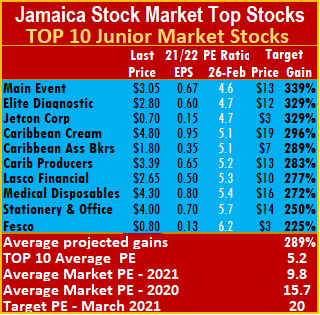

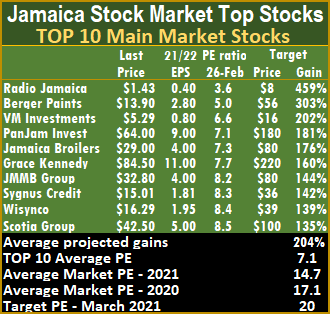

IC TOP10 stocks are now based on earnings for 2021/22 fiscal years. Of the January listing, Access Financial Services moved out of the TOP 10 Junior Market list while Main Market QWI Investment and Carreras fell from the Main market list with increased prices.

Coming into the TOP10 are Fesco, the latest IPO that is expected to come to market shortly, with the prospectus having been released but temporarily withdrawn to correct some errors. JMMB Group and Sygnus Credit Investments are now in the TOP10 Main market listing.

Coming into the TOP10 are Fesco, the latest IPO that is expected to come to market shortly, with the prospectus having been released but temporarily withdrawn to correct some errors. JMMB Group and Sygnus Credit Investments are now in the TOP10 Main market listing.

Since the start of the year, the Junior Market is up 10.5 percent, with 11 companies’ stock rising between 20 and 63 percent, including four with gains from 49 percent up. The Main Market, on the other hand, is marginally down for the year by less than one percent, with five stocks recording gains between 21 percent and 47 percent and Ciboney rising 500 percent for the year to date.

The Junior Market and the Main Market moves are supported by technical indicators, pointing to robust gains ahead and back up by some companies reporting positive profit results.

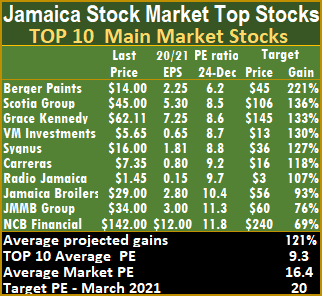

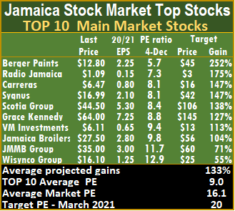

This week’s focus: Grace Kennedy had outstanding results for 2020 with much more to come in 2021; expect the price to move sharply over the next few weeks. Caribbean Cement reported a 70 percent rise in profit for 2020 and is projected to earn $6.70 for 2021, the stock is an ideal candidate to move higher in the weeks ahead.

This week’s focus: Grace Kennedy had outstanding results for 2020 with much more to come in 2021; expect the price to move sharply over the next few weeks. Caribbean Cement reported a 70 percent rise in profit for 2020 and is projected to earn $6.70 for 2021, the stock is an ideal candidate to move higher in the weeks ahead.

The top three stocks in the Junior Market can gain between 329 to 339 percent are Main Event followed by Elite Diagnostic and Jetcon. With expected gains of 202 to 459 percent, the top three Main Market stocks are Radio Jamaica, followed by Berger Paints and VM Investments.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, a clear indication of strong gains ahead. The JSE Main Market ended the week, with an overall PE of 14.7 and the Junior Market 9.8 based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.2 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.1 or 48 percent of the PE of that market.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, up to the second quarter of 2021. The Junior and Main markets are currently trading well below the market average, a clear indication of strong gains ahead. The JSE Main Market ended the week, with an overall PE of 14.7 and the Junior Market 9.8 based on ICInsider.com’s projected 2021-22 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 5.2 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 7.1 or 48 percent of the PE of that market.

The average projected gain for the Junior Market IC TOP 10 stocks is 289 percent and 204 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 289 percent and 204 percent for the JSE Main Market, based on 2021-22 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Lasco Distributors earnings were also adjusted down, with the release of the nine months results showing earnings per share of 21 cents and 7 cents for the December quarter, putting the full-year numbers at 30 cents per share.

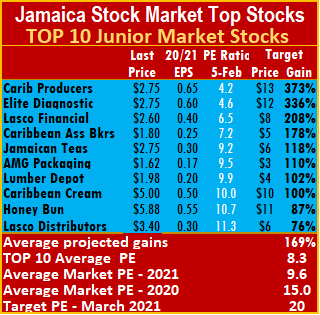

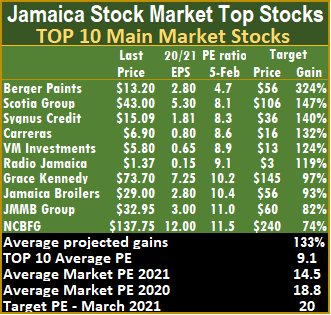

Lasco Distributors earnings were also adjusted down, with the release of the nine months results showing earnings per share of 21 cents and 7 cents for the December quarter, putting the full-year numbers at 30 cents per share. The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings.

