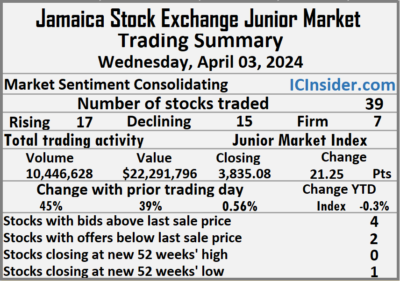

The Junior Market of the Jamaica Stock Exchange recovered a third of the losses incurred on Tuesday at the close of the Wednesday session, with trading in 39 securities down from 45 on Tuesday and ending with prices of 17 rising, 15 declining and seven unchanged, following a 45 percent rise in the volume of stocks traded, after a 39 percent increase in value compared with Tuesday’ trading.

The market closed with trading of 10,446,628 shares for $22,291,796 compared with 7,214,648 units at $16,008,489 on Tuesday.

The market closed with trading of 10,446,628 shares for $22,291,796 compared with 7,214,648 units at $16,008,489 on Tuesday.

Trading averaged 267,862 shares at $571,585, compared with 160,326 units at $355,744 on Tuesday with the month to date, averaging 210,253 units at $455,956 compared to March with an average of 221,659 units at $464,382.

Spur Tree Spices led trading with 4.31 million shares for 41.2 percent of total volume followed by JFP Ltd with 990,360 stocks for 9.5 percent of the day’s trade and MFS Capital Partners with 912,316 units for 8.7 percent market share.

At the close of trading, the Junior Market Index rose 21.25 points to close at 3,835.08.

The Junior Market ended trading with an average PE Ratio of 12.7 based on last traded prices in conjunction with earnings projected by ICInsider.com for financial years, ending around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

