The Junior Market closed at record highs on each of the last seven days, fueled by an upsurge in trading, with several days ending with all listed securities trading driving the volume and value traded upwards to levels not seen in months and resulting in several stocks reaching new 52 weeks’ highs.

The Main Market showed some bullishness this past week with the JSE All Jamaican Composite Index climbing 6,525.97 points to the highest level since late October last year. More than two thirds of the gains came on Friday helped by gains by heavyweights, Sagicor Group putting on $1, Scotia Group popping $1.60 and Wisynco jumping $2.25 after reporting strong increased profit for the December quarter.

The Main Market showed some bullishness this past week with the JSE All Jamaican Composite Index climbing 6,525.97 points to the highest level since late October last year. More than two thirds of the gains came on Friday helped by gains by heavyweights, Sagicor Group putting on $1, Scotia Group popping $1.60 and Wisynco jumping $2.25 after reporting strong increased profit for the December quarter.

The Junior Market Index is up a remarkable 16.3 percent for the year to Friday that is more than half of all of the 2021 gains, with the average rise in prices even greater at 19 percent. That quick upward movement is equivalent to an annualized gain of 194 percent and may result in investors questioning its sustainability.

Spur Tree Spices seems to have reached a peak for now but the previously last listed Junior Market stock, Future Energy, gained new life and sprinted to an all-time high of $4.50, no doubt driven by investors’ views that the increased price of gasoline will drive up sales and margins. While sales will rise in dollar terms margin may not. The party was not only for the gasoline supplier, Fontana in the TOP10 for the week ending the 21st of January at $7.40 hit new record highs this week up to $12.49 for an increase of 69 percent in a matter of weeks.

Spur Tree Spices seems to have reached a peak for now but the previously last listed Junior Market stock, Future Energy, gained new life and sprinted to an all-time high of $4.50, no doubt driven by investors’ views that the increased price of gasoline will drive up sales and margins. While sales will rise in dollar terms margin may not. The party was not only for the gasoline supplier, Fontana in the TOP10 for the week ending the 21st of January at $7.40 hit new record highs this week up to $12.49 for an increase of 69 percent in a matter of weeks.

Two high performing stocks pulled back this week Dolphin Cove hit a record high of $30 during the week but pulled back to $22 on Friday while former ICTOP10 listed Caribbean Producers hit a record high of $25.99 earlier in the week, pulled back to $16 on Thursday before closing the week at $17.85. December results should be out for this stock during the coming week and will have benefitted from the resurgence in tourist arrivals.

Medical Disposables gained 12 percent this past week to end at $7.55 and exited the Junior Market TOP10 listing, with Elite Diagnostic having traded at a 52 weeks’ high of $4.40 two weeks ago and ended the previous week at $3.73, suffered more losses this past week and is back to the TOP10. In the Main Market, Scotia Group rose nine percent to $37.50 and was replaced in the TOP10 by Jamaica Broilers.

Medical Disposables gained 12 percent this past week to end at $7.55 and exited the Junior Market TOP10 listing, with Elite Diagnostic having traded at a 52 weeks’ high of $4.40 two weeks ago and ended the previous week at $3.73, suffered more losses this past week and is back to the TOP10. In the Main Market, Scotia Group rose nine percent to $37.50 and was replaced in the TOP10 by Jamaica Broilers.

Lasco Distributors jumped 15 percent to $3.73 ahead of third quarter results due out shortly and General Accident moved up 7 percent to $6.50, while Honey Bun and Jetcon Corporation both rose 5 percent in the week. AMG Packaging rose 3 percent to end at $3.70 and so did Caribbean Assurance Brokers that closed at $3.10.

Guardian Holdings climbed 5 percent to close at $575, JMMB Group held on to a 2 percent rise for the week and traded at a 52 weeks’ high of $44.61 on Friday but closed at $41.99. Pan Jam Investment and Radio Jamaica settled with a 5 percent rise for the week, while Proven Investment lost 8 percent to close at US$0.21 and Sygnus Credit Investments slipped 4 percent to $15.23.

The sharp price movements in the Junior Market over the recent past weeks reduced the potential gains markedly, with the average increase projected for the TOP 10 Junior Market stocks now at 104 percent versus 114 percent last week and is now lower than the Main Market at 128 percent.

The sharp price movements in the Junior Market over the recent past weeks reduced the potential gains markedly, with the average increase projected for the TOP 10 Junior Market stocks now at 104 percent versus 114 percent last week and is now lower than the Main Market at 128 percent.

The top three stocks are Caribbean Assurance Brokers followed by Lasco Financial and Lasco Distributors to gain between 114 and 126 percent, compared to 128 and 148 percent, previously.

