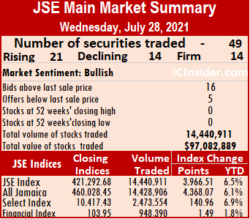

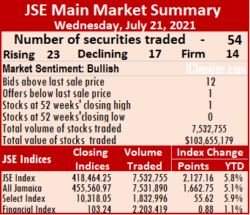

Market activity ended on Wednesday with the indices rebounding strongly after advancing stocks outnumbered declining ones, with the volume of shares traded up 5 percent, but the value dropped 44 percent lower than on Tuesday at the close of the Jamaica Stock Exchange Main Market.

At the close at trading, the All Jamaican Composite Index bolted 4,368.07 points to 460,028.45, the JSE Main Index climbed 3,966.51 points to end at 421,292.68 and the JSE Financial Index rose 1.49 points to 103.95.

At the close at trading, the All Jamaican Composite Index bolted 4,368.07 points to 460,028.45, the JSE Main Index climbed 3,966.51 points to end at 421,292.68 and the JSE Financial Index rose 1.49 points to 103.95.

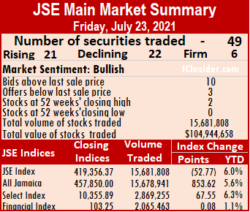

Trading ended with 49 securities compared to 50 on Tuesday, with 21 stocks rising, 14 declining and 14 remaining unchanged. The PE Ratio, a measure that determines an appropriate relative value of each stock, averaged 16.5 based on ICInsider.com’s forecast of 2021-22 earnings.

The market closed with 14,440,911 shares trading for $97,082,889 versus 13,712,829 units at $174,075,107 on Tuesday. Transjamaican Highway led trading with 27.2 percent for an exchange of 3.93 million shares, followed by JMMB Group 7.5% preference share 24.3 percent, with 3.51 million units and Wigton Windfarm with 12.4 percent exchanging 1.79 million units.

Trading averaged 294,712 units at $1,981,283 compared to 274,257 shares at $3,481,502 on Tuesday. Trading month to date averages 325,554 units at $16,300,774, compared to 327,152 units at $17,042,482 on Tuesday.  June ended with an average of 249,610 units at $3,877,606.

June ended with an average of 249,610 units at $3,877,606.

Investor’s Choice bid-offer indicator reading has 16 stocks ending with bids higher than their last selling prices and five with lower offers.