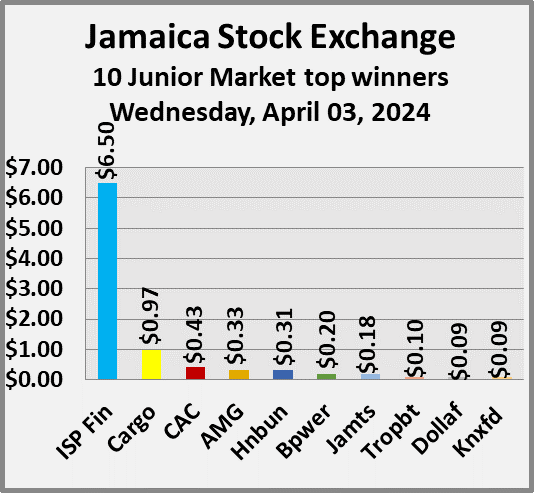

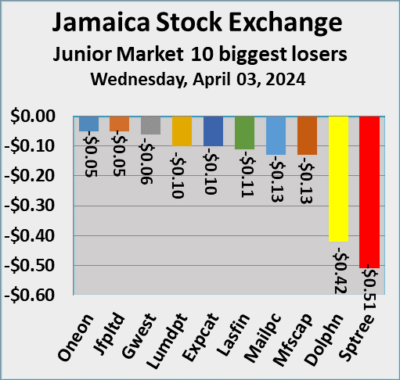

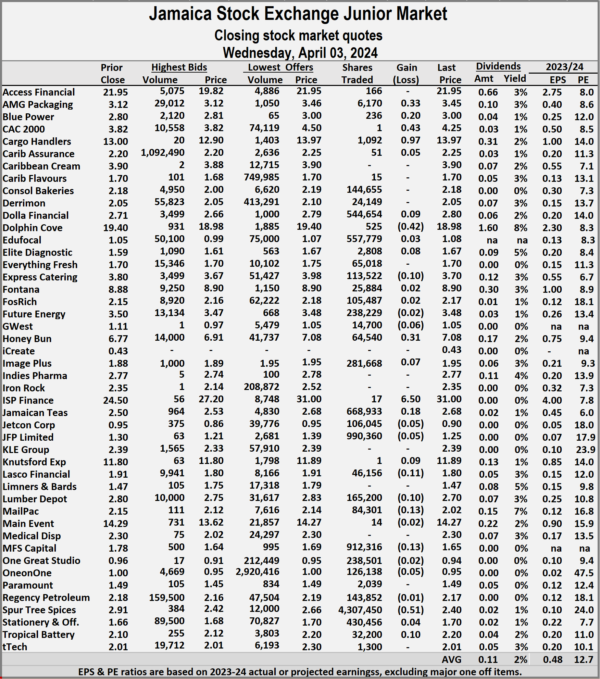

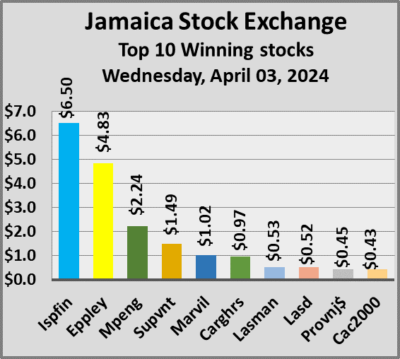

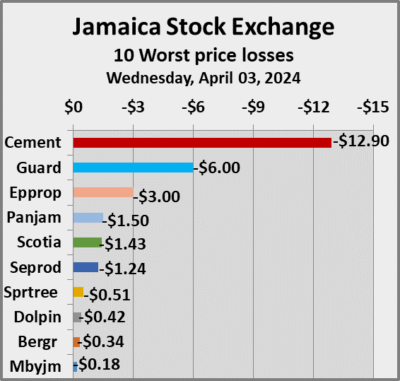

At the close, AMG Packaging rose 33 cents to end at $3.45, with 6,170 stock units changing hands, Blue Power rallied 20 cents in closing at $3 in trading 236 shares, CAC 2000 increased 43 cents to $4.25 after a mere one unit passed through the market. Cargo Handlers climbed 97 cents to $13.97, with 1,092 stocks crossing the exchange, Dolla Financial popped 9 cents to $2.80 after a transfer of 544,654 shares, Dolphin Cove fell 42 cents to $18.98, with 525 stock units crossing the market. Elite Diagnostic gained 8 cents in closing at $1.67 with an exchange of 2,808 shares, Express Catering shed 10 cents to end at $3.70 with 113,522 stocks clearing the market, Honey Bun advanced 31 cents and ended at $7.08 with investors transferring 64,540 units. Image Plus rose 7 cents to close at $1.95 in switching ownership of 281,668 stocks, ISP Finance climbed $6.50 to $31 after exchanging just 17 shares, Jamaican Teas popped 18 cents in closing at $2.68, with 668,933 stock units crossing the market.  Knutsford Express rallied 9 cents to end at $11.89 with traders dealing in just one share, Lasco Financial dropped 11 cents to close at $1.80 after closing with an exchange of 46,156 stocks, Lumber Depot sank 10 cents and ended at $2.70 with a transfer of 165,200 units. Mailpac Group dipped 13 cents to $2.02 after trading in 84,301 stock units, MFS Capital Partners lost 13 cents in closing at $1.65 with investors dealing in 912,316 shares, Spur Tree Spices skidded 51 cents to end at $2.40 in an exchange of 4,307,450 stock units and Tropical Battery increased 10 cents to $2.20 with investors trading 32,200 units.

Knutsford Express rallied 9 cents to end at $11.89 with traders dealing in just one share, Lasco Financial dropped 11 cents to close at $1.80 after closing with an exchange of 46,156 stocks, Lumber Depot sank 10 cents and ended at $2.70 with a transfer of 165,200 units. Mailpac Group dipped 13 cents to $2.02 after trading in 84,301 stock units, MFS Capital Partners lost 13 cents in closing at $1.65 with investors dealing in 912,316 shares, Spur Tree Spices skidded 51 cents to end at $2.40 in an exchange of 4,307,450 stock units and Tropical Battery increased 10 cents to $2.20 with investors trading 32,200 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big jump in trading on the JSE USD market

Trading jumped sharply on the Jamaica Stock Exchange US dollar market ended on Tuesday, with a 260 percent rise in the volume of stocks exchanged following a 288 percent rise in value compared to Thursday and resulting in trading in seven securities, compared to six on Thursday with prices of three rising, four declining.

The market closed with an exchange of 304,275 shares for US$13,337 compared to 84,506 units at US$3,441 on Thursday.

The market closed with an exchange of 304,275 shares for US$13,337 compared to 84,506 units at US$3,441 on Thursday.

Trading averaged 43,468 units at US$1,905 up from 14,084 shares at US$574 on Thursday, compared with March with an average of 49,394 units for US$3,593.

The US Denominated Equities Index skidded 1.39 points to end the day at 246.42.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share shed 0.49 of one cent and ended at 4.5 US cents with traders dealing in 1,010 stock units,  Proven Investments fell 0.08 of a cent to 14.8 US cents while investors exchanged 2,670 shares, Sterling Investments popped 0.01 of a cent to close at 1.7 US cents after 2,500 units were traded. Sygnus Credit Investments dropped 1.58 cents in closing at 7.02 US cents after exchanging 62,162 stocks, Sygnus Real Estate Finance USD share lost 2.03 cents to end at 8.97 US cents with a transfer of 40,852 units and Transjamaican Highway increased 0.03 of a cent in closing at 2.23 US cents after an exchange of 194,681 stocks.

Proven Investments fell 0.08 of a cent to 14.8 US cents while investors exchanged 2,670 shares, Sterling Investments popped 0.01 of a cent to close at 1.7 US cents after 2,500 units were traded. Sygnus Credit Investments dropped 1.58 cents in closing at 7.02 US cents after exchanging 62,162 stocks, Sygnus Real Estate Finance USD share lost 2.03 cents to end at 8.97 US cents with a transfer of 40,852 units and Transjamaican Highway increased 0.03 of a cent in closing at 2.23 US cents after an exchange of 194,681 stocks.

In the preference segment, JMMB Group US8.5% preference share rose 1 cent to US$1.19 with investors transferring 400 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on JSE USD market

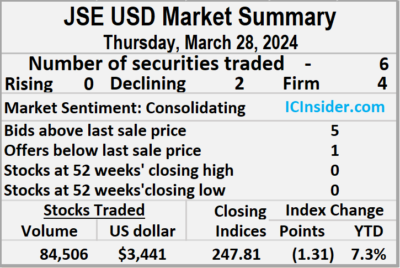

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks exchanged declining 72 percent after 91 percent fall in value than on Wednesday, resulting in trading in six securities, compared to nine on Wednesday with price of no stock rising, two declining and four ending unchanged.

The market closed with an exchange of 84,506 shares for US$3,441 compared to 303,812 units at US$36,667 on Wednesday.

The market closed with an exchange of 84,506 shares for US$3,441 compared to 303,812 units at US$36,667 on Wednesday.

Trading averaged 14,084 units at US$574 versus 33,757 shares at US$4,074 on Wednesday, with a month to date average of 49,394 shares at US$3,593 compared with 50,886 units at US$3,720 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index skidded 1.31 points to close at 247.81.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, AS Bryden shed 0.39 of one cent to 22.01 US cents while exchanging one share, First Rock Real Estate USD share ended at 4.99 US cents with traders dealing in 50 stocks, Margaritaville remained at 10 US cents, with 25 shares crossing the market. Proven Investments dropped 0.11 of a cent and ended at 14.88 US cents after trading 3,233 stocks and Transjamaican Highway remained at 2.2 US cents with investors dealing in 80,197 shares.