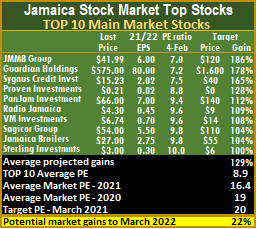

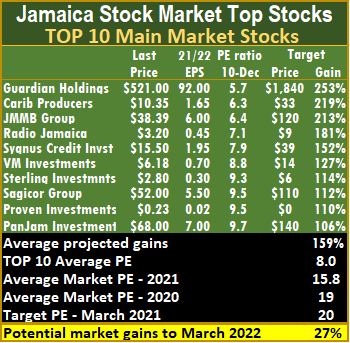

The potential gains for Main Market stocks moved from 131 percent to this weeks’ 128 percent, with the top three being JMMB Group followed by Guardian Holdings and Sygnus Credit Investments all projected to gain between 165 and 186 percent from 155 and 193 percent last week.

After trading at a big discount to the Main Market for two years, the average PE for both the JSE primary markets has virtually merged just below 17 times 2021 earnings.

The Junior Market closed the week, with an average PE of 16.8 based on ICInsider.com’s 2021-22 earnings and is currently below the target of 20 and now virtually at the average of 17 that was achieved at the end of March last year. The TOP 10 stocks trade at a PE of a mere 9.8, with a 42 percent discount to that market’s average. That means there is a lot of room for the TOP10 stocks to run between now and the end of March.

The Junior Market can gain 19 percent to March this year, based on an average PE of 20 that would take the index to 4,700 points. About a third of Junior Market stocks with positive earnings are trading at or above this level, averaging around 23.

The average PE for the JSE Main Market is 16.4 just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March this year. The Main Market TOP 10 average PE is 8.9 representing a 46 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times current year’s earnings.

The average PE for the JSE Main Market is 16.4 just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March this year. The Main Market TOP 10 average PE is 8.9 representing a 46 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

More changes for ICTOP10 listings

More fresh ICTOP10 listings

The markets were active this past week with the Junior Market closing at record highs on Thursday and Friday while the main market rose 2,750 points for the week, with former ICTOP10 listed Caribbean Producers hitting a record high of $20 at the close on Friday, up 19 percent from $16.74 last week and a stunning 614 since the start of 2021 as three TOP10 Main Market stocks enjoyed decent gains.

The markets were active this past week with the Junior Market closing at record highs on Thursday and Friday while the main market rose 2,750 points for the week, with former ICTOP10 listed Caribbean Producers hitting a record high of $20 at the close on Friday, up 19 percent from $16.74 last week and a stunning 614 since the start of 2021 as three TOP10 Main Market stocks enjoyed decent gains.

Access Financial fell from the Junior Market ICTOP10, with results for the nine months to December indicating that earnings for the full year will be in the $2 region rather than $2.60 that ICInsider.com previously projected, but it remains high on the 2022 TOP10. Elite Diagnostic traded at a 52 weeks’ high of $4.40 on Friday and ended at $3.73 with a gain of 7 percent in exiting the TOP10.  Lumber Depot rose 10 percent to $3.20 and dropped out of the top listing. AMG Packaging rose 18 percent to end at $3.59, while Caribbean Assurance Brokers and Stationery & Office Supplies both gained 3 percent to remain in the TOP10. There are no new listings for the TOP10 Main Market for the week.

Lumber Depot rose 10 percent to $3.20 and dropped out of the top listing. AMG Packaging rose 18 percent to end at $3.59, while Caribbean Assurance Brokers and Stationery & Office Supplies both gained 3 percent to remain in the TOP10. There are no new listings for the TOP10 Main Market for the week.

Guardian Holdings climbed 6 percent to close at $550, JMMB Group rose 8 percent to $40.99 and Sygnus Credit Investments jumped 10 percent to $15.84.

The sharp price movements in the Junior Market over the recent past weeks reduced the potential gains markedly, with the average increase projected for the TOP 10 Junior Market stocks now at 114 percent versus 119 percent last week and is now lower than the Main Market.

The top three stocks are Lasco Distributors followed by Caribbean Assurance Brokers and Lasco Financial to gain between 128 and 148 percent, compared to 131 and 150 percent, previously.

The top three stocks are Lasco Distributors followed by Caribbean Assurance Brokers and Lasco Financial to gain between 128 and 148 percent, compared to 131 and 150 percent, previously.

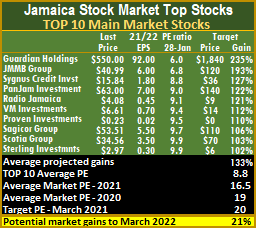

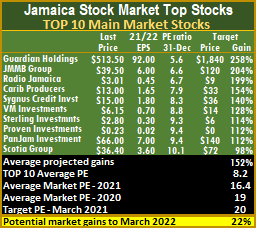

The potential gains for Main Market stocks moved from 139 percent to this weeks’ 131 percent, with the top three stocks being JMMB Group followed by Guardian Holdings and Sygnus Credit Investments all projected to gain between 155 and 193 percent from 151 and 254 percent last week.

After trading at a big discount to the Main Market for two years, the average PE for both the JSE primary markets has merged at 16.5 times 2021 earnings.