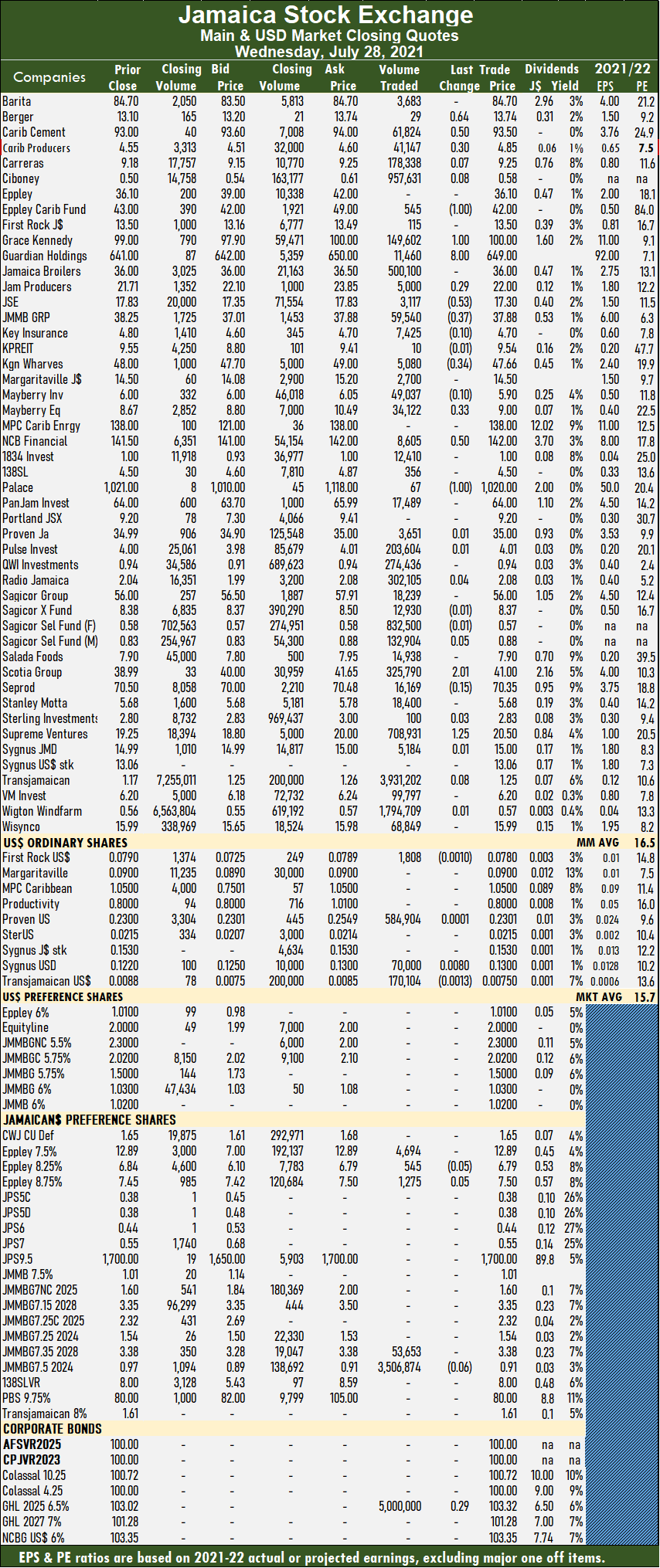

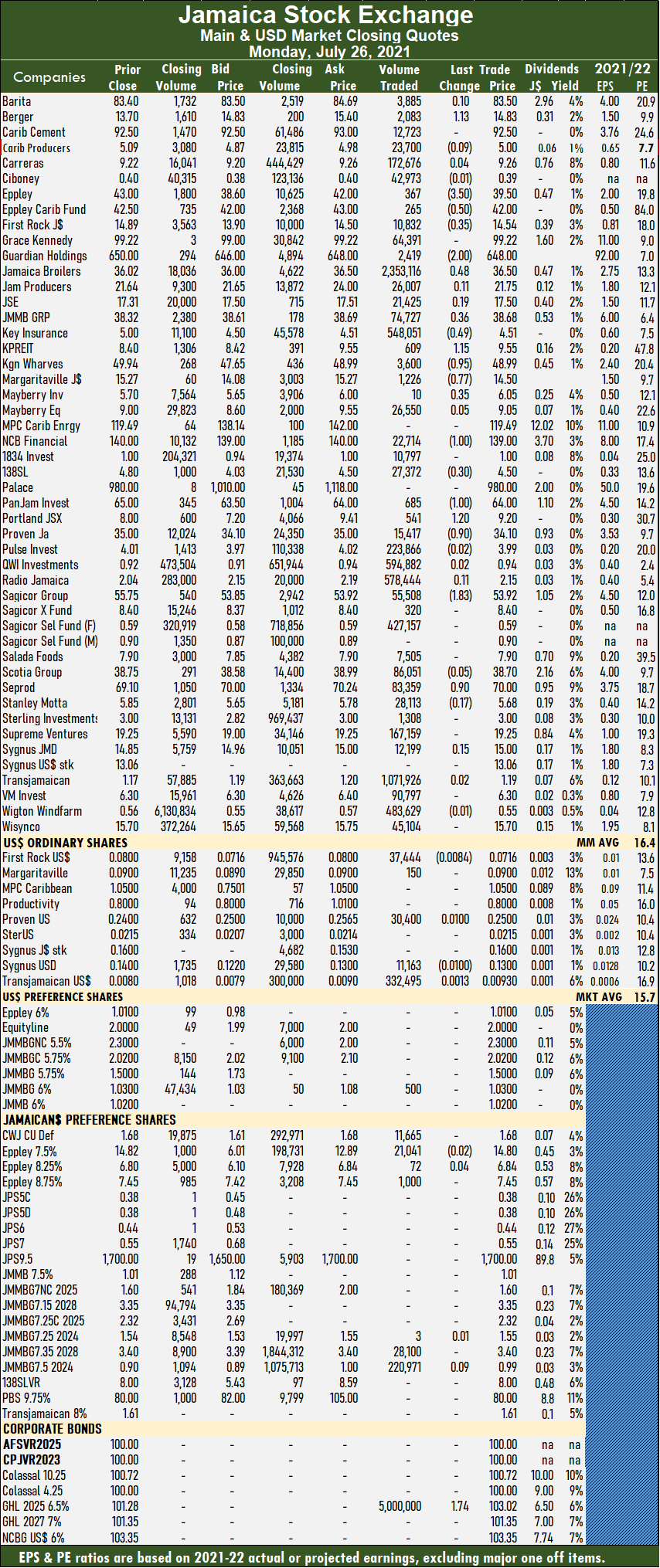

At the close, Barita Investments fell $1.20 to $83.50 with the swapping of 3,683 shares, Berger Paints rose 64 cents to $13.74 with 29 stocks crossing the market, Caribbean Cement rallied 50 cents to $93.50 in trading 61,824 stock units. Caribbean Producers popped 30 cents to $4.85 with 41,147 shares changing hands, Eppley Caribbean Property Fund shed $1 to settle at $42 in transferring 545 units, GraceKennedy rose $1 to $100 in an exchange of 149,602 stocks. Guardian Holdings bolted $8 to $649 with the swapping of 11,460 stock units, Jamaica Producers gained 29 cents in closing at $22 after exchanging 5,000 shares, Jamaica Stock Exchange slipped 53 cents to $17.30, with the swapping of 3,117 units. JMMB Group lost 37 cents to settle at $37.88, with 59,540 stocks clearing the market, Kingston Wharves shed 34 cents to end at $47.66 with 5,080 stock units crossing the market, Mayberry Jamaican Equities popped 33 cents to $9 in exchanging 34,122 shares.  NCB Financial Group rose 50 cents to $142 with 8,605 stocks clearing the market, Palace Amusement shed $1 to end at $1,020 in transferring 67 units, Scotia Group popped $2.01 to $41 after 325,790 stock units crossed the exchange and Supreme Ventures advanced $1.25 to $20.50, with 708,931 shares changing hands.