At the close, AS Bryden shed 0.39 of one cent to 22.01 US cents while exchanging one share, First Rock Real Estate USD share ended at 4.99 US cents with traders dealing in 50 stocks, Margaritaville remained at 10 US cents, with 25 shares crossing the market. Proven Investments dropped 0.11 of a cent and ended at 14.88 US cents after trading 3,233 stocks and Transjamaican Highway remained at 2.2 US cents with investors dealing in 80,197 shares.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.18 with 1,000 units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

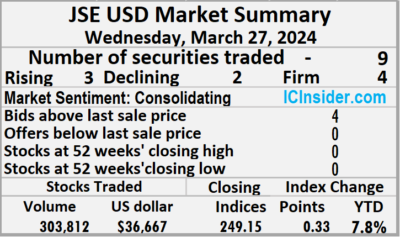

Trading surged on the JSE USD market

Trading surged on Wednesday with a 97 percent jump in the volume of stocks changing hands on the Jamaica Stock Exchange US dollar market following a 221 percent jump in the value of stocks changing hands compared to Tuesday, resulting from trading in nine securities, up from eight on Tuesday and ended with prices of three rising, two declining and four ending unchanged.

The market closed with an exchange of 303,812 shares for US$36,667 up from 154,383 units at US$11,426 on Tuesday.

The market closed with an exchange of 303,812 shares for US$36,667 up from 154,383 units at US$11,426 on Tuesday.

Trading averaged 33,757 units at US$4,074 versus 19,298 shares at US$1,428 on Tuesday, with a month to date average of 50,886 shares at US$3,720 compared with 52,045 units at US$3,696 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index popped 0.33 points to settle at 249.15.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share remained at 4.99 US cents while investors exchanged 3,813 stocks, Margaritaville dipped 0.99 of one cent to 10 US cents, with 22,170 units crossing the market, Proven Investments ended at 14.99 US cents after an exchange of 9,156 shares. Sterling Investments advanced 0.07 of a cent to close at 1.69 US cents with 58 stock units crossing the market, Sygnus Credit Investments lost 0.1 of a cent to end at 8.6 US cents in switching ownership of 11 shares, Sygnus Real Estate Finance USD share ended at 11 US cents, with 1,000 stocks changing hands and Transjamaican Highway rose 0.03 of a cent to 2.2 US cents and closed with an exchange of 245,862 units.

Sterling Investments advanced 0.07 of a cent to close at 1.69 US cents with 58 stock units crossing the market, Sygnus Credit Investments lost 0.1 of a cent to end at 8.6 US cents in switching ownership of 11 shares, Sygnus Real Estate Finance USD share ended at 11 US cents, with 1,000 stocks changing hands and Transjamaican Highway rose 0.03 of a cent to 2.2 US cents and closed with an exchange of 245,862 units.

In the preference segment, JMMB Group US8.5% preference share rallied 1 cent to end at US$1.18 with 19,754 stock units clearing the market and JMMB Group 5.75% remained at US$2.12 with investors dealing in 1,988 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

At the close of trading, the JSE Combined Market Index fell 1,050.46 points to close at 339,633.63, the All Jamaican Composite Index dropped 1,899.54 points to finish trading at 365,600.06, the JSE Main Index shed 1,250.30 points to end at 326,412.67. The Junior Market Index climbed 21.25 points to finish at 3,835.08 and the JSE USD Market Index declined by 5.57 points to end the day at 240.85.

At the close of trading, the JSE Combined Market Index fell 1,050.46 points to close at 339,633.63, the All Jamaican Composite Index dropped 1,899.54 points to finish trading at 365,600.06, the JSE Main Index shed 1,250.30 points to end at 326,412.67. The Junior Market Index climbed 21.25 points to finish at 3,835.08 and the JSE USD Market Index declined by 5.57 points to end the day at 240.85. In the Junior Market, Spur Tree Spices led trading with 4.31 million shares followed by JFP Ltd with 990,360 units and MFS Capital Partners with 912,316 stock units.

In the Junior Market, Spur Tree Spices led trading with 4.31 million shares followed by JFP Ltd with 990,360 units and MFS Capital Partners with 912,316 stock units. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

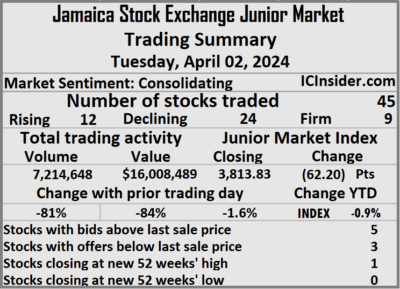

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed with an 81 percent decline in the volume of stocks traded of 7,214,648 shares for $16,008,489, 84 percent lower than on Thursday’s 37,301,154 units at $98,792,252.

