Junior market recovery

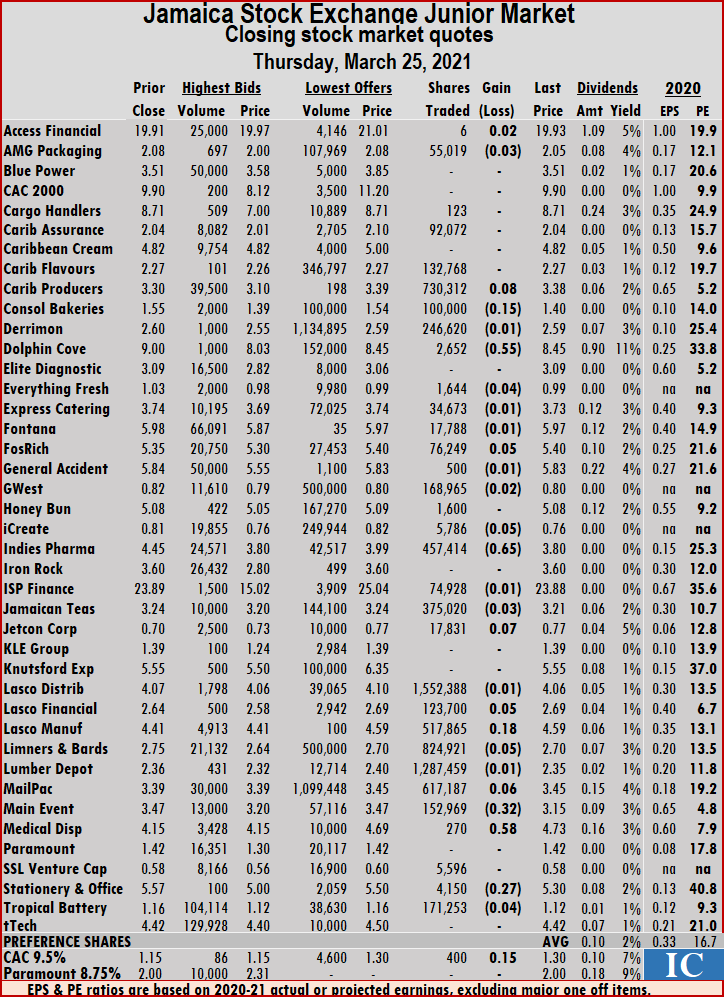

Rising stocks outnumbered declining ones by a two to one margin on Friday, leading the Junior Market Index to continue its ascent in clawing back last year’s losses by adding 12.51 points to Thursday close to settle at 2,984.70 after the volume and values exchanged dropped 22 percent each from Thursday.

Overall, 33 securities traded, similar to Thursday and closed with 18 stocks rising, eight declining and seven remaining unchanged. The average PE Ratio ended at 16.9 based on ICInsider.com’s forecast of 2020-21 earnings.

Overall, 33 securities traded, similar to Thursday and closed with 18 stocks rising, eight declining and seven remaining unchanged. The average PE Ratio ended at 16.9 based on ICInsider.com’s forecast of 2020-21 earnings.

In all, 6,154,149 shares traded at $20,517,294, down from 7,850,128 units at $26,568,082 on Thursday. Limners and Bards led trading with 37 percent of total volume in exchanging 2.28 million shares, followed by General Accident with 22.8 percent for 1.4 million units and GWest Corporation with 8.3 percent for 511,334 units.

