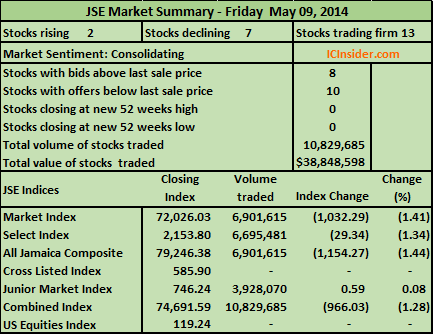

In Friday’s trading on the Jamaica Stock Exchange the prices of 3 stocks rose and 7 declined as 22 securities traded resulting in 10,829,685 shares changing hands valued at $38,848,598.

Main Market| The prices of only 2 companies in the main market rose and 6 declined as the indices dropped to the lowest level for the year, with the JSE Market Index erasing 1,032.29 points to 72,026.03 and the JSE All Jamaican Composite index dropping by 1,154.27 points to close at 79,246.38. The previous low for the JSE All Jamaica Index was at 79,357.40 on December 27, last year.

Main Market| The prices of only 2 companies in the main market rose and 6 declined as the indices dropped to the lowest level for the year, with the JSE Market Index erasing 1,032.29 points to 72,026.03 and the JSE All Jamaican Composite index dropping by 1,154.27 points to close at 79,246.38. The previous low for the JSE All Jamaica Index was at 79,357.40 on December 27, last year.

Gains| Stocks recording gains at the end of trading in the main market are Desnoes & Geddes with 500,000 shares to close with a gain of 20 cents at $4.50 and Jamaica Money Market Brokers with 24,100 ordinary shares changing hands, gained a cent to close at $7.31.

Firm| There were 7 stocks in the main market closing without a change in price as Berger Paints with 19,500 shares closed at $1.67, Caribbean Cement traded 5,062 units and closed at $3.50, Carreras traded 10,000 units to close at $33.65, Gleaner 100,000 units in closing at $1.10, Grace Kennedy 394 units at $56, National Commercial Bank 467,250 shares at $18 and Salada with 6,065 units to close at $8.

Declines| The number of stocks declining in the main market are Cable & Wireless with 3,189,689 units while losing 5 cents to end at 30 cents, Jamaica Broilers with 1,933,332 units changing hands to close at $4.80 as the price fell 5 cents, Pan Jamaican Investment 14,874 shares to close at $48.06 for a fall of 44 cents, Sagicor Group 156,333 units to close at $9 with a loss of 10 cents, Scotia Group 470,716 shares to close at $19.50 as the price lost 56 cents and Seprod with 4,300 units as the price declined by 45 cents to close at $10.55.

Junior Market| The JSE Junior Market Index declined by 0.59 points to close at 746.24 as 5 stocks and one bond traded with none advancing and 2 declining.

Gains| There were no stocks recording gains at the end of trading in the junior market at the close of the week.

Firm Trades| The stocks in the junior market that traded to close at the same price as the previous trading day are 5,603 Cargo Handlers shares traded at $14.35, Consolidated Bakeries with 70,230 units to close at $1.10, 66,600 units of Eppley 9.5% preference share changing hands at $6.02, Lasco Distributors had 39,000 units traded to close at $1.35, Lasco Manufacturing traded 2,309,867 shares in closing at $1.20 and 9,000 Access 9% Unsecured Short Term Notes traded to end at $99.50.

Declines| Only one stock declined in the junior market at the end of trading with Lasco Financial with 1,436,770 units changing hands with a loss of 5 cents to close at $1.20.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 8 stocks with the bid higher than the last selling price and 10 stocks with offers that were lower.

JSE hits 2014 low

More losses for the market

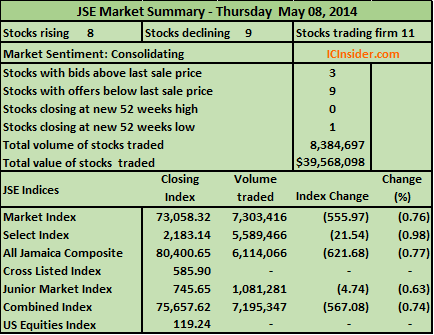

In today’s trading on the Jamaica Stock Exchange the prices of 8 stocks rose and 9 declined as 28 securities traded resulting in 8,384,697 shares trading valued at $39,568,098 but the two main market indices fell a bit to add to the losses on Wednesday. The advance decline ratio at the close was an improvement on Wednesday’s 5 to 9.

