod rallied $4.99 in closing at $74.99 with investors transferring 435,817 stocks, Supreme Ventures skidded 49 cents to end at $27.50, with 361,791 units changing hands. In the preference segment, Eppley 7.50% preference share fell 48 cents to close at $5.52 after an exchange of 13,126 stock units and Jamaica Public Service 7% popped $6.02 and ended at $52.82 in an exchange of 93 stocks.

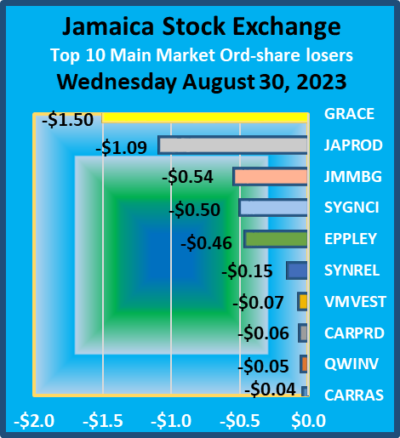

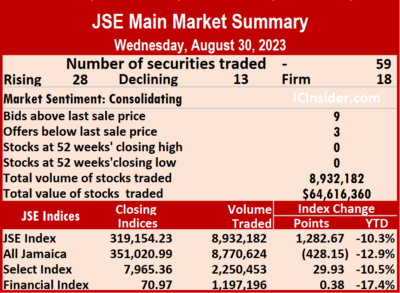

In the preference segment, Eppley 7.50% preference share fell 48 cents to close at $5.52 after an exchange of 13,126 stock units and Jamaica Public Service 7% popped $6.02 and ended at $52.82 in an exchange of 93 stocks. Trading resulted in an exchange for 8,932,182 shares for $64,616,360, down from 17,477,049 units at $200,353,274 on Tuesday.