The Junior Market closed the week, with an average PE of 16.5 based on ICInsider.com’s 2021-22 earnings and is currently below the target of 20 and now very close to the average of 17 that was achieved at the end of March last year based on 2020 earnings.  The TOP 10 stocks trade at a PE of a mere 9.4, with a 43 percent discount to that market’s average.

The TOP 10 stocks trade at a PE of a mere 9.4, with a 43 percent discount to that market’s average.

The Junior Market can gain 21 percent to March this year, based on an average PE of 20 that would take the index to 4,400 points. Twelve stocks representing 29 percent of all Junior Market stocks with positive earnings are trading at or above this level, averaging 25.

The average PE for the JSE Main Market is 16.5 just 15 percent less than the PE of 19 at the end of March and 21 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.8 representing a 47 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

New ICTOP10 listings & more big gains

Long time Junior Market ICTOP10 listed Access Financial, finally broke away from resistance and jumped 31 percent for the week to $26.28, but traded at a 52 weeks’ high of $28 on Wednesday and just barely hung on to the top ten in the tenth spot.

Access Financial Services top performing ICTOP10 stock for the past week.

In the Main Market, Radio Jamaica rose 19 percent to $4.10, the 2021 ICTOP10 top performer, Caribbean Producers, climbed 5 percent and finally slipped out of the top 10 after a ride lasting more than a year and a gain of 573 percent, but the stock has more room for healthy gains.

Sagicor Group returns to the TOP10 Main Market and Stationery & Office Supplies returns to the Junior Market listing after an earnings upgrade, following a review of the forecasted numbers as the company continues to recover to pre-Covid-19 sales and Fontana dropped out with a 4 percent rise, but has much more room to grow in 2022.

Junior Market Elite Diagnostic gained 10 percent to $3.50, Honey Bun rose 7 percent. AMG Packaging lost 10 percent to end at $3.05, Lasco Financial lost 8 percent, Caribbean Assurance Brokers fell 7 percent and General Accident slipped 5 percent.

The week ended with the supplies for some stocks becoming very limited, this applies to Access and Radio Jamaica. Newly listed Spur Tree Spices came in for profit taking on Thursday and Friday after the price peaked at $2.75 and closed the week at $2.15 a fall of 22 percent from the peak, which suggests suggesting more room for decline before the price bottoms. That could take it to around $1.95 based on declines from peak to through of some previous IPOs.

The week ended with the supplies for some stocks becoming very limited, this applies to Access and Radio Jamaica. Newly listed Spur Tree Spices came in for profit taking on Thursday and Friday after the price peaked at $2.75 and closed the week at $2.15 a fall of 22 percent from the peak, which suggests suggesting more room for decline before the price bottoms. That could take it to around $1.95 based on declines from peak to through of some previous IPOs.

The sharp price movements in the Junior Market reduced the potential gains markedly, with the average increase projected for the TOP 10 Junior Market stocks now at 119 percent versus 122 percent last week.

The top three stocks are Lasco Distributors followed by Caribbean Assurance Brokers and Lasco Financial to gain between 131 and 150 percent, compared to 124 and 160 percent, previously.

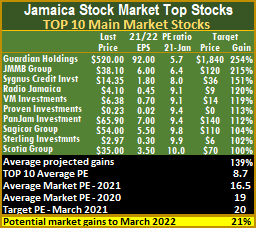

The potential gains for Main Market stocks moved from 144 percent to this weeks’ 139 percent this week, with the top three stocks being Guardian Holdings followed by JMMB Group and Sygnus Credit Investments all projected to gain between 151 and 254 percent down from 161 and 257 percent last week.

The potential gains for Main Market stocks moved from 144 percent to this weeks’ 139 percent this week, with the top three stocks being Guardian Holdings followed by JMMB Group and Sygnus Credit Investments all projected to gain between 151 and 254 percent down from 161 and 257 percent last week.

After trading at a big discount to the Main Market for two years, the average PE for both the JSE primary markets have virtually merged around 16 times earnings multiple based on 2021 earnings, with the Junior Market looking poised to surpass the main Market soon. The difference in potential gains for both TOP10 listings shows the Junior Market with an average rise of 118 percent versus 139 percent for the Main Market. That is an indication that the Junior Market is priced slightly higher than the Main Market.

The Junior Market closed the week, with an average PE of 16 based on ICInsider.com’s 2021-22 earnings and is currently below the target of 20 and the average of 17 at the end of March last year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 9.2, with a 43 percent discount to that market’s average.

The Junior Market can gain 25 percent to March this year, based on an average PE of 20 and 6 percent based on an average PE of 17. Twelve stocks representing 29 percent of all Junior Market stocks with positive earnings are trading at or above this level averaging 25.

The Junior Market can gain 25 percent to March this year, based on an average PE of 20 and 6 percent based on an average PE of 17. Twelve stocks representing 29 percent of all Junior Market stocks with positive earnings are trading at or above this level averaging 25.