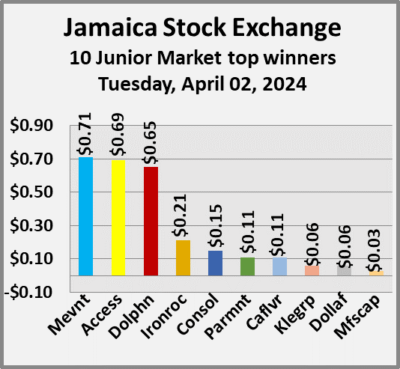

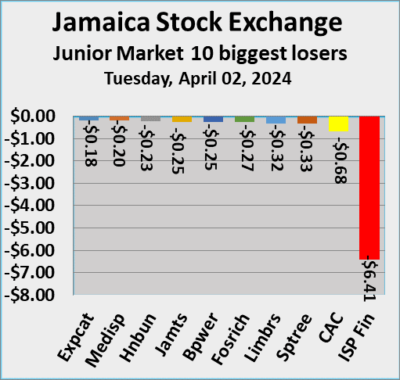

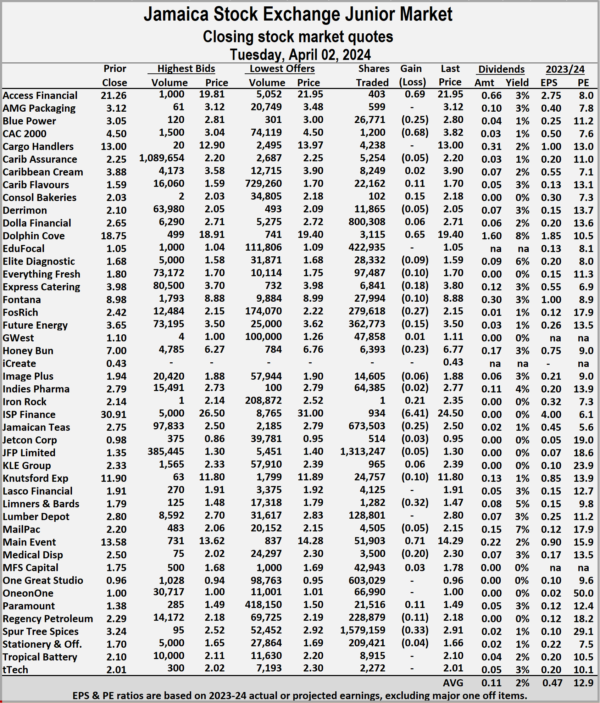

The market closed with an 81 percent decline in the volume of stocks traded of 7,214,648 shares for $16,008,489, 84 percent lower than on Thursday’s 37,301,154 units at $98,792,252. At the close, Access Financial increased 69 cents to end at $21.95 with investors trading 403 shares, Blue Power shed 25 cents to $2.80, with 26,771 stock units changing hands, CAC 2000 lost 68 cents to close at $3.82 with investors dealing in 1,200 stocks. Caribbean Flavours climbed 11 cents and ended at $1.70 in swapping 22,162 units, Consolidated Bakeries popped 15 cents in closing at $2.18, with 102 shares crossing the market, Dolphin Cove gained 65 cents to end at $19.40 in an exchange of 3,115 units. Elite Diagnostic dropped 9 cents to $1.59 with traders dealing in 28,332 stocks, Everything Fresh fell 10 cents in closing at $1.70 as investors exchanged 97,487 stock units, Express Catering skidded 18 cents and ended at $3.80 in trading 6,841 shares. Fontana sank 10 cents to close at $8.88 after 27,994 stock units passed through the market, Fosrich dipped 27 cents to $2.15 with an exchange of 279,618 units, Future Energy declined 15 cents to close at $3.50 with 362,773 stocks clearing the market.

At the close, Access Financial increased 69 cents to end at $21.95 with investors trading 403 shares, Blue Power shed 25 cents to $2.80, with 26,771 stock units changing hands, CAC 2000 lost 68 cents to close at $3.82 with investors dealing in 1,200 stocks. Caribbean Flavours climbed 11 cents and ended at $1.70 in swapping 22,162 units, Consolidated Bakeries popped 15 cents in closing at $2.18, with 102 shares crossing the market, Dolphin Cove gained 65 cents to end at $19.40 in an exchange of 3,115 units. Elite Diagnostic dropped 9 cents to $1.59 with traders dealing in 28,332 stocks, Everything Fresh fell 10 cents in closing at $1.70 as investors exchanged 97,487 stock units, Express Catering skidded 18 cents and ended at $3.80 in trading 6,841 shares. Fontana sank 10 cents to close at $8.88 after 27,994 stock units passed through the market, Fosrich dipped 27 cents to $2.15 with an exchange of 279,618 units, Future Energy declined 15 cents to close at $3.50 with 362,773 stocks clearing the market. Honey Bun lost 23 cents to end at $6.77 in an exchange of 6,393 shares, Iron Rock Insurance rose 21 cents to $2.35 with investors swapping just one stock, ISP Finance dropped $6.41 and ended at $24.50, with 934 units crossing the exchange. Jamaican Teas declined 25 cents to $2.50 after a transfer of 673,503 stock units, Knutsford Express sank 10 cents to close at $11.80 after 24,757 shares passed through the market, Limners and Bards skidded 32 cents and ended at $1.47 after an exchange of 1,282 stocks. Main Event advanced 71 cents to end at $14.29 with investors trading 51,903 units, Medical Disposables shed 20 cents in closing at $2.30 after an exchange of 3,500 stock units, Paramount Trading rallied 11 cents to $1.49 in trading 21,516 shares. Regency Petroleum dropped 11 cents in closing at $2.18, with 228,879 stocks crossing the market and Spur Tree Spices dipped 33 cents to end at $2.91 while exchanging 1,579,159 units.

Honey Bun lost 23 cents to end at $6.77 in an exchange of 6,393 shares, Iron Rock Insurance rose 21 cents to $2.35 with investors swapping just one stock, ISP Finance dropped $6.41 and ended at $24.50, with 934 units crossing the exchange. Jamaican Teas declined 25 cents to $2.50 after a transfer of 673,503 stock units, Knutsford Express sank 10 cents to close at $11.80 after 24,757 shares passed through the market, Limners and Bards skidded 32 cents and ended at $1.47 after an exchange of 1,282 stocks. Main Event advanced 71 cents to end at $14.29 with investors trading 51,903 units, Medical Disposables shed 20 cents in closing at $2.30 after an exchange of 3,500 stock units, Paramount Trading rallied 11 cents to $1.49 in trading 21,516 shares. Regency Petroleum dropped 11 cents in closing at $2.18, with 228,879 stocks crossing the market and Spur Tree Spices dipped 33 cents to end at $2.91 while exchanging 1,579,159 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.  At the close of trading, the JSE Combined Market Index climbed 563.57 points to 340,684.10, the All Jamaican Composite Index shed 1,084.66 points to 367,499.60, the JSE Main Index shed 135.73 points to lock up trading at 327,662.97. The Junior Market Index dropped 62.20 points to conclude trading at 3,813.83 and the JSE USD Market Index dipped 1.39 points to end trading at 246.42.

At the close of trading, the JSE Combined Market Index climbed 563.57 points to 340,684.10, the All Jamaican Composite Index shed 1,084.66 points to 367,499.60, the JSE Main Index shed 135.73 points to lock up trading at 327,662.97. The Junior Market Index dropped 62.20 points to conclude trading at 3,813.83 and the JSE USD Market Index dipped 1.39 points to end trading at 246.42. In the Junior Market, Spur Tree Spices led trading with 1.58 million shares followed by JFP Ltd with 1.31 million stock units and Dolla Financial with 800,308 units.