NCB Financial Group rose 50 cents to $142 with 8,605 stocks clearing the market, Palace Amusement shed $1 to end at $1,020 in transferring 67 units, Scotia Group popped $2.01 to $41 after 325,790 stock units crossed the exchange and Supreme Ventures advanced $1.25 to $20.50, with 708,931 shares changing hands.

Guardian Holdings 2025 6.5% corporate bond traded 5 million units and rose 29 cents to $103.32.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

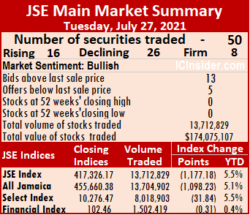

The All Jamaican Composite Index declined by 1,098.23 points to 455,660.38, the JSE Main Index dropped 1,177.18 points to end at 417,326.17 and the JSE Financial Index shed 0.31 points to close at 102.46.

The All Jamaican Composite Index declined by 1,098.23 points to 455,660.38, the JSE Main Index dropped 1,177.18 points to end at 417,326.17 and the JSE Financial Index shed 0.31 points to close at 102.46. Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and five with lower offers.

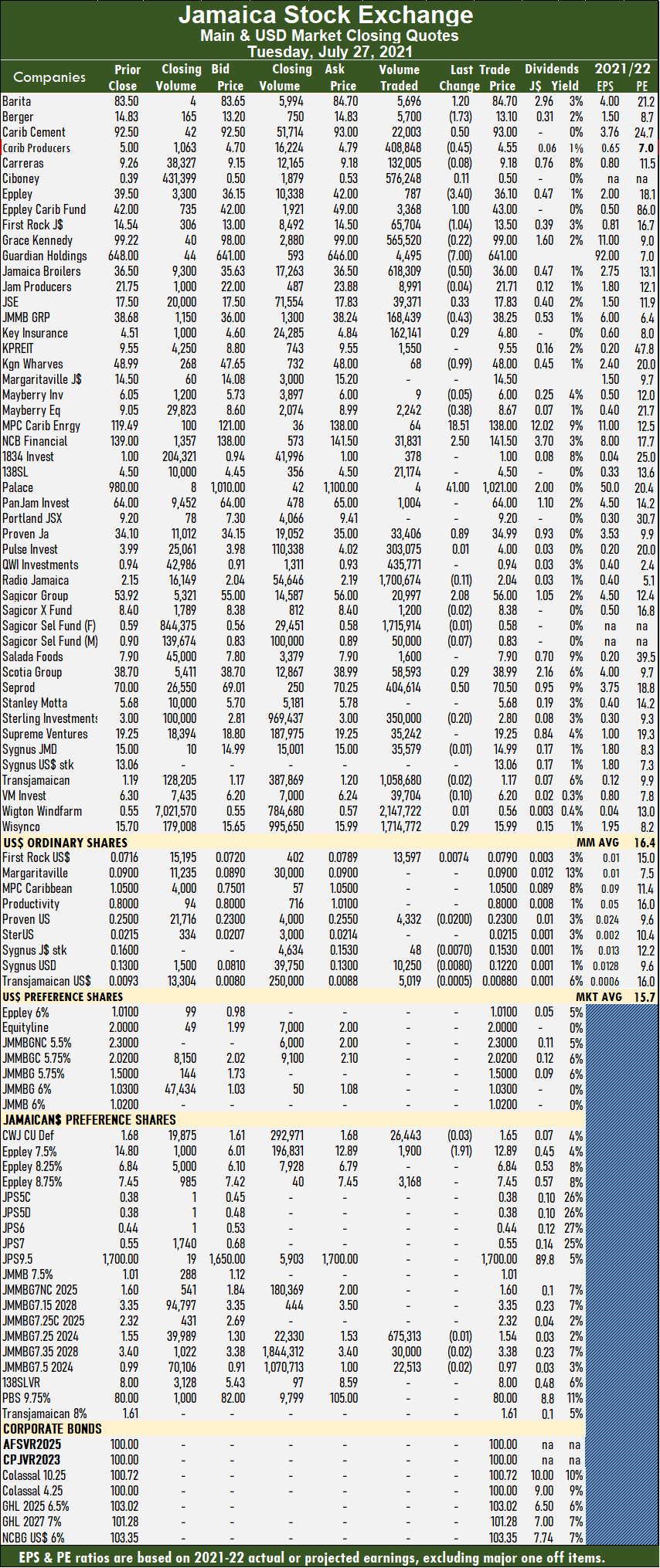

Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and five with lower offers. Proven Investments popped 89 cents to $34.99 with 33,406 units clearing the market, Sagicor Group rose $2.08 to $56 with 20,997 shares crossing the exchange, Scotia Group spiked 29 cents to $38.99, with 58,593 stocks trading. Seprod popped 50 cents to $70.50 in transferring 404,614 units, Sterling Investments shed 20 cents to end at $2.80 with the swapping of 350,000 stock units and Wisynco Group gained 29 cents to finish at $15.99 in switching ownership of 1,714,772 shares.

