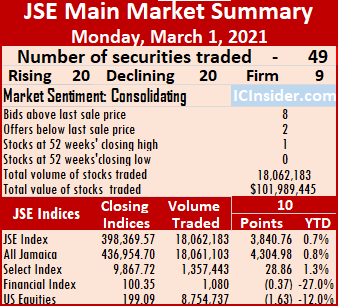

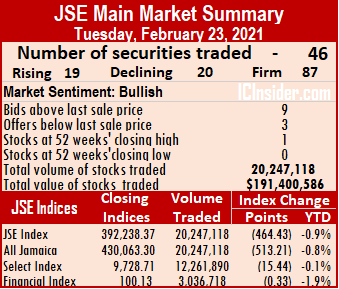

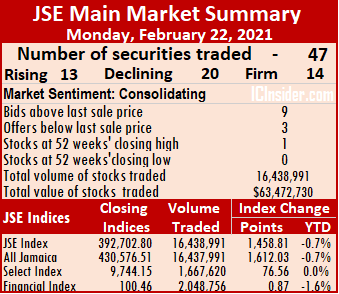

Stocks rising and declining share the honours with 20 each, at the close of trading on Monday leaving to the Jamaica Stock Exchange Main Market to close above Friday’s close with the volume of shares traded falling 51 percent and values down 9 percent to Friday.

Several stocks posted strong gains leading the market into positive for the year to date, for only the second time since the start of the year, with January 5th being the only other day the market recorded gains over the 2020 close. The All Jamaican Composite Index climbed 4,304.98 points to 436,954.70 at the close, the Main Index advanced 3,840.76 points to 398,369.57, but the JSE Financial Index slipped 037 points to 100.35.

Several stocks posted strong gains leading the market into positive for the year to date, for only the second time since the start of the year, with January 5th being the only other day the market recorded gains over the 2020 close. The All Jamaican Composite Index climbed 4,304.98 points to 436,954.70 at the close, the Main Index advanced 3,840.76 points to 398,369.57, but the JSE Financial Index slipped 037 points to 100.35.