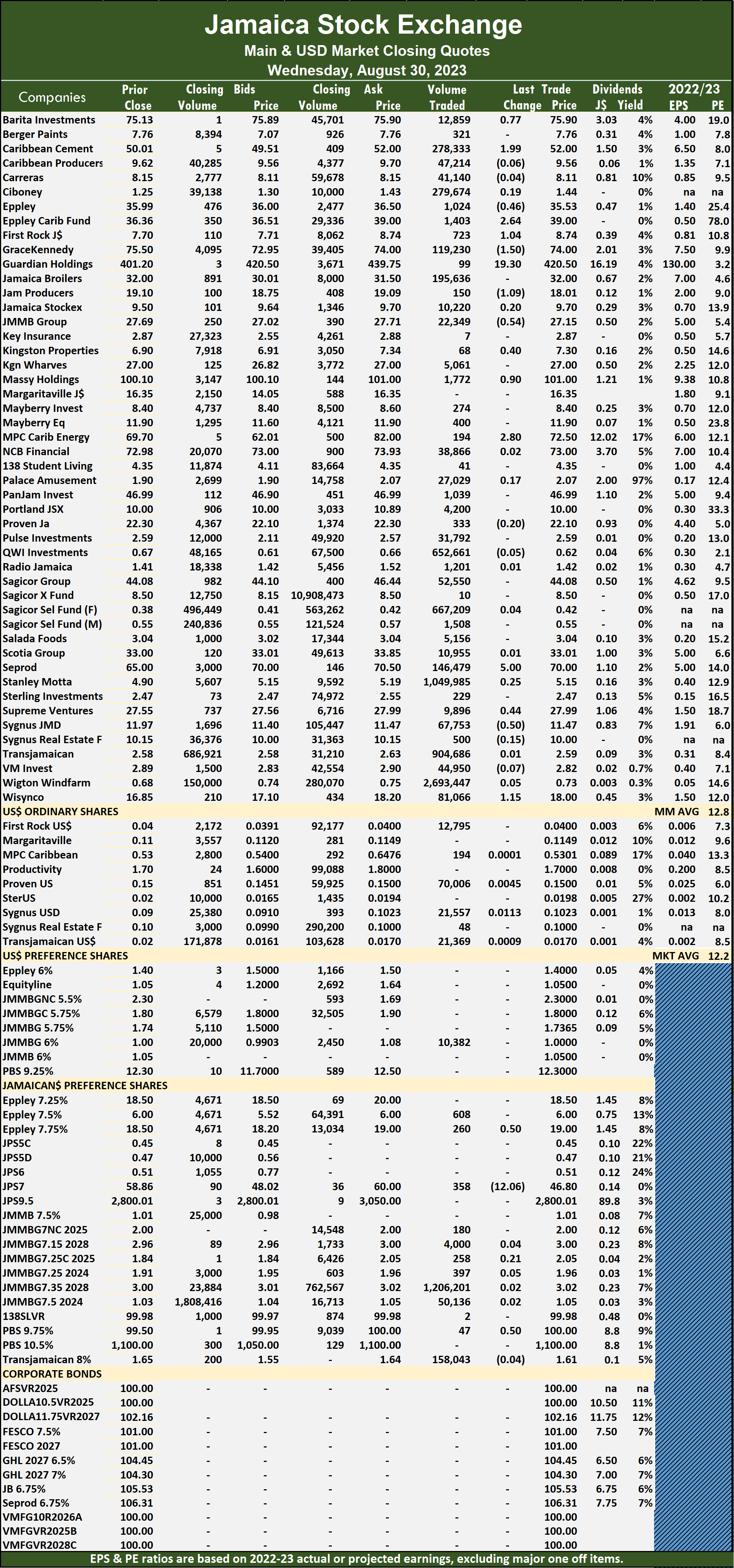

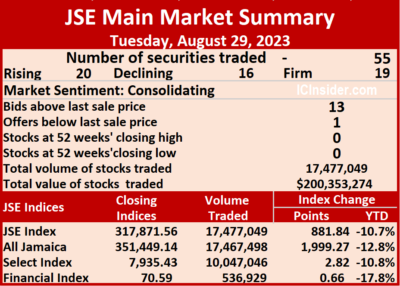

Trading resulted in an exchange for 8,932,182 shares for $64,616,360, down from 17,477,049 units at $200,353,274 on Tuesday. The PE Ratio, the most common formula used in valuing stocks, averages 12.8 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

The PE Ratio, the most common formula used in valuing stocks, averages 12.8 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. JMMB Group dropped 54 cents to close at $27.15 after an exchange of 22,349 stocks, Kingston Properties increased 40 cents in closing at $7.30 with investors dealing in 68 stock units, Massy Holdings climbed 90 cents to $101 with stakeholders exchanging 1,772 shares, MPC Caribbean Clean Energy gained $2.80 and ended at $72.50 after a transfer of 194 units. Seprod rallied $5 to close at $70 with a transfer of 146,479 units, Supreme Ventures gained 44 cents in closing at $27.99, with 9,896 shares changing hands, Sygnus Credit Investments shed 50 cents to land at $11.47 in an exchange of 67,753 stocks and Wisynco Group climbed $1.15 in closing at $18, with 81,066 stock units crossing the exchange before reporting full year profit results after the market closed, of $4.9 billion, up 21 percent over earnings for 2022 and resulting in earnings of $1.31 per share.

JMMB Group dropped 54 cents to close at $27.15 after an exchange of 22,349 stocks, Kingston Properties increased 40 cents in closing at $7.30 with investors dealing in 68 stock units, Massy Holdings climbed 90 cents to $101 with stakeholders exchanging 1,772 shares, MPC Caribbean Clean Energy gained $2.80 and ended at $72.50 after a transfer of 194 units. Seprod rallied $5 to close at $70 with a transfer of 146,479 units, Supreme Ventures gained 44 cents in closing at $27.99, with 9,896 shares changing hands, Sygnus Credit Investments shed 50 cents to land at $11.47 in an exchange of 67,753 stocks and Wisynco Group climbed $1.15 in closing at $18, with 81,066 stock units crossing the exchange before reporting full year profit results after the market closed, of $4.9 billion, up 21 percent over earnings for 2022 and resulting in earnings of $1.31 per share. Jamaica Public Service 7% fell $12.06 to $46.80, with 358 stock units clearing the market and Productive Business Solutions 9.75% preference share advanced 50 cents to end at $100 in an exchange of 47 stocks.