Main Market| 6 companies in the main market advanced and 7 declined as the indices moved down with the JSE Market Index shedding 555.97 points to 73,058.32 and the JSE All Jamaican Composite index fell by 621.68 points to close at 80,400.65 just a shade from the low for 2014 of 80,359.75 reached on January 7th.

Main Market| 6 companies in the main market advanced and 7 declined as the indices moved down with the JSE Market Index shedding 555.97 points to 73,058.32 and the JSE All Jamaican Composite index fell by 621.68 points to close at 80,400.65 just a shade from the low for 2014 of 80,359.75 reached on January 7th.

Gains| Stocks recording gains at the end of trading in the main market are Carreras that gained 8 cents to close at $33.65 with only 1,000 units changing hands, Desnoes & Geddes trading 72,966 shares to close with a gain of 20 cents at $4.30, Jamaica Money Market Brokers 73,808 ordinary shares to close at $7.30 with 3 cents gain, Jamaica Money Market Brokers 8.50% preference share 72,000 units to close up a cent at $3.51, Sagicor Group with 415,594 shares to close at $9.10 up by 20 cents and Seprod with 968 units to close at $11 with a 20 cents gain.

Firm| There were 7 stocks in the main market to close without a change in price, with Gleaner trading 548,887 shares in closing at $1.10, Jamaica Broilers with 1,030,997 shares and closed at $4.85, Jamaica Money Market Brokers 8.75% preference share with 1,104,250 units and closed at $3.03, Mayberry Investments 20,560 shares as the price closed at $1.71, Proven Investments 8% preference share, 13,100 units to end at $5.09, Radio Jamaica 10,000 shares and closed at $1.28 and Scotia Investments with 18,790 units and closed at $23.10.

Declines| The number of stocks that declined in the main market are Cable & Wireless with 2,869,910 shares in losing 5 cents to end at 35 cents, Caribbean Cement with 71,784 shares to end at $3.50 with a 50 cents fall, Grace Kennedy 51,906 shares while closing at $56, down by 50 cents, National Commercial Bank 33,961 units as the price ended at $18 with a loss of 50 cents, Pan Jamaican Investment 4,000 units, closing at $48.50 for a fall of a cent, Sagicor Real Estate Fund traded 3,464 units at $6 as it shed 50 cents and Scotia Group with 885,471 shares in closing at $20.06 for a 49 cents drop.

Junior Market| The JSE Junior Market Index declined by only 4.74 points to close at 745.65 as 8 stocks traded with 2 advancing and 2 declining.

Gains| Stocks recording gains at the end of trading in the junior market are Caribbean Producers trading 456,206 units to close at $3.10, up 10 cents and Lasco Distributors with 424,000 shares to close at $1.35 with a gain of 5 cents.

Firm Trades| Stocks in the junior market that traded to close at the same price as the day before are Access Financial with 6,000 units and closed at $11.50, Blue Power 4,000 units and closed at $9.01, General Accident Insurance 53,068 units, closing at $1.50 and Lasco Manufacturing with 77,934 shares as the price closed at $1.20.

Declines| Stocks declining in the junior market at the end of trading are Lasco Financial with 21,800 units at $1.25, down by 5 cents and Paramount Trading in trading 38,273 shares, landed at a 52 weeks low of $2.68 with a decline of 23 cents.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had only 3 stocks with the bid higher than the last selling price and 9 stocks with offers that were lower, continuing to indicate a negative market sentiment.

