The Main and Junior Markets closed the past week lower than the close of the previous week, with the Main market at a higher level than the third week of July, while the Junior Market continues at the lowest levels since the early summer months.

The Main and Junior Markets closed the past week lower than the close of the previous week, with the Main market at a higher level than the third week of July, while the Junior Market continues at the lowest levels since the early summer months.

The Junior Market is currently signaling a big surge coming that will start in a few weeks as short term moving averages cross over longer-term ones to confirm a strong rally.

The price of Salada Foods sank to $20 on Friday, pushing NCB Financial out of the IC TOP 10 Main Market. As the markets continue to trade in a narrow band, there was no other movement in and out of the TOP 10.

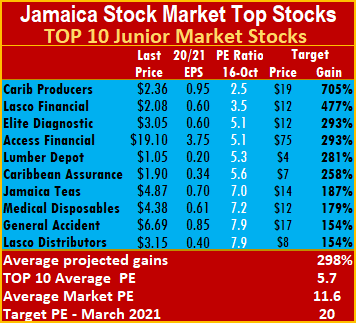

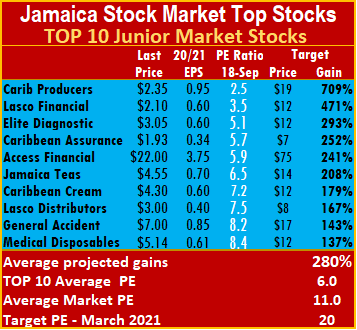

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 282 to 764 percent by March 2021. Caribbean Producers heads the list, followed by  Lasco Financial and Elite Diagnostic.

Lasco Financial and Elite Diagnostic.  The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 227 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Grace Kennedy.

The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 227 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Grace Kennedy.

The local stock market’s targeted average PE ratio is 20 based on companies reporting full year’s results from now to the second quarter in 2021. The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead.  The JSE Main Market ended the week, with an overall PE of 16.1 and the Junior Market 12.2, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 47 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.4 or 52 percent of the PE of that market.

The JSE Main Market ended the week, with an overall PE of 16.1 and the Junior Market 12.2, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 47 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.4 or 52 percent of the PE of that market.

The average projected gain for the Junior Market IC TOP 10 stocks is 299 percent and 144 percent for the JSE Main Market, based on 2020-21 earnings, indicating potentially greater gains in the Junior Market than the Main Market.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

In its annual report for the just concluded financial year, the company reported that “during the new financial year, the Company will continue to build out its productive capacity. We have capitalized our lubricant plant and installed the packaging line. Renovation activities already started on the bleach and chlorine plants will continue in the new financial year. We have also expanded into manufacturing sanitation products and will widen the product base over time. Our main drivers in the short term will be the revenue we will derive from our new products, the expansion of our offerings in the Bleach division, and our continued pursuit of contract manufacturing in our Lubricant division”.

In its annual report for the just concluded financial year, the company reported that “during the new financial year, the Company will continue to build out its productive capacity. We have capitalized our lubricant plant and installed the packaging line. Renovation activities already started on the bleach and chlorine plants will continue in the new financial year. We have also expanded into manufacturing sanitation products and will widen the product base over time. Our main drivers in the short term will be the revenue we will derive from our new products, the expansion of our offerings in the Bleach division, and our continued pursuit of contract manufacturing in our Lubricant division”.

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 293 to 705 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 245 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 293 to 705 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 245 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.8 and the Junior Market 11.6, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 49 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.5 or 54 percent of the PE of that market.

The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.8 and the Junior Market 11.6, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 49 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.5 or 54 percent of the PE of that market. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in the selection process in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in the selection process in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information. Operating revenues rose nine percent for the quarter, to $461 million from $422 million and six percent for the year to date, from $840 million in 2019 to $891 million. For the fiscal year to February, this year, revenues rose by 10 percent to $1.7 billion.

Operating revenues rose nine percent for the quarter, to $461 million from $422 million and six percent for the year to date, from $840 million in 2019 to $891 million. For the fiscal year to February, this year, revenues rose by 10 percent to $1.7 billion.

The markets moved moderately higher to close at their highest levels since mid-August for the. The Main Market closed the past week higher than the previous one, but the Junior Market closed the week lower than the prior one.

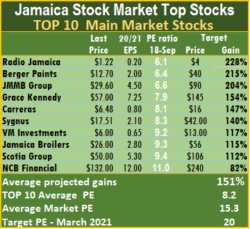

The markets moved moderately higher to close at their highest levels since mid-August for the. The Main Market closed the past week higher than the previous one, but the Junior Market closed the week lower than the prior one. With expected gains of 152 to 240 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Carreras. Radio Jamaica is now down to the fifth spot with slightly lower earnings per share of 15 cents from 20 cents previously.

With expected gains of 152 to 240 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Carreras. Radio Jamaica is now down to the fifth spot with slightly lower earnings per share of 15 cents from 20 cents previously. The average projected gain for the Junior Market IC TOP 10 stocks is 279 percent and 145 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially greater gains in the Junior Market than in the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 279 percent and 145 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially greater gains in the Junior Market than in the Main Market.

This week’s focus: Jamaican Teas came in for increased buying during the past week after the company advised the Jamaica Stock Exchange that the board of directors will meet to determine a new record date for the sub-division of the Company’s shares, following the deferral at the Annual General meeting. The stock traded at $4.30 on September 29 and closed at $4.83 on Wednesday, with 161,040 units changing hands, with the offer at $4.50. The volume ballooned to over one million units on Thursday, with the price hitting $5.55 during the day. The company completed the 2020 fiscal year at the end of September.