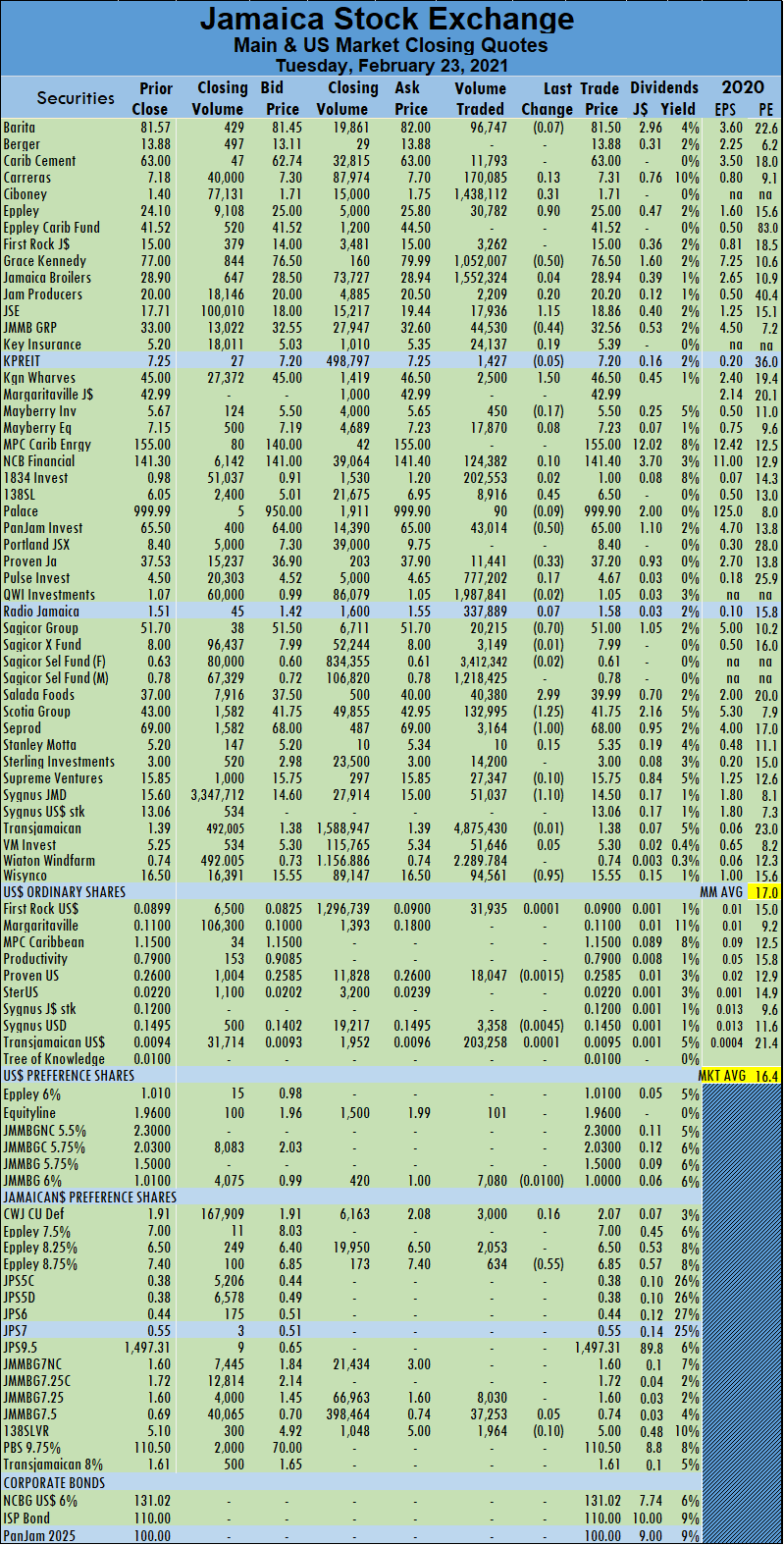

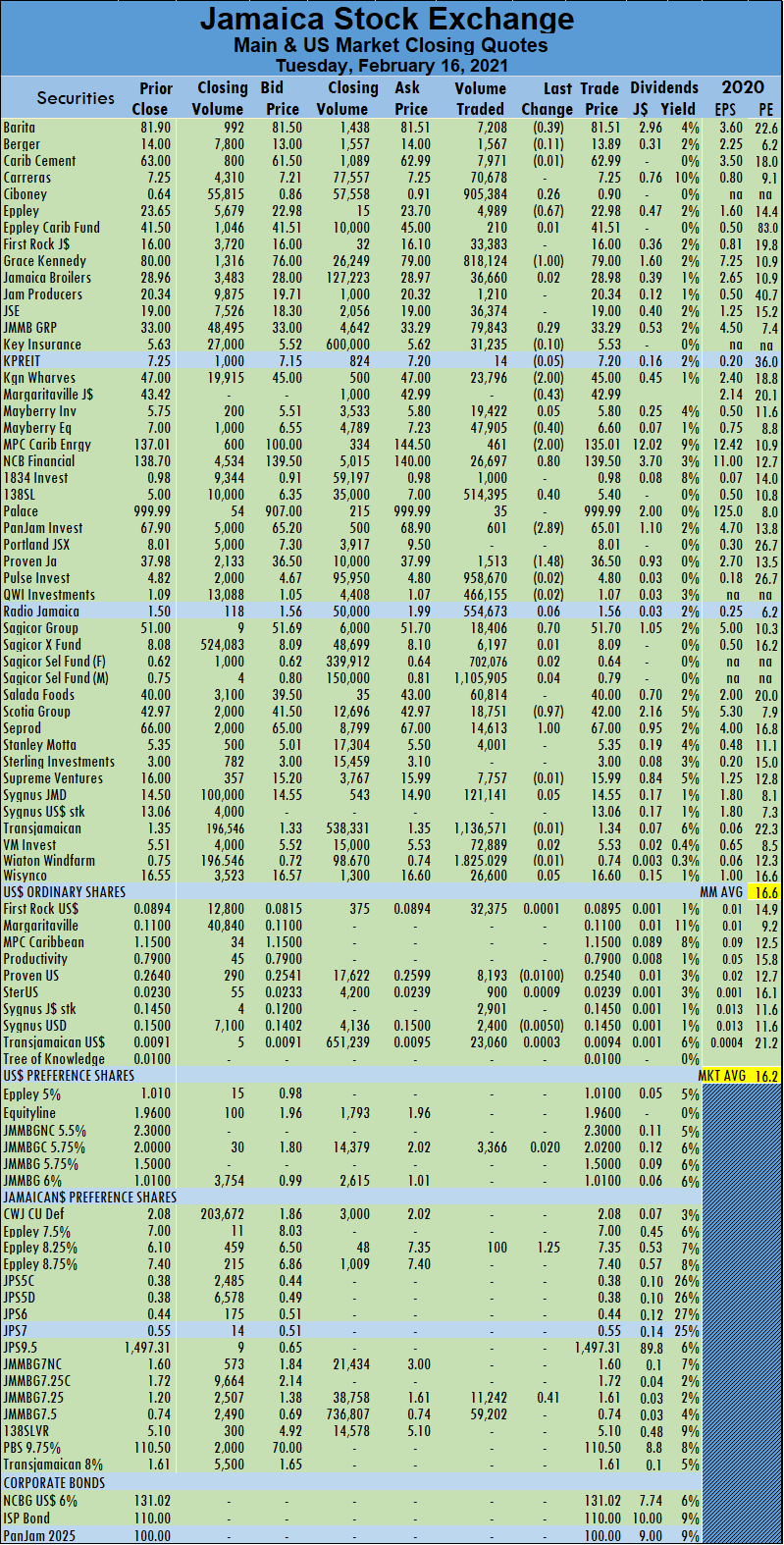

Investors traded 49 Securities, up from 47 on Friday and closed with 20 rising, 20 declining and 9 remaining unchanged. The PE Ratio averages 19.4 based on ICInsider.com’s forecast of 2020-21 earnings.

Traders exchanged 18,062,183 shares for $101,989,445 compared to 35,675,257 units at $112,526,954 on Friday. Wigton Windfarm led trading with 45 percent of total volume, after an exchange of 8.12 million shares followed by Pulse Investments with 21.4 percent for 3.86 million units, Sagicor Select Financial Fund 7.9 percent for 1.42 million units and Transjamaican Highway with 6.1 percent market share for 1.11 million units.

JSE Main Market recorded gains in 2021 for only the second time for the year when the market closed on Monday.

Trading for the day averaged 368,616 units at $2,081,417, compared to 759,048 shares at $2,394,191 on Friday. February closed with an average of 419,015 units at $2,509,660.

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and two with lower offers.

