Profit rose 26 percent before tax in the second quarter for Limners and Bards (the LAB) 20 percent for the six months to year-over-year to April this year. With no corporation taxes payable since listing in 2019, profit after tax increased 52 percent for the six months to April and 54 percent for the second quarter.

Net profit soared from $25 million in 2019 to $38 million for the quarter and the six-month net profit was up 52 percent, at $87 million from $57 million. The Lab incurred Corporation taxes of $15 million for the half-year for 2019 and $5.4 million for the 2019 April quarter. Profit for the half-year was 81 percent of pretax profit for all of 2019 when the company reported $107 million in profit before taxation, while revenues are 75 percent of the 2019 outturn. The principal activities of the company are production, media and advertising services.

Net profit soared from $25 million in 2019 to $38 million for the quarter and the six-month net profit was up 52 percent, at $87 million from $57 million. The Lab incurred Corporation taxes of $15 million for the half-year for 2019 and $5.4 million for the 2019 April quarter. Profit for the half-year was 81 percent of pretax profit for all of 2019 when the company reported $107 million in profit before taxation, while revenues are 75 percent of the 2019 outturn. The principal activities of the company are production, media and advertising services.

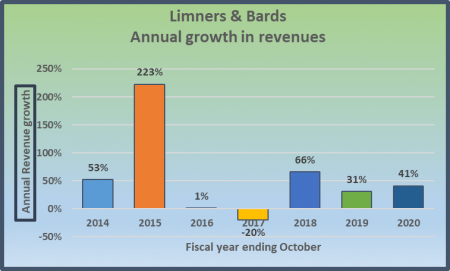

Growth in profit in 2020 to date is disappointing considering the blistering pace that revenue grew by, with an increase of 44 percent for the quarter, to hit $208 million from $145 million in 2019 and 41 percent for the six months, to $471 million from $334 million in 2019. Growth over the six months for revenues “was driven by growth in media by 72.5 percent increase and agency, up 78 percent,” Steven Gooden, Chairman and Kimala Bennett, CEO, reported to shareholders in their joint commentary accompanying the quarterly. The sharp rise in revenues follows a 31 percent increase in the 2019 fiscal year over 2018.

Direct costs increased at a faster pace than revenues at 51 percent for the quarter, to $133 million and 46 percent for the six-months with expenses of $306 million.  The result is a slight decline in the gross profit margin down three percentage points at 36 percent for the quarter from 39 percent in 2019 and down two percentage points, at 35 percent for the six months.

The result is a slight decline in the gross profit margin down three percentage points at 36 percent for the quarter from 39 percent in 2019 and down two percentage points, at 35 percent for the six months.

Gross profit increased by 32 percent for the quarter and 33 percent for the month at $75 million and $166 million, respectively.

Administrative and selling costs increased 44 percent to $37 million for the quarter and 55 percent year-over-year for the six-months to $79 million.

Gross cash inflows pulled in $92 million for the half-year, but after payment of dividend, loans and working capital increase $61 million remained, when added to funds on hand before cash funds ended at $352 million. Net current assets ended the period at $490 million inclusive of receivables of $119 million, down from$133 million at the end of April 2019 but up from the year-end of $84 million and cash and bank balances of $352 million. Current liabilities stand at $111 million for a healthy current ratio of 4.4. At the end of April, shareholders’ equity stood at $424 million with long-term loans and lease payable amounted to $64 million.

Earnings per share came out at 4 cents for the quarter and 9 cents for the six months. IC Insider.com is forecasting 18 cents per share for PE of 14.5 times 2020 earnings and 25 cents for 2021.

The stock traded at $2.46 on the Junior Market of the Jamaica Stock Exchange with a PE ratio of 14 times 2020 earnings.

Limners & Bards LAB Q2 profit jumps 54%

June 21, 2020 by IC Insider.com

Filed Under: Company News, Company Results Tagged With: Emerging markets, Jamaica Stock Exchange, junior market, Kimala Bennett, Limners and Bards, Steven Gooden, The Lab

About IC Insider.com