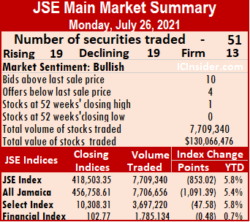

Proven Investments popped 89 cents to $34.99 with 33,406 units clearing the market, Sagicor Group rose $2.08 to $56 with 20,997 shares crossing the exchange, Scotia Group spiked 29 cents to $38.99, with 58,593 stocks trading. Seprod popped 50 cents to $70.50 in transferring 404,614 units, Sterling Investments shed 20 cents to end at $2.80 with the swapping of 350,000 stock units and Wisynco Group gained 29 cents to finish at $15.99 in switching ownership of 1,714,772 shares. The All Jamaican Composite Index fell 1,091.39 points to 456,758.61, the JSE Main Index shed 853.02 points to end at 418,503.35 and the JSE Financial Index slipped 0.48 points to 102.77.

The All Jamaican Composite Index fell 1,091.39 points to 456,758.61, the JSE Main Index shed 853.02 points to end at 418,503.35 and the JSE Financial Index slipped 0.48 points to 102.77. QWI Investments with 7.7 percent for 594,882 units.

QWI Investments with 7.7 percent for 594,882 units. Portland JSX advanced $1.20 to $9.20 with the swapping of 541 units, Proven Investments fell 90 cents to $34.10 after exchanging 15,417 shares, Radio Jamaica spiked 11 cents to end trading at a 52 weeks’ closing high of $2.15, with 578,444 shares clearing the market. Sagicor Group dropped $1.83 to $53.92 with the transfer of 55,508 units and Seprod gained 90 cents to end at $70 in exchanging 83,359 stocks.

Portland JSX advanced $1.20 to $9.20 with the swapping of 541 units, Proven Investments fell 90 cents to $34.10 after exchanging 15,417 shares, Radio Jamaica spiked 11 cents to end trading at a 52 weeks’ closing high of $2.15, with 578,444 shares clearing the market. Sagicor Group dropped $1.83 to $53.92 with the transfer of 55,508 units and Seprod gained 90 cents to end at $70 in exchanging 83,359 stocks.

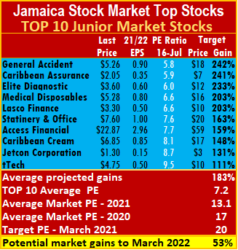

That is one reason why many of the selections at the start of the year have done well. Examples are as such, Caribbean Cream up 43 percent for the year to date started the year at the number 2 spot, Caribbean Producers the number 3 spot selection is up 82 percent, Main Event up 73 percent, Medical Disposables up just 12 percent, Stationery & Office Supplies 55 percent, Lumber Depot 116 percent and Mailpac 32 percent. Later, Future Energy Source was added to the list at the IPO stage and is up an impressive 110 percent. Additionally, Jetcon Corporation up 76 percent and Jamaican Teas 100 percent are not being counted. The Main Market with few overall winners for that market so far also produced winners from the TOP15 list, posted at the start of the year, Grace, Carreras, Caribbean Cement and Jamaica Broilers.

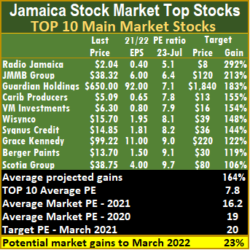

That is one reason why many of the selections at the start of the year have done well. Examples are as such, Caribbean Cream up 43 percent for the year to date started the year at the number 2 spot, Caribbean Producers the number 3 spot selection is up 82 percent, Main Event up 73 percent, Medical Disposables up just 12 percent, Stationery & Office Supplies 55 percent, Lumber Depot 116 percent and Mailpac 32 percent. Later, Future Energy Source was added to the list at the IPO stage and is up an impressive 110 percent. Additionally, Jetcon Corporation up 76 percent and Jamaican Teas 100 percent are not being counted. The Main Market with few overall winners for that market so far also produced winners from the TOP15 list, posted at the start of the year, Grace, Carreras, Caribbean Cement and Jamaica Broilers.  PanJam Investment earnings is downgraded to $4.50 per share and the stock moved out of the TOP10 Main Market listing and is replaced by Scotia Group, now in at tenth spot. There are no changes in or out of the Junior Market list.

PanJam Investment earnings is downgraded to $4.50 per share and the stock moved out of the TOP10 Main Market listing and is replaced by Scotia Group, now in at tenth spot. There are no changes in or out of the Junior Market list. The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 17 percent to hit a PE of 19 and 23 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 6.8, just 52 percent of the market average, indicating substantial gains ahead.

The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 17 percent to hit a PE of 19 and 23 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 6.8, just 52 percent of the market average, indicating substantial gains ahead. The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.8 or 48 percent of the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.8 or 48 percent of the PE of that market, well off the potential of 20. The All Jamaican Composite Index popped 853.62 points to 457,850.00, the JSE Main Index dipped 52.77 points to 419,356.37 and the JSE Financial Index inched 0.08 points higher to 103.25.