Very moderate market movement

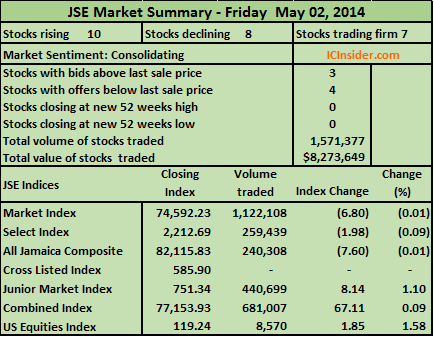

There was very moderate activity on the Jamaica Stock Exchange at the close of the trading week as the prices of 10 stocks rose and 8 declined as only 25 securities traded in a very slow market session resulting in 1,571,377 shares trading valued at a mere $8,273,649.

Main Market| Six companies in the main and US dollar markets advanced and 6 declined as the indices moved down moderately with the JSE Market Index inching down by 6.80 points to 74,592.23 and the JSE All Jamaican Composite index shedding just 7.60 points to close at 82,115.83.

Main Market| Six companies in the main and US dollar markets advanced and 6 declined as the indices moved down moderately with the JSE Market Index inching down by 6.80 points to 74,592.23 and the JSE All Jamaican Composite index shedding just 7.60 points to close at 82,115.83.

Gains| Stocks recording gains at the end of trading in the main market are Kingston Wharves with 9,534 shares to close with a gain of 48 cents at $5.99, National Commercial Bank gained 10 cents to close at $18.10 with 9,100 units changing hands, Proven Investments ordinary share, with 8,570 units to close up 0.02 us cents at 18 US cents, Sagicor Group 18,000 units closing at $9.80 for a 30 cents gain, Salada Foods 5,000 shares to close at $8 as the price gained 50 cents and Scotia Investments with only 700 shares to end at $23.10 for a gain of 10 cents.

Firm| There were only 4 stocks in the main market to close without a change in price as Cable & Wireless with 43,699 shares closed at 40 cents, Carreras with 5,000 units closed at $33.56, Jamaica Money Market Brokers 7.50% preference share traded 500,000 and closed at $2 and Proven Investments 8% preference share with 381,800 units closed at $5.07.

Declines| The stocks declining in the main market are Gleaner with 2,500 shares while falling a cent to close at $1.10, Grace Kennedy lost $1.49 to end at $56.51 with 1,600 shares, Jamaica Broilers exchanged 20,538 units to close down a cent at $4.85. Pan Jamaican Investment 10,529 shares to end 55 cents lower at $49.05, Scotia Group had 110,308 units at $20.50 at the close as the price shed 12 cents and Supreme Ventures 3,800 shares to close with a 5 cents decline at $2.05.

Junior Market| The JSE Junior Market Index declined by 8.14 points to close at 751.34 as 9 stocks traded with 4 advancing and only 2 declining.

Gains| Stocks recording gains at the end of trading in the junior market are AMG Packaging that traded 5,560 units to close at $3.50, up by a cent, Access Financial with 72,600 units to close at $11.50 with a gain of $1.50, Caribbean Cream 3,000 units to close at 79 cents with a 4 cents increase and Caribbean Producers with 90,000 units in closing at $3, up 2 cents.

Firm Trades| The 3 stocks in the junior market traded to close at the same price as the day before are Blue Power with 3,400 shares in closing at $9.01, Lasco Financial 3,000 shares while closing at $1.20 and Medical Disposables 94,700 units, closing at $2.04.

Declines| Stocks declining in the junior market at the end of trading are General Accident with 2,000 units a $1.60, down 10 cents and Lasco Manufacturing with 166,439 shares to end down by 10 cents at $1.10.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 3 stocks with the bid higher than the last selling price and 4 stocks with offers that were lower.

Market directionless

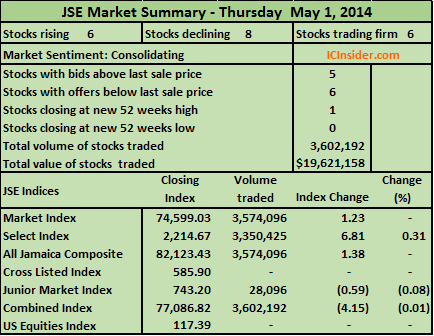

In Thursday’s trading on the Jamaica Stock Exchange, the market was directionless with advancing stocks numbering just below declining ones and the IC market indicator showing investors in a tussle over the immediate future direction of the market. Prices of 6 stocks rose and 8 declined as 20 securities traded resulting in 3,602,192 shares changing hands valued at $19,621,158 in another lacklustre session.