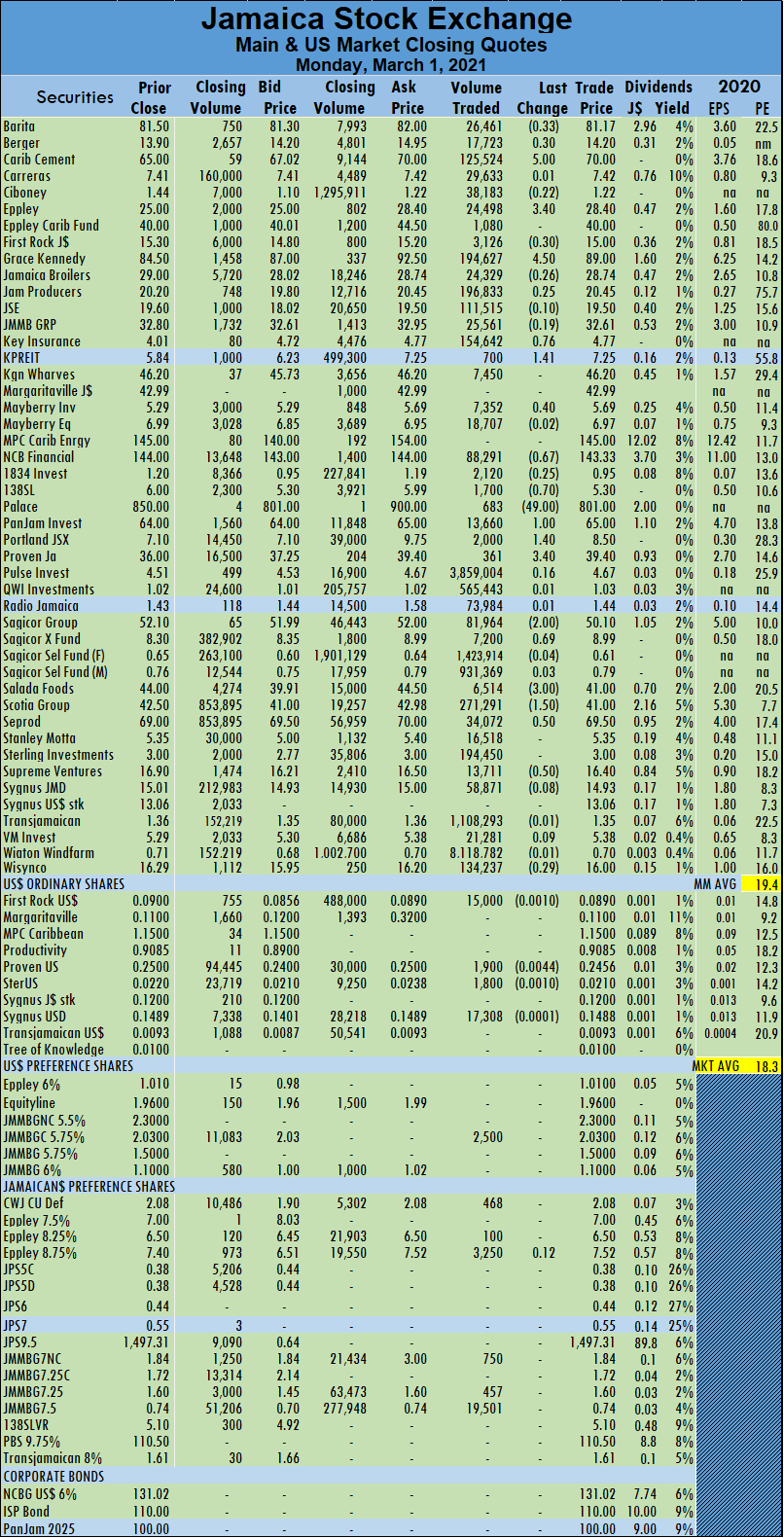

At the close, Barita Investments slipped 33 cents to $81.17, after exchanging 26,461 shares, Berger Paints closed 30 cents higher at $14.20, with 17,723 units changing hands. Caribbean Cement advanced $5 to $70, after the stock surged to $75 in early trading, with the switching of 125,524 stocks, Ciboney Group lost 22 cents to finish at $1.22, with 38,183 shares clearing the market, Eppley advanced $3.40 to $28.40, with the swapping of 24,498 units. First Rock Jamaica lost 30 cents to end at $15 trading 3,126 stocks, Grace Kennedy climbed $4.50 to close at a 52 weeks’ high of $89, with 194,627 shares changing hands. The stock traded upto $95 in response to a strong rise in profit, the company reported for 2020, Jamaica Broilers lost 26 cents to close at $28.74, with an exchange of 24,329 units. Jamaica Producers gained 25 cents to end at $20.45 in swapping 196,833 stocks, Key Insurance rose 76 cents to $4.77 trading 154,642 stock units, Kingston Properties rose $1.41 to $7.25, with 700 units crossing the exchange. Mayberry Investments ended 40 cents higher at $5.69, transferring 7,352 shares, NCB Financial fell 67 cents to $143.33 with an exchanging of 88,291 stock units, 1834 Investments fell 25 cents to 95 cents trading 2,120 units, 138 Student Living shed 70 cents to end at $5.30 while exchanging 1,700 stock units.  Palace Amusement dropped $49 to $801, with 683 shares crossing the market, PanJam Investments rose $1 to $65, in an exchange of 13,660 stocks, Portland JSX ended $1.40 higher at $8.50, with the swapping of 2,000 units, Proven Investments climbed $3.40 to $39.40 trading 361 stock units. Sagicor Group declined $2 to finish at $50.10, in switching ownership of 81,964 units, Sagicor Real Estate Fund gained 69 cents to close at $8.99 after 7,200 shares crossed the market, Salada Foods fell $3 to $41 in exchanging 6,514 stocks. Scotia Group declined $1.50 to $41 trading 271,291 units, Seprod gained 50 cents to close at $69.50, with the swapping of 34,072 shares, Supreme Ventures lost 50 cents to finish at $16.40 in switching ownership of 13,711 units and Wisynco Group lost 29 cents to close at $16, in transferring 134,237 stock units.

Palace Amusement dropped $49 to $801, with 683 shares crossing the market, PanJam Investments rose $1 to $65, in an exchange of 13,660 stocks, Portland JSX ended $1.40 higher at $8.50, with the swapping of 2,000 units, Proven Investments climbed $3.40 to $39.40 trading 361 stock units. Sagicor Group declined $2 to finish at $50.10, in switching ownership of 81,964 units, Sagicor Real Estate Fund gained 69 cents to close at $8.99 after 7,200 shares crossed the market, Salada Foods fell $3 to $41 in exchanging 6,514 stocks. Scotia Group declined $1.50 to $41 trading 271,291 units, Seprod gained 50 cents to close at $69.50, with the swapping of 34,072 shares, Supreme Ventures lost 50 cents to finish at $16.40 in switching ownership of 13,711 units and Wisynco Group lost 29 cents to close at $16, in transferring 134,237 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

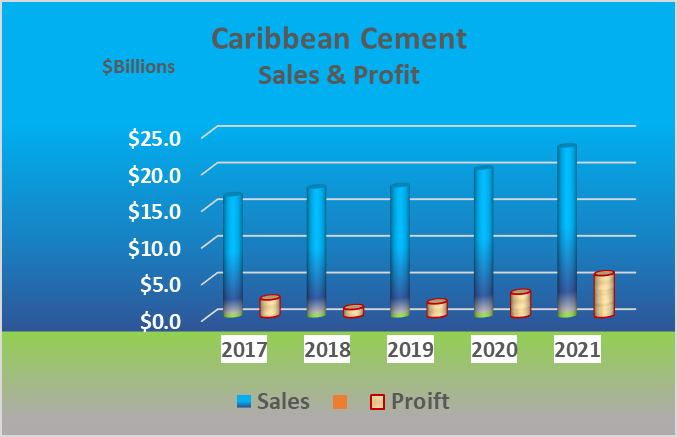

For the year, profit after tax surged 70 percent to $3.2 billion after tax provision of $1.2 billion. The tax charge includes deferred tax amounting to $414 million, down from $664 million in 2019. The results would have been far better but for a billion loss in foreign exchange movement, but interest cost fell from $939 million to $812 million, partially cushioning some exchange losses. Interest cost will fall further in 2021 as the debt load recedes with the strong cash flows allowing for the rapid repayment of the $4.4 billion of long term loans.