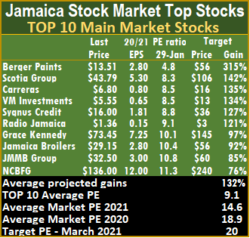

The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings. Main Market TOP 10 stocks trade at a PE of 9.1 or 48 percent of the PE of that market.

Main Market TOP 10 stocks trade at a PE of 9.1 or 48 percent of the PE of that market. While the Junior Market had a new addition, the Main Market TOP10 continued with the same stocks as the week before but Grace Kennedy price rose from $68 to $73.45 with the stock moving from 5th spot to 7th.

While the Junior Market had a new addition, the Main Market TOP10 continued with the same stocks as the week before but Grace Kennedy price rose from $68 to $73.45 with the stock moving from 5th spot to 7th.

In this regard, based on 2020 release of results, interim financials are expected this week, from Access Financial, Barita Investments, Iron Rock Insurance, NCB Financial, the Lasco group of companies and Jamaican Teas.

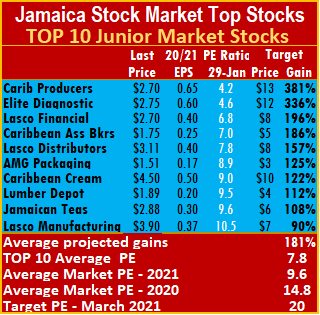

In this regard, based on 2020 release of results, interim financials are expected this week, from Access Financial, Barita Investments, Iron Rock Insurance, NCB Financial, the Lasco group of companies and Jamaican Teas. The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, from now to the second quarter in 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 18.9 and the Junior Market 14.8, based on ICInsider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 7.8 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.1 or 48 percent of the PE of that market.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, from now to the second quarter in 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 18.9 and the Junior Market 14.8, based on ICInsider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 7.8 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.1 or 48 percent of the PE of that market. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

initially reported by the company to just $29 million with the stock selling off to a low of 95 cents but bounced a bit thereafter.

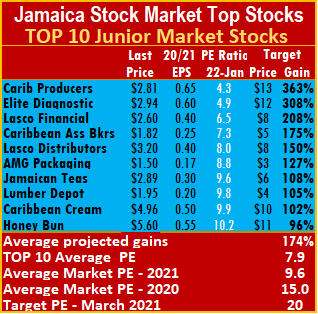

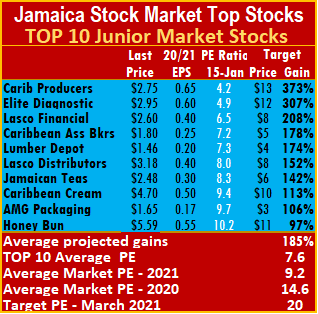

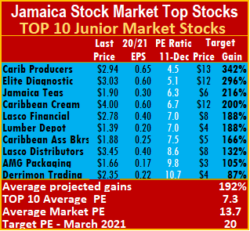

initially reported by the company to just $29 million with the stock selling off to a low of 95 cents but bounced a bit thereafter. The top three stocks in the Junior Market with the potential to gain between 208 to 363 percent are Caribbean Producers followed by Elite Diagnostic and Lasco Financial. With expected gains of 124 to 331 percent, the top three Main Market stocks are, Berger Paints followed by Scotia Group and Carreras.

The top three stocks in the Junior Market with the potential to gain between 208 to 363 percent are Caribbean Producers followed by Elite Diagnostic and Lasco Financial. With expected gains of 124 to 331 percent, the top three Main Market stocks are, Berger Paints followed by Scotia Group and Carreras. The average projected gain for the Junior Market IC TOP 10 stocks is 174 percent and 127 percent for the JSE Main Market, based on 2020-21 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 174 percent and 127 percent for the JSE Main Market, based on 2020-21 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The stock gained 50 cents at the close on Friday but traded as high as $5 during the week and moved from fifth spot last week to ninth position on the 2020/21 TOP10 list. Jamaican Teas gained 25 percent since December and seems poised to move higher as interest in the stock grows since the announcement of a three for one stock split late last year. An indication of increased interest is the exchange of 4 million shares on Friday. The stock moved from the fourth position last week to seventh this past week as it gained 24 percent for the week.