Main Market| All advancing shares in the market was in the main market and all but one stock that declined was also in this market, but the indices moved up slightly, with the JSE Market Index inching up by just 1.23 points to 74,599.03 and the JSE All Jamaican Composite index edging up by only 1.38 points to close at 82,123.43.

Main Market| All advancing shares in the market was in the main market and all but one stock that declined was also in this market, but the indices moved up slightly, with the JSE Market Index inching up by just 1.23 points to 74,599.03 and the JSE All Jamaican Composite index edging up by only 1.38 points to close at 82,123.43.

Gains| Stocks recording gains at the end of trading in the main market are Berger Paints trading 89,657 unitss to close with a gain of a cent at $1.68, Caribbean Cement gained 21 cents to close at $3.91 with 20,500 units changing hands, Carreras traded 443 shares to close 6 cents higher at $33.56, Ciboney with 50,000 shares by increasing by a cent to close at 12 cents for a new 52 weeks high, Grace Kennedy 7,439 shares with a gain of $1 to close at $58 and Jamaica Money Market Brokers with 451,214 ordinary shares to close up by 4 cents at $7.24.

Firm| There were only 5 stocks in the main market to close without a change in price as Gleaner with 228,484 shares closed at $1.10, Hardware & Lumber traded 3,300 units and closed at $11.70, Mayberry Investments with 3,060 units closed at $1.70, Scotia Group had 59,888 units changing hands to close at $20.62 and Seprod traded 685 shares in closing at $10.84.

Declines| The number of stocks that declined in the main market are Cable & Wireless with 1,500,888 units while losing a cent to end at 40 cents, Desnoes & Geddes with 76,472 shares to end at $4.30 as the price lost 30 cents, Jamaica Broilers with 450,872 shares to close at $4.86, down 4 cents, Jamaica Producers that traded 6,600 units to close at $18.26 while losing 4 cents, National Commercial Bank 571,665 shares as the price closed with a 10 cents lost, at $18, Sagicor Group had 50,529 units changing hands to close with a fall of 71 cents to $9.50 and Salada Foods 2,400 shares to close 45 cents lower, to end at $7.50

Junior Market| The JSE Junior Market Index declined by 0.59 points to close at 743.20 as only 2 junior market stocks traded at the end of the trading session.

Gains| No stock gained at the end of trading in the junior market.

Firm Trades| Lasco Manufacturing was the only stock in the junior market that traded to close at the same price as the previous trading day with 27,096 units to end at $1.20.

Declines| Caribbean Producers was the only stock declining in the junior market at the end of trading as the price fell 9 cents to close at $2.91 as it traded a mere 1,000 units.

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 5 stocks with the bid higher than the last selling price and 6 stocks with offers that were lower.

Carreras is back

Profits at Carreras is back on track dollar wise, as revenues hit $3.66 billion in the 2013 December quarter versus $3.745 billion in 2012.

Gross profit is above the 2012 period of $1.69 billion at $1.75 billion in 2013. Selling and administrative expenses declined in the latest quarter, which would have pushed the 2013 results above 2012. Carreras booked interest due on the debt owed by the tax department of $1.8 billion as other income, resulting in profits growing to $2.18 billion after tax, versus $1.17 billion in the prior year. Gross profit is down for the nine months to $3.98 billion from $4.34 billion in 2012. Profit after tax for the year-to-date is $3.1 billion versus $5.1 billion, with both periods having swollen figures due to exceptional income.

Volumes are still down, but not as badly as in the June quarter, when sales were negatively affected by the hike in cigarette prices in March 2013 and the stock piling of inventories by the trade ahead of the price hike, a practise that goes back for several years. The December quarter’s performance is in stark contrast to the June quarter when revenues plummeted from $3.1 billion in June 2012 quarter to just $2.16 billion, a sharp 30 percent drop, but profit after tax fared even worse, dipping by 40 percent.