Trading averaged 186,489 units at $621,736 in contrast to 237,883 at $805,093 on Thursday. Month to date averaged 255,365 units at $752,990, compared to 258,747 units at $759,436 on Thursday. February closed with an average of 365,365 units at $881,118.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Access Financial climbed $1.08 to $21.01 with 16,826 shares crossing the exchange, Blue Power gained 33 cents ending at $3.84 after trading 175 stocks, Caribbean Cream rose 23 cents to close at $5.05 after clearing the market of 52,748 units. Caribbean Flavours shed 37 cents to $1.90 in exchanging 29,212 shares, Consolidated Bakeries closed 14 cents higher at $1.54 in the swapping of 1,000 units, Fosrich lost 15 cents to close at $5.25, with 59,598 stock units switching owners, General Accident shed 27 cents to $5.56, with 1,400,497 shares changing hands. iCreate picked up 6 cents in ending at 82 cents trading 11,747 stock units, ISP Finance gained 12 cents to close at $24 after finishing with an exchange of 8 shares. Jamaican Teas fell 5 cents to $3.16 in transferring 76,571 stock units, KLE Group lost 15 cents in closing at $1.24 with 100 stocks changing hands.  Knutsford Express rose 80 cents to $6.35 after exchanging 500 units, Lasco Distributors rose 8 cents to $4.14, with 49,688 stock units changing hands, Lasco Manufacturing lost 13 cents to end at $4.46 in an exchange of 101,862 stocks. Limners and Bards gained 5 cents to close at $2.75 with the swapping of 2,276,465 shares, Main Event rose 32 cents to $3.47, with 50,000 stocks hands and tTech finished 8 cents higher at $4.50 after transferring 40 units.

Knutsford Express rose 80 cents to $6.35 after exchanging 500 units, Lasco Distributors rose 8 cents to $4.14, with 49,688 stock units changing hands, Lasco Manufacturing lost 13 cents to end at $4.46 in an exchange of 101,862 stocks. Limners and Bards gained 5 cents to close at $2.75 with the swapping of 2,276,465 shares, Main Event rose 32 cents to $3.47, with 50,000 stocks hands and tTech finished 8 cents higher at $4.50 after transferring 40 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