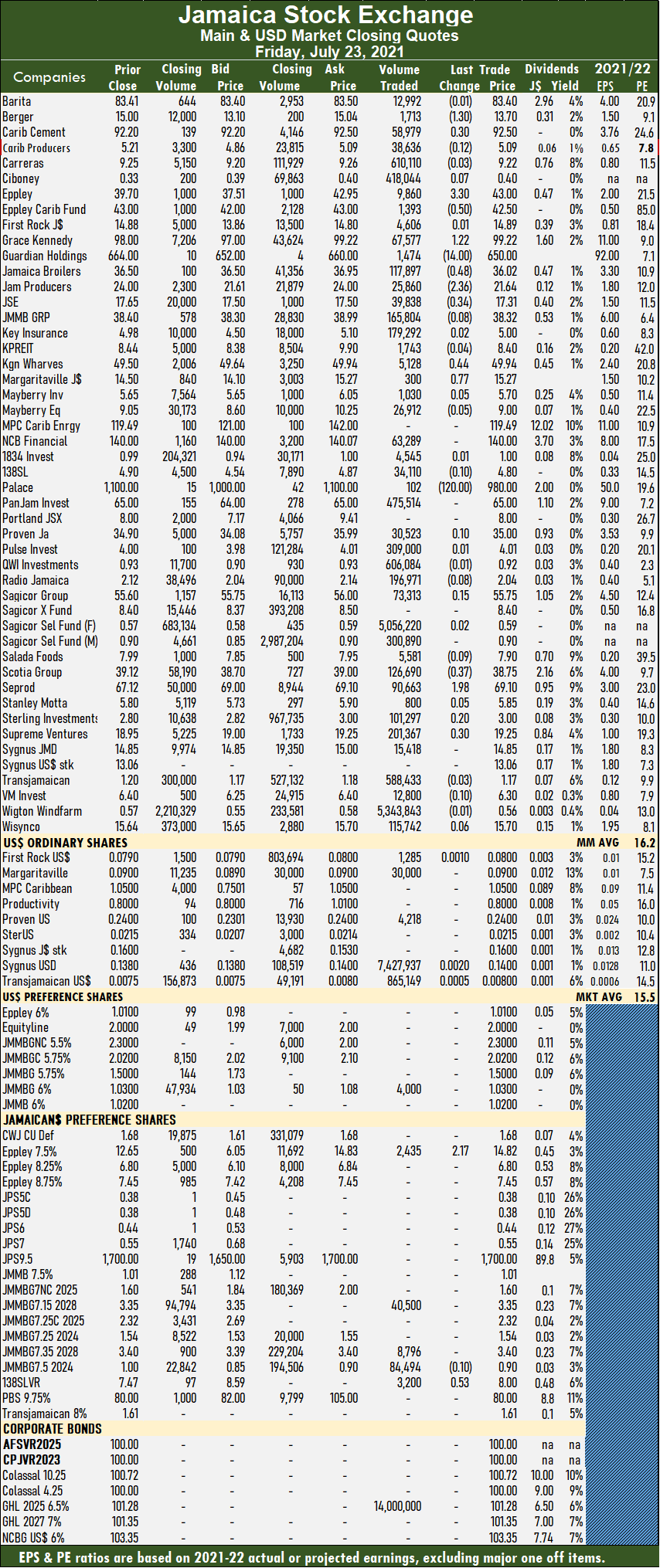

The All Jamaican Composite Index popped 853.62 points to 457,850.00, the JSE Main Index dipped 52.77 points to 419,356.37 and the JSE Financial Index inched 0.08 points higher to 103.25. Trading averaged 320,037 units at $2,141,728, compared to 240,337 shares at $897,464 on Thursday. Trading month to date averages 340,903 units at $18,719,581, in contrast to 342,188 units at $19,740,077 on Thursday. June ended with an average of 249,610 units at $3,877,606.

Trading averaged 320,037 units at $2,141,728, compared to 240,337 shares at $897,464 on Thursday. Trading month to date averages 340,903 units at $18,719,581, in contrast to 342,188 units at $19,740,077 on Thursday. June ended with an average of 249,610 units at $3,877,606. Palace Amusement dived $120 to $980 with 102 stocks crossing the exchange, Scotia Group lost 37 cents to $38.75 in trading 126,690 shares, Seprod rallied $1.98 to $69.10 in switching ownership of 90,663 stock units, Sterling Investments gained 20 cents to finish at $3 in exchanging 101,297 units and Supreme Ventures popped 30 cents to close at $19.25 with the swapping of 201,367 shares.