The stock gained 50 cents at the close on Friday but traded as high as $5 during the week and moved from fifth spot last week to ninth position on the 2020/21 TOP10 list. Jamaican Teas gained 25 percent since December and seems poised to move higher as interest in the stock grows since the announcement of a three for one stock split late last year. An indication of increased interest is the exchange of 4 million shares on Friday. The stock moved from the fourth position last week to seventh this past week as it gained 24 percent for the week. The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings.

The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings. The PE ratio for the Junior Market Top 10 stocks average a mere 7.6 at just 52 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.2 or 56 percent of the PE of that market.

The PE ratio for the Junior Market Top 10 stocks average a mere 7.6 at just 52 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.2 or 56 percent of the PE of that market.

This week’s focus: The long awaited initial public offer of shares by

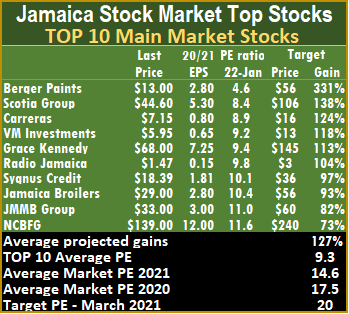

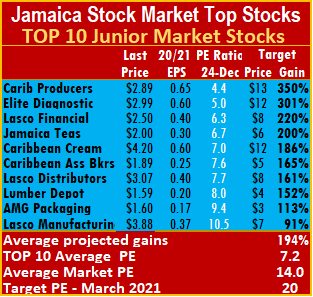

This week’s focus: The long awaited initial public offer of shares by The top three stocks in the Junior Market with the potential to gain between 220 to 350 percent by March 2021 are Caribbean Producers, followed by Elite Diagnostic and

The top three stocks in the Junior Market with the potential to gain between 220 to 350 percent by March 2021 are Caribbean Producers, followed by Elite Diagnostic and  The Main Market TOP 10 stocks trade at a PE of 9.3 or 57 percent of the PE of that market.

The Main Market TOP 10 stocks trade at a PE of 9.3 or 57 percent of the PE of that market.

AMG Packaging and Caribbean Producers fell 7 percent to $1.55 and $2.74, respectively. Lasco Distributors fell 8 percent to $3.16 from $3.55. Lumber Depot rose 12 percent to $1.55 and Jamaican Teas gained 8 percent to $2.05.

AMG Packaging and Caribbean Producers fell 7 percent to $1.55 and $2.74, respectively. Lasco Distributors fell 8 percent to $3.16 from $3.55. Lumber Depot rose 12 percent to $1.55 and Jamaican Teas gained 8 percent to $2.05. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 16.8 and the Junior Market 13.7, based on ICInsider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 7.2 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.2 or 55 percent of the PE of that market.

The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 16.8 and the Junior Market 13.7, based on ICInsider.com’s projected 2020-21 earnings. The PE ratio for the Junior Market Top 10 stocks average a mere 7.2 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.2 or 55 percent of the PE of that market. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information. The Junior Market closed the week at the highest level since November 17 and before that, October 2 and seems poised to take out all recent highs on the way to the year-end rally and a bullish period to come, to take it over 3,000 points. The main Market pulled back from last week’s levels but closed at the highest point for the week on Friday.

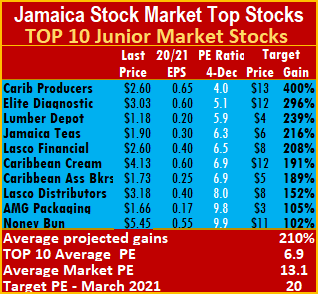

The Junior Market closed the week at the highest level since November 17 and before that, October 2 and seems poised to take out all recent highs on the way to the year-end rally and a bullish period to come, to take it over 3,000 points. The main Market pulled back from last week’s levels but closed at the highest point for the week on Friday. Honey Bun dropped out of the TOP 10, with Derrimon Trading replacing it at the bottom of the list. Honey Bun’s stock price jumped 19 percent for the week to $6.49 on Friday, with the stock now showing very limited supply and a bit of demand on the buying side, although a bit below the last sale price. The increased demand this week follows a strong September quarter profit that rose 76 percent over 2019. Wisynco Group spent just a week in the Main Market TOP 10, moved up in price to close out the week with the stock rising to $16.43 from $16.10 and replaced by NCB, in at the tenth position. The projections are for earnings to recover from the increased provision for expected credit loss charges in 2020 and from continued growth in the business and deliver earnings of $12 per share for the current year to September.