In the Junior Market, Spur Tree Spices led trading with 1.58 million shares followed by JFP Ltd with 1.31 million stock units and Dolla Financial with 800,308 units. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

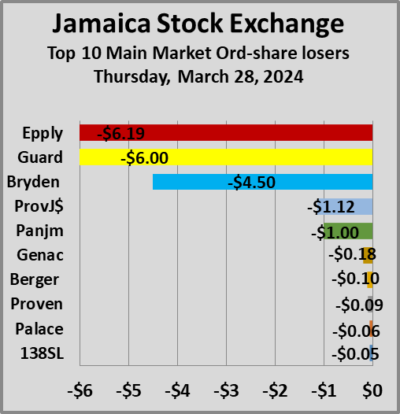

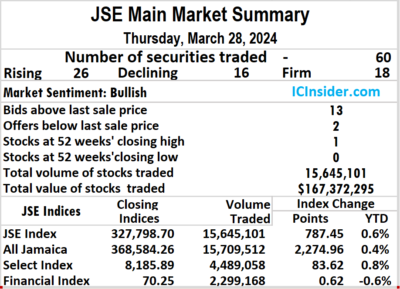

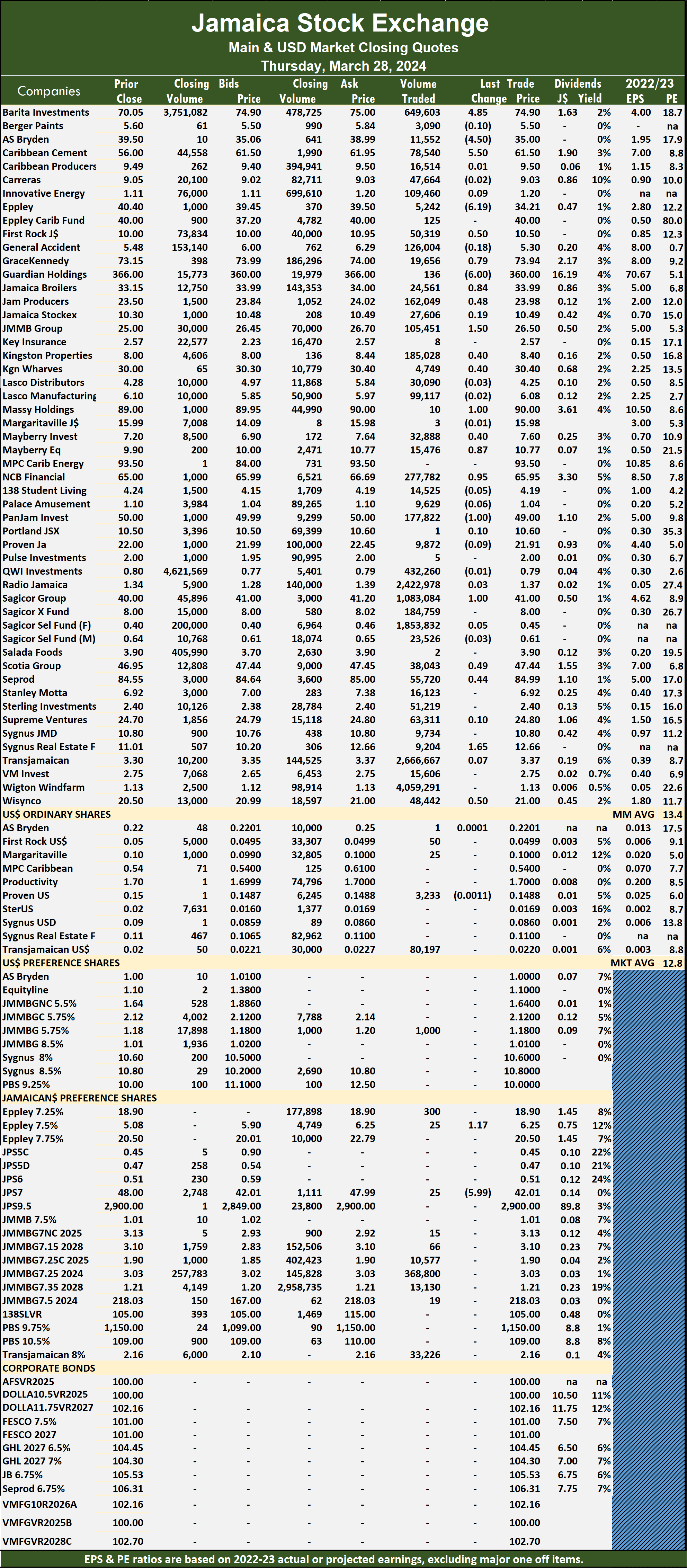

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed after 15,645,101 shares were traded for $167,372,295 compared with 8,091,866 units at $89,053,515, on Wednesday.

The market closed after 15,645,101 shares were traded for $167,372,295 compared with 8,091,866 units at $89,053,515, on Wednesday. The Main Market ended trading with an average PE Ratio of 13.4. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