Jamaica Public Service 7% fell $12.06 to $46.80, with 358 stock units clearing the market and Productive Business Solutions 9.75% preference share advanced 50 cents to end at $100 in an exchange of 47 stocks. A total of 17,477,049 shares were traded for $200,353,274 compared to 4,844,640 units at $59,990,583 on Monday.

A total of 17,477,049 shares were traded for $200,353,274 compared to 4,844,640 units at $59,990,583 on Monday. The PE Ratio, a formula used to compute appropriate stock values, averages 12.6 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecast by ICInsider.com for companies with the financial year ending up to August 2024.

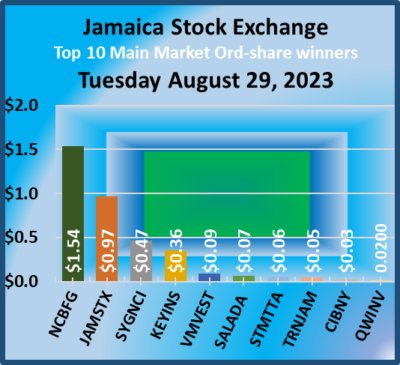

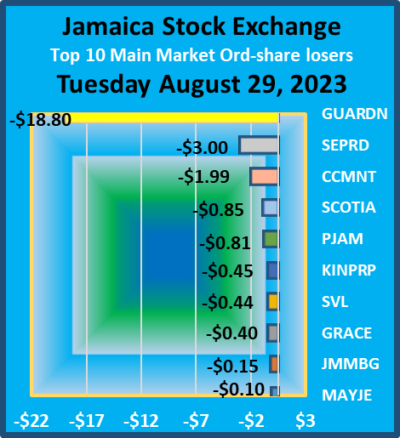

The PE Ratio, a formula used to compute appropriate stock values, averages 12.6 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecast by ICInsider.com for companies with the financial year ending up to August 2024. Margaritaville climbed $2.32 to close at $16.35 in switching ownership of 2 stocks, NCB Financial jumped $1.54 and ended at $72.98, with 54,335 shares crossing the market, Pan Jamaica fell 81 cents to close at $46.99 after 2,889 stock units passed through the market. Scotia Group fell 85 cents to end at $33, with 60,007 stocks changing hands, Seprod shed $3 to close at $65 after an exchange of 1,943 shares, Supreme Ventures skidded 44 cents to $27.55 in an exchange of 8,926 units and Sygnus Credit Investments gained 47 cents and ended at $11.97 in trading 33,270 shares.

Margaritaville climbed $2.32 to close at $16.35 in switching ownership of 2 stocks, NCB Financial jumped $1.54 and ended at $72.98, with 54,335 shares crossing the market, Pan Jamaica fell 81 cents to close at $46.99 after 2,889 stock units passed through the market. Scotia Group fell 85 cents to end at $33, with 60,007 stocks changing hands, Seprod shed $3 to close at $65 after an exchange of 1,943 shares, Supreme Ventures skidded 44 cents to $27.55 in an exchange of 8,926 units and Sygnus Credit Investments gained 47 cents and ended at $11.97 in trading 33,270 shares. JMMB Group 7.25% preference share increased 59 cents and ended at $1.84 with traders dealing in 10 stocks and Productive Business Solutions 9.75% preference share skidded 50 cents to $99.50 with investors trading 26 stocks.

JMMB Group 7.25% preference share increased 59 cents and ended at $1.84 with traders dealing in 10 stocks and Productive Business Solutions 9.75% preference share skidded 50 cents to $99.50 with investors trading 26 stocks. traded following a modest increase in value over Friday and closed with two stocks ending at 52 weeks’ lows.