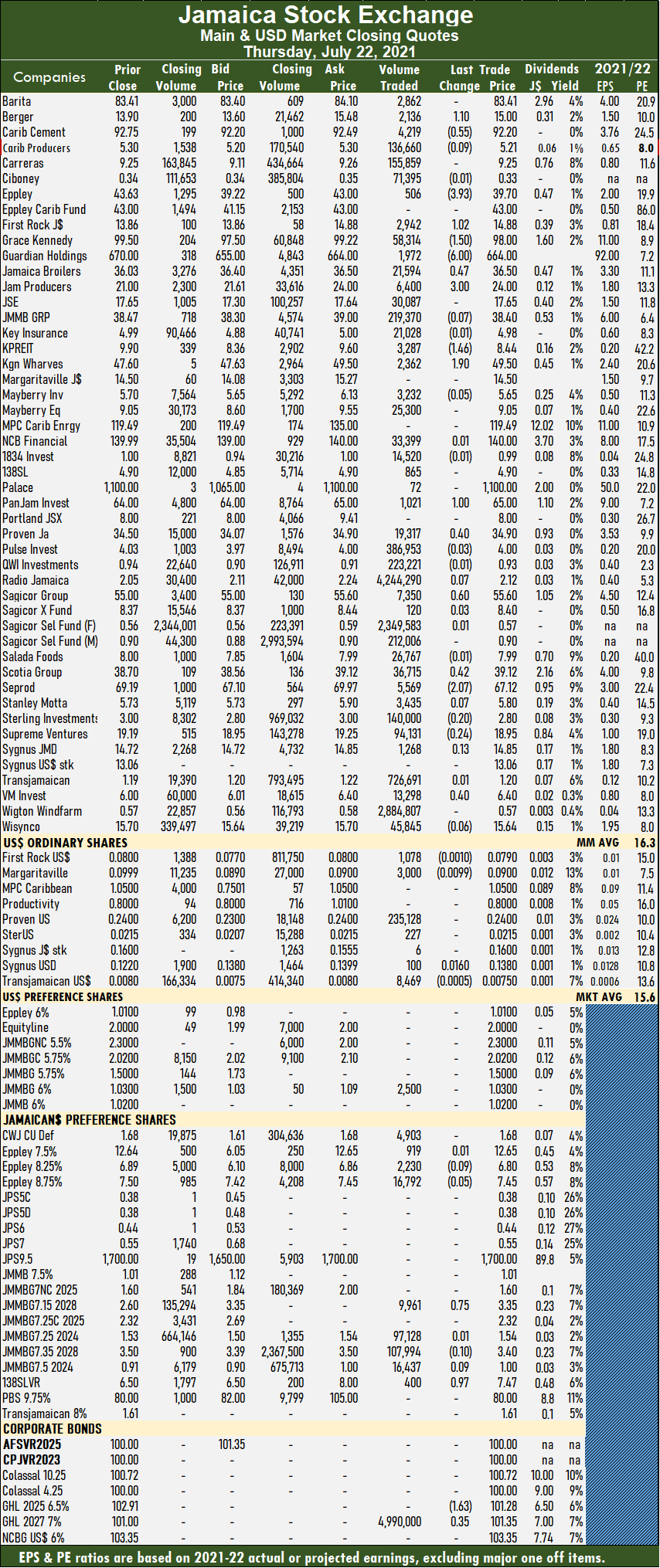

Palace Amusement dived $120 to $980 with 102 stocks crossing the exchange, Scotia Group lost 37 cents to $38.75 in trading 126,690 shares, Seprod rallied $1.98 to $69.10 in switching ownership of 90,663 stock units, Sterling Investments gained 20 cents to finish at $3 in exchanging 101,297 units and Supreme Ventures popped 30 cents to close at $19.25 with the swapping of 201,367 shares. Trading averaged 240,337 units at $897,464, compared to 139,495 shares at $1,919,540 on Wednesday. Trading month to date, averages 342,188 units at $19,740,077, in contrast to 349,306 units at $21,057,034 on Wednesday. June ended with an average of 249,610 units at $3,877,606.

Trading averaged 240,337 units at $897,464, compared to 139,495 shares at $1,919,540 on Wednesday. Trading month to date, averages 342,188 units at $19,740,077, in contrast to 349,306 units at $21,057,034 on Wednesday. June ended with an average of 249,610 units at $3,877,606. Radio Jamaica popped 7 cents to end at a 52 weeks’ closing high of $2.12 after hitting a high of $2.35 in trading 4,244,290 stock units, Sagicor Group rose 60 cents to $55.60 with the swapping of 7,350 units, Scotia Group rallied 42 cents to $39.12 in exchanging 36,715 shares, Seprod fell $2.07 to $67.12 in transferring 5,569 units, Sterling Investments lost 20 cents to end at $2.80 in exchanging 140,000 stock units, Supreme Ventures dipped 24 cents to $18.95 in trading 94,131 shares and Victoria Mutual Investments popped 40 cents to end at $6.40 in switching ownership of 13,298 stock units.

Radio Jamaica popped 7 cents to end at a 52 weeks’ closing high of $2.12 after hitting a high of $2.35 in trading 4,244,290 stock units, Sagicor Group rose 60 cents to $55.60 with the swapping of 7,350 units, Scotia Group rallied 42 cents to $39.12 in exchanging 36,715 shares, Seprod fell $2.07 to $67.12 in transferring 5,569 units, Sterling Investments lost 20 cents to end at $2.80 in exchanging 140,000 stock units, Supreme Ventures dipped 24 cents to $18.95 in trading 94,131 shares and Victoria Mutual Investments popped 40 cents to end at $6.40 in switching ownership of 13,298 stock units. At the close, the All Jamaican Composite Index advanced 1,662.75 points to 455,560.97, the JSE Main Index climbed 2,127.16 points to end at 418,464.25 and the JSE Financial Index rose 0.88 points to 103.24.