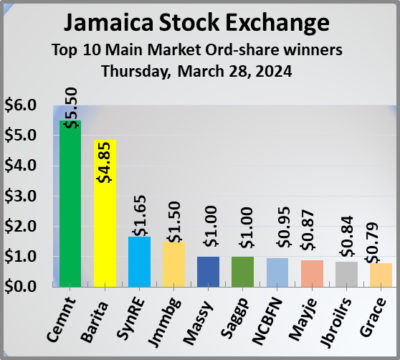

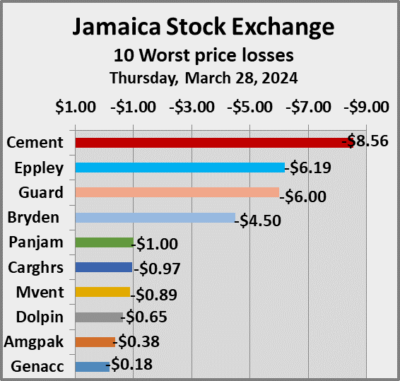

The Main Market ended trading with an average PE Ratio of 13.4. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. JMMB Group gained $1.50 and ended at $26.50 with investors trading 105,451 shares, Kingston Properties popped 40 cents to $8.40 with 185,028 stock units clearing the market, Kingston Wharves advanced 40 cents and ended at $30.40 after an exchange of 4,749 units. Massy Holdings rose $1 in closing at $90 in trading 10 shares, Mayberry Group gained 40 cents to end at $7.60 after an exchange of 32,888 units, Mayberry Jamaican Equities climbed 87 cents to close at $10.77 after 15,476 stocks passed through the market. NCB Financial increased 95 cents to $65.95 in an exchange of 277,782 stock units, Pan Jamaica skidded $1 and ended at $49 with 177,822 shares crossing the market, Sagicor Group rallied $1 to end at $41 while exchanging 1,083,084 stock units. Scotia Group rose 49 cents in closing at a 52 weeks’ high of $47.44 with traders dealing in 38,043 stocks, Seprod climbed 44 cents to close at $84.99 in an exchange of 55,720 units,

JMMB Group gained $1.50 and ended at $26.50 with investors trading 105,451 shares, Kingston Properties popped 40 cents to $8.40 with 185,028 stock units clearing the market, Kingston Wharves advanced 40 cents and ended at $30.40 after an exchange of 4,749 units. Massy Holdings rose $1 in closing at $90 in trading 10 shares, Mayberry Group gained 40 cents to end at $7.60 after an exchange of 32,888 units, Mayberry Jamaican Equities climbed 87 cents to close at $10.77 after 15,476 stocks passed through the market. NCB Financial increased 95 cents to $65.95 in an exchange of 277,782 stock units, Pan Jamaica skidded $1 and ended at $49 with 177,822 shares crossing the market, Sagicor Group rallied $1 to end at $41 while exchanging 1,083,084 stock units. Scotia Group rose 49 cents in closing at a 52 weeks’ high of $47.44 with traders dealing in 38,043 stocks, Seprod climbed 44 cents to close at $84.99 in an exchange of 55,720 units,  Sygnus Real Estate Finance increased $1.65 to $12.66 with investors trading 9,204 shares and Wisynco Group popped 50 cents to end at $21, with 48,442 stock units crossing the market.

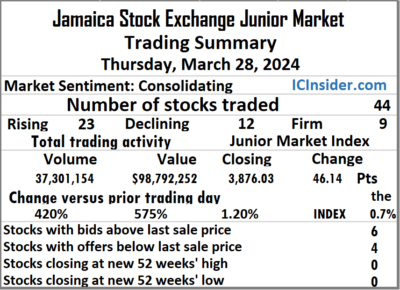

Sygnus Real Estate Finance increased $1.65 to $12.66 with investors trading 9,204 shares and Wisynco Group popped 50 cents to end at $21, with 48,442 stock units crossing the market. The market closed with 37,301,154 shares being traded for $98,792,252 up sharply from 7,170,788 units at $14,644,800 on Wednesday.

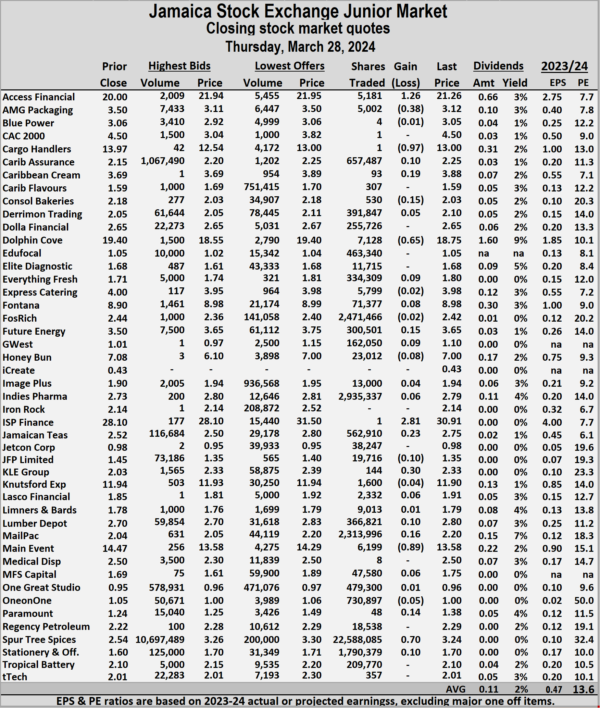

The market closed with 37,301,154 shares being traded for $98,792,252 up sharply from 7,170,788 units at $14,644,800 on Wednesday. The Junior Market ended trading with an average PE Ratio of 13.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

