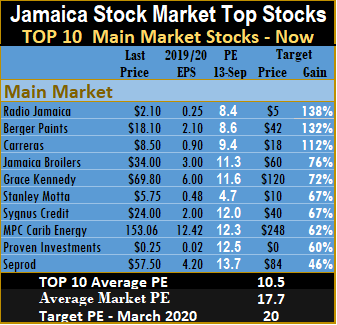

Scotia Group joins IC TOP 10

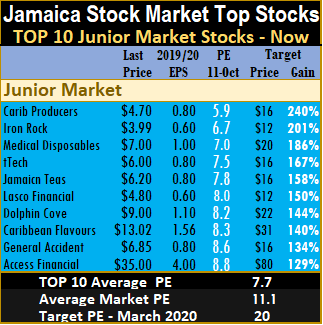

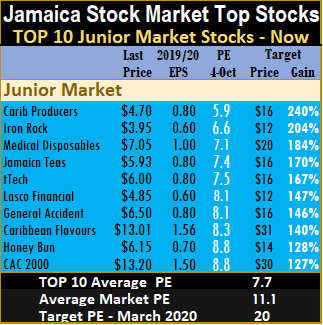

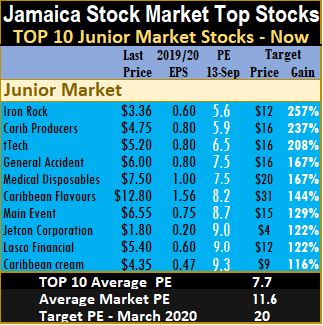

Buy Rated Junior Market stocks have two new entrants this week with Dolphin Cove price dropping to $9 and Access Financial trading at $35 joining the list while Honey Bun with the price rising to $6.50 and CAC2000 that rose to $13.50 exiting the top listing. Scotia Group dropped back to $57.10 from $61.50 at the end of the previous week and returns to the main market TOP 10 list at the expense of Stanley Motta.

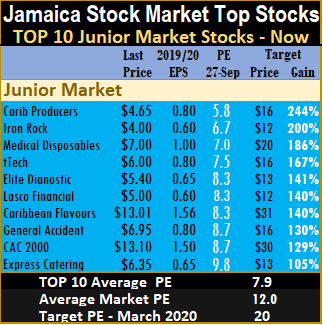

Market activity resulted in no change to the top three Junior Market stocks, leaving Caribbean Producers

with projected gains of 240 percent as the leader, followed by Iron Rock Insurance with potential gains of 201 percent and Medical Disposables with 186 percent.

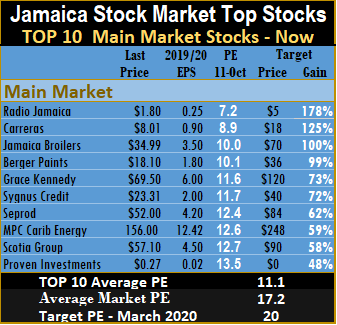

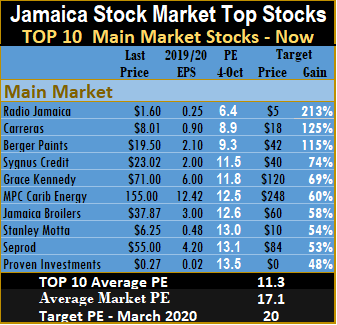

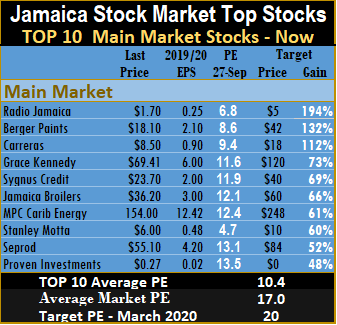

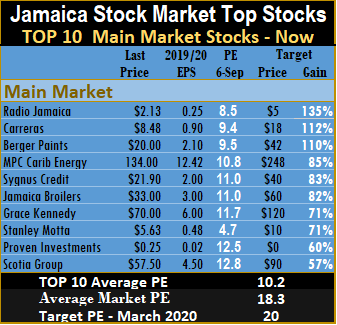

with projected gains of 240 percent as the leader, followed by Iron Rock Insurance with potential gains of 201 percent and Medical Disposables with 186 percent.Radio Jamaica (RJR) share price that slipped during the previous week to a low of $1.35 and closed that week at $1.60, climbed further this past week with increased investors’ interest that pushed the price to $1.80 with projected gains to 213 percent, to remain the leading main market stock. Carreras sits at the number two spot with likely gains of 125 percent and Jamaica Broilers with projected gains of 100 percent is next. Berger Paints slipped to the fourth spot with a downward revision of earnings to $1.80 for the year.

The main market, closed the week with the overall PE of 17.2, inching up from 17.1 for the previous week and the Junior Market remaining unchanged at 11.1 based on current year’s earnings.

The PE ratio for Junior Market Top 10 stocks average remains at 7.7 and the main market PE at 11.1, up from 10.4 at the close of the previous week.