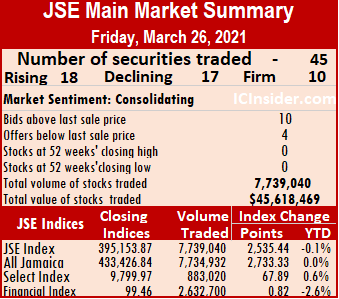

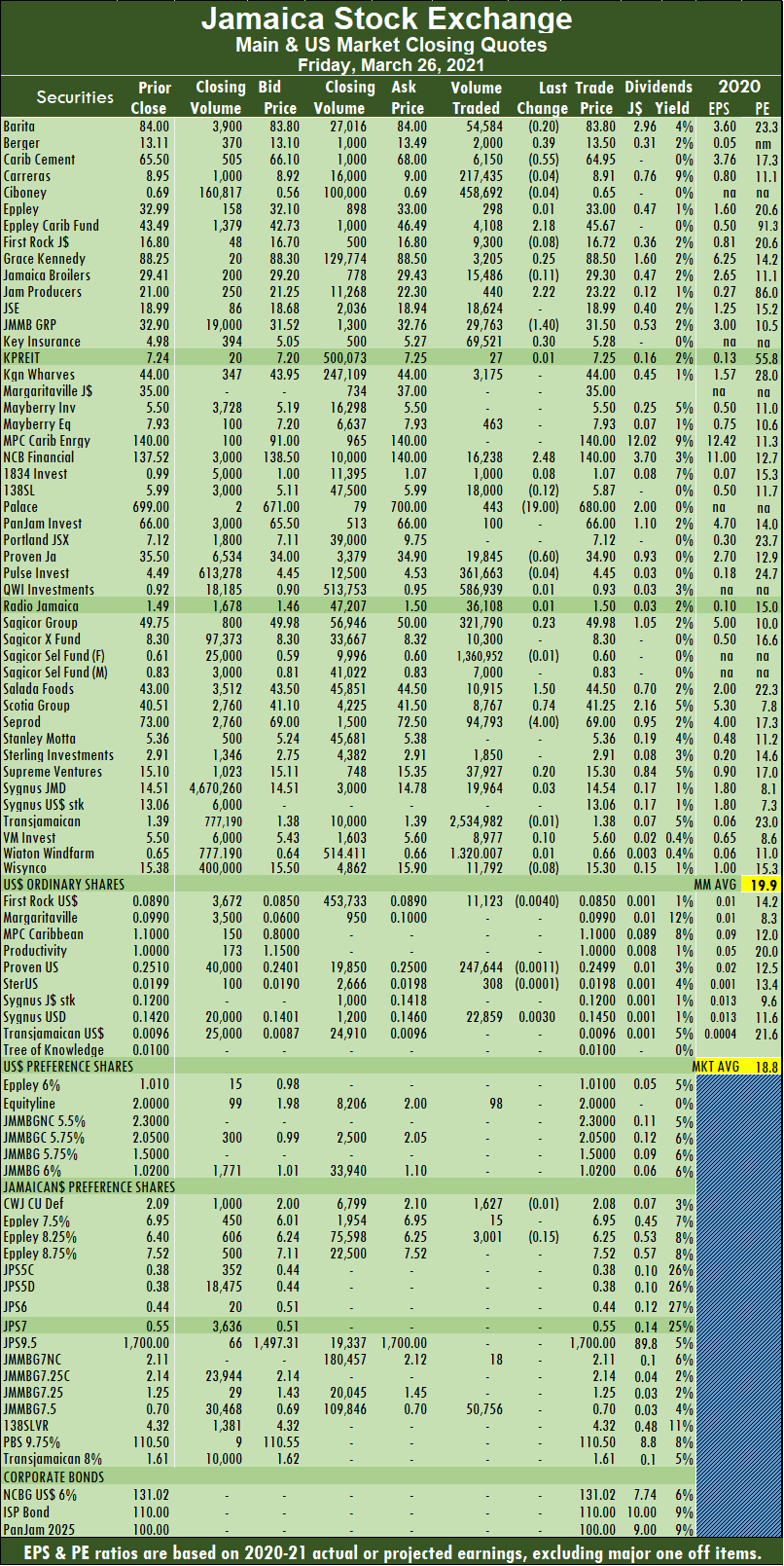

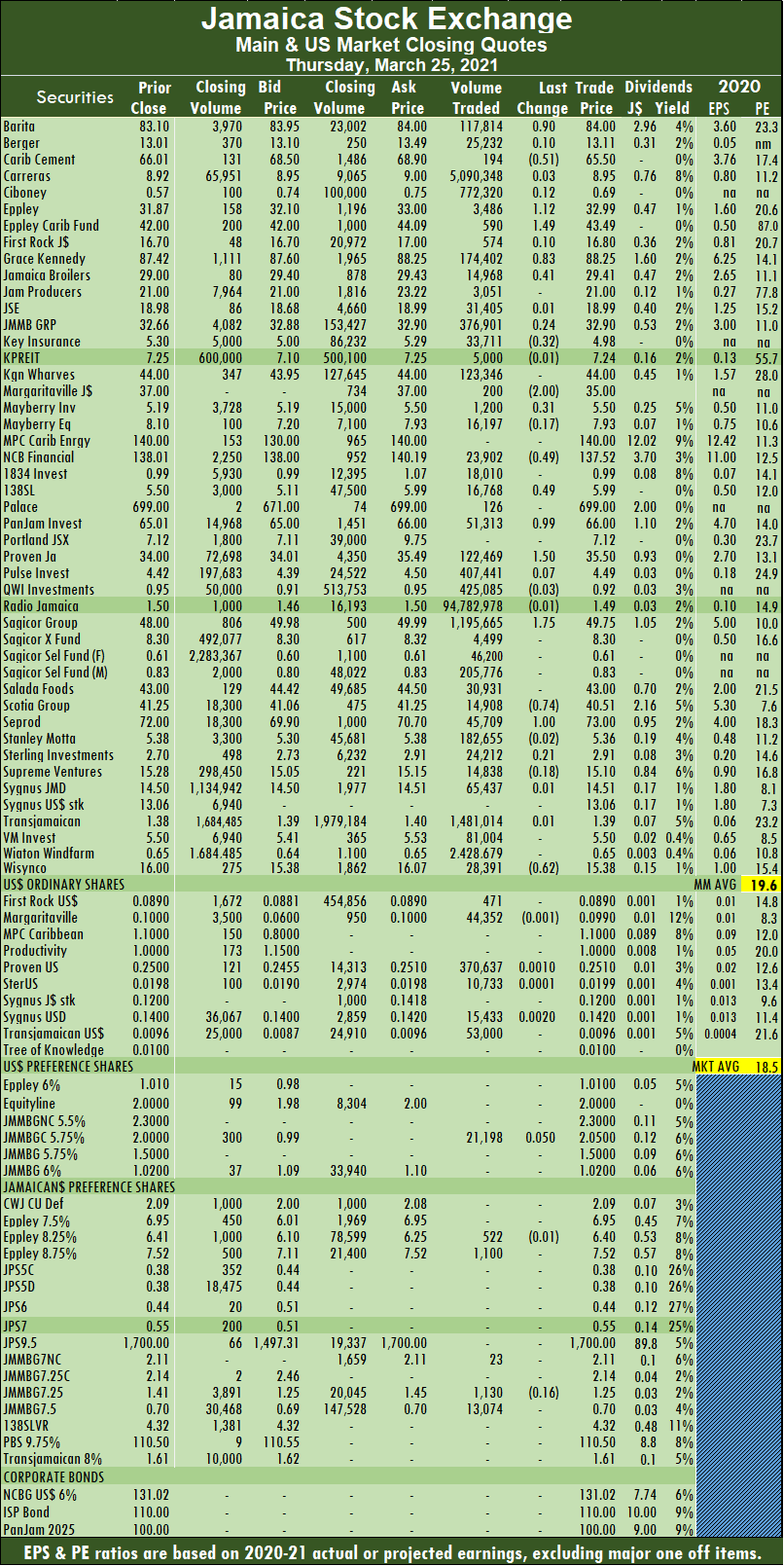

The All Jamaican Composite Index advanced 2,733.33 points to 433,426.84, the Main Index rose 2,535.44 points to 395,153.87 and the JSE Financial Index gained 0.82 points to settle at 99.46.

The All Jamaican Composite Index advanced 2,733.33 points to 433,426.84, the Main Index rose 2,535.44 points to 395,153.87 and the JSE Financial Index gained 0.82 points to settle at 99.46. Month to date trading averaged 341,423 units at $2,407,074, in contrast to 350,058 units at $2,478,082 on Thursday. February closed with an average of 419,015 units at $2,509,660.

Month to date trading averaged 341,423 units at $2,407,074, in contrast to 350,058 units at $2,478,082 on Thursday. February closed with an average of 419,015 units at $2,509,660.  Palace Amusement fell $19 to $680, with 443 units crossing the exchange, Proven Investments shed 60 cents in ending at $34.90 with 19,845 stock units clearing the market, Sagicor Group gained 23 cents to finish at $49.98 in transferring 321,790 units. Salada Foods rose $1.50 to $44.50 with the swapping of 10,915 shares, Scotia Group closed 74 cents higher at $41.25 with an exchange of 8,767 stock, Seprod dropped $4 to $69 in trading 94,793 units and Supreme Ventures finished 20 cents higher at $15.30 in switching ownership of 37,927 stock units.