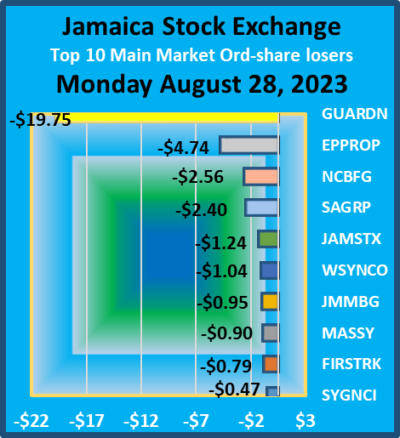

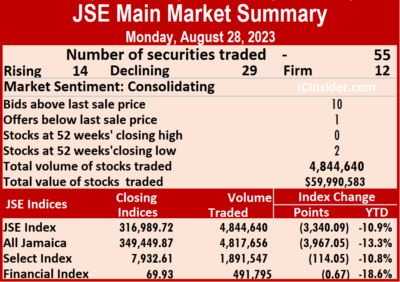

traded following a modest increase in value over Friday and closed with two stocks ending at 52 weeks’ lows. The All Jamaican Composite Index skidded 3,967.05 points to 349,449.87, the JSE Main Index dropped 3,340.09 points to finish at 316,989.72 and the JSE Financial Index

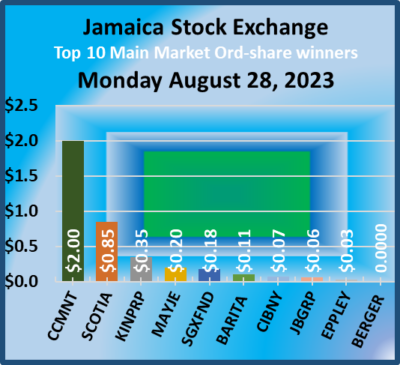

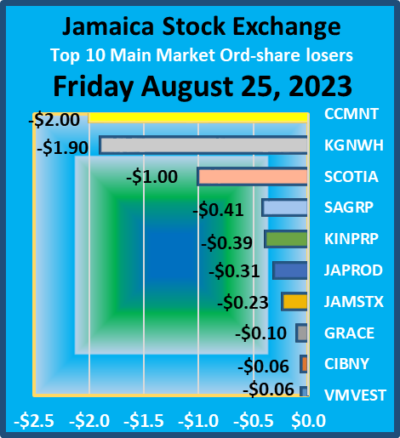

The All Jamaican Composite Index skidded 3,967.05 points to 349,449.87, the JSE Main Index dropped 3,340.09 points to finish at 316,989.72 and the JSE Financial Index Jamaica Stock Exchange shed $1.24 to close at a 52 weeks’ low of $8.53, with 14,677 stock units crossing the market, after trading at a 52 weeks’ intraday low of $8.25. JMMB Group dipped 95 cents to end at $27.84 with 284,271 units clearing the market, Kingston Properties climbed 35 cents to $7.35 after 7 stocks passed through the market, Massy Holdings skidded 90 cents to $100.10 with an exchange of 5,230 stock units. NCB Financial dropped $2.56 in closing at $71.44 after an exchange of 18,829 stocks, Sagicor Group fell $2.40 to close at $44.09 in switching ownership of 16,798 units, Scotia Group popped 85 cents and ended at $33.85 while exchanging 10,411 shares. Sygnus Credit Investments declined 47 cents in closing at $11.50 after trading in 4,927 stocks and Wisynco Group dipped $1.04 to end at $16.91, with 62,100 shares crossing the market.