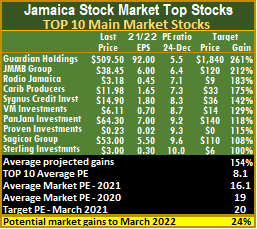

The average PE for the JSE Main Market is 16.5 just 15 percent less than the PE of 19 at the end of March and 21 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.7 representing a 47 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

3 new ICTOP10 listings as Spur Tree exists

The Junior Market ICTOP10 stocks have three new listings in a week that saw Spur Tree Spices trading for the first time on Friday with the price climbing to $1.32 for a rise of 32 percent since the Initial Public offer at the end of 2021, there are no new Main Market listings.

Other stocks that were in the spotlight this past week were ones that lasted off to record new all-time highs and include AMG Packaging, Caribbean Assurance Brokers, Caribbean Producers and Dolphin Cove a TOP10 contender up to the week ending December 2, also hit a 52 weeks’ high of $23.50 this past week to be up more than 100% since it came into the top flight in August last year at $9.86.

Other stocks that were in the spotlight this past week were ones that lasted off to record new all-time highs and include AMG Packaging, Caribbean Assurance Brokers, Caribbean Producers and Dolphin Cove a TOP10 contender up to the week ending December 2, also hit a 52 weeks’ high of $23.50 this past week to be up more than 100% since it came into the top flight in August last year at $9.86.

With the rise in the price of Spur Tree Spices, the stock is one of four to move out of the TOP10, followed by Medical Disposables that 16 percent for the week and Caribbean Cream that reported terrible third quarter results with a loss being made in the period as revenues climbed 14 percent in the quarter. Coming into the TOP10 are Lumber Depot, Fontana and General Accident.

Junior Market, AMG Packaging rose a strong 45 percent, ahead of the first quarter results to November that showed profit after tax jumping a big 146 percent over 2020. Investors can expect more gains to come this coming week as the stock traded up $3.90 last week. Caribbean Assurance Brokers climbed to a new 52 weeks’ high during the week and closed $3.12 up 26 percent, Access Financial Services continues to seesaw and recovered 17 percent to $20 this past week and Elite Diagnostic gained 8 percent to $3.18.

Junior Market, AMG Packaging rose a strong 45 percent, ahead of the first quarter results to November that showed profit after tax jumping a big 146 percent over 2020. Investors can expect more gains to come this coming week as the stock traded up $3.90 last week. Caribbean Assurance Brokers climbed to a new 52 weeks’ high during the week and closed $3.12 up 26 percent, Access Financial Services continues to seesaw and recovered 17 percent to $20 this past week and Elite Diagnostic gained 8 percent to $3.18.

The sharp price movements in the Junior Market reduced the potential gains markedly, with the average gains projected for the TOP 10 Junior Market stocks now 122 percent versus 148 percent last week.

The top three stocks are Access Financial Services followed by Lasco Distributors and Caribbean Assurance Brokers can gain between 124 and 160 percent, sharply down from 182 and 204 percent, previously.

The top three stocks are Access Financial Services followed by Lasco Distributors and Caribbean Assurance Brokers can gain between 124 and 160 percent, sharply down from 182 and 204 percent, previously.

Major Main Market TOP10 moving stocks are Caribbean Producers up 7 percent, to $15.99 and Radio Jamaica rallying 7 percent to $3.45 as increased buying interest came in for the stock.

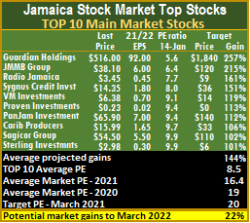

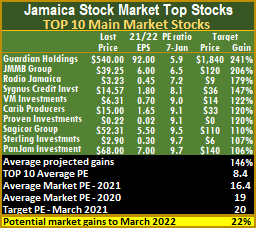

The potential gains for Main Market stocks moved from 146 percent to this weeks’ 144 percent this week, with top three Main Market stocks being Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 161 and 257 percent up from 199 and 258 percent last week.

The Junior Market closed the week, with an average PE of 14.7 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings.  The TOP 10 stocks trade at a PE of a mere 9.1, with a 38 percent discount to that market’s average.

The TOP 10 stocks trade at a PE of a mere 9.1, with a 38 percent discount to that market’s average.

The Junior Market can gain 36 percent to March this year, based on an average PE of 20 and 16 percent based on an average PE of 17. Eleven stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level averaging 25.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.5 representing a 48 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

ICTOP10 scaling new highs

Main Market TOP10 stock, Sagicor Group price fell to $52.31 to return to the TOP10 after closing the previous week at $58 and replaced by Scotia Group that slipped from $36 to $35.50 as both the Main and Junior Markets displayed some bullish signs in the past week, with Caribbean Producers hitting a record high of $15 and gained 436 percent in just over a year.

Sagicor Group back in ICTOP10.

Other big news for the week was the continued rise of ICTOP10 Main Market stock, Caribbean Producers that closed the week with a gain of 15 percent at a record high of $15 and is now in the sixth spot with the potential to gain another 120 percent in months. Radio Jamaica rose 7 percent for the week to $3.23 and Guardian Holdings rose 5 percent.