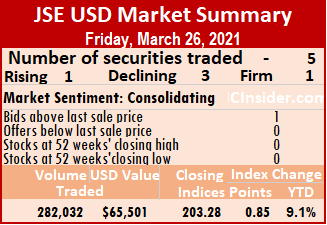

Palace Amusement fell $19 to $680, with 443 units crossing the exchange, Proven Investments shed 60 cents in ending at $34.90 with 19,845 stock units clearing the market, Sagicor Group gained 23 cents to finish at $49.98 in transferring 321,790 units. Salada Foods rose $1.50 to $44.50 with the swapping of 10,915 shares, Scotia Group closed 74 cents higher at $41.25 with an exchange of 8,767 stock, Seprod dropped $4 to $69 in trading 94,793 units and Supreme Ventures finished 20 cents higher at $15.30 in switching ownership of 37,927 stock units. Trading ended with five securities changing hands, compared to seven on Thursday and ended with the prices of one stock rising, three declining and one remaining unchanged.

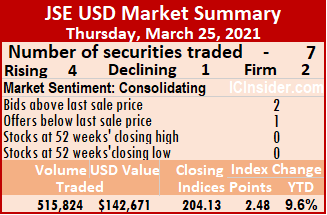

Trading ended with five securities changing hands, compared to seven on Thursday and ended with the prices of one stock rising, three declining and one remaining unchanged. At the close, First Rock Capital fell 0.4 of a cent to 8.5 US cents trading 11,123 shares, Proven Investments dipped 0.11 of a cent to 24.99 US cents, with 247,644 stock units clearing the market, Sterling Investments lost 0.01 of a cent in ending at 1.98 US cents in an exchange of 308 stock units and Sygnus Credit Investments advanced 0.3 of one cent to 14.5 US cents with 22,859 stocks changing hands.