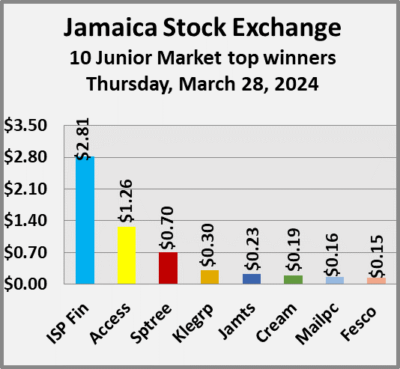

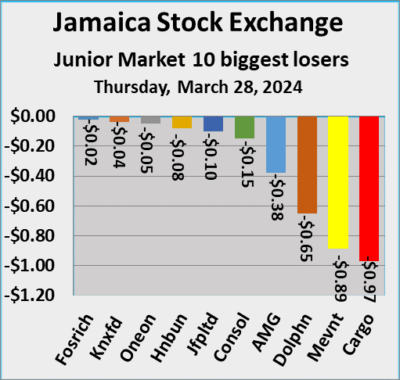

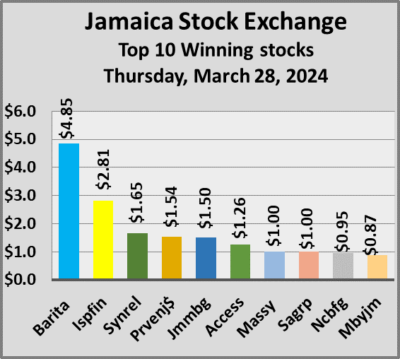

The Junior Market ended trading with an average PE Ratio of 13.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024. Future Energy rallied 15 cents and ended at $3.65 in trading 300,501 units, GWest Corporation gained 9 cents to end at $1.10 with 162,050 stocks clearing the market, Honey Bun dropped 8 cents in closing at $7 with traders dealing in 23,012 stock units. ISP Finance popped $2.81 to end at $30.91, with a mere one share crossing the market, Jamaican Teas gained 23 cents to close at $2.75 after an exchange of 562,910 stock units, JFP Ltd lost 10 cents and ended at $1.35, with 19,716 stocks crossing the market. KLE Group rose 30 cents to $2.33 with investors swapping 144 units, Lumber Depot climbed 10 cents and ended at $2.80 with a transfer of 366,821 stocks, Mailpac Group increased 16 cents to end at $2.20 after investors ended trading 2,313,996 units. Main Event skidded 89 cents in closing at $13.58 with investors dealing in 6,199 shares, Paramount Trading advanced 14 cents to close at $1.38 after an exchange of 48 stock units,

Future Energy rallied 15 cents and ended at $3.65 in trading 300,501 units, GWest Corporation gained 9 cents to end at $1.10 with 162,050 stocks clearing the market, Honey Bun dropped 8 cents in closing at $7 with traders dealing in 23,012 stock units. ISP Finance popped $2.81 to end at $30.91, with a mere one share crossing the market, Jamaican Teas gained 23 cents to close at $2.75 after an exchange of 562,910 stock units, JFP Ltd lost 10 cents and ended at $1.35, with 19,716 stocks crossing the market. KLE Group rose 30 cents to $2.33 with investors swapping 144 units, Lumber Depot climbed 10 cents and ended at $2.80 with a transfer of 366,821 stocks, Mailpac Group increased 16 cents to end at $2.20 after investors ended trading 2,313,996 units. Main Event skidded 89 cents in closing at $13.58 with investors dealing in 6,199 shares, Paramount Trading advanced 14 cents to close at $1.38 after an exchange of 48 stock units,  Regency Petroleum rallied 7 cents to $2.29 in an exchange of 18,538 shares. Spur Tree Spices rose 70 cents and ended at $3.24 as investors exchanged 22,588,085 units and Stationery and Office Supplies rallied 10 cents to close at $1.70 after a transfer of 1,790,379 stocks.

Regency Petroleum rallied 7 cents to $2.29 in an exchange of 18,538 shares. Spur Tree Spices rose 70 cents and ended at $3.24 as investors exchanged 22,588,085 units and Stationery and Office Supplies rallied 10 cents to close at $1.70 after a transfer of 1,790,379 stocks. At the close of trading, the JSE Combined Market Index climbed 1,076.40 points to 341,247.67, the All Jamaican Composite Index climbed 2,274.96 points to 368,584.26, the JSE Main Index rose 787.45 points to end at 327,798.70. The Junior Market Index jumped 46.14 points to 3,876.03 and the JSE USD Market Index declined 1.34 points to wrap-up trading at 247.81.