For the year, profit after tax surged 70 percent to $3.2 billion after tax provision of $1.2 billion. The tax charge includes deferred tax amounting to $414 million, down from $664 million in 2019. The results would have been far better but for a billion loss in foreign exchange movement, but interest cost fell from $939 million to $812 million, partially cushioning some exchange losses. Interest cost will fall further in 2021 as the debt load recedes with the strong cash flows allowing for the rapid repayment of the $4.4 billion of long term loans. At the end of the year, shareholders’ equity moved to $11.5 billion from $8.3 billion at the end of 2019. The stock is one of the original

At the end of the year, shareholders’ equity moved to $11.5 billion from $8.3 billion at the end of 2019. The stock is one of the original  The market should move higher during the coming week following record breaking results by

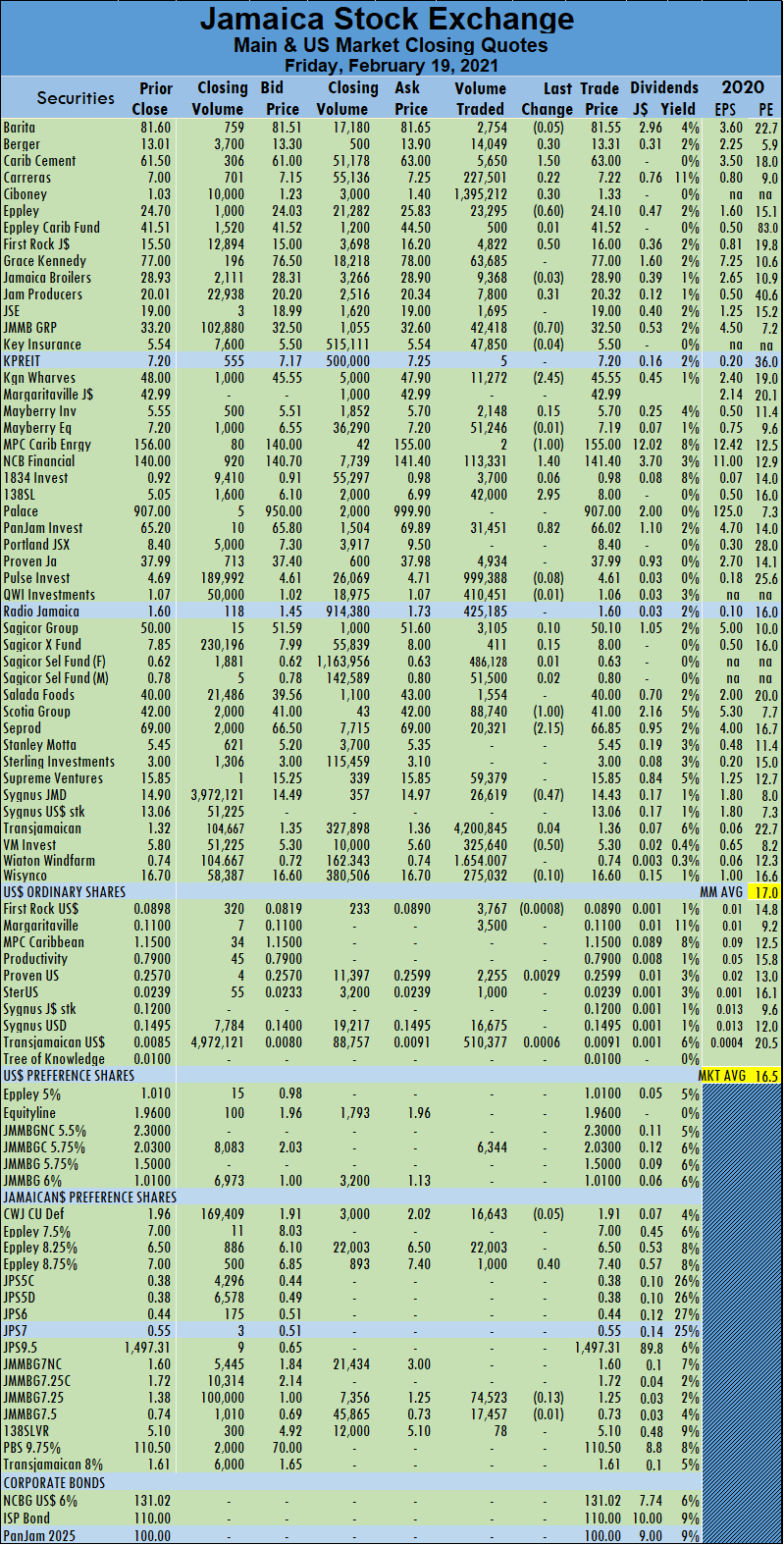

The market should move higher during the coming week following record breaking results by  Trading for the day averaged 759,048 units at $2,394,191, Thursday ended with an average of 338,795 shares at $1,351,229. Trading month to date averaged 419,015 units at $2,509,660 for each security, in contrast to 399,667 units at $2,516,231 on Thursday. January closed with an average of 311,275 units at $1,432,133.

Trading for the day averaged 759,048 units at $2,394,191, Thursday ended with an average of 338,795 shares at $1,351,229. Trading month to date averaged 419,015 units at $2,509,660 for each security, in contrast to 399,667 units at $2,516,231 on Thursday. January closed with an average of 311,275 units at $1,432,133. Sagicor Real Estate Fund picked up 48 cents to close at $8.30, after 155,883 shares crossed the market, Salada Foods climbed $3.50 to $44, exchanging 97 stocks. Scotia Group lost 50 cents in ending at $42.50 trading 34,852 units, Seprod shed 54 cents to $69, with the swapping of 8,011 shares, Stanley Motta gained 35 cents to settle at $5.35, with 50 units clearing the market. Sterling Investments ended 36 cents higher at $3 in an exchange of 33,207 stock units and Supreme Ventures climbed $1.60 to $16.90 with 138,316 units changing hands.