Jamaica Stock Exchange shed $1.24 to close at a 52 weeks’ low of $8.53, with 14,677 stock units crossing the market, after trading at a 52 weeks’ intraday low of $8.25. JMMB Group dipped 95 cents to end at $27.84 with 284,271 units clearing the market, Kingston Properties climbed 35 cents to $7.35 after 7 stocks passed through the market, Massy Holdings skidded 90 cents to $100.10 with an exchange of 5,230 stock units. NCB Financial dropped $2.56 in closing at $71.44 after an exchange of 18,829 stocks, Sagicor Group fell $2.40 to close at $44.09 in switching ownership of 16,798 units, Scotia Group popped 85 cents and ended at $33.85 while exchanging 10,411 shares. Sygnus Credit Investments declined 47 cents in closing at $11.50 after trading in 4,927 stocks and Wisynco Group dipped $1.04 to end at $16.91, with 62,100 shares crossing the market. In the preference segment, Eppley 7.50% preference share increased 49 cents to $6 with investors transferring 66 stock units, JMMBGL 7.25% preference share traded 612 units at a 52 weeks’ low of $1.25, after declining 20 cents and Productive Business Solutions 10.5 % preference share rallied $98 to close at $1,100 as investors exchanged 40 units.

In the preference segment, Eppley 7.50% preference share increased 49 cents to $6 with investors transferring 66 stock units, JMMBGL 7.25% preference share traded 612 units at a 52 weeks’ low of $1.25, after declining 20 cents and Productive Business Solutions 10.5 % preference share rallied $98 to close at $1,100 as investors exchanged 40 units.

Caribbean Cream the leading mover in the Junior Market ICTOP10, climbed 10 percent to $4.15, followed by Edufocal rising 4 percent to $1.45. Iron Rock Insurance was the worst performer, falling 12 percent to $2.10 and was followed by general Accident, down 10 percent to $4.43, while Caribbean Assurance Brokers slipped just 4 percent to $2.87.

Caribbean Cream the leading mover in the Junior Market ICTOP10, climbed 10 percent to $4.15, followed by Edufocal rising 4 percent to $1.45. Iron Rock Insurance was the worst performer, falling 12 percent to $2.10 and was followed by general Accident, down 10 percent to $4.43, while Caribbean Assurance Brokers slipped just 4 percent to $2.87. The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

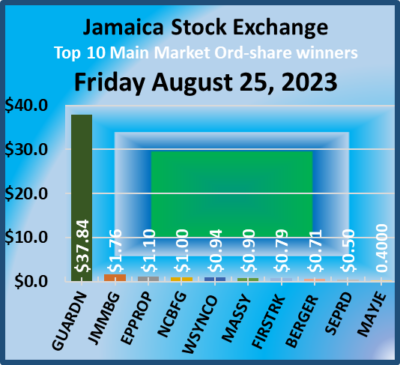

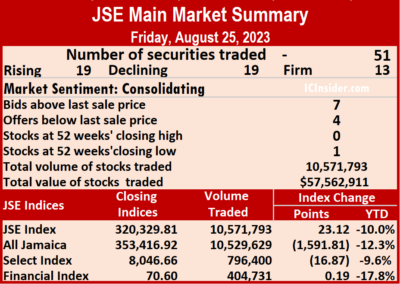

The divergence between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks. A total of 10,571,793 shares were traded for $57,562,911 up from 9,151,844 units at $35,266,609 on Thursday.

A total of 10,571,793 shares were traded for $57,562,911 up from 9,151,844 units at $35,266,609 on Thursday. The PE Ratio, a formula used to compute appropriate stock values, averages 12.9 for the Main Market. The JSE Main and USD Markets’ PE ratios are calculated based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

The PE Ratio, a formula used to compute appropriate stock values, averages 12.9 for the Main Market. The JSE Main and USD Markets’ PE ratios are calculated based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. Jamaica Stock Exchange lost 23 cents and closed at a 52 weeks’ low of $9.77 after hitting an intraday 52 weeks’ low of $9.10 in trading 86,890 shares. Jamaica Producers shed 31 cents to end at $19.18 after an exchange of 1,100 shares, JMMB Group rallied $1.76 to $28.79 with traders dealing in 82,869 stock units, Kingston Properties skidded 39 cents to $7 with a transfer of 1,302 stocks. Kingston Wharves dipped $1.90 and ended at $27 with shareholders swapping 16,096 shares, Massy Holdings climbed 90 cents in closing at $101 in an exchange of 960 stocks, Mayberry Jamaican Equities popped 40 cents to end at $11.80, with 38,877 stock units crossing the exchange. NCB Financial rallied $1 to $74, with 26,455 units crossing the market, Sagicor Group lost 41 cents to end at $46.49 as investors exchanged 1,711 shares,