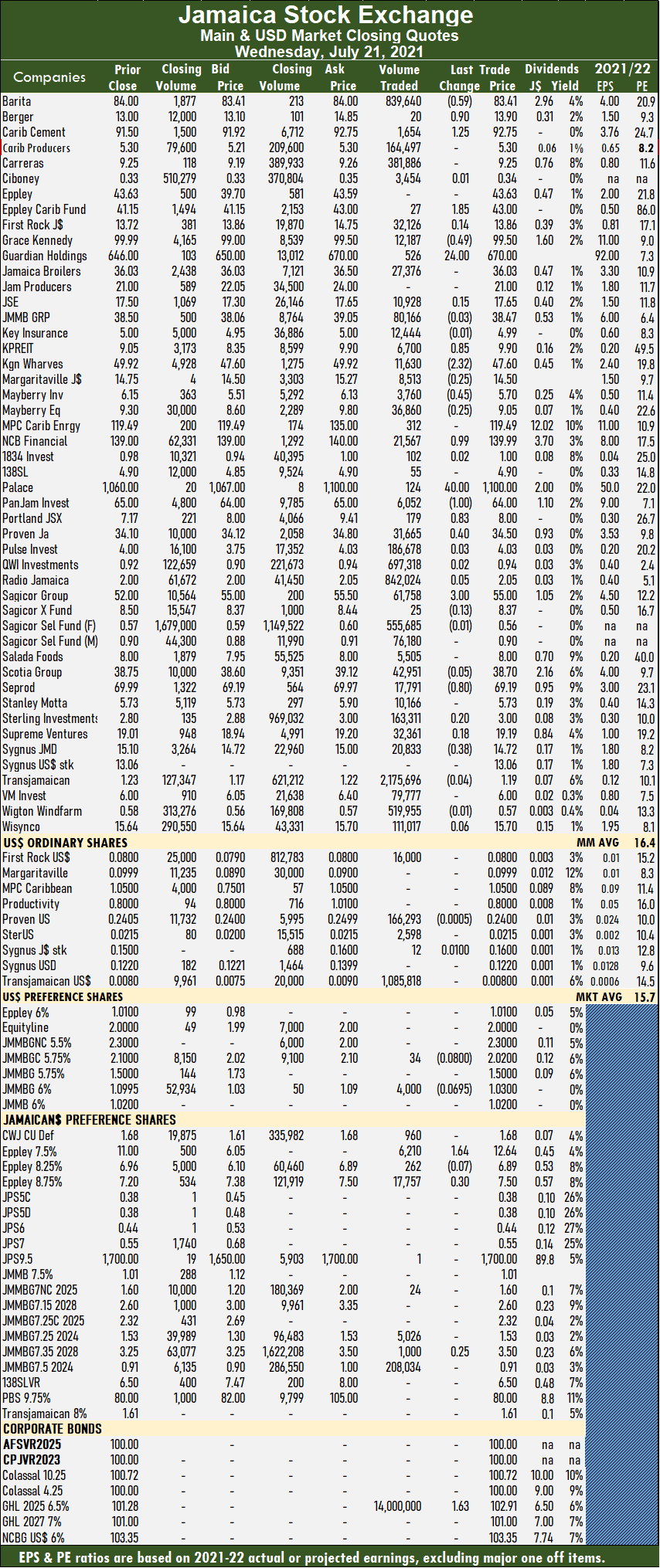

At the close, the All Jamaican Composite Index advanced 1,662.75 points to 455,560.97, the JSE Main Index climbed 2,127.16 points to end at 418,464.25 and the JSE Financial Index rose 0.88 points to 103.24. At the close, Barita Investments shed 59 cents to end at $83.41 with a transfer of 839,640 shares, Berger Paints spiked 90 cents to $13.90 in exchanging 20 stock units, Caribbean Cement popped $1.25 to $92.75 with 1,654 units crossing the market. Eppley Caribbean Property Fund spiked $1.85 to $43 with the swapping of 27 stocks, Grace Kennedy lost 49 cents to close at $99.50 in switching ownership of 12,187 units. Guardian Holdings surged $24 to $670 in trading 526 stocks, Kingston Properties rallied 85 cents to $9.90 in exchanging 6,700 stock units, Kingston Wharves declined $2.32 to $47.60, with 11,630 shares changing hands. Margaritaville fell 25 cents to $14.50 with 8,513 units crossing the exchange, Mayberry Investments shed 45 cents to $5.70 with the swapping of 3,760 shares, Mayberry Jamaican Equities fell 25 cents to $9.05 in switching ownership of 36,860 stocks. NCB Financial rose 99 cents to $139.99 in switching ownership of 21,567 stock units, Palace Amusement climbed $40 to $1,100 in trading 124 stocks, PanJam Investment slipped $1 to $64 after an exchange of 6,052 units. Portland JSX rose 83 cents to $8 in trading 179 stock units, Proven Investments picked up 40 cents to close at $34.50 after trading 31,665 stocks, Radio Jamaica popped 5 cents to end at a 52 weeks’ high of $2.05 while exchanging 842,024 shares.