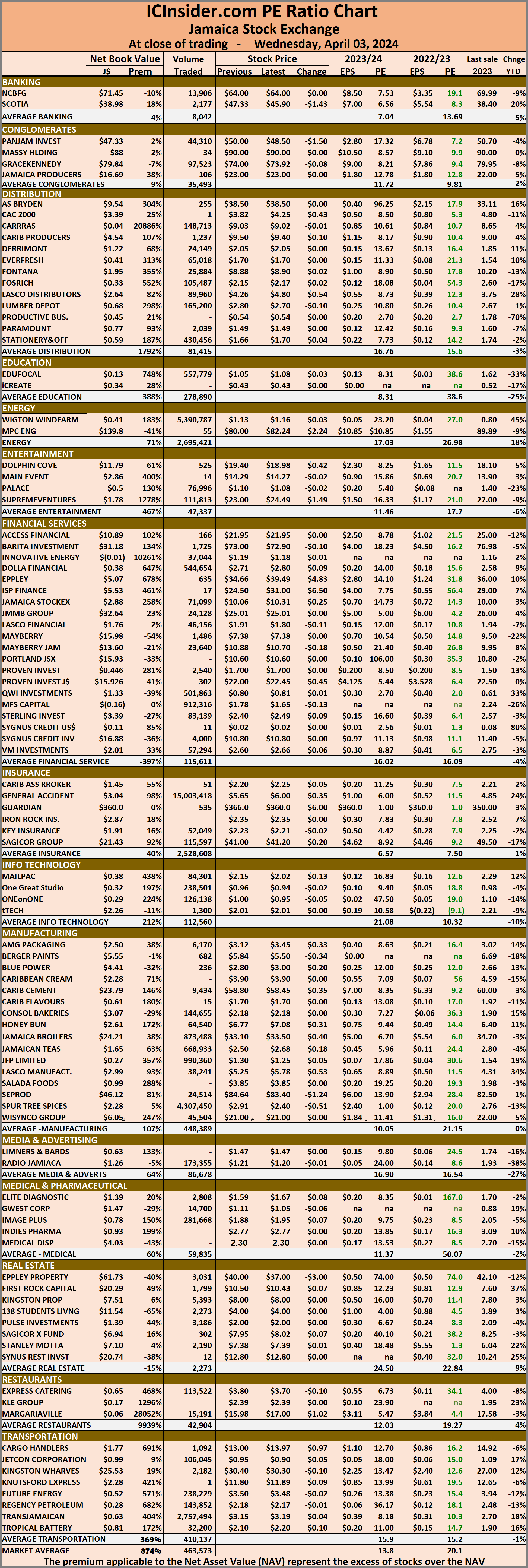

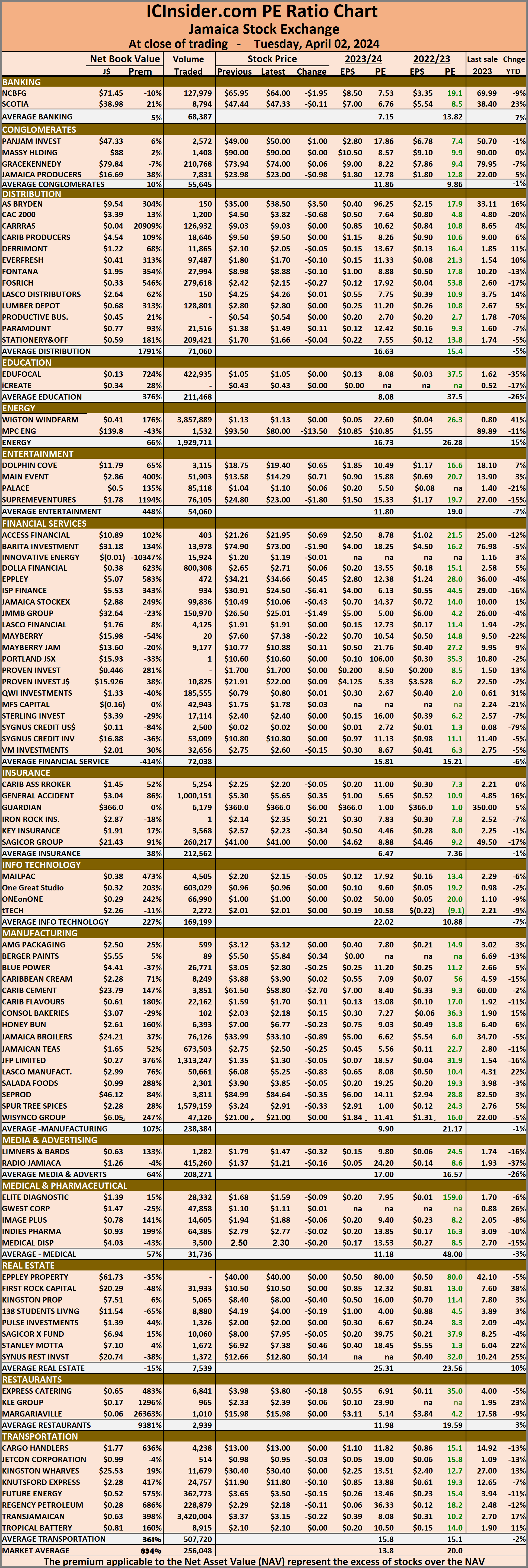

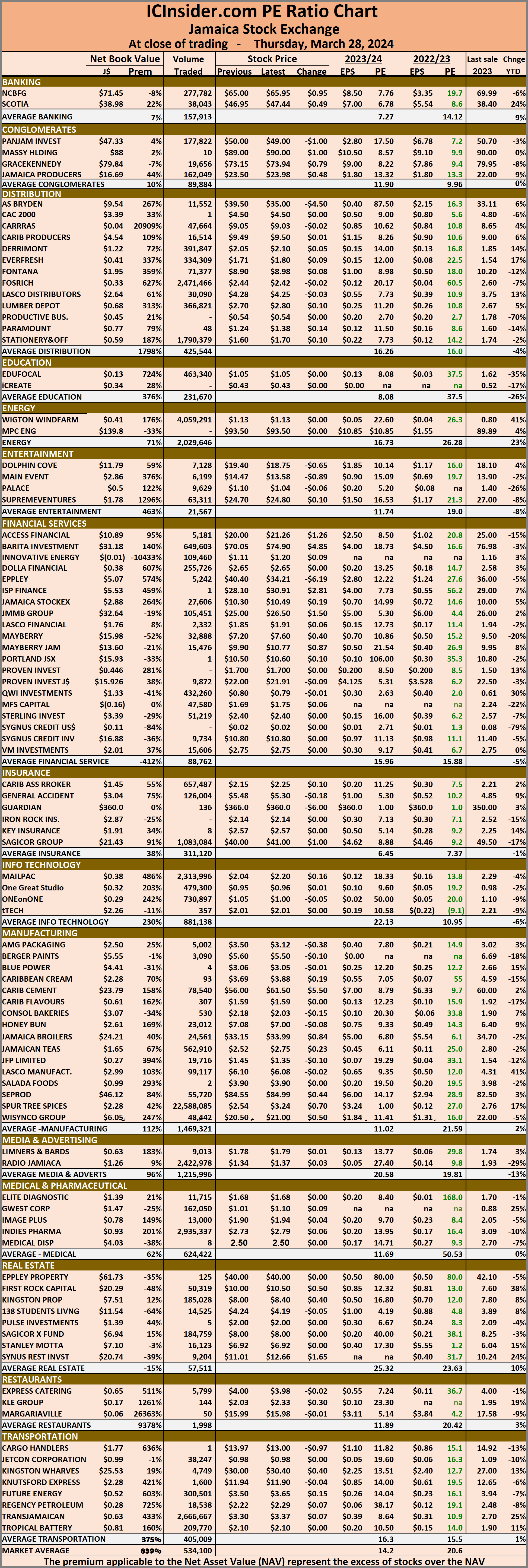

At the close of trading, the JSE Combined Market Index climbed 1,076.40 points to 341,247.67, the All Jamaican Composite Index climbed 2,274.96 points to 368,584.26, the JSE Main Index rose 787.45 points to end at 327,798.70. The Junior Market Index jumped 46.14 points to 3,876.03 and the JSE USD Market Index declined 1.34 points to wrap-up trading at 247.81. The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.6 on 2022-23 earnings and 14.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.6 on 2022-23 earnings and 14.2 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making. The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.