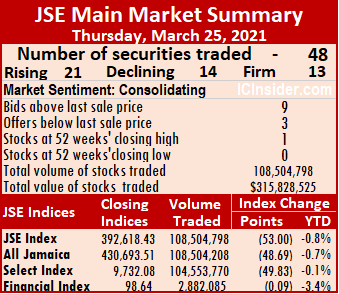

At the close, First Rock Capital fell 0.4 of a cent to 8.5 US cents trading 11,123 shares, Proven Investments dipped 0.11 of a cent to 24.99 US cents, with 247,644 stock units clearing the market, Sterling Investments lost 0.01 of a cent in ending at 1.98 US cents in an exchange of 308 stock units and Sygnus Credit Investments advanced 0.3 of one cent to 14.5 US cents with 22,859 stocks changing hands. At the close, the All Jamaican Composite Index shed 48.69 points to 430,693.51, the JSE Main Index declined 53.00 points to 392,618.43 and the JSE Financial Index lost 0.09 points to settle at 98.64.

At the close, the All Jamaican Composite Index shed 48.69 points to 430,693.51, the JSE Main Index declined 53.00 points to 392,618.43 and the JSE Financial Index lost 0.09 points to settle at 98.64. Investor’s Choice bid-offer indicator reading has thirteen stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator reading has thirteen stocks ending with bids higher than their last selling prices and four with lower offers. Scotia Group ended 74 cents lower at $40.51 with the swapping of 14,908 stock units, Seprod rose $1 to $73 with 45,709 units changing hands. Sterling Investments gained 21 cents to settle at $2.91in the transfer of 24,212 stocks and Wisynco Group shed 62 cents to close at $15.38, with 28,391 stocks changing hands.

Scotia Group ended 74 cents lower at $40.51 with the swapping of 14,908 stock units, Seprod rose $1 to $73 with 45,709 units changing hands. Sterling Investments gained 21 cents to settle at $2.91in the transfer of 24,212 stocks and Wisynco Group shed 62 cents to close at $15.38, with 28,391 stocks changing hands.

Trading averaged 237,883 units at $805,093, a fall from 337,793 at $1,021,945 on Wednesday.

Trading averaged 237,883 units at $805,093, a fall from 337,793 at $1,021,945 on Wednesday. Limners and Bards lost 5 cents to finish at $2.70 with a transfer of 824,921 units, Mailpac Group rose 6 cents to $3.45 with 617,187 shares traded, Main Event shed 32 cents to settle at $3.15 with 152,969 stocks passing through the market.Medical Disposables jumped 58 cents to $4.73 with a transfer of 270 units and Stationery and Office Supplies dropped 27 cents to $5.30 with 4,150 shares crossing the exchange.

Limners and Bards lost 5 cents to finish at $2.70 with a transfer of 824,921 units, Mailpac Group rose 6 cents to $3.45 with 617,187 shares traded, Main Event shed 32 cents to settle at $3.15 with 152,969 stocks passing through the market.Medical Disposables jumped 58 cents to $4.73 with a transfer of 270 units and Stationery and Office Supplies dropped 27 cents to $5.30 with 4,150 shares crossing the exchange. JSE USD Equity Index gained 2.48 points to end at 204.13. The average PE Ratio ends at 13.7 based on ICInsider.com’s forecast of 2020-21 earnings.

JSE USD Equity Index gained 2.48 points to end at 204.13. The average PE Ratio ends at 13.7 based on ICInsider.com’s forecast of 2020-21 earnings. Sterling Investments advanced 0.01 of a cent to end at 1.99 US cents while exchanging 10,733 stock units, Sygnus Credit Investments rose 0.2 of a cent to end at 14.2 US cents in an exchange of 15,433 stocks and Transjamaican Highway ended at 0.96 US cents in an exchange of 53,000 shares.

Sterling Investments advanced 0.01 of a cent to end at 1.99 US cents while exchanging 10,733 stock units, Sygnus Credit Investments rose 0.2 of a cent to end at 14.2 US cents in an exchange of 15,433 stocks and Transjamaican Highway ended at 0.96 US cents in an exchange of 53,000 shares.