At the close, Barita Investments shed 59 cents to end at $83.41 with a transfer of 839,640 shares, Berger Paints spiked 90 cents to $13.90 in exchanging 20 stock units, Caribbean Cement popped $1.25 to $92.75 with 1,654 units crossing the market. Eppley Caribbean Property Fund spiked $1.85 to $43 with the swapping of 27 stocks, Grace Kennedy lost 49 cents to close at $99.50 in switching ownership of 12,187 units. Guardian Holdings surged $24 to $670 in trading 526 stocks, Kingston Properties rallied 85 cents to $9.90 in exchanging 6,700 stock units, Kingston Wharves declined $2.32 to $47.60, with 11,630 shares changing hands. Margaritaville fell 25 cents to $14.50 with 8,513 units crossing the exchange, Mayberry Investments shed 45 cents to $5.70 with the swapping of 3,760 shares, Mayberry Jamaican Equities fell 25 cents to $9.05 in switching ownership of 36,860 stocks. NCB Financial rose 99 cents to $139.99 in switching ownership of 21,567 stock units, Palace Amusement climbed $40 to $1,100 in trading 124 stocks, PanJam Investment slipped $1 to $64 after an exchange of 6,052 units. Portland JSX rose 83 cents to $8 in trading 179 stock units, Proven Investments picked up 40 cents to close at $34.50 after trading 31,665 stocks, Radio Jamaica popped 5 cents to end at a 52 weeks’ high of $2.05 while exchanging 842,024 shares. Sagicor Group advanced $3 to $55 in switching ownership of 61,758 shares, Seprod fell 80 cents to $69.19 with 17,791 shares changing hands, Sterling Investments gained 20 cents to end at $3 with 163,311 units crossing the market and Sygnus Credit Investments lost 38 cents after ending at $14.72 in trading 20,833 units.

Sagicor Group advanced $3 to $55 in switching ownership of 61,758 shares, Seprod fell 80 cents to $69.19 with 17,791 shares changing hands, Sterling Investments gained 20 cents to end at $3 with 163,311 units crossing the market and Sygnus Credit Investments lost 38 cents after ending at $14.72 in trading 20,833 units. At the close, the All Jamaican Composite Index fell 587.12 points to 453,898.22, the JSE Main Index shed 595.66 points to end at 416,337.09 and the JSE Financial Index slipped 0.30 points to 102.36.

At the close, the All Jamaican Composite Index fell 587.12 points to 453,898.22, the JSE Main Index shed 595.66 points to end at 416,337.09 and the JSE Financial Index slipped 0.30 points to 102.36. Trading averaged 928,081 units at $5,234,041, compared to 291,157 shares at $1,401,376 on Monday. Trading month to date averages 365,726 units at $22,554,751, in contrast to 322,738 units at $23,878,799 on Monday. June ended with an average of 249,610 units at $3,877,606.

Trading averaged 928,081 units at $5,234,041, compared to 291,157 shares at $1,401,376 on Monday. Trading month to date averages 365,726 units at $22,554,751, in contrast to 322,738 units at $23,878,799 on Monday. June ended with an average of 249,610 units at $3,877,606. PanJam Investment popped $3.99 to $65 after exchanging 1,110 stock units, Sagicor Group slipped $3 to $52 with the swapping of 110,420 stocks, Sagicor Select Manufacturing & Distribution Fund popped 5 cents to 90 cents, with 440,711 stock units crossing the market. Scotia Group dipped 25 cents to $38.75, with 12,993 units crossing the exchange and Victoria Mutual Investments lost 49 cents after ending at $6 with 107,913 shares changing hands.

PanJam Investment popped $3.99 to $65 after exchanging 1,110 stock units, Sagicor Group slipped $3 to $52 with the swapping of 110,420 stocks, Sagicor Select Manufacturing & Distribution Fund popped 5 cents to 90 cents, with 440,711 stock units crossing the market. Scotia Group dipped 25 cents to $38.75, with 12,993 units crossing the exchange and Victoria Mutual Investments lost 49 cents after ending at $6 with 107,913 shares changing hands. The All Jamaican Composite Index tumbled 3,626.92 points to 454,485.34, the JSE Main Index plunged 3,138.91 points to 416,932.75 and the JSE Financial Index fell 0.63 points to 102.66.

The All Jamaican Composite Index tumbled 3,626.92 points to 454,485.34, the JSE Main Index plunged 3,138.91 points to 416,932.75 and the JSE Financial Index fell 0.63 points to 102.66. Investor’s Choice bid-offer indicator shows 15 stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows 15 stocks ending with bids higher than their last selling prices and three with lower offers.

This past week the average gains projected for the Junior Market fell from 202 percent last week to 183 percent and Main Market stocks moved to 176 percent from 170 percent.

This past week the average gains projected for the Junior Market fell from 202 percent last week to 183 percent and Main Market stocks moved to 176 percent from 170 percent. The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 as well as the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 19 percent to hit a PE of 19 and 24 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 7.2., just 55 percent of the market average, indicating substantial gains ahead.

The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 as well as the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 19 percent to hit a PE of 19 and 24 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 7.2., just 55 percent of the market average, indicating substantial gains ahead. This week’s focus: Results for

This week’s focus: Results for  IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.