The PE ratio for Junior Market Top 10 stocks average remains at 7.7 and the main market PE at 11.1, up from 10.4 at the close of the previous week.The TOP 10 stocks now trade at a discount of 31 percent to the average for the Junior Market stocks and main market stocks trade at a discount of 36 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with

the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

Buy Rated Junior Market stocks have two new entrants this week with

Buy Rated Junior Market stocks have two new entrants this week with

Market activity, left Caribbean Producers with projected gains of 240 percent as the leading Junior Market stock with likely gains, followed by

Market activity, left Caribbean Producers with projected gains of 240 percent as the leading Junior Market stock with likely gains, followed by  Carreras sits at the number two spot with projected gains of 125 percent with the price slipping a bit during the week and

Carreras sits at the number two spot with projected gains of 125 percent with the price slipping a bit during the week and  TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

TOP 10 stocks are likely to deliver the best returns to March next year. Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list. Attention by investors seems set to be focused on

Attention by investors seems set to be focused on

Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, along with the PE ratio for each company’s current fiscal year are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Proven Investments selling half of their holdings in Access Financial stock by way of a public offer, at an attractive price of $32 each. Market conditions resulted in just two changes to IC TOP 10 BUY RATED list as CAC 2000 returned to the top 10 Junior Market list, replacing Caribbean Cream and Scotia Group moved back into the main market listing at the expense of Seprod.

Proven Investments selling half of their holdings in Access Financial stock by way of a public offer, at an attractive price of $32 each. Market conditions resulted in just two changes to IC TOP 10 BUY RATED list as CAC 2000 returned to the top 10 Junior Market list, replacing Caribbean Cream and Scotia Group moved back into the main market listing at the expense of Seprod.  Radio Jamaica

Radio Jamaica

Prices pulled back during the past week but the new IC TOP 10 BUY RATED main market stocks MPC Caribbean Energy surged to an all-time high of $153.06 and is still in the TOP 10 and seems poised to move higher with no sellers in sight.

Prices pulled back during the past week but the new IC TOP 10 BUY RATED main market stocks MPC Caribbean Energy surged to an all-time high of $153.06 and is still in the TOP 10 and seems poised to move higher with no sellers in sight.

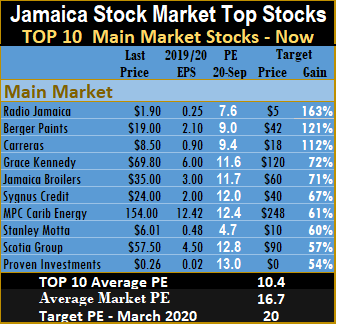

The PE ratio for Junior Market Top 10 stocks averages 7.7 compared to 8.4 the previous week and the main market PE is now 10.5. These levels of PE ratios point to big upside for TOP 10 stocks.

The PE ratio for Junior Market Top 10 stocks averages 7.7 compared to 8.4 the previous week and the main market PE is now 10.5. These levels of PE ratios point to big upside for TOP 10 stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list. Profit at newly listed Junior market

Profit at newly listed Junior market

IC TOP 10 BUY RATED main market stocks got a surprise entry as MPC Caribbean Energy surged into the top list for the first time to sit at fourth position at the expense of Seprod.

IC TOP 10 BUY RATED main market stocks got a surprise entry as MPC Caribbean Energy surged into the top list for the first time to sit at fourth position at the expense of Seprod.

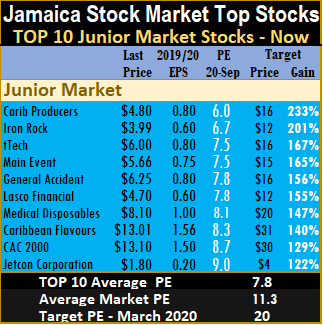

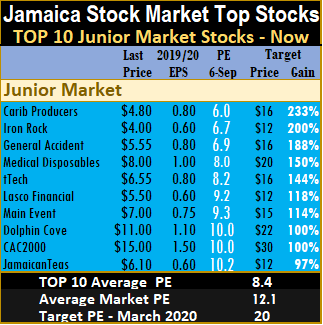

The three most attractive Junior Market stocks are Caribbean Producers with projected gains of 233 percent, followed by Iron Rock with likely gains of 200 percent and General Accident with projected gains of 188 percent.

The three most attractive Junior Market stocks are Caribbean Producers with projected gains of 233 percent, followed by Iron Rock with likely gains of 200 percent and General Accident with projected gains of 188 percent. The main market closed the week with the overall PE of 18.3 and the Junior Market remains at 12.1 current year’s earnings. The PE ratio for Junior Market Top 10 stocks averages 8.4 and the main market PE is now 10.2. These levels, point to big upside for TOP 10 stocks to the end of March next year and Junior Market stocks in particular as they lag, the values of the main market by a third.

The main market closed the week with the overall PE of 18.3 and the Junior Market remains at 12.1 current year’s earnings. The PE ratio for Junior Market Top 10 stocks averages 8.4 and the main market PE is now 10.2. These levels, point to big upside for TOP 10 stocks to the end of March next year and Junior Market stocks in particular as they lag, the values of the main market by a third. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.