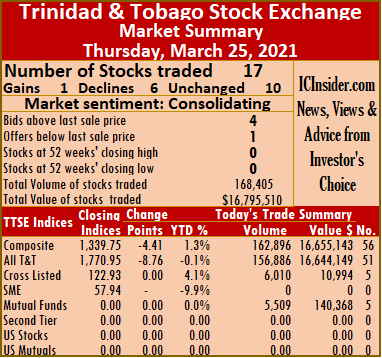

JMMB Group dipped 1 cent to $1.82 after 6,010 stocks crossed the market, Massy Holdings shed 15 cents to close at $63.75 with an exchange of 3,108 stocks, National Enterprises ended at $2.95 with the swapping of 2,000 shares. National Flour Mills ended at $2.15 with 4,600 stocks changing hands, One Caribbean Media ended at $4.60 in exchanging 3,000 stocks, Republic Financial Holdings had an exchange of 119,234 stocks units at $131.75. Scotiabank traded 6,920 units at $55, Trinidad & Tobago NGL settled at $14.99 in trading 3,952 stocks, Trinidad Cement closed at $3, with 1,432 units crossing the exchange and West Indian Tobacco ended at $32.51 while exchanging 980 stocks.

JMMB Group dipped 1 cent to $1.82 after 6,010 stocks crossed the market, Massy Holdings shed 15 cents to close at $63.75 with an exchange of 3,108 stocks, National Enterprises ended at $2.95 with the swapping of 2,000 shares. National Flour Mills ended at $2.15 with 4,600 stocks changing hands, One Caribbean Media ended at $4.60 in exchanging 3,000 stocks, Republic Financial Holdings had an exchange of 119,234 stocks units at $131.75. Scotiabank traded 6,920 units at $55, Trinidad & Tobago NGL settled at $14.99 in trading 3,952 stocks, Trinidad Cement closed at $3, with 1,432 units crossing the exchange and West Indian Tobacco ended at $32.51 while exchanging 980 stocks. February closed with an average of 365,365 units at $881,118.