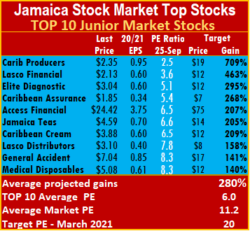

This week’s focus: Jamaican Teas came in for increased buying during the past week after the company advised the Jamaica Stock Exchange that the board of directors will meet to determine a new record date for the sub-division of the Company’s shares, following the deferral at the Annual General meeting. The stock traded at $4.30 on September 29 and closed at $4.83 on Wednesday, with 161,040 units changing hands, with the offer at $4.50. The volume ballooned to over one million units on Thursday, with the price hitting $5.55 during the day. The company completed the 2020 fiscal year at the end of September. The market’s targeted average PE ratio is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.1 and the Junior Market 11.2, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 6.1 at just 54 percent to the overall Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.2 or 54 percent of the PE of the overall market.

The market’s targeted average PE ratio is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.1 and the Junior Market 11.2, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 6.1 at just 54 percent to the overall Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.2 or 54 percent of the PE of the overall market. The average projected gain for the Junior Market IC TOP 10 stocks is 283 percent, and 153 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially greater gains in the Junior Market than in the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 283 percent, and 153 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially greater gains in the Junior Market than in the Main Market.

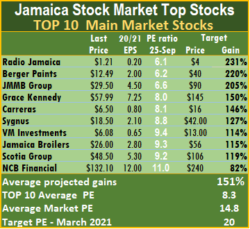

The top three stocks in each market saw no change in ranking for the top three Junior Market stocks, with the potential to gain between 295 to 709 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is the 2021 fiscal year results, projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 205 to 231 percent, are Radio Jamaica, followed by Berger Paints and JMMB Group.

The top three stocks in each market saw no change in ranking for the top three Junior Market stocks, with the potential to gain between 295 to 709 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is the 2021 fiscal year results, projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 205 to 231 percent, are Radio Jamaica, followed by Berger Paints and JMMB Group. The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior Market and the Main Market are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 14.8 and the Junior Market 11.2, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 54 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.3 or 56 percent of the PE of the overall market.

The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior Market and the Main Market are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 14.8 and the Junior Market 11.2, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 54 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.3 or 56 percent of the PE of the overall market. The average projected gain for the Junior Market IC TOP 10 stocks is 280 percent, and 151 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially more significant gains in the Junior Market than in the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 280 percent, and 151 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially more significant gains in the Junior Market than in the Main Market.

The focus on all three is on the 2021 fiscal year results projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 204 to 228 percent, are Radio Jamaica, followed by Berger Paints, with the price rising 7 percent during the week and JMMB Group.

The focus on all three is on the 2021 fiscal year results projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 204 to 228 percent, are Radio Jamaica, followed by Berger Paints, with the price rising 7 percent during the week and JMMB Group. The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.3 and the Junior Market 11, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 55 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.2 or 54 percent of the PE of the overall market.

The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.3 and the Junior Market 11, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 55 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.2 or 54 percent of the PE of the overall market. The average projected gain for the Junior Market IC TOP 10 stocks is 280 percent, and 151 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially more significant gains in the Junior Market than in the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 280 percent, and 151 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially more significant gains in the Junior Market than in the Main Market. Nine months profit, rose 54 percent to $108 million, from $70 million, aftertax, while profit rose 22 percent from $88.6 million before tax in 2019, to $107.8 million. In 2019, the Company incurred a tax charge of $19 million for the nine months but had none in 2020, as it benefited from the listing on the Junior Market of the Jamaica Stock Exchange. Profit for the nine months equals the 2019 full year pretax profit of $107.5 million. The company enjoyed increased profit due to a 41.4 percent rise in revenues in the July quarter, from $152 million to $217 million and an increase of 41 percent for the nine months from $486 million to $686 million.

Nine months profit, rose 54 percent to $108 million, from $70 million, aftertax, while profit rose 22 percent from $88.6 million before tax in 2019, to $107.8 million. In 2019, the Company incurred a tax charge of $19 million for the nine months but had none in 2020, as it benefited from the listing on the Junior Market of the Jamaica Stock Exchange. Profit for the nine months equals the 2019 full year pretax profit of $107.5 million. The company enjoyed increased profit due to a 41.4 percent rise in revenues in the July quarter, from $152 million to $217 million and an increase of 41 percent for the nine months from $486 million to $686 million.

The issue for 325 million ordinary shares at $1 each of with up to 187.5 million units reserved for priority applications, opens September 22 and is scheduled for closing on September 30, subject to the right of the Company to close it earlier.

The issue for 325 million ordinary shares at $1 each of with up to 187.5 million units reserved for priority applications, opens September 22 and is scheduled for closing on September 30, subject to the right of the Company to close it earlier. The Company plans to use the amount collected for expansion and working capital purposes, including but not limited to new product lines, expansion and renovation of retail stores, including an expansion of the parking area at the retail store at Grove Road in St Andrew. Completion of the buildout of and relocating to the new warehouse, head office and retail store at Ferry, Acquiring and install information technology systems for greater efficiency and improve customer experience and expansion of Mobile delivery fleet of vehicles.

The Company plans to use the amount collected for expansion and working capital purposes, including but not limited to new product lines, expansion and renovation of retail stores, including an expansion of the parking area at the retail store at Grove Road in St Andrew. Completion of the buildout of and relocating to the new warehouse, head office and retail store at Ferry, Acquiring and install information technology systems for greater efficiency and improve customer experience and expansion of Mobile delivery fleet of vehicles.