Junior Market AMG Packaging rose 6 percent but could climb higher with the first quarter results to November, due this coming week and the company is also expected to announce a dividend. Lasco Financial put on 7 percent to land at $3.20, Elite Dynastic gained 4 percent to $2.95, Caribbean Assurance Brokers climbed as high as $2.75 during the week but closed down at $2.48 for a 3 percent gain, and Access Financial Services fell 10 percent to $17.08 and Lasco Distributors lost 6 percent to $3.20.

Elsewhere, investors in the Spur Tree Spices Initial Public offer will receive just over 11.76 percent of the shares they applied for in the heavily oversubscribed issue that is sure to drive the stock price with a big bang in the first week of trading which should be ahead of the end of January.

Elsewhere, investors in the Spur Tree Spices Initial Public offer will receive just over 11.76 percent of the shares they applied for in the heavily oversubscribed issue that is sure to drive the stock price with a big bang in the first week of trading which should be ahead of the end of January.

The top three Main Market stocks, this week are Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 199 and 258 percent up from 183 and 261 percent last week.

The Junior Market’s top three stocks for the week are Access Financial Services followed by AMG Packaging and Caribbean Assurance Brokers. All three can gain between 182 and 204 percent versus 174 and 218 percent, previously.

The average gains projected for the TOP 10 Junior Market stocks is 148 percent and Main Market stocks moved from 152 percent to this weeks’ 146 percent.

The average gains projected for the TOP 10 Junior Market stocks is 148 percent and Main Market stocks moved from 152 percent to this weeks’ 146 percent.

The Junior Market closed the week, with an average PE of 14.8 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of just 8.2, with a 45 percent discount to that market’s average.

The Junior Market can gain 35 percent to March this year, based on an average PE of 20 and 15 percent based on an average PE of 17. Ten stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level and averaging 25.

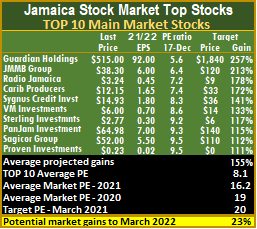

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.4 representing a 49 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.4 representing a 49 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Coming soon  reports

reports

64% gains for ICTOP10 picks in 2021

The 2021 calendar year ended on Friday, with the Junior Market rising a near 30 percent and the Main Market just holding above the close of the prior year. Against this backdrop ICInsider.com TOP 15 stocks at the start of the year had a 53 percent average gain in the Junior Market but 64 percent when Honey Bun that was reported on in December 2020 and Future Energy Sources (Fesco) that was Buy Rated when the IPO hit the market was up and impressive 64 percent.

IC Buy Rated Caribbean Producers was by far the best performing stock on the JSE for 2021.

Only three Junior Market stocks declined amongst our selection with Elite being the worse with a loss of 11 percent.

TOP10 MM stock did not do as well as the JM but that was told to readers at the start of the year. The average gain for the TOP15 Main Market stocks was 10 percent that excludes Caribbean Producers. The highest gaining stock from the list was Radio Jamaica up 61 percent and Grace Kennedy 58 percent, the two worse performers were Berger Paints and Scotia Group down 12 percent each.

The big news for the market for the past week continues to be the Initial Public offer of Spur Tree Spices priced at $1 per share that was heavily oversubscribed.

Medical Disposables rose 7 percent for the week to $6.49 and dropped out of the TOP10 and was replaced by General Accident that comes in at $6. In the Main Market TOP10, Sagicor Group rose 9 percent for the week to close at $58 and was replaced by Scotia Group at $36.

Medical Disposables rose 7 percent for the week to $6.49 and dropped out of the TOP10 and was replaced by General Accident that comes in at $6. In the Main Market TOP10, Sagicor Group rose 9 percent for the week to close at $58 and was replaced by Scotia Group at $36.

During the week AMG Packaging rose 4 percent to $2.20, Access Financial Services lost 9 percent to $19, Lasco Distributors rose 6 percent to $3.47, Elite Diagnostic rose 5 percent to $2.85 and Honey Bun gained 8 percent to $9.25. In the Main Market, Caribbean Producers popped 9 percent to $13, JMMB Group and PanJam Investment rose 3 percent, while losses were suffered by Radio Jamaica down 5 percent and Sterling Investments with a fall of 7 percent

The top three Main Market stocks, this week are Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 199 and 258 percent up from 183 and 261 percent last week.

The top three Main Market stocks, this week are Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 199 and 258 percent up from 183 and 261 percent last week.

The Junior Market top three stocks changed a bit during the week, with AMG Packaging leading, followed by Caribbean Assurance Brokers and Access Financial Services. All three can gain between 174 and 218 percent versus 158 and 230 percent, previously.

The average gains projected for the TOP 10 Junior Market stocks remained unchanged at 149 percent and Main Market stocks moved from 154 percent to this weeks’ 152 percent.