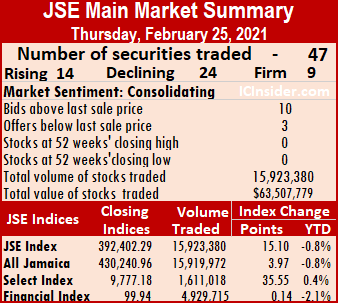

Sagicor Real Estate Fund picked up 48 cents to close at $8.30, after 155,883 shares crossed the market, Salada Foods climbed $3.50 to $44, exchanging 97 stocks. Scotia Group lost 50 cents in ending at $42.50 trading 34,852 units, Seprod shed 54 cents to $69, with the swapping of 8,011 shares, Stanley Motta gained 35 cents to settle at $5.35, with 50 units clearing the market. Sterling Investments ended 36 cents higher at $3 in an exchange of 33,207 stock units and Supreme Ventures climbed $1.60 to $16.90 with 138,316 units changing hands. The All Jamaican Composite Index inched 3.97 points up to 430,240.96 the Main Index rose 15.10 points to 392,402.29, and the JSE Financial Index rose 0.14 points to settle at 99.94.

The All Jamaican Composite Index inched 3.97 points up to 430,240.96 the Main Index rose 15.10 points to 392,402.29, and the JSE Financial Index rose 0.14 points to settle at 99.94. Trading for the day averaged 338,795 units at $1,351,229, compared to an average of 626,545 shares at $3,374,266 on Wednesday. Trading month to date averages 399,667 units at $2,516,231, versus 403,340 units at $2,586,520 on Wednesday. Trading in January averaged 311,275 units at $1,432,133.

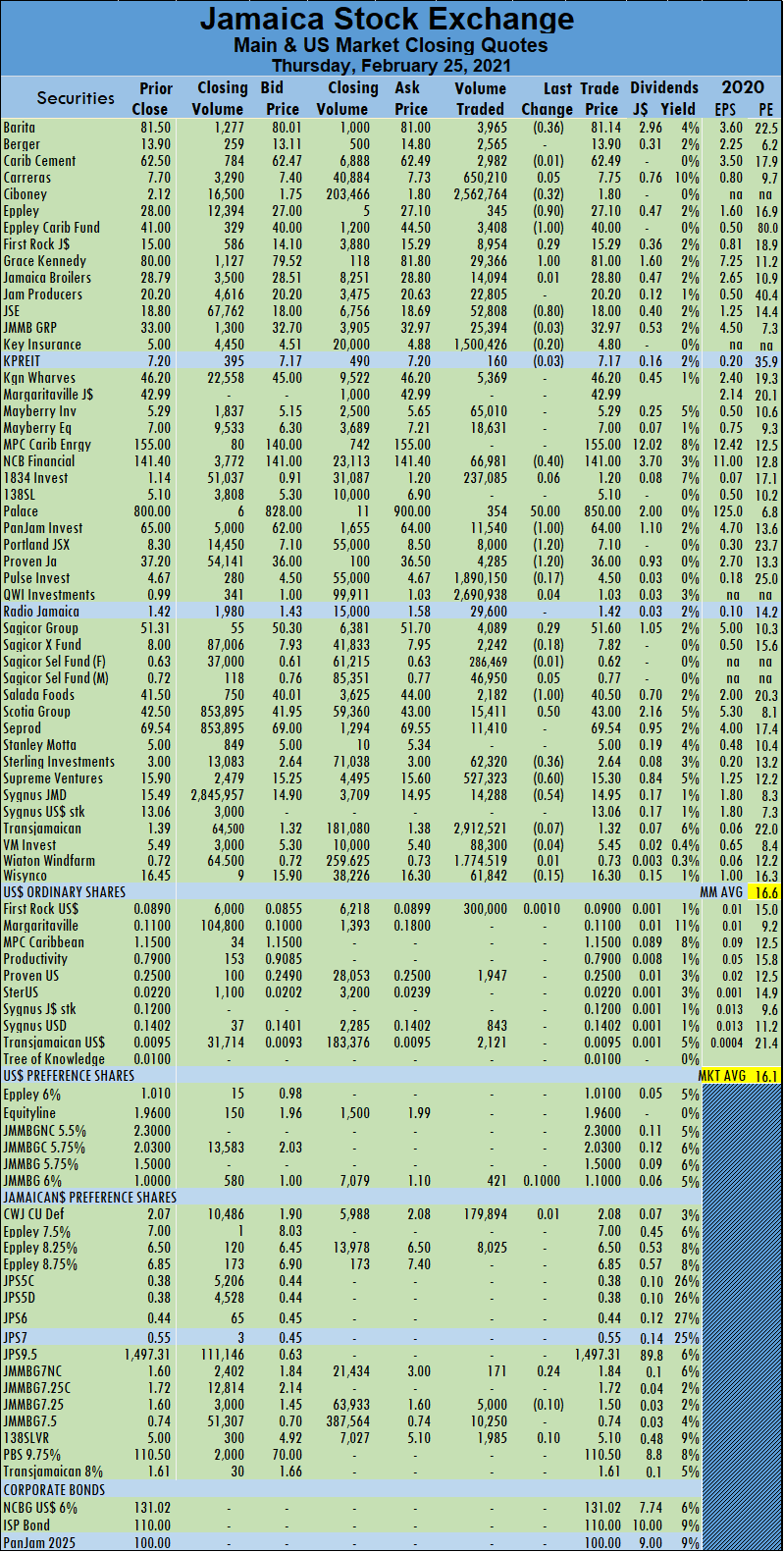

Trading for the day averaged 338,795 units at $1,351,229, compared to an average of 626,545 shares at $3,374,266 on Wednesday. Trading month to date averages 399,667 units at $2,516,231, versus 403,340 units at $2,586,520 on Wednesday. Trading in January averaged 311,275 units at $1,432,133. Portland JSX declined $1.20 to $7.10 in trading 8,000 stocks, Proven Investments closed $1.20 lower at $36 after exchanging 4,285 units, Sagicor Group gained 29 cents to close at $51.60, with the swapping of 4,089 shares. Salada Foods dropped $1 to $40.50 with a transfer of 2,182 shares, Scotia Group gained 50 cents to end at $43, with 15,411 stock units crossing the exchange. Sterling Investments shed 36 cents to $2.64 in exchanging 62,320 stocks, Supreme Ventures dropped 60 cents to close at $15.30, after a transfer of 527,323 units and Sygnus Credit Investments lost 54 cents to close at $14.95 in trading 14,288 shares.