Jamaica Stock Exchange lost 23 cents and closed at a 52 weeks’ low of $9.77 after hitting an intraday 52 weeks’ low of $9.10 in trading 86,890 shares. Jamaica Producers shed 31 cents to end at $19.18 after an exchange of 1,100 shares, JMMB Group rallied $1.76 to $28.79 with traders dealing in 82,869 stock units, Kingston Properties skidded 39 cents to $7 with a transfer of 1,302 stocks. Kingston Wharves dipped $1.90 and ended at $27 with shareholders swapping 16,096 shares, Massy Holdings climbed 90 cents in closing at $101 in an exchange of 960 stocks, Mayberry Jamaican Equities popped 40 cents to end at $11.80, with 38,877 stock units crossing the exchange. NCB Financial rallied $1 to $74, with 26,455 units crossing the market, Sagicor Group lost 41 cents to end at $46.49 as investors exchanged 1,711 shares,  Scotia Group dropped $1 in closing at $33 in trading 4,346 units, Seprod increased 50 cents to close at $68 with 18,577 stocks clearing the market and Wisynco Group rose 94 cents and ended at $17.95 trading 7,870 stock units.

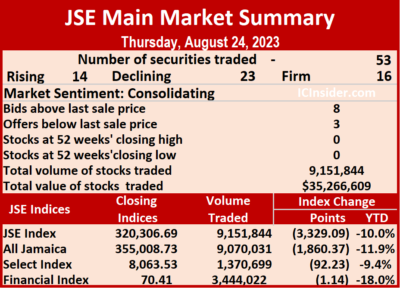

Scotia Group dropped $1 in closing at $33 in trading 4,346 units, Seprod increased 50 cents to close at $68 with 18,577 stocks clearing the market and Wisynco Group rose 94 cents and ended at $17.95 trading 7,870 stock units. A total of 9,151,844 shares were traded for $35,266,609 versus 7,549,896 units at $79,965,770 on Wednesday.

A total of 9,151,844 shares were traded for $35,266,609 versus 7,549,896 units at $79,965,770 on Wednesday. The JSE Main and USD Market PE ratios are calculated using the last traded prices in conjunction with ICInsider.com forecasted earnings for companies with the financial year ending up to August 2024.

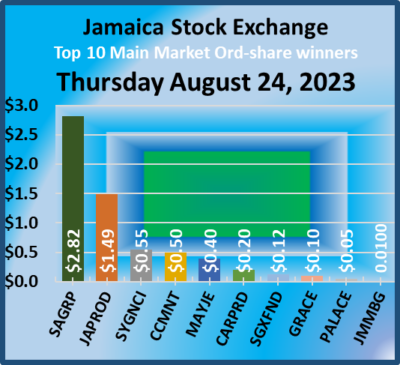

The JSE Main and USD Market PE ratios are calculated using the last traded prices in conjunction with ICInsider.com forecasted earnings for companies with the financial year ending up to August 2024. Mayberry Jamaican Equities rose 40 cents to $11.40 with 78,223 stocks changing hands, MPC Caribbean Clean Energy skidded $12.30 to $69.70 with 2,285 shares clearing the market. NCB Financial shed $2 to close at $73 with investors dealing in 12,895 units, Sagicor Group increased $2.82 to $46.90 with traders exchanging 2,625 shares, Seprod dipped 50 cents in closing at $67.50 with 6,941 stocks crossing the market. Supreme Ventures shed 46 cents and ended at $27.99 with an exchange of 176,814 stocks, Sygnus Credit Investments popped 55 cents to end at $11.99 after trading 25,143 units and Wisynco Group skidded 84 cents to close at $17.01 with a transfer of 123,716 shares.