Volumes are still down, but not as badly as in the June quarter, when sales were negatively affected by the hike in cigarette prices in March 2013 and the stock piling of inventories by the trade ahead of the price hike, a practise that goes back for several years. The December quarter’s performance is in stark contrast to the June quarter when revenues plummeted from $3.1 billion in June 2012 quarter to just $2.16 billion, a sharp 30 percent drop, but profit after tax fared even worse, dipping by 40 percent.

Expenses rise | Administrative, sales & marketing expenses fell in the latest quarter to $600 million from $710 million in 2012 but is marginally up to $1.655 billion for the nine months compared to $1.58 billion for the same period as of December 2012.

Tax Recovered | The tax now recoverable is down to $980 million from $1.733 billion at the end of March and is expected to be fully recovered over the next 12 months and will most likely be distributed as dividends to shareholders.

Carreras ended up with cash funds of $3.8 billion at the end of December, equity is at $4.7 billion or $9.60 per share.

Earnings appears to be back on track to deliver around $6 per share annualised, which would result in some increase in the quarterly dividend that was cut from $1.50 to $1 last year in light of the drop in profit. Carreras declared $1.62 as the latest dividend to be paid March after paying a special capital cash distribution of $1.18 on January 30, 2014.

Carreras is an IC Insider Buy Rated Stock.

Related posts | D&G, Carreras & C&WJ now Buy Rated | Carreras pays out liquidation money | Carreras takes a big hit but tax recovery starts | Carreras grew income

Carreras pays out liquidation money

Carreras declared a special interim capital cash distribution of $1.18 per stock unit to be paid out of proceeds received from the liquidation of a subsidiary, pending the granting of a transfer tax exemption pursuant to the Transfer Tax Act.

The special capital cash distribution will be paid on January 30, 2014 to shareholders on record as at January 17, 2014. The ex-dividend date is January 15, 2014.

Carreras liquidated its subsidiary Cigarettes Company of Jamaica but was slapped with an unwarranted tax assessment in the mid 2000’s. The case was appealed up to the Privy Council and the company won, thus permitting it to be entitled to recover nearly $3 billion in taxes wrongfully paid along with interest and legal fees.

The company started to recover the amount in 2013 and should in all likelihood recover all of it before the end of 2014.

Related posts | Carreras down but not out | Carreras takes a big hit but tax recovery starts

New additions to Buy Rated stocks

Monday, 25th November 2013 | There are two additions to the Buy Rated and Market Watch list for the coming week. Added to the Buy Rated stock list is Jamaican Teas due to a 30 percent gain in profits for the year ended in September flowing from a 46 percent jump in export sales, sales of apartments in its first real estate development and expectation of further growth in 2014.

Carreras is added to the Market Watch list based on IC Insider’s assessment for earnings around $5 per share for the current fiscal year and dividend yield above 10 percent. Trading in the mid $30’s, this stock has a very good chance to head back into the mid $40 range.

Performance tracking | During the past week, a few of the Jamaican stocks made some recovery with JMMB breaking even in Jamaica but has retreated in Trinidad. Access Financial is up 15 percent so far but Lasco Financial and Manufacturing are still off by good margins. The selections in the main market remain mostly under water, but the ideal time to buy may be slipping away as prices seem to be at their bottom. More importantly, there are indicators that a year-end market rally will happen again in December.

Performance tracking | During the past week, a few of the Jamaican stocks made some recovery with JMMB breaking even in Jamaica but has retreated in Trinidad. Access Financial is up 15 percent so far but Lasco Financial and Manufacturing are still off by good margins. The selections in the main market remain mostly under water, but the ideal time to buy may be slipping away as prices seem to be at their bottom. More importantly, there are indicators that a year-end market rally will happen again in December.

While Jamaica has disappointed, the same can’t be said about Trinidad. There are only two losers so far; Guardian Holdings and Scotia Investments. During the past week Neal & Massy, that had declined below the price at the time of selection, has bounced back from its low to be just slightly ahead at the close on Friday.

What seems clear, is that the focus ought to be on longer term performance rather than just short term gains. The Trinidad market performance of slow price movements illustrates this very well. There are also signs in the Jamaican market suggesting the same, the major difference being the Jamaican market is more aggressive with price movements.

Related posts | Exports push Jamaican Teas’ profit | Carreras down but not out | Jamaican Teas raises over $100m