Portland JSX declined $1.20 to $7.10 in trading 8,000 stocks, Proven Investments closed $1.20 lower at $36 after exchanging 4,285 units, Sagicor Group gained 29 cents to close at $51.60, with the swapping of 4,089 shares. Salada Foods dropped $1 to $40.50 with a transfer of 2,182 shares, Scotia Group gained 50 cents to end at $43, with 15,411 stock units crossing the exchange. Sterling Investments shed 36 cents to $2.64 in exchanging 62,320 stocks, Supreme Ventures dropped 60 cents to close at $15.30, after a transfer of 527,323 units and Sygnus Credit Investments lost 54 cents to close at $14.95 in trading 14,288 shares.

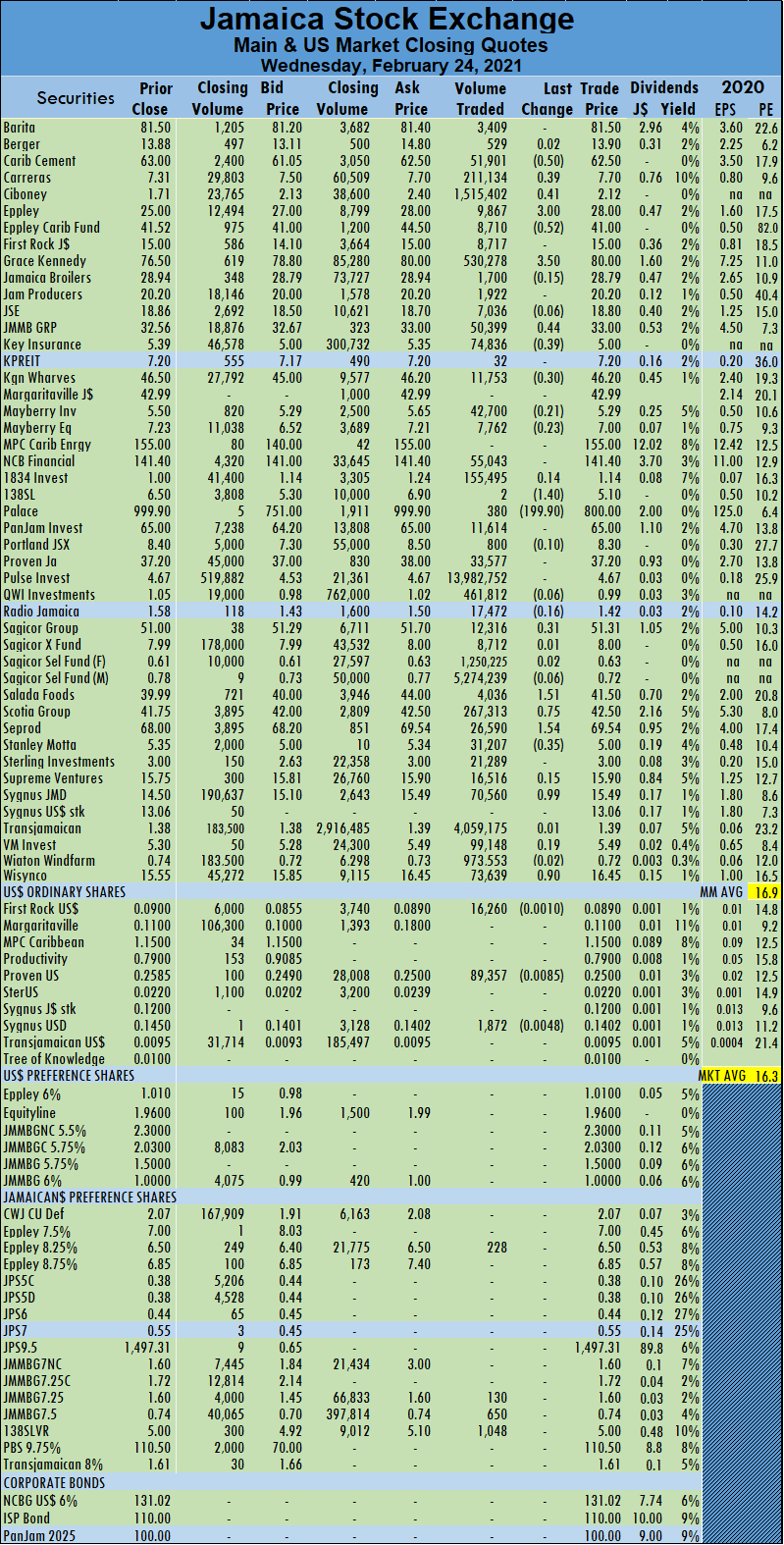

Trading for the day averaged 626,545 units at $3,374,266, compared to 440,155 shares at $4,160,882 on Tuesday. Trading month to date averaged 403,340 units at $2,586,520 for each security, in contrast to 389,008 units at $2,535,940 on the prior trading day. Trading in January closed with an average of 311,275 units at $1,432,133.

Trading for the day averaged 626,545 units at $3,374,266, compared to 440,155 shares at $4,160,882 on Tuesday. Trading month to date averaged 403,340 units at $2,586,520 for each security, in contrast to 389,008 units at $2,535,940 on the prior trading day. Trading in January closed with an average of 311,275 units at $1,432,133. Palace Amusement fell $199.90 to a 52 weeks’ low of $800, with 380 stocks crossing the market, Sagicor Group gained 31 cents to end at $51.31, in an exchange of 12,316 stocks, Salada Foods rose $1.51 to $41.50, with the swapping of 4,036 shares. Scotia Group closed 75 cents higher at $42.50, with 267,313 stock units crossing the exchange, Seprod advanced $1.54 to $69.54 trading 26,590 shares, Stanley Motta lost 35 cents to close at $5 in exchanging 31,207 units. Sygnus Credit Investments advanced 99 cents to $15.49 after transferring 70,560 stock units and Wisynco Group rose 90 cents to $16.45, with investors switching ownership of 73,639 shares.