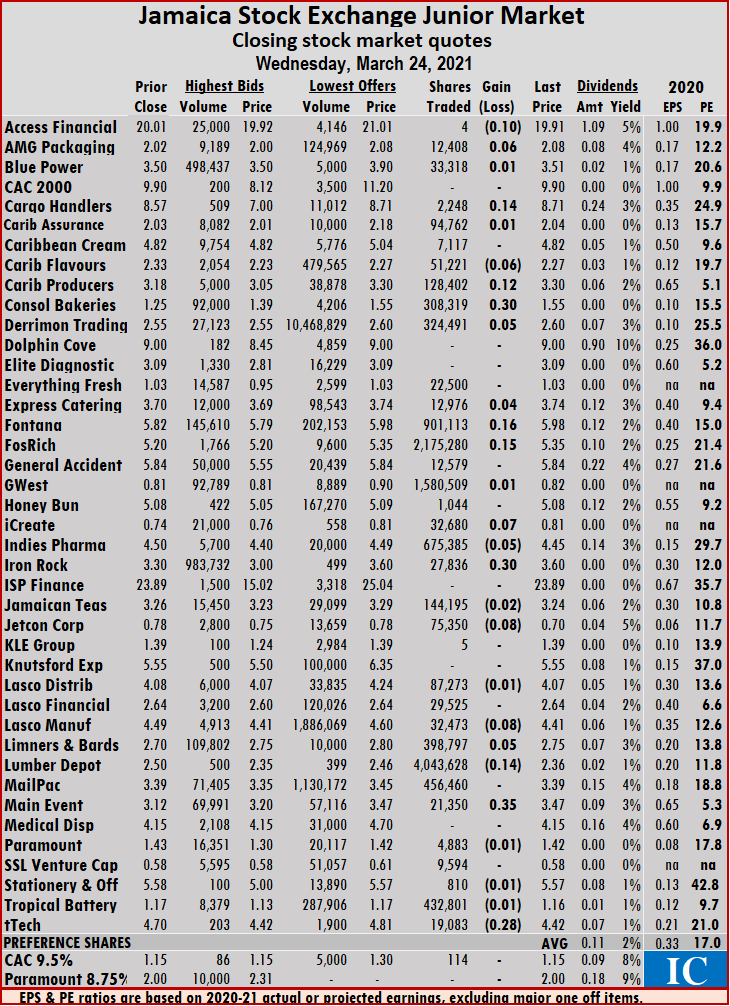

February closed with an average of 365,365 units at $881,118. Jetcon Corporation fell 8 cents to 70 cents with 75,350 stocks traded, Lasco Manufacturing lost 8 cents to end at $4.41 with 32,473 units passing through the market, Limners and Bards rose 5 cents to $2.75 with a transfer of 398,797 shares. Lumber Depot fell 14 cents to $2.36 with 4,043,628 stocks passing through the market, Main Event climbed 35 cents to $3.47 with a transfer of 21,350 stock units and tTech dropped 28 cents to $4.42 with 19,083 shares crossing the exchange.

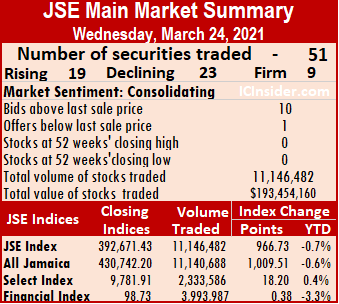

Jetcon Corporation fell 8 cents to 70 cents with 75,350 stocks traded, Lasco Manufacturing lost 8 cents to end at $4.41 with 32,473 units passing through the market, Limners and Bards rose 5 cents to $2.75 with a transfer of 398,797 shares. Lumber Depot fell 14 cents to $2.36 with 4,043,628 stocks passing through the market, Main Event climbed 35 cents to $3.47 with a transfer of 21,350 stock units and tTech dropped 28 cents to $4.42 with 19,083 shares crossing the exchange. The All Jamaican Composite Index advanced 1,009.51 points to 430,742.20, the Main Index rose 966.73 points to 392,671.43 and the JSE Financial Index gained 0.38 points to settle at 98.73.

The All Jamaican Composite Index advanced 1,009.51 points to 430,742.20, the Main Index rose 966.73 points to 392,671.43 and the JSE Financial Index gained 0.38 points to settle at 98.73. February closed with an average of 419,015 units at $2,509,660.