Honey Bun dropped out of the TOP 10, with Derrimon Trading replacing it at the bottom of the list. Honey Bun’s stock price jumped 19 percent for the week to $6.49 on Friday, with the stock now showing very limited supply and a bit of demand on the buying side, although a bit below the last sale price. The increased demand this week follows a strong September quarter profit that rose 76 percent over 2019. Wisynco Group spent just a week in the Main Market TOP 10, moved up in price to close out the week with the stock rising to $16.43 from $16.10 and replaced by NCB, in at the tenth position. The projections are for earnings to recover from the increased provision for expected credit loss charges in 2020 and from continued growth in the business and deliver earnings of $12 per share for the current year to September. Former TOP10 holder MailPac, hit a record high on Friday, in closing at $2.60, up 19 percent from $2.19 last week. Lumber Depot reported earnings for the October quarter, keeping earnings on track for 20 cents per share and put added life into the stock, moving the price up 6 percent to close the week at $1.39 at a PE of 7 times earnings, well below the market average of 13.7. Caribbean Producers moved up 13 percent from $2.60 to $2.94 at the close and up a nice 21.5 percent for the month to date. The stock seems on target to move back into the $4 range sooner than later, with stock supplies thinning out and prospects for improved business looking increasingly better in 2021.

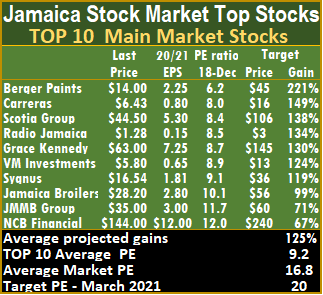

Former TOP10 holder MailPac, hit a record high on Friday, in closing at $2.60, up 19 percent from $2.19 last week. Lumber Depot reported earnings for the October quarter, keeping earnings on track for 20 cents per share and put added life into the stock, moving the price up 6 percent to close the week at $1.39 at a PE of 7 times earnings, well below the market average of 13.7. Caribbean Producers moved up 13 percent from $2.60 to $2.94 at the close and up a nice 21.5 percent for the month to date. The stock seems on target to move back into the $4 range sooner than later, with stock supplies thinning out and prospects for improved business looking increasingly better in 2021. Diagnostic and Jamaican Teas. Lumber Depot, in at third position last week, is now down to sixth after investors responded positively to quarterly results. With expected gains of 146 to 236 percent, the top three Main Market stocks are Berger Paints, followed by Radio Jamaica and Carreras.

Diagnostic and Jamaican Teas. Lumber Depot, in at third position last week, is now down to sixth after investors responded positively to quarterly results. With expected gains of 146 to 236 percent, the top three Main Market stocks are Berger Paints, followed by Radio Jamaica and Carreras. The average projected gain for the Junior Market IC TOP 10 stocks is 192 percent down from 210 percent and 129 percent from 133 percent last week for the JSE Main Market, based on 2020-21 earnings. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

The average projected gain for the Junior Market IC TOP 10 stocks is 192 percent down from 210 percent and 129 percent from 133 percent last week for the JSE Main Market, based on 2020-21 earnings. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Wisynco Group’s performance was on a roll, with revenues up 27.5 percent in the nine months to March this year, and 24 percent in the March quarter, but gross profit margin slipped in the March quarter while rising Administration and other expenses squeezed profits even more. Sales dipped slightly in the June and September quarters, but the September 2019 quarter, includes sales of $503 million from a discontinued operation, leaving flat sales from ongoing operations. Net Profits Attributable to Stockholders from continuing operations was $851 million or 23 cents per stock unit compared to $932 million or 25 cents per stock unit for the corresponding period of the prior year. Revenues for the quarter from continuing operations of $8.1 billion fell 6.1 percent from $8.6 billion in the 2019 quarter.

Wisynco Group’s performance was on a roll, with revenues up 27.5 percent in the nine months to March this year, and 24 percent in the March quarter, but gross profit margin slipped in the March quarter while rising Administration and other expenses squeezed profits even more. Sales dipped slightly in the June and September quarters, but the September 2019 quarter, includes sales of $503 million from a discontinued operation, leaving flat sales from ongoing operations. Net Profits Attributable to Stockholders from continuing operations was $851 million or 23 cents per stock unit compared to $932 million or 25 cents per stock unit for the corresponding period of the prior year. Revenues for the quarter from continuing operations of $8.1 billion fell 6.1 percent from $8.6 billion in the 2019 quarter.  The company expects to have lower energy costs with the successfully commissioning of the Cogeneration plant in July 2020, with the company seeing a positive contribution from the implementation through reduced energy costs.

The company expects to have lower energy costs with the successfully commissioning of the Cogeneration plant in July 2020, with the company seeing a positive contribution from the implementation through reduced energy costs. The PE ratio for the Junior Market Top 10 stocks average a mere 6.9 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9 or 56 percent of the PE of that market.

The PE ratio for the Junior Market Top 10 stocks average a mere 6.9 at just 53 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9 or 56 percent of the PE of that market.