Mayberry Jamaican Equities rose 40 cents to $11.40 with 78,223 stocks changing hands, MPC Caribbean Clean Energy skidded $12.30 to $69.70 with 2,285 shares clearing the market. NCB Financial shed $2 to close at $73 with investors dealing in 12,895 units, Sagicor Group increased $2.82 to $46.90 with traders exchanging 2,625 shares, Seprod dipped 50 cents in closing at $67.50 with 6,941 stocks crossing the market. Supreme Ventures shed 46 cents and ended at $27.99 with an exchange of 176,814 stocks, Sygnus Credit Investments popped 55 cents to end at $11.99 after trading 25,143 units and Wisynco Group skidded 84 cents to close at $17.01 with a transfer of 123,716 shares. Jamaica Public Service 7% lost $5 and ended at $50 in an exchange of 1,000 units and Jamaica Public Service 9.5% dived $249.99 to end at $2800.01 after just one stock was traded.

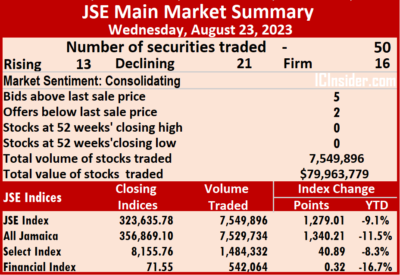

Jamaica Public Service 7% lost $5 and ended at $50 in an exchange of 1,000 units and Jamaica Public Service 9.5% dived $249.99 to end at $2800.01 after just one stock was traded. At the close, the All Jamaican Composite Index climbed 1,340.21 points to 356,869.10, the JSE Main Index rose 1,279.01 points to close at 323,635.78 and the JSE Financial Index popped 0.32 points to end trading at 71.55.

At the close, the All Jamaican Composite Index climbed 1,340.21 points to 356,869.10, the JSE Main Index rose 1,279.01 points to close at 323,635.78 and the JSE Financial Index popped 0.32 points to end trading at 71.55. The PE Ratio, a formula used to compute appropriate stock values, averages 12.9 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending up to August 2024.

The PE Ratio, a formula used to compute appropriate stock values, averages 12.9 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending up to August 2024. Mayberry Jamaican Equities fell 40 cents to close at $11 with 37,481 units being traded. Pan Jamaica advanced 86 cents in closing at $48.05 after a transfer of 23,977 stock units, Sagicor Group shed $2.82 to end at $44.08 with investors exchanging 28,063 shares, Scotia Group climbed 99 cents to close at $34 in trading 1,066 stocks. Seprod fell $1.99 to $68 with a transfer of 5,919 stocks, Sygnus Credit Investments dropped 55 cents in closing at $11.44, with 9,330 shares crossing the market and Victoria Mutual Investments gained 33 cents to close at $3.03 after a transfer of 4,947 units.

Mayberry Jamaican Equities fell 40 cents to close at $11 with 37,481 units being traded. Pan Jamaica advanced 86 cents in closing at $48.05 after a transfer of 23,977 stock units, Sagicor Group shed $2.82 to end at $44.08 with investors exchanging 28,063 shares, Scotia Group climbed 99 cents to close at $34 in trading 1,066 stocks. Seprod fell $1.99 to $68 with a transfer of 5,919 stocks, Sygnus Credit Investments dropped 55 cents in closing at $11.44, with 9,330 shares crossing the market and Victoria Mutual Investments gained 33 cents to close at $3.03 after a transfer of 4,947 units. In the preference segment, Jamaica Public Service 7% declined $1 and ended at $55 after three units cleared the market and Jamaica Public Service 9.5% lost $50 to end at $3050 in an exchange of 9 stocks.

In the preference segment, Jamaica Public Service 7% declined $1 and ended at $55 after three units cleared the market and Jamaica Public Service 9.5% lost $50 to end at $3050 in an exchange of 9 stocks.