The Junior Market closed the week, with an average PE of 14.8 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings.  The TOP 10 stocks trade at a PE of a mere 8.2, with a 45 percent discount to that market’s average.

The TOP 10 stocks trade at a PE of a mere 8.2, with a 45 percent discount to that market’s average.

The Junior Market can gain 35 percent to March next year, based on an average PE of 20 and 15 percent based on an average PE of 17.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.2 representing a 50 percent discount to the market and well below the potential of 20. A total of 13 stocks or 28 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Spur Tree Spices joins ICTOP10

The big news for the market for the past week was the release of the prospectus of the long-awaited Initial Public offer of Spur Tree Spices priced at $1 per share at PE of 8.7 based on earnings before tax and propelling the stock in this week’s Junior Market ICTOP10. Investors should also see the prospectus release for Jamaica Fibreglass Products this week or next.

The big news for the market for the past week was the release of the prospectus of the long-awaited Initial Public offer of Spur Tree Spices priced at $1 per share at PE of 8.7 based on earnings before tax and propelling the stock in this week’s Junior Market ICTOP10. Investors should also see the prospectus release for Jamaica Fibreglass Products this week or next.

Spur Tree pushed Jetcon Corporation out of the TOP10, with the latter enjoying a 9 percent price rise to 99 cents. Over in the Main Market TOP10, Sagicor Group rose just 2 percent to close at $53.

During the week, AMG Packaging rose 3 percent to $2.12, Access Financial Services climbed 7 percent to $20.95, Lasco Distributors rose 6 percent to $3.47, but Elite Diagnostic and Honey Bun both fell 10 percent to $2.71 and $8.55, respectively and Caribbean Cream fell 4 percent to $5.70.

The public offer for Spur Tree Spices shares opens on Wednesday this week and should be heavily oversubscribed, with closure likely by the end of the week.

The public offer for Spur Tree Spices shares opens on Wednesday this week and should be heavily oversubscribed, with closure likely by the end of the week.

This week, the top three Main Market stocks are Guardian Holdings, followed by JMMB Group and Radio Jamaica, all projected to gain between 183 and 261 percent, up from 178 and 257 percent last week.

The Junior Market top three stocks changed a bit during the week, with AMG Packaging leading, followed by Caribbean Assurance Brokers, with Access Financial Services moving from the second spot to the third position. All three can gain between 158 and 230 percent versus 167 and 240 percent previously.

The average gains projected for the TOP 10 Junior Market stocks moved from 149 percent last week to 151 percent and Main Market stocks moved from 155 percent to this weeks’ 154 percent.

The average gains projected for the TOP 10 Junior Market stocks moved from 149 percent last week to 151 percent and Main Market stocks moved from 155 percent to this weeks’ 154 percent.

The Junior Market closed the week with an average PE of 14.4 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.1, with a 44 percent discount to that market’s average.

The Junior Market can gain 39 percent to March next year, based on an average PE of 20 and 18 percent based on an average PE of 17. Eleven stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level, similar to last week, indicating that many others will rise towards the 17 mark in the months ahead.

Eleven stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level, similar to last week, indicating that many others will rise towards the 17 mark in the months ahead.

The average PE for the JSE Main Market is 16.1, some 18 percent less than the PE of 19 at the end of March and 24 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.1, representing a 51 percent discount to the market and well below the potential of 20. A total of 13 stocks or 28 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

ICTOP10 winner up 369% to date

Caribbean Producers (CPJ) stock jumped 17 percent to close the week at a record high of $12.15 and now sits at fourth position in the Main Market TOP 10 with a lot more ground to cover before peaking.

Caribbean Producers traded 52 weeks’ high during the week following a near US$2 quarterly profit.

CPJ started the year in the Junior Market TOP 15 at $2.89 in the number three spot, with a price target of $13, is now up by 369 percent since the start of the year based on projected earnings of 65 cents, since then ICInsider.com upgraded earnings to $1.65 for the current year with a new price target between March and July next year of $33.

Barring some unusual events, CPJ now the leading stock on the overall Jamaica Stock Exchange will most likely end the year way out front and well above Future Energy, another ICTOP10 winner with gains of 254 percent to date.

Lumber Depot dropped out of the Junior Market top 10 and Jetcon Corporation returned to the TOP10. There were no additions to the Main market TOP10 for the week.

Other notable TOP10 movers this week are; Lasco Distributors that rose 9 percent in closing at $3.28 and Honey Bun up 5 percent to $9.50, but Caribbean Assurance Brokers slipped 8 percent to $2.40 from $2.60 at the close of the previous week.  In the Main Market, other than Caribbean Producers, Sygnus and Pan Jam Investment fell 4 percent.

In the Main Market, other than Caribbean Producers, Sygnus and Pan Jam Investment fell 4 percent.

For the week ahead investors should watch for a possible move higher, CPJ that could hit $15 with dwindling supply now on offer below $14.50 when the market closed on Friday. RJR is another worth watching with a limited supply under $3.50 during Friday there is relatively only moderate selling overall, but buying remains tepid.