Palace Amusement fell $199.90 to a 52 weeks’ low of $800, with 380 stocks crossing the market, Sagicor Group gained 31 cents to end at $51.31, in an exchange of 12,316 stocks, Salada Foods rose $1.51 to $41.50, with the swapping of 4,036 shares. Scotia Group closed 75 cents higher at $42.50, with 267,313 stock units crossing the exchange, Seprod advanced $1.54 to $69.54 trading 26,590 shares, Stanley Motta lost 35 cents to close at $5 in exchanging 31,207 units. Sygnus Credit Investments advanced 99 cents to $15.49 after transferring 70,560 stock units and Wisynco Group rose 90 cents to $16.45, with investors switching ownership of 73,639 shares. Trading ended with stocks playing hopscotch, one day up one day down, on the Jamaica Stock Exchange Main Market, with the market declining after almost the same number of stocks rose as fell. The value of trading climbed 202 percent, with only 23 percent more shares exchanged than on Monday.

Trading ended with stocks playing hopscotch, one day up one day down, on the Jamaica Stock Exchange Main Market, with the market declining after almost the same number of stocks rose as fell. The value of trading climbed 202 percent, with only 23 percent more shares exchanged than on Monday. Transjamaican Highway led trading with 24.1 percent of total volume, after an exchange of 4.88 million shares followed by Sagicor Select Financial Fund 16.9 percent with 3.41 million units, Wigton Windfarm 11.3 percent for 2.29 million units. QWI Investments ended with 9.8 percent of the day’s trade for 1.99 million units, Ciboney Group 7.1 percent for 1.44 million units, Sagicor Manufacturing & Distribution Fund with 6 percent for 1.22 million units and Grace Kennedy with 5.2 percent market share for 1.05 million units.

Transjamaican Highway led trading with 24.1 percent of total volume, after an exchange of 4.88 million shares followed by Sagicor Select Financial Fund 16.9 percent with 3.41 million units, Wigton Windfarm 11.3 percent for 2.29 million units. QWI Investments ended with 9.8 percent of the day’s trade for 1.99 million units, Ciboney Group 7.1 percent for 1.44 million units, Sagicor Manufacturing & Distribution Fund with 6 percent for 1.22 million units and Grace Kennedy with 5.2 percent market share for 1.05 million units. 138 Student Living rose 45 cents to $6.50 after exchanging 8,916 units, PanJam Investment shed 50 cents to end at $65, in switching ownership of 43,014 shares, Proven Investments lost 33 cents to $37.20 trading 11,441 stock units, Sagicor Group fell 70 cents to $51 with 20,215 stocks clearing the market. Salada Foods advanced $2.99 to $39.99, with the swapping of 40,380 units, Scotia Group declined by $1.25 to $41.75, after exchanging 132,995 shares, Seprod shed $1 in closing at $68 with 3,164 stock units changing hands. Sygnus Credit Investments fell $1.10 to $14.50, in exchanging 51,037 units and Wisynco Group shed 95 cents to close at $15.55, with 94,561 shares changing hands.

138 Student Living rose 45 cents to $6.50 after exchanging 8,916 units, PanJam Investment shed 50 cents to end at $65, in switching ownership of 43,014 shares, Proven Investments lost 33 cents to $37.20 trading 11,441 stock units, Sagicor Group fell 70 cents to $51 with 20,215 stocks clearing the market. Salada Foods advanced $2.99 to $39.99, with the swapping of 40,380 units, Scotia Group declined by $1.25 to $41.75, after exchanging 132,995 shares, Seprod shed $1 in closing at $68 with 3,164 stock units changing hands. Sygnus Credit Investments fell $1.10 to $14.50, in exchanging 51,037 units and Wisynco Group shed 95 cents to close at $15.55, with 94,561 shares changing hands. Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and four with lower offers. Seprod climbed $2.15 to $69, with 16,385 stock units changing hands, Stanley Motta lost 25 cents in closing at $5.20 trading 418 shares and Sygnus Credit Investments rose $1.17 to $15.60, in transferring 69,924 stocks.

Seprod climbed $2.15 to $69, with 16,385 stock units changing hands, Stanley Motta lost 25 cents in closing at $5.20 trading 418 shares and Sygnus Credit Investments rose $1.17 to $15.60, in transferring 69,924 stocks. Trading averaged 244,928 units at $1,247,943, compared to 240,393 shares at $954,393 on Thursday. The month to date averaged 388,213 units at $2,506,158 in contrast to 399,327 units at $2,608,760 on Thursday. Trading in January averaged 311,275 units at $1,432,133.

Trading averaged 244,928 units at $1,247,943, compared to 240,393 shares at $954,393 on Thursday. The month to date averaged 388,213 units at $2,506,158 in contrast to 399,327 units at $2,608,760 on Thursday. Trading in January averaged 311,275 units at $1,432,133. Scotia Group dropped $1 to $41 after exchanging 88,740 units, Seprod declined $2.15 to $66.85, with the swapping of 20,321 shares, Sygnus Credit Investments lost 47 cents to end at $14.43, with 26,619 stock units crossing the exchange. Victoria Mutual Investments closed 50 cents lower at $5.30, with 325,640 stocks changing hands.

Scotia Group dropped $1 to $41 after exchanging 88,740 units, Seprod declined $2.15 to $66.85, with the swapping of 20,321 shares, Sygnus Credit Investments lost 47 cents to end at $14.43, with 26,619 stock units crossing the exchange. Victoria Mutual Investments closed 50 cents lower at $5.30, with 325,640 stocks changing hands.