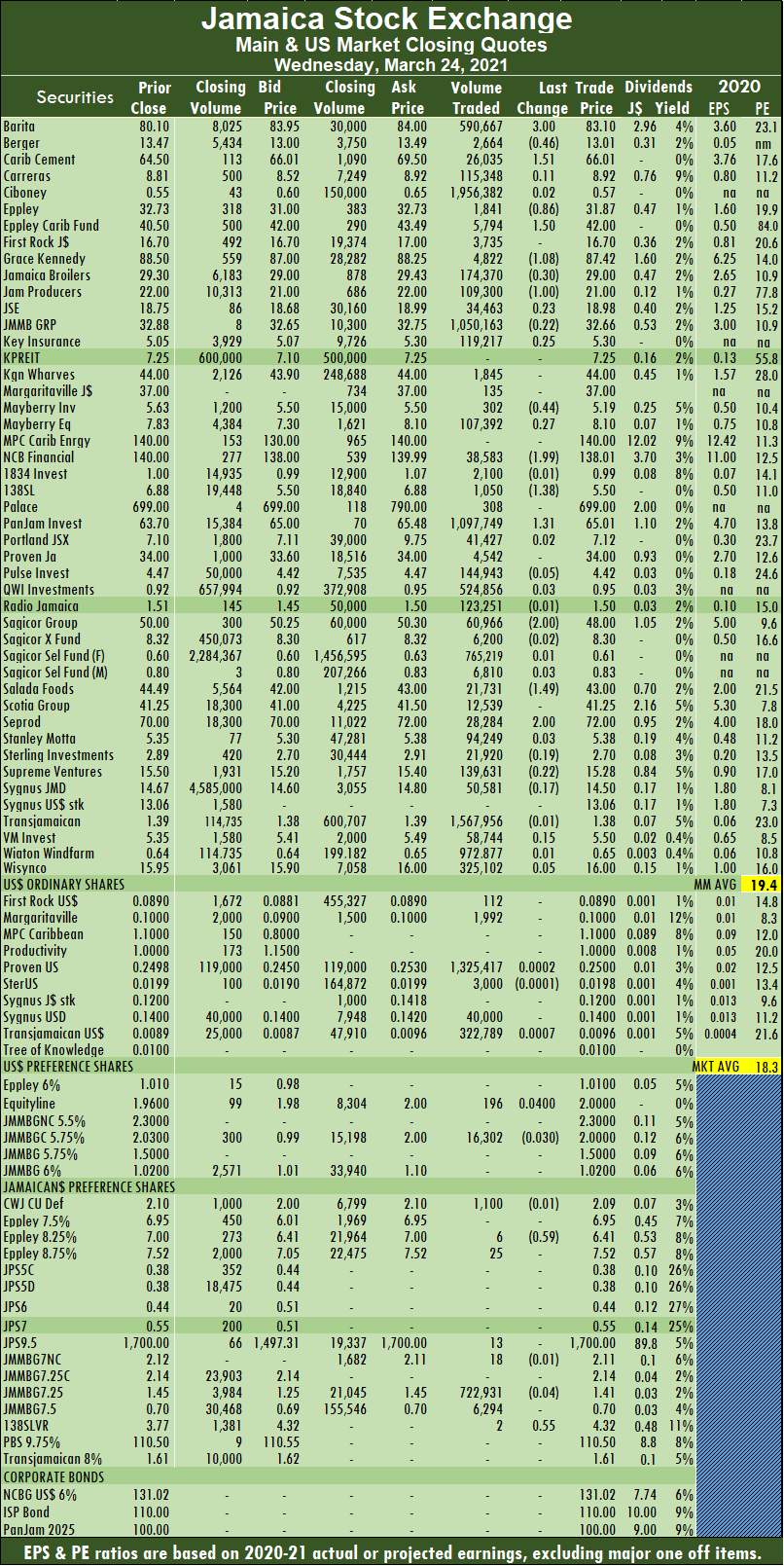

February closed with an average of 419,015 units at $2,509,660. NCB Financial declined $1.99 to $138.01 with 38,583 stock units changing hands, 138 Student Living dropped $1.38 to $5.50 in trading 1,050 units, PanJam Investment rose $1.31 to $65.01 with the swapping of 1,097,749 shares, Sagicor Group declined $2 to $48 in trading 60,966 stock units. Salada Foods fell $1.49 to $43 in exchanging 21,731 units, Seprod advanced $2 to $72 in switching ownership of 28,284 shares and Supreme Ventures lost 22 cents to close at $15.28 with 139,631 stocks changing hands.

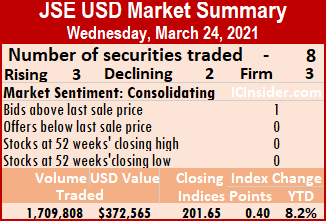

NCB Financial declined $1.99 to $138.01 with 38,583 stock units changing hands, 138 Student Living dropped $1.38 to $5.50 in trading 1,050 units, PanJam Investment rose $1.31 to $65.01 with the swapping of 1,097,749 shares, Sagicor Group declined $2 to $48 in trading 60,966 stock units. Salada Foods fell $1.49 to $43 in exchanging 21,731 units, Seprod advanced $2 to $72 in switching ownership of 28,284 shares and Supreme Ventures lost 22 cents to close at $15.28 with 139,631 stocks changing hands. At the close, 1,709,808 shares traded, for US$372,565 compared to 216,610 units at US$36,569 on Tuesday.

At the close, 1,709,808 shares traded, for US$372,565 compared to 216,610 units at US$36,569 on Tuesday. Sterling Investments dipped 0.01 cent to 1.98 US cents swapping 3,000 units, Sygnus Credit Investments ended at 14 US cents trading 40,000 units and Transjamaican Highway carved out a gain of 0.07 cents to close at 0.96 US cents in an exchange of 322,789 units.

Sterling Investments dipped 0.01 cent to 1.98 US cents swapping 3,000 units, Sygnus Credit Investments ended at 14 US cents trading 40,000 units and Transjamaican Highway carved out a gain of 0.07 cents to close at 0.96 US cents in an exchange of 322,789 units.