The top three Main Market stocks, this week with CPJ dropping to number four are Guardian Holdings still in the lead followed by Radio Jamaica that returned in second spot and JMMB Group in the third spot with all projected to gain between 178 and 257 percent from 213 to 253 percent last week.

The Junior Market top three stocks changed a bit during the week, with AMG Packaging leading, followed by Caribbean Assurance Brokers, with Access Financial Services moving from the second spot to the third position. All three can gain between 167 and 240 versus 167 and 238 percent, previously.

This week’s focus: Why Lumber Depot is a stock to watch for the future? After posting outlandish first quarter results that were boosted by inventory profit, the company reported what appear to be normal profit in the second quarter of 5 cents per share and raised the half years earnings to 15 cents. While first quarter revenues grew 16 percent, the second quarter was flat, suggesting that full year results should end up around 25 cents or a little above that. On this basis, the stock may be considered a bit undervalued. With Paul Scott’s Stony Hill Capital Limited taking a controlling interest in it, what could be in it for them. There is good scope for expansion and growth, first within Kingston, Portmore, Spanish Town and nationally. Other factors include the fact that the Musson Group has large holdings of real estate owned directly by the group or indirectly in the investment companies that can purchase materials for repairs or expansion through them.

This week’s focus: Why Lumber Depot is a stock to watch for the future? After posting outlandish first quarter results that were boosted by inventory profit, the company reported what appear to be normal profit in the second quarter of 5 cents per share and raised the half years earnings to 15 cents. While first quarter revenues grew 16 percent, the second quarter was flat, suggesting that full year results should end up around 25 cents or a little above that. On this basis, the stock may be considered a bit undervalued. With Paul Scott’s Stony Hill Capital Limited taking a controlling interest in it, what could be in it for them. There is good scope for expansion and growth, first within Kingston, Portmore, Spanish Town and nationally. Other factors include the fact that the Musson Group has large holdings of real estate owned directly by the group or indirectly in the investment companies that can purchase materials for repairs or expansion through them.

The average gains projected for the TOP 10 Junior Market stocks slipped from 150 percent last week to 149 percent and Main Market stocks moved from 159 percent to this weeks’ 155 percent.

The Junior Market closed the week, with an average PE of 14.3 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.1, with a 42 percent discount to that market’s average.

The Junior Market closed the week, with an average PE of 14.3 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.1, with a 42 percent discount to that market’s average.

The Junior Market can gain 40 percent to March next year, based on an average PE of 20 and 19 percent based on an average PE of 17. Seven stocks representing 17 percent of all Junior Market stocks with positive earnings are trading at or above this level, similar to last week, indicating that many others will rise towards the 17 mark in the months ahead.

The average PE for the JSE Main Market is 16.2, some 17 percent less than the PE of 19 at the end of March and 23 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8, representing a 50 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Honey Bun in General Accident exits ICTOP10

General Accident rose 7 percent to close at $6.40 and slipped out of the TOP 10 while Honey Bun jumped into the Junior Market top 10, while Main Market stocks were pretty steady with movements not exceeding 2 percent for the week in a week when Main Market indices closed the week higher than it started with the Junior Market slipping from the start of the week.

Notable TOP10 movers this week are; AMG Packaging rose 9 percent in closing at $2.07 from $1.90 at the previous week’s close and Lumber Depot rose 18 percent to $3.25. Medical Disposables lost 5 percent of its value to close the week at $6 and Caribbean Assurance Brokers dived 13 percent to $2.60.

Notable TOP10 movers this week are; AMG Packaging rose 9 percent in closing at $2.07 from $1.90 at the previous week’s close and Lumber Depot rose 18 percent to $3.25. Medical Disposables lost 5 percent of its value to close the week at $6 and Caribbean Assurance Brokers dived 13 percent to $2.60.

The top three Main Market stocks remained unchanged at the close of the week, with Guardian Holdings still in the lead, followed by Caribbean Producers and JMMB Group, projected to gain between 213 to 253 percent, as was the case last week.

The Junior Market top three stocks changed a bit during the week, with AMG Packaging leading, followed by Caribbean Assurance Brokers, with Access Financial Services moving from second spot to third position. All three can gain between 167 and 238 versus 162 percent and 268 percent previously.

The average gains projected for the TOP 10 Junior Market stocks moved from 142 percent last week to 150 percent and Main Market stocks moved from 157 percent to this weeks’ 159 percent.

The average gains projected for the TOP 10 Junior Market stocks moved from 142 percent last week to 150 percent and Main Market stocks moved from 157 percent to this weeks’ 159 percent.

The Junior Market closed the week with an average PE of 14.1 based on ICInsider.com’s 2021-22 earnings and currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.1, with a 42 percent discount to that market’s average PE.