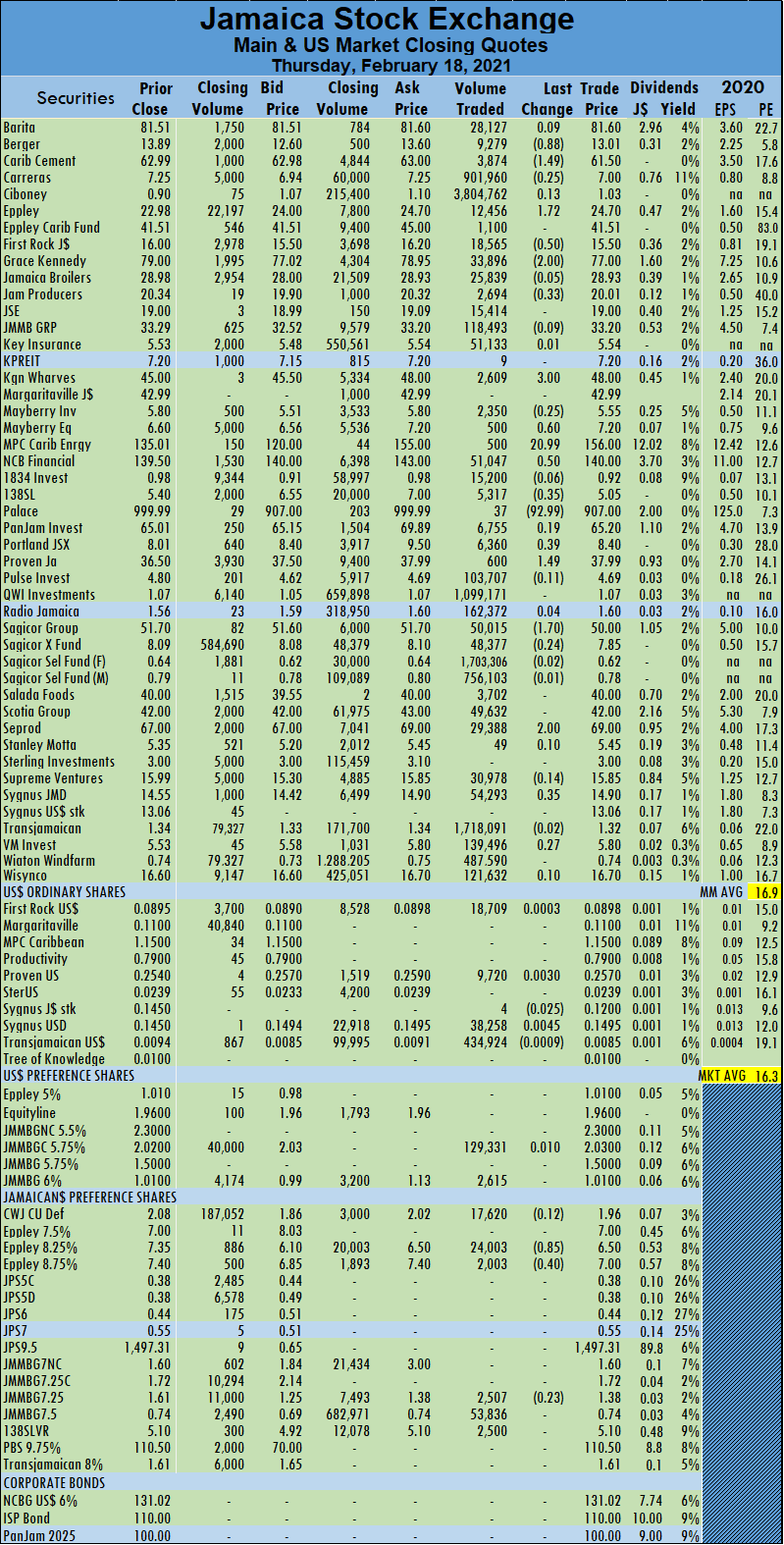

Trading for the day averaged 240,393 units at $954,393 for each security, compared to an average of 218,699 units at $2,129,289 on Tuesday. Month to date averages 399,327 units at $2,608,760 for each security, in contrast to 413,643 units at $2,752,324 on the prior trading day. Trading in January closed with an average of 311,275 units at $1,432,133.

Trading for the day averaged 240,393 units at $954,393 for each security, compared to an average of 218,699 units at $2,129,289 on Tuesday. Month to date averages 399,327 units at $2,608,760 for each security, in contrast to 413,643 units at $2,752,324 on the prior trading day. Trading in January closed with an average of 311,275 units at $1,432,133. Proven Investments increased $1.49 to $37.99 with 600 stocks traded, Sagicor Group shed $1.70 in closing at $50 with 50,015 units changing hands, Seprod gained $2 to settle at $69 with an exchange of 29,388 stock units. Sygnus Credit Investments rose 35 cents to $14.90, trading 54,293 units and Victoria Mutual Investments advanced 27 cents to $5.80 with 139,146 shares crossing the exchange.

Proven Investments increased $1.49 to $37.99 with 600 stocks traded, Sagicor Group shed $1.70 in closing at $50 with 50,015 units changing hands, Seprod gained $2 to settle at $69 with an exchange of 29,388 stock units. Sygnus Credit Investments rose 35 cents to $14.90, trading 54,293 units and Victoria Mutual Investments advanced 27 cents to $5.80 with 139,146 shares crossing the exchange. The All Jamaican Composite Index fell 686.84 points to 429,363.77, the Main Index lost 618.66 points to 391,508.19 and the JSE Financial Index rose 0.43 points to 100.29.

The All Jamaican Composite Index fell 686.84 points to 429,363.77, the Main Index lost 618.66 points to 391,508.19 and the JSE Financial Index rose 0.43 points to 100.29. Trading averaged 218,699 units at $2,129,289, compared to 468,946 shares at $2,041,431 on Monday. The month to date averaged 413,643 units at $2,752,324, close to the average of 431,223 units at $2,808,510 on Monday. Trading in January closed with an average of 311,275 units at $1,432,133.

Trading averaged 218,699 units at $2,129,289, compared to 468,946 shares at $2,041,431 on Monday. The month to date averaged 413,643 units at $2,752,324, close to the average of 431,223 units at $2,808,510 on Monday. Trading in January closed with an average of 311,275 units at $1,432,133. Proven Investments slipped $1.48 to $36.50 trading 1,513 units, Radio Jamaica gained 6 cents to close at $1.56 with the swapping of 554,673 shares, after traded as high as $1.80 during the morning session. Sagicor Group rose 70 cents to $51.70, with 18,406 stocks clearing the market. Scotia Group finished 97 cents lower at $42, after 18,751 shares crossing the market and Seprod gained $1 to end at $67, in an exchange of 14,613 units.

Proven Investments slipped $1.48 to $36.50 trading 1,513 units, Radio Jamaica gained 6 cents to close at $1.56 with the swapping of 554,673 shares, after traded as high as $1.80 during the morning session. Sagicor Group rose 70 cents to $51.70, with 18,406 stocks clearing the market. Scotia Group finished 97 cents lower at $42, after 18,751 shares crossing the market and Seprod gained $1 to end at $67, in an exchange of 14,613 units.