The Junior Market can gain 42 percent to March next year, based on an average PE of 20 and 21 percent based on an average PE of 17. Ten stocks representing 25 percent of all Junior Market stocks with positive earnings are trading at or above this level, down from seven last week, indicating that many others will rise towards the 17 mark in the weeks ahead.

The average PE for the JSE Main Market is 15.8, which is 20 percent less than the PE of 19 at the end of March and 27 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8, representing a 51 percent discount to the market and well below the potential of 20. A total of 17 stocks or 36 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

The average PE for the JSE Main Market is 15.8, which is 20 percent less than the PE of 19 at the end of March and 27 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8, representing a 51 percent discount to the market and well below the potential of 20. A total of 17 stocks or 36 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

ICTOP10 CaribAssurance jumps 21%, AMG drops 16%

Caribbean Assurance Brokers rose 21 percent to close at a 52 weeks’ high of $2.98 for the week, while AMG Packaging fell 16 percent in closing at $1.90, with most Junior Market stocks declining for the week. Main Market stocks were pretty steady, with movements not exceeding 4 percent for the week even as the market indices fell just over 6,500 points or 1.5 percent. On the other hand, the Junior Market gave up 31 points or one percent.

The other notable large TOP10 movers this week are; AMG Packaging, with a loss of 16 percent in closing at $1.90 from $2.25 at the previous week’s close after it fell from $2.40 at the end prior week and Caribbean Cream rose 2 percent to $5.70. Access Financial Services slipped 6 percent to $19.50, Elite Diagnostic dropped 7 percent on top of the 8 percent fall last week to $2.97 and General Accident lost 9 percent in closing at $6, Lasco Distributors and Lumber Depot lost 5 percent each. On Friday, the latter declined as Mayberry Jamaica Equities sold off their holdings to Stony Hill Investments.

The other notable large TOP10 movers this week are; AMG Packaging, with a loss of 16 percent in closing at $1.90 from $2.25 at the previous week’s close after it fell from $2.40 at the end prior week and Caribbean Cream rose 2 percent to $5.70. Access Financial Services slipped 6 percent to $19.50, Elite Diagnostic dropped 7 percent on top of the 8 percent fall last week to $2.97 and General Accident lost 9 percent in closing at $6, Lasco Distributors and Lumber Depot lost 5 percent each. On Friday, the latter declined as Mayberry Jamaica Equities sold off their holdings to Stony Hill Investments.

In the Main Market, Caribbean Producers added another 3 percent to the 15 percent increase last week to close at $10.36 and Proven Investments was up 4 percent. PanJam Investment dropped from $73 9 to $68 to reenter the TOP10, with Carreras dropping out of the Main Market TOP10. In the Junior Market, the price of Medical Disposables slipped from $6.72 last week to $6.30 this past week and swapped back its spot with Dolphin Cove, with the price of the latter closing at $13, up marginally from $12.90.

The top three Main Market stocks are Guardian Holdings, Caribbean Producers and JMMB Group, projected to gain between 213 to 253 percent expected versus last weeks’ 214 to 254 percent.

The top three Main Market stocks are Guardian Holdings, Caribbean Producers and JMMB Group, projected to gain between 213 to 253 percent expected versus last weeks’ 214 to 254 percent.

The top three stocks in the Junior Market are AMG Packaging, followed by Access Financial Services and Lasco Distributors. All three can gain between 162 and 268 percent, up from 150 percent and 211 percent previously.

This week’s focus: Lumber Depot stock was under pressure since the release of the first quarter results in September, with price slipping from $3.18 days after the release to below $3. Now that Mayberry sold off their holdings, the stock may be allowed to move up unless other top holders resume selling. The stocks have the potential to record strong price appreciation and the company has good long term prospects for growth and expansion. With earnings per share projected at 35 cents for the current year and the price under $3 with a PE of just 8, there is much upside potential in the short term.

The average gains projected for the TOP 10 Junior Market stocks moved from 142 percent last week to 151 percent and Main Market stocks moved from 159 percent to this weeks’ 157 percent.

The Junior Market closed the week with an average PE of 14.3 based on ICInsider.com’s 2021-22 earnings and currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.1, with a 43 percent discount to that market’s average PE.

The Junior Market closed the week with an average PE of 14.3 based on ICInsider.com’s 2021-22 earnings and currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 8.1, with a 43 percent discount to that market’s average PE.

The Junior Market can gain 40 percent to March next year, based on an average PE of 20 and 9percent based on an average PE of 17. Ten stocks representing 25 percent of all Junior Market stocks with positive earnings are trading at or above this level, down from seven last week, indicating that many others will rise towards the 17 mark in the weeks ahead.

The average PE for the JSE Main Market is 15.7, which is 21 percent less than the PE of 19 at the end of March and 27 percent below the target of 20 to March 2022.  The Main Market TOP 10 average PE is 8.1, representing a 51 percent discount to the market and well below the potential of 20. A total of 17 stocks or 36 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

The Main Market TOP 10 average PE is 8.1, representing a 51 percent discount to the market and well below the potential of 20. A total of 17 stocks or 36 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.